A Guide to Raising Property Finance for Investors and Landlords

-

by Property Investments UK

The Property Investments UK editorial team have been researching and writing about the UK's property market for more than a decade.

One of the most critical aspects of successful property investment is raising the finance for your project. Here we’ll look at the different ways of raising property finance open to landlords and investors.

Saving Up

Although it’s often overlooked, saving for your property project has a lot to recommend it. The main advantage of saving up is that the money is yours – you don’t have to ask anyone for it and you need no security.

Although you might not be able to save enough to fund an entire project saving up is a very good way to raise a deposit.

By saving for a deposit you can make use of leverage and, potentially, control a large amount of property with a small amount of your cash.

Selling Some Assets

Think about what surplus assets you might have and which you could sell to raise property finance. For example, do you have valuable jewellery, a caravan, a motorhome, a motorbike or a car which you don’t need?

Could your own home be a source of property finance? Could you downsize into a smaller property and release finance from it? Could you sell your existing home and live in a property project while you work on it? (There can be Capital Gains Tax advantages to doing this too.)

Remortgaging

One way in which investors and landlords raise finance is to remortgage a property you already own and make use of the equity within it. This might be your own home, a buy-to-let property or a commercial property you already own. You could make use of a first mortgage or a second mortgage on the property.

If you are above the age of 55 approximately you could consider releasing money from your own home using some kind of equity release, home reversion or lifetime mortgage scheme. (Always take expert advice when considering these schemes.)

Withdrawing Money from Your Pension

If you have a workplace or private pension scheme then you might consider withdrawing money from it in order to finance a property project.

- If you are over age 55 then, under current laws, you are able to withdraw money from your pension pot including 25% of the total free of income tax. (Bear in mind doing this will reduce the amount of your future pension.)

- If you are a company director or senior executive (of any age) with a Self-Invested Personal Pension (SIPP) or Small Self-Administered Scheme (SSAS) then you may be able to use money from these kinds of pension scheme to invest in property. These funds may be invested in commercial property and land although not into residential property.

Joint Ventures

In property, there are generally more people with money to invest than there are entrepreneurs with good projects. So one way to raise finance for a property project is to look at setting up a joint venture with a partner or partners who have the cash to invest (or can raise the money) and want to invest in a property project.

Joint ventures are a very flexible way of raising finance and can be set up according to the needs of the individual parties. For example, you can input what capital you have and your time and effort. Other parties might provide only the capital and so be involved as sleeping partners. The profits can be divided on a basis that suits all the partners.

Joint ventures can be used to raise property finance for just one project or a series of projects.

Variations on the theme of joint ventures are to raise finance from venture capitalists or angel investors.

Peer-to-Peer Finance (P2P)

Peer-to-peer finance, known as P2P for short, is a way in which you can raise finance for a property project direct from investors who have money to lend.

The most usual way to raise money using peer-to-peer finance is to list your proposal on a P2P marketplace site. Investors can then consider your proposal and decide if and how much they want to invest.

P2P can be used either as a way to raise money for a property investment business or for a specific project or both. You can seek finance either from a single investor or a group of investors contributing to the same project. Security for this can be offered by way of the property itself.

A key advantage of raising property finance using P2P finance is that investors are likely to have a more relaxed approach to lending than banks do. They may consider more risky property projects in the hope of making a larger return. However, it is likely that the interest rate will be higher than a normal, commercial rate of interest.

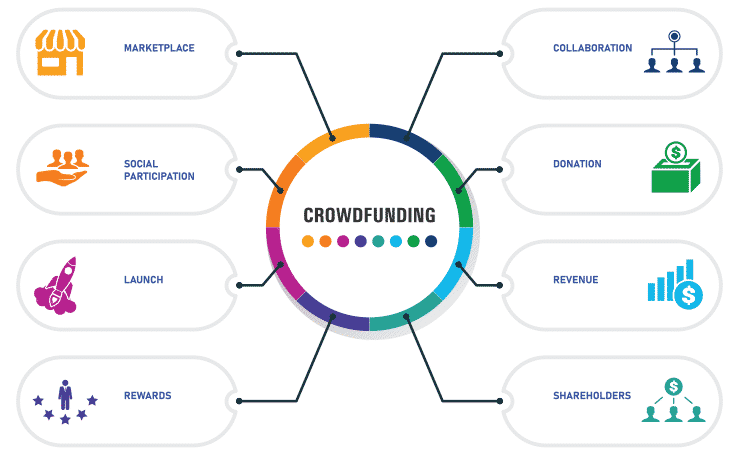

Crowdfunding

Crowdfunding is a different take on P2P finance. Crowdfunding is usually done through a crowdfunding marketplace. It allows you to raise finance by combining relatively small amounts of money from large numbers of people.

Although crowdfunding can be used to raise finance for commercial projects it may work better for projects which also have a social benefit.

Borrowing

The market for property lending in the UK is large and diverse. Many different lenders are willing to lend for property projects and in many different ways. The property finance sector is very competitive with many lenders competing to offer the best rates.

Here we will look at some of the different ways of borrowing money:

Credit Cards

Some people suggest that borrowing money on a credit card can be a way to raise property finance. Credit cards are an easy way to borrow, but are very expensive and generally not ideal for anything but a short-term facility for day-to-day working capital.

It should go without saying that we don't recommend this.

Overdrafts

Overdrafts may be suitable as a form of very short-term finance for a property project, such as for working capital. They tend to be an expensive way of financing a project and we (again) do not recommend this method of raising property finance.

Business Loans

A business loan is a loan from a bank for a commercial purpose, which may include property projects. They can be used toward a property purchase, for development costs or for working capital. They are medium-term finance, typically up to 10 years maximum.

The more established your business and lending track record is the better terms you should be able to obtain on a business loan.

Development Finance

Development finance may be suitable for a property development, renovation or refurbishment project. Development finance may be released in stage payments as your development progresses. For example, on the purchase of land or property, on acquiring planning permission and as the work progresses.

Development finance may come in the form of first and second charge or senior debt and mezzanine finance depending on the nature of the project.

Development finance is generally short-term finance with a term of 12 or 24 months maximum. Development finance is usually intended to be repaid when you sell your property project, or when you refinance to a buy-to-let mortgage in the case of a buy-to-let property.

Bridging Finance

Bridging finance is usually used as a short-term method of finance, typically for between 1 and 24 months. Bridging loans tend to be a more expensive form of finance. Bridging loans are most likely to be used to, for example, fund a buy-to-let or development project purchase before refinancing onto longer-term finance such as a mortgage.

Auction Finance

If you are buying property at auction then there are some lenders who specialise in auction finance and who offer to arrange it at short notice, after you have purchased a lot. Auction finance is usually a kind of bridging finance.

Buy-to-Let Mortgages

Standard residential mortgages are not available for buy-to-let purchases.

A buy-to-let mortgage is the most usual type of borrowing when purchasing or refinancing a property that is being let out. Buy-to-let mortgages are usually a long-term type of property finance, being available for typically up to 25 years. A buy-to-let mortgage is generally the cheapest way of borrowing money for a buy-to-let project too.

Buy-to-let mortgages work in a similar way to residential mortgages but there are some key differences: The interest rate will be higher and the LTV (loan-to-value) will usually be lower. The amount available to you as a buy-to-let mortgage may depend on the rental income the property will generate and your own personal income. Lenders may apply an interest cover ratio or ICR – meaning the monthly rent must cover the monthly mortgage payment by a minimum margin.

They may also apply stress testing to the mortgage, ie. to check that the repayments will still be affordable if interest rates rise and so the mortgage payment rises. Buy-to-let mortgages are often offered on an interest-only basis rather than a repayment basis.

Commercial Mortgages

If you are investing in commercial property such as offices, industrial property, warehouses or retail property then you may need a commercial mortgage. You will also generally need a commercial mortgage if you are buying a mixed-use (mixed commercial and residential) property.

Commercial mortgages tend to have higher interest rates and require a larger deposit than buy-to-let mortgages.

Summary

There is no best way of raising property finance. It depends on your personal and business situation and the type of property project you are considering. Most property investors will make use of a combination of different types of property finance, sometimes using several methods of finance on the same project.

When using any type of property finance it is essential to take expert financial advice on the pros and cons of doing so, and to help find the most appropriate and cost-effective method of property finance.