The Best Sources of Free (& Paid) Property Data

In today’s technological era, data is everything. Data can tell us the answers to our most burning questions. In relation to the property market, such questions might include things like:

- How big is the rental market in the UK?

- What is the expected economic growth of a particular town?

- Which locations in the UK have the highest expected gross yield value?

- Which locations are seeing the most development, and where are house builders most active?

- What part of the 18-year property cycle are we on?

Knowing the answers to the above and gathering information on other property investment topics will put power into your hands when you're making decisions about acquiring new properties, growing your portfolio and business, seeing your options on a map.

We all need information, so the question becomes:

Where are the best sources of property data?

Article updated: August 2025

Contents

- Free property datasets

- Paid property datasets

- Conclusion

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Free UK Property Datasets

Our Website

To help simplify your search for property data, we have created over 150+ location articles, one for each of the major cities and towns in the UK. These include datasets for rental yields, house price growth, buyer demand and more.

We have also analysed many data sets to help further understand whats driving local and national markets outside of house prices, like mortgage repossession statistics, the UK rental market and even population statistics like the population of Manchester.

Here are a few of the guides below, and a link to all of our location guides here.

This is going to seem obvious but given Google’s company policy and mission statement is

to organise the world's information and make it universally accessible and useful

It makes sense to leverage their search algorithms and free services to find the property data that is specific to your location.

Whilst doing a simple Google search for the piece of data you want is useful, there are some tricks you can use to find specific information. These include:

- Using quotes to search for an exact phrase.

- Using an asterisk within quotes to specify unknown or variable words.

- Using the minus sign to eliminate results containing certain words.

- Searching for datasets that are by country, region, city, postcode sector or postcode district.

The Land Registry

The Land Registry publishes government data as part of a commitment to the Government’s priorities of economic growth and data transparency.

They have three core datasets available:

For those that aren’t aware, the Land Registry safeguards land and property ownership (valued at £7 trillion), enabling over £1 trillion worth of personal and commercial lending to be secured against property over England and Wales.

So, it’s the ‘crème de la crème’ of property market data and it is the original source of datasets that all other companies get their insights from.

However it can be a difficult data-set to crunch and understand as it is often presented as raw data or graphs, but no actual insights.

Paid UK Property Datasets

Property Data

Property Data does exactly what it says. Their website contains much of the property data at location level you could need, however it comes at a cost.

Depending on what you need and how much data you need, you can join as a landlord or a company.

Datsets include

- National datasets

- Local datasets

- Plot level data

- Sourcing tools

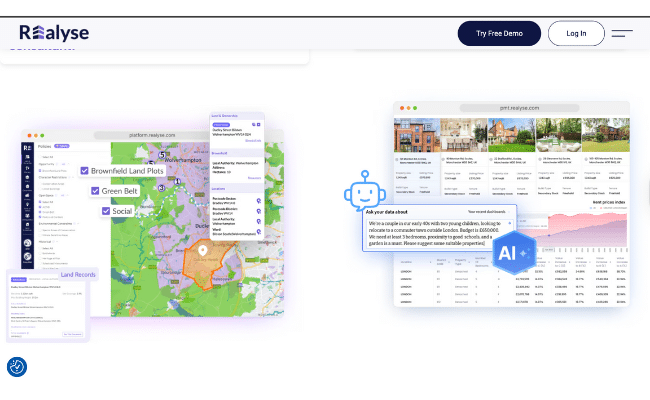

Realyse

Realyse is an interesting platform, as it is aimed at larger developers and enterprises, both in terms of its price point and its data offering.

It is more expensive that the options above, however it comes with additional features including the option to ask your data questions using the latest artificial intelligence technology.

The Best Free Property Datasets Conclusion

There are a lot of different property data and analytics tools available. For investors seeking simpler solutions, our guide to the best property tools covers free Chrome browser extensions and apps that can streamline your property analysis.

What you use, ultimately, comes down to your use case and your preferences because chances are, you will be able to get the information you need from a variety of different sources.

It should go without saying that house builders and development companies have different requirements to those of straightforward buy-to-let investors.

And, it's worth noting, that the numbers might not always match. Figures from one source, might not match another, even when they are both covering the same issue with the same parameters.

The UK property market is vast and every area has it's nuances. When it comes to more nuanced information, different companies will have different ways of aggregating the information and modelling it, which can create different results.

The sites and sources mentioned above are ones that we have personally used at different stages throughout our own property journey.