Oldham Property Investment: Best Buy-to-Let Areas

Oldham combines affordable entry prices with strong rental yields, offering property investors significant value within Greater Manchester's expanding economy. Located just 7 miles from Manchester city centre, Oldham's strategic position and ongoing regeneration make it particularly attractive for those seeking higher returns at lower entry costs than neighbouring Manchester, Stockport and Cheshire.

Article Updated: February 2025

Oldham Buy-to-Let Market Overview 2025

Average yields range from 3.00% to 6.40%, with property prices spanning £198,682 to £393,492 (30% below UK average). Top performing areas include OL8 for yields (6.40%) and OL3 for capital growth. With average weekly rents between £181-£271, equivalent to monthly rents of £784-£1,174.

Contents

- Best areas for buy-to-let in Oldham

- Why invest in Oldham?

- When was the last house price crash in Oldham

- Average sold house prices in Oldham by property types

- House prices in Oldham: For sale asking prices (£)

- Price per square foot in Oldham (£)

- House price growth in Oldham (%)

- Rental prices in Oldham (£)

- Gross rental yields in Oldham (%)

- Is Oldham rent high?

- Are Oldham house prices high?

- How much deposit to buy a house in Oldham?

- Oldham population growth

- Oldham landlord licensing

- How to invest in buy-to-let in Oldham

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. All data is presented as provided by our sources without adjustments or amendments.

Best Areas for Buy-to-Let in Oldham

Highlights

Oldham's strategic location within Greater Manchester, combined with affordable property prices and strong rental demand, creates compelling buy-to-let opportunities across its diverse postcodes.

Average house prices £

- Premium areas: OL3 (Saddleworth) leads at £393,492, with OL2 at £248,237

- Mid-range: M35 (Failsworth) at £263,077 and OL4 at £240,036

- Value opportunity: OL8 at £198,682 represents the most accessible entry point

Average rents and yields

- Highest weekly rent: M35 (Failsworth) achieves £271, delivering a 5.40% yield

- Top yield area: OL8 leads with 6.40% yield

- Premium yield: OL3 (Saddleworth) offers 3.00% due to higher purchase prices

OL8 emerges as a standout opportunity, combining the highest yields (6.40%) with the lowest entry prices (£198,682). Premium areas like Saddleworth (OL3) attract families and professionals, while areas closer to Manchester like Failsworth (M35) benefit from excellent transport links.

Why Invest in Oldham?

Oldham is one of the boroughs which makes up Greater Manchester and although it was traditionally a textile manufacturing town, today it's undergoing significant economic transformation. The borough's key sector strengths now include advanced manufacturing, professional services, creative industries, retail, leisure, and green technology.

The development of Hollinwood Junction stands as a testament to Oldham's economic evolution. This 30-acre mixed-use development is creating a thriving business community.

The £285 million Creating a New Oldham masterplan represents the borough's most ambitious regeneration project. This comprehensive program is transforming the town with over 2,000 new homes, 1,000 new jobs and 100 apprenticeships.

These economic initiatives, combined with significantly lower entry prices than nearby Manchester and Salford, make Oldham an increasingly attractive proposition for property investors. While areas like Manchester's most expensive streets can command premium prices, Oldham offers similar connectivity but at more accessible price points. For investors seeking value opportunities in Greater Manchester, Oldham provides an alternative to Manchester's cheapest areas, with strong yields and growth potential.

Access our selection of exclusive, high-yielding, residential investment property deals and a personal consultant to guide you through your options.

Oldham Buy-to-Let Market Analysis 2025

When was the last house price crash in Oldham?

House price trends vary across Oldham postcode districts with some areas experiencing faster growth than others. However, the overall trend for house prices in Oldham has been upward over the long term.

The last significant property price crash in Oldham occurred during the global financial crisis of 2008-2010, although compared to many areas it weathered the price reductions well.

However, it took a while to see further house price increases with many years of static house prices between 2010 and 2015.

2016 to 2020 was a period of steady growth for most property types, although detached houses grew higher and faster than semi-detached, terraces, flats or maisonettes.

Since then there has been a steady rise for all property types.

Average Sold House Prices in Oldham by Property Types

The latest sold house price index by the land registry, Nov 2024 (it is always a couple of months behind reporting its datasets), shows the following average house prices across the Oldham local authority area.

Oldham's property prices show significant affordable value compared to both UK averages. The most significant discounts are found in the flat and maisonette sector, where prices are 41% below the national average, while detached houses offer the smallest discount at 21% below UK averages.

Oldham (local authority area)

Updated February 2025

| Property Type | Oldham Average Price | UK Average | Difference |

|---|---|---|---|

| Detached houses | £343,960 | £436,949 | -21% |

| Semi-detached houses | £226,437 | £283,546 | -20% |

| Terraced houses | £168,080 | £242,598 | -31% |

| Flats and maisonettes | £137,597 | £233,230 | -41% |

| All property types | £202,367 | £289,707 | -30% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. All data is presented as provided by our sources without adjustments or amendments.

House Prices in Oldham: For Sale Asking Prices (£)

Updated February 2025

The data represents the average asking prices of properties currently listed for sale in Oldham.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | OL3 (Saddleworth) | £393,492 |

| 2 | M35 (Failsworth) | £263,077 |

| 3 | OL2 (Shaw, Royton) | £248,237 |

| 4 | OL4 (Lees) | £240,036 |

| 5 | OL9 (Chadderton) | £225,876 |

| 6 | OL1 (Oldham Central) | £207,170 |

| 7 | OL8 (Hollinwood) | £198,682 |

Price Per Square Foot in Oldham (£)

Updated February 2025

The data represents a blended average, combining the average asking price per square foot of properties currently for sale in Oldham and the sold price per square foot of sold properties.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | OL3 (Saddleworth) | £322 |

| 2 | M35 (Failsworth) | £250 |

| 3 | OL2 (Shaw, Royton) | £246 |

| 4 | OL4 (Lees) | £228 |

| 5 | OL9 (Chadderton) | £228 |

| 6 | OL1 (Oldham Central) | £200 |

| 7 | OL8 (Hollinwood) | £192 |

Oldham's price per square foot values show significant variation across the borough, with Saddleworth (OL3) commanding the highest at £322 and Failsworth (M35) following at £250 per square foot. The more suburban areas generally show higher values, while areas closer to the town center and Hollinwood show lower prices per square foot. These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode.

House Price Growth in Oldham (%)

Updated February 2025

The table below shows how house prices have changed over the past five years in Oldham's key postcode districts.

| Rank | Postcode District (Area) | 5-Year Growth (%) |

|---|---|---|

| 1 | OL2 (Shaw, Royton) | 41.50% |

| 2 | OL4 (Lees) | 39.20% |

| 3 | OL1 (Oldham Central) | 32.90% |

| 4 | OL3 (Saddleworth) | 32.70% |

| 5 | OL8 (Hollinwood) | 28.00% |

| 6 | OL9 (Chadderton) | 27.50% |

| 7 | M35 (Failsworth) | 25.00% |

OL2 (Shaw, Royton) has seen the biggest rise, with house prices jumping by 41.50% over the last five years. Close behind is OL4 (Lees), where prices have gone up by 39.20%, showing steady demand.

Even in areas like M35 (Failsworth), where growth is a bit lower at 25.00%, prices have still climbed significantly. This mix of strong growth across Oldham makes it a place worth watching for property investors.

Note: These figures should be viewed with some caution as they represent average prices across all property types and include properties 'for sale' and 'sold prices'.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2025. All data is presented as provided by our sources without adjustments or amendments.

Oldham Buy-to-Let Rental Market Analysis

For first-time investors buying their first rental property, and thinking about how much they can charge for rent in Oldham?

The rental data below gives an indication of rental income per month and the rental yields landlords can achieve.

Rental Prices in Oldham (£)

Updated February 2025

The data represents the average monthly rent for long-let AST properties in Oldham. These figures reflect rents across all property types and do not account for differences in property size, number of bedrooms, or short-term lets.

| Rank | Postcode District (Area) | Average Weekly Rent (£) | Average Monthly Rent (£) |

|---|---|---|---|

| 1 | M35 (Failsworth) | £271 | £1,174 |

| 2 | OL8 (Hollinwood) | £243 | £1,053 |

| 3 | OL9 (Chadderton) | £237 | £1,027 |

| 4 | OL3 (Saddleworth) | £226 | £979 |

| 5 | OL4 (Lees) | £221 | £957 |

M35 (Failsworth) tops the list with the highest average weekly rent at £271, which translates to around £1,174 per month. This reflects strong demand in the area, making it an attractive spot for rental investments.

Meanwhile, areas like OL3 (Saddleworth) and OL4 (Lees) offer slightly more affordable rents, but still show steady rental demand, offering good potential for landlords seeking long-term tenants.

Note: Remember these figures represent average rents across all property types, from studio apartments to larger houses, and actual achievable rents can vary significantly based on property size, condition, and specific location.

Gross Rental Yields in Oldham (%)

Updated February 2025

The data represents the average gross rental yield in Oldham, calculated using a snapshot of current properties for sale and properties for rent. These figures are based on asking prices.

| Rank | Postcode District (Area) | Gross Rental Yield (%) |

|---|---|---|

| 1 | OL8 (Hollinwood) | 6.40% |

| 2 | M35 (Failsworth) | 5.40% |

| 3 | OL9 (Chadderton) | 5.40% |

| 4 | OL4 (Lees) | 4.80% |

| 5 | OL1 (Oldham Central) | 4.60% |

OL8 (Hollinwood) offers the highest gross rental yield at 6.40%, making it an attractive option for investors looking for strong returns. Close behind are M35 (Failsworth) and OL9 (Chadderton), both with yields of 5.40%, reflecting solid rental demand in these areas.

Areas like OL4 (Lees) and OL1 (Oldham Central) offer slightly lower yields but still present good opportunities for steady rental income.

Note: These figures represent gross rental yields calculated from average rents and prices. Investors should note that net yields will be lower after accounting for costs, void periods, and management expenses.

Access our selection of exclusive, high-yielding, residential investment property deals and a personal consultant to guide you through your options.

Is Oldham Rent High?

Yes, Oldham's rental costs represent a notable financial commitment for residents relative to local earnings, though they are generally more affordable compared to nearby Manchester.

Based on ONS data showing North West median weekly household income at £696 (£36,192 annually), Oldham's rental costs consume a significant portion of local earnings.

In Failsworth (M35), which has Oldham's highest weekly rents at £271 (£1,174 monthly), residents need to commit around 38.9% of their gross income to rent. The situation is similar in Hollinwood (OL8), where weekly rents of £243 (£1,053 monthly) would require 34.9% of the median household income.

Even in more affordable areas like Lees (OL4), where weekly rents average £221 (£957 monthly), residents still need to commit around 31.8% of their income to rent. Central locations like Oldham Central (OL1) show slightly higher rates, with average weekly rents of £226 (£979 monthly), consuming approximately 32.5% of household income.

While Oldham's rental prices generally sit below those in larger cities like nearby Manchester, Birmingham or of course London, the reality for local residents is that housing costs still consume a substantial share of their income. With most areas requiring between 31-39% of median gross household income for rent, before tax, utilities, and other living expenses.

Oldham’s rental market presents notable affordability challenges, particularly in areas with strong rental demand like Failsworth and Hollinwood, whose significant rental demand is keeping rent prices high.

Is Oldham Sold House Prices High?

Oldham's property market offers a more affordable option compared to the wider UK market, with HM Land Registry House Price Index data highlighting significant discounts across all property types.

Oldham's average property price of £202,367 sits 30.1% below the UK average of £289,707, with similar value evident across all property categories.

Detached houses in Oldham average £343,960 (21.3% below the UK average of £436,949), semi-detached houses at £226,437 (20.1% below £283,546), terraced houses at £168,080 (30.7% below £242,598), and flats/maisonettes at £137,597 (41.0% below the national average of £233,230).

Yet, with median annual earnings in the North West at £36,192 (£696 weekly), Oldham's most affordable areas still require around 5.7 times the median annual salary, while higher-priced areas like Saddleworth exceed 10 times the regional median income. This ratio highlights affordability challenges, particularly for first-time buyers.

Even traditionally more affordable areas such as Shaw and Royton (OL2), with an average price of £248,237, require over 6.8 times the median salary, exceeding typical mortgage lending limits of 4-4.5 times household income.

The lower entry prices compared to much more affluent and expensive larger North West towns like Stockport, Warrington, and Chester have increased interest in Oldham’s property market.

With strong transport links to Manchester and the wider North West region, areas like Failsworth (M35) and Hollinwood (OL8), are particularly attractive to buyers seeking affordability without compromising on commuting access.

How Much Deposit to Buy a House in Oldham?

So how much do you need to buy a house in Oldham? Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Oldham areas:

North Oldham

- OL1 (Oldham Central): A buy-to-let investor looking at an average property (£207,170) would need to put down a 30% deposit of £62,151, with yields at 4.6%.

- OL2 (Shaw, Royton): In Shaw and Royton, an investor would need a 30% deposit of £74,471 for an average property (£248,237), achieving a yield of 4.8%.

East Oldham

- OL3 (Saddleworth): A buy-to-let investor would need a 30% deposit of £118,047 for an average property (£393,491), with an attractive yield of 3.9%.

- OL4 (Lees): In Lees, an investor would need a 30% deposit of £72,010 for an average property (£240,036), offering a yield of 4.5%.

South Oldham

- OL8 (Hollinwood): For an average property in Hollinwood (£180,500), a deposit of £54,150 would be needed, offering Oldham's highest yield at 5.7%.

- OL9 (Chadderton): In Chadderton, an investor would require a 30% deposit of £64,500 for an average property (£215,000), achieving a yield of 4.2%.

West Oldham

- M35 (Failsworth): A buy-to-let investor would need a 30% deposit of £78,922 for an average property (£263,076), with yields at 4.4%.

For those considering their first buy-to-let investment, areas like Hollinwood (OL8) and Shaw, Royton (OL2) offer an excellent balance of affordable entry prices and solid yields, while maintaining good transport links to Manchester making it an appealing long term choice for attracting tenants.

Oldham Population Growth

The total population of Oldham was 242,100 as of the 2021 Census.

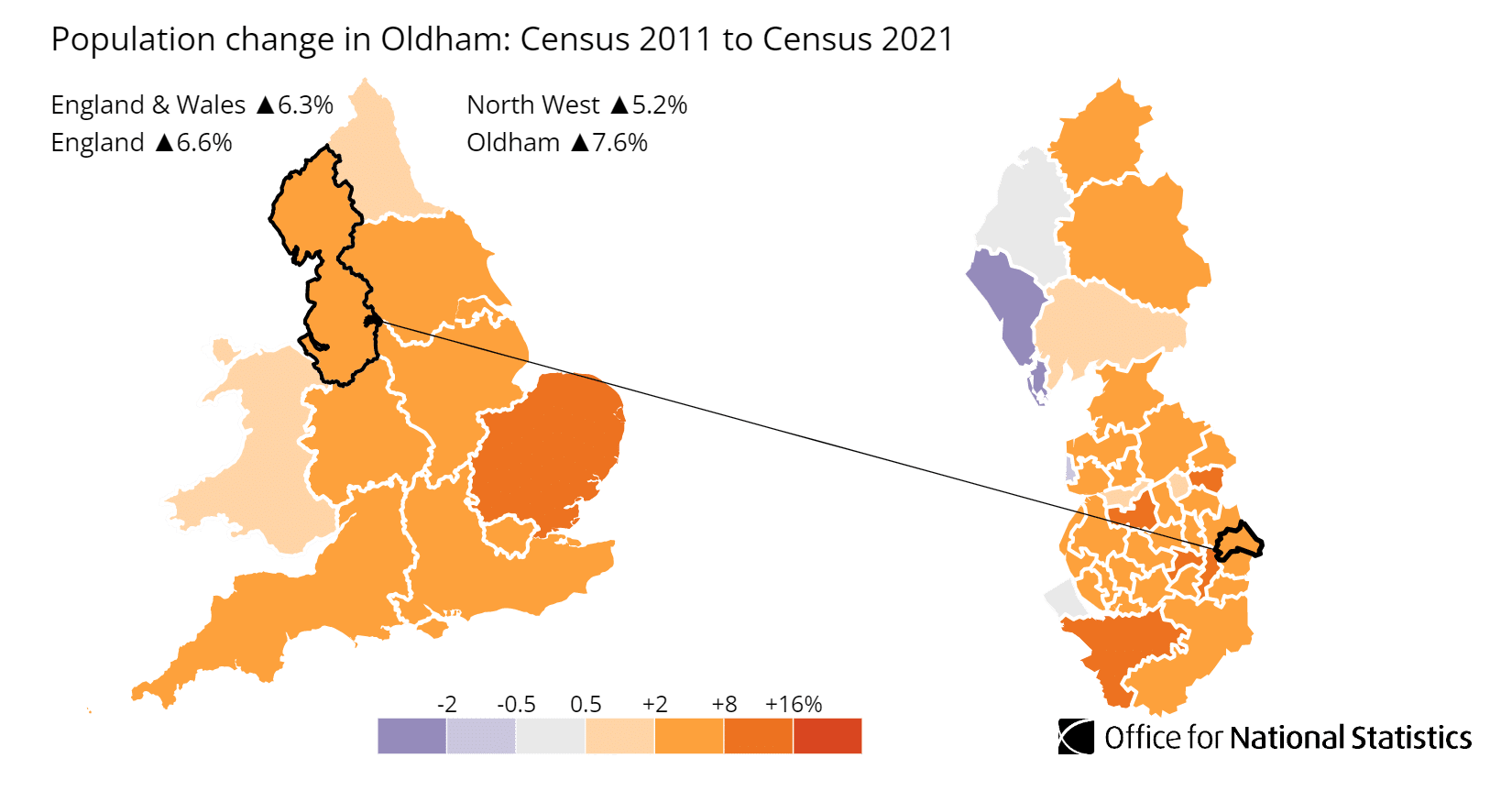

Oldham's population has grown by 7.6%, rising from around 224,900 in 2011. This is impressive and higher than both the regional average and national average growth, although still a little behind nearby Manchester, where the recent Government census shows the population of Manchester has increased by 9.7%.

This growth rate outpaced both the North West region (5.2%) and England overall (6.6%).

The average (median) age in Oldham remained stable at 37 years between the two censuses. This indicates a relatively younger demographic profile compared to both the North West region and England overall, which both had median ages of 40 years. Oldham's age stability suggests a balanced community that's maintaining its demographic structure while growing.

Notable age-related changes in Oldham's population between 2011 and 2021 include:

- The number of residents aged 50-64 years increased by approximately 4,500 (an 11.5% rise)

- The 35-49 age group decreased by around 500 (a 4.0% reduction)

- The proportion of residents aged 50-64 grew by 0.6 percentage points, now representing 18.1% of the population

Population density in Oldham has also increased, with the area now home to approximately 12.1 people per football pitch-sized piece of land, up from 11.3 in 2011. This places Oldham among the top 35% most densely populated English local authority areas.

Below we look at the largest postcode districts by population across Oldham and the population growth for each.

Population Growth in Oldham by Postcode District

Population and growth rates by area (2021 Census data)

| Rank | Area | Population at 2021 Census | Population Growth 2011 to 2021 |

|---|---|---|---|

| 1 | OL4 (Lees) | 44,247 | 8% |

| 2 | OL2 (Shaw, Royton) | 42,193 | 8% |

| 3 | OL9 (Chadderton) | 40,528 | 8% |

| 4 | OL8 (Hollinwood) | 39,658 | 8% |

| 5 | OL1 (Oldham Central) | 21,373 | 8% |

| 6 | M35 (Failsworth) | 20,671 | 8% |

| 7 | OL3 (Saddleworth) | 15,192 | 8% |

The population data shows consistent growth across Oldham's postal districts, with all areas experiencing an 8% increase over the past decade. OL4 (Lees) and OL2 (Shaw, Royton) are the most populous districts, each home to over 40,000 residents. The population distribution shows a clear pattern, with central and northern districts having larger populations than outlying areas. Even the smallest district by population, OL3 (Saddleworth) with 15,192 residents, maintained strong growth at 8%, indicating stable development across the borough. Note: While the postcode district data totals 223,862 residents, Oldham's total population is 242,100. This difference occurs because some postcode districts cross local authority boundaries and are not included in the district-level breakdown.

Oldham Landlord Licensing

Buy-to-Let Licensing

Oldham Council operates a Selective Licensing scheme that requires private landlords to obtain a license in specific designated areas. Since July 4th, 2022, this scheme covers five distinct areas across Oldham including parts of:

- St Mary's ward

- Waterhead ward

- Coldhurst ward

- Hollinwood ward

- Medlock Vale ward

The license fee is £582 per property, split into two payments:

- £340.34 on application

- £241.66 upon license grant

Failure to obtain a required license can result in:

- Unlimited fines

- Rent repayment orders

- Civil penalties up to £30,000

- Management orders

Landlords can check if their property requires licensing using Oldham Council's interactive mapping system.

Houses of Multiple Occupation Licensing

A mandatory HMO license is required for properties with:

- Five or more tenants

- From two or more households

- Who share facilities

Oldham has various conservation areas with Article 4 directions in place, requiring planning permission to convert a standard residential property (C3) into a House in Multiple Occupation (C4). These conservation areas include:

- Alexandra Park

- Victoria Street, Chadderton

- Garden Suburb

- Woodhouses

- Uppermill

- Denshaw

- Delph

Landlords should check Oldham Council's planning portal and interactive maps to verify conservation areas and licensing requirements, as these can be updated regularly.

For those learning how to source property deals, this is especially important, as this will impact any property investment you source, as the landlord will need to register for a licence if they are purchasing a buy-to-let in Oldham.

How to Invest in Buy-to-Let in Oldham

For properties to buy in Oldham, including:

- Off-market properties

- Buy-to-lets

- Holiday lets or serviced accommodation

- HMOs (houses of multiple occupation)

- PBSA (purpose-built student accommodation)

- and other high-yielding opportunities

We have partnered with the best property investment agents we can find for 8+ years.

Here you can get access to the latest investment property opportunities from our network.

For more information about specific areas:

- If you're interested in the highest returns, consider OL8 with yields of 6.40%

- For alternative options with affordable entry prices, check out the cheapest areas to live in Manchester

- For similar opportunities further afield explore buy-to-let in Nottingham or buy-to-let in Leeds.