Where Next for UK House Prices? Forecasts, Reality, and What Really Matters

Are UK house prices falling? Where are they heading in 2026, 2027, and beyond? A house price forecast is essentially a prediction about future property values based on economic models, market trends, and historical data.

Current forecasts from major institutions predict modest growth of 2-5% annually over the next five years, with regional variations favouring the North over the South. The Bank of England expects steady but unspectacular appreciation, while property consultancies like Savills and Knight Frank project cumulative gains of 15-20% by 2029.

However, before you make your property investment decisions based on these predictions, consider this: in May 2020, every major forecaster predicted a house price crash of 7-8%. Prices rose 10% instead.

In 2002, economists forecast 5% growth for the year. HM Land registry shows the market delivered 28.4% growth. The history of UK house price forecasting reveals a consistent pattern. Even the best models struggle to predict what actually happens.

This guide examines current forecasts, documents where predictions have failed spectacularly, and explains what property investors should focus on instead of trying to time the market.

Article updated: December 2025

Contents

- Current State: Are UK House Prices Falling?

- What the Forecasts Say: 2026-2030 Predictions

- When Forecasts Miss Spectacularly

- Why Even Good Forecasters Get It Wrong

- The Cost of Trying to Time the Market

- What to Focus On Instead of Predictions

- The Long-Term Perspective: Numbers That Matter

- Frequently Asked Questions

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Current State: Are UK House Prices Falling?

As of late 2025, UK house prices aren't falling nationally. The average house price sits at approximately £271,531 according to the latest HM Land Registry data, showing modest growth of around 2-3% over the past year. This follows volatility in 2022-2023 when prices dipped slightly after the post-pandemic boom peaked.

Transaction volumes remain below pre-pandemic levels, suggesting buyers are cautious but not panicking. The UK rental market continues to show strength with rents rising faster than property prices in many areas.

What the Forecasts Say: 2026-2030 Predictions

The consensus among major forecasting institutions? Modest, steady growth over the next five years. Nobody predicts a boom and few predict a crash. The general view is UK house prices will rise 2-5% annually, with regional variations continuing to dominate.

Bank of England and OBR Forecasts

The Bank of England's latest economic projections assume house prices will track inflation relatively closely over the next five years, implying real terms growth close to zero. They expect mortgage rates to remain elevated compared to the ultra-low period of 2020-2021, keeping affordability stretched for first-time buyers. The Office for Budget Responsibility expects similar with growth of around 2.5% annually inline with income growth.

Major Property Consultancies

Savills forecasts cumulative UK house price growth of 17% between 2025 and 2029, with London significantly underperforming at around 8% total growth. They expect the North and Midlands to lead with gains of 20-25%. Their model assumes mortgage rates stabilise around 4.5-5%, employment remains strong, and no major economic shocks occur.

Knight Frank projects similar figures, with 15-18% cumulative growth over five years. They highlight the "ripple effect" continuing to push wealth out from London into commuter belt areas and regional cities with strong connectivity.

Mortgage Lenders

Halifax and Nationwide, drawing on their extensive mortgage approval data, predict 3-4% annual growth in 2026, accelerating slightly to 4-5% by 2028 as mortgage rates ease. Both institutions note the key variable is the path of interest rates. If the Bank of England can bring rates down more quickly than expected, housing market activity could strengthen faster.

Regional Breakdown

Nearly all forecasts agree on regional divergence continuing. London and the South East face the slowest growth of 1-2% annually due to affordability constraints. The Midlands and North show the strongest potential with 4-6% annually. Cities like Nottingham, Leeds, and Newcastle are tipped to outperform significantly. Scotland and Wales sit in the middle with moderate 2-4% annual growth.

These forecasts sound reasonable. They're based on sophisticated models, decades of data, teams of expert economists. So what's the problem?

Access our selection of exclusive, high-yielding, residential investment property deals and a personal consultant to guide you through your options.

When Forecasts Miss Spectacularly

When you examine what forecasters actually predicted versus what happened, the track record is poor. Not slightly off. Catastrophically wrong at the moments that matter most.

May 2020: The Pandemic Paradox

This represents the single biggest forecasting failure in modern UK property market history. March 2020, the UK entered strict lockdown. The housing market physically closed for eight weeks. The economy contracted by over 20% in Q2. Every major institution applied their recession models and predicted house prices would crash.

One forecast predicted a 7% fall for 2020. Another predicted 7.5% down. The OBR warned of an 8% decline in 2021.

What actually happened? UK house prices rose approximately 8% in 2020 and accelerated to 10% growth in 2021. Instead of the predicted crash, the market boomed. The opposite outcome entirely.

Lockdowns fundamentally changed the utility value of housing. People needed home offices and gardens. Middle-class households accumulated record savings which were deployed into property deposits. The government's Stamp Duty holiday poured fuel on an already hot market. In May 2020, not a single major forecaster saw this coming.

2008: The Crash Nobody Saw

2005 & 2006, the housing boom showed signs of cooling. Forecasters universally predicted a "soft landing." Halifax forecast a 2% decline followed by modest increases. Nationwide predicted prices would be broadly stable. The consensus was that any correction would happen gradually. Prices staying flat while inflation caught up, rather than nominal falls.

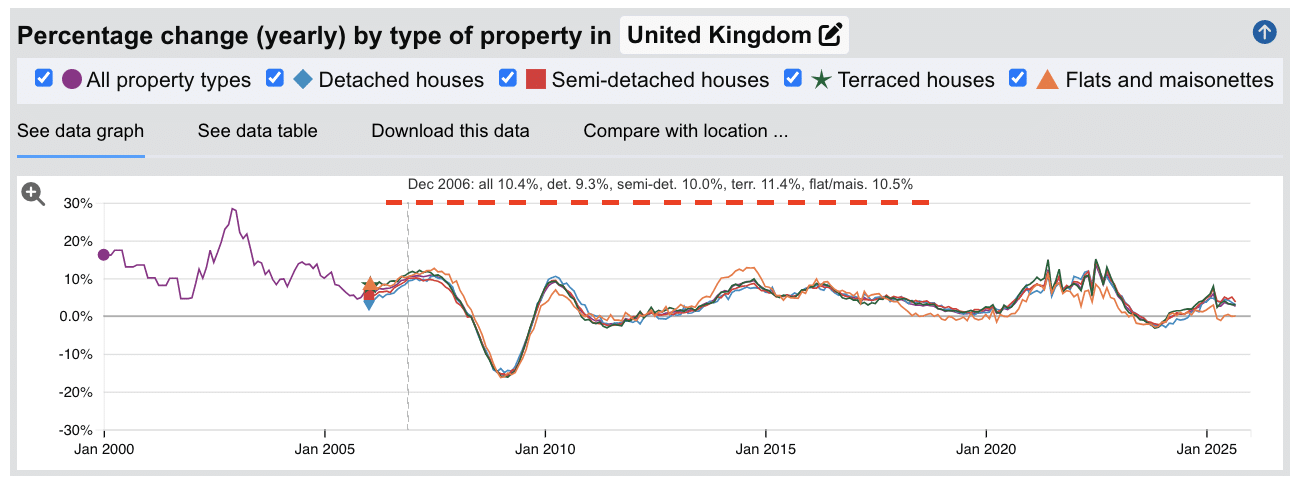

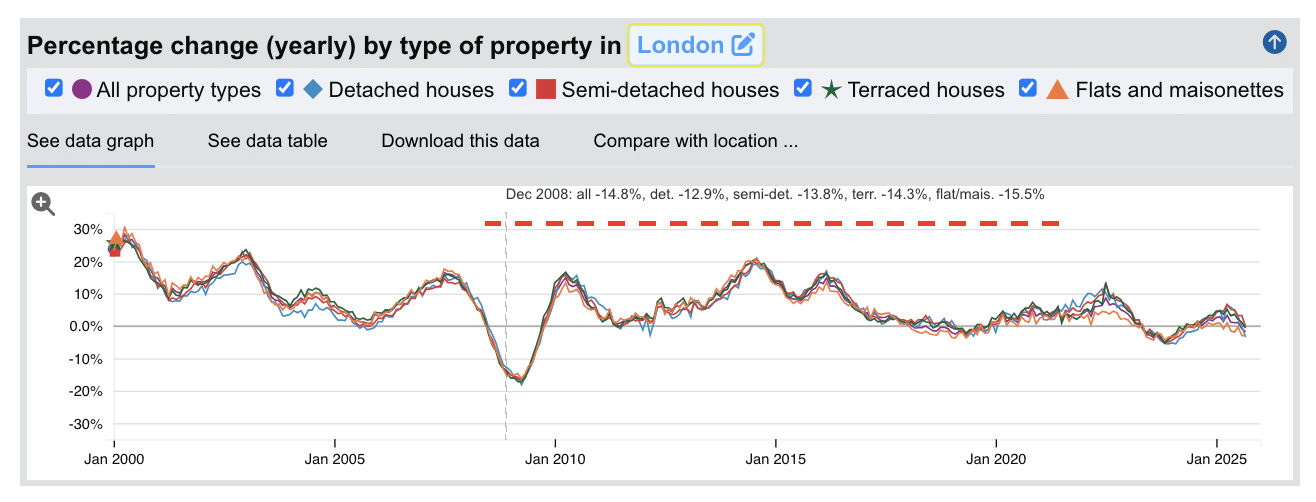

Instead, the market experienced one final boom in 2005,2006 and 2007 with prices as high as 10% annual growth across the UK on average.

This was then followed by the 2008 global financial crisis and a 15% house price crash. The soft landing never materialised. For a detailed analysis, see our retrospective on the 2008-2009 housing market crash.

Major events. Catastrophic forecast failures. When markets are calm, forecasts are reasonably accurate. When something structural changes, when exogenous shocks hit, when human behaviour shifts unexpectedly, the models and predictions break.

Why Even Good Forecasters Get It Wrong

These aren't failures of intelligence or effort. The economists producing these forecasts are highly skilled professionals using sophisticated models and the most up to date property data. But they're trying to predict a system that's fundamentally unpredictable in the medium term.

They Can't Predict Government Intervention

UK governments of all colours have consistently demonstrated they will intervene to support house prices at any sign of trouble. Help to Buy in 2013 put a floor under the market when recovery was fragile. The 2020 Stamp Duty holiday turned a predicted crash into a boom. The mortgage guarantee scheme propped up lending when banks were nervous.

They Can't Predict Behavioral Shifts

Forecasting models treat housing as a financial asset correlated with GDP, interest rates, employment. In 2020, housing became something else entirely. The value of a garden or spare room surged. The desire to move overrode the economic fear of moving. Standard economic models can't capture these psychological shifts because they assume rational actors responding to financial fundamentals.

They Can't Predict Exogenous Shocks

The biggest forecast failures were all driven by events external to the housing market itself. Credit deregulation, global banking collapse, once-in-a-century health crisis. Not variables in any housing market model.

Some investors reference the 18-year property cycle as a more reliable timing framework. While this cyclical pattern has shown some historical validity, even Fred Harrison, who accurately predicted the 1990 and 2008 crashes using this model, acknowledges exact timing is impossible and cycles can be extended or compressed by policy interventions.

The Cost of Trying to Time the Market

The natural response to unreliable forecasts is to think you can do better. Look at the data yourself, make your own judgment about where the peak or trough is, time your entry accordingly. I've seen this play out many times, including in my own investing career.

Early in my career, I spent considerable time analysing growth data and market cycles. Around 2008, I was convinced London had peaked. The numbers looked stretched, prices were now dropping after having doubled in less than a decade. So I avoided London and bought property elsewhere, thinking I was being clever.

That property I bought in 2008 in a low value low growth area? It's worth roughly the same today as it was then. Meanwhile, London property has delivered massive gains over the same period despite the crash, despite Brexit, despite everything. If I'd bought in London when I thought it was "too expensive," I'd have been through the 2008 crash, yes. But I'd also have captured all the recovery and growth since.

The lesson isn't that London is always the right choice. It's that trying to time peaks and troughs cost me significant capital appreciation. I was trying to be smart when I should have been thinking long-term. Instead look at guidance on setting realistic property investment goals that don't depend on perfect timing, focus on fundamentals rather than market cycles.

What to Focus On Instead of Predictions

If forecasts are unreliable and timing doesn't work, what should property investors actually focus on? The fundamentals. These checks take less time than reading most forecast reports and tell you what's actually happening on the ground versus what models predict might happen.

1. Local employment data: Visit Nomis and check employment rates, unemployment trends, and dominant industries. Populations follow jobs which then create rental demand. Simple as that. Is employment growing or declining? What industries dominate, and are they expanding or contracting? Our location guides for cities like Stoke, Leicester, and Bradford break down these fundamentals.

2. Population trends: Check ONS data for population growth or decline. An area might have strong employment today, but if the population is declining or aging, long-term demand will weaken regardless of current prices.

3. Price-to-earnings ratio: Divide average house prices by average local earnings. If you're looking at 8-10x, that's stretched. If you see 4-6x, there's room for sustainable growth. Instead of asking "will prices rise or fall," ask "are prices too high for local incomes?"

4. Rental yield reality check: Search the area on Rightmove for rental properties. Use our buy-to-let calculator to see if the numbers actually work with current interest rates. Stress-test different scenarios. What happens if interest rates rise another 1%? What if you have a two-month void period? If the numbers still work, you've got a resilient investment.

Rental income must always cover your costs. Not negotiable. I target a combined return of around 10% with a minimum 10-year holding period. The rental yield component is the foundation because it determines whether you can hold the property through market downturns. For investors considering whether buy-to-let remains viable in the current market, cashflow sustainability is the deciding factor.

The Long-Term Perspective: Numbers That Matter

Here's the most important data point in UK housing.

January 2000, the average UK house price was £77,950. September 2025, it was £271,531. That's 248% growth over 25 years, despite the 2008 crash, despite Brexit, despite the pandemic, despite everything forecasters got wrong along the way.

UK House Price Growth 2000-2025

Land Registry average prices at key milestones

| Year | Average UK House Price | Growth from 2000 |

|---|---|---|

| 2000 | £77,950 | - |

| 2005 | £152,000 | +95% |

| 2010 | £167,000 | +114% |

| 2015 | £189,000 | +142% |

| 2020 | £238,000 | +205% |

| 2025 | £271,531 | +248% |

Source: HM Land Registry UK House Price Index

The market is cyclical. Prices rise, fall, rise again. But the long-term trajectory has been consistently upward, like inflation has and like earnings have. This is not controversial. However the percentage of growth is. Remember: The low point of each new cycle has been higher than the low point of the previous cycle.

For property investors with a 10+ year horizon, this long-term trend matters more than any individual year's forecast. Whether prices rise 2% or 5% in 2026 may be less important than whether you've bought in the right location with the right strategy and can hold through whatever short-term volatility occurs.

The investors I know who've built genuine wealth through property didn't do it by timing markets. They did it by buying decent properties in decent locations, ensuring the cashflow worked, and holding for 15-20 years. They lived through the 2008 crash. They lived through Brexit uncertainty. They kept collecting rent, kept paying down mortgages. When they look back now, the exact year they bought matters far less than the fact they bought and held.

Frequently Asked Questions

Are house prices falling in the UK right now?

No, nationally house prices are not falling as of late 2025. The average UK property price shows modest growth of around 2-3% over the past year according to Land Registry data. However, there's significant regional variation. London and parts of the South East show flat or marginally negative growth, while the Midlands and North continue showing 4-6% annual growth.

Should I trust house price forecasts for 2026 and beyond?

Use forecasts for general direction but be skeptical of precise predictions. The documented pattern shows major forecasts miss spectacularly during turning points. In 2020, all major institutions predicted a 7-8% crash; prices rose 10% instead. Forecasts can't predict government intervention, behavioral shifts, or exogenous shocks. Focus on structural arguments rather than specific percentages.

Should I wait to buy property if forecasts predict slower growth?

"Don't wait to buy property, buy property and wait" is a popular saying in property. If a property works for your strategy with current numbers and you're holding 10+ years, the exact entry point matters far less than people think and is impossible to predict exact market timing.

Which regions are forecast to perform best in 2026-2030?

The consensus is that the Midlands and North will outperform with 4-6% annual growth, while London and the South East will see slower 1-2% growth due to affordability constraints. Cities frequently highlighted include Manchester, Birmingham, Nottingham, Leeds, and Newcastle. However, as above, DO NOT RELY ON FORECASTS. rather than investing based purely on predicted outperformance, verify local fundamentals like employment growth, rental demand and do the numbers work for your budgets.

What makes a house price forecast unreliable?

Red flags include: predicting precise percentages years in advance, not acknowledging government intervention risk, assuming "return to normal" without defining what normal means, treating the UK as a single market, and relying purely on historical patterns. The most reliable forecasts acknowledge uncertainty and provide ranges rather than specific numbers.

How do house price forecasts affect mortgage rates?

Forecasts don't directly affect mortgage rates. Often it is the other way around, forecasters will try and estimate what they think mortgage rates 'might be' and will have their house price forecasts reflect this. Most advice generally suggests to focus on current mortgage rates and stress-test your investment against potential 1-2% rate increases rather than trying to predict future house price movements.