Everything You Need to Know About the Incoming Tenant Fee Ban

-

with Tracy Wardle

Tracy Wardle is the director of the lettings agency Abode Property Management. You can see her company website here and read her blog here.

June 1st, 2019, signals the beginning of the Tenant Fees Act, an approach by the Government to ban fees paid by tenants to letting agents and landlords in the rental sector. For many tenants, renting a property or for those looking to rent, this may seem like the lifeline they’ve been waiting for.

Over the past few weeks, I’ve been contacting our portfolio of over 400 landlords with properties across the entire country with regards to the Tenant Fee Ban.

By using us as a letting agent, our landlords have been aware of the act since it was first drafted last year and the impacts that would consequentially take place.

Scarily, however, there are some landlords and letting agents that have buried their heads in the sand when it comes to such a huge change in our industry; either they are choosing to ignore it and are just hoping it goes away, or they are entirely unaware of its forthcoming implementation.

What is the Tenant Fee Ban?

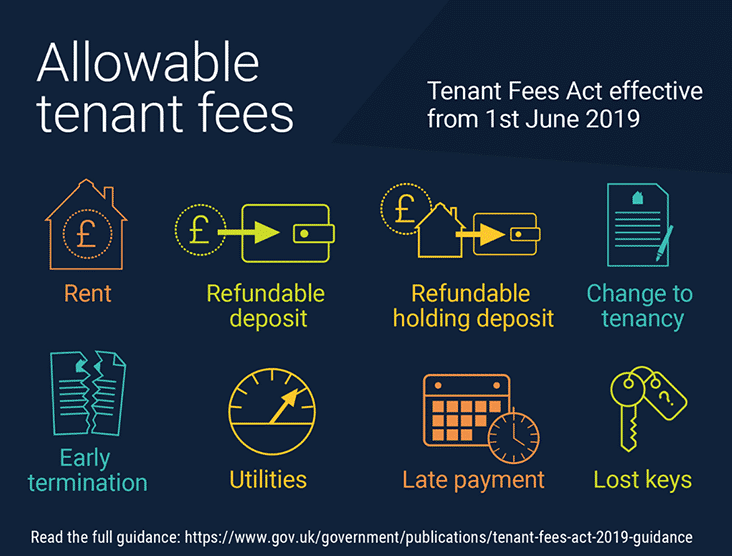

In essence, the Tenant Fee Ban is an act by the Government to cease letting fees paid by tenants, whilst also capping tenancy deposits across the whole of England.

Coming into force on Saturday 1 June 2019, the act aims to reduce the costs that tenants face when initially renting a property, seeking to improve the relationship between tenants and landlords whilst making the private rented sector more affordable.

From this date, letting agents and landlords won’t be able to charge for a range of services that at present, contribute a reasonable chunk of income to the business.

To ensure that landlords and letting agents are complying, local enforcement authorities have been given the primary responsibility for enforcing and protecting the legislation.

In addition, the Tenant Fees Act creates an independently lead enforcement authority to oversee operations of letting agency legislation. This lead enforcement authority will provide and offer advice and information to the local authorities in conducting their duties to enforce the legislation.

How have tenants and landlords responded to the Tenant Fee Ban?

The general consensus thus far, as expected, has seen a wealth of mixed reactions. On one hand, those looking to or are currently renting as tenants have seen the move as extremely positive. For them, it means the upfront cost of renting is much cheaper. Given that the rental sector is the answer to many who can’t afford to jump on the homeownership ladder, the act has the power to increase the appeal of renting.

For landlords and letting agents however, the views aren’t as simple. The division somewhat lies between those who feel this is yet another targeted attack on landlords by the Government, whilst there are those who feel the act is a positive step to rid the sector of the rogue landlords and letting agents.

Many of my landlords who I’ve spoken to in preparing them for the forthcoming changes have been remarkably supportive. They have recognised the reasoning behind the implementation and have been happy with proposed amendments to our fees. This is mainly down the sheer advance notice we have given them regarding the act, as well as ensuring all our landlords are informed and kept compliant on a wealth of other legislation. It helps of course that all our landlords are kind-hearted and want the best for their tenants as well as their investments.

How should letting agents feel about the Tenant Fee Ban?

Any good letting agent like us understands that unscrupulous fees simply are not ethical. However, what many fail to understand is that letting agents are in the grand scheme of things, a business. Whilst the initial upfront charges do go somewhat towards business costs, they are designed to ensure that tenants are committed to the property they want to rent. This is opposed to allowing anyone and everyone to apply for a property and opening the door to time wasters; costing time and resources that simply cannot be afforded.

As a business and in order to survive, letting agents will be forced to recoup revenue from other areas. This includes our management fees, which in turn will cause landlords to raise rents in order to meet the cost of the service they are being delivered. This ultimately comes back to hitting the tenant’s pocket anyway, whilst likely proving to be more expensive in the long term than it is currently.

Why is the Tenant Fee Ban necessary?

As the industry is not regulated as such, the Government are using the opportunity to clamp down on the number of rogue landlords and letting agents that are immorally operating in the sector.

Despite the sheer number of hardworking, ethical and by-the-book landlords and letting agents, we will always be tarnished by those who charge obscene amounts of money for fees, take more than one application fee on a property and the landlords who offer sub-standard properties to live in. The fee ban is necessary to scupper their vile tactics and bring a blanket expectation across the industry.

Virtually every day a news publication platform in one area of the country or another will have reported on rogue landlords or letting agents. Whilst ethical, compliant and empathetic landlords and letting agents like ourselves will never feature in any of these (after all, the news outlets would never want a non-dramatised story on happy tenants), it paints a very murky photo of the industry and is one that needs to be corrected.

Is the Tenant Fee Ban a positive or negative move for the industry?

will boost the morale and hopes for prospective tenants, it will generate a large number of time wasters who will fail at the referencing stage.

We use a very thorough and external referencing company to guarantee our landlords the best tenants. By removing the referencing fee, anyone and everyone will see the ease of being able to apply for the property, even if they can’t meet certain criteria. Then when the reference comes back failed, it’s a quantity of time wasted that we can’t get back and a cost to us that we have to pay the reference company to conduct.

Thankfully the Government have allowed for the holding deposits to be paid in order to protect us from this.

The positive side as I’ve already mentioned is that this will hopefully eliminate all the unethical and non-compliant landlords and letting agents. They simply will not be able to continue as their stream of revenue for business costs will dry up, having survived only by securing extortionate fees.

Will the Tenant Fee Ban include renewal fees for existing tenants?

It will apply to renewals of tenancies, excluding statutory and contractual periodic tenancies that arise after the Tenant Fees Act comes into force.

After one year the ban will attach to pre-existing tenancies and clauses that charge fees in them will become ineffective. If a landlord or agent takes a prohibited payment after that date they will have 28 days to return it or be considered in breach of this legislation.

Who will the Tenant Fee Ban benefit and impact the cost?

Firstly, the biggest impact will land on the smaller letting agents who have not prepared for the ban. I’ve been surprised over recent months at the number of agents who haven’t made the significant leaps and bounds to ensure costs are accounted for and landlords made aware.

There will be some agents who face backlash from the landlords when they inform them of the increased fees, or whatever method they are deploying to counteract the impact of the ban. We’ve found that by being transparent and honest, as well as striving to deliver the best service we can, our landlords are openly accepting about the changes we’ve made thus far. Ultimately, we are delivering the service for a price they are happy to pay and will continue to do so.

Other solid and compliant letting agents will also find themselves coping well. The notion of acquiring some of these smaller agents to protect them whilst gathering new business also seems to be a sturdy method of succeeding in the wake of the ban.

Are there any similar rulings and laws coming into place soon that landlords need to be aware of?

My experience in lettings depicts that there is always something that landlords should be aware of. The other month upon distributing our monthly newsletter, I had several landlords phoning to enquire what I meant about landlords needing to be part of a redress scheme.

This is due to an article we put out regarding the Government outlining plans to introduce the Housing Complaints Resolution Service, whilst fining landlords £5,000 if they fail to sign up to a scheme, such as the Property Ombudsman or the Property Redress Scheme.

Whilst there is no set date yet, it’s something that landlords should certainly be looking at taking steps towards avoiding the inevitable fine for not signing up.

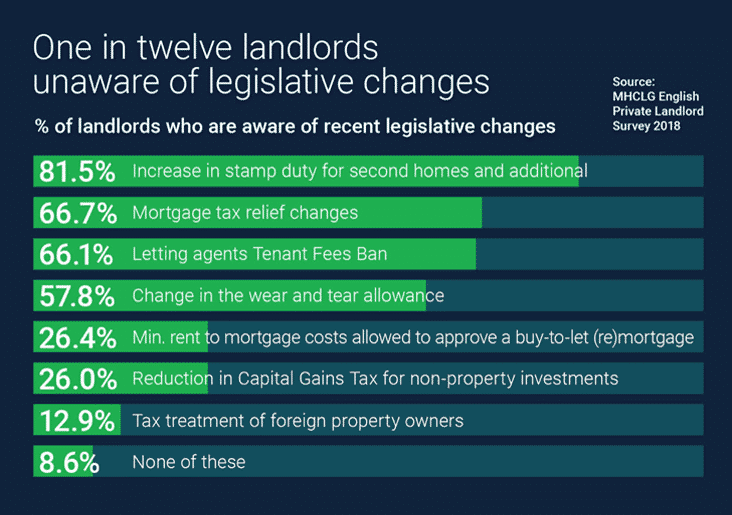

Recently there were figures released that show one in twelve landlords are actually unaware of changes to or new legislation entirely. The Tenant Fee Ban isn’t the only subject that some landlords are actually unaware of:

One thing I would certainly suggest, and hope landlords are aware of is being part of a CMP (client money protection scheme). All letting agents and property managers as of only recently are now required to be part of an approved CMP or they face fines for non-compliance.

Yet again another move by the Government fearing the rogue landlords who could run off with tenant’s money.

Who should I contact for help on rent guarantee insurance?

If you’re with a good letting agent, then they should be able to assist you further with this. At Abode we use Rent4sure, but there are a plethora of other companies out there that do this. The key is to ensure that not only are you getting the best service but also the best value. Companies such as Endsleigh, Homelet, Rentguard and PaymentShield are all ones that spring to mind, but you would certainly benefit from shopping around.