Manchester Property Investment: Best Buy-to-Let Areas 2025

Property investment in Manchester continues to thrive, driven by the city's position as the North West's leading commercial and economic powerhouse. As one of the UK's most rapidly expanding urban centres, Manchester offers compelling buy-to-let opportunities for investors, with strong market fundamentals supporting both current returns and future growth potential across its residential and commercial sectors.

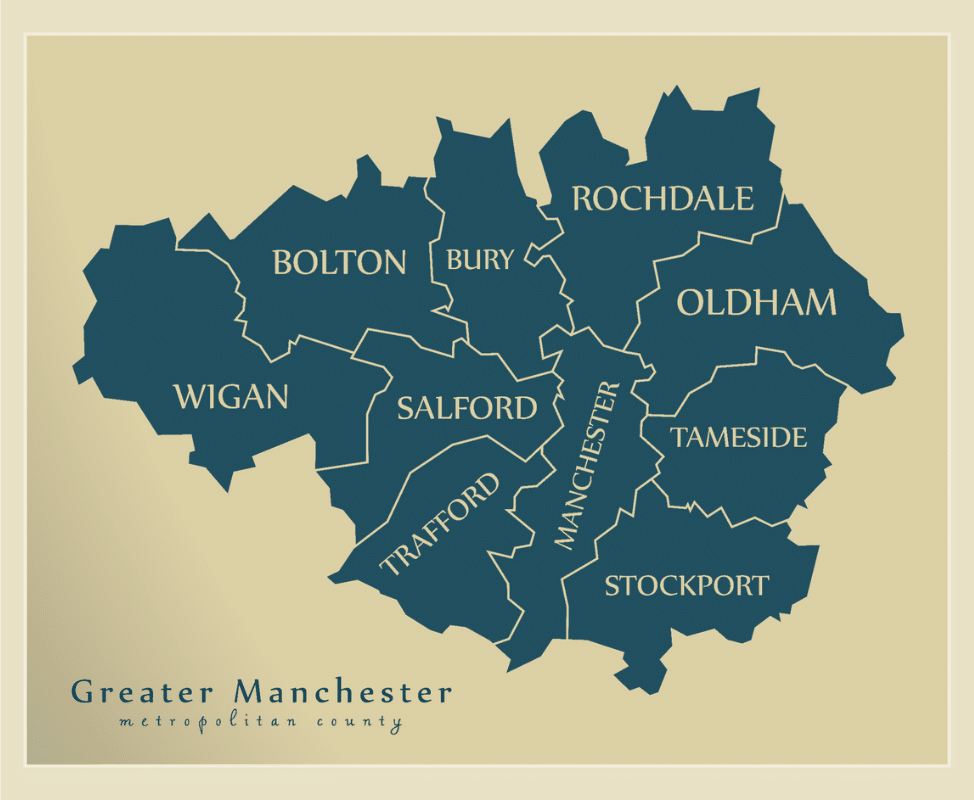

Located at the heart of Greater Manchester and bordering Salford to the west, Stockport to the east and Cheshire to the south. The city of Manchester has transformed from its industrial heritage into a vibrant city to rival England's finest, that attracts investors, businesses, and a growing young population.

Data updated: February 2025. Next update: April 2025

Manchester Buy-to-Let Market Overview 2025

Average yields range from 3.4% to 10.6%, with property prices spanning £205,267 to £447,518. Top performing areas include Fallowfield (M14) for yields (10.6%) and Chorlton (M21) for capital growth. Areas that attract students and young professional show strongest rental demand, with average monthly rents between £1,109-£2,096.

Contents

- Best areas for buy-to-let in Manchester

- Why invest in Manchester?

- When was the last house price crash in Manchester

- Average sold house prices in Manchester by property types

- House prices in Manchester: For sale asking prices (£)

- Price per square foot in Manchester (£)

- House price growth in Manchester (%)

- Rental prices in Manchester (£)

- Gross rental yields in Manchester (%)

- Is Manchester rent high?

- Are Manchester house prices high?

- How much deposit to buy a house in Manchester?

- Manchester landlord licensing

- How to invest in buy-to-let in Manchester

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

Best Areas for Buy-to-Let in Manchester

Highlights

Manchester is the largest city in the north of England and the third largest city across the whole of England. Manchester's population is around half of Birmingham but when you consider the wider area of Greater Manchester, population stats for both of these major cities is very close.

Manchester City offers a multitude of compelling reasons for investors, with affordable house prices and strong rental yields compared to many areas across England (especially the midlands and south).

Average house prices £

- High end: M21 (Chorlton-cum-Hardy) leads the market at £447,518, while M20 (Didsbury) follows at £366,531, both representing Manchester's premium suburban locations.

- Mid-range: Areas like M16 (Old Trafford) at £275,786 and M15 (Hulme) at £269,357 offer good value with strong growth potential.

- More affordable: Areas like M9 (Blackley) at £205,267 and M18 (Gorton) at £208,714 represent more accessible entry points to the market.

Average cost of rents per week £

- High end: M14 (Fallowfield) commands the highest rents at £483.80 per week, likely due to strong student demand.

- Mid-range: M20 (Didsbury) achieves £357.80 per week, while M13 (Ardwick) sees £334.80 per week.

- More affordable: M11 (Clayton) shows £256 per week, while M9 (Blackley) averages £269.70 per week.

Average buy-to-let rental yields %

- High yield: M14 (Fallowfield) leads with an impressive 10.60%, followed by M18 (Gorton) and M12 (Ardwick) both offering strong yields at 7.30% and 7.50% respectively.

- Mid-range: M8 (Cheetham Hill) and M9 (Blackley) both offer solid yields around 6.70-6.80%.

- Lower yield: Premium areas show lower yields, with M21 (Chorlton-cum-Hardy) at 3.40% due to higher purchase prices.

Manchester's property market has three distinct factors: its substantial student population with purpose built student accommodation and student houses of multiple occupation, it's growing professional workforce and population, and ongoing regeneration initiatives to improve the cheapest areas of Manchester to buy houses.

The highest property yields currently emerge from Fallowfield (M14), where investors achieve remarkable 10.6% yields through strong student demand, despite moderate average property prices of £236,941. Nearby Ardwick (M12) delivers compelling 7.5% yields, benefiting from consistent tenant demand and relatively accessible purchase prices around £218,521.

Premium areas like Chorlton-cum-Hardy (M21) and Didsbury (M20) (often voted one of the most popular areas to live in Manchester by the local and national press). These suburbs achieve the highest property values at £447,518 and £366,531 respectively. These areas attract young professionals though yields are more modest at 3.4-5.1%.

For value-focused investors, areas like Collyhurst (M40) and Clayton (M11) present interesting opportunities. With average prices around £224,817 and £211,124 respectively, these locations deliver strong yields for Manchester buy-to-lets of 6.2-6.3%.

Why Invest in Manchester?

So is it worth investing in Manchester property? Manchester's appeal as an investment destination extends far beyond its local property market fundamentals.

As a key player in the Northern Powerhouse it is set to see a growth rate of £2.3 billion in its GVA (gross value added) between 2023 and 2027.

Manchester is experiencing unprecedented growth in its digital and creative sectors, with MediaCityUK leading a £5 billion technology ecosystem.

The city's robust educational sector, hosting around 100,000 students across five universities, combines with its thriving employment market - projected to grow 1.7% annually until 2027 - to create sustained rental demand.

This demographic strength is evidenced in our population data, showing significant growth of up to 18% in key areas like Swinton. When coupled with major regeneration projects like the Northern Gateway, a massive regeneration of the city including 15,000 homes and extensive transport infrastructure, public parks and schools.

Manchester significantly also benefits from a major international airport, the largest airport in the UK outside of London, helping to attract international investors, international students and international businesses.

For those landlords and investors seeking property investment advice, on what are the best locations for buy-to-let in the UK, you can see why Manchester offers investors a rare combination of affordable house prices, historic steady growth, impressive tenant demand and growing population and employment. All of this makes Manchester one of the UK's most compelling buy-to-let locations around today.

Manchester Buy-to-Let Market Analysis 2025

When was the last house price crash in Manchester?

House price trends vary across Greater Manchester, with some areas experiencing faster growth than others. However, the overall trend for Manchester has been upward over the long term.

The last significant property price crash in Manchester occurred during the global financial crisis of 2008-2009. Since then, despite some fluctuations, the market has generally shown resilience and recovery with an upward trend to 2022.

2022 to 2024 there has been a flat lining in house prices for semi-detached and terrace houses, making it crucial to understand how to assess potential when investing for capital growth opportunities.

During this time there has also been a reduction in apartments house prices and a continued increase in prices of detached houses. So there isn't one 'trend' across the area.

Therefore, what is the future of Manchester property market?

Below we look at the answer to this question by reviewing sold house prices, house price growth, rental prices and population.

Average Sold House Prices in Manchester by Property Types

The latest sold house price index by the land registry, Nov 2024 (it is always a couple of months behind reporting it's datasets), shows the following average sold house prices across Manchester and Greater Manchesters local authority areas.

Manchester City (local authority area)

- All property types - £255,835

- Flats and maisonettes - £215,851

- Terrace houses - £245,235

- Semi-detached houses - £317,435

- Detached houses - £450,707

Greater Manchester (local authority area)

- All property types - £246,994

- Flats and maisonettes - £192,449

- Terrace houses - £201,518

- Semi-detached houses - £273,303

- Detached houses - £409,437

So you can see the city of Manchester has a higher average sold house price for all property types than the rest of Greater Manchester.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

House Prices in Manchester: For Sale Asking Prices (£)

Updated February 2025

The data represents the average asking prices of properties currently listed for sale in Manchester.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | M21 (Chorlton-cum-Hardy) | £447,518 |

| 2 | M20 (Didsbury) | £366,531 |

| 3 | M2 (City Centre) | £320,935 |

| 4 | M19 (Levenshulme) | £303,611 |

| 5 | M13 (Ardwick) | £285,798 |

| 6 | M23 (Wythenshawe) | £285,299 |

| 7 | M1 (City Centre) | £277,739 |

| 8 | M16 (Old Trafford) | £275,786 |

| 9 | M22 (Wythenshawe) | £275,210 |

| 10 | M15 (Hulme) | £269,357 |

| 11 | M3 (Salford) | £253,642 |

| 12 | M4 (Northern Quarter) | £251,321 |

| 13 | M14 (Fallowfield) | £236,941 |

| 14 | M8 (Cheetham Hill) | £233,127 |

| 15 | M40 (Collyhurst) | £224,817 |

| 16 | M12 (Ardwick) | £218,521 |

| 17 | M11 (Clayton) | £211,124 |

| 18 | M18 (Gorton) | £208,714 |

| 19 | M9 (Blackley) | £205,267 |

Price Per Square Foot in Manchester (£)

Updated February 2025

The data represents a blended average, combining the average asking price per square foot of properties currently for sale in Manchester and the sold price per square foot of sold properties.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | M15 (Hulme) | £400 |

| 2 | M1 (City Centre) | £391 |

| 3 | M21 (Chorlton) | £390 |

| 4 | M3 (Salford) | £386 |

| 5 | M20 (Didsbury) | £377 |

| 6 | M4 (Northern Quarter) | £375 |

| 7 | M16 (Old Trafford) | £316 |

| 8 | M23 (Wythenshawe) | £287 |

| 9 | M19 (Levenshulme) | £286 |

| 10 | M22 (Wythenshawe) | £281 |

| 11 | M13 (Ardwick) | £274 |

| 12 | M14 (Fallowfield) | £263 |

| 13 | M12 (Ardwick) | £246 |

| 14 | M40 (Collyhurst) | £231 |

| 15 | M8 (Cheetham Hill) | £221 |

| 16 | M11 (Clayton) | £215 |

| 17 | M18 (Gorton) | £206 |

| 18 | M9 (Blackley) | £203 |

Manchester's price per square foot values show significant variation across the city, with Hulme (M15) the highest at £400 likely due to the many new developments of tall skyrises of luxury apartments with smaller size accommodation but high quality and high price tags to match. Followed closely by central locations M1 and M21 at £391 and £390 respectively for similar reasons. These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode. The city centre and southern suburbs consistently achieve high values.

House Price Growth in Manchester (%)

Updated February 2025

The data represents the average house price per square foot growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices. These figures should be interpreted with caution, as they reflect average prices across all property types and include both properties currently for sale and those already sold.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | M16 (Old Trafford) | 88.10% |

| 2 | M23 (Wythenshawe) | 53.30% |

| 3 | M8 (Cheetham Hill) | 48.50% |

| 4 | M9 (Blackley) | 47.50% |

| 5 | M22 (Wythenshawe) | 41.70% |

| 6 | M40 (Collyhurst) | 39.50% |

| 7 | M14 (Fallowfield) | 38.00% |

| 8 | M19 (Levenshulme) | 32.10% |

| 9 | M21 (Chorlton) | 29.30% |

| 10 | M11 (Clayton) | 24.50% |

| 11 | M12 (Ardwick) | 24.10% |

| 12 | M18 (Gorton) | 21.60% |

| 13 | M20 (Didsbury) | 17.20% |

| 14 | M13 (Ardwick) | 17.10% |

| 15 | M1 (City Centre) | 14.40% |

| 16 | M15 (Hulme) | 11.80% |

| 17 | M4 (Northern Quarter) | 9.10% |

| 18 | M3 (Salford) | -2.70% |

Manchester's highest growth areas show substantial 5-year price increases, led by Old Trafford (M16) at 88.1% and Wythenshawe (M23) at 53.3%. These figures should be viewed with some caution as they represent average prices across all property types and include properties 'for sale' and 'sold prices'. In addition changes in the mix of properties being sold (such as more houses versus apartments) in a postcode can significantly impact these growth rates. Notably, the northern districts dominate the rankings, with areas like Cheetham Hill (M8) and Blackley (M9) showing strong appreciation above 47%. This suggests a sustained trend of buyers seeking value in previously overlooked areas, driven by factors such as regeneration initiatives and improved transport links. The average prices in these high-growth areas remain relatively affordable by Manchester standards, ranging from £205,267 in Blackley to £275,786 in Old Trafford.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. Next update: April 2025. All data is presented as provided by our sources without adjustments or amendments.

Manchester Buy-to-Let Rental Market Analysis

For those buying their first rental property, and thinking how much can you charge for rent in Manchester?

The rental prices below show why understanding Manchester's rental demand at a postcode level is critical, so you can achieve the very best rental yields across the city.

Generally, the rental demand in Manchester is really strong, driven by the city's growing population, its status as an educational and business hub, and its appeal to various demographic groups.

The type of property in demand depends on the area. Apartments, especially in the city centre and near universities, are popular among students, young professionals, and people working in the city who want to be close to work, leisure, and transport links. Single-family homes are more sought after in suburban areas, attracting families and those seeking more space and a quieter environment.

Rental Prices in Manchester (£)

Updated February 2025

The data represents the average monthly rent for long-let AST properties in Manchester. These figures reflect rents across all property types and do not account for differences in property size, number of bedrooms, or short-term lets.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | M14 (Fallowfield) | £483 | £2,096 |

| 2 | M20 (Didsbury) | £357 | £1,550 |

| 3 | M13 (Ardwick) | £334 | £1,450 |

| 4 | M19 (Levenshulme) | £318 | £1,378 |

| 5 | M12 (Ardwick) | £314 | £1,363 |

| 6 | M8 (Cheetham Hill) | £299 | £1,299 |

| 7 | M21 (Chorlton) | £296 | £1,283 |

| 8 | M15 (Hulme) | £295 | £1,280 |

| 9 | M4 (Northern Quarter) | £295 | £1,279 |

| 10 | M18 (Gorton) | £291 | £1,264 |

| 11 | M1 (City Centre) | £290 | £1,260 |

| 12 | M3 (Salford) | £284 | £1,232 |

| 13 | M23 (Wythenshawe) | £279 | £1,211 |

| 14 | M22 (Wythenshawe) | £273 | £1,186 |

| 15 | M9 (Blackley) | £269 | £1,168 |

| 16 | M40 (Collyhurst) | £267 | £1,157 |

| 17 | M16 (Old Trafford) | £263 | £1,143 |

| 18 | M11 (Clayton) | £256 | £1,109 |

| 19 | M2 (City Centre) | £0 | £0 |

Manchester's rental market shows distinct patterns, with Fallowfield (M14) and the other top 6 postcodes in this list achieving significantly higher weekly rents that expected, likely driven by large student populations and HMOs renting by the room. Remember these figures represent average rents across all property types, from studio apartments to larger houses, and actual achievable rents can vary significantly based on property size, condition, and specific location.

Gross Rental Yields in Manchester (%)

Updated February 2025

The data represents the average gross rental yield in Manchester, calculated using a snapshot of current properties for sale and properties for rent. These figures are based on asking prices.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | M14 (Fallowfield) | 10.60% |

| 2 | M12 (Ardwick) | 7.50% |

| 3 | M18 (Gorton) | 7.30% |

| 4 | M9 (Blackley) | 6.80% |

| 5 | M8 (Cheetham Hill) | 6.70% |

| 6 | M11 (Clayton) | 6.30% |

| 7 | M40 (Collyhurst) | 6.20% |

| 8 | M4 (Northern Quarter) | 6.10% |

| 9 | M13 (Ardwick) | 6.10% |

| 10 | M3 (Salford) | 5.80% |

| 11 | M15 (Hulme) | 5.70% |

| 12 | M19 (Levenshulme) | 5.40% |

| 13 | M1 (City Centre) | 5.40% |

| 14 | M22 (Wythenshawe) | 5.20% |

| 15 | M23 (Wythenshawe) | 5.10% |

| 16 | M20 (Didsbury) | 5.10% |

| 17 | M16 (Old Trafford) | 5.00% |

| 18 | M21 (Chorlton) | 3.40% |

Manchester's rental yields demonstrate significant variation across different postcodes, with Fallowfield (M14) showing an exceptional yield of 10.6%, significantly higher than other areas due to its strong student PBSA and HMO rental market. These figures represent gross rental yields calculated from average rents and prices, and investors should note that net yields will be lower after accounting for costs, void periods, and management expenses.

Access our selection of exclusive, high-yielding, off-market property deals and a personal consultant to guide you through your options.

Is Manchester Rent High?

Yes, Manchester's rental costs pose a significant financial burden for its residents when compared to their earnings.

Based on ONS data showing North West median weekly household income at £696 (£36,192 annually), Manchester's rental costs consume a substantial portion of local earnings. In central Manchester (M1), where weekly rents average £291 (£1,260 monthly), residents need to commit 41.8% of their gross income to rent. The situation is even more challenging in Didsbury (M20), where weekly rents of £358 (£1,550 monthly) would require 51.4% of the median household income.

Even in more affordable areas like Blackley (M9), where weekly rents average £269 (£1,168 monthly), residents still need to commit 38.6% of median household income to rent. Student areas like Fallowfield (M14) show the highest rental rates at £483 per week (£2,096 monthly), though these are typically split between multiple occupants in shared houses.

While Manchester's rental prices might appear moderate compared to renting a buy-to-let in London, the reality for local residents is that housing costs consume a disproportionate share of their income. With most areas requiring between 38-51% of median gross household income for rent - before tax, utilities, and other living expenses - Manchester's rental market presents significant affordability challenges for its residents.

Are Manchester House Prices High?

Manchester's property market shows significant price variation across its postcodes, from Chorlton-cum-Hardy (M21) at £447,518 and Didsbury (M20) at £366,531, down to more affordable areas like Blackley (M9) at £205,267 and Gorton (M18) at £208,714. With median annual earnings in the North West at £36,192 (£696 weekly), even Manchester's most affordable areas require around 5.7 times annual salary, while the premium southern suburbs exceed 12 times the median regional wage.

The city's pricing differentials extend beyond the traditional hotspots, with average prices in mid-range areas like Levenshulme (M19) at £303,611 and Wythenshawe (M23) at £285,299 still requiring 7.9-8.4 times the North West's median annual salary.

Using the UK's median annual wage of £37,856 as a benchmark, Manchester's property market remains more accessible than London's but still presents significant affordability challenges, with most areas requiring 6-10 times typical earnings.

Even in the city's more affordable northern districts, where prices drop below £225,000, property values still represent around 6 times the regional median salary.

With traditional mortgage lending typically capped at 4-4.5 times household income, the data points to a significant affordability challenge across the city.

This house price boom is seeing homeowners and tenants seek out the cheapest places to live in Manchester, and moving further out of the city if affordability is too stretched, to close by towns like Oldham, where they can commute on the tram to Manchester city centre easily.

How Much Deposit to Buy a House in Manchester?

So how much do you need to earn to buy a house in Manchester? Assuming a 30% deposit for the average buy-to-let Manchester investor, here's an overview of deposit requirements across different Manchester regions:

South Manchester

- M21 (Chorlton): A buy-to-let investor looking at an average property in Chorlton (£447,518) would need to put down a 30% deposit of £134,255, though yields are lower at 3.4%.

- M20 (Didsbury): In Didsbury, an investor would need a 30% deposit of £109,959 for an average property (£366,531), with yields at 5.1%.

- M19 (Levenshulme): An investor would need a 30% deposit of £91,083 for an average property (£303,611), offering a yield of 5.4%.

- M14 (Fallowfield): For an average property in Fallowfield (£236,941), a deposit of £71,082 would be needed, achieving Manchester's highest gross rental yield of 10.6%.

Central Manchester

- M2 (City Centre): A buy-to-let investor would need a 30% deposit of £96,280 for an average property (£320,935).

- M1 (City Centre): An investor would require a 30% deposit of £83,321 for an average property (£277,739), with a rental yield of 5.4%.

- M15 (Hulme): In Hulme, an investor would need a 30% deposit of £80,807 for an average property (£269,357), achieving a yield of 5.7%.

- M4 (Northern Quarter): For an average property in the Northern Quarter (£251,321), a deposit of £75,396 would be needed, with a yield of 6.1%.

- M3 (Salford): An investor would need a 30% deposit of £76,092 for an average property (£253,642), offering a yield of 5.8%.

East Manchester

- M13 (Ardwick): A buy-to-let investor would need a 30% deposit of £85,739 for an average property (£285,798), with a yield of 6.1%.

- M12 (Ardwick): In this part of Ardwick, an investor would need a 30% deposit of £65,556 for an average property (£218,521), achieving a strong yield of 7.5%.

- M11 (Clayton): For an average property in Clayton (£211,124), a deposit of £63,337 would be needed, with a yield of 6.3%.

- M18 (Gorton): An investor would need a 30% deposit of £62,614 for an average property (£208,714), offering an excellent yield of 7.3%.

North Manchester

- M8 (Cheetham Hill): A buy-to-let investor would need a 30% deposit of £69,938 for an average property (£233,127), with a strong yield of 6.7%.

- M9 (Blackley): In Blackley, an investor would need a 30% deposit of £61,580 for an average property (£205,267), achieving a healthy yield of 6.8%.

- M40 (Collyhurst): For an average property in Collyhurst (£224,817), a deposit of £67,445 would be needed, with a yield of 6.2%.

South West Manchester

- M16 (Old Trafford): A buy-to-let investor would need a 30% deposit of £82,736 for an average property (£275,786), with a yield of 5.0%.

- M23 (Wythenshawe): In Wythenshawe, an investor would need a 30% deposit of £85,590 for an average property (£285,299), achieving a yield of 5.1%.

- M22 (Wythenshawe): For another part of Wythenshawe, a deposit of £82,563 would be needed for an average property (£275,210), with a yield of 5.2%.

Manchester Landlord Licensing

Buy-to-Let Properties

For buy-to-let landlords there is selective licensing in place across key areas of Manchester.

Selective licensing requires all private landlords operating within a designated area to license any privately rented property within that area. The period of designation lasts for 5 years and will include statutory and general conditions aimed at ensuring licensed properties are safe, meet basic standards and they are managed in a satisfactory way.

This includes areas of

- M11 postcode - Clayton & Openshaw area - Ben Street

- M18 postcode - Gorton & Abbey Hey - Hyde Road

- M18 postcode - Gorton & Abbey Hey - The Ladders

- M19 postcode - Levenshulme

- M16 postcode - Moss Side & Whalley Range

- M14 postcode - Rusholme

- M18 postcode - Longsight - The Royals

- M9 postcode - Harpurhey - Trinity

Houses of Multiple Occupation

Landlords who want to invest in or set up a HMO or house in multiple occupation in Manchester are likely to need a mandatory licence.

Here is the link for the Manchester city council mandatory HMO requirements.

Manchester also has a requirement for planning permission, called an Article 4 direction, regulating the creation of new HMOs across the city. This means you need planning permission to change a house from a traditional buy-to-let home (classed as a C3 dwelling house) to a HMO (classed as a C4 house in multiple occupation).

More information about the Manchester Article 4 direction is here.

For investors looking to the west of Manchester and some parts of the city-centre, please note these postcodes may be covered by the neighbouring local authorities or Salford City Council or Trafford Council where landlord licensing differs. If you aren’t sure which council a property falls under you can find the correct local council here by simply adding your property postcode.

How to Invest in Buy-to-Let in Manchester

For properties to buy in Manchester including:

- Off-market properties

- Buy-to-lets

- Holiday lets

- HMOs (houses of multiple occupation)

- PBSA (purpose built student accomodation)

- and other high yielding opportunities

We have partnered with the best property investment agents we can find for 8+ years.

Here you can get access to the latest investment property opportunities from our network.

Access our selection of exclusive, high-yielding, off-market property deals and a personal consultant to guide you through your options.