EPC 'C' Target and Improving Energy Efficiency: A Landlords Guide

The Energy Performance Certificate 'C' target is a key part of the UK government's strategy to improve the energy efficiency of residential rental properties. It requires landlords to ensure their properties meet a minimum EPC rating of 'C' by a specific deadline (the new target is the year 2030).

Currently, rental properties in England and Wales must have a minimum EPC rating of 'E' and properties rated 'F' or 'G' cannot be let unless they have a valid exemption.

Contents

- Timeline for EPC 'C' implementation

- Introduction to energy efficiency in buy-to-let

- What targets are central government currently achieving?

- Understanding energy performance certificates

- Steps to improve your properties' energy efficiency

- How landlords can prioritise improvements

- Costs and savings of improvements

- Potential exemptions and how to apply

- Penalties for non-compliance

- How landlords can plan ahead

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Timeline for EPC 'C' Implementation

- In 2017/2018 the Conservative government set out to improve housing standards across England & Wales with the introduction of the domestic minimum energy efficiency standard (MEES).

- One target was by April 1st 2020 all domestic residential properties that were rented had to be a minimum of EPC rating ‘E’. This date passed and this is a legal requirement for all rental properties and buy-to-let landlords.

- An additional target was also agreed by 2025 all new tenancies would need to be a minimum of EPC rating ‘C’ and by 2028 all existing tenancies would also need to achieve this standard.

- In 2023 Rishi Sunak scrapped this additional requirement and 2025 timeline.

- In 2024 a new Labour government confirmed its intention to achieve this goal again and mentioned its aims were for all rented properties to achieve this minimum EPC rating ‘C’ by 2030.

This timeline represents a significant extension from previous proposals, giving landlords more time to make necessary improvements.

These changes highlight the evolving nature of energy efficiency policies and the importance for landlords to stay informed about the latest regulations.

Whatever date eventually gets settled on. It is clear successive governments have this target in their sights. Understanding the 18-year housing market cycle can help you plan energy improvements around market timing.

Governments are set on achieving a net-zero carbon future and landlords should plan ahead to achieve this as soon as possible to provide the best home for their tenants and maintain their assets.

Below we outline what current landlords and those looking to buy property investments should be considering.

Introduction to Energy Efficiency in Buy-to-Let Properties

Let’s go back to basics to see why this is being bought in and why it can actually be a good thing for landlords.

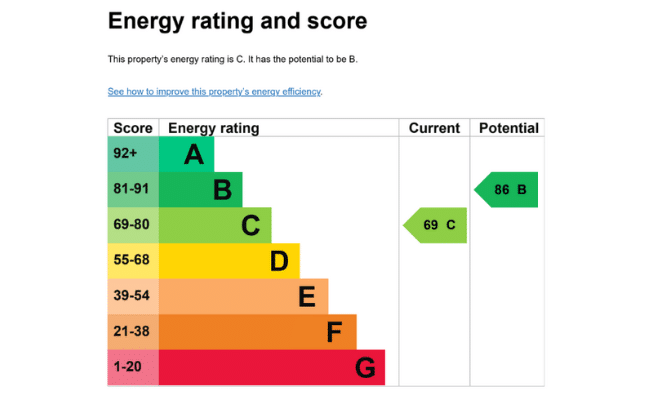

What is an EPC?

An Energy Performance Certificate (EPC) is a document that provides information about a property's energy use and typical energy costs. It also recommends ways to reduce energy use and save money.

The certificate provides the property with an energy efficiency rating from A (most efficient) to G (least efficient).

They have been a requirement since 2008.

An EPC is always the responsibility of the seller, vendor or landlord. A property cannot be legally sold or marketed without one.

They have a 10-year lifespan and should be renewed before this timeline if significant works have been carried out.

As an EPC is a snapshot in time, it is not always an accurate reflection of a property in its present condition.

If you have bought a property that has an existing EPC used for marketing purposes and you wanted to know how you could improve the dwelling's efficiency, we would recommend checking the date of the EPC and if it is not recent it may be worthwhile investing in a more accurate up to date replacement certificate.

How to get a copy of your energy performance certificate

You can find an energy performance certificate for any residential property in England, Wales and Northern Ireland directly from the governments' website here.

You can find an energy performance certificate for any residential property in Scotland directly from the Scottish government's website here.

Why does EPC compliance matter?

Energy performance certificates matter for several reasons:

- Legal requirement: It is a legal obligation to be compliant and have a valid EPC when selling or renting a property.

- Energy efficiency indication: They provide a clear indication of how energy efficient a property is.

- Cost savings: Properties with better EPC ratings are generally cheaper to run.

- Environmental impact: Improving EPC ratings helps reduce carbon emissions.

- Property value: Higher EPC ratings can potentially increase property value

- Appeal to tenants: Higher EPC ratings are attractive to tenants and since 2012 have been a requirement to show on property listings. It’s easy to see a tenant choosing a property with an EPC of C compared to a property with an EPC of E, to benefit from lower running costs with some savings being significant.

- Improved financing: Lenders are seeing the benefits of improved housing stock by offering new mortgage rates with ‘green mortgages’ on properties achieving high EPC ratings.

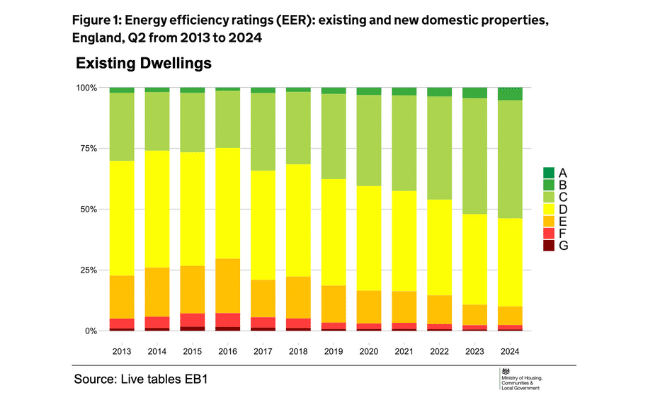

What EPC Targets are Government Currently Achieving

By understanding the landscape of EPC ratings across the UK rental sector, you can get context for the challenges ahead in meeting the government targets.

Currently, how many properties have an A to G rating? How realistic therefore is the 'C' target? and what is the current state of play today across the nation?

At the current rate of progress, 340,000 properties will need to be upgraded each year to hit the labour government target of all rented properties being a minimum EPC ‘C’ by 2030.

According to the latest data from the Ministry of Housing. The distribution of EPC ratings for existing dwellings in England and Wales were as follows in their latest assessment.

Existing Dwellings

- A: 0.4%

- B: 7%

- C: 34%

- D: 39%

- E: 16%

- F: 4%

- G: 0.6%

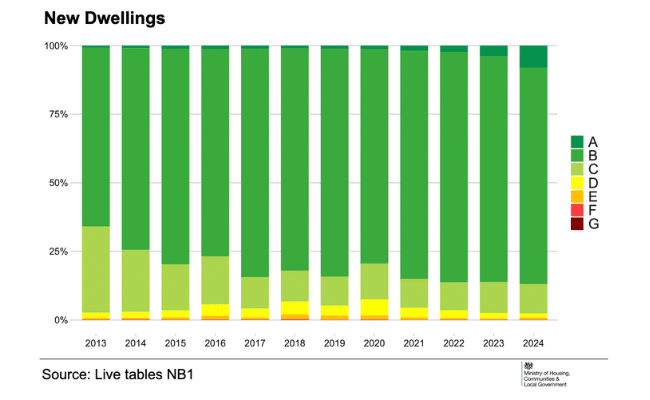

New Dwellings

- A: 22%

- B: 71%

- C: 5%

- D: 1%

- E: 0.3%

- F: 0.1%

- G: 0%

(note: percentage changes have been calculated using unrounded figures, therefore proportions may not add to 100%)

This data shows that approximately 41.4% of properties currently meet the future EPC 'C' requirement, while 58.6% will need improvements to comply with the new regulations.

Understanding Energy Performance Certificates

How much do they cost?

This varies depending on location in the country and the size of the dwelling. As an example, if you are investing in Birmingham and you need an EPC for a standard 2-bedroom semi-detached house, it might cost £60-£80 if you go directly to the domestic energy assessor.

It can take 45 minutes to an hour to complete.

Larger properties, commercial properties or rural properties with more complex needs may take longer and cost more.

How are EPC's calculated and what do they measure?

EPCs are calculated based on a property's energy efficiency features, including:

- Insulation (walls, roof, floor)

- Heating systems and controls

- Windows and glazing

- Lighting

- Renewable energy technologies (if any)

The calculation considers the property's size, layout, and construction materials. It measures:

- Energy use per square metre of floor area

- Carbon dioxide emissions

- Fuel costs

EPC ratings explained

EPC ratings range from A (most efficient) to G (least efficient). The certificate includes:

- Current and potential energy efficiency rating

- Current and potential environmental impact rating

- Estimated energy costs

- Recommendations for improvements

- Estimated cost savings if improvements are made

Steps to Improve Your Property

Insulation (wall, roof, floor)

- Cavity wall insulation

- Solid wall insulation

- Loft insulation

- Floor insulation

- External wall insulation

Heating systems and controls

- Upgrading to a more efficient boiler (especially important for reducing costs for those investing in Student HMOs).

- Installing smart thermostats

- Improving heating controls

Windows and doors

- Double or triple glazing

- Draught-proofing

Lighting

- Switching to LED bulbs

- Installing motion sensors

Renewable energy technologies

- Solar panels

- Heat pumps

- Biomass boilers

How Landlords Can Prioritise Improvements

When looking at how to become a landlord if you are a beginner (or even improving your current portfolio if you are already an investor):

- Start with low-cost, high-impact measures like draught-proofing and LED lighting

- Focus on insulation, which often provides the best return on investment

- Consider the property's current EPC rating and target recommendations that will have the biggest impact on improving the rating by the highest number for your specific property

- Check for any government funding support that may be available to help, like the 'help to heat funding grants', ECO scheme or as part of the planned oil boiler ban or gas boiler ban you can look into the boiler upgrade scheme.

- Consider current and upcoming government guidelines that are connected like the 2035 gas boiler ban timeline.

Costs & Savings of Improvements

Typical costs for various improvement measures

This will vary depending on the size of your house, the number of rooms, the number of walls and the total floor area. For properties built in the 1950s and 1960s housing, these improvements are particularly important due to their original construction methods.

But a rough estimate of costs to consider

- Loft insulation: £300 - £600

- Cavity wall insulation: £500 - £1,500

- Solid wall insulation: £5,000 - £18,000

- Double glazing: £3,000 - £7,000 for a whole house

- New boiler: £2,000 - £4,000

- Solar panels: £4,000 - £10,000

Potential energy savings

Energy savings can be substantial if you are the one paying the bills each year an these suggestions will help improve your average monthly profits from your rental property.

These improvements can also really help your tenant's yearly costs and help retain good tenants for years to come, improving your rental yield:

- Loft insulation can save up to £180 per year

- Cavity wall insulation can save up to £150 per year

- Upgrading to an A-rated boiler can save up to £300 per year

Return on investment varies but can be significant over time, especially for measures like insulation and LED lighting.

Potential Exemptions and How to Apply

Exemptions may be available if:

- The cost of improvements exceeds £3,500 (current cap, subject to change)

- Necessary permissions (e.g., planning permission) cannot be obtained

- The improvements would devalue the property by more than 5%

- The property is listed as a historic building or in a conservation area with restrictions

To apply for an exemption:

- Gather evidence supporting your exemption claim. There are a range of different exemptions from ‘High cost’ exemptions to ‘Property devaluation’ exemptions. You can see all of them here and their criteria.

- Register the exemption on the PRS exemption register

- Exemptions typically last for 5 years

Penalties for Non-Compliance

If your property doesn't meet the minimum EPC rating required by central government and you don't have a valid exemption, the penalties for non-compliance can be:

- You may face fines of thousands of pounds from your local council.

- You may be unable to let the property legally and this can impact your buildings insurance

- Local authorities are responsible for enforcement and can issue compliance notices

How Landlords Can Plan Ahead

So all that being said. What should you do next to help confirm you are currently compliant and future-proofing your property for any upcoming changes

- Check your property's current EPC rating

- If below 'C', get an up-to-date EPC assessment with recommendations

- Create an improvement plan, prioritising cost-effective measures to help reduce the impact of rising energy prices.

- Research available funding and support

- Start implementing improvements well ahead of the 2030 deadline

- Keep records of all improvements and associated costs

- If improvements aren't feasible, consider applying for an exemption

- Stay informed about any changes to regulations or deadlines

By taking proactive steps now, you can ensure your property meets the government's future EPC 'C' targets and, more importantly, benefit from the improvements immediately for you and your tenants.