Where to Buy Property Investments in Nottingham: Yields of 7.6%

Nottingham represents a powerhouse in the East Midlands property market, offering a compelling mix of high rental yields and accessible entry prices. Known for its legendary history and two major universities, the city offers those looking for property investment average rental yields reaching 7.6% in NG1, a postcode where average property prices are significantly lower than the national average.

The disconnect between Nottingham's high rental demand, driven by over 60,000 students and a growing professional sector, and its affordable housing stock creates a "sweet spot" for buy-to-let investors. While the England average house price sits at £295,670, Nottingham's local authority sold house price average is just £193,422, offering a massive 34.6% saving for investors entering the market.

Our buy-to-let analysis examines Nottingham's diverse postcode districts, evaluating property price growth, rental yields, and the true cost of entering this vibrant city's property market.

Article updated: November 2025

Nottingham Buy-to-Let Market Overview 2025

Nottingham's property market delivers house sold prices at 34.6% below the England average, creating distinct ownership entry points with these key statistics:

- Asking price range: £167,177 (NG1) to £400,000+ (Premium suburbs)

- Rental yields: Averages up to 7.6% in city centre locations (NG1)

- Rental income: Average monthly rent of £1,057 in NG1

- Price per sq ft: Averages £238/sq ft in the city centre

- Market activity: Robust sales volumes with average turnover of 16% in prime spots

- Deposit requirements: 30% deposits from as low as £50,153 in NG1

- Affordability ratios: Property prices are approx 6.6 times the Nottingham median annual income of £29,115

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Nottingham?

Nottingham combines the economic stability of a major UK city with some of the most attractive entry prices you will find anywhere in the country. For investors, the headline figure is the 7.6% yield available in NG1, but the real story is the underlying strength of buyer demand.

The value proposition here is hard to ignore. Nottingham's local authority sold house price average is just £193,422. That means properties here sit 34.6% below the England average, providing a low-risk entry point for investors looking to build a diversified portfolio without over-leveraging.

Then there is the student factor. The city is a major educational powerhouse, home to over 60,000 students across the University of Nottingham and Nottingham Trent University. It’s not just about the numbers, though; it’s about the shortage of beds.

Crucially for landlords, recent reports highlight a structural deficit of over 11,000 student beds. The purpose-built sector simply cannot keep pace with demand, creating a consistent stream of tenants for student HMOs and private rentals. You can see the full breakdown of this supply imbalance in the latest Nottingham Student HMO Market Report.

Connectivity is another major draw. Nottingham sits right at the heart of the East Midlands, with direct M1 access and a train link to London St Pancras that takes just 1 hour 40 minutes. Locally, the award-winning tram network (NET) connects major employers like the Queen's Medical Centre (QMC) and Boots HQ to residential areas, effectively expanding the commuter belt for buy-to-let landlords.

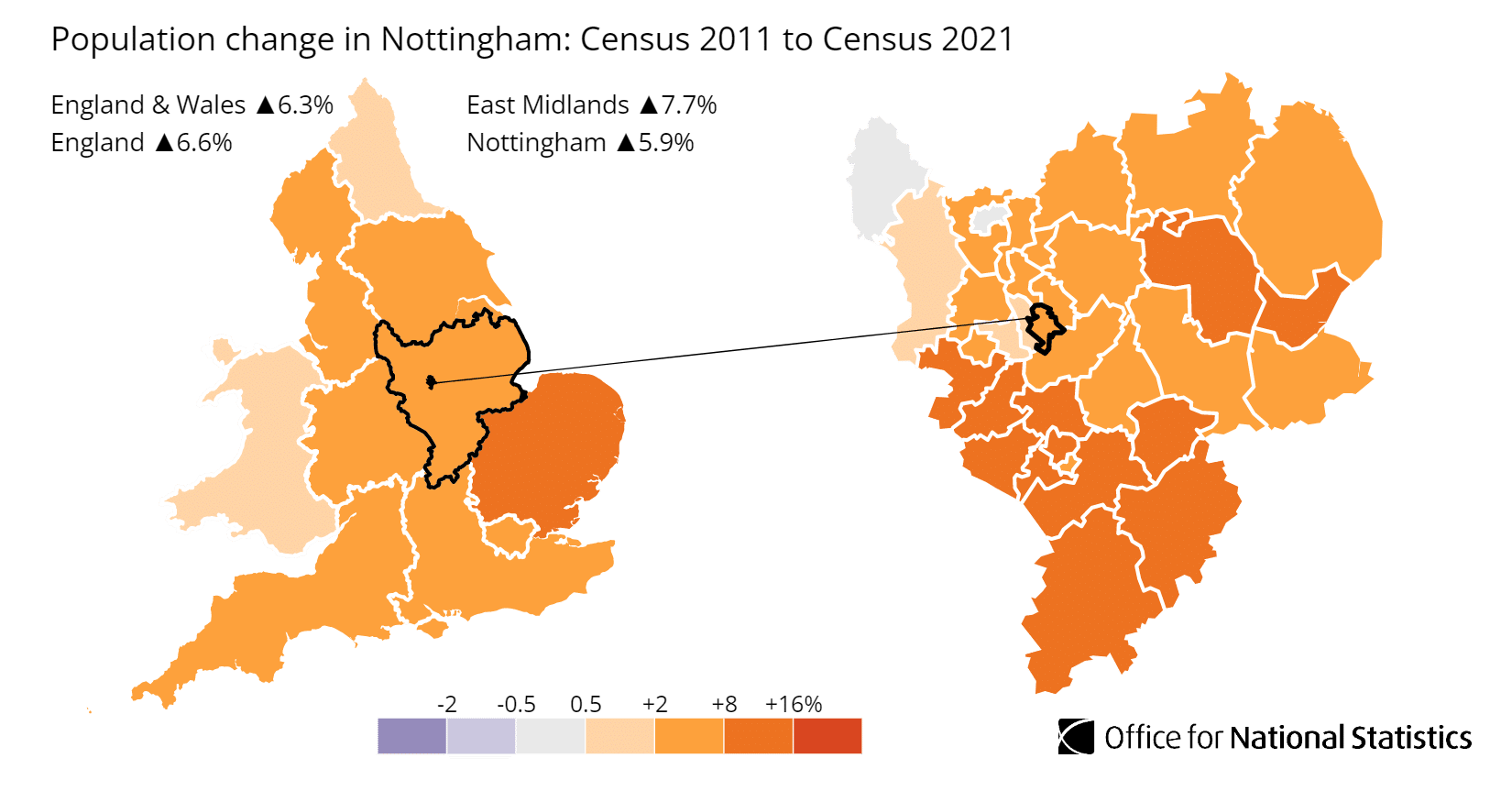

The city's population is also on an upward trajectory. According to the latest census data, the population of Nottingham increased by 5.9%, rising from 305,700 in 2011 to 323,700 in 2021. This sustained growth underpins the long-term tenant demand that makes the city such a reliable investment location. You can explore the full demographic breakdown via the ONS Census Data for Nottingham.

For investors considering other high-yield Midlands locations, you might also want to explore buy-to-let in Leicester, buy-to-let in Derby, or buy-to-let in Coventry.

Regeneration and Investment in Nottingham

Nottingham is currently undergoing a multi-billion pound physical transformation, often cited as the "Southside Regeneration." This isn't just about shiny new buildings; it's about reshaping the city's entire investment landscape and driving long-term capital growth for property owners.

Major projects delivering real change include:

- The Broad Marsh (Green Heart): Historically a concrete barrier to city growth, the former shopping centre site is being completely reimagined. The new wildlife-rich "Green Heart" park officially opened in September 2024, creating a stunning, high-quality gateway between the train station and city centre. Future phases include a masterplan for 1,000 new homes and 20,000 sqm of commercial space. You can track the progress on the Nottingham City Council Broad Marsh page.

- The Island Quarter: One of the UK's largest regeneration schemes, this 36-acre site (formerly Boots Island) represents a massive £1 billion investment. With Phase 1 complete and a 693-bed student accommodation scheme recently delivered, future phases will bring hotels, residential apartments, and bioscience labs, effectively creating a brand new mixed-use district. Read more at The Island Quarter official site.

- New River Trent Bridge: Connectivity is set to improve further with construction scheduled to begin in 2025 on the first new bridge over the River Trent in 60 years. This dedicated pedestrian and cycle bridge will link the expanding Waterside regeneration area to West Bridgford (NG2), significantly boosting property desirability in the riverside corridor. Full details are available via Transport Nottingham.

Nottingham Property Market Analysis

When Was the Last House Price Crash in Nottingham?

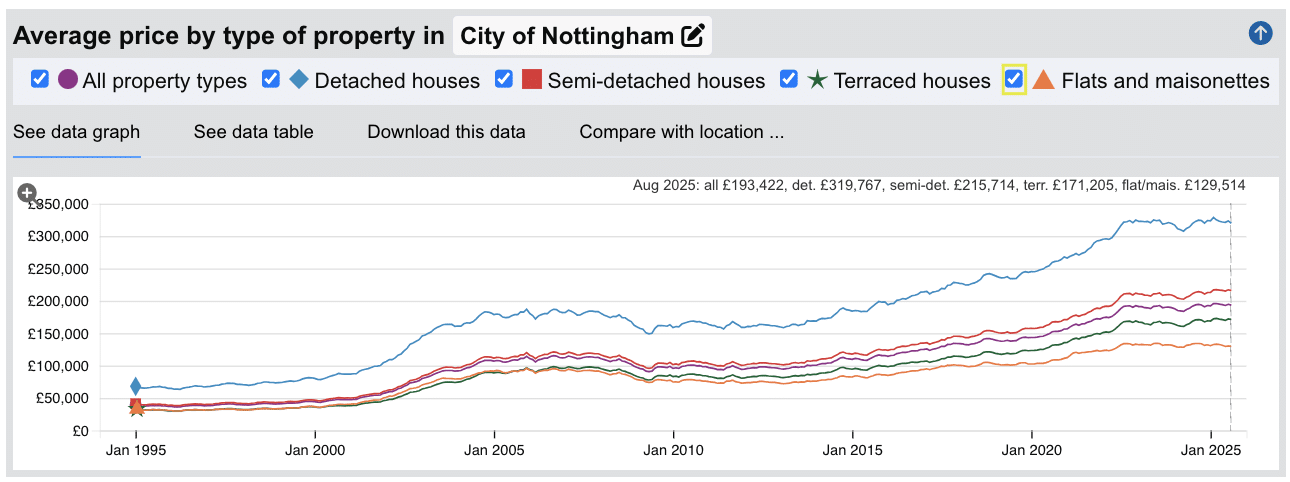

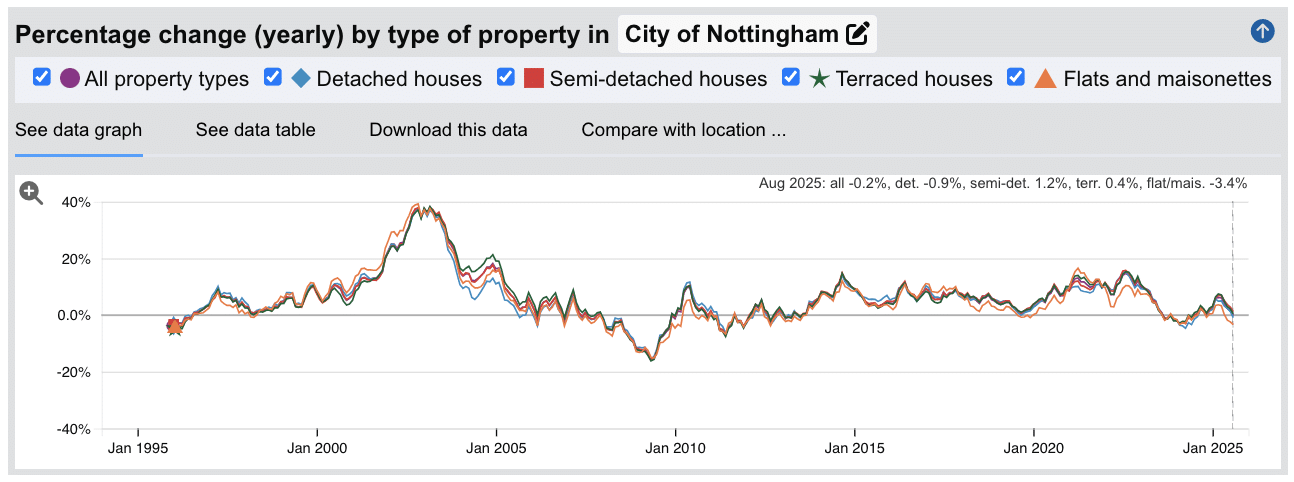

The last significant property price crash in Nottingham occurred during the global financial crisis of 2008-2009, with a more recent but smaller market correction observed in 2023-2024. Unlike many UK markets that have struggled to regain momentum, Nottingham has shown remarkable resilience, with positive annual growth returning in 2025.

Source: HM Land Registry House Price Index for Nottingham

Looking at Nottingham's historical property performance, we can identify clear market cycles:

- 1995-2007 (The Boom Years): A period of explosive growth where average prices rose from just £38,250 in January 1995 to a peak of £113,635 in September 2007.

- 2008-2009 (The Financial Crisis): The market reacted sharply to the global credit crunch. From that 2007 peak, values dropped by approximately 20.1%, hitting a low of £90,779 in May 2009. This aligns with the wider housing market crash seen across the UK, though Nottingham's recovery began steadily from late 2009.

- 2020-2022 (Pandemic Surge): Driven by the "race for space" and stamp duty holidays, Nottingham saw exceptional growth. Prices surged from £144,016 in March 2020 to a peak of £192,358 in October 2022—a growth of over 33% in just two years.

- 2023-2024 (The Correction): As interest rates rose, affordability tightened. The market entered a correction phase, with prices dipping to £183,610 by April 2024. However, this was a shallow dip compared to 2008, reflecting the city's severe supply shortage.

- 2025 (Recovery & Growth): The market has bounced back strongly. By August 2025, average prices hit £193,422, surpassing previous records and signaling a return to long-term appreciation.

Long-Term Property Value Growth in Nottingham

Despite short-term fluctuations, Nottingham has delivered substantial capital appreciation for buy-to-let landlords and homeowners over extended holding periods:

- 5 years (2020-2025): +27.0% (Average house price rising from £152,233 to £193,422)

- 10 years (2015-2025): +71.1% (Average house price rising from £113,007 to £193,422)

- 20 years (2005-2025): +77.5% (Average house price rising from £108,914 to £193,422)

- 30 years (1995-2025): +405.6% (Average house price rising from £38,250 to £193,422)

The 2024 correction reflected temporary affordability constraints. Nottingham's swift recovery in 2025 demonstrates the city's resilient buyer demand fundamentals, driven by its heritage appeal, massive student population, and sustained regeneration investment.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Nottingham

The latest data from the HM Land Registry UK House Price Index illustrates exactly why Nottingham is catching the eye of savvy investors. It’s not just about being cheaper; it’s about the sheer scale of the value gap compared to the rest of the country.

Nottingham's average sold property price is £193,422. That is 34.6% below the England average of £295,670.

For investors, this means you can acquire prime assets in a major UK Core City for significantly less than the national benchmark. This is classic below market value territory relative to the wider UK market.

Flats and apartments stand out as the entry-level opportunity, averaging just £129,514. That is a massive 42.5% saving compared to the national average for flats (£225,149). This price point is incredibly attractive if you are targeting the student market or young professionals in the city centre (NG1), where yields are naturally higher.

Terraced houses also offer exceptional value at £171,205 (30.5% below the national average). These properties are the backbone of the Nottingham buy-to-let market, perfect for family rentals or conversion into high-performing HMOs.

Updated November 2025

| Property Type | Nottingham Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £319,767 | £476,862 | -32.9% |

| Semi-detached houses | £215,714 | £292,942 | -26.4% |

| Terraced houses | £171,205 | £246,321 | -30.5% |

| Flats and maisonettes | £129,514 | £225,149 | -42.5% |

| All property types | £193,422 | £295,670 | -34.6% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Nottingham

Updated November 2025

The data represents the average asking prices of properties currently listed for sale across Nottingham's postcode districts.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | NG32 (Grantham / Sleaford) | £477,500 |

| 2 | NG33 (Grantham / Bourne) | £470,937 |

| 3 | NG23 (Newark) | £468,150 |

| 4 | NG25 (Southwell) | £428,864 |

| 5 | NG13 (Bingham) | £420,161 |

| 6 | NG12 (Ruddington / Cotgrave) | £407,764 |

| 7 | NG14 (Calverton / Lowdham) | £388,499 |

| 8 | NG22 (Newark) | £327,344 |

| 9 | NG11 (Clifton / Ruddington) | £288,320 |

| 10 | NG8 (Wollaton / Aspley) | £279,030 |

| 11 | NG2 (West Bridgford) | £278,797 |

| 12 | NG34 (Sleaford) | £270,816 |

| 13 | NG9 (Beeston / Stapleford) | £270,619 |

| 14 | NG21 (Blidworth / Rainworth) | £269,911 |

| 15 | NG24 (Newark) | £266,126 |

| 16 | NG16 (Eastwood / Kimberley) | £261,259 |

| 17 | NG15 (Hucknall / Ravenshead) | £254,517 |

| 18 | NG31 (Grantham) | £250,780 |

| 19 | NG18 (Mansfield) | £243,007 |

| 20 | NG3 (Mapperley / St Ann's) | £231,728 |

| 21 | NG4 (Gedling / Carlton) | £231,321 |

| 22 | NG10 (Long Eaton) | £228,637 |

| 23 | NG19 (Mansfield Woodhouse) | £218,734 |

| 24 | NG17 (Sutton-in-Ashfield) | £216,173 |

| 25 | NG5 (Arnold / Sherwood) | £208,207 |

| 26 | NG20 (Shirebrook / Langwith) | £202,565 |

| 27 | NG7 (Lenton / The Park) | £200,962 |

| 28 | NG6 (Bulwell / Old Basford) | £174,191 |

| 29 | NG1 (City Centre) | £167,177 |

Asking prices across the Nottingham postcode area reveal a massive £310,323 disparity between the most exclusive enclaves and the high-yield city centre. Topping the list are the rural and semi-rural postcodes like NG32 and NG33, where large detached homes command prices approaching half a million pounds.

However, for the buy-to-let investor, the most compelling opportunities are found at the other end of the table. NG1 (City Centre) offers the lowest entry point at just £167,177, yet delivers the highest yields fueled by student and professional demand. Similarly, NG7 (Lenton) at £200,962 remains a perennial favourite for student landlords, while NG6 (Bulwell) at £174,191 offers strong potential for those targeting affordable family rentals.

If you are looking to acquire assets in these areas, you can view our current list of residential investment properties for sale.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Nottingham (£)

Updated November 2025

The data represents the average price per square foot across Nottingham postcodes, blending current asking prices and recent sold prices.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | NG25 (Southwell) | £334 |

| 2 | NG12 (Ruddington & Edwalton) | £312 |

| 3 | NG2 (West Bridgford) | £306 |

| 4 | NG14 (Calverton) | £298 |

| 5 | NG13 (Bingham) | £298 |

| 6 | NG9 (Beeston) | £287 |

| 7 | NG11 (Clifton) | £270 |

| 8 | NG23 (Newark) | £270 |

| 9 | NG8 (Wollaton) | £268 |

| 10 | NG33 (Grantham) | £258 |

| 11 | NG32 (Grantham) | £257 |

| 12 | NG15 (Hucknall) | £248 |

| 13 | NG4 (Gedling) | £248 |

| 14 | NG10 (Long Eaton) | £245 |

| 15 | NG3 (Mapperley) | £243 |

| 16 | NG16 (Eastwood) | £243 |

| 17 | NG1 (City Centre) | £238 |

| 18 | NG5 (Arnold) | £235 |

| 19 | NG34 (Sleaford) | £234 |

| 20 | NG24 (Newark) | £232 |

| 21 | NG22 (Newark) | £232 |

| 22 | NG31 (Grantham) | £230 |

| 23 | NG7 (Lenton) | £225 |

| 24 | NG21 (Blidworth) | £222 |

| 25 | NG18 (Mansfield) | £211 |

| 26 | NG6 (Bulwell) | £205 |

| 27 | NG19 (Mansfield Woodhouse) | £199 |

| 28 | NG17 (Sutton-in-Ashfield) | £197 |

| 29 | NG20 (Shirebrook) | £191 |

Price per square foot values show a notable £143 spread across Nottingham's postcodes. NG25 (Southwell) commands the highest value at £334 per square foot, reflecting the premium nature of this historic minster town and its high demand from affluent buyers.

NG2 (West Bridgford) follows closely at £306 per square foot. This area is widely considered Nottingham's most desirable urban location, home to the cricket ground and a thriving café culture, justifying the premium over the city average.

Interestingly, NG1 (City Centre) sits mid-table at £238 per square foot. This highlights the value available in city centre apartments compared to the premium suburbs. For investors, this price point, combined with high rental demand, makes city centre new build apartments a compelling proposition.

At the other end of the spectrum, NG20 (Shirebrook) and NG17 (Sutton-in-Ashfield) offer the lowest entry costs at £191 and £197 per square foot respectively, providing opportunities for high-yield strategies where capital entry costs are a priority.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Nottingham (%)

Updated November 2025

The data represents the average house price growth over the past five years, calculated using postcode-level data blending sold prices and asking prices.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | NG11 (Clifton / Ruddington) | 43.7% |

| 2 | NG20 (Shirebrook / Langwith) | 36.4% |

| 3 | NG14 (Calverton / Lowdham) | 33.2% |

| 4 | NG17 (Sutton-in-Ashfield) | 32.9% |

| 5 | NG6 (Bulwell / Old Basford) | 31.5% |

| 6 | NG16 (Eastwood / Kimberley) | 30.3% |

| 7 | NG5 (Arnold / Sherwood) | 29.6% |

| 8 | NG22 (Newark) | 28.7% |

| 9 | NG21 (Blidworth / Rainworth) | 28.6% |

| 10 | NG4 (Gedling / Carlton) | 28.2% |

| 11 | NG10 (Long Eaton) | 27.7% |

| 12 | NG9 (Beeston / Stapleford) | 27.5% |

| 13 | NG7 (Lenton / The Park) | 26.8% |

| 14 | NG3 (Mapperley / St Ann's) | 26.8% |

| 15 | NG2 (West Bridgford) | 26.7% |

| 16 | NG8 (Wollaton / Aspley) | 25.2% |

| 17 | NG23 (Newark) | 24.7% |

| 18 | NG15 (Hucknall / Ravenshead) | 24.5% |

| 19 | NG19 (Mansfield Woodhouse) | 24.2% |

| 20 | NG31 (Grantham) | 23.8% |

| 21 | NG34 (Sleaford) | 21.9% |

| 22 | NG24 (Newark) | 21.3% |

| 23 | NG32 (Grantham / Sleaford) | 18.6% |

| 24 | NG33 (Grantham / Bourne) | 14.4% |

| 25 | NG13 (Bingham) | 14.2% |

| 26 | NG18 (Mansfield) | 14.2% |

| 27 | NG25 (Southwell) | 11.4% |

| 28 | NG12 (Ruddington / Cotgrave) | 8.6% |

| 29 | NG1 (City Centre) | 8.1% |

NG11 (Clifton) has delivered an exceptional 43.7% growth over the last five years, significantly outperforming the wider Nottingham market. This area's performance is largely driven by the expansion of Nottingham Trent University's Clifton Campus and the "tram effect," where excellent connectivity has unlocked value in previously overlooked suburbs.

Interestingly, the data shows that fastest growing areas are often the more affordable outer zones like NG20 (Shirebrook) and NG14 (Calverton), which have both seen growth exceeding 33%. This "ripple effect" demonstrates that as prime locations become expensive, capital growth shifts to accessible commuter towns.

Meanwhile, NG1 (City Centre) has seen more modest growth of 8.1%, which is typical for high-yield city centre markets where the investment case is driven by rental income rather than rapid capital appreciation.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Nottingham

Updated November 2025

The data represents the average number of residential property sales per month across Nottingham's postcode districts.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | NG5 (Arnold / Sherwood) | 59 |

| 2 | NG17 (Sutton-in-Ashfield) | 56 |

| 3 | NG9 (Beeston / Stapleford) | 53 |

| 4 | NG16 (Eastwood / Kimberley) | 51 |

| 5 | NG24 (Newark) | 44 |

| 6 | NG10 (Long Eaton) | 41 |

| 7 | NG19 (Mansfield Woodhouse) | 41 |

| 8 | NG31 (Grantham) | 39 |

| 9 | NG4 (Gedling / Carlton) | 38 |

| 10 | NG18 (Mansfield) | 34 |

| 11 | NG2 (West Bridgford) | 34 |

| 12 | NG3 (Mapperley / St Ann's) | 33 |

| 13 | NG34 (Sleaford) | 28 |

| 14 | NG8 (Wollaton / Aspley) | 27 |

| 15 | NG12 (Ruddington / Cotgrave) | 26 |

| 16 | NG11 (Clifton / Ruddington) | 26 |

| 17 | NG15 (Hucknall / Ravenshead) | 25 |

| 18 | NG6 (Bulwell / Old Basford) | 25 |

| 19 | NG7 (Lenton / The Park) | 22 |

| 20 | NG20 (Shirebrook / Langwith) | 20 |

| 21 | NG21 (Blidworth / Rainworth) | 20 |

| 22 | NG22 (Newark) | 18 |

| 23 | NG13 (Bingham) | 16 |

| 24 | NG14 (Calverton / Lowdham) | 11 |

| 25 | NG32 (Grantham / Sleaford) | 9 |

| 26 | NG1 (City Centre) | 9 |

| 27 | NG23 (Newark) | 8 |

| 28 | NG33 (Grantham / Bourne) | 6 |

| 29 | NG25 (Southwell) | 5 |

High transaction volumes are a key indicator of market liquidity, and Nottingham performs exceptionally well here. NG5 (Arnold) leads the way with 59 sales per month, driven by its popularity with families and first-time buyers who value the balance of good schools and affordable semi-detached homes.

NG9 (Beeston) is another standout performer with 53 monthly sales. As a major employment hub with the University of Nottingham nearby, Beeston operates almost as a satellite town with its own thriving high street, ensuring that properties listed here typically find buyers quickly. This liquidity is crucial for investors who need a clear exit strategy to sell their buy to lets..

Conversely, lower volumes in premium areas like NG25 (Southwell) and NG1 (City Centre) reflect different dynamics. Southwell's low turnover is due to long-term owner-occupiers holding onto desirable assets, while the City Centre market is tighter, often dominated by long-hold investors rather than frequent residential flipping.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Nottingham Rental Market Analysis

For first-time buyers buying their first rental property in the vibrant city of Nottingham, understanding the rental landscape is crucial. Whether you are looking at city centre apartments or family homes in the suburbs, the data below gives a clear indication of the monthly rental income and yields you can aim to achieve for your AST buy-to-lets.

This data is essential reading if you are considering how to start a property portfolio in the East Midlands.

Average Rent in Nottingham (£)

Updated November 2025

The data represents the average monthly rent for long-let AST properties in Nottingham.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | NG7 (Lenton / The Park) | £1,410 |

| 2 | NG14 (Calverton / Lowdham) | £1,243 |

| 3 | NG11 (Clifton / Ruddington) | £1,195 |

| 4 | NG8 (Wollaton / Aspley) | £1,131 |

| 5 | NG2 (West Bridgford) | £1,097 |

| 6 | NG13 (Bingham) | £1,063 |

| 7 | NG1 (City Centre) | £1,057 |

| 8 | NG5 (Arnold / Sherwood) | £1,056 |

| 9 | NG9 (Beeston / Stapleford) | £1,047 |

| 10 | NG22 (Newark) | £963 |

| 11 | NG15 (Hucknall / Ravenshead) | £952 |

| 12 | NG6 (Bulwell / Old Basford) | £951 |

| 13 | NG3 (Mapperley / St Ann's) | £949 |

| 14 | NG34 (Sleaford) | £949 |

| 15 | NG21 (Blidworth / Rainworth) | £945 |

| 16 | NG17 (Sutton-in-Ashfield) | £888 |

| 17 | NG4 (Gedling / Carlton) | £876 |

| 18 | NG10 (Long Eaton) | £872 |

| 19 | NG16 (Eastwood / Kimberley) | £859 |

| 20 | NG19 (Mansfield Woodhouse) | £855 |

| 21 | NG18 (Mansfield) | £847 |

| 22 | NG20 (Shirebrook / Langwith) | £807 |

| 23 | NG24 (Newark) | £796 |

| 24 | NG31 (Grantham) | £782 |

NG7 (Lenton) commands the highest rents in Nottingham at £1,410 per month. This is largely driven by the student HMO market, where large Victorian properties are let by the room, significantly boosting the total monthly income relative to single-family lets.

NG14 (Calverton) follows at £1,243, driven by families renting substantial detached homes in the commuter belt. NG1 (City Centre) achieves a solid £1,057 monthly average, supported by the young professional market seeking modern apartments close to amenities and transport links.

Note: These figures represent average rents across all property types. Actual achievable rents vary based on property size, condition, and specific location.

Gross Rental Yields in Nottingham (%)

Updated November 2025

The data represents the average gross rental yields across Nottingham's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | NG7 (Lenton / The Park) | 8.4% |

| 2 | NG1 (City Centre) | 7.6% |

| 3 | NG6 (Bulwell / Old Basford) | 6.5% |

| 4 | NG5 (Arnold / Sherwood) | 6.1% |

| 5 | NG11 (Clifton / Ruddington) | 5.0% |

| 6 | NG3 (Mapperley / St Ann's) | 4.9% |

| 7 | NG17 (Sutton-in-Ashfield) | 4.9% |

| 8 | NG8 (Wollaton / Aspley) | 4.9% |

| 9 | NG20 (Shirebrook / Langwith) | 4.8% |

| 10 | NG19 (Mansfield Woodhouse) | 4.7% |

| 11 | NG2 (West Bridgford) | 4.7% |

| 12 | NG10 (Long Eaton) | 4.6% |

| 13 | NG9 (Beeston / Stapleford) | 4.6% |

| 14 | NG15 (Hucknall / Ravenshead) | 4.5% |

| 15 | NG4 (Gedling / Carlton) | 4.5% |

| 16 | NG21 (Blidworth / Rainworth) | 4.2% |

| 17 | NG18 (Mansfield) | 4.2% |

| 18 | NG34 (Sleaford) | 4.2% |

| 19 | NG16 (Eastwood / Kimberley) | 3.9% |

| 20 | NG14 (Calverton / Lowdham) | 3.8% |

| 21 | NG31 (Grantham) | 3.7% |

| 22 | NG24 (Newark) | 3.6% |

| 23 | NG22 (Newark) | 3.5% |

| 24 | NG13 (Bingham) | 3.0% |

| 25 | NG25 (Southwell) | 3.0% |

NG7 (Lenton) tops the table with an impressive 8.4% gross yield, solidifying its status as Nottingham's premier student investment zone. The combination of high HMO rents and relatively accessible property prices creates exceptional cash flow opportunities.

NG1 (City Centre) follows closely with 7.6%, offering a hands-off investment style through modern apartments. Interestingly, affordable family areas like NG6 (Bulwell) at 6.5% and NG5 (Arnold) at 6.1% show that high yields are not exclusive to student lets but can also be found in strong residential family markets.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy to let ownership costs.

Is Nottingham Rent High?

Nottingham's rental prices represent a wide range of local incomes, from highly affordable former industrial towns to more expensive premium suburbs. This reflects the city's diverse housing stock, from student HMOs to large suburban family homes.

Average rent in Nottingham costs between 28.5% and 51.3% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Nottingham residents is £32,963 (based on £633.90 per week).

The highest-rent postcode, NG7 (Lenton), requires 51.3% of the local average income. This high figure is reflective of the area's large student HMOs, where rent is typically shared between multiple tenants or covered by loans/guarantors. In contrast, commuter towns like NG31 (Grantham) are highly affordable, requiring only 28.5% of the median local income.

Here is the full breakdown of rental affordability across Nottingham:

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | NG7 (Lenton / The Park) | 51.3% |

| 2 | NG14 (Calverton / Lowdham) | 45.3% |

| 3 | NG11 (Clifton / Ruddington) | 43.5% |

| 4 | NG8 (Wollaton / Aspley) | 41.2% |

| 5 | NG2 (West Bridgford) | 39.9% |

| 6 | NG13 (Bingham) | 38.7% |

| 7 | NG1 (City Centre) | 38.5% |

| 8 | NG5 (Arnold / Sherwood) | 38.4% |

| 9 | NG9 (Beeston / Stapleford) | 38.1% |

| 10 | NG22 (Newark) | 35.1% |

| 11 | NG15 (Hucknall / Ravenshead) | 34.7% |

| 12 | NG6 (Bulwell / Old Basford) | 34.6% |

| 13 | NG3 (Mapperley / St Ann's) | 34.5% |

| 14 | NG34 (Sleaford) | 34.5% |

| 15 | NG21 (Blidworth / Rainworth) | 34.4% |

| 16 | NG17 (Sutton-in-Ashfield) | 32.3% |

| 17 | NG4 (Gedling / Carlton) | 31.9% |

| 18 | NG10 (Long Eaton) | 31.7% |

| 19 | NG16 (Eastwood / Kimberley) | 31.3% |

| 20 | NG19 (Mansfield Woodhouse) | 31.1% |

| 21 | NG18 (Mansfield) | 30.8% |

| 22 | NG20 (Shirebrook / Langwith) | 29.4% |

| 23 | NG24 (Newark) | 29.0% |

| 24 | NG31 (Grantham) | 28.5% |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Nottingham House Prices High?

For a local property buyer on average mean full-time earnings, Nottingham offers an exceptionally wide range of affordability.

Purchasing a property in Nottingham requires between 5.1 and 14.5 times the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Nottingham residents is £32,963 (based on £633.90 per week).

The most accessible area, NG1 (City Centre), requires just 5.1 times the local salary. This is remarkably low for a major UK city centre, highlighting the immense value available in the apartment market.

At the other end of the scale, exclusive rural postcodes like NG32 (Grantham / Sleaford) require 14.5 times the average salary, reflecting the premium paid for large detached homes in the commuter belt.

Here is the full breakdown of housing affordability across Nottingham:

| Rank | Area | Price as Multiple of Salary |

|---|---|---|

| 1 | NG32 (Grantham / Sleaford) | 14.5x |

| 2 | NG33 (Grantham / Bourne) | 14.3x |

| 3 | NG23 (Newark) | 14.2x |

| 4 | NG25 (Southwell) | 13.0x |

| 5 | NG13 (Bingham) | 12.7x |

| 6 | NG12 (Ruddington / Cotgrave) | 12.4x |

| 7 | NG14 (Calverton / Lowdham) | 11.8x |

| 8 | NG22 (Newark) | 9.9x |

| 9 | NG11 (Clifton / Ruddington) | 8.7x |

| 10 | NG8 (Wollaton / Aspley) | 8.5x |

| 11 | NG2 (West Bridgford) | 8.5x |

| 12 | NG34 (Sleaford) | 8.2x |

| 13 | NG9 (Beeston / Stapleford) | 8.2x |

| 14 | NG21 (Blidworth / Rainworth) | 8.2x |

| 15 | NG24 (Newark) | 8.1x |

| 16 | NG16 (Eastwood / Kimberley) | 7.9x |

| 17 | NG15 (Hucknall / Ravenshead) | 7.7x |

| 18 | NG31 (Grantham) | 7.6x |

| 19 | NG18 (Mansfield) | 7.4x |

| 20 | NG3 (Mapperley / St Ann's) | 7.0x |

| 21 | NG4 (Gedling / Carlton) | 7.0x |

| 22 | NG10 (Long Eaton) | 6.9x |

| 23 | NG19 (Mansfield Woodhouse) | 6.6x |

| 24 | NG17 (Sutton-in-Ashfield) | 6.6x |

| 25 | NG5 (Arnold / Sherwood) | 6.3x |

| 26 | NG20 (Shirebrook / Langwith) | 6.1x |

| 27 | NG7 (Lenton / The Park) | 6.1x |

| 28 | NG6 (Bulwell / Old Basford) | 5.3x |

| 29 | NG1 (City Centre) | 5.1x |

How Much Deposit to Buy a House in Nottingham?

Assuming a typical buy-to-let deposit of 30% based on the average asking price for each postcode, here is an overview of the capital required to enter the market across Nottingham, ranked from most to least accessible.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | NG1 (City Centre) | £50,153 |

| 2 | NG6 (Bulwell / Old Basford) | £52,257 |

| 3 | NG7 (Lenton / The Park) | £60,289 |

| 4 | NG20 (Shirebrook / Langwith) | £60,770 |

| 5 | NG5 (Arnold / Sherwood) | £62,462 |

| 6 | NG17 (Sutton-in-Ashfield) | £64,852 |

| 7 | NG19 (Mansfield Woodhouse) | £65,620 |

| 8 | NG10 (Long Eaton) | £68,591 |

| 9 | NG4 (Gedling / Carlton) | £69,396 |

| 10 | NG3 (Mapperley / St Ann's) | £69,519 |

| 11 | NG18 (Mansfield) | £72,902 |

| 12 | NG31 (Grantham) | £75,234 |

| 13 | NG15 (Hucknall / Ravenshead) | £76,355 |

| 14 | NG16 (Eastwood / Kimberley) | £78,378 |

| 15 | NG24 (Newark) | £79,838 |

| 16 | NG21 (Blidworth / Rainworth) | £80,973 |

| 17 | NG9 (Beeston / Stapleford) | £81,186 |

| 18 | NG34 (Sleaford) | £81,245 |

| 19 | NG2 (West Bridgford) | £83,639 |

| 20 | NG8 (Wollaton / Aspley) | £83,709 |

| 21 | NG11 (Clifton / Ruddington) | £86,496 |

| 22 | NG22 (Newark) | £98,203 |

| 23 | NG14 (Calverton / Lowdham) | £116,550 |

| 24 | NG12 (Ruddington / Cotgrave) | £122,329 |

| 25 | NG13 (Bingham) | £126,048 |

| 26 | NG25 (Southwell) | £128,659 |

| 27 | NG23 (Newark) | £140,445 |

| 28 | NG33 (Grantham / Bourne) | £141,281 |

| 29 | NG32 (Grantham / Sleaford) | £143,281 |

If you're new to property, or just starting out through a property investment course, the inner-city postcodes offer the most accessible entry points. NG1 (City Centre) requires a 30% deposit of just £50,153 while offering the city's highest non-HMO average yield at 7.6%. This is closely followed by NG6 (Bulwell) with a £52,257 deposit (6.5% yield) and NG7 (Lenton) with a £60,289 deposit (8.4% yield). This combination of low entry cost and strong yields makes these areas particularly attractive for first-time buy-to-let investors.

How to Invest in Buy-to-Let in Nottingham

Property Investments UK and our partners have ready-to-go buy-to-let properties to purchase across Nottingham, Nottinghamshire, and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Nottingham and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Nottingham for Buy-to-Let Investment

For nearby East Midlands investment opportunities, buy-to-let in Leicester and buy-to-let in Derby provide excellent alternatives with strong transport links to Nottingham. Investors should also explore buy-to-let in Sheffield for opportunities just to the north. For renovation projects, review empty home grants available across the East Midlands.