The Ultimate Property Investment Checklist

Since starting my property career in 2005, I've been on quite the journey. Over the years, I've fine-tuned my approach to sourcing properties, not just for myself, but for my clients and our property sourcing company too. This experience led me to create something I wish I'd had when I was just starting out – a comprehensive Property Investment Checklist.

This isn't just any checklist; it's a distillation of years of hands-on experience and lessons learned. Today, it serves as the cornerstone investment criteria for every property strategy and property deal I consider, whether it's for my own real estate portfolio or for my clients.

This checklist isn't just theory – it's a practical tool you can start using right away to analyse your current or upcoming property deals. Think of it as your property investment cheatsheet, designed to help you avoid common pitfalls and make informed decisions when carrying out due diligence on your investment properties.

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Investor Checklist

Choosing the correct criteria can make the difference between the success or failure of your real estate portfolio.

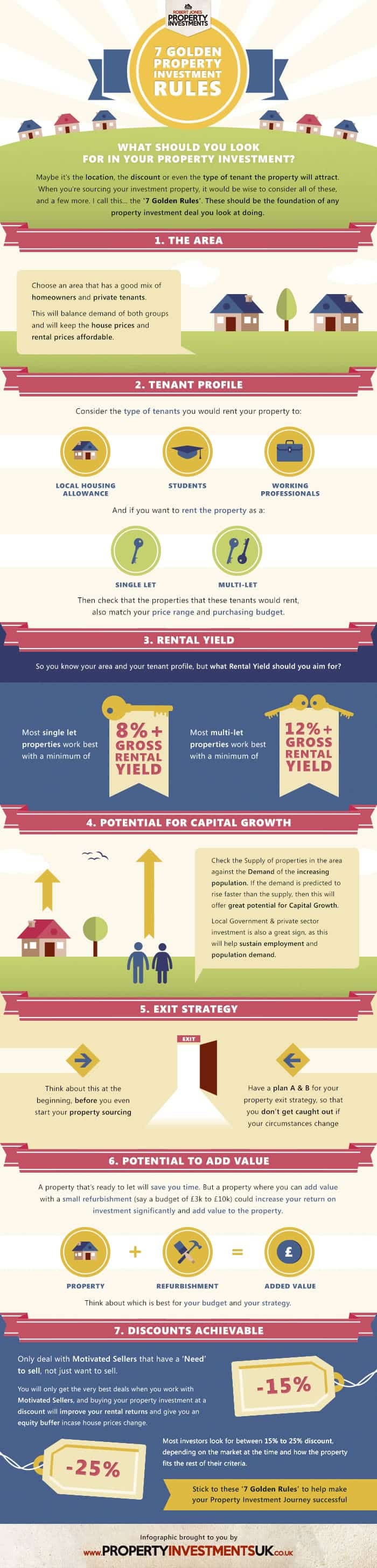

So what should your investment criteria include? Maybe it's the location, the discount or even the type of tenant the property will attract. When selecting your investment property, consider all of these, and a few more.

We call this checklist our 7 golden rules.

These should be the foundation of any property investment you consider.

1. The Area

Choose an area that has a good mix of homeowners and private tenants. This will balance the demand of both groups and help maintain property values.

You are aiming for a good blend of local amenities, shops, transport links and schools, whilst trying to keep rental prices affordable.

Go deep with your location research and check out the data for yields, house price growth, buyer demand, tenant demand. Make sure you know how each location you are considering compares to one an other. Here is an example of the type of data you can consider with a guide on buy-to-let in Newcastle as an example.

2. Tenant Profile

Consider the type of tenants who would be looking to rent properties in this area. Is the location a better fit for local housing allowance tenants, students, working professionals or corporate short term stays.

Some locations and properties are also better-suited tenancies to individuals, couples and families. Whilst others are best for multi-let (also known as houses of multiple occupation).

3. Rental Yield

So now you know your area and tenant profile. How about rental yield? What is a good gross rental yield or net rental yield that you should aim for?

As a guide, when you consider the cost of running and maintaining a buy-to-let, it is important to have a solid rental yield. In locations with higher asset values, this can lead to a reduced yield. If your yield is to low, it will be hard to cover your running costs.

As a guide, most property investors aim to achieve a minimum of 8%+ gross rental yield for a single let and 12%+ gross rental yield for a house of multiple occupation. When considering buying a holiday let or serviced accommodation, yields really vary as occupancy levels can fluctuate widely from cities to seaside resorts. A gross rental yield of 20%+ for a holiday let can be a good target.

4. Potential For Capital Growth

What is Capital Growth? This is the potential for the property to increase in value during your ownership.

This can come with simply buying and holding and growth happening over time as house prices increase. Or it can come with forced appreciation by adding value with refurbishments or planning gain.

In addition, simple steps like checking buyer demand and the supply of properties in the area can help you focus on areas with potential.

Additional tips can be to look for areas of regeneration to transport links and government infrastructure. Or where there is a high employment rate to population ratio to ensure consistent demand and increasing affordability.

5. Exit Strategy

This is one thing many property investors and even property developers get wrong. They think about the exit plan too late. A key tip is to think about your exit, at the beginning of your property search. Before you even view or purchase your property investment.

Make sure to have a plan A & B for your property exit strategy. In case your circumstances change.

6. Potential To Add Value

A property that's ready to let out straight away can save you a significant amount of time. However, a property where you can add value with even a small refurbishment could significantly increase your return on investment.

Think about what is best for your budget and your personal goals, to help define your strategy.

7. Discounts Achievable

No property investor checklist is complete without considering the price of your purchase.

Whether you are buying one property or building a portfolio. Overpaying by even a small amount can significantly impact your return on investment.

Tip number 7 is to only deal with motivated sellers. Sellers that have a 'need' to sell, not just 'want' to sell.

To get the very best deals, work with motivated sellers.