Where to Buy Property Investments in Derby: Yields of 5.9%

Derby's gross rental yields range from 3.4% to 5.9% across all 9 postcodes, with DE1 delivering the highest returns. Average sold prices sit 30.2% below the England average, and the city's population grew 5.1% to 261,364 between the 2011 and 2021 censuses.

Derby's average sold price of £204,622 positions it as one of the most affordable cities in the East Midlands for buy-to-let investors. That is 15.5% below the East Midlands regional average of £242,180, with asking prices starting from £173,482 in DE1. All 9 postcodes return rental and yield data, giving a complete picture of the city's investment landscape.

This guide covers all 9 Derby postcodes from DE1 to DE74 under the City of Derby unitary authority (ONS code E06000015). Derby is a city in the East Midlands region of England, situated on the River Derwent with strong transport links via the A38 and A50 corridors. Investors comparing options in the region may also consider Nottingham, Leicester, or Stoke-on-Trent. Browse all our Midlands location guides.

Article updated: February 2026

Derby Buy-to-Let Market Overview 2026

Derby offers entry prices well below the national and regional averages, backed by a manufacturing-led economy and a major city centre regeneration programme.

- Average sold price: £204,622 (30.2% below England's £293,131)

- Asking price range: £173,482 (DE1) to £348,212 (DE73)

- Rental yields: 3.4% (DE73, DE74) to 5.9% (DE1) across all 9 postcodes

- Rental income: Monthly rents from £834 (DE22) to £1,121 (DE72)

- Price per sq ft: Sold prices from £230/sq ft (DE23) to £299/sq ft (DE3)

- Market activity: Sales ranging from 12 per month (DE1) to 61 per month (DE21)

- Deposit requirements: 30% deposits range from £52,045 (DE1) to £104,463 (DE73)

- Affordability ratios: Property prices from 4.8 to 9.6 times Derby's median annual salary of £36,428

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Derby?

Derby's economy is built on advanced manufacturing. Rolls-Royce employs around 12,000 people at its civil aerospace headquarters on the southern edge of the city, making it the single largest private employer in the East Midlands. Toyota's vehicle plant at Burnaston, just outside the city boundary, employs around 3,000 more and supports a network of suppliers across the region. These are not seasonal or cyclical jobs. Aerospace engine programmes run over decades, and automotive production lines need full-time workforces year-round.

The University of Derby has around 17,000 students and has been expanding its campus footprint in the city centre. Student housing demand concentrates around DE1 and the Kedleston Road corridor in DE22, though the university's Markeaton Street campus also draws students into DE23. Healthcare employment adds another layer through Royal Derby Hospital, which sits in the Mickleover corridor and is one of the largest acute hospitals in the East Midlands.

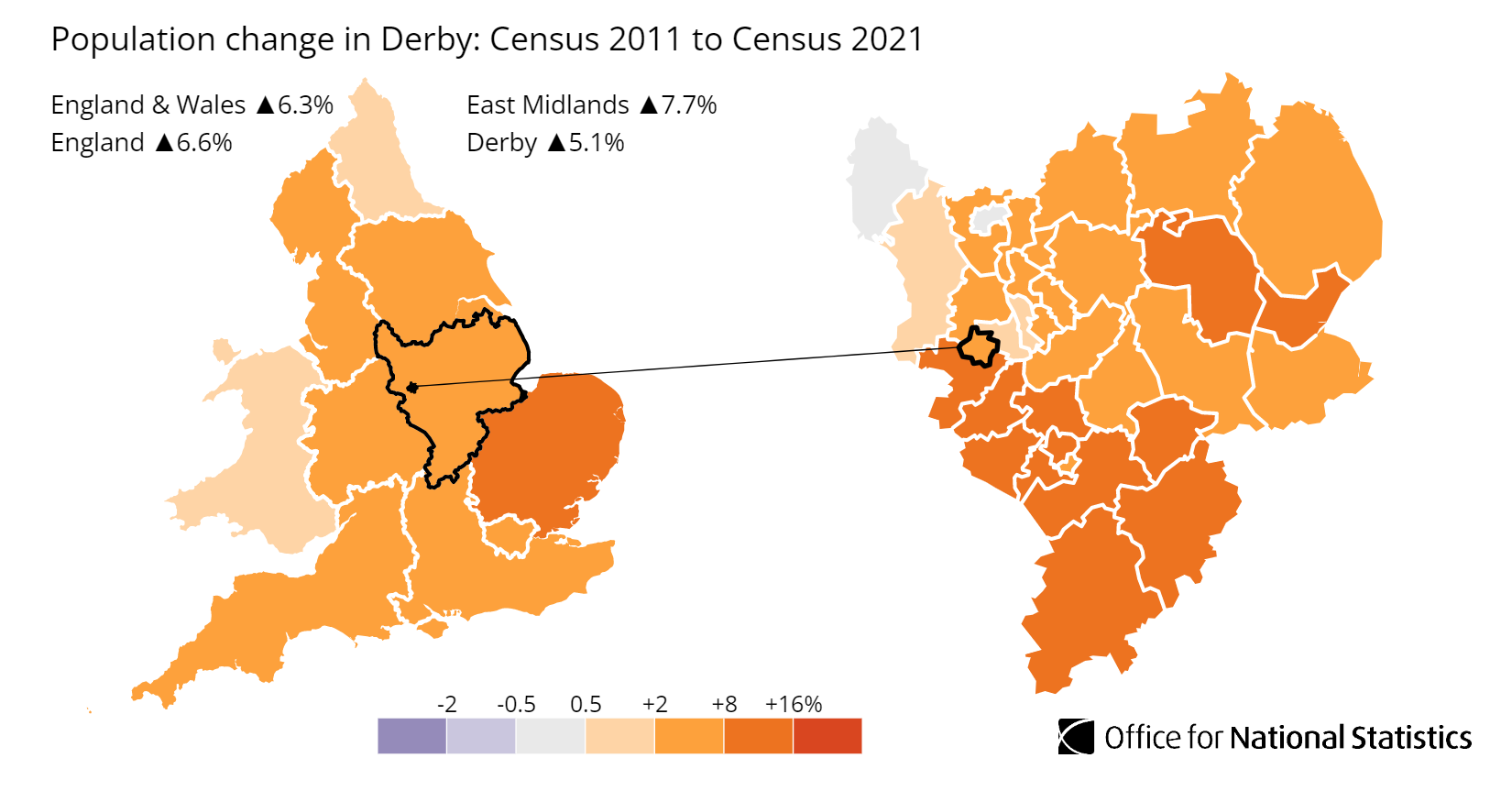

Between the 2011 and 2021 censuses, Derby's population grew from 248,752 to 261,364, a rise of 5.1%. That outpaces the East Midlands regional average and reflects both natural growth and inward migration linked to the manufacturing and logistics sectors. Derby's position on the A50 corridor also connects it to East Midlands Airport and the distribution hubs around Castle Donington in DE74.

Earnings in Derby sit close to the regional average. The median annual salary is £36,428, compared to £36,192 across the East Midlands and £39,125 for Great Britain. That combination of median earnings and below-average house prices creates a market where price-to-earnings ratios start from just 4.8x in DE1.

Derby Economic Summary

- Population: 261,364 (2021 Census). Growth of 5.1% from 2011.

- Median annual salary: £36,428 (Derby), £36,192 (East Midlands), £39,125 (Great Britain)

- Employment rate: 73.2% (Derby), 76.2% (East Midlands), 75.6% (Great Britain)

- Unemployment rate: 4.3% (Derby), 3.8% (East Midlands), 4.3% (Great Britain)

- Key employment sectors: Advanced manufacturing (Rolls-Royce, Toyota), healthcare, higher education, logistics, rail engineering

Source: ONS Census 2021, Nomis Labour Market Profile (ASHE 2025, Employment Oct 2024-Sep 2025)

Derby's employment rate of 73.2% sits below the East Midlands average of 76.2%. The unemployment rate of 4.3% matches the Great Britain average exactly. That combination reflects a city where workforce participation is slightly lower than the region, but those in employment have stable, skilled jobs. For buy-to-let investors, the quality of local employment matters as much as the quantity. Tenants on Rolls-Royce or Toyota contracts are about as reliable as it gets. Explore our property investment resources for broader UK market context.

Regeneration and Investment in Derby

Derby's city centre is in the middle of its most significant transformation in decades. Three major schemes are delivering new homes, commercial space, and cultural infrastructure within the DE1 postcode, directly supporting rental demand and property values in the city core.

- Becketwell (Phase 1 under construction, £200 million): St James Securities and Derby City Council are delivering 259 build-to-rent apartments funded by Grainger plc, a 3,500-capacity performance venue (now open as Vaillant Live), and a new public square. The venue is already generating an estimated £10 million annually for the local economy. Updates at Derby City Council.

- Castleward Urban Village (Phase 4 handovers from Q1 2026, £100 million): A 15-20 year placemaking scheme between Derbion shopping centre and Derby Midland station, delivering 700+ homes with a tree-lined boulevard and primary school already in place. Lovell and Placefirst have a £22 million partnership for serviced rental homes in the development. Updates at Derby City Council.

- Friar Gate Goods Yard (Under construction, £80 million): Wavensmere Homes is converting an 11.5-acre brownfield site that has been derelict since 1967 into 276 new homes and 111,275 sq ft of commercial space within two Grade II listed Victorian buildings. The first 31 houses are due for occupation in Q2 2026, with full completion by 2028. Updates at Wavensmere Homes.

Derby Property Market Analysis

When was the last house price crash in Derby?

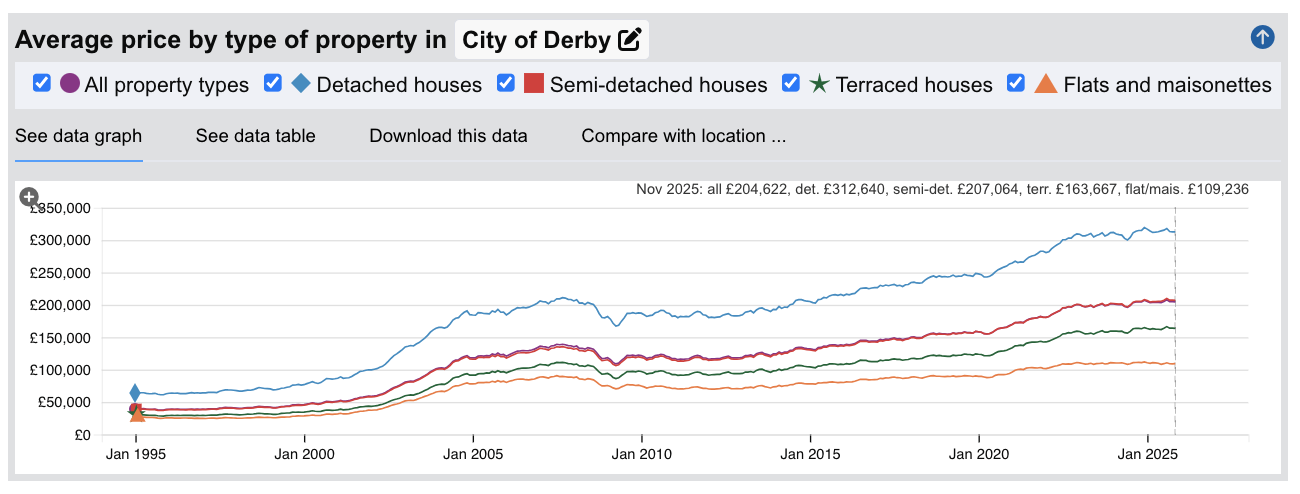

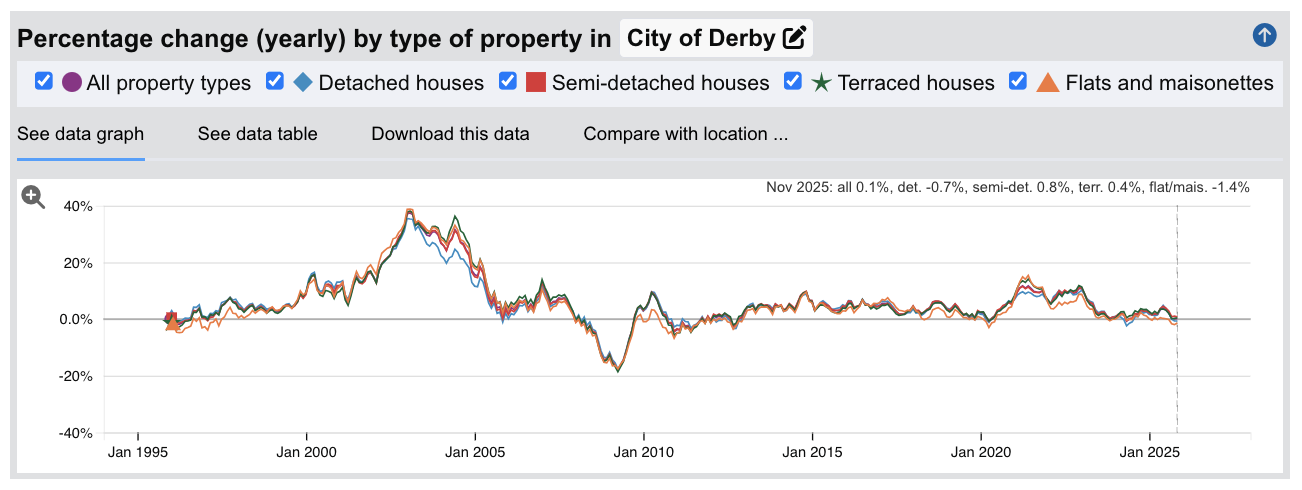

Derby's full house price history from the HM Land Registry House Price Index runs from January 1995 to November 2025. The average sold price has risen from £38,898 to £204,622, a total increase of 426%. That three-decade growth has not been a straight line. Derby has experienced two sustained downturns, one brief dip, and several periods of flat growth.

- 1995-2007 (The Long Boom): Prices rose from £38,898 to a pre-crash peak of £139,094 in September 2007. That is a 257% increase over 12 years, driven by cheap credit, buy-to-let mortgage expansion, and rising employment in the manufacturing and service sectors.

- 2008-2009 (The Financial Crisis): Derby's average price fell from £139,094 (September 2007) to £108,810 (April 2009), a decline of 21.8%. The worst annual change reading hit -18.1% in April 2009. Derby's crash was deeper than the East Midlands regional decline of 18.6% (£153,623 to £125,062) and comparable to England's 18.2% drop (£183,883 to £150,438). The steepest monthly declines came in late 2008, when annual change readings reached -14.5% in November 2008.

- 2010-2012 (Stagnation): Prices bounced off the 2009 trough but could not sustain momentum. Annual change turned negative again from October 2010 through to October 2012, with readings ranging from -0.1% to -4.5%. By December 2012, the average price sat at £118,242, still 15.0% below the 2007 peak.

- 2013-2015 (Slow Recovery): Positive annual growth returned in January 2013 and held through 2015, but prices remained below the pre-crash peak. By December 2015 the average had reached £135,770, still £3,324 short of the September 2007 figure.

- 2016 (Recovery): Derby prices finally passed the 2007 peak in May 2016 at £139,985. The recovery took eight years and eight months from peak to peak, during which the average price spent nearly every month below its September 2007 level.

- 2017-2019 (Steady Growth): Prices continued climbing steadily, reaching £163,025 by December 2019. Annual growth was consistent but unspectacular, typically between 2% and 5%.

- 2020-2022 (Pandemic Surge): Stamp duty holiday demand and the shift to hybrid working pushed prices sharply higher. The average rose from £158,287 (January 2020) to £200,238 (March 2024), with the fastest annual growth hitting 13.3% in mid-2021. Derby briefly dipped into negative territory in April 2020 (-1.0%) before the stimulus took effect.

- 2023 (Rate Shock): Higher mortgage rates slowed momentum. Annual growth turned briefly negative in May 2024 at -0.8%, the first negative reading since April 2020.

- 2024-2025 (Current): Growth returned in the second half of 2024 and has been stable through 2025. The November 2025 reading stands at £204,622 with annual growth of 0.1%. Derby has been gaining steadily, with mid-2025 readings touching 3.9% annual growth (June 2025).

Long-term growth summary:

- 5 years (2020-2025): 23.5% growth (£165,630 to £204,622)

- 10 years (2015-2025): 49.1% growth (£137,235 to £204,622)

- 15 years (2010-2025): 71.4% growth (£119,391 to £204,622)

- 20 years (2005-2025): 66.8% growth (£122,678 to £204,622)

- 30 years (1995-2025): 446.4% growth (£37,452 to £204,622)

The 20-year figure being lower than the 15-year figure is a direct result of when you measure from. November 2005 prices (£122,678) were already inflated by the late-stage boom, while November 2010 prices (£119,391) sat in the post-crash trough. Timing matters. An investor who bought at the 2007 peak waited eight years and eight months just to break even. An investor who bought at the 2009 trough has seen 88.1% growth to date.

The 2008 crash is the reference point for Derby investors assessing downside risk. A 21.8% decline took eight years and eight months to recover. Derby's structural position today is different from 2007. The Becketwell and Castleward regeneration schemes are bringing new housing stock and commercial investment into the city centre for the first time in decades. Rolls-Royce's civil aerospace programmes are funded on multi-decade contracts, and Toyota's Burnaston plant continues to attract supply chain investment. The risk profile has changed, even if property prices are never guaranteed.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Derby

The average sold price in Derby is £204,622, which is 30.2% below the England average of £293,131. That discount holds across every property type, with flats showing the largest gap and detached houses the smallest. The table below uses Land Registry data from November 2025.

| Property Type | Derby Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £312,640 | £474,400 | -34.1% |

| Semi-detached houses | £207,064 | £290,004 | -28.6% |

| Terraced houses | £163,667 | £245,002 | -33.2% |

| Flats and maisonettes | £109,236 | £221,565 | -50.7% |

| All property types | £204,622 | £293,131 | -30.2% |

Detached houses in Derby average £312,640, a 34.1% discount to the England figure of £474,400. Derby's detached stock is concentrated in the outer postcodes (DE3 Mickleover, DE72 Borrowash, DE73 Chellaston), where suburban estates and period properties push the average well above the city-wide figure.

Semi-detached houses at £207,064 sit 28.6% below England's £290,004. This is the closest property type to the national average in percentage terms, reflecting Derby's large stock of interwar and 1950s-1970s semis across postcodes like DE21, DE23, and DE24.

Terraced houses average £163,667, a 33.2% discount. Derby's terraced stock spans Victorian terraces near the city centre in DE1 and DE23 (Normanton) through to newer-build terraces in the outer areas. Normanton's terraced streets are a well-established buy-to-let area with strong tenant demand from the adjacent hospital and university.

Flats and maisonettes at £109,236 show the largest discount at 50.7% below England's £221,565. Derby's flat market is small compared to its house stock. Most flats are concentrated in DE1 (city centre apartments and conversions) with limited stock in the outer postcodes. The England average is heavily skewed by London and the South East, so this 50.7% gap is common for Midlands cities.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Price Per Square Foot in Derby

Floor space in Derby costs between £230 and £299 per square foot, a spread of £69 across all 9 postcodes. These figures come from PropertyData's transaction-based sold price analysis, not listing estimates. They show what buyers have actually paid per square foot of floor space across each postcode.

| Rank | Area | Price Per Sq Ft |

|---|---|---|

| 1 | DE23 (Littleover, Sunny Hill, Normanton) | £230 |

| 2 | DE24 (Alvaston, Sinfin, Shelton Lock) | £241 |

| 3 | DE1 (City Centre) | £243 |

| 4 | DE22 (Allestree, Mackworth, Darley Abbey) | £257 |

| 5 | DE21 (Chaddesden, Oakwood, Spondon) | £259 |

| 6 | DE74 (Castle Donington, Kegworth) | £284 |

| 7 | DE72 (Borrowash, Ockbrook) | £288 |

| 8 | DE73 (Chellaston, Melbourne) | £295 |

| 9 | DE3 (Mickleover) | £299 |

DE23 (Littleover, Sunny Hill, Normanton) at £230 per square foot is the cheapest area by floor space cost. Normanton's dense terraced housing and higher proportion of HMO conversions bring the average down. For yield-focused investors, lower cost per square foot combined with reasonable rents can improve the return per pound spent. DE1 at £243 per square foot also sits at the affordable end, driven by the city centre flat stock that trades at a lower rate than suburban houses.

DE3 (Mickleover) commands the highest price per square foot at £299. Mickleover is a popular suburban area with good schools and a village character, which pushes a premium on space. DE73 (Chellaston, Melbourne) follows closely at £295, reflecting a similar suburban family market.

For Sale Asking Prices in Derby

Sellers in Derby are listing properties between £173,482 in DE1 and £348,212 in DE73, a spread of £174,730. The mean asking price across all 9 postcodes is £276,761. These are PropertyData's current asking price averages, which reflect what sellers are listing at rather than what properties sell for.

| Rank | Area | Asking Price |

|---|---|---|

| 1 | DE73 (Chellaston, Melbourne) | £348,212 |

| 2 | DE72 (Borrowash, Ockbrook) | £338,705 |

| 3 | DE74 (Castle Donington, Kegworth) | £332,109 |

| 4 | DE3 (Mickleover) | £308,389 |

| 5 | DE22 (Allestree, Mackworth, Darley Abbey) | £267,263 |

| 6 | DE23 (Littleover, Sunny Hill, Normanton) | £266,598 |

| 7 | DE21 (Chaddesden, Oakwood, Spondon) | £241,654 |

| 8 | DE24 (Alvaston, Sinfin, Shelton Lock) | £214,439 |

| 9 | DE1 (City Centre) | £173,482 |

DE73 (Chellaston, Melbourne) tops the asking price table at £348,212. This is a premium residential area south of the city with large detached homes and good road links to the A50. Melbourne adds period village properties that command higher prices. Investors here are buying into a lower-yield, capital-growth profile.

DE1 (City Centre) at £173,482 is the most affordable entry point in Derby. The city centre's asking price is 50.2% below the most expensive postcode (DE73) and sits well below the Derby mean of £276,761. That low entry price is the primary driver behind DE1's top yield of 5.9%. The regeneration schemes at Becketwell, Castleward, and Friar Gate Goods Yard are all within the DE1 boundary, which means new-build supply is increasing and the character of the stock is shifting from dated conversions toward purpose-built apartments. Browse our current investment property listings for available stock near Derby.

House Price Growth in Derby

Seven of Derby's 9 postcodes have delivered double-digit asking price growth over five years, led by DE22 at 30.4%. DE1 sits at the bottom of the table with 5.8%. One-year figures are more mixed, with three postcodes showing negative annual growth. The table below ranks all 9 Derby postcodes by 5-year growth.

| Area | 1 Year | 3 Years | 5 Years |

|---|---|---|---|

| DE22 (Allestree, Mackworth, Darley Abbey) | 7.2% | 14.2% | 30.4% |

| DE24 (Alvaston, Sinfin, Shelton Lock) | -4.6% | 6.1% | 27.7% |

| DE74 (Castle Donington, Kegworth) | -0.4% | -5.6% | 19.5% |

| DE3 (Mickleover) | 1.3% | 2.7% | 18.0% |

| DE21 (Chaddesden, Oakwood, Spondon) | 3.8% | 4.0% | 17.1% |

| DE73 (Chellaston, Melbourne) | 0.0% | 0.8% | 13.2% |

| DE23 (Littleover, Sunny Hill, Normanton) | 3.5% | 0.8% | 11.9% |

| DE72 (Borrowash, Ockbrook) | 0.6% | -4.7% | 9.8% |

| DE1 (City Centre) | -1.2% | -7.3% | 5.8% |

DE22 (Allestree, Mackworth, Darley Abbey) leads with 30.4% growth over five years and 7.2% over one year. This is the standout growth postcode in Derby. Allestree is a premium residential area with good schools and proximity to both the university and the A38, and Mackworth has seen new-build development. The combination of strong fundamentals and limited new supply has driven prices upward consistently.

DE1 (City Centre) has delivered the weakest growth at 5.8% over five years, with a -1.2% one-year reading and -7.3% over three years. The high volume of regeneration-driven new-build supply coming into DE1 is likely exerting downward pressure on existing stock values. For yield-focused investors, that flat price trajectory is offset by the 5.9% yield. For growth-focused investors, DE22 and DE24 present a different profile entirely.

Monthly Property Sales in Derby

Derby sees a combined average of 298 property sales per month across all 9 postcodes, with individual postcode volumes ranging from 12 in DE1 to 61 in DE21. Turnover rates vary widely, from 12% in DE1 to 136% in DE21. Higher turnover generally signals more liquid markets where properties sell and re-let faster.

| Area | Sales Per Month | Turnover | Asking Price |

|---|---|---|---|

| DE21 (Chaddesden, Oakwood, Spondon) | 61 | 136% | £241,654 |

| DE24 (Alvaston, Sinfin, Shelton Lock) | 55 | 124% | £214,439 |

| DE22 (Allestree, Mackworth, Darley Abbey) | 47 | 59% | £267,263 |

| DE23 (Littleover, Sunny Hill, Normanton) | 41 | 84% | £266,598 |

| DE3 (Mickleover) | 26 | 94% | £308,389 |

| DE73 (Chellaston, Melbourne) | 22 | 68% | £348,212 |

| DE72 (Borrowash, Ockbrook) | 19 | 112% | £338,705 |

| DE74 (Castle Donington, Kegworth) | 15 | 44% | £332,109 |

| DE1 (City Centre) | 12 | 12% | £173,482 |

DE21 (Chaddesden, Oakwood, Spondon) is the most active market in Derby with 61 sales per month and 136% turnover. The high turnover rate reflects a diverse housing stock across three distinct areas, from affordable terraces in Chaddesden to family homes in Oakwood and Spondon. Investors buying here benefit from a liquid market with strong exit options.

DE1 (City Centre) records just 12 sales per month with 12% turnover. That low volume is partly a function of stock type. City centre properties are disproportionately flats and apartments, and the new-build pipeline at Becketwell and Castleward has not yet fully entered the resale market. DE74 (Castle Donington, Kegworth) also shows lower activity at 15 sales per month and 44% turnover, consistent with a semi-rural postcode further from the city core.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Derby Rental Market Analysis

For investors weighing up whether if rental property is a good investment in Derby, the data below breaks down average monthly rents and gross rental yields across the city's postcodes.

Rental data is available for all 9 Derby postcodes, with monthly rents ranging from £834 to £1,121 and gross yields from 3.4% to 5.9%. If you are looking to build a new property company in the East Midlands, Derby's combination of affordable prices and complete rental data coverage makes it straightforward to model returns across the entire city.

Average Rent & Gross Rental Yields in Derby

Gross rental yields in Derby range from 3.4% in DE73 and DE74 to 5.9% in DE1, with a clear split between the affordable city centre and the premium outer postcodes. All 9 postcodes return rental data, and the table below ranks them by yield.

| Area | Monthly Rent | Asking Price | Gross Yield |

|---|---|---|---|

| DE1 (City Centre) | £854 | £173,482 | 5.9% |

| DE24 (Alvaston, Sinfin, Shelton Lock) | £849 | £214,439 | 4.8% |

| DE21 (Chaddesden, Oakwood, Spondon) | £951 | £241,654 | 4.7% |

| DE3 (Mickleover) | £1,108 | £308,389 | 4.3% |

| DE72 (Borrowash, Ockbrook) | £1,121 | £338,705 | 4.0% |

| DE23 (Littleover, Sunny Hill, Normanton) | £858 | £266,598 | 3.9% |

| DE22 (Allestree, Mackworth, Darley Abbey) | £834 | £267,263 | 3.7% |

| DE73 (Chellaston, Melbourne) | £995 | £348,212 | 3.4% |

| DE74 (Castle Donington, Kegworth) | £945 | £332,109 | 3.4% |

DE1 (City Centre) delivers the highest gross yield at 5.9%, driven by the lowest asking price in Derby (£173,482) rather than the highest rent. Monthly rent in DE1 is £854, which is mid-range for the city. The yield is a function of low entry cost. That is the classic city centre dynamic: affordable flats and student-adjacent properties producing strong percentage returns on a smaller capital outlay.

DE72 (Borrowash, Ockbrook) commands the highest monthly rent at £1,121, but its asking price of £338,705 brings the yield down to 4.0%. DE3 (Mickleover) at £1,108 per month is close behind on rent but yields 4.3% thanks to a slightly lower asking price. The outer postcodes collect more rent in absolute terms but require significantly more capital. A £1,121 rent on a £338,705 investment versus an £854 rent on a £173,482 investment tells two very different stories.

Is Derby Rent High?

Annual rent as a percentage of the local median salary ranges from 27.5% in DE22 to 36.9% in DE72. This measures how much of a Derby resident's gross income would go toward renting in each postcode. Higher percentages indicate areas where rent takes a larger share of earnings, which can signal either strong rental demand or constrained supply.

The median gross weekly salary in Derby is £700.50, which equates to £3,036 per month or £36,428 per year. This is marginally above the East Midlands regional median of £696.00 per week and below the Great Britain median of £752.40 per week. Data from the Nomis Labour Market Profile (ASHE 2025).

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | DE72 (Borrowash, Ockbrook) | 36.9% |

| 2 | DE3 (Mickleover) | 36.5% |

| 3 | DE73 (Chellaston, Melbourne) | 32.8% |

| 4 | DE21 (Chaddesden, Oakwood, Spondon) | 31.3% |

| 5 | DE74 (Castle Donington, Kegworth) | 31.1% |

| 6 | DE23 (Littleover, Sunny Hill, Normanton) | 28.3% |

| 7 | DE1 (City Centre) | 28.1% |

| 8 | DE24 (Alvaston, Sinfin, Shelton Lock) | 28.0% |

| 9 | DE22 (Allestree, Mackworth, Darley Abbey) | 27.5% |

DE72 (Borrowash, Ockbrook) and DE3 (Mickleover) top the affordability pressure table at 36.9% and 36.5% of income respectively. These are both premium suburban areas where rents are the highest in Derby. Tenants renting here are typically dual-income households or professionals willing to pay more for the school catchments and village feel.

DE22 (Allestree, Mackworth, Darley Abbey) at 27.5% is the most affordable rental area relative to local earnings. Allestree is one of Derby's most sought-after suburbs, but its lower rents (£834 per month, the cheapest in the city) combined with the median salary mean the affordability ratio stays manageable. DE1, DE24, and DE23 cluster together around 28%, forming an affordable band in the city's inner postcodes.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are House Prices High in Derby? Price-to-Earnings Ratios

Purchasing a property in Derby requires between 4.8 and 9.6 times the median annual salary. This is based on the Nomis Labour Market Profile for Derby showing the median gross annual income for Derby residents is £36,428.

For context, the England benchmark is 7.5x (England average price of £293,131 divided by the Great Britain median salary of £39,125). The East Midlands regional benchmark is 6.7x (£242,180 / £36,192). Derby's range of 4.8x to 9.6x straddles both benchmarks, with 5 of 9 postcodes sitting below the national figure.

| Rank | Area | Price-to-Earnings Ratio |

|---|---|---|

| 1 | DE1 (City Centre) | 4.8x |

| 2 | DE24 (Alvaston, Sinfin, Shelton Lock) | 5.9x |

| 3 | DE21 (Chaddesden, Oakwood, Spondon) | 6.6x |

| 4 | DE22 (Allestree, Mackworth, Darley Abbey) | 7.3x |

| 5 | DE23 (Littleover, Sunny Hill, Normanton) | 7.3x |

| 6 | DE3 (Mickleover) | 8.5x |

| 7 | DE74 (Castle Donington, Kegworth) | 9.1x |

| 8 | DE72 (Borrowash, Ockbrook) | 9.3x |

| 9 | DE73 (Chellaston, Melbourne) | 9.6x |

DE1 (City Centre) at 4.8x is among the most affordable price-to-earnings ratios of any East Midlands postcode. An asking price of £173,482 against a local median salary of £36,428 means property here costs less than five years' gross income. That is well below the England benchmark of 7.5x and the East Midlands 6.7x.

DE73 (Chellaston, Melbourne) at 9.6x sits at the other end of the scale. At nearly ten times the local median salary, this postcode is priced above both the national and regional benchmarks. The premium reflects the family-oriented housing stock and village character that attracts owner-occupiers rather than yield-driven investors. DE72 (Borrowash, Ockbrook) at 9.3x shows a similar profile. Read these alongside the full breakdown of buy-to-let costs to understand total investment requirements.

Deposit Requirements in Derby

A 30% buy-to-let deposit in Derby ranges from £52,045 in DE1 to £104,463 in DE73. Most buy-to-let lenders require a minimum 25% deposit, but 30% is the standard assumption used across this guide to reflect typical lending practice and secure more competitive mortgage rates. Use our stamp duty calculator to estimate the full upfront cost including tax.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | DE1 (City Centre) | £52,045 |

| 2 | DE24 (Alvaston, Sinfin, Shelton Lock) | £64,332 |

| 3 | DE21 (Chaddesden, Oakwood, Spondon) | £72,496 |

| 4 | DE23 (Littleover, Sunny Hill, Normanton) | £79,979 |

| 5 | DE22 (Allestree, Mackworth, Darley Abbey) | £80,179 |

| 6 | DE3 (Mickleover) | £92,517 |

| 7 | DE74 (Castle Donington, Kegworth) | £99,633 |

| 8 | DE72 (Borrowash, Ockbrook) | £101,612 |

| 9 | DE73 (Chellaston, Melbourne) | £104,463 |

The £52,045 entry deposit in DE1 is one of the lowest in the East Midlands region. Combined with the 5.9% gross yield, the city centre offers the most accessible starting point for investors with limited capital. Three Derby postcodes (DE1, DE24, DE21) require deposits under £75,000, representing the more affordable inner-city and suburban areas.

The four postcodes above £90,000 (DE3, DE74, DE72, DE73) are all outer suburban or semi-rural areas where larger detached and family homes push average prices higher. The deposit spread of £52,418 between cheapest and most expensive postcodes shows there is genuine choice across the investment spectrum in Derby.

What the Derby Data Tells Buy-to-Let Investors

DE1 (City Centre) tops the yield table at 5.9% with the lowest asking price (£173,482) and lowest deposit requirement (£52,045) in Derby. The tenant pool here draws from university students, young professionals, and workers drawn to the city centre regeneration. DE24 (Alvaston, Sinfin, Shelton Lock) at 4.8% yield offers a similar affordable profile with higher sales volume (55 per month vs 12 in DE1), giving investors a more liquid market for both purchase and exit.

DE22 (Allestree, Mackworth, Darley Abbey) has delivered the strongest growth in Derby at 30.4% over five years, alongside 7.2% over one year. DE24 follows at 27.7% over five years, though its one-year reading has pulled back to -4.6%. For investors targeting capital growth alongside income, DE22 combines 3.7% yield with top-tier price appreciation. DE21 (Chaddesden, Oakwood, Spondon) offers a middle ground with 4.7% yield, 17.1% five-year growth, and the highest transaction volume in the city at 61 sales per month.

DE1 shows negative three-year growth of -7.3% and weak five-year growth of 5.8%. DE74 (Castle Donington, Kegworth) has negative readings at both one-year (-0.4%) and three-year (-5.6%) despite 19.5% over five years. DE72 (Borrowash, Ockbrook) also shows a -4.7% three-year figure. These postcodes have higher asking prices but flatter recent trajectories. DE74's lower sales volume (15 per month) and 44% turnover rate also indicate a slower-moving market. The data shows contrasting outcomes depending on whether an investor's primary objective is immediate income or longer-term growth.

Derby City Council operates a selective licensing scheme in parts of the city. Landlords in designated areas need a property licence to let residential properties. Check the current licensing boundaries before purchasing.

How Derby Compares

Derby's mean asking price of £276,761 sits between Nottingham (£244,881) and Leicester (£294,580) among nearby East Midlands cities. The table below compares Derby with four locations that investors in the region frequently consider side by side. All figures use the same PropertyData dataset from February 2026.

| Location | Mean Asking Price | Mean Monthly Rent | Top Gross Yield |

|---|---|---|---|

| Nottingham | £244,881 | £1,089 | 9.2% |

| Stoke-on-Trent | £246,714 | £833 | 6.6% |

| Derby | £276,761 | £946 | 5.9% |

| Leicester | £294,580 | £1,041 | 7.3% |

| Wolverhampton | £253,780 | £849 | 6.5% |

Derby's top yield of 5.9% is the lowest of the five cities in this comparison. Nottingham leads at 9.2%, reflecting a large student population and lower entry prices in postcodes like NG7. Leicester at 7.3% and Stoke-on-Trent at 6.6% both outperform Derby on headline yield. Where Derby differs is in the quality of its employment base. Rolls-Royce and Toyota provide the kind of long-term, skilled employment that supports consistent tenant demand and stable rental income. For a full analysis of each city, see our guides to Nottingham, Leicester, Stoke-on-Trent, and Wolverhampton.

Frequently Asked Questions

What are the different areas of Derby?

Derby's 9 postcodes split broadly into three zones. The city centre (DE1) and inner ring (DE21, DE22, DE23, DE24) cover the urban core and traditional residential suburbs. Allestree and Littleover (DE22, DE23) are popular with families, while Chaddesden and Alvaston (DE21, DE24) offer more affordable housing stock with higher sales volumes.

The outer postcodes (DE3, DE72, DE73, DE74) include village-feel areas like Mickleover, Borrowash, and Chellaston, where larger properties command higher prices but lower yields. Castle Donington in DE74 sits furthest from the city, closer to East Midlands Airport and the logistics corridor.

What are the best places to live in Derby?

Allestree (DE22) is consistently rated as one of Derby's most desirable residential areas, with good schools, proximity to Allestree Park, and a village high street. Mickleover (DE3) offers a similar suburban character with newer housing estates. Darley Abbey (DE22) is a conservation area along the River Derwent with a mix of period and modern homes.

For city centre living, the Becketwell and Castleward regeneration zones in DE1 are delivering new apartment stock. The answer depends on priorities. Allestree scores on lifestyle. Chaddesden and Alvaston score on affordability and rental returns.

What are the areas of Derby?

Derby's postcode districts cover distinct neighbourhoods: DE1 is the city centre. DE21 takes in Chaddesden, Oakwood, and Spondon to the east. DE22 covers Allestree, Mackworth, and Darley Abbey to the north and west. DE23 includes Littleover, Sunny Hill, and Normanton to the south of the centre. DE24 spans Alvaston, Sinfin, and Shelton Lock in the south-east. DE3 is Mickleover. DE72 covers Borrowash and Ockbrook. DE73 includes Chellaston and Melbourne. DE74 takes in Castle Donington and Kegworth, the furthest postcode from the city centre.

What is the average rent in Derby?

The mean monthly rent across all 9 Derby postcodes is £946. Individual postcodes range from £834 per month in DE22 (Allestree, Mackworth, Darley Abbey) to £1,121 in DE72 (Borrowash, Ockbrook). City centre rents in DE1 average £854 per month. The outer suburban postcodes generally command higher absolute rents (£995 to £1,121) but deliver lower gross yields (3.4% to 4.3%) because of their higher property prices. All rental data comes from PropertyData and reflects current asking rents across available listings.

How does Derby compare to Nottingham for property investment?

Nottingham offers higher headline yields (up to 9.2% vs Derby's 5.9%) and lower mean asking prices (£244,881 vs £276,761). Nottingham's student population is significantly larger, which concentrates rental demand in postcodes like NG7 and NG1. Derby's advantage is in employment quality. Rolls-Royce and Toyota provide long-term, high-skilled jobs that create stable tenant demand from professionals rather than students.

Derby's sold prices are also higher (£204,622 vs £193,879 on Land Registry data), which partly explains the yield gap. Investors focused on income alone may favour Nottingham. Those prioritising tenant quality and economic stability may find Derby's data more compelling. See our best buy-to-let locations guide for a broader UK comparison.

Does Derby have a university?

The University of Derby has around 17,000 students across campuses in the city centre and at Kedleston Road. The university has been expanding its city centre presence, which supports rental demand in DE1 and parts of DE22. Student accommodation demand is supplemented by Buxton campus students who commute or seek Derby-based housing. The student market in Derby is smaller than Nottingham or Leicester, but it provides a consistent base of tenants for lower-value city centre properties. For more on this sector, see our guide to purpose-built student accommodation.