Where to Buy Property Investments in Plymouth: Yields of 5.9%

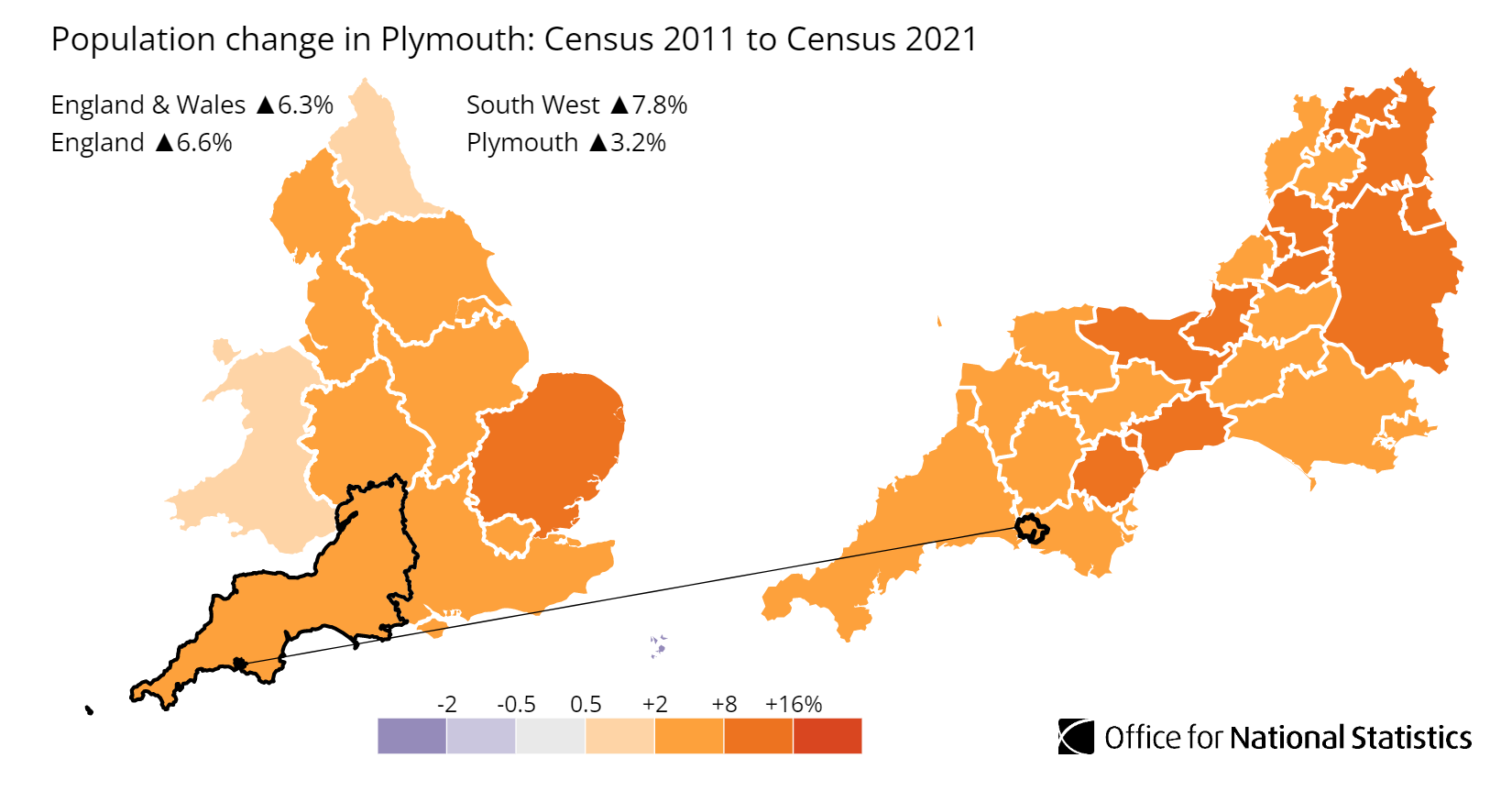

Plymouth's gross rental yields range from 4.3% to 5.9% across postcodes with rental data, with PL5 delivering the highest returns. Average sold prices sit 25.6% below the England average, and the city's population grew 3.2% to 264,695 between the 2011 and 2021 censuses.

Plymouth's average sold price of £218,125 makes it one of the most affordable cities in the South West for buy-to-let investors. That is 28.7% below the South West regional average and creates entry points that most southern English cities cannot match. Asking prices start from £197,931 in PL4, and rental data is available for 7 of the city's 9 postcodes.

This guide covers all 9 Plymouth postcodes from PL1 to PL9 under the City of Plymouth unitary authority (ONS code E06000026). Plymouth sits on Devon's south coast, anchored by the largest naval base in Western Europe. Investors comparing options in the region may also consider Exeter, Truro, or Bristol. Browse all our South West location guides.

Article updated: February 2026

Plymouth Buy-to-Let Market Overview 2026

Plymouth offers some of the lowest entry prices in southern England, backed by long-term defence employment and a growing university city economy.

- Average sold price: £218,125 (25.6% below England's £293,131)

- Asking price range: £197,931 (PL4) to £551,196 (PL8)

- Rental yields: 4.3% (PL9) to 5.9% (PL5) across postcodes with rental data

- Rental income: Monthly rents from £718 (PL4) to £1,175 (PL9)

- Price per sq ft: Sold prices from £193/sq ft (PL4) to £384/sq ft (PL8)

- Market activity: Sales ranging from 5 per month (PL8) to 44 per month (PL6)

- Deposit requirements: 30% deposits range from £59,379 (PL4) to £165,359 (PL8)

- Affordability ratios: Property prices from 5.6 to 15.7 times Plymouth's median annual salary of £35,188

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Plymouth?

Plymouth's economy runs on two engines that most UK cities would envy. HMNB Devonport is the largest naval base in Western Europe and the Royal Navy's sole nuclear submarine repair facility. Babcock International operates the dockyard and employs thousands directly, with the base supporting around 400 local firms and contributing roughly 10% of Plymouth's total income. That is not a number that disappears in a recession.

The second engine is the University of Plymouth, with around 18,000 to 20,000 students and a growing Peninsula Medical School partnership with Exeter. Students and healthcare trainees create reliable rental demand across the city centre and traditional letting areas like Mutley, Lipson, and Greenbank.

Between the 2011 and 2021 censuses, Plymouth's population grew from 256,384 to 264,695, a rise of 3.2%. That is modest compared to some cities, but Plymouth's growth is backed by structural employment rather than speculative development. The AUKUS submarine programme has committed the UK to building up to 12 new submarines with maintenance based at Devonport, extending the employment guarantee for decades.

Earnings in Plymouth sit below both the regional and national averages. The median annual salary is £35,188, compared to £37,544 across the South West and £39,125 for Great Britain. Lower local wages combined with affordable house prices create a market where rental yields hold up well even though rents themselves are not headline-grabbing.

Derriford Hospital is the region's major acute hospital and Plymouth's second largest employer after the naval base. The hospital is in an ongoing expansion programme, and its surrounding area has been designated as the city's primary growth corridor with thousands of new homes planned or under construction.

Plymouth Economic Summary

- Population: 264,695 (2021 Census). Growth of 3.2% from 2011.

- Median annual salary: £35,188 (Plymouth), £37,544 (South West), £39,125 (Great Britain)

- Employment rate: 73.7% (Plymouth), 79.3% (South West), 75.6% (Great Britain)

- Unemployment rate: 2.4% (Plymouth), 3.3% (South West), 4.3% (Great Britain)

- Key employment sectors: Defence and naval, healthcare, higher education, marine technology, advanced manufacturing

Source: ONS Census 2021, Nomis Labour Market Profile (ASHE 2025, Employment Oct 2024-Sep 2025)

Plymouth's employment rate of 73.7% sits below the South West average of 79.3%. But the unemployment rate of 2.4% is well below both the regional 3.3% and national 4.3%. That combination suggests a city where those in work are securely employed, even if workforce participation rates are lower. For buy-to-let investors, low unemployment matters more than the headline employment rate.

Regeneration and Investment in Plymouth

Plymouth's regeneration is anchored by defence investment that most UK cities cannot replicate. The AUKUS submarine programme alone secures generational employment at Devonport, and the Freeport designation adds tax incentives on top.

- AUKUS Submarine Programme and Devonport Dockyard Upgrade (underway, £4bn+ contracts): The UK will build up to 12 SSN-AUKUS submarines with maintenance based at Devonport. Babcock International began a ten-year upgrade of the dockyard's nuclear-licensed facilities in 2022, securing thousands of jobs for decades. Updates at GOV.UK Submarine Delivery Agency.

- Plymouth and South Devon Freeport (operational): One of eight English Freeports, bringing tax incentives and customs zones focused on marine and defence industries. For investors, Freeport employment means higher-skilled tenants in the Devonport and Keyham areas. Updates at Plymouth City Council.

- Sherford New Town (under construction, 5,500 homes): A new town on Plymouth's eastern fringe delivered by Taylor Wimpey, Linden Homes, and Bovis Homes, expected to create 7,000 jobs. While Sherford adds housing supply, the scale of employment generation creates its own rental demand. Updates at Sherford.

- Millbay Waterfront (substantially complete, English Cities Fund): Transformed derelict historic docks into 600 new homes, 40,000 sq ft of commercial space, and a 171-berth marina. Won Development of the Year at the 2020 South West Property Awards. Updates at English Cities Fund.

Plymouth Property Market Analysis

When Was the Last House Price Crash in Plymouth?

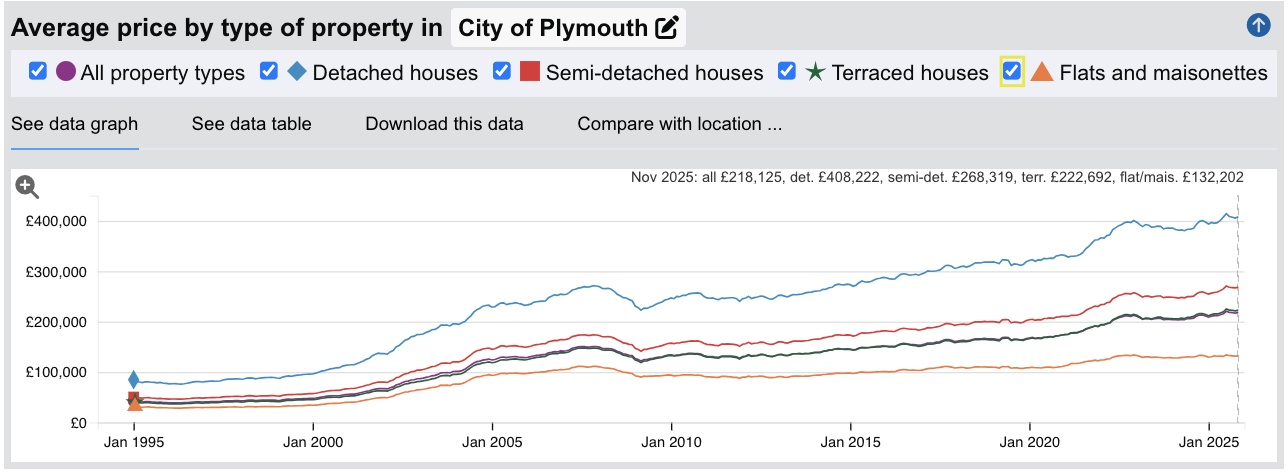

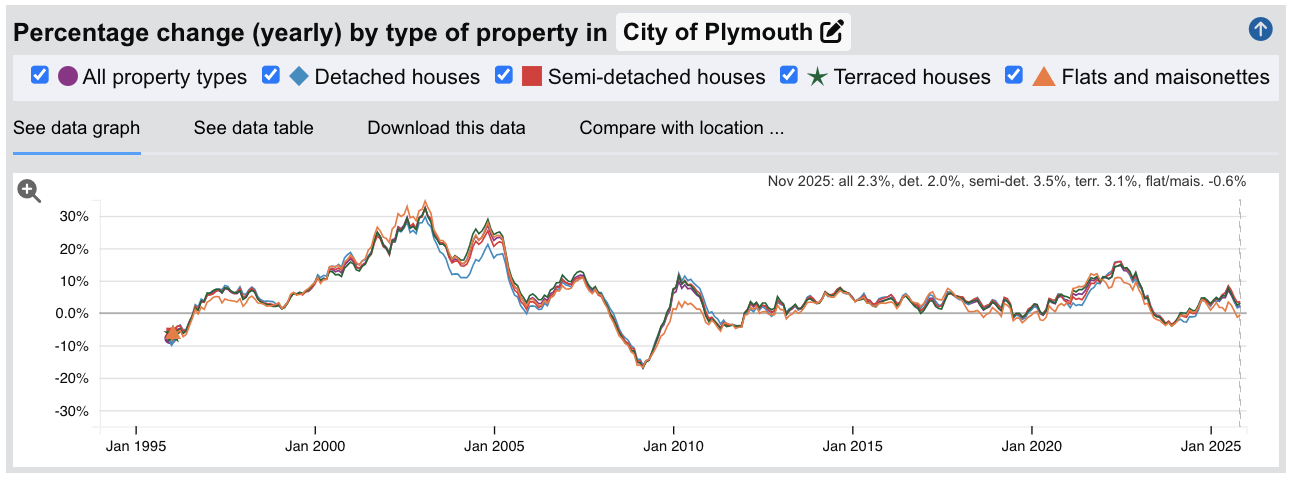

Plymouth's full house price history from the HM Land Registry House Price Index runs from January 1995 to November 2025. The data shows one major crash, a prolonged recovery, and a sharp pandemic-era surge.

- 1995-2000 (Slow start): Plymouth began 1995 at £42,036. Prices actually fell in 1996, dropping to £38,540 by January. Annual change hit -8.3% that month. By January 2000, prices had only recovered to £47,589. Five years of near-stagnation while London and the South East boomed.

- 2000-2007 (The boom): Plymouth caught up fast. Prices more than tripled from £47,589 in January 2000 to a peak of £150,527 in August 2007. The sharpest growth came in 2004-2005, when annual change exceeded 22%. Defence spending was strong, the university was expanding, and cheap credit pushed prices beyond what local wages could support.

- 2007-2009 (The financial crisis): From the peak of £150,527 in August 2007 to the trough of £121,771 in March 2009, Plymouth lost 19.1% of its value in 19 months. The worst annual change reading was -16.9% in March 2009. All property types fell almost equally: detached -16.1%, semi-detached -16.8%, terraced -17.0%, flats -16.8%. Plymouth's decline of 19.1% was broadly in line with the South West region (-19.4%) and slightly worse than England overall (-18.2%).

- 2009-2013 (Stagnation): Plymouth bounced quickly off the trough. By December 2009, prices had recovered to £133,669. But then growth stalled. Prices traded sideways between £127,000 and £138,000 for four years. By December 2013, the average was £137,709. Still 8.5% below the pre-crash peak.

- 2014-2016 (Slow recovery): Growth returned but at a modest pace. Annual changes of 3-5% gradually closed the gap. Prices finally passed the pre-crash peak in October 2015 at £150,705. That recovery took over 8 years from the August 2007 peak. Plymouth was slower to recover than London and the South East, where prices passed pre-crash levels by 2013-2014.

- 2017-2019 (Steady growth): Prices rose from £154,062 in January 2017 to £166,394 by December 2019. Consistent growth of 1-3% per year. Not spectacular, but stable. The naval base provided a floor under the market that more speculative cities lacked.

- 2020-2022 (Pandemic surge): The stamp duty holiday and the remote working shift hit Plymouth hard in the best way. Prices jumped from £166,959 in March 2020 to £212,433 by December 2022. That is 27.2% growth in under three years. Plymouth's coastal location and relative affordability made it a beneficiary of the lifestyle relocation trend.

- 2023 (Rate shock): Interest rate rises cooled the market. Prices dipped from £212,433 in December 2022 to £204,369 by December 2023. A decline of 3.8%. Brief and relatively mild compared to the 2008 crash.

- 2024-2025 (Recovery): Prices stabilised and began rising again. By November 2025, the average reached £218,125 with annual growth of 2.3%. Plymouth now sits 44.9% above its pre-crash peak.

Long-Term Property Value Growth in Plymouth

- 5 years (2020-2025): +26.5% (£172,471 to £218,125)

- 10 years (2015-2025): +44.6% (£150,869 to £218,125)

- 15 years (2010-2025): +61.1% (£135,425 to £218,125)

- 20 years (2005-2025): +69.1% (£129,004 to £218,125)

- 30 years (1995-2025): +418.9% (£42,036 to £218,125)

The 2008 crash is the reference point for Plymouth investors assessing downside risk. A 19.1% decline took 8 years to recover. But the recovery came. And Plymouth's structural advantages are stronger now than in 2007. The AUKUS submarine programme did not exist then. The Freeport was not designated. Millbay was derelict. The risk profile today is different, even if property prices are never guaranteed.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Plymouth

The latest sold house price index by the Land Registry confirms what most investors already suspect about Plymouth. Prices sit well below the national average. The headline figure of £218,125 is 25.6% below England's £293,131 and 28.7% below the South West's £306,045. But the size of that discount varies dramatically depending on what you buy.

Flats in Plymouth average £132,202. That is 40.3% below the England average of £221,565. No other property type comes close to that gap. It is the widest discount in Plymouth's market and reflects a combination of city-centre student stock, ex-local authority flats, and an absence of the premium new-build apartment market that inflates flat prices in cities like Bristol or Exeter.

| Property Type | Plymouth Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £408,222 | £474,400 | -13.9% |

| Semi-detached houses | £268,319 | £290,004 | -7.5% |

| Terraced houses | £222,692 | £245,002 | -9.1% |

| Flats and maisonettes | £132,202 | £221,565 | -40.3% |

| All property types | £218,125 | £293,131 | -25.6% |

Semi-detached houses show the narrowest discount at just 7.5%. Semis are the core family housing stock in Plymouth's suburban postcodes like PL6 (Derriford), PL7 (Plympton), and PL9 (Plymstock). Owner-occupier demand competes directly with buy-to-let investors in these areas, which keeps semi prices closer to the national average than any other type.

Detached houses sit 13.9% below England at £408,222. There are relatively few detached properties within the city boundary, concentrated in the eastern suburbs and PL8's rural fringe. Plymouth's distance from the commuter premium that inflates detached prices in the South East explains the gap.

Terraced houses average £222,692, a 9.1% discount. The Victorian and Edwardian terraces in PL4 (Lipson, Laira) and PL1 (City Centre) are the backbone of Plymouth's rental stock, particularly for student lets near the university. They offer some of the lowest entry prices in the city and the strongest combination of yield and tenant demand.

Flats represent the clearest value play at 40.3% below the national market. For investors, that discount means even modest rental income can generate meaningful yields. But flat stock in Plymouth ranges from purpose-built blocks near the Hoe to converted Victorian houses in the student quarter. The postcode-level data in the sections below shows which areas deliver and which to approach with caution.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Price Per Square Foot in Plymouth

Average asking prices can mislead. A postcode might look expensive simply because it has larger properties. Price per square foot strips out that size bias and shows what you are actually paying for space. It is the closest measure to true underlying value across different property types and sizes.

Plymouth's price per square foot ranges from £193 in PL4 to £384 in PL8, a spread of almost 2x across nine postcodes. That is a wider range than you see in many cities and it reflects the gulf between Plymouth's affordable urban core and its rural South Hams fringe.

| Rank | Area | Price Per Sq Ft |

|---|---|---|

| 1 | PL4 (Lipson, Laira) | £193 |

| 2 | PL2 (Devonport, Stoke) | £208 |

| 3 | PL1 (City Centre, Devonport) | £221 |

| 4 | PL5 (Honicknowle, Crownhill) | £239 |

| 5 | PL3 (Mannamead, Mutley) | £245 |

| 6 | PL6 (Derriford, Roborough) | £276 |

| 7 | PL7 (Plympton) | £303 |

| 8 | PL9 (Plymstock, Elburton) | £309 |

| 9 | PL8 (Brixton, Yealmpton) | £384 |

PL4 at £193 per square foot is the cheapest space in Plymouth. This is the student and young professional belt near the university. Older terraced housing stock keeps per-foot costs low, which is exactly why landlords buying for yield gravitate here. PL4 ranks cheapest by price per square foot yet delivers 23.8% five-year growth. Investors who bought here in 2021 are now sitting on meaningful equity gains from a low base.

PL7, PL9, and PL8 form the premium tier at £303 to £384 per square foot. These are the suburban and rural postcodes where larger family homes and period properties command higher rates. PL8 at £384 is the outlier again. South Hams rural stock trades at nearly double the price per square foot of the urban core.

The mid-range cluster of PL1, PL5, PL3, and PL6 (£221 to £276) is where most buy-to-let activity sits. Read this alongside the yield data. PL5 ranks fourth for price per square foot at £239 but delivers the highest gross yield at 5.9%. That combination of reasonable space costs and strong rental returns is what makes PL5 the standout postcode across multiple measures.

Figures reflect averages across all property types and ages. Individual values depend on condition, location within the postcode, and building age.

For Sale Asking Prices in Plymouth

Asking prices reflect what sellers and agents think the market will pay. They are not the same as sold prices, which capture what buyers actually paid. The gap between the two matters. In a rising market, asking prices run ahead of sold prices. In a cooling market, asking prices sit above what eventually transacts.

Plymouth's asking prices range from £197,931 in PL4 to £551,196 in PL8. Exclude the PL8 rural outlier and the urban range narrows to £197,931 to £330,970. That is a manageable spread for investors comparing entry points across the city.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | PL4 (Lipson, Laira) | £197,931 |

| 2 | PL5 (Honicknowle, Crownhill) | £209,608 |

| 3 | PL1 (City Centre, Devonport) | £210,172 |

| 4 | PL2 (Devonport, Stoke) | £210,249 |

| 5 | PL6 (Derriford, Roborough) | £268,429 |

| 6 | PL3 (Mannamead, Mutley) | £276,250 |

| 7 | PL7 (Plympton) | £285,537 |

| 8 | PL9 (Plymstock, Elburton) | £330,970 |

| 9 | PL8 (Brixton, Yealmpton) | £551,196 |

Four postcodes cluster between £197,931 and £210,249. PL4, PL5, PL1, and PL2 all sit within £12,000 of each other. For investors, that means the entry price is essentially the same across these four areas. The decision comes down to yield, tenant profile, and growth trajectory rather than affordability. PL5 is the standout in that cluster: similar price to PL1 and PL2 but significantly higher yield at 5.9%.

PL9 Plymstock at £330,970 is the most expensive urban postcode. It attracts families and professional owner-occupiers, which supports long-term capital growth but compresses yields. PL8 at £551,196 sits in a different market entirely. Five sales per month and no rental data mean this is not a buy-to-let postcode for most investors.

The mean asking price across all nine Plymouth postcodes is £282,260. That figure appears in the comparison section later, where Plymouth is measured against Exeter, Bristol, Bournemouth, and Truro.

House Price Growth in Plymouth

Growth data shows where prices have moved over 1, 3, and 5 years. For buy-to-let investors, the five-year figure matters most. It captures a full market cycle and filters out short-term noise. One-year growth can swing on a handful of transactions. Five years tells you whether an area is genuinely appreciating.

Eight of Plymouth's nine postcodes delivered positive five-year growth, with PL5 leading at 25.6%. Only PL8 is in negative territory at -1.1%. An investor who bought a £167,000 property in PL5 five years ago would be sitting on a property now asking £209,608. That is £42,600 in equity growth from one of Plymouth's most affordable entry points.

| Area | 1 Year | 3 Years | 5 Years |

|---|---|---|---|

| PL5 (Honicknowle, Crownhill) | 4.7% | 7.6% | 25.6% |

| PL6 (Derriford, Roborough) | 2.5% | -0.6% | 24.3% |

| PL4 (Lipson, Laira) | 1.4% | 8.3% | 23.8% |

| PL3 (Mannamead, Mutley) | 4.8% | 6.0% | 22.4% |

| PL2 (Devonport, Stoke) | 3.7% | 3.1% | 20.8% |

| PL7 (Plympton) | 1.5% | 4.2% | 18.0% |

| PL9 (Plymstock, Elburton) | 0.3% | 3.2% | 13.8% |

| PL1 (City Centre, Devonport) | 0.8% | 1.7% | 2.8% |

| PL8 (Brixton, Yealmpton) | -5.6% | 6.4% | -1.1% |

The top five postcodes for five-year growth are all in western and northern Plymouth. PL5, PL6, PL4, PL3, and PL2 each delivered over 20% growth. These are working and middle-class residential areas where rising demand from first-time buyers and investors has pushed prices up from a low base. The same postcodes dominate the yield table. That convergence of growth and yield in the same areas is unusual and makes Plymouth's west side particularly attractive for total return investors.

PL1 City Centre at 2.8% is technically positive but barely keeping pace with inflation. City centre stock in Plymouth is predominantly flats, and the 40.3% discount to England on flat prices tells you that demand for city centre living in Plymouth is not where it is in Bristol or Manchester. PL1 may benefit from the Millbay and waterfront regeneration pipeline, but the growth data has not caught up yet.

PL6 shows an interesting pattern: strong five-year growth at 24.3% but negative three-year growth at -0.6%. That suggests prices surged early in the five-year window (likely during the pandemic stamp duty holiday) and have since plateaued. The Derriford area may be at or near fair value for now, which means future growth depends on the hospital expansion and AUKUS employment impact.

Monthly Property Sales in Plymouth

Transaction volumes reveal which areas have the deepest buyer pools. For buy-to-let investors, this is an exit strategy question. If you need to sell, can you? High volume and high turnover mean a liquid market. Low volume means you may wait.

Plymouth's monthly sales range from 5 in PL8 to 44 in PL6, with a combined total of 298 transactions per month across all nine postcodes. The standout figure is PL7 Plympton's turnover rate of 131%, meaning properties change hands faster than new stock comes to market.

| Area | Sales Per Month | Turnover | Asking Price |

|---|---|---|---|

| PL6 (Derriford, Roborough) | 44 | 79% | £268,429 |

| PL7 (Plympton) | 41 | 131% | £285,537 |

| PL3 (Mannamead, Mutley) | 39 | 108% | £276,250 |

| PL5 (Honicknowle, Crownhill) | 38 | 81% | £209,608 |

| PL9 (Plymstock, Elburton) | 38 | 40% | £330,970 |

| PL4 (Lipson, Laira) | 35 | 25% | £197,931 |

| PL2 (Devonport, Stoke) | 32 | 73% | £210,249 |

| PL1 (City Centre, Devonport) | 26 | 32% | £210,172 |

| PL8 (Brixton, Yealmpton) | 5 | 38% | £551,196 |

PL4 Lipson has the lowest turnover at 25% despite healthy sales of 35 per month. That tells you there is a large pool of rental stock that rarely comes to market. Landlords hold properties long-term in this student and young professional area. If you are buying to hold for ten years or more, the low turnover confirms that other investors have the same idea.

PL3 Mannamead and PL7 Plympton both show turnover above 100%. These are desirable residential areas where properties attract multiple buyers quickly. For exit strategy planning, PL6 and PL7 offer the strongest combination of volume and turnover. If you need to realise an investment, these postcodes have the deepest buyer pool in Plymouth.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Plymouth Rental Market Analysis

For investors weighing up whether rental property is a worthwhile investment in Plymouth, the data below breaks down average monthly rents and gross rental yields across the city's postcodes.

Rental data is available for 7 of 9 postcodes. PL7 (Plympton) and PL8 (Brixton, Yealmpton) have insufficient current listings for reliable figures. For the seven with data, monthly rents range from £718 in PL4 to £1,175 in PL9 and gross yields range from 4.3% to 5.9%. If you are looking to build a property portfolio in the South West, Plymouth's combination of low entry prices and above-average yields makes it a strong contender.

Average Rent & Gross Rental Yields in Plymouth

Gross rental yield is calculated from the average asking price and average monthly rent for each postcode. It does not account for void periods, maintenance, management fees, or mortgage costs. It is a starting point for comparison, not a profit forecast.

PL5 delivers Plymouth's highest gross yield at 5.9%, where monthly rents of £1,025 meet asking prices of £209,608. At the other end, PL9 Plymstock at 4.3% reflects higher asking prices absorbing strong absolute rents. The yield spread across Plymouth is 1.6 percentage points. That gap means the difference between a property that cash-flows from day one and one that relies on capital growth to justify the investment.

| Area | Avg Monthly Rent | Avg Asking Price | Gross Yield |

|---|---|---|---|

| PL5 (Honicknowle, Crownhill) | £1,025 | £209,608 | 5.9% |

| PL1 (City Centre, Devonport) | £911 | £210,172 | 5.2% |

| PL6 (Derriford, Roborough) | £1,146 | £268,429 | 5.1% |

| PL2 (Devonport, Stoke) | £850 | £210,249 | 4.9% |

| PL3 (Mannamead, Mutley) | £1,069 | £276,250 | 4.6% |

| PL4 (Lipson, Laira) | £718 | £197,931 | 4.4% |

| PL9 (Plymstock, Elburton) | £1,175 | £330,970 | 4.3% |

| PL7 (Plympton) | Not enough data | £285,537 | Not enough data |

| PL8 (Brixton, Yealmpton) | Not enough data | £551,196 | Not enough data |

Three postcodes sit above 5% gross yield: PL5, PL1, and PL6. Each taps into a different tenant pool. PL5 Honicknowle draws working families and key workers. PL1 City Centre attracts students and young professionals. PL6 Derriford benefits from the hospital and university campus. That diversity of demand is a strength. If one tenant pool weakens, the others still hold.

PL4 at 4.4% is a puzzle at first glance. It has Plymouth's lowest asking prices at £197,931, which should push yields higher. But rents at £718 are also the lowest in the city. That is the student market effect. During term time, shared houses generate strong per-room income through HMO lets. The headline single-let rent underplays what experienced landlords actually achieve in this postcode.

PL9 commands Plymouth's highest absolute rent at £1,175 per month but delivers the lowest yield at 4.3%. Plymstock attracts professional tenants willing to pay a premium for suburban living. The yield is compressed by asking prices of £330,970. Investors here are typically buying for tenant quality and long-term appreciation rather than cash flow.

Is Plymouth Rent High?

Rent affordability matters from both sides. For tenants, it determines whether they can sustain payments long-term. For landlords, areas where rent consumes a lower share of income tend to produce more reliable tenants and fewer arrears.

The median gross weekly salary in Plymouth is £676.70, which equates to £2,932 per month or £35,188 per year. This is below the South West regional median of £722.00 per week and the Great Britain median of £752.40 per week. Data from the Nomis Labour Market Profile (ASHE 2025).

Across Plymouth's seven postcodes with rental data, rent ranges from 24.5% to 40.1% of the local median gross monthly salary. The general benchmark is that rent becomes stretched above 30% of gross income. Five of the seven postcodes sit above that level, which reflects Plymouth's relatively low earnings rather than unusually high rents.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | PL9 (Plymstock, Elburton) | 40.1% |

| 2 | PL6 (Derriford, Roborough) | 39.1% |

| 3 | PL3 (Mannamead, Mutley) | 36.4% |

| 4 | PL5 (Honicknowle, Crownhill) | 34.9% |

| 5 | PL1 (City Centre, Devonport) | 31.1% |

| 6 | PL2 (Devonport, Stoke) | 29.0% |

| 7 | PL4 (Lipson, Laira) | 24.5% |

| — | PL7 (Plympton) | Not enough data |

| — | PL8 (Brixton, Yealmpton) | Not enough data |

PL9 and PL6 at 40.1% and 39.1% look stretched on paper. But these are higher-rent areas attracting tenants who earn above the Plymouth median. Hospital consultants in PL6 and professional families in PL9 are not on £35,188. The median salary is a city-wide figure that understates what tenants in these postcodes actually earn.

PL5 at 34.9% sits in the sweet spot for investors. Rents are high enough to deliver the best yield in Plymouth (5.9%) but low enough relative to income that tenants can pay reliably without financial stress. PL4 at 24.5% is the most affordable, which aligns with its student and early-career tenant base. Low affordability pressure here means arrears risk is lower, even if the headline yield is more modest.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Plymouth House Prices High? Price-to-Earnings Ratios

The price-to-earnings ratio compares a postcode's average asking price to the local median annual salary. Lower ratios mean more affordable entry points relative to local wages. The national benchmark is 7.5x, calculated from England's average sold price of £293,131 against Great Britain's median annual salary of £39,125.

Purchasing a property in Plymouth requires between 5.6 and 15.7 times the median annual salary. This is based on the Nomis Labour Market Profile for Plymouth showing the median gross annual income for Plymouth residents is £35,188.

Four of Plymouth's nine postcodes sit below the national benchmark of 7.5x. PL4, PL5, PL1, and PL2 all come in at 6.0x or below. PL6 at 7.6x sits just above. Exclude the PL8 rural outlier at 15.7x and the urban range narrows to 5.6x to 9.4x.

| Rank | Area | Price-to-Earnings Ratio |

|---|---|---|

| 1 | PL4 (Lipson, Laira) | 5.6x |

| 2 | PL5 (Honicknowle, Crownhill) | 6.0x |

| 3 | PL1 (City Centre, Devonport) | 6.0x |

| 4 | PL2 (Devonport, Stoke) | 6.0x |

| 5 | PL6 (Derriford, Roborough) | 7.6x |

| 6 | PL3 (Mannamead, Mutley) | 7.9x |

| 7 | PL7 (Plympton) | 8.1x |

| 8 | PL9 (Plymstock, Elburton) | 9.4x |

| 9 | PL8 (Brixton, Yealmpton) | 15.7x |

Those four sub-7.5x postcodes are also where the strongest yields sit. PL5 at 6.0x delivers the highest gross yield at 5.9%. PL1 and PL2 at 6.0x deliver 5.2% and 4.9%. Affordable entry prices relative to local wages and strong rental returns in the same postcodes is a combination that supports sustainable buy-to-let investment.

PL8 at 15.7x is completely detached from local incomes. Rural South Hams prices are driven by lifestyle demand from buyers outside Plymouth, not by what Plymouth workers earn. PL9 at 9.4x is the most stretched urban postcode. Plymstock attracts owner-occupier families willing to pay a premium, which pushes the ratio well above the national benchmark.

For investors comparing across the South West, Plymouth's price-to-earnings ratios are more favourable than Exeter, Bournemouth, and Bristol, where higher prices and similar regional salaries push ratios significantly higher.

Deposit Requirements in Plymouth

Most buy-to-let mortgage lenders require a minimum 25% deposit. The table below uses a more conservative 30% to reflect the rates and products available at higher loan-to-value ratios. A 30% deposit typically unlocks better interest rates, which matters for cash flow in a yield-driven market.

Plymouth's entry costs range from £59,379 in PL4 to £165,359 in PL8. Four postcodes require deposits under £65,000, putting buy-to-let within reach for investors who might be priced out of Bristol, Exeter, or Bournemouth.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | PL4 (Lipson, Laira) | £59,379 |

| 2 | PL5 (Honicknowle, Crownhill) | £62,882 |

| 3 | PL1 (City Centre, Devonport) | £63,052 |

| 4 | PL2 (Devonport, Stoke) | £63,075 |

| 5 | PL6 (Derriford, Roborough) | £80,529 |

| 6 | PL3 (Mannamead, Mutley) | £82,875 |

| 7 | PL7 (Plympton) | £85,661 |

| 8 | PL9 (Plymstock, Elburton) | £99,291 |

| 9 | PL8 (Brixton, Yealmpton) | £165,359 |

PL5 at £62,882 is arguably the best value entry in the table. It requires a similar deposit to PL4, PL1, and PL2 but delivers the highest yield (5.9%) and the strongest five-year growth (25.6%). The extra £3,500 over PL4's deposit buys access to a significantly better-performing postcode.

A clear gap separates the sub-£65,000 tier from the rest. PL6 at £80,529 is the next step up, followed by PL3 and PL7 in the £83,000-£86,000 range. PL9 approaches £100,000 and PL8 sits at £165,000. For investors with limited capital, the four cheapest postcodes all deliver yields between 4.4% and 5.9%. You do not need to stretch into the higher deposit brackets to access Plymouth's strongest rental returns.

Deposit is only part of the upfront cost. Budget for stamp duty (use our stamp duty calculator for an accurate figure), legal fees, and survey costs. For a full breakdown, see our guide to buy-to-let costs.

What the Plymouth Data Tells Buy-to-Let Investors

The postcode-level data across this guide points to three distinct approaches depending on whether you are optimising for income, growth, or both.

For yield, the numbers favour PL5 (5.9%), PL1 (5.2%), and PL6 (5.1%). All three sit below 6.1x price-to-earnings with 30% deposits between £63,000 and £80,500. PL5 stands out across every measure: highest yield, highest five-year growth (25.6%), and a deposit of £62,882. PL6 benefits from proximity to Derriford Hospital and the university. PL1 taps into city centre and naval demand.

For growth, the same postcodes lead. PL5 (25.6%), PL6 (24.3%), and PL4 (23.8%) delivered the strongest five-year appreciation. PL4 also offers the lowest entry point in Plymouth at £59,379 deposit. That convergence of yield and growth in the same postcodes is unusual. In most cities they pull in opposite directions.

PL8 and PL9 suit different investor profiles. PL8 is rural South Hams: £551,196 average asking price, 5 sales per month, no rental data, and negative five-year growth. It is not a buy-to-let postcode for most. PL9 Plymstock delivers Plymouth's highest absolute rents at £1,175 but asking prices of £330,970 compress the yield to 4.3%. It works for investors prioritising tenant quality and long-term holds over cash flow.

How Plymouth Buy-to-Let Compares to Nearby Areas

Investors looking at Plymouth are typically also considering other South West cities. The table below compares Plymouth against four nearby locations using the same methodology: mean asking price across all postcodes, mean monthly rent across postcodes with data, and top single-postcode gross yield.

| Location | Mean Asking Price | Mean Monthly Rent | Top Gross Yield |

|---|---|---|---|

| Plymouth | £282,260 | £985 | 5.9% |

| Bournemouth | £360,376 | £1,458 | 7.8% |

| Bristol | £373,245 | £1,784 | 8.3% |

| Exeter | £389,666 | £1,327 | 5.7% |

| Truro | £448,887 | £1,150 | 4.5% |

Plymouth is the most affordable entry point in this group by a significant margin. Mean asking prices of £282,260 are £78,000 below Bournemouth and £167,000 below Truro. That lower entry price is what keeps Plymouth's yields competitive despite lower absolute rents.

Bristol and Bournemouth show higher top yields (8.3% and 7.8%), but those headline figures require substantially more capital. Bristol's mean asking price of £373,245 means a 30% deposit of £112,000, nearly double Plymouth's entry-level postcodes. Exeter is the closest comparison in character: similar rents, similar top yield (5.7% vs 5.9%), but asking prices £107,000 higher.

Truro is the outlier. The most expensive entry point with the lowest top yield. Cornwall's lifestyle premium pushes prices well above what rental income can support. For investors with limited capital looking for the best yield-per-pound-invested in the South West, Plymouth's numbers are the strongest in this group.

Frequently Asked Questions

How does Plymouth compare to Exeter for buy-to-let?

Plymouth offers lower entry prices (mean asking price £282,260 vs Exeter's £389,666), a higher top yield (5.9% vs 5.7%), and four postcodes with 30% deposits under £65,000. Exeter commands higher absolute rents (£1,327 vs £985 mean) and benefits from stronger connectivity to London via the mainline railway. Plymouth's advantage is capital efficiency: more yield per pound of deposit. Exeter's advantage is tenant demand depth from a wealthier catchment. Both sit in the South West but serve different investor profiles.

Are there property investment companies operating in Plymouth?

Several firms market buy-to-let properties in Plymouth, particularly new-build developments and off-plan stock. Be cautious with any company offering guaranteed yields or sourcing fees above 2-3% of purchase price. The data in this guide covers the open market. Any property sold through an investment company could be benchmarked against these figures but it doesn't guarantee a market value as these are average values.

Is student accommodation a good investment in Plymouth?

The University of Plymouth has over 19,000 students, with a further 7,500 studying for Plymouth degrees at partner institutions. That creates consistent rental demand in PL4 (Lipson, Laira) and PL3 (Mannamead, Mutley). For a broader view of the sector, see our guide to purpose-built student accommodation.

When will AUKUS and the Freeport affect Plymouth property prices?

The AUKUS submarine programme is expected to create up to 6,000 jobs at Devonport Dockyard, with recruitment ramping up from 2027 onwards. The South Yard Freeport gained designation in 2023 with tax incentives running until 2031. The employment impact is not yet reflected in the property data. Investors positioning early may benefit from price growth as demand builds, but the timeline is long. The first AUKUS submarines are not expected until the 2030s. This is a decade-long structural play, not a short-term catalyst.

Can I find buy-to-let property in Plymouth under £100,000?

The average asking prices in this guide range from £197,931 (PL4) to £551,196 (PL8), but these are postcode averages across all property types. Individual flats in PL1, PL2, and PL4 do list below £100,000, particularly ex-local authority stock and smaller one-bedroom units. Plymouth's average flat price of £132,202 from the Land Registry confirms that sub-£100,000 stock exists. At that price point, a 30% deposit is under £30,000. Due diligence on actual tenant demand and the lease length, service charges, and building condition is essential at the lower end of the market.