Should I Buy Two Properties or One?

A common question we get asked: if you've got £100,000 to invest, should you buy one £300,000 property or split the deposit over many properties - maybe two £150,000 properties?

Every property investor and landlord is different and there is no one right answer, so here are three questions you can ask yourself as a guide:

- How much time do you have?

- Do you want capital growth or rental income?

- How will you fund future purchases?

Below I look at my experience with each of these questions and common outcomes from building a property portfolio to help if you're still deciding whether buy-to-let is worthwhile across multiple properties.

Article updated: December 2025

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

How Much Time Does Owning Multiple Properties Take?

More properties require more of your time. Simple as that.

X times more roofs to replace (£10,000-£20,000 each). X times more boilers that fail in winter. X times more tenants to manage. X times more maintenance.

One property with a letting agent managing it might need attention a couple of times a year. Three properties? You're dealing with something every few weeks.

When one property makes sense: Full-time job, family commitments, other business interests. One tenant relationship, one property to maintain, one set of issues. You want simplicity. Your time is valuable. If your hourly rate is £50-£100+, spending 15 hours monthly managing multiple properties doesn't make financial sense.

When multiple properties make sense: Semi-retired, self-employed with flexible hours, making property your full-time focus. You have time to manage the admin and don't mind coordinating across multiple locations. Many investors use letting agents to handle day-to-day management, but if you are self managing to save costs, then you are trading your time for a chance of maximising your rental returns.

Think five years ahead. Will you have more time or less? Property is a long-term game and planning for the future as well as today will help guide you on how many properties is in your ideal portfolio.

One Expensive Property vs Multiple Cheaper Ones

When you split £100,000 across multiple properties versus one, you may be choosing between capital growth and rental income. Check here to understand more about capital growth.

One property > aiming for capital growth. If mortgage finance is readily available, then a £100,000 deposit may buy a £300,000-£400,000 property. This opens up higher-value locations for you. Better areas with historically stronger growth and your property type can be semi-detached or even detached family housing, instead of an entry level one or two bedroom apartment.

A £350,000 property at 5% gross yield would generate £17,500 annual rent. After costs, maybe £200-£400 monthly cashflow. Assuming 5% annual growth, over 10 years the property could be worth £570,000, with £220,000 equity growth.

Multiple properties > aiming for income. Split £100,000 over three properties. Lower-value but higher yields. A £100,000 property at 8% yield would generate £8,000 rent. Three properties = £24,000 gross income versus £17,500 from one.

More monthly cashflow. But more costs. Three sets of maintenance, agent fees, insurance, safety certificates. Lower-value properties tend not to appreciate as quickly. Three £100,000 properties at 5% growth would generate £160,000 equity over 10 years. £60,000 less than one property.

Quality over quantity? You may be expecting dinner table talk at networking events or between friends. The question "How many properties have you got?" gets raised. If you answer with, 'Ten'. This may sound impressive. But what if they're all in negative equity, you have bad tenants you can't evict, or they are in a town with declining population and with no buyers?

Which would you really prefer? One, £1 million property or ten £100,000 properties? There is no perfect answer of course. However, one property offers simplicity, growth, better locations, easier exit. Multiple properties offer diversification, higher yields, different rental strategies.

You can model your own scenarios using our LTV: Loan to Value calculator and our buy to let rental yield calculator.

Buying Multiple Properties: Equity vs Cashflow Strategy

If you are planning to buy more properties, have a think about where your future deposit money will come from.

If you have income from other sources (like your job, savings, shares or a business)? then you don't have to rely on your growing property portfolio to fund new purchases. However, if you need your properties to pay for the next purchase, then plan ahead now.

Two options:

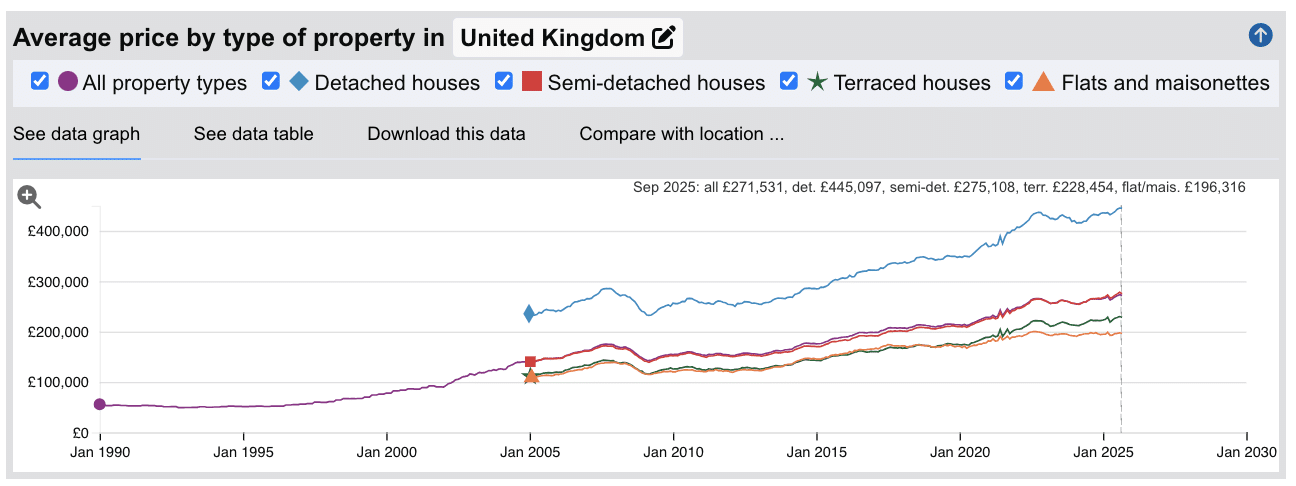

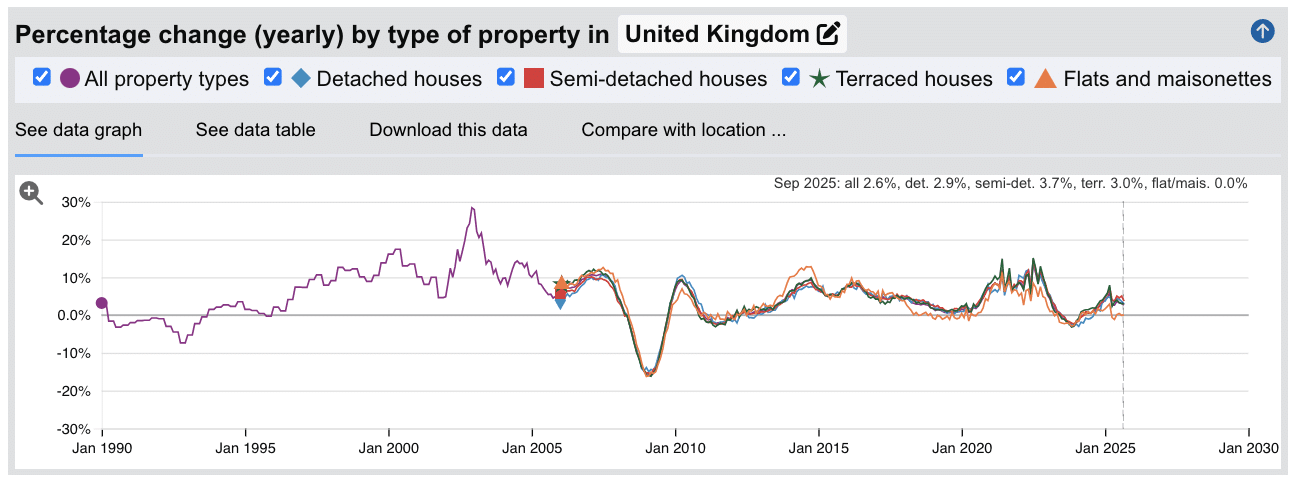

Equity strategy (one property). Assets grow, refinance to release capital, use for next deposit. A £300,000 property growing at 5% annually would generate approximately £15,000 equity in year one. After ten years, you may have some decent equity to release. Historical UK house price growth data from the Land Registry shows how property values have increased over time. You can also see our property investment business guide on what strategies to consider.

When one property makes sense: If you are planning on building a substantial portfolio long-term, you need strong equity growth for future purchases, so you want better locations.

Cashflow strategy (multiple properties). Save rental income for deposits. Although this could easily get spent, reduced with taxation and may not compound like equity does.

When multiple properties make sense: If you need the income now (higher yields generate more monthly cashflow), if you have time to manage them and if you want strategy diversification like (buying a standard buy-to-let, buying student lets or a holiday let).

£100k Deposit Example: One Property vs Two

Here's an example of how the numbers might work with a fictional £100,000 deposit.

Option A: One £300,000 Property

Maybe a suburb of Manchester like Whalley Range, Burnage or Withington. Family housing with popular nearby schools.

Deposit: £100,000 (33% down). Mortgage: £200,000 at 5.5% = £833 monthly. Purchase costs: £23,250 (stamp duty £20,000 + fees £3,250).

For more information on the stamp duty rates check out our Stamp Duty Calculator.

Monthly rent: £1,450. After mortgage (£833), insurance (£40), maintenance reserve (£145), letting agent (£174): £258 monthly profit = £3,096 annually.

Year 5 (assuming 5% annual growth): Property could be worth £383,000. Minus your mortgage of £200k and your original investment and purchase costs of £100k + £23,250. Your new equity: £59,750.

Year 10 (assuming 5% annual growth): Property could be worth £489,000. Minus your mortgage of £200k and your original investment and purchase costs of £100k + £23,250. Your new equity: £165,750.

Option B: Two £150,000 Properties

Bolton and Stoke. Higher-yield areas. Terraced houses.

Total deposit: £100,000 (£50,000 each, 33% down). Total mortgages: £200,000 at 5.5% = £833 monthly. Purchase costs: £20,500 (stamp duty £16,000 + fees £4,500).

Monthly rent: £1,750 combined (£875 each at 7% yield). After mortgages (£833), insurance (£70), maintenance reserve (£210), letting agents (£210): £427 monthly profit = £5,124 annually.

Year 5 (assuming 4% annual growth on lower-value properties): Properties could be worth £365,000. Minus your mortgages of £200k and your original investment and purchase costs of £100k + £20,500. Your new equity: £44,500.

Year 10: Properties could be worth £444,000. Minus your mortgages of £200k and your original investment and purchase costs of £100k + £20,500. Your new equity: £123,500.

The Trade-Off

Option B delivers more cashflow: £2,028 more annually (65% higher income).

Option A builds more equity: £15,250 more at year 5 (34% more growth) and £42,250 more at year 10 (34% more growth).

In this scenario: Option B for income now, Option A for equity building. Option B also offers diversification across two locations and two tenant bases. Your priority determines your choice. Past performance doesn't guarantee future results and this is a simplified version without consideration for additional costs like void periods, utilities and council tax during vacant periods, taxation and any other unexpected items. It is not intended as financial advice it is simply intended as a rough guide to show you an example of how a portfolio decision can play out.

Frequently Asked Questions

Can I buy two properties at the same time?

Yes, if you have sufficient deposit funds and meet lending criteria for each mortgage. Lenders assess your income and existing commitments to determine how much you can borrow across multiple properties. A mortgage broker experienced in property portfolios and a range of lenders is best placed to help you navigate what finance is suitable for you.

What is a portfolio landlord?

Someone who owns more than one rental property could be considered a portfolio landlord. However lenders apply their own strict criteria. They will often stress-test at higher interest rates, look at detailed income and expenditure assessments across all properties, and consider maximum loan-to-value ratios for the entire portfolio. No property investment company can give you specific advice on this, instead it is advisable to speak with an experienced mortgage broker.

Should I buy properties in the same area or different locations?

Again this is personal choice. There isn't one correct answer. If you buy in the same area then you can benefit from having the same letting agent, refurbishment team, handyman, electrician, plumber etc). If you purchase in completely different locations you can spread your risk and diversify. This way if there is a major downturn in a local economy somewhere, then all your properties won't be impacted at the same time.

Can I use equity from one property to buy another?

Yes, although there are downsides. It requires selling the property completely or remortgaging and releasing equity based on a new valuation. Once your property increases in value, you can sometimes remortgage to release equity for your next deposit. However some lenders may have strict criteria that doesn't allow this or limits the loan to value you could potentially release. Plan ahead before you make a decision by speaking with your accountant and mortgage broker first to see what their advice is for your strategy of future property purchases.

What are the main risks of owning multiple rental properties?

If you are purchasing with finance, it might mean you are taking on more 'leverage', which is debt and this alone can be a primary risk factor that puts people off. There is also concentration risk (multiple properties in one area affected by local market decline), tenant risk multiplied (more properties = more potential void periods and bad tenants), maintenance cost spikes (three boilers could all fail in the same winter), cashflow pressure (mortgage payments, council tax and insurance all continue even during void periods with no rental income coming in), and management complexity (coordination across multiple properties, agents, and contractors).