Where to Buy Property Investments in Leeds: Yields of 10%

While property investors pile into Manchester and Birmingham, Leeds quietly delivers some of the strongest buy-to-let returns in England. The city centre postcode LS2 shows property investment yields of 10.0% on average prices of just £139,084.

Leeds property market delivers a staggering range of house prices, ranging from 53.0% below to 82.8% above the England average across its 29 postcodes.What makes Leeds particularly interesting is how the market splits between high-yield inner-city opportunities and premium suburban villages. You can buy into LS2, LS9, or LS3 for under £190,000 and see yields around 8-10%, perfect for investors building portfolios on modest budgets. These postcodes sit just a few miles from places like Ilkley (LS29) and Wetherby (LS22) where properties average over £500,000 and attract wealthy commuters who want period homes, good schools, and countryside access while staying within reach of Leeds' city centre jobs. This creates an unusual dynamic where you're not forced to choose between yield and capital growth; you can access both strategies in the same city depending on which postcode you target.

The student market drives much of the rental demand, but it's not just students. Leeds has a young professional population working in law (with 1,600 legal companies in the region), finance, healthcare, and digital sectors who need rental accommodation near the city centre. This mix of tenants means you're not completely dependent on the academic calendar, and areas like Headingley (LS6) that started as pure student zones are increasingly attracting young workers who want the same walkable access to bars, restaurants, and transport links.

Our analysis examines all 29 Leeds postcodes, breaking down where the rental yields sit, what growth patterns look like over 1, 3, 5, and 7 years, and what kind of deposit you actually need to enter each part of the Leeds housing market.

Article updated: November 2025

Leeds Buy-to-Let Market Overview 2025

Leeds' property market is a tale of two cities: ultra-high yields in accessible inner-city postcodes and high-value, low-yield markets in its premium outer suburbs. Key statistics from our November 2025 analysis include:

- Asking Price Range: £139,084 (LS2) to £541,233 (LS22) across 29 postcodes.

- Rental Yields: 2.8% (LS29) up to a massive 10.0% (LS2).

- Rental Income: Monthly rents from £837 (LS11) to £1,839 (LS6).

- Price per Sq Ft: Property values range from £207.55/sq ft (LS9) to £363.60/sq ft (LS29).

- Market Activity: Sales range from just 2-3 per month (LS3, LS2) to 37 per month (LS27).

- Deposit Requirements: Entry costs range from £41,725 (LS2) to £162,370 (LS22).

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Leeds?

Leeds has firmly established itself as the economic capital of Yorkshire, combining a powerful finance and legal sector with a vibrant, young population. For property investors, this creates a deep and sustainable tenant pool. The city's core investment appeal is built on its economic strength, transport connectivity, and tenant demographics.

The city is a genuine economic powerhouse, referred to by the Leeds Law Society as the "biggest legal centre outside of London". This is part of a wider strategic vision, backed by the government, to accelerate growth and leverage the city's role as a key economic pillar of the North (as detailed in the 2024 'Vision for Leeds' report). Major employers like Channel 4, the UK Infrastructure Bank, PwC, and Sky have major operations here, attracting a constant flow of skilled professionals who need high-quality rental accommodation.

This economic power is supported by major transport links. Leeds is positioned at the nexus of the M1, M62, and A1(M) motorways, offering easy access to Sheffield, Manchester, and the rest of the UK. Leeds railway station is one of the busiest outside of London, anchoring the city's role as a northern hub.

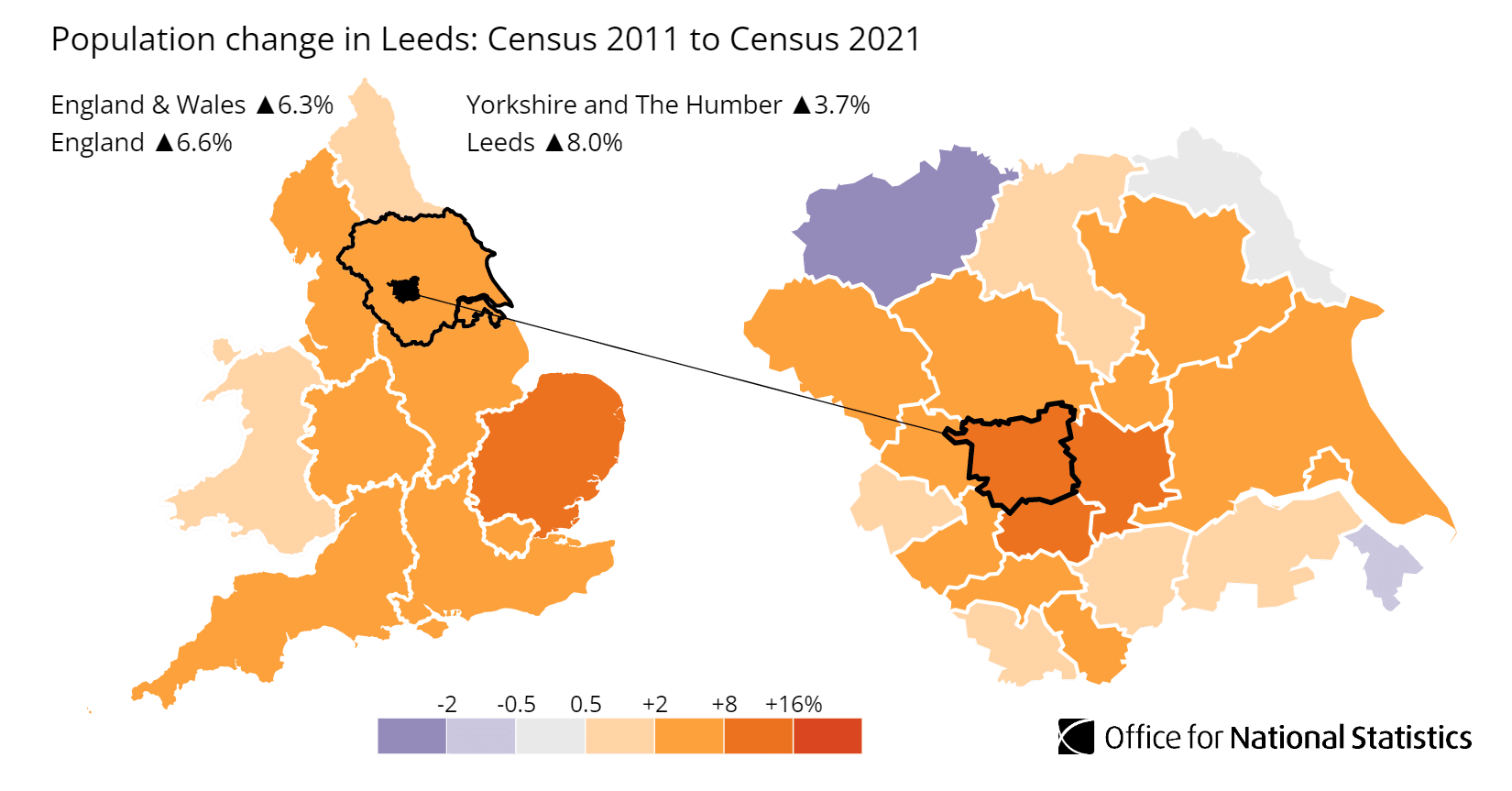

The tenant market is exceptionally strong, underpinned by two major institutions, the University of Leeds and Leeds Beckett University. This large student body dominates postcodes like LS6 (Headingley) and provides a steady demand for HMOs and flats. This graduates into a strong young professional market, with ONS census data showing a high concentration of residents in the 20-34 age groups, ensuring high demand for city centre living in postcodes like LS2 and LS3.

For investors considering other northern powerhouses, explore buy-to-let in Manchester for its media and tech scene, or buy-to-let in Liverpool for its world-renowned heritage and regeneration focus.

Regeneration and Investment in Leeds

Leeds is undergoing one of the most ambitious urban transformations in Europe, with billions of pounds being invested in projects that are reshaping the city. This regeneration is a key driver for property investors, creating new desirable districts and boosting long-term capital growth prospects.

Key projects active in 2024 and 2025 include:

- Leeds South Bank: This is one of the largest regeneration projects in Europe, aiming to double the size of the city centre. It's a collection of massive developments creating a new global destination for living, working, and leisure.

- The Temple District: A core part of the South Bank, development manager CEG's 'Temple' project is delivering new offices, hundreds of new homes, restaurants, and green spaces, all centred around the historic Temple Works (as detailed on the official Temple Leeds site). The council's planning brief supports this comprehensive regeneration (source: Leeds.gov.uk).

- Aire Valley Leeds: This is a vast 1,400-hectare Enterprise Zone (as per the official Area Action Plan) to the east of the city. It's already attracted major names and is set to create thousands of new jobs, driving housing demand in nearby postcodes like LS10.

- City Centre Public Realm: Following the completion of major phases in 2024, the "Grey to Green" transformation of the city core, including the Headrow, is making the city far more attractive (as documented by Public Practice). This plan to pedestrianise and improve the city's core directly benefits postcodes like LS1 and LS2.

Leeds Property Market Analysis

When Was the Last House Price Crash in Leeds?

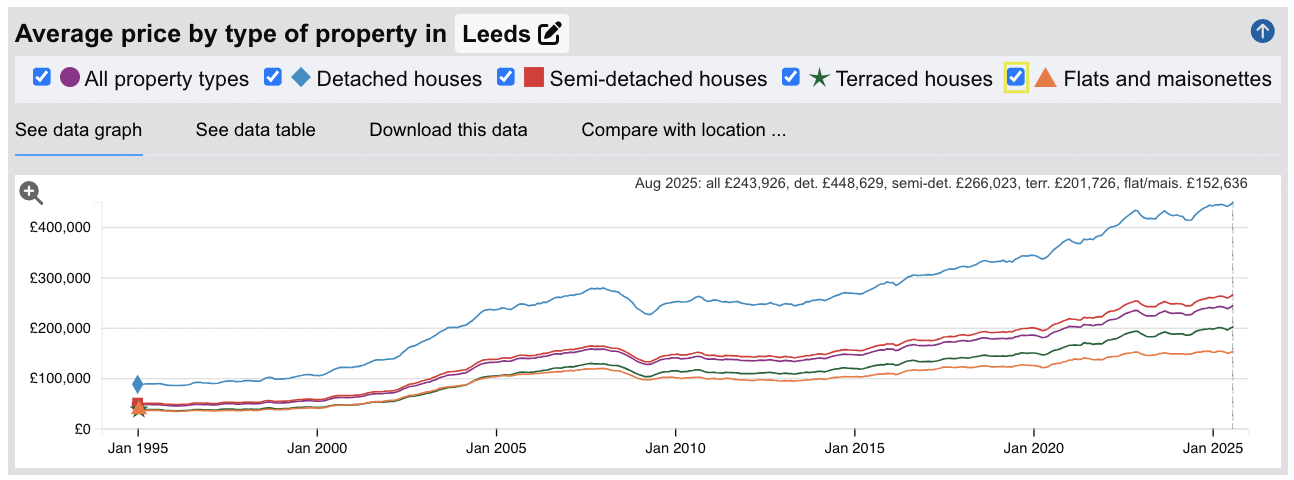

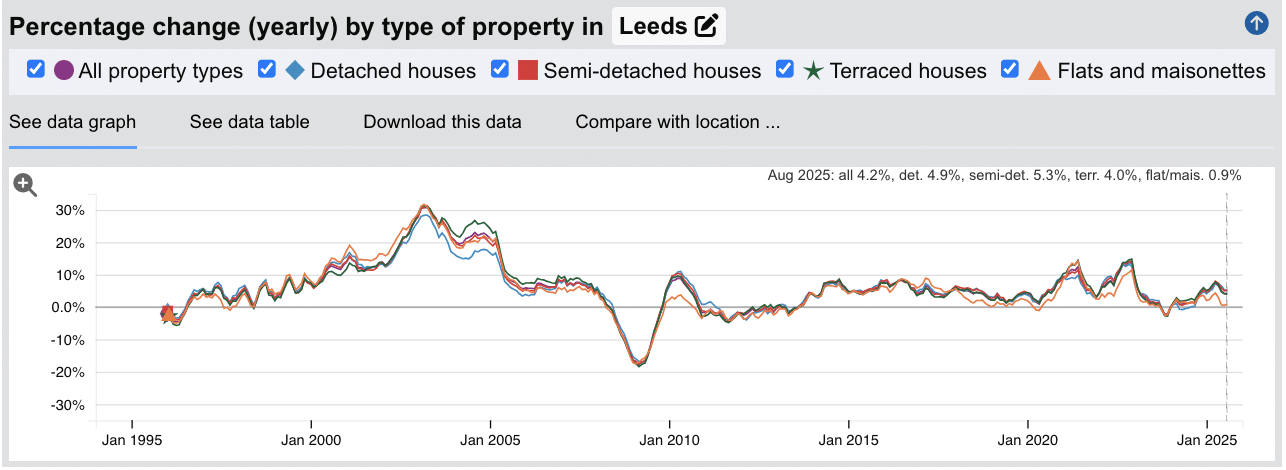

The last significant property price crash in Leeds occurred during the global financial crisis of 2008-2010, with a more recent and much briefer correction period in 2023. Unlike the sharp drop in 2008, the 2023 correction was moderate, and official data shows prices have returned to strong positive annual growth through 2024 and into 2025.

Source: HM Land Registry UK House Price Index for Leeds

Looking at Leeds' historical property prices from the data:

- 1995-2000: Steady appreciation as the market recovered from the 90s recession, with average prices rising from £45,679 to £61,170.

- 2000-2004: An exceptional growth period. Prices more than doubled, with annual increases peaking over 24% (e.g., Aug 2002-Aug 2003) as the market boomed.

- 2004-2007: Growth continued but moderated, with annual increases slowing from double digits down to around 5-8% as the market approached its peak.

- 2008-2010 (The Crash): A sharp and significant correction. Average prices fell from a peak of £157,612 (Sep 2007) to a low of £127,184 (Mar 2009), a drop of -19.3%. The market remained volatile through 2010.

- 2010-2014: A period of relative stagnation and slow recovery. Prices showed very modest growth, moving from £137,311 (Dec 2010) to £146,514 (Dec 2014).

- 2014-2018: A period of steady, consistent growth, with prices rising from £146,514 to £177,668, reflecting the North's strong economic recovery.

- 2018-2020: Growth continued, accelerating into the pandemic with strong demand.

- 2020-2022 (Pandemic Boom): A second surge of exceptional growth, driven by stamp duty holidays and the "race for space." Prices climbed rapidly, with annual growth peaking at +13.7% (Dec 2021-Dec 2022).

- 2023 (Correction): A brief correction as high interest rates impacted affordability. Prices dipped from a peak of £233,785 (Dec 2022) to a low of £228,265 (Dec 2023), a minor dip of -2.4%.

- 2024-2025 (Recovery): The market has shown a strong recovery. From January 2024, prices have climbed consistently, reaching £243,926 by August 2025.

Long-Term Property Value Growth in Leeds

Leeds has delivered strong capital appreciation for long-term landlords and homeowners, calculated from the official data (using August as the consistent month):

- 5 years (2020-2025): +27.6% (average sold prices from £191,172 to £243,926)

- 10 years (2015-2025): +59.4% (average sold prices from £153,033 to £243,926)

- 15 years (2010-2025): +71.1% (average sold prices from £142,555 to £243,926)

- 20 years (2005-2025): +77.3% (average sold prices from £137,579 to £243,926)

- 30 years (1995-2025): +417.0% (average sold prices from £47,179 to £243,926)

The minor 2023 market correction reflected temporary affordability constraints. The market's swift recovery to positive growth, with annual growth running at +4.2% as of August 2025, demonstrates the city's resilient buyer demand, strong economic fundamentals, and the impact of ongoing regeneration.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Leeds

The latest sold house price index by the Land Registry shows the average sold prices in the Leeds local authority (as of August 2025) compared against the national average for England.

Property in Leeds is significantly more affordable than the England average across every property type. The average property in Leeds sells for 17.6% less than the national average.

This value gap is most significant for property investment. Flats and maisonettes in Leeds are over 32% cheaper than the national average, making them ideal for investors targeting the student or young professional market.

Terraced houses, which make up much of the stock in areas like LS6 (Headingley) and LS11 (Beeston), are 18% cheaper. These traditional Victorian-era homes are perfect for HMO conversions or as family lets.

Semi-detached houses are 9.2% cheaper and remain the staple for the family rental market in suburbs like LS13 (Pudsey). Detached houses offer a smaller, but still significant, 5.9% saving against the national average.

Updated November 2025

| Property Type | Leeds Average (Aug 2025) | England Average (Aug 2025) | Difference |

|---|---|---|---|

| Detached houses | £448,629 | £477,000 | -5.9% |

| Semi-detached houses | £266,023 | £293,000 | -9.2% |

| Terraced houses | £201,726 | £246,000 | -18.0% |

| Flats and maisonettes | £152,636 | £225,000 | -32.2% |

| All property types | £243,926 | £296,000 | -17.6% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Leeds

Updated November 2025

The data represents the average asking prices of properties currently listed for sale across all 29 Leeds postcode districts.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | LS22 (Wetherby) | £541,233 |

| 2 | LS29 (Ilkley / Burley in Wharfedale) | £513,568 |

| 3 | LS24 (Tadcaster) | £505,754 |

| 4 | LS17 (Alwoodley / Moortown) | £476,964 |

| 5 | LS23 (Boston Spa / Bramham) | £453,347 |

| 6 | LS16 (Adel / Cookridge) | £432,905 |

| 7 | LS21 (Otley) | £419,295 |

| 8 | LS20 (Guiseley) | £379,991 |

| 9 | LS8 (Roundhay / Oakwood) | £334,226 |

| 10 | LS25 (Sherburn in Elmet / Garforth) | £329,119 |

| 11 | LS18 (Horsforth) | £327,421 |

| 12 | LS15 (Cross Gates / Barwick-in-Elmet) | £325,898 |

| 13 | LS26 (Rothwell / Woodlesford) | £306,340 |

| 14 | LS6 (Headingley / Hyde Park) | £295,993 |

| 15 | LS19 (Yeadon / Rawdon) | £282,171 |

| 16 | LS14 (Seacroft / Thorner) | £274,562 |

| 17 | LS28 (Pudsey / Farsley) | £264,247 |

| 18 | LS27 (Morley) | £254,554 |

| 19 | LS7 (Chapel Allerton / Potternewton) | £245,027 |

| 20 | LS5 (Hawksworth / Kirkstall) | £244,550 |

| 21 | LS4 (Burley / Kirkstall) | £217,219 |

| 22 | LS1 (City Centre) | £216,809 |

| 23 | LS12 (Armley / Bramley) | £207,848 |

| 24 | LS13 (Pudsey / Bramley) | £206,809 |

| 25 | LS3 (Woodhouse) | £189,915 |

| 26 | LS10 (Hunslet / Middleton) | £172,191 |

| 27 | LS11 (Beeston / Holbeck) | £162,563 |

| 28 | LS9 (Cross Green / East End Park) | £158,871 |

| 29 | LS2 (City Centre) | £139,084 |

Leeds' property market shows a staggering price spread of over £400,000 between its most and least expensive postcodes. The most accessible entry points are found in the inner-city postcodes of LS2 (£139,084), LS9 (£158,871), and LS11 (£162,563). These areas are prime targets for investors seeking low capital outlay and high rental yields.

At the other end of the spectrum are the affluent spa towns and villages on the rural fringe of the district. LS22 (Wetherby), LS29 (Ilkley), and LS24 (Tadcaster) all command average prices over £500,000. These areas attract wealthy homeowners and commuters, offering a completely different investment strategy focused on long-term capital growth from premium tenants.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Leeds (£)

Updated November 2025

The data represents the average price per square foot across Leeds postcodes, blending current asking prices and recent sold prices.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | LS29 (Ilkley / Burley in Wharfedale) | £363.60 |

| 2 | LS22 (Wetherby) | £353.05 |

| 3 | LS23 (Boston Spa / Bramham) | £348.10 |

| 4 | LS17 (Alwoodley / Moortown) | £342.80 |

| 5 | LS18 (Horsforth) | £331.65 |

| 6 | LS16 (Adel / Cookridge) | £322.55 |

| 7 | LS21 (Otley) | £321.85 |

| 8 | LS20 (Guiseley) | £317.15 |

| 9 | LS1 (City Centre) | £308.60 |

| 10 | LS7 (Chapel Allerton / Potternewton) | £300.90 |

| 11 | LS24 (Tadcaster) | £300.10 |

| 12 | LS15 (Cross Gates / Barwick-in-Elmet) | £294.35 |

| 13 | LS8 (Roundhay / Oakwood) | £293.40 |

| 14 | LS19 (Yeadon / Rawdon) | £292.55 |

| 15 | LS25 (Sherburn in Elmet / Garforth) | £278.40 |

| 16 | LS28 (Pudsey / Farsley) | £274.65 |

| 17 | LS5 (Hawksworth / Kirkstall) | £274.60 |

| 18 | LS26 (Rothwell / Woodlesford) | £273.05 |

| 19 | LS6 (Headingley / Hyde Park) | £269.35 |

| 20 | LS14 (Seacroft / Thorner) | £260.30 |

| 21 | LS27 (Morley) | £258.80 |

| 22 | LS4 (Burley / Kirkstall) | £255.00 |

| 23 | LS2 (City Centre) | £251.95 |

| 24 | LS10 (Hunslet / Middleton) | £240.90 |

| 25 | LS13 (Pudsey / Bramley) | £238.10 |

| 26 | LS12 (Armley / Bramley) | £230.90 |

| 27 | LS3 (Woodhouse) | £221.80 |

| 28 | LS11 (Beeston / Holbeck) | £212.40 |

| 29 | LS9 (Cross Green / East End Park) | £207.55 |

Price per square foot (PSF) data confirms the value divide. The premium postcodes of LS29 (Ilkley), LS22 (Wetherby), and LS23 (Boston Spa) achieve the highest values, all exceeding £348 PSF.

In contrast, the high-yield inner-city areas offer the best value on a per-foot basis for investors. LS9 (£207.55), LS11 (£212.40), and LS3 (£221.80) offer property at nearly half the price per square foot of the premium suburbs. This metric is crucial for investors, as it highlights where refurbishment projects (to increase value per-foot) or new-build developments are most viable.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Leeds (%)

Updated November 2025

The data represents the average house price growth over the past five years, calculated using postcode-level data blending sold prices and asking prices.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | LS11 (Beeston / Holbeck) | 35.1% |

| 2 | LS8 (Roundhay / Oakwood) | 32.1% |

| 3 | LS12 (Armley / Bramley) | 31.5% |

| 4 | LS7 (Chapel Allerton / Potternewton) | 31.3% |

| 5 | LS2 (City Centre) | 31.3% |

| 6 | LS13 (Pudsey / Bramley) | 27.9% |

| 7 | LS26 (Rothwell / Woodlesford) | 26.0% |

| 8 | LS27 (Morley) | 25.8% |

| 9 | LS9 (Cross Green / East End Park) | 25.1% |

| 10 | LS6 (Headingley / Hyde Park) | 24.5% |

| 11 | LS10 (Hunslet / Middleton) | 24.0% |

| 12 | LS5 (Hawksworth / Kirkstall) | 23.9% |

| 13 | LS21 (Otley) | 23.8% |

| 14 | LS17 (Alwoodley / Moortown) | 23.7% |

| 15 | LS28 (Pudsey / Farsley) | 22.6% |

| 16 | LS25 (Sherburn in Elmet / Garforth) | 20.9% |

| 17 | LS22 (Wetherby) | 20.5% |

| 18 | LS15 (Cross Gates / Barwick-in-Elmet) | 19.7% |

| 19 | LS24 (Tadcaster) | 19.5% |

| 20 | LS14 (Seacroft / Thorner) | 19.2% |

| 21 | LS4 (Burley / Kirkstall) | 18.8% |

| 22 | LS23 (Boston Spa / Bramham) | 18.7% |

| 23 | LS19 (Yeadon / Rawdon) | 17.8% |

| 24 | LS18 (Horsforth) | 15.4% |

| 25 | LS29 (Ilkley / Burley in Wharfedale) | 13.4% |

| 26 | LS20 (Guiseley) | 12.6% |

| 27 | LS16 (Adel / Cookridge) | 9.6% |

| 28 | LS1 (City Centre) | Not Enough Data |

| 29 | LS3 (Woodhouse) | Not Enough Data |

Over the last five years, areas offering affordable family housing and strong capital growth have performed exceptionally well. LS11 (Beeston, Holbeck) leads with 35.1% growth, followed by LS8 (Roundhay) at 32.1% and LS12 (Armley) at 31.5%. Even the high-yield hotspot of LS2 (City Centre) has posted a strong 31.3% growth over this period.

Investors should note that long-term growth data for LS1 and LS3 is limited to be reliable. This is supported by the extremely low monthly sales volumes in these postcodes (2-5 sales per month), which can skew long-term averages.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Leeds

Updated November 2025

The data represents the average number of residential property sales per month across Leeds' postcode districts.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | LS27 (Morley) | 37 |

| 2 | LS25 (Sherburn in Elmet / Garforth) | 33 |

| 3 | LS12 (Armley / Bramley) | 32 |

| 4 | LS13 (Pudsey / Bramley) | 30 |

| 5 | LS28 (Pudsey / Farsley) | 26 |

| 6 | LS10 (Hunslet / Middleton) | 25 |

| 7 | LS29 (Ilkley / Burley in Wharfedale) | 24 |

| 8 | LS26 (Rothwell / Woodlesford) | 23 |

| 9 | LS17 (Alwoodley / Moortown) | 23 |

| 10 | LS16 (Adel / Cookridge) | 22 |

| 11 | LS9 (Cross Green / East End Park) | 21 |

| 12 | LS8 (Roundhay / Oakwood) | 20 |

| 13 | LS18 (Horsforth) | 18 |

| 14 | LS15 (Cross Gates / Barwick-in-Elmet) | 18 |

| 15 | LS14 (Seacroft / Thorner) | 18 |

| 16 | LS11 (Beeston / Holbeck) | 18 |

| 17 | LS7 (Chapel Allerton / Potternewton) | 17 |

| 18 | LS19 (Yeadon / Rawdon) | 16 |

| 19 | LS6 (Headingley / Hyde Park) | 13 |

| 20 | LS21 (Otley) | 11 |

| 21 | LS22 (Wetherby) | 9 |

| 22 | LS24 (Tadcaster) | 9 |

| 23 | LS4 (Burley / Kirkstall) | 8 |

| 24 | LS5 (Hawksworth / Kirkstall) | 7 |

| 25 | LS23 (Boston Spa / Bramham) | 6 |

| 26 | LS1 (City Centre) | 5 |

| 27 | LS20 (Guiseley) | 4 |

| 28 | LS2 (City Centre) | 3 |

| 29 | LS3 (Woodhouse) | 2 |

Market liquidity, or the volume of sales, shows where the transaction hotspots are. The busiest markets are in the popular suburban and commuter towns, led by LS27 (Morley) with 37 sales per month, LS25 (Sherburn in Elmet) with 33, and LS12 (Armley) with 32. These areas are dominated by family homes and have a high turnover.

Crucially for investors, the postcodes with the absolute highest yields (LS2 and LS3) also have the lowest sales volumes, at just 3 and 2 sales per month, respectively. This indicates that while the yields are exceptional, properties are scarce and competition may be high when they do come to market. This low volume also helps explain the price and growth volatility seen in the data for these core city-centre areas.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Leeds Rental Market Analysis

For first-time buyers buying their first rental property in the city of Leeds and thinking how much they can charge for rent, the rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for their AST buy to lets. This is helpful if you are considering how to start a property portfolio in this area.

Rental Prices in Leeds (£)

Updated November 2025

The data represents the average monthly rent for long-let AST properties in Leeds. Postcodes with no rental data available (LS5, LS14, LS20, LS23, LS25, LS26) have been excluded from this ranking.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | LS6 (Headingley / Hyde Park) | £1,839 |

| 2 | LS3 (Woodhouse) | £1,406 |

| 3 | LS17 (Alwoodley / Moortown) | £1,349 |

| 4 | LS22 (Wetherby) | £1,349 |

| 5 | LS4 (Burley / Kirkstall) | £1,261 |

| 6 | LS29 (Ilkley / Burley in Wharfedale) | £1,216 |

| 7 | LS16 (Adel / Cookridge) | £1,203 |

| 8 | LS24 (Tadcaster) | £1,186 |

| 9 | LS2 (City Centre) | £1,156 |

| 10 | LS1 (City Centre) | £1,131 |

| 11 | LS21 (Otley) | £1,118 |

| 12 | LS18 (Horsforth) | £1,118 |

| 13 | LS7 (Chapel Allerton / Potternewton) | £1,077 |

| 14 | LS15 (Cross Gates / Barwick-in-Elmet) | £1,072 |

| 15 | LS9 (Cross Green / East End Park) | £1,061 |

| 16 | LS12 (Armley / Bramley) | £1,037 |

| 17 | LS10 (Hunslet / Middleton) | £1,018 |

| 18 | LS8 (Roundhay / Oakwood) | £1,017 |

| 19 | LS19 (Yeadon / Rawdon) | £988 |

| 20 | LS13 (Pudsey / Bramley) | £975 |

| 21 | LS28 (Pudsey / Farsley) | £940 |

| 22 | LS27 (Morley) | £930 |

| 23 | LS11 (Beeston / Holbeck) | £837 |

The rental market is dominated by the student heartlands. LS6 (Headingley) commands the highest average rent at £1,839 per month. This is almost certainly driven by the prevalence of large, multi-bedroom student HMOs rather than standard flats. LS3 (Woodhouse) and LS4 (Burley/Kirkstall), also popular student and young professional areas, follow closely behind.

The premium suburbs of LS17 (Alwoodley) and LS22 (Wetherby) also command high rents, but these are for large family homes, demonstrating the dual nature of Leeds' rental market.

Note: These figures represent average rents across all property types. Actual achievable rents vary based on property size, condition, and specific location.

Gross Rental Yields in Leeds (%)

Updated November 2025

The data represents the average gross rental yields across Leeds' postcode districts, based on asking prices and asking rents. Postcodes with no rental data available (LS5, LS14, LS20, LS23, LS25, LS26) have been excluded from this ranking.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | LS2 (City Centre) | 10.0% |

| 2 | LS3 (Woodhouse) | 8.9% |

| 3 | LS9 (Cross Green / East End Park) | 8.0% |

| 4 | LS6 (Headingley / Hyde Park) | 7.5% |

| 5 | LS10 (Hunslet / Middleton) | 7.1% |

| 6 | LS4 (Burley / Kirkstall) | 7.0% |

| 7 | LS1 (City Centre) | 6.3% |

| 8 | LS11 (Beeston / Holbeck) | 6.2% |

| 9 | LS12 (Armley / Bramley) | 6.0% |

| 10 | LS13 (Pudsey / Bramley) | 5.7% |

| 11 | LS7 (Chapel Allerton / Potternewton) | 5.3% |

| 12 | LS27 (Morley) | 4.4% |

| 13 | LS28 (Pudsey / Farsley) | 4.3% |

| 14 | LS19 (Yeadon / Rawdon) | 4.2% |

| 15 | LS18 (Horsforth) | 4.1% |

| 16 | LS15 (Cross Gates / Barwick-in-Elmet) | 3.9% |

| 17 | LS8 (Roundhay / Oakwood) | 3.6% |

| 18 | LS17 (Alwoodley / Moortown) | 3.4% |

| 19 | LS16 (Adel / Cookridge) | 3.3% |

| 20 | LS21 (Otley) | 3.2% |

| 21 | LS22 (Wetherby) | 3.0% |

| 22 | LS24 (Tadcaster) | 2.8% |

| 23 | LS29 (Ilkley / Burley in Wharfedale) | 2.8% |

This is the key metric for buy-to-let investors, and Leeds delivers in spectacular fashion. The inner-city postcodes offer some of the highest yields in the UK. LS2 (City Centre) leads with an incredible 10.0% average yield, driven by very low property prices (£139k) and strong rents (£1,156/month). It's important to note that these rental yields are likely due to HMOs in this location which pushes up the average monthly rents data.

It is followed by a cluster of high-performing neighbouring postcodes: LS3 (Woodhouse) at 8.9%, LS9 (Cross Green) at 8.0%, LS6 (Headingley) at 7.5%, and LS10 (Hunslet) at 7.1%. These five postcodes form a powerful investment hub around the city centre.

Conversely, the premium suburbs offer the lowest yields due to their high property prices. LS29 (Ilkley) and LS24 (Tadcaster) provide just 2.8%, while LS22 (Wetherby) offers 3.0%.

Note: These figures represent gross rental yields. Net yields will be lower after accounting for buy-to-let ownership costs like mortgage payments, maintenance, void periods, and management fees. Landlords can use our rental investment calculator to model these costs.

Is Leeds Rent High?

Leeds' rental prices represent a wide range of local incomes, from highly affordable inner-city areas to more expensive premium suburbs. This reflects the city's diverse housing stock, from student HMOs to large suburban family homes.

Average rent in Leeds costs between 26.7% and 58.7% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Leeds residents is £37,596 (based on £723 per week).

The highest-rent postcode, LS6 (Headingley), requires 58.7% of the local average income. This high figure is reflective of the area's large student HMOs, where rent is typically shared between multiple tenants. In contrast, inner-city postcodes like LS11 (Beeston / Holbeck) are highly affordable, requiring only 26.7% of the median local income.

Here is the full breakdown of rental affordability across Leeds:

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | LS6 (Headingley / Hyde Park) | 58.7% |

| 2 | LS3 (Woodhouse) | 44.9% |

| 3 | LS17 (Alwoodley / Moortown) | 43.1% |

| 4 | LS22 (Wetherby) | 43.1% |

| 5 | LS4 (Burley / Kirkstall) | 40.2% |

| 6 | LS29 (Ilkley / Burley in Wharfedale) | 38.8% |

| 7 | LS16 (Adel / Cookridge) | 38.4% |

| 8 | LS24 (Tadcaster) | 37.9% |

| 9 | LS2 (City Centre) | 36.9% |

| 10 | LS1 (City Centre) | 36.1% |

| 11 | LS21 (Otley) | 35.7% |

| 12 | LS18 (Horsforth) | 35.7% |

| 13 | LS7 (Chapel Allerton / Potternewton) | 34.4% |

| 14 | LS15 (Cross Gates / Barwick-in-Elmet) | 34.2% |

| 15 | LS9 (Cross Green / East End Park) | 33.9% |

| 16 | LS12 (Armley / Bramley) | 33.1% |

| 17 | LS10 (Hunslet / Middleton) | 32.5% |

| 18 | LS8 (Roundhay / Oakwood) | 32.5% |

| 19 | LS19 (Yeadon / Rawdon) | 31.5% |

| 20 | LS13 (Pudsey / Bramley) | 31.1% |

| 21 | LS28 (Pudsey / Farsley) | 30.0% |

| 22 | LS27 (Morley) | 29.7% |

| 23 | LS11 (Beeston / Holbeck) | 26.7% |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Leeds House Prices High?

For a local property buyer on average mean full-time earnings.

Purchasing a property in Leeds requires between 3.7 and 14.4 times the median local annual salary.

The most affordable inner-city postcodes like LS2 (City Centre) remain exceptionally accessible at 3.7 times salary. In contrast, LS22 (Wetherby) requires 14.4 times the same salary, reflecting its premium commuter town status.

Salary to House Price Ratios

Based on the official ONS earnings data for Leeds, the median gross annual income for a full-time resident is £37,596 (based on £723 per week). To calculate how this impacts affordability, below we have a table that shows how many times salary a property costs to buy in each location.

| Rank | Area | Price-to-Earnings Ratio |

|---|---|---|

| 1 | LS22 (Wetherby) | 14.4 times |

| 2 | LS29 (Ilkley / Burley in Wharfedale) | 13.7 times |

| 3 | LS24 (Tadcaster) | 13.5 times |

| 4 | LS17 (Alwoodley / Moortown) | 12.7 times |

| 5 | LS23 (Boston Spa / Bramham) | 12.1 times |

| 6 | LS16 (Adel / Cookridge) | 11.5 times |

| 7 | LS21 (Otley) | 11.2 times |

| 8 | LS20 (Guiseley) | 10.1 times |

| 9 | LS8 (Roundhay / Oakwood) | 8.9 times |

| 10 | LS25 (Sherburn in Elmet / Garforth) | 8.8 times |

| 11 | LS18 (Horsforth) | 8.7 times |

| 12 | LS15 (Cross Gates / Barwick-in-Elmet) | 8.7 times |

| 13 | LS26 (Rothwell / Woodlesford) | 8.1 times |

| 14 | LS6 (Headingley / Hyde Park) | 7.9 times |

| 15 | LS19 (Yeadon / Rawdon) | 7.5 times |

| 16 | LS14 (Seacroft / Thorner) | 7.3 times |

| 17 | LS28 (Pudsey / Farsley) | 7.0 times |

| 18 | LS27 (Morley) | 6.8 times |

| 19 | LS7 (Chapel Allerton / Potternewton) | 6.5 times |

| 20 | LS5 (Hawksworth / Kirkstall) | 6.5 times |

| 21 | LS4 (Burley / Kirkstall) | 5.8 times |

| 22 | LS1 (City Centre) | 5.8 times |

| 23 | LS12 (Armley / Bramley) | 5.5 times |

| 24 | LS13 (Pudsey / Bramley) | 5.5 times |

| 25 | LS3 (Woodhouse) | 5.1 times |

| 26 | LS10 (Hunslet / Middleton) | 4.6 times |

| 27 | LS11 (Beeston / Holbeck) | 4.3 times |

| 28 | LS9 (Cross Green / East End Park) | 4.2 times |

| 29 | LS2 (City Centre) | 3.7 times |

So Leeds presents a mixed picture. The official Leeds local authority average 'sold' price of £243,926 (from Aug 2025 ONS data) sits 17.6% below the England average of £296,000.

Yet first time buyers should remember the average 'asking house prices' for properties in Leeds currently on the market show a massive range of LS22 (Wetherby) at £541,233 commanding the highest prices, whilst LS2 (City Centre) at £139,084 offers the most affordable house prices.

Compared to nearby locations, Leeds sits between the more affordable markets of Bradford and Wakefield, and the similarly priced, high-demand markets of Sheffield and York.

How Much Deposit to Buy a House in Leeds?

Assuming a deposit based on the average asking price for each postcode, here is an overview of the deposit requirements across Leeds, ranked from most to least accessible.

| Rank | Area | Deposit Required |

|---|---|---|

| 1 | LS2 (City Centre) | £41,725 |

| 2 | LS9 (Cross Green / East End Park) | £47,661 |

| 3 | LS11 (Beeston / Holbeck) | £48,769 |

| 4 | LS10 (Hunslet / Middleton) | £51,657 |

| 5 | LS3 (Woodhouse) | £56,975 |

| 6 | LS13 (Pudsey / Bramley) | £62,043 |

| 7 | LS12 (Armley / Bramley) | £62,354 |

| 8 | LS1 (City Centre) | £65,043 |

| 9 | LS4 (Burley / Kirkstall) | £65,166 |

| 10 | LS5 (Hawksworth / Kirkstall) | £73,365 |

| 11 | LS7 (Chapel Allerton / Potternewton) | £73,508 |

| 12 | LS27 (Morley) | £76,366 |

| 13 | LS28 (Pudsey / Farsley) | £79,274 |

| 14 | LS14 (Seacroft / Thorner) | £82,369 |

| 15 | LS19 (Yeadon / Rawdon) | £84,651 |

| 16 | LS6 (Headingley / Hyde Park) | £88,798 |

| 17 | LS26 (Rothwell / Woodlesford) | £91,902 |

| 18 | LS15 (Cross Gates / Barwick-in-Elmet) | £97,769 |

| 19 | LS18 (Horsforth) | £98,226 |

| 20 | LS25 (Sherburn in Elmet / Garforth) | £98,736 |

| 21 | LS8 (Roundhay / Oakwood) | £100,268 |

| 22 | LS20 (Guiseley) | £113,997 |

| 23 | LS21 (Otley) | £125,789 |

| 24 | LS16 (Adel / Cookridge) | £129,871 |

| 25 | LS23 (Boston Spa / Bramham) | £136,004 |

| 26 | LS17 (Alwoodley / Moortown) | £143,089 |

| 27 | LS24 (Tadcaster) | £151,726 |

| 28 | LS29 (Ilkley / Burley in Wharfedale) | £154,070 |

| 29 | LS22 (Wetherby) | £162,370 |

If you're new to property, or just starting out through a property investment course, the inner-city postcodes offer the most accessible entry points. LS2 (City Centre) requires a deposit of just £41,725 while offering the city's highest average yield at 10.0%. This is closely followed by LS9 (Cross Green) with a £47,661 deposit (8.0% yield) and LS11 (Beeston) with a £48,769 deposit (6.2% yield). This combination of low entry cost and strong yields makes these areas particularly attractive for first-time buy-to-let investors.

How to Invest in Buy-to-Let in Leeds

Property Investments UK and our partners have ready-to-go buy-to-let properties to purchase across Leeds, West Yorkshire, and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Leeds and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Leeds for Buy-to-Let Investment

For other high-yield investment opportunities in Yorkshire, buy-to-let in Bradford and buy-to-let in Wakefield offer lower entry costs while maintaining strong commuter links to Leeds. Investors should also explore buy-to-let in Sheffield, another major northern city with a strong rental market.

Or to understand further afield, see our guide to buy-to-let across Huddersfield..