Responding to Rising Energy Prices: A Guide for Investors and Landlords

You will have read in the news, energy prices are increasing by 54% as of the 1st of April 2022. So, how does this affect you? What is a standard variable tariff? This article aims to explain how the increase in energy price affects you as a landlord as well as the options your tenants have.

As a landlord, there are only two scenarios where an increase in energy price affects you directly: when you are responsible for paying the utilities during a vacant period or if you are offering your property with bills included.

Please note: the information within this article does not act as official advice and all decisions should be made by a landlord or tenant on a case by case basis using current information at that time.

The Situation

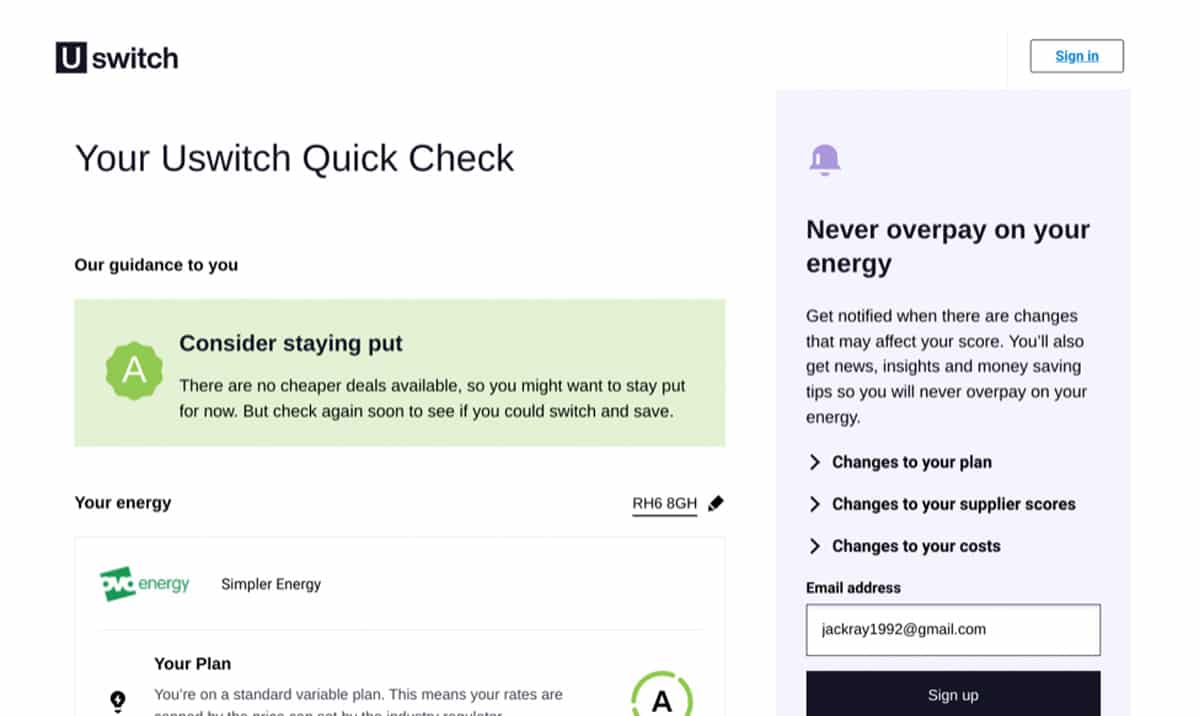

Throughout the last twenty years, we have all been conditioned through the emergence of uSwitch, Compare The Market and Martin Lewis to “switch and save” to ensure we are never paying more than we need to for our gas and electricity bills.

But what happens if you head to uSwitch right now (as of 1st April 2022)? You’ll see no energy options available because no energy suppliers want to have you as a customer!

There’s one simple reason for this: energy suppliers run the risk of losing money for every new customer that signs up with them. Energy suppliers purchase energy from the wholesale market and since September 2021, the wholesale prices have been significantly more expensive than the standard variable tariff (SVT).

What is the SVT?

The standard variable tariff is the tariff set by the government regulator Ofgem. Any new home mover lands on the SVT when they move into a new home or become responsible for paying the utilities for a property. You may recognise the term “standard tariff” because it is the tariff we’ve been encouraged to move away from for the last twenty years. The SVT represents a capped price protecting consumers from high tariffs.

So, unless a new occupier (a landlord) moves in and fixes themselves onto to an energy tariff that is significantly more expensive than the SVT and more expensive than the wholesale prices so that the energy company makes money - why would anyone do this? - then the energy company will be losing money. Typically a landlord will only be responsible for paying the bills during a vacant period for a (hopefully) short amount of time, so fixing on to a tariff would be rare anyway.

Therefore as a landlord, your best option is to pay the bill you receive from the supplier. Check that the bill shows that you’re on a “standard variable” tariff. Your unit prices should be no more than 7p for gas and 27p for electricity.

The SVT is the same for all residential energy suppliers, so it also doesn’t make sense to switch to any other supplier for the void period as you’ll be paying the same rate for your energy and could in theory have two bills to pay to different suppliers if the switch happens mid-void period.

Offering Your Properties with Bills Included

If you’re paying the bills for your property/properties and are offering a rent and bills inclusive package for your tenants, then you’re in a slightly different position.

If you’re on a fixed tariff with your supplier already, then you almost certainly will have no changes to your price because your energy supplier will have “hedged” or purchased your energy upfront when you took your fixed tariff.

The danger zone will be when your fixed deal comes to an end, at which point you’ll likely be offered a significantly more expensive tariff unless the wholesale prices come down. In this scenario, you can allow your energy to move onto the SVT (explained in the above section) rather than locking on to a more expensive fixed deal.

Alternatively, if you are currently not on a fixed tariff then your energy prices will on average be increasing by 54% per property in line with the new SVT. Although it sounds counterproductive, if you’re in this scenario then the best thing to do is to stick to the SVT with your existing supplier and keep monitoring the tariffs that your existing supplier is able to offer you.

If the price drops to below the SVT, great! If they don’t, then paying the SVT will continue to be the best option. Just because you are on a standard variable tariff, it does not mean that your bills will change each month as the SVT is fixed until October 2022.

Looking forward, there are rumours starting to circulate within the energy industry that the SVT will increase again in October 2022 to £3,000 per year, another 33% increase and almost a 200% increase from prior to the most recent SVT. With this in mind, one option could be to fix onto a tariff that is more expensive than the current SVT (£1,900 per year) but cheaper than the expected next SVT (£3,000 per year).

For example, if a supplier offered you a fixed 2-year deal at £2,400 per year this summer, it could save you £1,200 (£600 per year) across the next two years. It’s a tricky decision to make as no one knows where the energy prices will go in the coming weeks and months, but perhaps it’s an option that allows you to budget best over the next couple of years.

What Should I Suggest To My Tenants?

When moving into a new home, a tenant will automatically be placed onto the standard variable tariff (SVT - see more on the section above named: What is the SVT?). As we’ve already discussed, the SVT is the cheapest available tariff on the market as of the start of April 2022 and the SVT is the same tariff regardless of the residential supplier, meaning there is little benefit to switching other than being with a preferred supplier for non-price factors e.g. brand, customer service or having a mobile app to monitor usage.

Many tenants will want to know what their fixed costs are for their new home and fixing onto a tariff may seem like the natural choice to be made, however, there are two key factors to consider here that should be communicated to your tenants:

- Just because a tariff is fixed, it does not mean that the payments will be fixed. If more gas and electricity are used than expected by the supplier, the tenant’s payments will increase. Be aware of low usage estimates in order to display low monthly payment quotes that end up being inaccurate, causing monthly payments to increase.

- With this in mind, it’s important that the tenant checks the fixed tariff’s unit charges and standing charges compared to the SVT to make sure they are not paying more than they need to. The SVT unit charges for gas are 7p and electricity 27p.

One point to consider is that although it is almost impossible to compare energy prices at the moment, broadband suppliers are taking on new customers as normal. So, choosing the best deal for broadband is possibly more important than ever before.