Where to Buy Property Investments in Carlisle: Yields of 5.9%

Carlisle's position as England's most northerly city creates a property market often overlooked by investors focused on more well-known, larger northern hubs. Yet this historic border city offers property investment opportunities with rental yields reaching 5.9% in CA2, driven by steady tenant demand from the city's diverse employment base and affordable homes prices, making it higher in the tables for northern cities with the highest yield than some of its competitors.

The newest property data reflects genuine value. Cumberland's average sold price of £168,371 sits 43% below the England average, making Carlisle one of the most affordable cities in the country for buy-to-let investors and homebuyers.

Our buy-to-let analysis examines Carlisle's six postcode districts, evaluating capital growth, rental yields, and the investment potential across this historic cathedral city and its surrounding areas.

Article updated: December 2025

Carlisle Buy-to-Let Market Overview 2025

Carlisle's property market delivers asking house prices ranging from 49% to 16% below the England average across its postcodes, creating affordable entry points for buy-to-let investors with these key statistics:

- Asking price range: £150,351 (CA1) to £340,747 (CA5) across Carlisle postcodes

- Rental yields: 4.6% (CA3, CA6) to 5.9% (CA2) across different postcodes

- Rental income: Monthly rents from £731 (CA1) to £1,057 (CA6)

- Price per sq ft: House prices from £150/sq ft (CA1) to £243/sq ft (CA4)

- Market activity: Sales ranging from 5 per month (CA5, CA6) to 44 per month (CA2)

- Deposit requirements: 30% deposits range from £45,105 (CA1) to £102,224 (CA5)

- Affordability ratios: Property prices from 3.6 to 8.2 times Cumberland's median annual salary of £41,574

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Carlisle?

Carlisle offers something increasingly rare in UK property: a city market where the numbers actually work from day one. With yields approaching 6% and average prices under £160,000 in the urban postcodes, this is a rental cash-flow market rather than a speculative bet on future growth.

The value proposition is straightforward. Cumberland's average sold price is £168,371, which sits 43% below the national average of £293,292. For the price of a one-bed flat in many southern cities, you can buy a three-bed terrace in Carlisle with immediate rental income.

The employment base here is more diversified than people assume. Manufacturing accounts for 16.3% of jobs (nearly double the national average), driven by companies like Pirelli, McVitie's, and the nearby Sellafield nuclear site. Health and social care adds another 14%, anchored by the Cumberland Infirmary. You can see the full employment breakdown via the Nomis Labour Market Profile for Cumberland.

Transport links punch above what you'd expect for a city this size. The West Coast Main Line delivers direct trains to London Euston in around 3 hours, Glasgow in 1 hour, and Manchester in under 2 hours. The M6 provides direct motorway access south. Carlisle Lake District Airport now operates flights to London Southend, Belfast, and Dublin, bringing business and tourism traffic into the area.

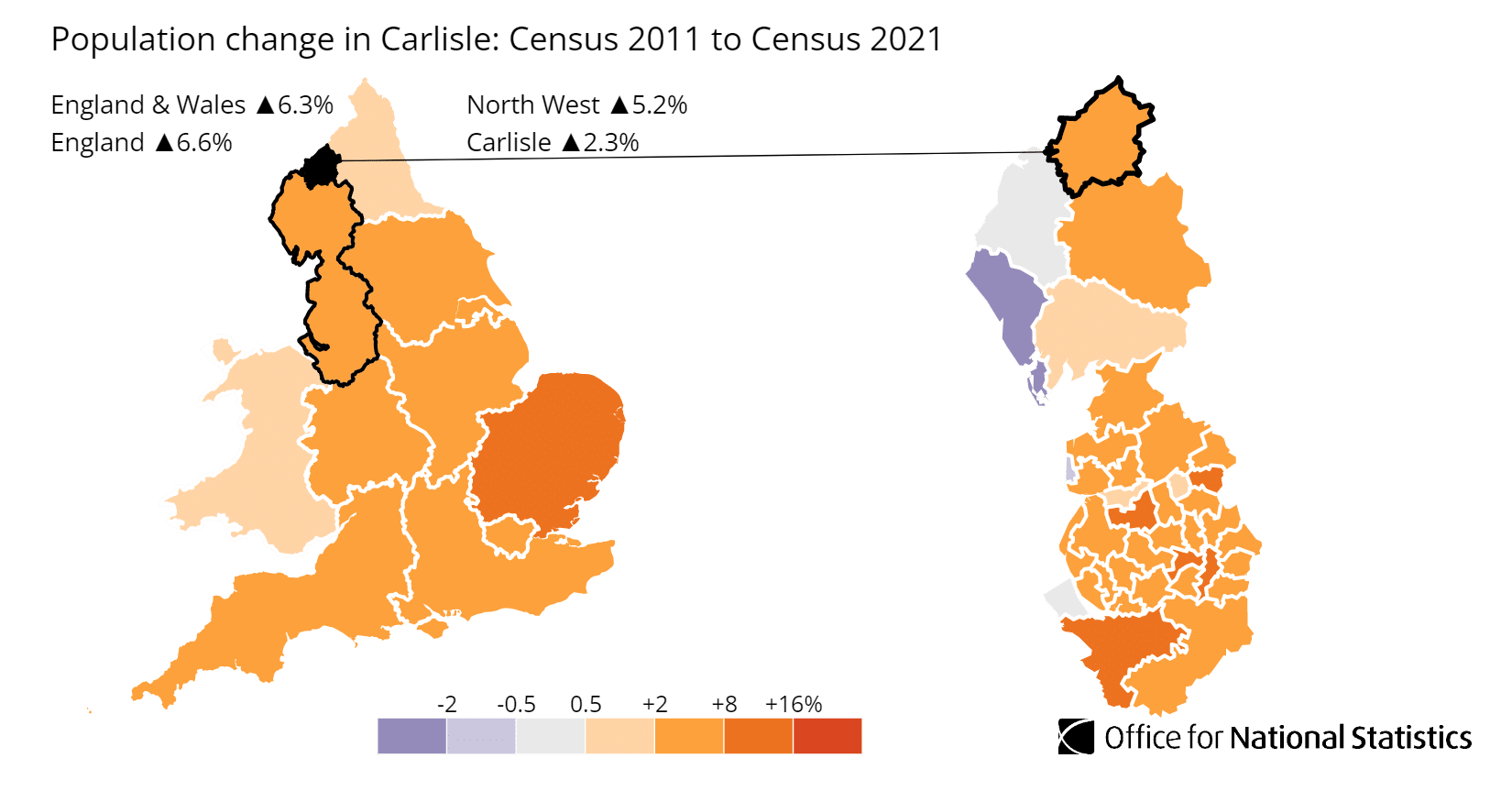

The city's population is stable with modest growth. According to the latest census data, the population of Carlisle increased by 2.3%, rising from 107,500 in 2011 to 110,000 in 2021. You can explore the breakdown via the ONS Census Data for Carlisle.

If you want similar affordable northern markets with strong yields, compare Carlisle with Lancaster (university town 60 miles south), Durham (cathedral city with student demand), or Newcastle (larger regional capital with higher entry prices but deeper tenant pool).

Regeneration and Investment in Carlisle

Carlisle is undergoing its most significant transformation in decades, with over £100 million of combined public and private investment reshaping the city centre. For investors, 2025 was a delivery year rather than a planning year, with major projects completing and strategic sites unlocking.

- Carlisle Station Gateway (£27m): The flagship infrastructure project transforming the historic station into a modern transport hub. In December 2025, the government confirmed an additional £13.5 million investment to accelerate delivery. The scheme includes a new southern entrance at George Square and full pedestrianisation of Court Square on the north side. Planning was approved in February 2025 (north) and April 2025 (south), with completion anticipated in 2026. For investors, this transforms the arrival experience into Carlisle. Updates at Cumberland Council Station Gateway.

- St Cuthbert's Garden Village (10,000 homes): One of the largest housing developments in the North of England. The critical Carlisle Southern Link Road opened in late 2025, physically unlocking the land for development. The Local Plan was submitted to government in October 2025 and an inspector has been appointed for examination. This creates a massive long-term pipeline for residential growth south of the city. Details at St Cuthbert's Garden Village.

- The Citadels Campus (£78m University Expansion): The University of Cumbria's plan to build a new city centre campus on the historic Citadels site. Updated plans were submitted in December 2025, with advance works set to begin in early 2026 and the first phase ready to welcome students from 2027. The £50 million lion's share comes from the Borderlands Inclusive Growth Deal, with additional funding from the Carlisle Town Deal. This will bring thousands of students directly into the city core. Project details at University of Cumbria Citadels.

- Market Square and Greenmarket (£5.5m): Completed and officially reopened in October 2025. This 5,000 square metre transformation includes new paving, street furniture, feature lighting, and natural stone elements, with Greenmarket now serving as a dedicated event space. The historic Market Hall food court also reopened in November 2025 under new management. View the project at Cumberland Council Market Square.

Carlisle Property Market Analysis

When Was the Last House Price Crash in Carlisle?

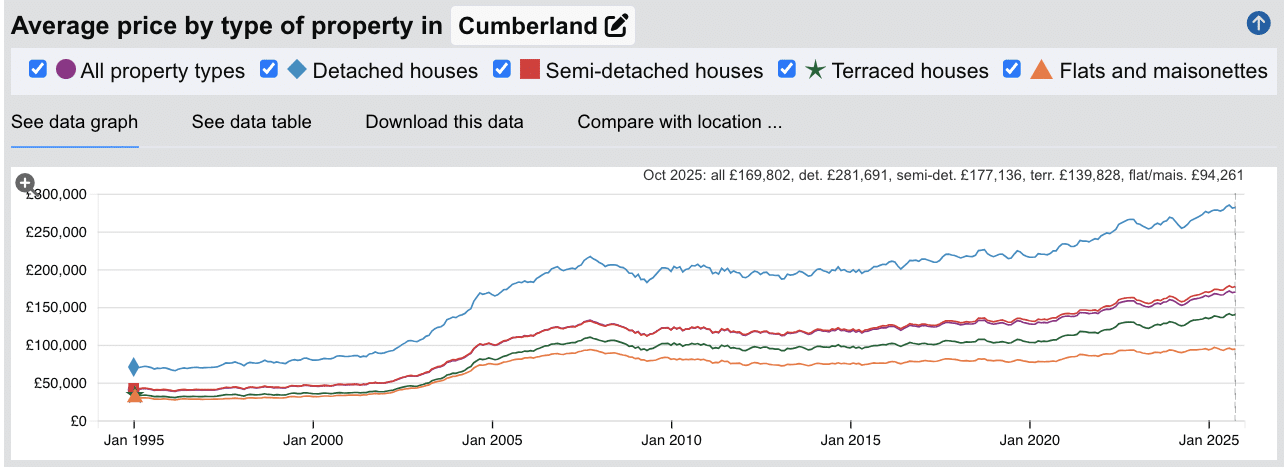

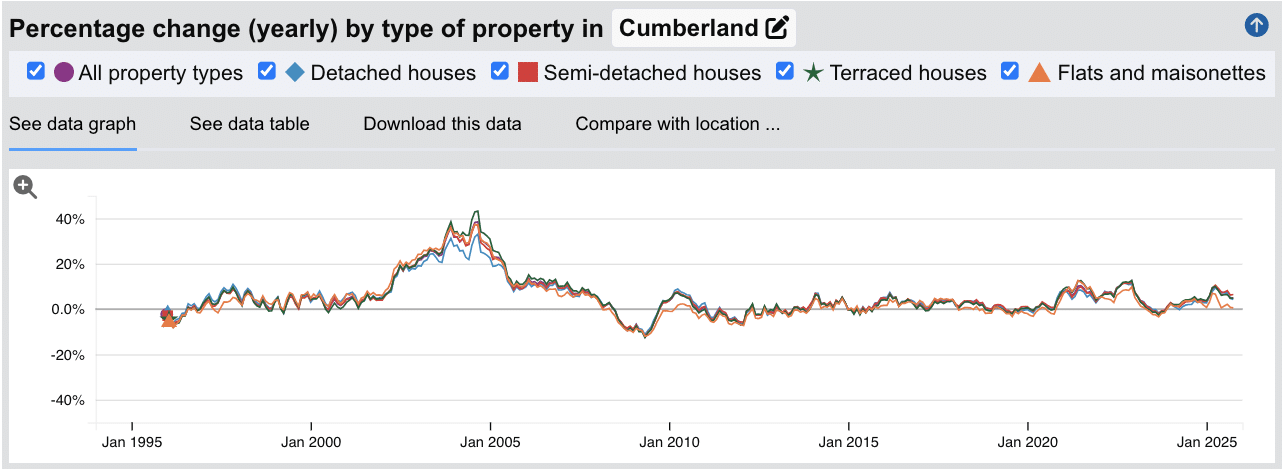

The last significant market correction in Carlisle came during the 2008 financial crisis. The city experienced a 12.2% peak-to-trough decline, with average prices falling from £127,285 in May 2008 to £111,800 by May 2009. Recovery was relatively swift, with prices returning to pre-crash levels by late 2014.

Source: HM Land Registry House Price Index for Cumberland

Here is how the market has performed over the key cycles:

- 1995-2007 saw property values more than triple, rising from around £40,000 to over £130,000 as the national boom lifted all markets.

- 2008-2009 brought the financial crisis correction where values dropped by approximately 12.2% at the lowest point. This was notably shallower than many northern markets.

- 2010-2019 was a decade of gradual recovery and modest growth, with prices fluctuating between £115,000 and £132,000 as the market consolidated.

- 2020-2022 delivered the pandemic-driven surge. Prices climbed from £127,000 to over £158,000 as buyers sought space and value outside major cities.

- 2023 saw a mild correction of around 5.4% as mortgage rates spiked, cooling the post-pandemic momentum.

- 2024-2025 has marked a clear recovery phase. Prices have stabilised and grown steadily, reaching £169,802 as of October 2025, with year-on-year growth of 4.9%.

Long-Term Property Value Growth in Carlisle

For buy-to-let investors focused on capital preservation and steady appreciation, the long-term trajectory shows consistent gains:

- 5 years (2020-2025): 28.9% growth (average prices rising from £131,688 to £169,802)

- 10 years (2015-2025): 40.6% growth (average prices rising from £120,775 to £169,802)

- 15 years (2010-2025): 37.5% growth (average prices rising from £123,467 to £169,802)

- 20 years (2005-2025): 53.5% growth (average prices rising from £110,649 to £169,802)

- 30 years (1995-2025): 326.8% growth (average prices rising from £39,779 to £169,802)

The relatively shallow 2008 correction and mild 2023 dip demonstrate Carlisle's resilience. This is not a speculative market prone to dramatic swings. It is a steady, affordable market where prices track local buyer demand, there are jobs, a growing population and a need for homes.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Carlisle

The latest sold house price index by the Land Registry confirms Carlisle's position as one of the most affordable city markets in England, with values sitting well below national benchmarks across every property type.

Cumberland property prices average £169,802, which is 42.6% below the England average of £295,670. This discount creates genuine entry points for investors who have been priced out of southern markets.

Terraced houses offer the sharpest value, averaging just £139,828, a 43.2% discount against the national average. These are the workhorses of the Carlisle rental market, delivering the strongest yields in postcodes like CA1 and CA2. Semi-detached houses average £177,136, sitting 39.5% below the national figure, offering a balance of space and affordability for family lets.

Detached houses average £281,691, representing a 40.9% discount on the England average. These are concentrated in the rural postcodes (CA4, CA5, CA6) where owner-occupier demand dominates. Flats and maisonettes are the most affordable entry point at just £94,261, a striking 58.1% below the national average, though stock is limited compared to larger cities.

Updated December 2025

| Property Type | Carlisle Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £281,691 | £476,862 | -40.9% |

| Semi-detached houses | £177,136 | £292,942 | -39.5% |

| Terraced houses | £139,828 | £246,321 | -43.2% |

| Flats and maisonettes | £94,261 | £225,149 | -58.1% |

| All property types | £169,802 | £295,670 | -42.6% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Carlisle

Updated December 2025

The data represents the average asking prices of properties currently listed for sale across Carlisle's postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | CA5 (Dalston, Thursby, Wigton Rural) | £340,747 |

| 2 | CA4 (Brampton, Wetheral, Eden Valley) | £335,603 |

| 3 | CA6 (Longtown, Gretna Border) | £273,138 |

| 4 | CA3 (Stanwix, North Carlisle, Kingstown) | £233,893 |

| 5 | CA2 (Denton Holme, Morton, South-West Carlisle) | £158,723 |

| 6 | CA1 (City Centre, Botcherby, South-East Carlisle) | £150,351 |

Carlisle's pricing shows a clear urban-rural divide. The rural postcodes CA4 and CA5 command the highest asking prices, averaging over £335,000, driven by detached properties in the Eden Valley and villages like Wetheral and Dalston. These areas attract owner-occupiers rather than landlords, with limited rental stock.

CA3 (Stanwix, Kingstown) sits at £233,893, covering Carlisle's premium suburban areas north of the city centre. This postcode includes the Kingstown Industrial Estate catchment, offering steady demand from working professionals.

For yield-focused investors, the urban postcodes offer the strongest value. CA2 at £158,723 covers the south-west suburbs including Denton Holme and Morton, delivering the highest yields in the city at 5.9%. CA1 is the most affordable at £150,351, covering the city centre and south-east areas like Botcherby, where entry prices under £100,000 are still achievable for terraced properties.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Carlisle (£)

Updated December 2025

The data represents the average price per square foot across Carlisle's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | CA4 (Brampton, Wetheral, Eden Valley) | £243 |

| 2 | CA5 (Dalston, Thursby, Wigton Rural) | £233 |

| 3 | CA3 (Stanwix, North Carlisle, Kingstown) | £216 |

| 4 | CA6 (Longtown, Gretna Border) | £210 |

| 5 | CA2 (Denton Holme, Morton, South-West Carlisle) | £170 |

| 6 | CA1 (City Centre, Botcherby, South-East Carlisle) | £150 |

For context, Brighton averages over £450 per square foot. Carlisle's most expensive postcode, CA4, comes in at just £243. You get roughly three times the space for your money in Carlisle compared to the south coast.

The rural postcodes CA4 and CA5 command the highest price per square foot despite having the largest properties. This reflects the premium for detached houses in villages like Wetheral, Brampton and Dalston, where buyers pay for land, gardens and period character rather than proximity to amenities.

For investors focused on maximising rental space, the urban postcodes offer significantly better value. CA1 at just £150 per square foot is where you get the most property for your deposit. A £45,000 deposit (30% on a £150,000 property) buys roughly 1,000 sq ft of living space in CA1, compared to around 620 sq ft in CA4 for a £100,000 deposit.

CA2 at £170 per sq ft hits the sweet spot for yield-focused investors. You get substantial space at affordable prices, combined with the highest yields in the city at 5.9%.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Carlisle (%)

Updated December 2025

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 5 Year | 7 Year |

|---|---|---|---|

| CA6 (Longtown, Gretna Border) | +9.1% | +29.8% | +45.3% |

| CA5 (Dalston, Thursby, Wigton Rural) | -12.2% | +5.0% | +32.1% |

| CA1 (City Centre, Botcherby, South-East Carlisle) | +3.0% | +9.6% | +21.2% |

| CA4 (Brampton, Wetheral, Eden Valley) | +10.5% | +20.2% | +18.2% |

| CA2 (Denton Holme, Morton, South-West Carlisle) | +0.4% | +17.8% | +18.4% |

| CA3 (Stanwix, North Carlisle, Kingstown) | +4.9% | +13.3% | +17.9% |

The numbers reveal where capital growth has been strongest over different holding periods. CA6 (Longtown) stands out as the clear winner across all timeframes, delivering +45.3% over seven years and maintaining momentum with +9.1% annual growth. This border postcode has benefited from buyers seeking rural space with easy access to both Carlisle and Scotland, while prices remain under £275,000.

CA5 (Dalston, Thursby) shows the most volatile pattern: strong seven-year growth of +32.1% but a sharp -12.2% decline over the past year. With just 5 sales per month and a 13% turnover rate, this rural postcode is susceptible to price swings from individual high or low value transactions. The long-term trajectory remains positive, but short-term investors should be cautious.

The urban postcodes tell a steadier story. CA4 (Brampton) is currently the strongest performer on annual growth at +10.5%, driven by continued demand for Eden Valley village living. CA2 and CA3 have delivered consistent mid-teen growth over five and seven years, tracking close to the Cumberland average without dramatic swings in either direction.

CA1 (City Centre) shows the most modest growth figures, but this reflects its already-affordable base price rather than weak demand. When properties start at £150,000, percentage growth naturally lags areas with higher absolute prices. The steady +3.0% annual growth and +21.2% over seven years suggests a stable, predictable market rather than a speculative one.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Carlisle

Updated December 2025

The data represents the average number of residential property sales per month across Carlisle's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | CA2 (Denton Holme, Morton, South-West Carlisle) | 44 |

| 2 | CA1 (City Centre, Botcherby, South-East Carlisle) | 25 |

| 3 | CA3 (Stanwix, North Carlisle, Kingstown) | 21 |

| 4 | CA4 (Brampton, Wetheral, Eden Valley) | 9 |

| 5 | CA5 (Dalston, Thursby, Wigton Rural) | 5 |

| 6 | CA6 (Longtown, Gretna Border) | 5 |

The urban-rural divide is stark. CA2's 44 monthly sales and 52% turnover rate creates the kind of liquid market where you can buy and sell without waiting months for the right buyer. This matters for BRR strategies where exit speed affects your return on capital. Although in such a buoyant market it makes it easier to sell but harder to negotiate with property sellers and buy the best properties at a discount as competition from other buyers is fierce. CA1 and CA3 offer similar liquidity at 25 and 21 sales respectively, giving investors multiple options in the active core.

The rural postcodes average just 5-9 sales per month, which explains both their price volatility and their appeal. When CA6 shows 45% growth over seven years but only 5 monthly transactions, a handful of premium sales can skew the averages significantly.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Carlisle Rental Market Analysis

For investors considering if buy to let is worth it in Carlisle and thinking how much they can charge for rent across the city and its surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Carlisle (£)

Updated December 2025

The data represents the average monthly rent for long-let AST properties in Carlisle.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | CA6 (Longtown, Gretna Border) | £1,057 |

| 2 | CA3 (Stanwix, North Carlisle, Kingstown) | £890 |

| 3 | CA2 (Denton Holme, Morton, South-West Carlisle) | £782 |

| 4 | CA1 (City Centre, Botcherby, South-East Carlisle) | £731 |

| 5 | CA4 (Brampton, Wetheral, Eden Valley) | Not enough data |

| 6 | CA5 (Dalston, Thursby, Wigton Rural) | Not enough data |

CA6 (Longtown) commands the highest average rent at £1,057, but this reflects the rural stock profile: larger detached properties letting to families rather than high tenant demand. With only 15 rental listings analysed and average prices of £273,000, this is not a volume rental market.

The urban postcodes tell the real rental story. CA3 achieves £890 on average prices of £234,000, while CA2 hits £782 on just £159,000 entry prices. That gap between rent and purchase price is why CA2 delivers the highest yields at 5.9%. For investors focused on monthly cash flow rather than absolute rent figures, the affordable postcodes outperform. CA4 and CA5 lack sufficient rental listings to calculate reliable averages, reflecting the lower number of properties on the market in these postcodes and maybe their predominantly owner-occupier character.

Gross Rental Yields in Carlisle (%)

Updated December 2025

The data represents the average gross rental yields across Carlisle's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | CA2 (Denton Holme, Morton, South-West Carlisle) | 5.9% |

| 2 | CA1 (City Centre, Botcherby, South-East Carlisle) | 5.8% |

| 3 | CA3 (Stanwix, North Carlisle, Kingstown) | 4.6% |

| 4 | CA6 (Longtown, Gretna Border) | 4.6% |

| 5 | CA4 (Brampton, Wetheral, Eden Valley) | Not enough data |

| 6 | CA5 (Dalston, Thursby, Wigton Rural) | Not enough data |

Carlisle's urban postcodes comfortably clear the 5% threshold that many investors target. CA2 leads at 5.9% and CA1 follows closely at 5.8%, both benefiting from the combination of low entry prices and steady working tenant demand. These yields compare favourably to larger northern cities like York where increased investor competition has compressed returns in recent years.

CA3 and CA6 both deliver 4.6%, reflecting higher purchase prices relative to achievable rents. These are areas where capital growth and tenant quality may compensate for the lower immediate cash flow.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy-to-let ownership costs.

Is Carlisle Rent High?

Carlisle's rental market is significantly more affordable than most English cities. Tenants commit a far smaller portion of their salary to rent compared to southern markets, which supports consistent demand and lower void risk for landlords.

Average rent in Carlisle costs between 21% and 31% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Cumberland residents is £41,574 (based on £799.50 per week).

The highest-rent postcode, CA6, requires 30.5% of the median local income, though this reflects larger rural properties rather than unaffordability. The urban postcodes are remarkably accessible: CA1 requires just 21.1% of income, well below the 30% threshold that housing experts consider affordable.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | CA6 (Longtown, Gretna Border) | 30.5% |

| 2 | CA3 (Stanwix, North Carlisle, Kingstown) | 25.7% |

| 3 | CA2 (Denton Holme, Morton, South-West Carlisle) | 22.6% |

| 4 | CA1 (City Centre, Botcherby, South-East Carlisle) | 21.1% |

| 5 | CA4 (Brampton, Wetheral, Eden Valley) | Not enough data |

| 6 | CA5 (Dalston, Thursby, Wigton Rural) | Not enough data |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Carlisle House Prices High?

For a local property buyer on average full-time earnings, Carlisle offers genuine affordability compared to most English cities.

Purchasing a property in Carlisle requires between 3.6 and 8.2 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Cumberland residents is £41,574.

The urban postcodes are remarkably accessible. CA1 requires just 3.6 times the average salary and CA2 requires 3.8 times, both well below the UK long-term average of around 8x. This affordability sustains a healthy balance of owner-occupiers and renters, supporting stable tenant demand without the extreme pressure seen in southern markets.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | CA5 (Dalston, Thursby, Wigton Rural) | 8.2x |

| 2 | CA4 (Brampton, Wetheral, Eden Valley) | 8.1x |

| 3 | CA6 (Longtown, Gretna Border) | 6.6x |

| 4 | CA3 (Stanwix, North Carlisle, Kingstown) | 5.6x |

| 5 | CA2 (Denton Holme, Morton, South-West Carlisle) | 3.8x |

| 6 | CA1 (City Centre, Botcherby, South-East Carlisle) | 3.6x |

The rural postcodes CA4 and CA5 sit around the 8x mark, but this reflects larger detached properties in desirable villages rather than unaffordability. For investors comparing northern markets, Preston and Blackburn offer similar affordability profiles with different employment dynamics.

How Much Deposit to Buy a House in Carlisle?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £57,000 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | CA1 (City Centre, Botcherby, South-East Carlisle) | £45,105 |

| 2 | CA2 (Denton Holme, Morton, South-West Carlisle) | £47,617 |

| 3 | CA3 (Stanwix, North Carlisle, Kingstown) | £70,168 |

| 4 | CA6 (Longtown, Gretna Border) | £81,941 |

| 5 | CA4 (Brampton, Wetheral, Eden Valley) | £100,681 |

| 6 | CA5 (Dalston, Thursby, Wigton Rural) | £102,224 |

For investors entering the market, CA1 and CA2 require deposits under £50,000. That's less than a third of what you'd need for a comparable yield in Brighton or Bristol. Crucially, these areas deliver the city's strongest yields at 5.8% and 5.9%, making them highly efficient for capital deployment.

The rural postcodes CA4 and CA5 require deposits exceeding £100,000, entering territory where the same capital could secure two properties in the urban core. Unless you're specifically targeting the Eden Valley lifestyle market, the numbers favour splitting your investment across CA1 or CA2.

How to Invest in Buy-to-Let in Carlisle

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Carlisle, Cumbria and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Carlisle and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Carlisle for Buy-to-Let Investment

For investors seeking similar affordability with strong yields, buy-to-let in Lancaster offers a comparable mix of historic city character and university-driven demand just an hour south on the West Coast Main Line. If you're drawn to the Scottish border region, buy-to-let in Glasgow provides access to Scotland's largest rental market with yields averaging over 8%.

Or to understand the wider regional market, see our guides to buy-to-let in Newcastle and the North East.