Where to Buy Property Investments in Manchester: Yields of 7.9%

Manchester delivers rental yields of 7.9% in M14, with property prices 13% below the England average and a population that grew 9.7% between the last two censuses. It is one of the few UK cities where you can still buy below the national average and achieve yields that most southern investors have stopped dreaming about.

Average sold prices in Manchester of £255,489 sit 13% below the England average of £293,131, but 18% above the North West average of £216,741. That tells you something about Manchester's position. It is the premium market in the region. Investors from the South East look at Manchester and see value. Investors from the rest of the North West look at Manchester and see the most expensive city in the area. Both are right. The question is which postcodes still offer genuine value, and that is what this 22-postcode analysis sets out to answer.

Manchester sits within the North West of England. This guide covers the Manchester local authority area (ONS code E08000003), which includes the city centre, inner suburbs, and southern residential areas through to Manchester Airport. It does not cover the wider Greater Manchester boroughs like Salford, Bolton, or Stockport, which have their own guides. We analyse asking prices, sold prices, rental income, yields, growth, and deposit requirements across all 22 Manchester postcodes.

Article updated: February 2026

Manchester Buy-to-Let Market Overview 2026

Manchester's property market sits 13% below the England average, offering one of the strongest yield-to-price ratios of any major UK city, with these key statistics:

- Average sold price: £255,489 (13% below England's £293,131)

- Asking price range: £199,411 (M11) to £410,466 (M21) across Manchester postcodes

- Rental yields: 3.9% (M21) to 7.9% (M14) across postcodes with rental data

- Rental income: Monthly rents from £1,102 (M16) to £1,781 (M14)

- Price per sq ft: House prices from £203/sq ft (M18) to £419/sq ft (M21)

- Market activity: Sales ranging from 2 per month (M2) to 55 per month (M22)

- Deposit requirements: 30% deposits range from £59,823 (M11) to £123,140 (M21)

- Affordability ratios: Property prices from 5.5 to 11.3 times Manchester's median annual salary of £36,280

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Manchester?

Manchester has three things that matter to buy-to-let investors: a population that is growing, earnings that are rising, and property prices that remain below the national average. That combination creates the conditions for both rental demand and capital growth.

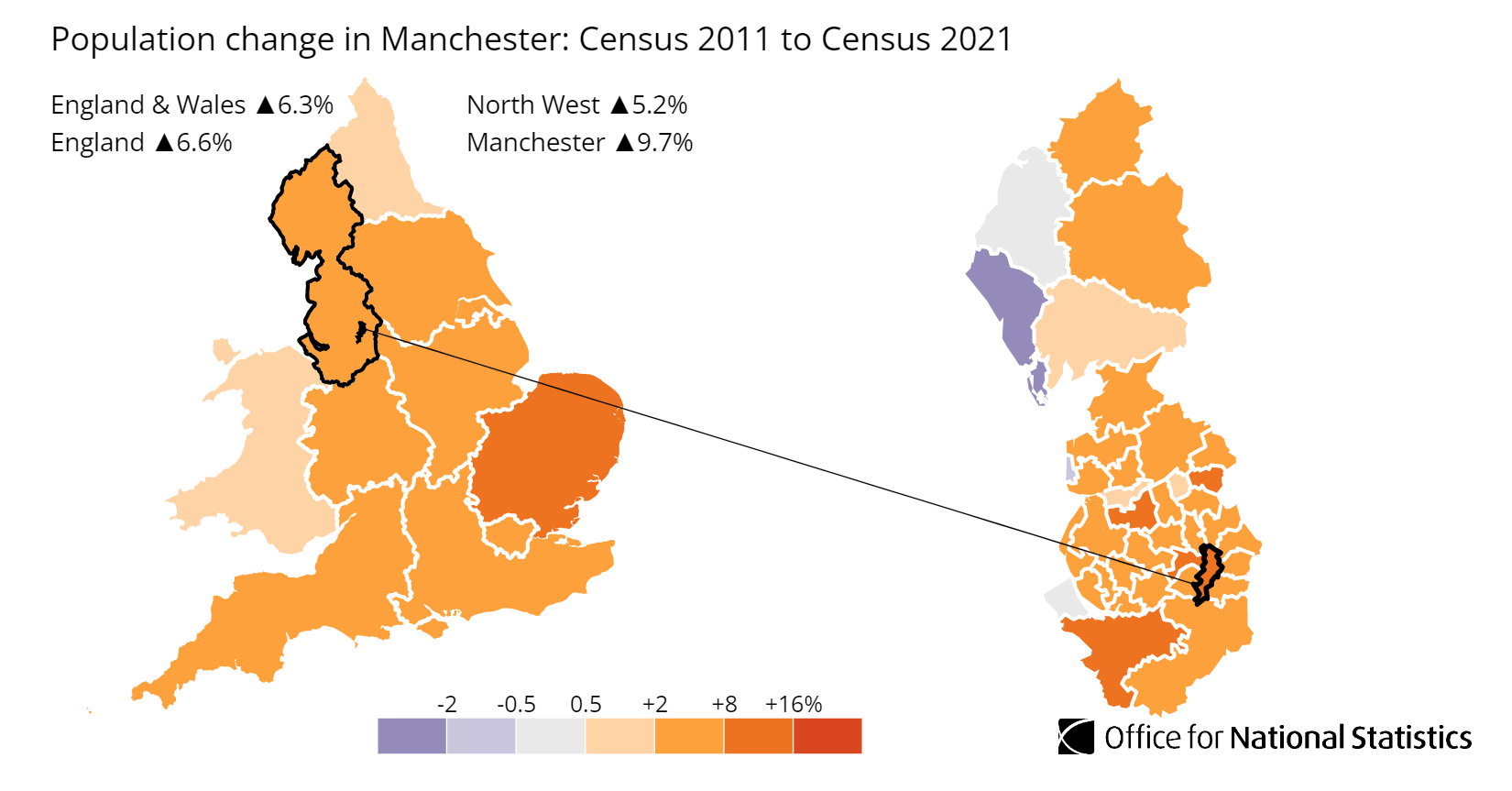

Population

Manchester's population grew from 503,127 in 2011 to 551,938 in 2021, according to the ONS Census. That is a 9.7% increase over the decade, well above the England and Wales average of 6.3%. More people means more demand for housing. Manchester is one of only a handful of English cities outside London that consistently attracts internal migration from the rest of the UK, driven largely by employment opportunities and its university sector.

The city has around 100,000 students across five universities. Not all of them stay after graduating, but Manchester's graduate retention rate is among the highest in the country. That creates a self-reinforcing cycle: young professionals stay, employers follow, more young professionals arrive.

Employment and Earnings

Manchester's median gross annual salary for full-time workers is £36,280 (2025 ASHE data via Nomis). That sits below both the North West regional median of £37,445 and the Great Britain median of £39,125.

Lower earnings relative to the national average might seem like a negative, but for property investors it means two things. First, it explains why Manchester house prices remain below the England average. Prices are anchored by what local earners can afford. Second, it creates a large pool of tenants who need to rent rather than buy, particularly in the city centre and inner suburbs where prices have pulled away from local earning power.

Manchester's employment rate stands at 73.6%, below the regional figure of 74.2% and the GB average of 75.6%. The unemployment rate of 6.6% is higher than the regional 4.1% and GB's 4.3% (source: Nomis Labour Market Profile, Oct 2024-Sep 2025). These figures reflect Manchester's urban profile. Large cities tend to have higher unemployment rates than their surrounding regions because they concentrate both opportunity and deprivation. What matters for investors is the trajectory: Manchester's economy has diversified significantly over the past decade, moving from a reliance on financial services and public sector employment into technology, creative industries, and life sciences.

Manchester Economic Summary

- Population: 551,938 (2021 Census). Growth of 9.7% from 2011.

- Median annual salary: £36,280 (local), £37,445 (North West), £39,125 (Great Britain)

- Employment rate: 73.6% (local), 74.2% (North West), 75.6% (Great Britain)

- Unemployment rate: 6.6% (local), 4.1% (North West), 4.3% (Great Britain)

- Key employment sectors: Financial and professional services, technology, creative and digital, higher education, healthcare, public sector

Source: ONS Census 2021, Nomis Labour Market Profile (ASHE 2025, Employment Oct 2024-Sep 2025)

Regeneration and Investment in Manchester

Manchester has over £15 billion of confirmed regeneration and infrastructure investment either under construction or with secured funding. That is not a typo. No other UK city outside London comes close to this pipeline. For property investors, the question is not whether Manchester is regenerating. It is which postcodes benefit most from which projects.

- Victoria North (under construction, £4 billion): The UK's largest residential regeneration programme. Up to 15,000 new homes across seven neighbourhoods between Victoria Station and Queen's Park, delivered by Far East Consortium in joint venture with Manchester City Council. Phase 1 at Collyhurst (274 homes including 100 council-rented) is due April 2026. A new Metrolink tram stop at Sandhills has secured £1.5m from the New Towns Programme. This project will shift the gravity of Manchester's rental market northward over the next decade, creating a new residential market in the M40, M9, and M4 postcodes. Updates at Manchester City Council.

- Old Trafford Regeneration (Mayoral Development Corporation launched January 2026, £7.3bn annual economic contribution): A 100,000-seat new stadium designed by Foster + Partners, with a 400-acre masterplan covering up to 48,000 jobs and 15,000 homes. The MDC is chaired by Lord Sebastian Coe. This is potentially the largest single regeneration catalyst in Manchester's history. The M16 and M17 corridors along the waterfront opposite MediaCityUK are likely to see significant capital appreciation as the masterplan progresses. Updates at GMCA.

- Mayfield (under construction, £1.4 billion): A 24-acre new city centre district behind Piccadilly Station. 1,700 homes, 1.6 million sq ft of office space, and a 650-bedroom hotel. The award-winning Mayfield Park is already open. LandsecU+I took full control in 2024, and 879 homes were approved in August 2025. Expected to support 10,000+ workers and 4,000 residents. Directly benefits M1 postcode properties. Updates at Manchester City Council.

- Northern Powerhouse Rail (funding confirmed January 2026, £45 billion programme): A new rail line from Liverpool to Manchester via Warrington and Manchester Airport, with a new underground station at Piccadilly and a new station at Manchester Airport. This replaces the cancelled HS2 northern leg. The "growth zones" around each station are designed to catalyse up to 500,000 homes and tens of thousands of jobs across the North. For Manchester, the key impacts are the Piccadilly underground station and the Airport station boosting the southern corridor (M22, M23). Updates at GOV.UK.

- Circle Square (near complete, £850 million): A 2.4 million sq ft mixed-use development on Oxford Road, now home to Disney Streaming, PUMA's UK headquarters, Octopus Energy, and the ICO's new national headquarters (relocating autumn 2026). This concentration of employers directly supports rental demand in the M1 and M15 postcodes. Updates at Circle Square.

- NOMA (substantially complete, £800 million, expansion planned): Home to Amazon's first UK corporate office outside London (600 tech workers), BNY Mellon (2,000 staff relocating by 2026), and the Co-operative Group's national headquarters. A further 620,000 sq ft of office expansion is in the pipeline. Amazon and BNY Mellon together bring 2,600+ highly skilled workers to the M4 postcode area. Updates at NOMA Manchester.

- Sister / ID Manchester (Phase 1 open, £1.7 billion): A 9-acre innovation district on the University of Manchester's former North Campus, focusing on biotech, advanced materials, and health innovation. 4 million sq ft of development including 1,500+ homes. The university's institutional backing provides long-term certainty that pure developer-led schemes lack. Benefits M1 and M13 postcodes. Updates at Sister Manchester.

- Manchester Airport Transformation (near complete, £1.3 billion): Terminal 2 transformation completing early 2026. Record 32 million passengers in 2025 with a target of 40 million by 2030. Seven new routes confirmed for 2026. The airport directly and indirectly supports tens of thousands of jobs in the M22, M23, and WA15 postcodes. Updates at Manchester Airport.

- Government Civil Service Relocations (ongoing): Manchester now hosts a major government hub at First Street (2,500 civil servants), a new Digital and AI Innovation Campus, the ICO national headquarters (moving to Circle Square autumn 2026), and 7,000 civil service jobs in a new Ancoats government office complex. Civil servants on stable public sector incomes represent low-risk tenants. Updates at GOV.UK.

- Atom Valley (under construction, £650m+ invested): A Mayoral Development Zone across Bury, Oldham, and Rochdale targeting 20,000 highly skilled jobs in technology and manufacturing. The flagship Sustainable Materials and Manufacturing Centre broke ground November 2025 and completes summer 2026. This drives rental demand in the more affordable boroughs along the M62 corridor. Updates at GMCA.

- MediaCityUK Phase Two (under construction, £1 billion): MediaCityUK is doubling in size with 72% of Phase Two being residential. Current tenants include BBC, ITV, Kellogg's, and the University of Salford. The M50 postcode has consistently outperformed Greater Manchester averages for rental growth. Updates at Salford City Council.

- University of Manchester Fallowfield Campus (planning approved, £400 million): Arguably Europe's largest purpose-built student accommodation project. The existing 770-bed Cambridge Halls will be replaced with 3,300 new beds, raising total campus capacity to 5,400. Phase 1 opens September 2029. The net increase of 950 beds is modest against a student population of 44,000+, so the impact on private rental demand in M14 should be limited. Updates at University of Manchester.

- North Manchester General Hospital (confirmed, part of £15 billion New Hospital Programme): Replacing over 70% of the existing estate. Shovel ready with £54m of enabling works complete. Adjacent to the Victoria North regeneration zone, creating a permanent healthcare employment anchor for the M8, M9, and M40 postcodes. Updates at Manchester University NHS Foundation Trust.

- Wythenshawe Town Centre (under construction, £500 million): A 10-15 year regeneration including a new £30m Culture Hub (opening late 2026), up to 2,000 new homes, and a separate 15-year hospital campus masterplan. Wythenshawe (M22, M23) is one of Manchester's most undervalued areas relative to its transport connectivity to both the city centre and the airport. Updates at Manchester City Council.

Planning and Policy

Three policy points that affect buy-to-let investors in Manchester:

- Places for Everyone (adopted March 2024): The joint development plan for nine Greater Manchester boroughs sets a target of 3,533 new homes per year through to 2039 with a brownfield-first approach. This constrains supply in suburban fringe areas and supports existing property values. Manchester's own Local Plan is expected for adoption in summer 2027.

- Article 4 Direction for HMOs (in force since 2011, city-wide): Planning permission is required to convert any dwelling to a small HMO (3-6 persons). The council is unlikely to approve conversions in areas with existing high concentrations. Investors pursuing the HMO strategy should focus on properties already in C4 or sui generis use rather than planning new conversions.

- Selective Licensing Scheme 3 (in force May 2025 to May 2030): Covers parts of Cheetham, Crumpsall, Harpurhey, Longsight, Miles Platting, Newton Heath, and Moss Side. Licence fee from £798 per property over five years (£160/year). Not a barrier to investment, but properties in these areas must meet minimum standards.

Manchester Property Market Analysis

When Was the Last House Price Crash in Manchester?

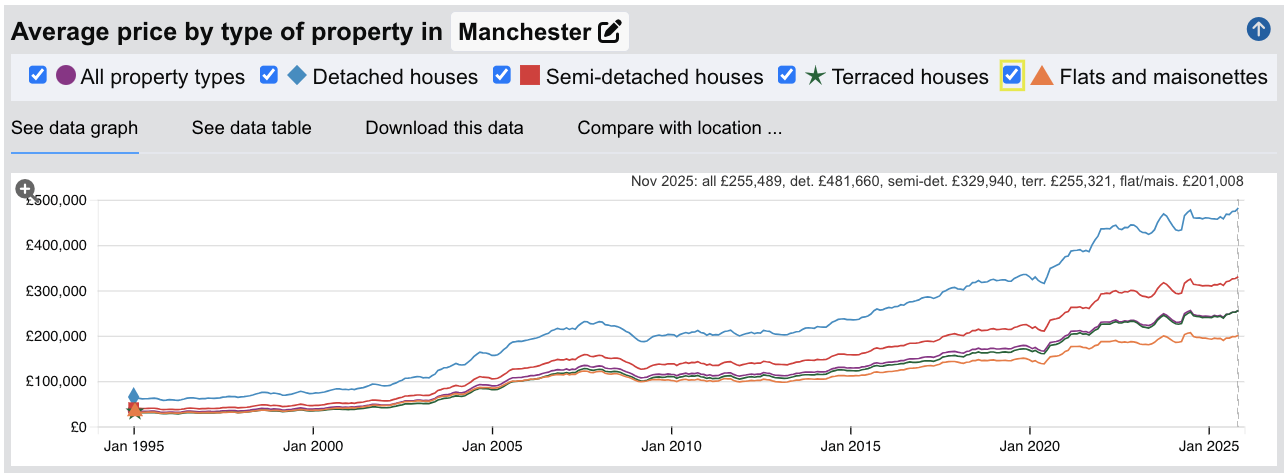

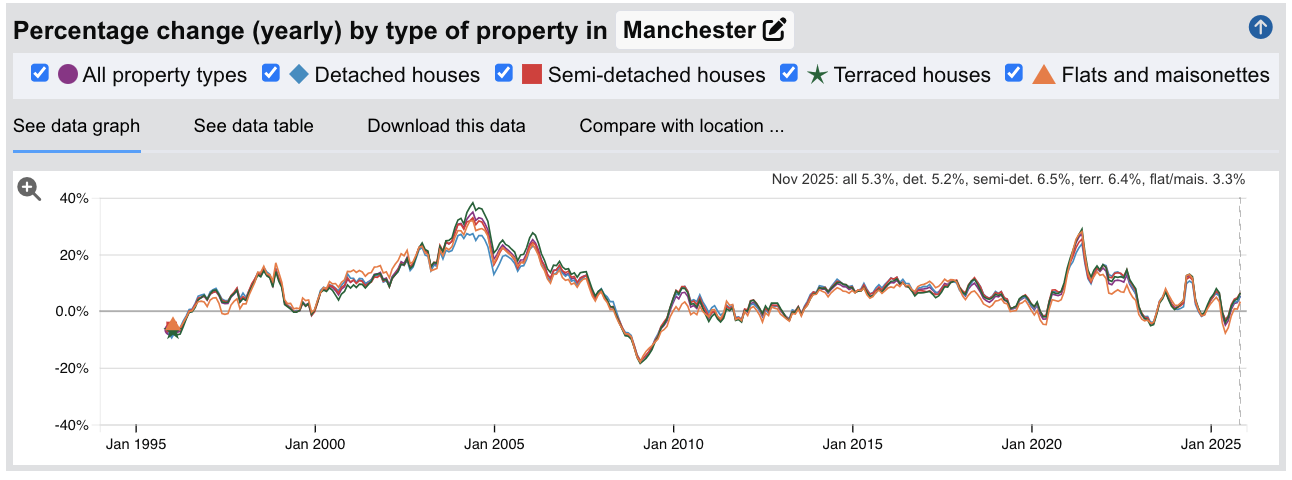

Manchester experienced a sharper correction than both the national and regional averages during the 2008 financial crisis. Average sold prices fell from a peak of £134,540 in August 2007 to a trough of £106,994 by March 2009, a decline of 20.5%. Recovery was slow. Prices did not return to pre-crash levels until August 2015, eight years after the peak.

Source: HM Land Registry House Price Index for Manchester

Here is how the Manchester property market has performed over key cycles:

- 1995-2007 saw property values nearly quadruple, rising from £33,806 to £134,540. Manchester's transformation from a post-industrial city into a major services and knowledge economy drove sustained demand. The Commonwealth Games in 2002 accelerated regeneration across East Manchester and the city centre.

- 2008-2009 brought a correction of 20.5%. Manchester fell harder than both England (-18.2%) and the North West region (-18.3%). The worst annual change reading hit -18.1% in February 2009. All property types were affected fairly evenly, with terraced houses hardest hit (-18.5%) and detached least affected (-17.4%).

- 2010-2013 saw a prolonged stagnation. Prices fluctuated between £107,000 and £118,000 with no sustained recovery. The North West as a whole bottomed out even later, not reaching its trough until January 2013. Manchester's economy was rebuilding, but buyer confidence remained fragile.

- 2014-2016 delivered the turning point. Prices climbed from £119,000 to £148,000 as Manchester's economic diversification began to pay off. The BBC's move to MediaCityUK, the expansion of Manchester Airport, and growing tech sector employment created new demand. Prices finally surpassed the pre-crash peak in August 2015.

- 2017-2019 saw strong growth continue. Prices rose from £148,000 to £189,000 as Manchester established itself as one of the UK's top buy-to-let cities. Institutional investment in build-to-rent and purpose-built student accommodation accelerated. The Northern Powerhouse narrative attracted both domestic and overseas capital.

- 2020-2022 brought the pandemic surge. Prices climbed from £189,000 to £243,000. Manchester's relative affordability compared to London and the South East made it a magnet for investors seeking yield. The stamp duty holiday amplified demand.

- 2023 saw a brief pause as mortgage rates spiked, with prices dipping to around £237,000 before stabilising. The correction was modest compared to 2008, lasting months rather than years.

- 2024-2025 has marked renewed growth. Prices have climbed to £255,489 as of November 2025, showing year-on-year growth of 5.3%. Manchester has outperformed the national average in this recovery phase.

Long-Term Property Value Growth in Manchester

For buy-to-let investors focused on capital preservation and long-term appreciation, Manchester's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 35.2% growth (£189,000 to £255,489)

- 10 years (2015-2025): 88.8% growth (£135,285 to £255,489)

- 15 years (2010-2025): 126.1% growth (£112,994 to £255,489)

- 20 years (2005-2025): 107.2% growth (£123,333 to £255,489)

- 30 years (1995-2025): 655.7% growth (£33,806 to £255,489)

The 2008 correction demonstrates that Manchester is not immune to property market cycles. It fell harder than the national average and took longer to recover than England as a whole (8 years versus 6 years 8 months). However, the North West region took even longer at 9 years 5 months, meaning Manchester led the regional recovery. Those who held through 2008 have seen their investments nearly double since the pre-crash peak. The key risk for investors remains overpaying at the top of a cycle, but Manchester's diversifying economy, growing population, and £15 billion regeneration pipeline provide stronger structural support than existed in 2007.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Manchester

The latest sold house price index by the Land Registry reveals something most investors do not expect. Manchester's headline average of £255,489 sits 13% below the England average. But break it down by property type and the picture flips. Detached, semi-detached, and terraced houses all cost more than the national average. Only flats pull the overall figure down.

Manchester property prices average £255,489, which is 13% below the England average of £293,131. That discount is almost entirely explained by the city's housing mix. Manchester has a higher proportion of flats and terraced stock than the national average, and a lower proportion of detached homes. The "below average" headline is real, but it does not mean every property type is cheap.

Semi-detached houses are where Manchester commands its steepest premium, averaging £329,940, a 13.8% uplift against the England average. Semis dominate the suburban postcodes like M20 (Didsbury), M21 (Chorlton), and M19 (Levenshulme), where family demand keeps prices firm. Detached houses average £481,660, sitting 1.5% above the national figure. There are relatively few detached properties within the Manchester local authority boundary, concentrated in the southern suburbs, and scarcity supports their premium.

Terraced houses average £255,321, a 4.2% premium over England. The Victorian and Edwardian terraces in M14 (Fallowfield), M19 (Levenshulme), and M40 (Moston) are the backbone of Manchester's buy-to-let market. They offer the strongest combination of yield and tenant demand. Flats and maisonettes average £201,008, sitting 9.3% below the England average. For investors, Manchester flats represent the clearest value play against the national market. However, the negative growth readings in city centre postcodes M1 and M15 (covered in the growth section below) suggest that not all flat stock is equal. Location within Manchester matters more than the property type alone.

Updated February 2026

| Property Type | Manchester Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £481,660 | £474,400 | +1.5% |

| Semi-detached houses | £329,940 | £290,004 | +13.8% |

| Terraced houses | £255,321 | £245,002 | +4.2% |

| Flats and maisonettes | £201,008 | £221,565 | -9.3% |

| All property types | £255,489 | £293,131 | -12.8% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Manchester (£)

Price per square foot strips out the distortions that headline averages create. A £200,000 terraced house and a £200,000 city centre flat are very different propositions in terms of actual space. This metric shows where your money buys the most physical property across 21 of Manchester's 22 postcodes. M2 (Deansgate, St Ann's Square) is excluded due to insufficient transaction data.

The table below ranks Manchester postcodes from most to least expensive per square foot, based on average sold prices from completed transactions.

| Rank | Area | Sold Price Per Sq Ft |

|---|---|---|

| 1 | M21 (Chorlton) | £419 |

| 2 | M20 (Didsbury) | £389 |

| 3 | M3 (Deansgate, Blackfriars) | £388 |

| 4 | M1 (City Centre) | £387 |

| 5 | M4 (Ancoats, Northern Quarter) | £353 |

| 6 | M15 (Hulme, Castlefield) | £327 |

| 7 | M50 (Salford Quays) | £326 |

| 8 | M16 (Old Trafford, Stretford) | £315 |

| 9 | M23 (Wythenshawe) | £306 |

| 10 | M19 (Levenshulme, Burnage) | £300 |

| 11 | M5 (Salford, Ordsall) | £294 |

| 12 | M22 (Wythenshawe, Northenden) | £286 |

| 13 | M14 (Fallowfield, Rusholme) | £272 |

| 14 | M13 (Longsight, Ardwick) | £263 |

| 15 | M6 (Irlams o' th' Height, Pendleton) | £254 |

| 16 | M12 (Ardwick, Openshaw) | £249 |

| 17 | M40 (Moston, Collyhurst) | £232 |

| 18 | M8 (Crumpsall, Cheetham Hill) | £224 |

| 19 | M9 (Blackley, Harpurhey) | £211 |

| 20 | M11 (Openshaw, Clayton) | £210 |

| 21 | M18 (Gorton, Abbey Hey) | £203 |

The spread here tells the story. M21 in Chorlton commands £419 per square foot. M18 in Gorton costs £203. That is more than double the price for the same amount of physical space. The south Manchester premium is real and it is driven by owner-occupier demand. Chorlton and Didsbury are lifestyle postcodes where buyers pay for the village feel, the restaurants, and the schools.

For buy-to-let investors, the more interesting data sits further down the table. M14 (Fallowfield, Rusholme) ranks 13th for price per square foot at £272 but delivers the highest gross rental yield in Manchester at 7.9%. You get more physical property per pound spent, and the rental demand from students and young professionals keeps income strong. The same pattern applies to M11 (£210/sqft, 6.8% yield) and M18 (£203/sqft, 6.7% yield). Lower entry costs, more space, solid returns.

The city centre postcodes (M1, M3, M4) cluster tightly between £353 and £388 per square foot. These are predominantly apartment-led markets where new-build premiums push the per-square-foot cost higher despite lower headline prices than the south Manchester houses. If you are buying a city centre flat, expect to pay more per square foot than you would for a terraced house in Fallowfield or Gorton.

Figures reflect averages across all property types and ages. Individual values depend on condition, location within the postcode, and building age.

For Sale Asking House Prices in Manchester by Postcode (£)

Asking property prices show what sellers are currently listing at across Manchester's 22 postcodes. This is not what properties sell for. It is what they are marketed at. Sold prices (covered above) reflect completed transactions. Asking prices reflect seller expectations and current stock on the market.

The range across Manchester is significant. Entry prices start below £200,000 in M11 and rise above £410,000 in M21. That is a £211,000 gap within the same city. Across all 22 postcodes, the mean asking price in Manchester is £265,494.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | M11 (Openshaw, Clayton) | £199,411 |

| 2 | M18 (Gorton, Abbey Hey) | £211,519 |

| 3 | M6 (Irlams o' th' Height, Pendleton) | £218,449 |

| 4 | M9 (Blackley, Harpurhey) | £225,937 |

| 5 | M50 (Salford Quays) | £230,235 |

| 6 | M40 (Moston, Collyhurst) | £232,720 |

| 7 | M5 (Salford, Ordsall) | £237,929 |

| 8 | M12 (Ardwick, Openshaw) | £240,225 |

| 9 | M4 (Ancoats, Northern Quarter) | £247,148 |

| 10 | M3 (Deansgate, Blackfriars) | £252,647 |

| 11 | M22 (Wythenshawe, Northenden) | £254,341 |

| 12 | M13 (Longsight, Ardwick) | £257,222 |

| 13 | M1 (City Centre) | £261,271 |

| 14 | M23 (Wythenshawe) | £262,716 |

| 15 | M16 (Old Trafford, Stretford) | £264,635 |

| 16 | M8 (Crumpsall, Cheetham Hill) | £264,996 |

| 17 | M14 (Fallowfield, Rusholme) | £270,781 |

| 18 | M15 (Hulme, Castlefield) | £275,084 |

| 19 | M19 (Levenshulme, Burnage) | £306,975 |

| 20 | M2 (Deansgate, St Ann's Square) | £327,264 |

| 21 | M20 (Didsbury) | £388,906 |

| 22 | M21 (Chorlton) | £410,466 |

Fourteen of Manchester's 22 postcodes have average asking prices below the England average of £293,131. That is the core of Manchester's investment case. Most of the city offers entry prices well below what you would pay nationally, and rents are not discounted in the same way.

The cheapest postcodes (M11, M18, M6, M9) sit below £226,000. These are the east and north Manchester areas where terraced housing dominates and yields run between 5.9% and 6.8%. M11 at £199,411 is the only Manchester postcode where the average asking price dips below £200,000. At a 30% deposit, that is an entry point of around £59,800.

The middle band between £230,000 and £275,000 covers the bulk of the city including the city centre postcodes (M1, M3, M4), Salford (M5, M50), and the high-yield student areas (M13, M14). This is where most buy-to-let activity concentrates. Prices are accessible, rental demand is established, and yields consistently sit above 6%.

At the top, M20 (Didsbury) and M21 (Chorlton) are in a different market. Asking prices above £388,000 reflect strong owner-occupier demand and a housing stock that skews towards larger family homes. Yields here are lower (3.9% to 5.4%) because the price premium is not matched by proportionally higher rents. These are capital growth plays, not income plays.

House Price Growth by Postcode in Manchester (%)

House price growth per square foot measures how property values in Manchester have changed over 1, 3, and 5 year periods. This is calculated from sold price transactions, not asking prices. It shows which Manchester postcodes are gaining value and which are correcting.

Growth figures across Manchester vary enormously. Some postcodes have delivered over 50% growth in five years. Others are in negative territory. The table is ranked by 5 year growth, which smooths out the short-term noise and gives a clearer picture of the underlying trend.

| Area | 1 Year Growth | 3 Year Growth | 5 Year Growth |

|---|---|---|---|

| M9 (Blackley, Harpurhey) | +12.5% | +20.8% | +55.2% |

| M12 (Ardwick, Openshaw) | +8.1% | +21.1% | +54.8% |

| M16 (Old Trafford, Stretford) | +14.1% | +20.3% | +49.1% |

| M23 (Wythenshawe) | +1.6% | +10.3% | +43.2% |

| M18 (Gorton, Abbey Hey) | -0.5% | +7.3% | +39.0% |

| M40 (Moston, Collyhurst) | +7.1% | +8.6% | +37.4% |

| M19 (Levenshulme, Burnage) | +3.8% | +9.8% | +35.8% |

| M14 (Fallowfield, Rusholme) | -1.4% | +8.3% | +34.9% |

| M22 (Wythenshawe, Northenden) | +5.0% | +12.4% | +34.7% |

| M6 (Irlams o' th' Height, Pendleton) | +33.1% | +0.9% | +33.7% |

| M21 (Chorlton) | +7.9% | +11.6% | +25.7% |

| M8 (Crumpsall, Cheetham Hill) | -4.8% | +2.0% | +19.9% |

| M20 (Didsbury) | +3.5% | +8.3% | +15.0% |

| M11 (Openshaw, Clayton) | -4.0% | -3.2% | +9.1% |

| M50 (Salford Quays) | -2.1% | -2.7% | +8.7% |

| M13 (Longsight, Ardwick) | -3.9% | -10.8% | +7.4% |

| M4 (Ancoats, Northern Quarter) | -18.5% | -15.5% | -1.0% |

| M1 (City Centre) | -26.3% | -7.6% | -2.4% |

| M3 (Deansgate, Blackfriars) | +13.3% | +1.2% | -3.2% |

| M5 (Salford, Ordsall) | -13.4% | -3.9% | -16.8% |

| M15 (Hulme, Castlefield) | -26.4% | -28.3% | -18.2% |

| M2 (Deansgate, St Ann's Square) | Not enough data | Not enough data | Not enough data |

Two distinct Manchester property markets are visible in this data. The established residential postcodes in east and south Manchester have delivered strong capital growth over five years. M9 (Blackley, Harpurhey) leads at +55.2%, followed closely by M12 (Ardwick, Openshaw) at +54.8%. These are areas where house prices in Manchester started from a low base and have benefited from regeneration spend and rising demand from first-time buyers priced out of trendier postcodes.

The city centre and inner-city apartment postcodes tell a different story. M15 (Hulme, Castlefield) shows -26.4% over one year and -18.2% over five years. M1 (City Centre) is down -26.3% over one year. M4 (Ancoats, Northern Quarter) has dropped -18.5% in twelve months. M5 (Salford, Ordsall) is down -16.8% over five years. This is a new-build correction. Manchester's city centre saw a surge of off-plan apartment development between 2018 and 2023, much of it sold to overseas investors at premium prices. As those units resell on the open market, the per-square-foot values are repricing downward to reflect what local buyers will actually pay.

This matters for buy-to-let investors researching Manchester property investment. The headline yield in a city centre postcode might look attractive, but if the underlying asset is losing value per square foot, the total return picture changes. Postcodes like M14 (Fallowfield) show the opposite pattern. Modest 1 year dip of -1.4% but +34.9% over five years. That combination of strong long-term capital growth in Manchester and a 7.9% gross rental yield is harder to find in the apartment-led postcodes.

M6 (Irlams o' th' Height, Pendleton) stands out with +33.1% growth in a single year. This is a low-volume postcode where a small number of higher-value transactions can move the average significantly. The 3 year figure of +0.9% gives a more reliable picture of the underlying trend.

Average Monthly Property Sales in Manchester

Sales volume shows how active each Manchester postcode is in terms of completed property transactions per month. Turnover measures those monthly sales as a percentage of current for-sale stock. High turnover means properties sell quickly relative to what is listed. Low turnover means stock sits on the market longer.

For buy-to-let investors, both metrics matter. A postcode with strong sales volume but low turnover has plenty of choice but slower movement. A postcode with high turnover signals properties are being snapped up fast, which typically reflects strong buyer demand in that Manchester postcode.

| Area | Sales Per Month | Turnover | Avg Asking Price |

|---|---|---|---|

| M20 (Didsbury) | 55 | 50% | £388,906 |

| M6 (Irlams o' th' Height, Pendleton) | 35 | 37% | £218,449 |

| M19 (Levenshulme, Burnage) | 29 | 48% | £306,975 |

| M22 (Wythenshawe, Northenden) | 28 | 48% | £254,341 |

| M21 (Chorlton) | 27 | 65% | £410,466 |

| M14 (Fallowfield, Rusholme) | 26 | 38% | £270,781 |

| M15 (Hulme, Castlefield) | 26 | 8% | £275,084 |

| M40 (Moston, Collyhurst) | 26 | 32% | £232,720 |

| M23 (Wythenshawe) | 25 | 83% | £262,716 |

| M16 (Old Trafford, Stretford) | 23 | 9% | £264,635 |

| M4 (Ancoats, Northern Quarter) | 23 | 6% | £247,148 |

| M9 (Blackley, Harpurhey) | 22 | 43% | £225,937 |

| M3 (Deansgate, Blackfriars) | 17 | 3% | £252,647 |

| M5 (Salford, Ordsall) | 17 | 3% | £237,929 |

| M18 (Gorton, Abbey Hey) | 16 | 68% | £211,519 |

| M8 (Crumpsall, Cheetham Hill) | 15 | 41% | £264,996 |

| M1 (City Centre) | 13 | 4% | £261,271 |

| M11 (Openshaw, Clayton) | 12 | 36% | £199,411 |

| M50 (Salford Quays) | 9 | 6% | £230,235 |

| M12 (Ardwick, Openshaw) | 8 | 31% | £240,225 |

| M13 (Longsight, Ardwick) | 6 | 23% | £257,222 |

| M2 (Deansgate, St Ann's Square) | 2 | 10% | £327,264 |

The turnover column is where the real insight sits. M23 (Wythenshawe) turns over 83% of its listed stock each month. Properties listed in M23 move fast. M18 (Gorton) runs at 68% and M21 (Chorlton) at 65%. These are postcodes where Manchester property demand consistently outstrips supply. For buy-to-let investors, high turnover also signals a market where exit liquidity is strong. When you need to sell, buyers are active.

Compare that to the city centre apartment postcodes. M3 (Deansgate, Blackfriars) and M5 (Salford, Ordsall) both show 3% turnover. M4 (Ancoats) sits at 6% and M1 (City Centre) at 4%. These postcodes have decent sales volumes (13 to 23 per month) but massive amounts of listed stock relative to those sales. That oversupply is consistent with the negative price growth per square foot covered in the section above. More apartments are coming to market than buyers are absorbing.

M15 (Hulme, Castlefield) is a useful case study. It records 26 sales per month, level with M14 and M40. But its turnover is just 8%. The volume looks healthy until you see how much stock is sitting behind it. This postcode has the worst 5 year price growth in Manchester at -18.2%, and the turnover data explains part of the reason.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Manchester Rental Market Analysis

For landlords and investors considering if buy to let is worthwhile in Manchester and thinking how much they can charge for rent across the city's 22 postcodes, the rental data below covers monthly rental income, gross rental yields, and how Manchester rent compares to local earnings. This is helpful if you are considering growing your property business in this area.

Average Rent and Gross Rental Yields in Manchester by Postcode

Average monthly rent across Manchester's 22 postcodes ranges from £1,102 in M16 (Old Trafford, Stretford) to £1,781 in M14 (Fallowfield, Rusholme). That is a £679 per month difference depending on where in Manchester a landlord is letting a property. But rent on its own only tells half the story. Gross rental yield measures that annual rental income as a percentage of the property purchase price. It is the metric that shows whether the Manchester rental income justifies the entry cost.

Manchester gross rental yields range from 3.9% in M21 (Chorlton) to 7.9% in M14 (Fallowfield, Rusholme). Fifteen of Manchester's 22 postcodes deliver gross yields above 5.5%. The table ranks all Manchester postcodes by gross rental yield from highest to lowest.

| Area | Avg Monthly Rent | Avg Asking Price | Gross Yield |

|---|---|---|---|

| M14 (Fallowfield, Rusholme) | £1,781 | £270,781 | 7.9% |

| M13 (Longsight, Ardwick) | £1,544 | £257,222 | 7.2% |

| M11 (Openshaw, Clayton) | £1,138 | £199,411 | 6.8% |

| M18 (Gorton, Abbey Hey) | £1,183 | £211,519 | 6.7% |

| M12 (Ardwick, Openshaw) | £1,317 | £240,225 | 6.6% |

| M3 (Deansgate, Blackfriars) | £1,387 | £252,647 | 6.6% |

| M4 (Ancoats, Northern Quarter) | £1,350 | £247,148 | 6.6% |

| M15 (Hulme, Castlefield) | £1,486 | £275,084 | 6.5% |

| M1 (City Centre) | £1,395 | £261,271 | 6.4% |

| M6 (Irlams o' th' Height, Pendleton) | £1,158 | £218,449 | 6.4% |

| M5 (Salford, Ordsall) | £1,244 | £237,929 | 6.3% |

| M40 (Moston, Collyhurst) | £1,207 | £232,720 | 6.2% |

| M50 (Salford Quays) | £1,170 | £230,235 | 6.1% |

| M23 (Wythenshawe) | £1,307 | £262,716 | 6.0% |

| M9 (Blackley, Harpurhey) | £1,117 | £225,937 | 5.9% |

| M22 (Wythenshawe, Northenden) | £1,161 | £254,341 | 5.5% |

| M8 (Crumpsall, Cheetham Hill) | £1,222 | £264,996 | 5.5% |

| M20 (Didsbury) | £1,736 | £388,906 | 5.4% |

| M16 (Old Trafford, Stretford) | £1,102 | £264,635 | 5.0% |

| M19 (Levenshulme, Burnage) | £1,271 | £306,975 | 5.0% |

| M2 (Deansgate, St Ann's Square) | £1,311 | £327,264 | 4.8% |

| M21 (Chorlton) | £1,332 | £410,466 | 3.9% |

M14 (Fallowfield, Rusholme) delivers the highest gross rental yield in Manchester at 7.9%. It also commands the highest average rent at £1,781 per month. That combination is unusual. In most cities the highest-yielding postcodes achieve their yield through low purchase prices rather than high rents. M14 does both. The student and young professional rental market around the University of Manchester generates genuine demand-driven rental income, not just a low denominator.

M13 (Longsight, Ardwick) follows at 7.2% with the third highest rent in Manchester at £1,544 per month. This postcode benefits from similar university proximity without the premium asking prices of the city centre. M11 (Openshaw, Clayton) and M18 (Gorton, Abbey Hey) round out the top four at 6.8% and 6.7% respectively. These are the lower entry price postcodes where Manchester buy-to-let yields are driven by affordable purchase prices rather than exceptional rents.

The city centre postcodes (M1, M3, M4, M15) deliver between 6.4% and 6.6% gross yield. Respectable figures, but read these alongside the price growth data. M15 yields 6.5% but has lost -18.2% per square foot over five years. M4 yields 6.6% but is down -1.0% over five years. The gross yield does not account for capital value changes. An investor buying in M14 at 7.9% yield with +34.9% five year growth is in a fundamentally different position to an investor buying in M15 at 6.5% yield with -18.2% five year growth.

M21 (Chorlton) at 3.9% sits well below the rest of Manchester. This is a capital growth postcode where owner-occupier demand sets pricing. The Manchester rental income of £1,332 per month is solid but the £410,466 average asking price compresses the yield. Investors targeting Manchester rental yields above 6% will find 14 postcodes that deliver it.

Is Manchester Rent High? Rent as a Percentage of Earnings

Rent affordability matters for buy-to-let investors because it drives tenant demand and tenancy sustainability. If Manchester rent takes too large a share of local earnings, tenants struggle to pay and void periods increase. If rent is affordable relative to local wages, demand is more resilient and tenants stay longer.

The median gross weekly salary in Manchester is £697.70, which equates to £3,023 per month or £36,280 per year. This is below the North West regional median of £720.10 per week and the Great Britain median of £752.40 per week. Data from the Nomis Labour Market Profile (ASHE 2025).

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | M14 (Fallowfield, Rusholme) | 58.9% |

| 2 | M20 (Didsbury) | 57.4% |

| 3 | M13 (Longsight, Ardwick) | 51.1% |

| 4 | M15 (Hulme, Castlefield) | 49.2% |

| 5 | M1 (City Centre) | 46.1% |

| 6 | M3 (Deansgate, Blackfriars) | 45.9% |

| 7 | M4 (Ancoats, Northern Quarter) | 44.6% |

| 8 | M21 (Chorlton) | 44.1% |

| 9 | M12 (Ardwick, Openshaw) | 43.5% |

| 10 | M2 (Deansgate, St Ann's Square) | 43.4% |

| 11 | M23 (Wythenshawe) | 43.2% |

| 12 | M19 (Levenshulme, Burnage) | 42.1% |

| 13 | M5 (Salford, Ordsall) | 41.1% |

| 14 | M8 (Crumpsall, Cheetham Hill) | 40.4% |

| 15 | M40 (Moston, Collyhurst) | 39.9% |

| 16 | M18 (Gorton, Abbey Hey) | 39.1% |

| 17 | M50 (Salford Quays) | 38.7% |

| 18 | M22 (Wythenshawe, Northenden) | 38.4% |

| 19 | M6 (Irlams o' th' Height, Pendleton) | 38.3% |

| 20 | M11 (Openshaw, Clayton) | 37.6% |

| 21 | M9 (Blackley, Harpurhey) | 36.9% |

| 22 | M16 (Old Trafford, Stretford) | 36.4% |

These are gross earnings figures, meaning the actual take-home percentage is higher. A single earner on Manchester's median salary paying M14 rent at £1,781 per month would be allocating well over half their gross income to housing. In practice, M14 tenants are predominantly sharers. Students and young professionals splitting rent across a 3 or 4 bedroom house bring the per-person cost down significantly. That shared occupancy model is exactly what drives the high headline rents and high yields in that postcode.

The more sustainable single-tenant affordability picture sits in the lower half of the table. Twelve Manchester postcodes have rent below 42% of gross median earnings. M16 (Old Trafford) at 36.4% and M9 (Blackley) at 36.9% represent the most affordable Manchester rental postcodes relative to local wages. These are the postcodes where a single working tenant on a median Manchester salary can cover rent without needing to share.

Manchester's median earnings sit 7.3% below the Great Britain median of £752.40 per week. That wage gap means rent takes a larger share of income in Manchester than the headline rent figures alone suggest. For landlords, this reinforces why the lower-rent postcodes between £1,100 and £1,250 per month tend to have the most stable tenant demand. The rent is achievable on local wages without financial strain.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Manchester House Prices High? Price-to-Earnings Ratios

Manchester sits in an unusual position for a major regional city. Property prices are 13% below the England average, but local earnings are also below the national median. The question for buy-to-let investors is whether Manchester house prices are genuinely affordable or just look cheap against a lower wage base.

Purchasing a property in Manchester requires between 5.5 and 11.3 times the median annual salary. This is based on the Nomis Labour Market Profile for Manchester showing the median gross annual income for Manchester residents is £36,280.

The most affordable Manchester postcodes, M11 (Openshaw) at 5.5x and M18 (Gorton) at 5.8x, are well below the national benchmark. These are areas where a local buyer on a median Manchester salary faces a purchase price of less than six years' gross income. That affordability supports both first-time buyer demand and rental demand from people who could afford to buy but choose to rent for flexibility. The south Manchester postcodes of M20 (Didsbury) at 10.7x and M21 (Chorlton) at 11.3x sit at the other extreme. These attract dual-income professional households and owner-occupiers rather than single-earner tenants.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | M11 (Openshaw, Clayton) | 5.5x |

| 2 | M18 (Gorton, Abbey Hey) | 5.8x |

| 3 | M6 (Irlams o' th' Height, Pendleton) | 6.0x |

| 4 | M9 (Blackley, Harpurhey) | 6.2x |

| 5 | M50 (Salford Quays) | 6.3x |

| 6 | M40 (Moston, Collyhurst) | 6.4x |

| 7 | M5 (Salford, Ordsall) | 6.6x |

| 8 | M12 (Ardwick, Openshaw) | 6.6x |

| 9 | M4 (Ancoats, Northern Quarter) | 6.8x |

| 10 | M3 (Deansgate, Blackfriars) | 7.0x |

| 11 | M22 (Wythenshawe, Northenden) | 7.0x |

| 12 | M13 (Longsight, Ardwick) | 7.1x |

| 13 | M1 (City Centre) | 7.2x |

| 14 | M23 (Wythenshawe) | 7.2x |

| 15 | M16 (Old Trafford, Stretford) | 7.3x |

| 16 | M8 (Crumpsall, Cheetham Hill) | 7.3x |

| 17 | M14 (Fallowfield, Rusholme) | 7.5x |

| 18 | M15 (Hulme, Castlefield) | 7.6x |

| 19 | M19 (Levenshulme, Burnage) | 8.5x |

| 20 | M2 (Deansgate, St Ann's Square) | 9.0x |

| 21 | M20 (Didsbury) | 10.7x |

| 22 | M21 (Chorlton) | 11.3x |

For context, the England average price-to-income ratio sits around 7.4x based on the Great Britain median salary of £39,125 against average sold prices of £293,131. Sixteen of Manchester's 22 postcodes come in below this national benchmark. Manchester property prices are genuinely affordable relative to local earnings across the majority of the city, not just cheap in headline terms.

This affordability is part of what drives sustained rental demand across Manchester. Tenants who could stretch to buy in M11 or M18 often choose to rent for flexibility, particularly younger workers in their first few years in the city. For investors, low price-to-income ratios also mean lower deposit requirements and more accessible entry points compared to cities like Sheffield or Nottingham where similar yields come at comparable or higher price points.

Investors looking at the wider Greater Manchester market might also consider Rochdale, Bury, or Oldham, each offering different price-to-income profiles within commuting distance of Manchester city centre.

How Much Deposit to Buy a Buy-to-Let House in Manchester?

Most buy-to-let mortgage lenders require a minimum deposit of 25%, but the best rates and most competitive products typically start at 30% loan-to-value. The table below calculates the 30% deposit requirement for each Manchester postcode based on current average asking prices.

Manchester buy-to-let deposits range from £59,823 in M11 (Openshaw) to £123,140 in M21 (Chorlton). That is a £63,317 difference in upfront capital depending on which Manchester postcode an investor targets.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | M11 (Openshaw, Clayton) | £59,823 |

| 2 | M18 (Gorton, Abbey Hey) | £63,456 |

| 3 | M6 (Irlams o' th' Height, Pendleton) | £65,535 |

| 4 | M9 (Blackley, Harpurhey) | £67,781 |

| 5 | M50 (Salford Quays) | £69,071 |

| 6 | M40 (Moston, Collyhurst) | £69,816 |

| 7 | M5 (Salford, Ordsall) | £71,379 |

| 8 | M12 (Ardwick, Openshaw) | £72,068 |

| 9 | M4 (Ancoats, Northern Quarter) | £74,145 |

| 10 | M3 (Deansgate, Blackfriars) | £75,794 |

| 11 | M22 (Wythenshawe, Northenden) | £76,302 |

| 12 | M13 (Longsight, Ardwick) | £77,167 |

| 13 | M1 (City Centre) | £78,381 |

| 14 | M23 (Wythenshawe) | £78,815 |

| 15 | M16 (Old Trafford, Stretford) | £79,391 |

| 16 | M8 (Crumpsall, Cheetham Hill) | £79,499 |

| 17 | M14 (Fallowfield, Rusholme) | £81,234 |

| 18 | M15 (Hulme, Castlefield) | £82,525 |

| 19 | M19 (Levenshulme, Burnage) | £92,093 |

| 20 | M2 (Deansgate, St Ann's Square) | £98,179 |

| 21 | M20 (Didsbury) | £116,672 |

| 22 | M21 (Chorlton) | £123,140 |

Twelve Manchester postcodes require a 30% deposit below £80,000. For investors with a budget between £60,000 and £80,000 in available capital, that opens up the majority of Manchester's buy-to-let market including the highest-yielding postcodes. M14 (Fallowfield) at 7.9% gross yield requires an £81,234 deposit. M11 (Openshaw) at 6.8% yield needs just £59,823.

The deposit figures above cover the mortgage deposit only. Budget for stamp duty, solicitor fees, survey costs, and any refurbishment needed before letting. On a £200,000 Manchester buy-to-let purchase, stamp duty alone adds £1,500 at the standard rate or £7,500 with the additional property surcharge. Total acquisition costs including all fees typically add 5-7% on top of the deposit.

Investors considering whether to spread capital across multiple lower-value Manchester properties or concentrate on a single higher-value postcode should weigh yield against management complexity. Two properties in M11 at £199,411 each require roughly the same total deposit as one property in M21 at £410,466, but the two M11 properties would generate a combined gross yield of 6.8% versus 3.9% from the single M21 property.

How to Invest in Manchester Property

The data in this article points to three distinct Manchester buy-to-let strategies depending on budget and target return.

Yield-led: M14, M13, M11, and M18 deliver the highest gross rental yields in Manchester at 6.7% to 7.9%. Entry deposits start below £64,000. Tenant demand in these postcodes is driven by university proximity and affordability. Expect higher tenant turnover but shorter void periods.

Growth-led: M16, M19, M23, and M22 have delivered between 34% and 49% capital growth over five years with moderate yields of 5.0% to 5.5%. These are established residential areas where owner-occupier demand is rising. The investment thesis is total return over a 10+ year hold.

City centre: M1, M3, M4, M5, M15, and M50 require the most caution in 2026. Yields of 6.1% to 6.6% look competitive but several of these postcodes show negative price growth per square foot over five years. New-build oversupply is repricing the market. Buying resale at corrected prices may work. Paying new-build premiums carries capital risk.

Manchester buy-to-let purchases follow the same legal and regulatory process as any UK investment property. A detailed breakdown of the buy-to-let compliance process is covered separately. For Manchester specifically, check whether the property falls within a selective licensing area. Manchester City Council operates selective licensing schemes in parts of the city that require landlords to obtain an additional licence before letting.

How Manchester Buy-to-Let Compares to Nearby Areas

Investors researching Manchester property investment are typically also considering the surrounding Greater Manchester boroughs. Each offers a different balance of price, yield, and rental income. The table below compares Manchester against four nearby locations using the same data sources.

| Location | Avg Asking Price | Avg Monthly Rent | Top Gross Yield |

|---|---|---|---|

| Manchester | £265,494 | £1,314 | 7.9% |

| Salford | £249,070 | £1,171 | 6.7% |

| Bolton | £254,422 | £954 | 6.7% |

| Stockport | £369,265 | £1,322 | 6.2% |

| Bury | £281,990 | £1,004 | 5.3% |

Manchester delivers the highest top-end gross rental yield in the group at 7.9% and the highest average monthly rent at £1,314. The city's depth of rental demand from students, young professionals, and corporate tenants is difficult to replicate in the surrounding boroughs. Salford comes closest on rent at £1,171, reflecting its shared border and overlapping tenant market with Manchester city centre.

Bolton offers a comparable top yield to Salford at 6.7% but at significantly lower average rents of £954 per month. Bolton's investment case is entry price rather than rental income. Stockport sits at the other end. Average asking prices of £369,265 make it the most expensive location in this comparison, but rents of £1,322 almost match Manchester. The yield compression to 6.2% reflects Stockport's stronger owner-occupier market and proximity to the Cheshire commuter belt.

Bury at 5.3% top yield and £1,004 average rent is the most moderate profile in the group. It suits investors looking for lower-volatility residential areas with steady demand rather than the higher yields and higher turnover of Manchester's inner postcodes.

All five locations are covered in full detail in their own postcode-level guides on this site.

Frequently Asked Questions

Is Manchester a good place to invest in property?

Manchester has the fundamentals that support buy-to-let investment. Population grew 9.7% between 2011 and 2021. Average house prices sit 13% below the England average while gross rental yields reach 7.9% in the strongest postcodes. The city has a large and diverse tenant base drawn by two major universities, a growing professional services sector, and ongoing regeneration. Whether it is the right place for a specific investor depends on budget, target return, and risk tolerance. The postcode-level data in this article is designed to help with that decision.

What is a good rental yield in Manchester?

The Manchester average sits around 6%. Anything above that is performing well relative to the city. The top yield is 7.9% in M14 (Fallowfield, Rusholme) and 15 of 22 postcodes deliver above 5.5%. For context, a gross yield above 6% in a major UK city with strong tenant demand is considered competitive. Gross yield does not account for mortgage costs, management fees, maintenance, or void periods. Net yield after all costs will be lower.

What are the best areas for buy-to-let in Manchester?

That depends on strategy. For yield, M14 (Fallowfield), M13 (Longsight), M11 (Openshaw), and M18 (Gorton) deliver between 6.7% and 7.9% with entry prices below £271,000. For capital growth, M16 (Old Trafford), M23 (Wythenshawe), and M19 (Levenshulme) have delivered 35% to 49% growth over five years. The city centre postcodes (M1, M3, M4, M15) offer decent yields but are currently experiencing price corrections in the new-build apartment market.

Are Manchester house prices high compared to the national average?

No. Manchester's average sold price of £255,489 is 13% below the England average of £293,131. Sixteen of 22 Manchester postcodes have a price-to-income ratio below the national benchmark of 7.4x. Manchester property is affordable both in absolute terms and relative to local earnings. The premium postcodes of M20 (Didsbury) and M21 (Chorlton) are the exceptions, with price-to-income ratios above 10x.

Is Manchester buy-to-let still profitable in 2026?

The data supports profitability in most Manchester postcodes, but profitability depends entirely on purchase price, mortgage terms, and management costs. A property bought at average asking price in M14 with a 7.9% gross yield and a 65% LTV mortgage at 5% interest would generate positive cash flow before management fees. The same calculation in M21 at 3.9% yield would be marginal or negative. Higher interest rates since 2022 have compressed margins across the UK buy-to-let market. Running the numbers on a specific property with current mortgage rates is essential before committing.