Where to Buy Property Investments in Newcastle: Yields of 10%

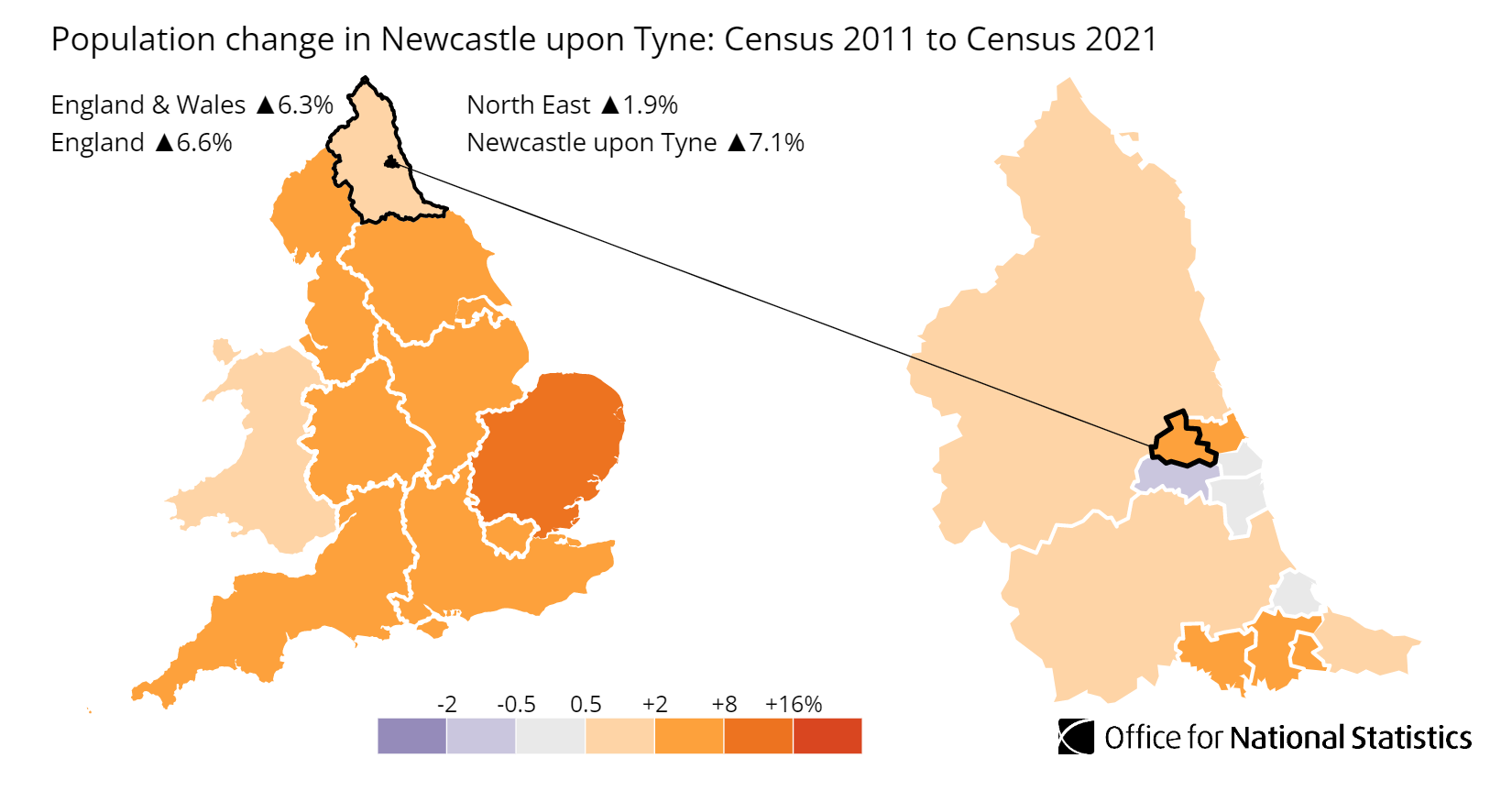

Newcastle's gross rental yields range from 4.9% to 10.0% across postcodes with rental data, with NE6 Walker and Byker delivering the highest returns. Average sold prices sit 29.9% below the England average, and the city's population grew 7.1% to 300,125 between the 2011 and 2021 censuses.

Newcastle's average sold price of £205,341 positions it as one of the most affordable major cities in England for buy-to-let investors. That is 23.3% above the North East regional average, reflecting Newcastle's status as the region's economic centre. Asking prices start from £147,557 in NE1 City Centre, and rental data is available for 9 of the city's 11 postcodes.

This guide covers all 11 Newcastle postcodes from NE1 to NE20 under the Newcastle upon Tyne metropolitan borough (ONS code E08000021). Newcastle sits on the north bank of the River Tyne and anchors the largest urban economy between Leeds and Edinburgh. Investors comparing options in the region may also consider Sunderland, Durham, or Middlesbrough. Browse all our North East location guides.

Article updated: February 2026

Newcastle Buy-to-Let Market Overview 2026

Newcastle combines strong university and healthcare employment with asking prices nearly 30% below the England average, creating entry points that most major English cities cannot match.

- Average sold price: £205,341 (29.9% below England's £293,131)

- Asking price range: £147,557 (NE1) to £625,516 (NE20)

- Rental yields: 4.9% (NE13) to 10.0% (NE6) across postcodes with rental data

- Rental income: Monthly rents from £874 (NE5) to £1,721 (NE2)

- Price per sq ft: Sold prices from £165/sq ft (NE4) to £327/sq ft (NE20)

- Market activity: Sales ranging from 8 per month (NE1) to 54 per month (NE3)

- Deposit requirements: 30% deposits range from £44,267 (NE1) to £187,655 (NE20)

- Affordability ratios: Property prices from 4.2 to 17.6 times Newcastle's median annual salary of £35,446

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Newcastle?

Newcastle's economy has two pillars that most northern cities would trade for. The first is its universities. Newcastle University and Northumbria University between them attract over 50,000 students. That is not just a number on a website. It is 50,000 people who need somewhere to live, most of them for three to five years. Student rental demand in Jesmond (NE2), Heaton (NE7), and the city centre (NE1) is structural, not cyclical.

The second pillar is healthcare. The Royal Victoria Infirmary and Freeman Hospital together form one of the NHS's largest teaching hospital complexes. Add the Centre for Life biomedical campus and the growing life sciences cluster at Newcastle Helix, and healthcare employment runs deep across the city. Nurses, doctors, researchers, and support staff all need housing. And they tend to stay.

Between the 2011 and 2021 censuses, Newcastle's population grew from 280,177 to 300,125, a rise of 7.1%. That is above the England average and reflects a city that is attracting people rather than losing them. The AI Growth Zone centred on the North East, with major data centre investment from Blackstone and partnerships with OpenAI and NVIDIA, is expected to create thousands of additional high-skilled jobs in and around Tyneside over the next decade.

Earnings in Newcastle sit below the national average but above the regional figure. The median annual salary is £35,446, compared to £34,835 across the North East and £39,125 for Great Britain. That combination of affordable house prices and reasonable local wages is what keeps yields competitive. Investors get rental returns that cities with higher wages and higher prices struggle to match.

Newcastle also benefits from being a genuine regional capital. It has the largest retail centre in the North East (Eldon Square and the Metrocentre across the river in Gateshead), a major international airport, direct East Coast Main Line trains to London in under three hours, and the Tyne and Wear Metro connecting suburbs to the city centre. That infrastructure underpins consistent tenant demand across a wide range of postcodes.

Newcastle Economic Summary

- Population: 300,125 (2021 Census). Growth of 7.1% from 2011.

- Median annual salary: £35,446 (Newcastle), £34,835 (North East), £39,125 (Great Britain)

- Employment rate: 70.0% (Newcastle), 71.0% (North East), 75.6% (Great Britain)

- Unemployment rate: Not available (sample size suppressed)

- Key employment sectors: Higher education, healthcare and life sciences, digital technology, professional services, retail and hospitality

Source: ONS Census 2021, Nomis Labour Market Profile (ASHE 2025, Employment Oct 2024-Sep 2025)

Newcastle's employment rate of 70.0% sits below both the North East average of 71.0% and the national 75.6%. The unemployment rate is not available due to ONS sample size suppression for this authority. For buy-to-let investors, the employment rate reflects a city with a large student population (who are economically inactive in the statistics but very much active in the rental market). The universities alone ensure a baseline of rental demand that employment figures do not fully capture.

Regeneration and Investment in Newcastle

Newcastle's regeneration story is no longer about plans on paper. The Helix science campus is at full occupancy, £30bn of AI investment has been committed to the region, and the city's last major brownfield site has government funding secured. Money is going in, not just being talked about.

- Forth Yards and Quayside West (underway, £121.8m government funding / ~£950m total): Transformation of 52 acres of brownfield land on the Tyne banks into a new neighbourhood delivering up to 2,500 homes, with Homes England leading Quayside West's 1,100 homes. This is the single largest housing pipeline in Newcastle city centre, backed by government funding that de-risks the area for investors. Updates at GOV.UK.

- North East AI Growth Zone (underway, £30bn committed): The largest inward investment in the North East's history, centred on Blyth and Cobalt Park near Newcastle, with data centre capacity from Blackstone and partnerships with OpenAI and NVIDIA creating up to 5,000 high-skilled jobs. Thousands of well-paid tech workers will need housing across Newcastle and its commuter belt. Updates at The Catalyst Newcastle.

- Newcastle Helix (operational, £350m+): A 24-acre science and innovation district in central Newcastle now at full occupancy, housing The Biosphere (life sciences), Leonardo's defence technology facility (200+ jobs), and the National Innovation Centre for Data. Helix is the proof that large-scale regeneration delivers in Newcastle. Companies on site have raised over £50m in the last 18 months. Updates at Newcastle City Council.

Newcastle Property Market Analysis

When Was the Last House Price Crash in Newcastle?

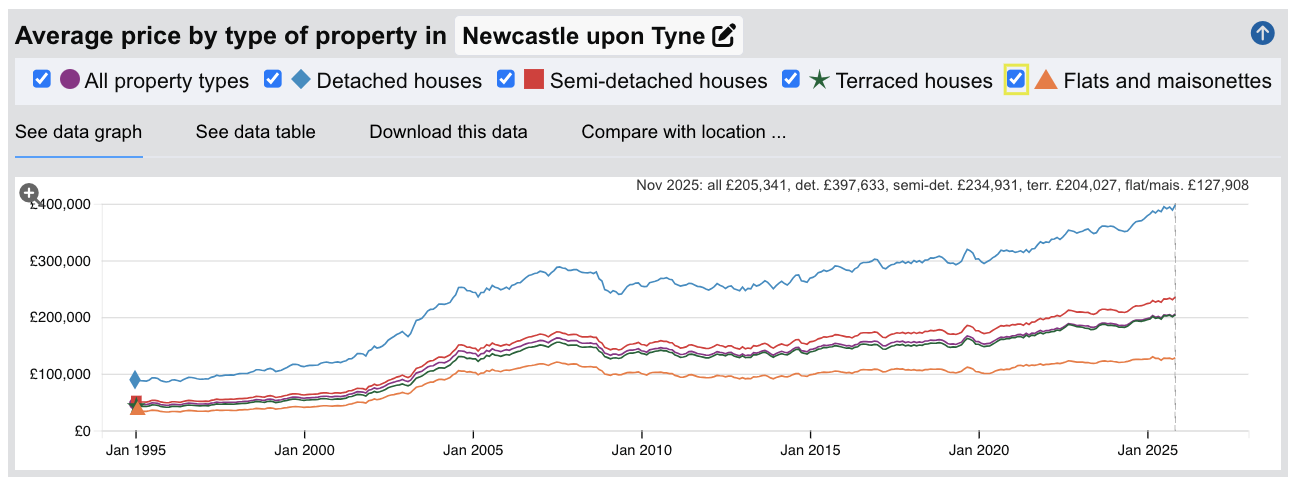

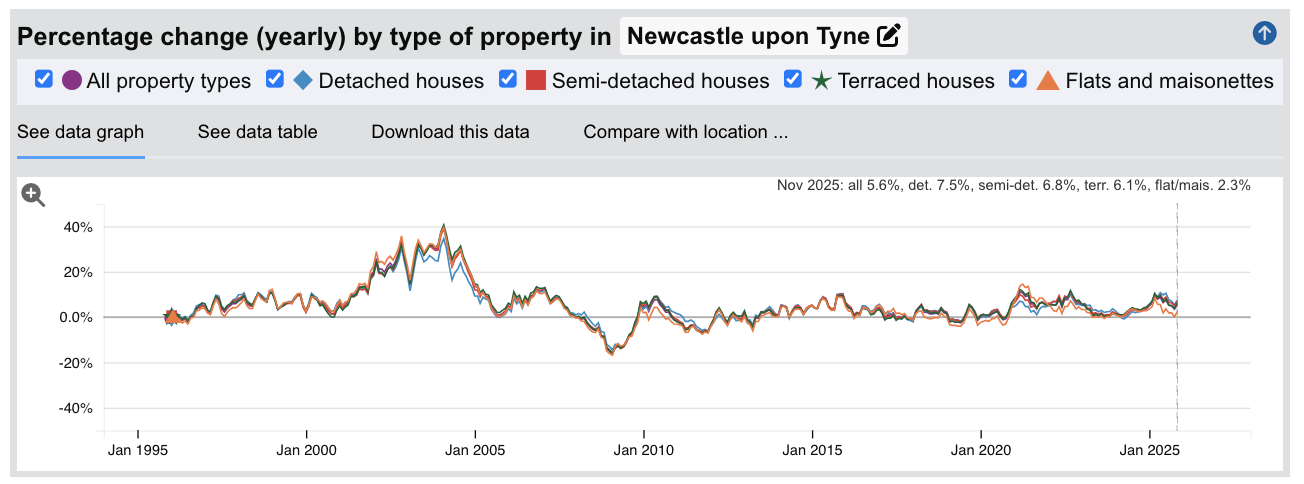

Newcastle's full house price history from the HM Land Registry House Price Index runs from January 1995 to November 2025. The data reveals one major crash, a painfully slow recovery, and a sharp pandemic-era catch-up.

- 1995-2000 (Slow build): Newcastle started 1995 at £44,733. Growth was modest through the mid-1990s. By January 2000, the average had reached £55,571. Respectable but nothing compared to what came next.

- 2000-2007 (The boom): Prices nearly tripled from £55,571 in January 2000 to a peak of £163,104 in July 2007. The sharpest growth came in 2001-2003, with annual change exceeding 20% in several months. Cheap credit, Buy-to-Let mortgage expansion, and regeneration hype around the Quayside pushed prices well beyond what local wages could support.

- 2007-2009 (The financial crisis): From the peak of £163,104 in July 2007 to a low of £132,528 in February 2009, Newcastle lost 18.7% of its value in 19 months. The worst annual change reading was -16.3% in February 2009. Flats were hit hardest at -16.9%, while detached houses fell -14.6%. Newcastle's decline was broadly in line with the North East region (-19.6%) and slightly worse than England overall (-18.2%).

- 2009-2013 (The long stagnation): This is where Newcastle diverged from London and the South East. Prices bounced off the 2009 trough to £144,700 by July 2010, then fell again. A double-dip pattern. By December 2012, the average had dropped to £131,608, actually lower than the 2009 trough. Newcastle's recovery stalled for almost four years while southern England moved on. The second trough hit terraced houses hardest, with annual changes still negative into late 2013.

- 2014-2016 (Tentative recovery): Growth finally returned, but gently. Annual changes of 2-5% gradually pushed prices upward. By the end of 2016, the average sat around £153,000. Still below the July 2007 peak of £163,104. Newcastle was nearly a decade into recovery and still hadn't broken even.

- 2017-2019 (Pre-pandemic growth): Prices rose from £153,000 to £165,000 by early 2019. Newcastle finally passed its pre-crash peak in September 2019 at £166,661. That recovery took over 12 years from the July 2007 peak. For context, London recovered by 2014 and the national average by 2016.

- 2020-2022 (Pandemic surge): The stamp duty holiday and remote working shift accelerated growth. Prices jumped from £165,244 in November 2020 to £195,088 by November 2022. That is 18.1% growth in two years. Newcastle's relative affordability made it a beneficiary of the repricing that hit northern cities during this period.

- 2023 (Rate shock): Interest rate rises cooled the market briefly. Prices dipped from £195,088 in November 2022 to around £190,000 by mid-2023. A mild correction of approximately 2-3%.

- 2024-2025 (Current): Prices recovered and pushed to new highs. By November 2025, the average reached £205,341 with annual growth of 5.6%. Newcastle now sits 25.9% above its pre-crash peak.

Long-Term Property Value Growth in Newcastle

- 5 years (2020-2025): +24.3% (£165,244 to £205,341)

- 10 years (2015-2025): +34.4% (£152,819 to £205,341)

- 15 years (2010-2025): +44.0% (£142,600 to £205,341)

- 20 years (2005-2025): +47.9% (£138,836 to £205,341)

- 30 years (1995-2025): +358.2% (£44,811 to £205,341)

The lesson from Newcastle's crash is not just the size of the decline. An 18.7% fall is painful but not catastrophic. The real cost was time. It took over 12 years for prices to recover. Investors who bought at the 2007 peak waited until September 2019 to break even. The structural picture today is different. The AI Growth Zone, Helix campus, and Forth Yards pipeline did not exist in 2007. But property prices are never guaranteed, and Newcastle's long recovery should temper expectations about how quickly any downturn reverses in a regional market.

Source: HM Land Registry House Price Index for Newcastle upon Tyne

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Newcastle

The latest Land Registry data confirms Newcastle's position as one of the most affordable major cities in England. The headline figure of £205,341 is 29.9% below England's £293,131. But Newcastle also sits 23.3% above the North East regional average of £166,568. That tells you something important: Newcastle is cheap by national standards but commands a premium within its own region. It is the North East's most expensive local authority, not its cheapest.

Flats in Newcastle average £127,908. That is 42.3% below the England average of £221,565. That is the widest discount of any property type and reflects a combination of Tyneside flats (the traditional flat-above-flat terraced stock), ex-local authority blocks, and a large student rental market in city centre conversions.

| Property Type | Newcastle Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £397,633 | £474,400 | -16.2% |

| Semi-detached houses | £234,931 | £290,004 | -19.0% |

| Terraced houses | £204,027 | £245,002 | -16.7% |

| Flats and maisonettes | £127,908 | £221,565 | -42.3% |

| All property types | £205,341 | £293,131 | -29.9% |

Detached houses sit 16.2% below England at £397,633. Newcastle has relatively few detached properties within the city boundary. They concentrate in Gosforth (NE3), Ponteland (NE20), and the northern fringe. The discount is narrower than other types because detached stock in Newcastle tends to be in desirable areas that attract professional owner-occupiers competing directly with investors.

Semi-detached houses show a 19.0% discount at £234,931. Semis are the core family housing stock across suburban Newcastle. NE3 Gosforth and NE7 Heaton are dominated by this type. Owner-occupier demand is strong in these postcodes, which narrows the gap to the national average compared to terraced housing and flats.

Terraced houses average £204,027, a 16.7% discount. The traditional Tyneside terrace is the backbone of Newcastle's rental stock, particularly in NE6 Walker and Byker, NE4 Fenham, and NE15 Lemington. These are the streets where buy-to-let portfolios are built. Low entry prices and reliable tenant demand from students, young professionals, and key workers.

Flats represent the biggest discount at 42.3% below England. For investors, that gap creates yield opportunities. Even modest rental income generates meaningful returns when the purchase price is under £130,000. But flat stock in Newcastle varies dramatically. A converted Jesmond townhouse flat and an ex-council flat in Walker are worlds apart. The postcode-level data below separates the opportunities from the risks.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Price Per Square Foot in Newcastle

Average asking prices can mislead. A postcode might look expensive simply because it has larger properties. Price per square foot strips out that size bias and shows what you are actually paying for space. It is the closest measure to true underlying value across different property types and sizes.

Newcastle's price per square foot ranges from £165 in NE4 Fenham to £327 in NE20 Ponteland, a spread of almost 2x across ten postcodes with data. NE18 Stamfordham has insufficient sold data for a reliable figure. The range tells you that central and western Newcastle trades at half the per-foot cost of the affluent northern fringe.

| Rank | Area | Price Per Sq Ft |

|---|---|---|

| 1 | NE4 (Fenham, Westgate) | £165 |

| 2 | NE15 (Lemington, Throckley) | £182 |

| 3 | NE5 (Westerhope) | £199 |

| 4 | NE6 (Walker, Byker) | £204 |

| 5 | NE1 (City Centre) | £213 |

| 6 | NE7 (Heaton, High Heaton) | £247 |

| 7 | NE13 (Hazelrigg, Dinnington) | £251 |

| 8 | NE3 (Gosforth) | £253 |

| 9 | NE2 (Jesmond) | £279 |

| 10 | NE20 (Ponteland) | £327 |

| — | NE18 (Stamfordham) | Not enough data |

NE4 at £165 per square foot is the cheapest space in Newcastle. Fenham and Westgate sit just west of the city centre with strong transport links and a mix of student and working-class housing. At £165 per foot, an investor can access a 650 sq ft two-bed terrace for around £107,000. NE4 also delivers a 7.4% gross yield. That combination of low space costs and strong rental returns makes it one of Newcastle's most efficient buy-to-let postcodes.

NE6 Walker and Byker at £204 per square foot is where the standout numbers sit. This postcode delivers Newcastle's highest gross yield at 10.0% and has seen 38.9% five-year growth. Per-foot costs are firmly in the affordable tier. Investors who bought here five years ago are sitting on both equity growth and strong rental income.

NE2 Jesmond and NE20 Ponteland form the premium tier at £279 and £327. Jesmond is Newcastle's most desirable inner suburb, home to students, young professionals, and families. Ponteland is a semi-rural commuter village. Both trade at a significant premium to the rest of the city. NE20 at £327 is the outlier. A 30% deposit there runs to £187,655. This is affluent owner-occupier territory, not typical buy-to-let ground.

Figures reflect averages across all property types and ages. Individual values depend on condition, location within the postcode, and building age.

For Sale Asking Prices in Newcastle

Asking prices reflect what sellers and agents think the market will pay. They are not the same as sold prices, which capture what buyers actually paid. In a rising market, asking prices run ahead of sold prices. In a cooling market, asking prices sit above what eventually transacts.

Newcastle's asking prices range from £147,557 in NE1 to £625,516 in NE20. Exclude the NE20 Ponteland outlier and the urban range narrows to £147,557 to £287,035. That is a manageable spread for investors comparing entry points across the city.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | NE1 (City Centre) | £147,557 |

| 2 | NE4 (Fenham, Westgate) | £168,075 |

| 3 | NE6 (Walker, Byker) | £173,784 |

| 4 | NE5 (Westerhope) | £186,177 |

| 5 | NE15 (Lemington, Throckley) | £214,254 |

| 6 | NE7 (Heaton, High Heaton) | £225,435 |

| 7 | NE3 (Gosforth) | £243,867 |

| 8 | NE2 (Jesmond) | £272,413 |

| 9 | NE13 (Hazelrigg, Dinnington) | £287,035 |

| 10 | NE20 (Ponteland) | £625,516 |

| — | NE18 (Stamfordham) | Not enough data |

Three postcodes cluster below £175,000: NE1, NE4, and NE6. These are Newcastle's most affordable entry points. NE1 City Centre at £147,557 is dominated by flats and city centre apartments. NE4 Fenham at £168,075 and NE6 Walker at £173,784 are terraced housing areas. All three deliver yields above 7%, making them the natural starting point for cash flow-focused investors.

NE20 Ponteland at £625,516 sits in a different market entirely. Sixteen sales per month and no rental data. This is an affluent commuter village where detached family homes dominate. The asking price is more than four times the cheapest urban postcode. For most buy-to-let investors, NE20 is not the play.

The mean asking price across all ten Newcastle postcodes with data is £254,411. That figure appears in the comparison section later, where Newcastle is measured against Sunderland, Leeds, Liverpool, and Manchester.

House Price Growth in Newcastle

Growth data shows where prices have moved over 1, 3, and 5 years. For buy-to-let investors, the five-year figure matters most. It captures a full market cycle and filters out short-term noise. One-year growth can swing on a handful of transactions. Five years tells you whether an area is genuinely appreciating.

NE1 City Centre leads five-year growth at 49.7%, but there is a catch. That figure reflects NE1's very low base price and a small number of monthly sales (8). One or two high-value transactions can skew the number. NE6 Walker and Byker at 38.9% on 36 monthly sales is more statistically robust and arguably the more meaningful growth story.

| Area | 1 Year | 3 Years | 5 Years |

|---|---|---|---|

| NE1 (City Centre) | 1.2% | -1.4% | 49.7% |

| NE6 (Walker, Byker) | 16.3% | 29.2% | 38.9% |

| NE4 (Fenham, Westgate) | -0.7% | 24.8% | 16.3% |

| NE5 (Westerhope) | 4.3% | 2.2% | 20.6% |

| NE7 (Heaton, High Heaton) | 10.2% | 11.9% | 17.1% |

| NE15 (Lemington, Throckley) | 11.3% | 0.3% | 16.7% |

| NE20 (Ponteland) | -6.6% | -4.0% | 15.3% |

| NE2 (Jesmond) | 17.2% | 0.6% | 13.9% |

| NE3 (Gosforth) | 0.2% | 12.5% | 13.3% |

| NE13 (Hazelrigg, Dinnington) | -1.2% | -3.0% | 1.2% |

| NE18 (Stamfordham) | Not enough data | Not enough data | Not enough data |

NE6 is the growth story in Newcastle. 38.9% over five years, 29.2% over three, and 16.3% in the last year alone. An investor who bought a £125,000 property in Walker five years ago would now be looking at an asking price of £173,784. That is nearly £49,000 in equity growth from one of Newcastle's cheapest entry points. And NE6 simultaneously delivers the city's highest gross yield at 10.0%. Growth and yield converging in the same postcode is unusual.

NE2 Jesmond's one-year growth of 17.2% stands out against its three-year figure of just 0.6%. That pattern suggests Jesmond prices stalled or dipped during the interest rate shock of 2023 and have now bounced back sharply. The postcode appeals to professional tenants and owner-occupiers willing to pay a premium, and that demand has returned strongly.

NE13 at 1.2% five-year growth is effectively flat. Hazelrigg and Dinnington sit on Newcastle's northern fringe, mixing suburban housing with rural areas. Negative one-year and three-year figures suggest this postcode may be overpriced relative to what the market will support. Investors should read NE13's growth data alongside its 4.9% yield, the lowest in Newcastle. The combination of weak growth and low yield makes it the least attractive postcode on both measures.

Monthly Property Sales in Newcastle

Transaction volumes reveal which areas have the deepest buyer pools. For buy-to-let investors, this is an exit strategy question. If you need to sell, can you? High volume and high turnover mean a liquid market. Low volume means you may wait.

Newcastle's monthly sales range from 8 in NE1 to 54 in NE3, with a combined total of 254 transactions per month across postcodes with data. NE3 Gosforth dominates volume, processing more sales per month than any other Newcastle postcode. NE5 Westerhope and NE7 Heaton show turnover rates of 63% and 65% respectively, indicating fast-moving markets.

| Area | Sales Per Month | Turnover | Asking Price |

|---|---|---|---|

| NE3 (Gosforth) | 54 | 45% | £243,867 |

| NE5 (Westerhope) | 43 | 63% | £186,177 |

| NE6 (Walker, Byker) | 36 | 58% | £173,784 |

| NE15 (Lemington, Throckley) | 30 | 32% | £214,254 |

| NE13 (Hazelrigg, Dinnington) | 23 | 33% | £287,035 |

| NE4 (Fenham, Westgate) | 17 | 37% | £168,075 |

| NE20 (Ponteland) | 16 | 102% | £625,516 |

| NE2 (Jesmond) | 14 | 22% | £272,413 |

| NE7 (Heaton, High Heaton) | 13 | 65% | £225,435 |

| NE1 (City Centre) | 8 | 6% | £147,557 |

| NE18 (Stamfordham) | Not enough data | Not enough data | Not enough data |

NE2 Jesmond has the lowest turnover at 22% despite being one of Newcastle's most desirable postcodes. Fourteen sales per month from a large stock of period properties tells you that owners hold on. Landlords with Jesmond properties tend to keep them for decades. If you are buying to hold long-term, the low turnover confirms that other investors have the same idea. Getting in is the challenge, not getting out.

NE20 Ponteland's turnover of 102% looks extraordinary but reflects a specific dynamic. Properties in this affluent village sell faster than new listings appear. With only 16 sales per month and asking prices of £625,516, this is a tight market driven by owner-occupiers. The high turnover is not a buy-to-let signal. It tells you that buyer demand for premium Ponteland homes outstrips supply.

For exit strategy planning, NE3, NE5, and NE6 offer the strongest combination of volume and turnover. If you need to realise an investment in Newcastle, these three postcodes have the deepest buyer pools. NE6 is particularly interesting: high volume (36/month), strong turnover (58%), the highest yield (10.0%), and the strongest growth (38.9%). It delivers on every measure an investor would check.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Newcastle Rental Market Analysis

For investors weighing up whether buy to let property is a worthwhile investment in Newcastle, the data below breaks down average monthly rents and gross rental yields across the city's postcodes.

Rental data is available for 9 of 11 postcodes. NE18 (Stamfordham) and NE20 (Ponteland) have insufficient current listings for reliable figures. For the nine with data, monthly rents range from £874 in NE5 to £1,721 in NE2 and gross yields range from 4.9% to 10.0%. If you are looking to build a residential property portfolio in the North East, Newcastle's combination of low entry prices, double-digit yields, and university-driven rental demand makes it one of the strongest options in the region.

Average Rent & Gross Rental Yields in Newcastle

Gross rental yield is calculated from the average asking price and average monthly rent for each postcode. It does not account for void periods, maintenance, management fees, or mortgage costs. It is a starting point for comparison, not a profit forecast.

NE6 delivers Newcastle's highest gross yield at 10.0%, where monthly rents of £1,443 meet asking prices of £173,784. At the other end, NE13 Hazelrigg at 4.9% reflects higher asking prices absorbing moderate rents. The yield spread across Newcastle is 5.1 percentage points. That is a wider gap than most cities and reflects the diversity of Newcastle's housing market, from inner-city terraces to suburban family homes.

| Area | Avg Monthly Rent | Avg Asking Price | Gross Yield |

|---|---|---|---|

| NE6 (Walker, Byker) | £1,443 | £173,784 | 10.0% |

| NE1 (City Centre) | £1,191 | £147,557 | 9.7% |

| NE2 (Jesmond) | £1,721 | £272,413 | 7.6% |

| NE4 (Fenham, Westgate) | £1,036 | £168,075 | 7.4% |

| NE5 (Westerhope) | £874 | £186,177 | 5.6% |

| NE15 (Lemington, Throckley) | £967 | £214,254 | 5.4% |

| NE7 (Heaton, High Heaton) | £1,013 | £225,435 | 5.4% |

| NE3 (Gosforth) | £1,069 | £243,867 | 5.3% |

| NE13 (Hazelrigg, Dinnington) | £1,181 | £287,035 | 4.9% |

| NE18 (Stamfordham) | Not enough data | Not enough data | Not enough data |

| NE20 (Ponteland) | Not enough data | £625,516 | Not enough data |

Two postcodes break the 9% gross yield barrier: NE6 at 10.0% and NE1 at 9.7%. NE6 Walker and Byker is a traditionally working-class area that has seen significant regeneration. The £1,443 monthly rent is the second highest in Newcastle, driven by HMO and multi-let properties that push per-property rental income well above single-let averages. NE1 City Centre at £1,191 rent on a £147,557 asking price produces 9.7%. City centre flats and student accommodation dominate here.

NE2 Jesmond at 7.6% combines the highest absolute rent in Newcastle (£1,721/month) with a premium asking price. Jesmond is a student and young professional heartland. Shared houses and HMOs command strong per-room rents. The headline yield of 7.6% already outperforms most cities nationally, and experienced landlords running HMOs in Jesmond will achieve significantly higher effective yields.

The suburban tier of NE5, NE15, NE7, and NE3 clusters between 5.3% and 5.6%. These are family housing areas where single lets to working professionals and families produce reliable income at slightly lower yields. The trade-off is stability. Void periods are typically shorter in suburban family areas than in student-dominated postcodes, and tenant turnover costs are lower.

Is Newcastle Rent High?

Rent affordability matters from both sides. For tenants, it determines whether they can sustain payments long-term. For landlords, areas where rent consumes a lower share of income tend to produce more reliable tenants and fewer arrears.

The median gross weekly salary in Newcastle is £681.70, which equates to £2,954 per month or £35,446 per year. This is above the North East regional median of £669.90 per week but below the Great Britain median of £752.40 per week. Data from the Nomis Labour Market Profile (ASHE 2025).

Across Newcastle's nine postcodes with rental data, rent ranges from 29.6% to 58.3% of the local median gross monthly salary. The general benchmark is that rent becomes stretched above 30% of gross income. Seven of the nine postcodes sit above that level. Two of those, NE2 Jesmond (58.3%) and NE6 Walker (48.8%), look sharply elevated, but for different reasons.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | NE2 (Jesmond) | 58.3% |

| 2 | NE6 (Walker, Byker) | 48.8% |

| 3 | NE1 (City Centre) | 40.3% |

| 4 | NE13 (Hazelrigg, Dinnington) | 40.0% |

| 5 | NE3 (Gosforth) | 36.2% |

| 6 | NE4 (Fenham, Westgate) | 35.1% |

| 7 | NE7 (Heaton, High Heaton) | 34.3% |

| 8 | NE15 (Lemington, Throckley) | 32.7% |

| 9 | NE5 (Westerhope) | 29.6% |

| — | NE18 (Stamfordham) | Not enough data |

| — | NE20 (Ponteland) | Not enough data |

NE2 Jesmond at 58.3% looks alarming on paper, but the figure is misleading. Jesmond's average rent of £1,721 is inflated by HMO properties where the per-property rent reflects multiple tenants splitting the cost. A three-bed HMO at £1,721 per month works out at £574 per tenant. Against the city median salary, that individual share is under 20% of income. Jesmond tenants are also disproportionately students (funded by loans, not salaries) and young professionals earning above the city median.

NE6 at 48.8% follows a similar pattern. High per-property rents driven by HMO and multi-let structures. The city-wide median salary understates what tenants in Walker and Byker's regenerated housing actually earn per household. Dual-income households and professional sharers push effective affordability well below the headline figure.

NE5 Westerhope at 29.6% is the only postcode that sits comfortably below the 30% threshold. Rents of £874 per month against local earnings create genuine affordability headroom. For investors, that translates to lower arrears risk and more reliable income. NE15 at 32.7% and NE7 at 34.3% sit just above the line, both in solid family housing areas where tenant quality tends to be strong.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Newcastle House Prices High? Price-to-Earnings Ratios

The price-to-earnings ratio compares a postcode's average asking price to the local median annual salary. Lower ratios mean more affordable entry points relative to local wages. The national benchmark is 7.5x, calculated from England's average sold price of £293,131 against Great Britain's median annual salary of £39,125.

Purchasing a property in Newcastle requires between 4.2 and 17.6 times the median annual salary. This is based on the Nomis Labour Market Profile for Newcastle showing the median gross annual income for Newcastle residents is £35,446.

Seven of Newcastle's ten postcodes with data sit below the national benchmark of 7.5x. NE1, NE4, NE6, NE5, NE15, NE7, and NE3 all come in at 6.9x or below. Only NE2 Jesmond (7.7x), NE13 Hazelrigg (8.1x), and NE20 Ponteland (17.6x) exceed the national figure.

| Rank | Area | Price-to-Earnings Ratio |

|---|---|---|

| 1 | NE1 (City Centre) | 4.2x |

| 2 | NE4 (Fenham, Westgate) | 4.7x |

| 3 | NE6 (Walker, Byker) | 4.9x |

| 4 | NE5 (Westerhope) | 5.3x |

| 5 | NE15 (Lemington, Throckley) | 6.0x |

| 6 | NE7 (Heaton, High Heaton) | 6.4x |

| 7 | NE3 (Gosforth) | 6.9x |

| 8 | NE2 (Jesmond) | 7.7x |

| 9 | NE13 (Hazelrigg, Dinnington) | 8.1x |

| 10 | NE20 (Ponteland) | 17.6x |

| — | NE18 (Stamfordham) | Not enough data |

NE1 at 4.2x is one of the lowest price-to-earnings ratios you will find in any major English city. City centre asking prices of £147,557 against a £35,446 median salary create genuinely affordable entry points. Combine that with a 9.7% gross yield and you have a postcode where the numbers work on both income and affordability measures. NE4 at 4.7x and NE6 at 4.9x tell a similar story.

NE20 Ponteland at 17.6x is completely detached from local earnings. Rural commuter village prices are driven by buyers from across the region, not by what Newcastle residents earn locally. NE13 at 8.1x and NE2 at 7.7x sit just above the national benchmark, reflecting desirable suburban and inner-city areas where owner-occupier competition lifts prices beyond what rental income alone would justify.

For investors comparing across the North East, Newcastle's price-to-earnings ratios are notably more favourable than the national average, with the majority of postcodes offering entry below 7x earnings.

Deposit Requirements in Newcastle

Most buy-to-let mortgage lenders require a minimum 25% deposit. The table below uses a more conservative 30% to reflect the rates and products available at higher loan-to-value ratios. A 30% deposit typically unlocks better interest rates, which matters for cash flow in a yield-driven market.

Newcastle's entry costs range from £44,267 in NE1 to £187,655 in NE20. Six postcodes require deposits under £65,000, making buy-to-let accessible at capital levels that would barely cover a studio flat in London or a family home deposit in many southern cities.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | NE1 (City Centre) | £44,267 |

| 2 | NE4 (Fenham, Westgate) | £50,422 |

| 3 | NE6 (Walker, Byker) | £52,135 |

| 4 | NE5 (Westerhope) | £55,853 |

| 5 | NE15 (Lemington, Throckley) | £64,276 |

| 6 | NE7 (Heaton, High Heaton) | £67,630 |

| 7 | NE3 (Gosforth) | £73,160 |

| 8 | NE2 (Jesmond) | £81,724 |

| 9 | NE13 (Hazelrigg, Dinnington) | £86,110 |

| 10 | NE20 (Ponteland) | £187,655 |

| — | NE18 (Stamfordham) | Not enough data |

NE6 at £52,135 is arguably the best value deposit in the table. It costs £7,868 more than NE1's entry-level deposit but delivers the highest yield in Newcastle (10.0%), the strongest five-year growth (38.9%), and sits in a postcode with 36 sales per month. The extra capital buys access to significantly better performance across every measure.

A clear gap separates the sub-£56,000 tier from the rest. NE1, NE4, NE6, and NE5 all require deposits under £56,000. NE15 at £64,276 is the next step up, followed by NE7, NE3, and NE2 in the £68,000 to £82,000 range. For investors with limited capital, the four cheapest postcodes all deliver yields between 5.6% and 10.0%. Strong rental returns do not require stretching into higher deposit brackets.

Deposit is only part of the upfront cost. Budget for stamp duty (use our stamp duty calculator for an accurate figure), legal fees, and survey costs. For a full breakdown, see our guide to buy-to-let costs.

What the Newcastle Data Tells Buy-to-Let Investors

The postcode-level data across this guide points to three distinct profiles depending on whether you are optimising for income, growth, or stability.

For yield, the numbers favour NE6 (10.0%), NE1 (9.7%), and NE2 (7.6%). NE6 and NE1 sit below 5x price-to-earnings with 30% deposits under £53,000. NE6 stands out across every measure: highest yield, strongest five-year growth (38.9%), and healthy monthly volume (36 sales). NE2 Jesmond commands the highest absolute rents at £1,721, driven by student and professional HMO demand. An experienced landlord running multi-let properties in NE2 will exceed the 7.6% headline figure.

For growth, NE6 (38.9%) and NE5 (20.6%) lead on five-year appreciation. NE7 Heaton at 17.1% five-year growth also shows strong recent momentum with 10.2% in the last year alone. The convergence of yield and growth in NE6 is the standout finding in this data. In most cities, the highest-yielding postcodes deliver the weakest growth, or vice versa. NE6 does both.

NE18 and NE20 suit different investors. NE18 Stamfordham is rural with no meaningful market data. It is not a buy-to-let postcode. NE20 Ponteland at £625,516 average asking price, 16 sales per month, and no rental data is affluent owner-occupier territory. NE13 at 4.9% yield and 1.2% five-year growth is the weakest performer among urban postcodes. The data does not support a premium entry point in Hazelrigg when NE6 offers double the yield and 30x the growth from a lower base.

Newcastle operates a selective licensing scheme for private landlords in parts of the city. Check whether your target property falls within a licensing area before committing, as the scheme adds compliance costs and conditions to private lettings.

How Newcastle Buy-to-Let Compares to Nearby Areas

Investors looking at Newcastle are typically also considering other northern cities. The table below compares Newcastle against four nearby locations using the same methodology: mean asking price across all postcodes, mean monthly rent across postcodes with data, and top single-postcode gross yield.

| Location | Mean Asking Price | Mean Monthly Rent | Top Gross Yield |

|---|---|---|---|

| Newcastle | £254,411 | £1,166 | 10.0% |

| Sunderland | £164,426 | £691 | 9.7% |

| Leeds | £285,040 | £1,111 | 9.5% |

| Liverpool | £206,849 | £872 | 7.5% |

| Manchester | £265,494 | £1,314 | 7.9% |

Newcastle delivers the highest top yield in this group at 10.0%, from a mean asking price that sits between Liverpool and Leeds. Sunderland offers the cheapest entry at £164,426 and matches Newcastle's yield reach at 9.7%, but average rents of £691 are 41% lower. For investors prioritising rental income alongside yield, Newcastle's higher absolute rents make it the stronger proposition despite the higher entry cost.

Leeds and Manchester are the closest comparisons in scale and ambition. Both are larger markets with higher mean asking prices. Leeds at £285,040 delivers similar rents to Newcastle but from a 12% higher price base. Manchester commands the highest rents in this group at £1,314 but entry prices of £265,494 compress the top yield to 7.9%. Newcastle's advantage is efficiency: the best top yield in the group from a mid-range price point.

Liverpool sits closest to Newcastle on price at £206,849 but produces lower rents (£872) and a lower top yield (7.5%). Newcastle's university-driven and professional rental market generates stronger per-property income than Liverpool's comparable postcodes. For investors with a budget between £150,000 and £200,000, Newcastle currently offers more yield per pound invested than any of the four comparison cities.

Frequently Asked Questions

How does Newcastle compare to Sunderland for buy-to-let?

Newcastle and Sunderland produce similar top yields (10.0% vs 9.7%), but Newcastle's mean monthly rent of £1,166 is 69% higher than Sunderland's £691. Sunderland offers lower entry prices (mean asking price £164,426 vs £254,411) but the rental market is shallower, with fewer postcodes generating yields above 5%. Newcastle's two universities, larger professional employment base, and better transport links give it a wider tenant pool. Sunderland suits investors prioritising absolute capital efficiency. Newcastle suits investors who want higher rental income and stronger long-term demand fundamentals from the same region.

Are there property investment companies operating in Newcastle?

Several firms market buy-to-let properties in Newcastle, particularly off-plan city centre apartments and regeneration-area stock. Be cautious with any company offering guaranteed yields or sourcing fees above 2-3% of purchase price. The data in this guide covers the open market. Any property sold through an investment company could be benchmarked against these figures, but advertised yields from property companies are not the same as general market yields on the open market.

Is student accommodation a good investment in Newcastle?

Newcastle University and Northumbria University together attract over 50,000 students, making Newcastle one of the most student-dense cities in the UK. NE2 Jesmond and NE7 Heaton are the traditional student letting areas, with NE1 City Centre growing as purpose-built student accommodation blocks fill. For a broader view of the sector, see our guide to purpose-built student accommodation. Be aware of seasonal void risk during summer months and the higher management intensity of multi-let student properties.

When will the AI Growth Zone and Forth Yards affect Newcastle property prices?

The North East AI Growth Zone (£30bn committed) is already recruiting, with data centre construction underway at Blyth and Cobalt Park. The employment impact on Newcastle's housing market will build gradually over the next 5-10 years as thousands of tech workers settle in the area. Forth Yards (up to 2,500 homes) has government funding secured but a 15-year build-out timeline. Neither project will cause overnight price jumps. Investors positioning early in areas with good transport links to Cobalt Park (NE6, NE7) or the western city centre (NE1, NE4) may benefit from rising demand as these projects deliver, but the timeline is measured in years, not months.

Can I find buy-to-let property in Newcastle under £100,000?

The average asking prices in this guide range from £147,557 (NE1) to £625,516 (NE20), but these are postcode averages across all property types. Individual flats and Tyneside terraces in NE1, NE4, and NE6 do list below £100,000. Newcastle's average flat price from the Land Registry is £127,908, confirming that sub-£100,000 stock exists. At that price point, a 30% deposit is under £30,000. Due diligence on the building condition, lease length, service charges, and actual tenant demand at the lower end of the market is essential.