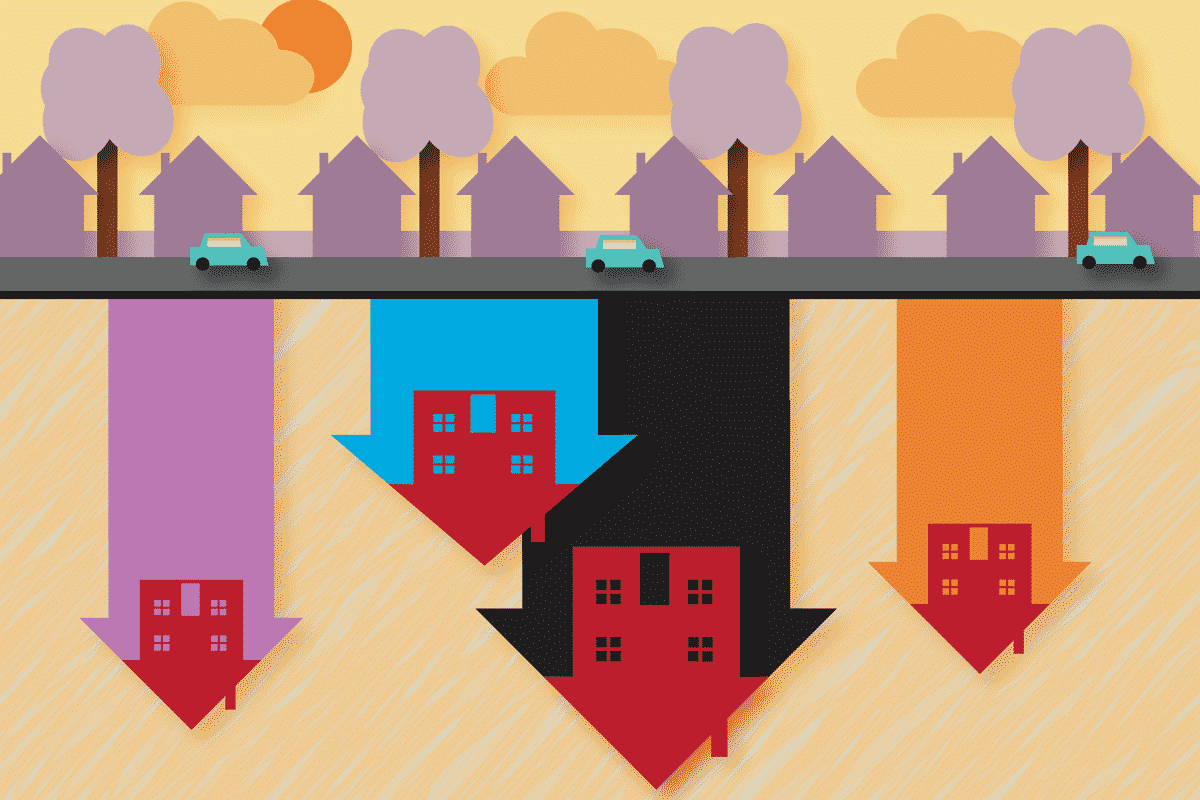

Negative Equity: What Exactly Is It and What Can I Do About It?

Negative equity is something that can happen to you If you’re selling a house, or even if you just own a house. Here’s what negative equity means, when it can happen and what to do if you find yourself in negative equity.

It’s possible that negative equity could become more of a problem over the next few years. With house prices rising at record levels over the last year there is more risk that they could fall, and leave more people in negative equity.

What Exactly is Negative Equity?

Negative equity is a situation where the value of your house is less than the amount of the mortgage you owe on it. That also usually means negative equity is a situation where your house is now worth less than you paid for it.

How to work out if you are or could be in negative equity: Estimate the likely selling price of your house now. Ask an estate agent if you are not sure. Find out how much you owe on your mortgage or any other secured loans by getting a mortgage statement. Deduct the balance owing from the likely house value to find out.

Sell Your Investment Property in Days

Any condition, tenanted or vacant, for it’s full market value. Offers in 3-5 days. No sale, no fee.

An Example of Negative Equity

To give an example of negative equity, let’s assume you bought a house worth £300,000. You bought the house with a 5% deposit and a 95% mortgage of £285,000.

Since you bought house prices in your area have fallen by around 10% and your house is now worth £270,000. Although it depends on exactly what your current mortgage balance is you could therefore have negative equity of approximately £285,000 minus £270,000 = £15,000.

In the years following the last financial crisis, after which houses prices slumped, it was estimated that half a million property owners were in negative equity.

When Can Negative Equity Happen?

Who is most likely to find themselves in a negative equity situation? These are some of the circumstances when homeowners can find themselves owing more on their house than it is worth:

- Negative equity is most likely to happen in times when property prices are falling.

- Negative equity is most likely to happen following a period of fast-rising property prices when there is then a risk that house prices will fall.

- Negative equity is most likely to happen to house buyers who have taken a high LTV or loan to value mortgage or bought with a small deposit.

- Negative equity is most likely to happen to house buyers who have bought fairly recently. (The risk of negative equity tends to fall over time as your mortgage is gradually paid off and especially if property prices rise over time.)

- Negative equity is most likely to affect those who have taken interest-only mortgages. This is because, unlike repayment mortgages, you always owe the capital sum borrowed until the end of the mortgage.

- Negative equity can also happen to house owners who have taken secured loans against their house, such as loans for home improvements.

- Negative equity can also affect those who have used an equity release scheme in some circumstances. For example older people who have used an equity release scheme to release money from their house to be repaid when they die.

- Negative equity can affect buy-to-let landlords with mortgages as well as owner-occupiers.

Why Negative Equity is a Problem

If you are in negative equity you are in debt.

Negative equity is a problem because you owe more money to the bank or building society than the house you have bought is worth. Negative equity can be a stressful and worrying situation to be in. However, how much of a problem it is depends on the amount of your negative equity and your own personal situation.

- If you can afford your mortgage repayments and have no plans to move negative equity may not actually be that much of a problem, however.

As long as you keep up your repayments there’s no risk of your home being repossessed even though it is worth less than you owe on it.

- Negative equity can be a problem if you want to remortgage. It can be difficult if not impossible to remortgage when you are in negative equity.

This is particularly a problem if you are on a fixed-rate mortgage. When the fixed-rate period comes to an end you will likely be switched to the lender’s standard variable rate or SVR. This is likely to be at a higher interest rate and so your mortgage repayments will go up. You probably won’t, however, be able to remortgage to a cheaper deal.

Homeowners who find themselves in this situation are sometimes known as ‘mortgage prisoners'.

- Negative equity can be a problem if you want or need to move house. You may not be able to pay off your current mortgage with the proceeds of selling the house. That might make it difficult to get a new mortgage on a new house.

- Negative equity can be a serious problem if you can’t afford to meet your mortgage repayments. If your bank or building society repossesses your house and sells it there could be a large shortfall between the sales price and the mortgage balance which you will still owe them.

What Can I Do About Negative Equity?

The possible solutions to negative equity vary depending on your personal circumstances:

-

Do nothing

One way to deal with negative equity might be to sit tight and do nothing. This could be an approach if you can afford to keep paying the mortgage and have no plans to move anytime soon. You can hope that as you pay off your mortgage, and if property prices rise, you will no longer be in negative equity.

-

Pay down some of your mortgage

Another way to get out of negative equity is to pay off some of your mortgage perhaps using savings, or overpay on your monthly mortgage payments (if your mortgage allows you to do so). If you can afford to do this it might help you get out of negative equity sooner or even straight away.

-

Consider moving

It may be possible to sell your house and transfer or ‘port’ the negative equity to another property, perhaps a smaller one. This might reduce your outgoings and mean you can get out of negative equity sooner. It might be appropriate if you really need to move.

Transferring a mortgage in negative equity is a specialist area of property finance though, so it is best to take expert advice.

-

Rent your house out

One option sometimes considered by those in negative equity who are unable to sell their house is to rent it out. The rent may cover the mortgage repayments and provide an element of profit on top, which can be used to reduce the negative equity.

-

Improve your house to raise its value

You could consider making some improvements to your property which will raise its value so that there is no longer any negative equity. This will involve spending more money, however.

-

Consider some kind of financial restructuring

This might be another option worth considering for homeowners in negative equity who also have financial difficulties. Possible options include mortgage debt restructuring, mortgage write-downs (where you persuade the lender to reduce your mortgage debt) or even an IVA or individual voluntary arrangement.

If you are in a difficult financial situation with negative equity it is best to take expert financial advice before deciding what to do. There are a number of impartial organisations that can offer advice. Your mortgage lender should also be able to offer guidance.

The Money Advice Service or National Debt Helpline may be able to help with advice.

How to Avoid Negative Equity - Existing Homeowners

Negative equity can be a difficult and uncomfortable situation to be in. So it is good practice for house owners and house buyers to take a few simple steps to avoid negative equity.

Check from time to time that you are not in or near negative equity. Do this by comparing the value of your house now with the mortgage balance you owe. This may be a check worth making if you have bought fairly recently with a high LTV mortgage and a small deposit.

Consider overpaying your mortgage, if you think a negative equity situation might arise. That is, if you can afford to do so and if your mortgage terms allow it.

How to Avoid Negative Equity - New Home Buyers

If you haven’t bought a property yet there are still some things you can do to help avoid negative equity happening to you in the future.

If you’re looking for a house to buy, aim to buy at the best price. Get an independent valuation to ensure that the price you’re paying is realistic and in line with property prices in the area. Avoid overpaying for a house just because you like it or to beat other buyers. This is especially important if buying when house prices are rising fast.

New build properties are often sold at a premium price so their value is more likely to fall if house prices fall, while existing builds are less susceptible to this.

Put down the largest deposit you can afford. As well as reducing the risk of negative equity it should reduce your monthly mortgage payments too.

Make sure you get the very best mortgage deal at the best interest rate possible. This means that more of your money will go to paying off the mortgage balance, reducing the risk of negative equity.