Trafford Property Investment: Best Buy-to-Let Areas

Trafford, a diverse borough of Greater Manchester, combines affluent suburbs like Hale and Bowden, with numerous outstanding schools and an envious mix of local green spaces with exceptional transport links to Manchester city centre and a number of nearby motorways.

This makes it very appealing to homeowners and families, keeping prices high and making it hard for first time buyers and new landlords looking to get started in property investment.

However there are still some opportunities for investors. The area's mix of residential neighbourhoods and commercial zones, including the iconic Trafford Centre and MediaCityUK, creates varied investment possibilities for buy-to-let landlords, with apartments and terraces houses still showing some solid rental yields with exceptional tenant demand.

It is true that it is harder at the higher end of the market with high prices for detached homes and semi-detached houses. This makes it a market that works well for flipping a house and buy-refurbish-refinance type developers, but much harder for investors seeking BMV properties (below market value) with very high rental yields.

In this article, we look in depth at house prices, growth, yields and population statistics to see how both types of investors can invest in the Trafford property market.

Data updated: February 2025.

Trafford Buy-to-Let Market Overview 2025

Average sold property prices in Trafford (£384,053) exceed the UK average by 32.6%, with rental yields ranging from 3.20% to 4.70% across different postcodes. Premium areas like Altrincham (WA14) command higher prices, particularly for detached homes (£693,340), while areas like Stretford (M32) offer stronger yields. Weekly rents span from £195 to £320, equivalent to monthly rents of £845 to £1,387.

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. All data is presented as provided by our sources without adjustments or amendments.

Best Areas for Buy-to-Let in Trafford

Highlights

Trafford, part of Greater Manchester, offers some impressive areas to live and invest including:

Average for sale house prices £

- Premium areas: WA15 (Altrincham/Bowdon) leads at £620,453, with WA14 (Altrincham) at £494,894

- Mid-range: M33 (Sale) at £399,557 and M41 (Urmston) at £332,777

- Value opportunity: M32 (Stretford) at £310,281 represents the most accessible entry point for established areas

Average asking rents and yields

- Highest yield area: M32 (Stretford) achieves 4.70% yield

- Strong yield area: M41 (Urmston) delivers 4.30% yield

- Premium yields: WA15 (Altrincham/Bowdon) offers 3.20% due to higher purchase prices

Trafford's property market significantly benefits from Manchester's extensive road and transport network, particularly the Metrolink tram system which serves multiple areas including Altrincham, Sale, and Stretford, making it highly attractive for commuters working in Manchester city centre and families living in the leafy suburbs and travelling to the city.

The borough maintains consistently high property values due to its excellent schools, with over 39 schools rated Ofsted outstanding.

M32 (Stretford) emerges as a standout opportunity for buy-to-let landlords looking for both capital growth potential and workable rental coverage, combining the highest yields (4.70%) with more accessible entry prices (£310,281).

Why Invest in Trafford?

Trafford seemingly has it all. It attracts, individuals, couples and families. Homeowners going up the property ladder and investors looking for consistent historic growth. Enviable schools, large historic green spaces, impressive transport links and local community with popular areas like the Altrincham Market House, Old Trafford Cricket Ground and of course Manchester United Old Trafford stadium.

It also has a council that is going out of it's way to secure additional investment in to the region.

There is plenty of growth going in to Trafford, with over 11,000 local businesses and Europe's first industrial business park it has a foundation for new investment. Including the New Carrington masterplan, aiming to deliver over 5,000 homes and 350,000 square meters of employment floor space.

For landlords that have the budget, Trafford is a very appealing option. Even if you are new and learning property investment, there are all types of properties in the region to get you started.

Trafford Buy-to-Let Market Analysis 2025

When Was the Last House Price Crash in Trafford?

The last significant property price crash in Trafford occurred during the global financial crisis of 2008-2010, which happened after a large growth period of house prices between 2000 - 2005.

Interesting house price trends in Trafford have periods of rapid growth and seemingly sharp decline rather than slow consistent growth.

In 2010 to 2015 house prices remained relatively static. Then a large boom until 2022. A sharp correction for most property types, then growth again from 2023.

There is currently a house price correction (not quiet a crash), from mid to late 2024 as house prices reach peak levels and affordability becomes difficult for local residents.

Average Sold House Prices in Trafford by Property Types

The latest sold house price index by the land registry, Nov 2024 (it is always a couple of months behind reporting its datasets), shows the following average sold house prices across the Trafford local authority area.

Trafford's property prices are significantly higher than UK averages, particularly in the detached housing sector where sold house prices exceed the national average by 58.7%. The semi-detached market also shows premium performance at 49.6% above UK averages, while flats and maisonettes remain relatively accessible at just 1% above national averages. This could indicate stronger value in the local apartment market for investors focused on rental yields as part of their investment property checklist.

Trafford (local authority area)

Updated February 2025

| Property Type | Trafford Average Price | UK Average | Difference |

|---|---|---|---|

| Detached houses | £693,340 | £436,949 | +58.7% |

| Semi-detached houses | £424,149 | £283,546 | +49.6% |

| Terraced houses | £328,684 | £242,598 | +35.5% |

| Flats and maisonettes | £235,457 | £233,230 | +1.0% |

| All property types | £384,053 | £289,707 | +32.6% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. All data is presented as provided by our sources without adjustments or amendments.

House Prices in Trafford: For Sale Asking Prices (£)

Updated February 2025

The data represents the average asking prices of properties currently listed for sale in Trafford.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | WA15 (Altrincham/Bowdon) | £620,453 |

| 2 | WA14 (Altrincham) | £494,894 |

| 3 | M33 (Sale) | £399,557 |

| 4 | M41 (Urmston) | £332,777 |

| 5 | M32 (Stretford) | £310,281 |

| 6 | M31 (Partington) | £260,807 |

| 7 | M17 (Trafford Park) | £234,893 |

Trafford's house prices show significant variation across different postcodes, with Altrincham and Bowdon (WA15) commanding the highest prices at £620,453, more than double the cost of properties in Trafford Park (M17).These figures represent average asking prices across all property types, and actual achievable prices may vary depending on property size, condition, and specific location within each postcode.

Price Per Square Foot in Trafford (£)

Updated February 2025

The data represents a blended average, combining the average asking price per square foot of properties currently for sale in Trafford and the sold price per square foot of sold properties.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | WA15 (Altrincham/Bowdon) | £441 |

| 2 | WA14 (Altrincham) | £412 |

| 3 | M17 (Trafford Park) | £399 |

| 4 | M33 (Sale) | £378 |

| 5 | M41 (Urmston) | £368 |

| 6 | M32 (Stretford) | £304 |

| 7 | M31 (Partington) | £253 |

Trafford's price per square foot values show significant variation across the borough, with Altrincham/Bowdon (WA15) commanding the highest at £441 and Altrincham (WA14) following at £412 per square foot. The more suburban areas like Sale (M33) and Urmston (M41) show mid-range values between £368-378, while Partington (M31) offers the most affordable space at £253 per square foot. These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode. The high value in M17 (Trafford Park) should be viewed with caution as it may reflect a small sample size of residential properties in what is primarily a commercial area.

House Price Growth in Trafford (%)

Updated February 2025

The data represents the average house price growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices. These figures should be interpreted with caution, as they reflect average prices across all property types and include both properties currently for sale and those already sold.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | M31 (Partington) | 41.20% |

| 2 | M32 (Stretford) | 36.90% |

| 3 | M33 (Sale) | 28.40% |

| 4 | M41 (Urmston) | 24.00% |

| 5 | WA14 (Altrincham) | 21.30% |

| 6 | WA15 (Altrincham/Bowdon) | 14.80% |

| 7 | M17 (Trafford Park) | not enough data |

Trafford's growth figures show significant variation across different areas, with Partington (M31) leading at 41.20%, followed by Stretford (M32) at 36.90%. These traditionally more affordable areas have shown the strongest growth, potentially driven by regeneration initiatives and spillover demand from more expensive neighbouring districts. Meanwhile, established premium areas like Altrincham show more modest but still positive growth rates. These figures should be viewed with some caution as they represent average prices across all property types and include properties 'for sale' and 'sold prices'. Growth rates in premium areas like WA14 and WA15 may be moderated by their already high base values. Some areas like M17 (Trafford Park) show insufficient data due to lower residential property volumes in predominantly commercial areas.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. All data is presented as provided by our sources without adjustments or amendments.

Trafford Buy-to-Let Rental Market Analysis

For those investors looking at how to make money from buy-to-let, and thinking how much can you charge for rent in Trafford?

The rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for traditional assured shorthold tenants. This is helpful if you are considering building a buy-to-let property portfolio in this area.

Rental Prices in Trafford (£)

Updated February 2025

The data represents the average monthly rent for long-let AST properties in Trafford. These figures reflect rents across all property types and do not account for differences in property size, number of bedrooms, or short-term lets.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | WA15 (Altrincham/Bowdon) | £320 | £1,387 |

| 2 | WA14 (Altrincham) | £295 | £1,278 |

| 3 | M33 (Sale) | £285 | £1,235 |

| 4 | M41 (Urmston) | £275 | £1,192 |

| 5 | M32 (Stretford) | £250 | £1,083 |

| 6 | M31 (Partington) | £195 | £845 |

| 7 | M17 (Trafford Park) | not enough data | not enough data |

Trafford's rental market shows clear price segmentation across different areas, with Altrincham/Bowdon (WA15) achieving the highest average weekly rents at £320 (£1,387 monthly) and Altrincham (WA14) following at £295 (£1,278 monthly). The established commuter areas of Sale and Urmston command mid-range rents, while Partington offers more affordable options at £195 weekly (£845 monthly). These figures represent average rents across all property types, from studio apartments to larger houses, and actual achievable rents can vary significantly based on property size, condition, and specific location within each postcode. Areas like M17 (Trafford Park) show insufficient data due to their predominantly commercial nature.

Gross Rental Yields in Trafford (%)

Updated February 2025

The data represents the average gross rental yield in Trafford, calculated using a snapshot of current properties for sale and properties for rent. These figures are based on asking prices.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | M32 (Stretford) | 4.70% |

| 2 | M41 (Urmston) | 4.30% |

| 3 | M33 (Sale) | 3.70% |

| 4 | WA14 (Altrincham) | 3.40% |

| 5 | WA15 (Altrincham/Bowdon) | 3.20% |

| 6 | M31 (Partington) | not enough data |

| 7 | M17 (Trafford Park) | not enough data |

Trafford's rental yields show notable variation across different postcodes, with Stretford (M32) offering the highest yield at 4.70%, followed by Urmston (M41) at 4.30%. These areas typically have more accessible property prices while maintaining strong rental demand from young professionals and families. Premium areas like Altrincham and Bowdon show lower yields due to their higher purchase prices. These figures represent gross rental yields calculated from average rents and prices, and investors should note that net yields will be lower after accounting for costs, void periods, and management expenses. Some areas like M31 and M17 show insufficient data due to very few rental properties on the market available to rent.

Access our selection of exclusive, high-yielding, residential investment property deals and a personal consultant to guide you through your options.

Is Trafford Rent High?

Yes, Trafford's rental costs represent a substantial financial commitment for residents relative to local earnings, and significantly exceed Manchester City, Greater Manchester and national averages.

Based on ONS data showing North West median weekly household income at £696 (£36,192 annually), rental coverage ratios are:

In Altrincham/Bowdon (WA15), which has Trafford's highest weekly rents at £320 (£1,387 monthly), residents need to commit 46.0% of their gross income to rent. The situation is similar in Altrincham (WA14), where weekly rents of £295 (£1,278 monthly) would require 42.4% of the median household income. This is unaffordable for the average family on an average income.

Established commuter locations like Sale (M33) show consistently high rental rates at £285 per week (£1,235 monthly), requiring around 41.0% of median gross household income.

In more affordable areas like Partington (M31), where weekly rents average £195 (£845 monthly), residents need to commit 28.0% of median household income to rent which is seen as generally affordable and similar to other nearby regions, making it an alternative option for landlords seeking buy-to-lets in Salford or buy-to-let investments in Manchester.

While Trafford's rental prices reflect its status as a premium Greater Manchester borough, the reality for local residents is that housing costs consume a substantial share of their income. With most areas requiring between 28-46% of median gross household income for rent, before tax, utilities, and other living expenses. Trafford's rental market presents significant affordability challenges for its residents.

Are Trafford House Prices High?

Yes, Trafford's property market shows significantly higher prices compared to the wider UK market, with HM Land Registry House Price Index data showing sold house prices consistently and substantially above national averages across all property types.

Trafford's average sold property price of £384,053 sits 32.6% above the UK average of £289,707, demonstrating its position as one of Greater Manchester's premium property markets, ahead of even Stockport and properties in Cheshire.

The asking prices for properties in Trafford right now (properties that are actively on the market for sale rather than actual sold prices noted above) vary considerably across postcodes, from Altrincham/Bowdon (WA15) at £620,453 and Altrincham (WA14) at £494,894, down to more affordable areas like Trafford Park (M17) at £234,893 and Partington (M31) at £260,807.

Yet with median annual earnings in the North West at £36,192 (£696 weekly), Trafford's most affordable areas require around 6.5 times annual salary, while the more affluent suburbs like Altrincham/Bowdon exceed a staggering 17.1 times the median regional wage if you wanted to buy a buy-to-let in this postcode based on current values.

Even traditionally more accessible areas like Stretford (M32), where prices average £310,281, still require around 8.6 times the regional median salary - significantly exceeding typical mortgage lending limits of 4-4.5 times household income.

The premium prices compared to other Greater Manchester boroughs make Trafford particularly challenging for first-time buyers and buy-to-let investors seeking strong yields.

Those looking for more affordable homes have started to look further afield including nearby, Warrington and even Chester.

How Much Deposit to Buy a House in Trafford?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Trafford regions:

North Trafford

- M32 (Stretford): A buy-to-let investor looking at an average property (£310,281) would need to put down a 30% deposit of £93,084.

- M41 (Urmston): In Urmston, an investor would need a 30% deposit of £99,833 for an average property (£332,777).

South Trafford

- WA14 (Altrincham): A buy-to-let investor would need a 30% deposit of £148,468 for an average property (£494,894).

- WA15 (Altrincham/Bowdon): In the premium Bowdon area, an investor would need a 30% deposit of £186,136 for an average property (£620,453).

Central Trafford

- M33 (Sale): A buy-to-let investor would need a 30% deposit of £119,867 for an average property (£399,557).

- M31 (Partington): An investor would require a 30% deposit of £78,242 for an average property (£260,807).

- M17 (Trafford Park): For an average property in Trafford Park (£234,893), a deposit of £70,468 would be needed.

For those considering how to start a property business, areas like Stretford (M32) and Urmston (M41) offer a balance of entry prices and ok yields above 4%, while maintaining excellent transport links to Manchester city centre and benefiting from Trafford's strong schools and amenities.

Trafford Population Growth

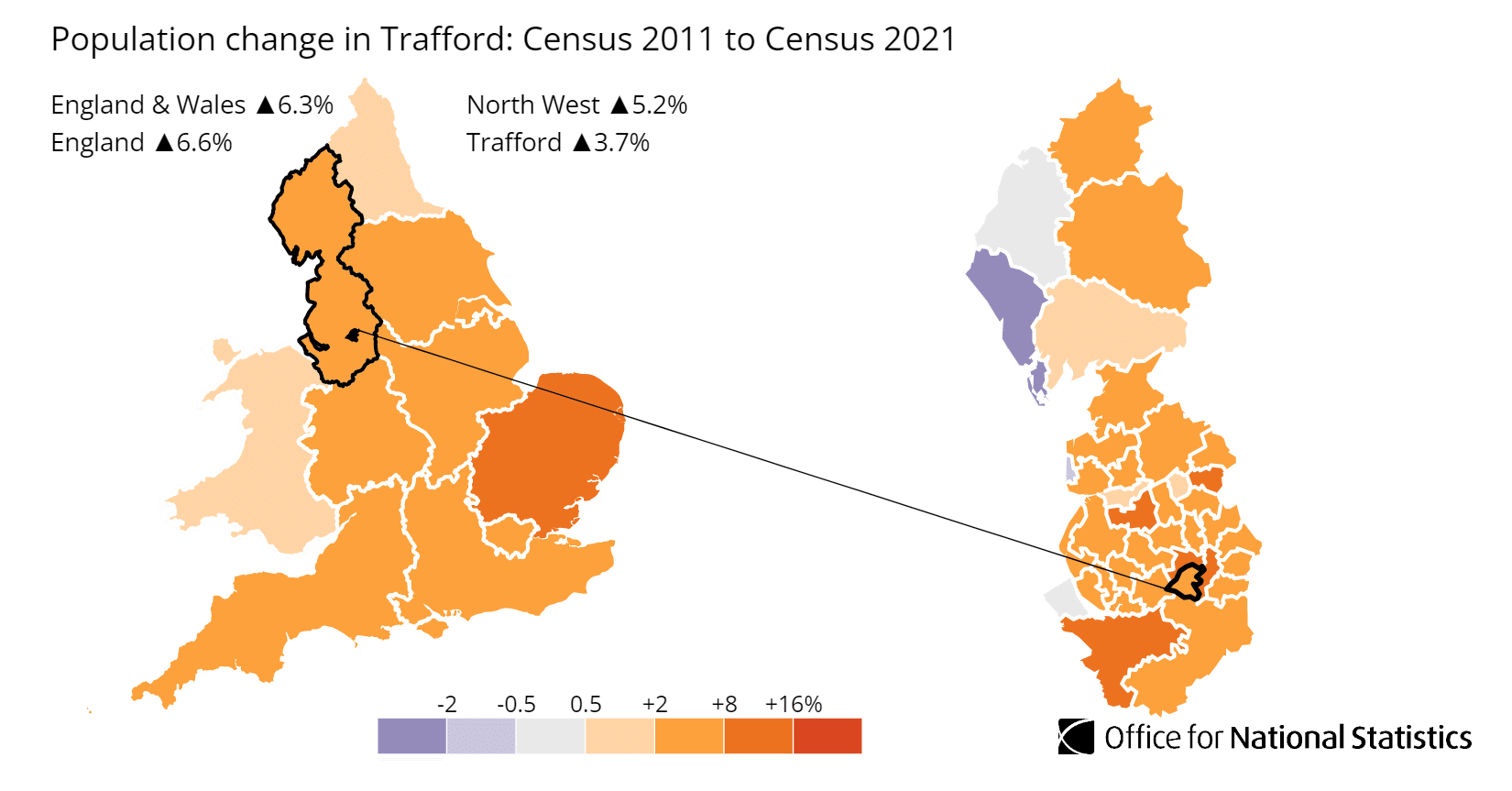

The total population of Trafford was 235,100 (as of the last UK government census in 2021).

Trafford's population has grown by 3.7%, increasing from 226,600 in 2011. This growth rate is exceptionally slow when you compare the population growth for Manchester city centre, which grew by 9.7% in the same 10 years.

Interestingly, even though house prices in Trafford have shot up in the years between the census data, the population growth rate was actually lower than both the overall population increase across the North West region (5.2%) and England's overall growth (6.6%).

The average (median) age in Trafford increased by one year to 40 years between the two censuses. This aligns with both the North West region and England overall, which both had median ages of 40 years.

Notable age-related changes in Trafford's population between 2011 and 2021 include:

- The number of residents aged 50-64 years increased by over 4,600 people (an 11.3% rise)

- The number of children aged 4 years and under decreased by over 1,400 (a 9.4% reduction)

- The proportion of residents aged 50-64 grew by 1.3 percentage points, now representing 19.3% of the population

Population density in Trafford has also increased, with the area now home to approximately 15.8 people per football pitch-sized piece of land, up from 15.3 in 2011. This places Trafford among the top 30% most densely populated English local authority areas.

Of particular interest to landlords, private renting has increased significantly:

- 15.3% of Trafford households now rent privately (up from 12.7% in 2011)

- 15.0% live in social rented housing (down from 16.4% in 2011)

- Home ownership has decreased slightly from 69.3% to 69.0%

Below we look at the largest postcode districts by population across Trafford and the population growth for each.

Population Growth in Trafford by Postcode District

Population and growth rates by area (2021 Census data)

| Rank | Area | Population at 2021 Census | Population Growth 2011 to 2021 |

|---|---|---|---|

| 1 | M33 (Sale) | 59,972 | 4% |

| 2 | WA15 (Altrincham/Bowdon) | 42,760 | 4% |

| 3 | M41 (Urmston) | 41,397 | 4% |

| 4 | M32 (Stretford) | 28,434 | 4% |

| 5 | WA14 (Altrincham) | 28,235 | 4% |

| 6 | M31 (Partington) | 8,349 | 4% |

| 7 | M17 (Trafford Park) | not enough data | not enough data |

The population data shows consistent growth across Trafford's postal districts, with most areas experiencing a 4% increase over the past decade. M33 (Sale) and WA15 (Altrincham/Bowdon) are the most populous districts, with Sale home to nearly 60,000 residents. The population distribution shows a clear pattern, with established residential areas having larger populations than more industrial or regeneration zones. Even smaller residential districts like M31 (Partington) with 8,349 residents maintained steady growth at 4%, indicating stable development across the borough. Note: While the postcode district data totals 209,147 residents, Trafford's total population is 235,100. This difference occurs because some postcode districts that cross local authority boundaries are not included in the district-level breakdown, and areas like M17 (Trafford Park) have insufficient residential data due to their primarily commercial nature.

Trafford Landlord Licensing

Buy-to-Let Licensing

For Trafford buy-to-let landlords with traditional individual or family tenants, there currently isn't a mandatory, selective or additional landlord licensing scheme in place across the Trafford borough.

Houses of Multiple Occupation Licensing

Landlords who want to invest in a HMO (house in multiple occupation) in Trafford need a mandatory licence. This is currently a requirement for all HMOs with:

- 5 or more people

- From 2 or more households

- Who share facilities (such as bathrooms or kitchens)

To apply for an HMO licence in Trafford, landlords must provide:

- Plan layout of the property with room measurements

- Fire alarm commissioning/test certificate

- Emergency lighting commissioning/test certificate

- Landlord gas safety certificate

- Electrical installation condition report

- Tenancy agreement

- Basic Criminal Disclosure Certificate (DBS)

Here is a complete list of Trafford HMO requirements.

Trafford Article 4 Directions

Trafford has a borough-wide Article 4 direction in place, which means you need planning permission to change a house from a traditional buy-to-let home (classed as a C3 dwelling house) to a HMO (classed as a C4 house in multiple occupation).

This Article 4 Direction:

- Came into force on December 21, 2017

- Covers the entire borough of Trafford

- Helps control the location and number of HMOs

How to Invest in Buy-to-Let in Trafford

For properties to buy in Trafford, including:

- Finding off-market properties

- Buy-to-lets

- Buying a Holiday let or investing in serviced accommodation

- HMOs (houses of multiple occupation)

- PBSA (purpose-built student accommodation)

- and other high-yielding opportunities

We have partnered with the best property investment agents we can find for 8+ years.

Here you can get access to the latest investment property opportunities from our network.

For more information about specific areas:

- If you're interested in the highest rental returns in Trafford, consider M32 (Stretford) with yields of 4.70% and M41 (Urmston) at 4.30%

- For alternative look at the local housing market, with affordable entry prices, check out our guide to the cheapest areas to live in Manchester

- For different opportunities further afield consider exploring buy-to-let in Worcester or buy-to-let in York.