Where to Buy Property Investments in Tameside: Yields of 5.7%

For landlords looking to purchase a property investment, Tameside combines the advantages of a strategic Greater Manchester location with more affordable homes than Manchester itself.

Affordable homes mean the housing market has prices that work for owners and landlord investors. Because of this, Tameside represents one of Greater Manchester's most undervalued buy-to-let opportunities.

Although on the face of it the rental yields between 3.7% and 5.7% may sound low, the reality is these are 'average' yields with many larger houses in the property data having higher prices and lowering the average. The reality on the ground is that entry-level apartments and terrace houses that are on the market today to buy, provide much greater rental yields towards 8%.

Yet even the average property prices are still in the affordable range, with property prices averaging £211,107, coming in at 28.6% below the England average.

Our buy-to-let analysis below examines eight postcode districts across Tameside, evaluating rental yields, historic property capital growth and the true cost to buy a home in the area.

Article updated: November 2025

Tameside Buy-to-Let Market Overview 2025

Tameside's property market delivers average sold house prices 28.6% below the England average, offering accessible Greater Manchester investment opportunities with these key statistics:

- Asking price range: £222,074 (SK16) to £298,452 (SK15) across Tameside postcodes

- Rental yields: 3.7% (SK15) to 5.7% (M43) across different postcodes

- Rental income: Weekly rents from £210 to £272 (monthly: £909 to £1,180)

- Price per sq ft: Market positioning from £236/sq ft (OL6) to £268/sq ft (M43)

- Market activity: Sales ranging from 7-8 per month (OL5, SK16, OL7) to 34 per month (SK14)

- Deposit requirements: 30% deposits range from £66,622 (SK16) to £89,536 (SK15)

- Affordability ratios: Property prices from 7.1 to 9.5 times Tameside's mean annual salary of £31,271

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Tameside?

Tameside is an established Greater Manchester borough with sold house prices 28.6% below the England average, offering accessible entry points for property investors seeking strong rental yields in a major UK city region. It might not be in the cheapest areas to buy in England, but this is a significant discount.

Located approximately 6 miles east of Manchester city centre, Tameside benefits from excellent tram and M60 and M67 motorway connectivity providing sub-20 minute commutes to Manchester Piccadilly.

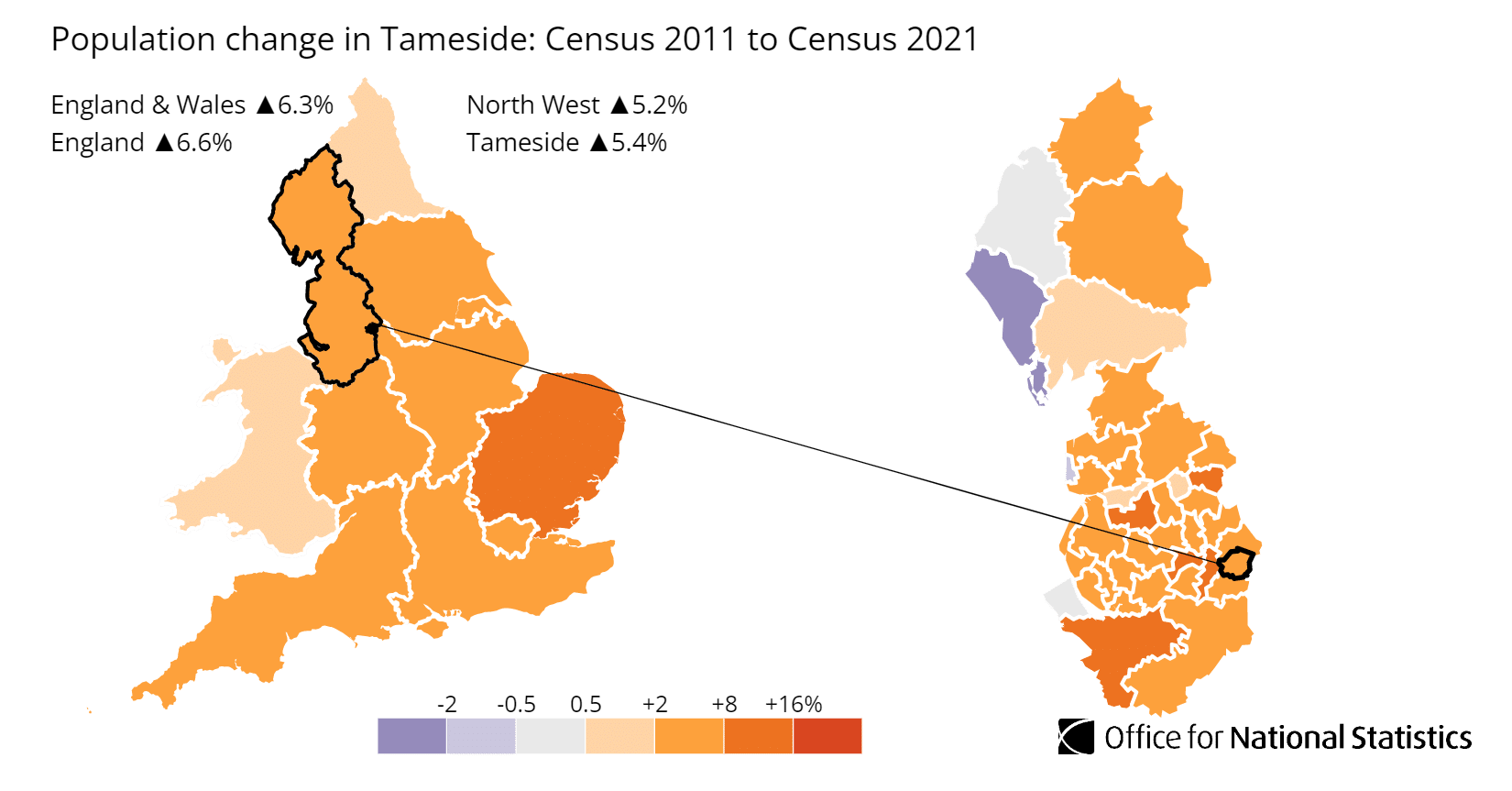

The total population of Tameside was 231,220 (as of the last UK government census in 2021) and Tameside's population has increased by 5.2%, rising from 219,727 in 2011.

This population growth aligns with broader Greater Manchester population growth trends, reflecting steady demand for residential property across the borough's nine towns.

Tameside borough comprises nine towns: Ashton-under-Lyne, Audenshaw, Denton, Droylsden, Dukinfield, Hyde, Longdendale, Mossley, and Stalybridge.

Tameside is covered by the main postcodes: M34, M43, OL5, OL6, OL7, SK14, SK15, SK16

For investors considering other nearby areas, you can also explore buy-to-let in Oldham (directly north with similar affordability), buy-to-let in Stockport (south with higher price points), or further across Greater Manchester like Bury for similar property opportunities.

Regeneration in Tameside

Tameside is experiencing transformational regeneration investment totaling over £800 million borough-wide, creating tangible catalysts for property value appreciation. Major projects include:

- Godley Green Garden Village: A £750 million development creating 2,150 new homes, generating over 8,000 construction jobs and 300 permanent positions

- Stalybridge Cultural Quarter: A £19.9 million transformation including the revival of the Civic Hall and Astley Cheetham Art Gallery

- Hyde Town Centre: A comprehensive masterplan supported by the UK Shared Prosperity Fund, focusing on town centre revival and new housing development

- Ashton Town Centre: A £10.8 million investment in modernising the market square and surrounding areas

Tameside Property Market Analysis

When Was the Last House Price Crash in Tameside?

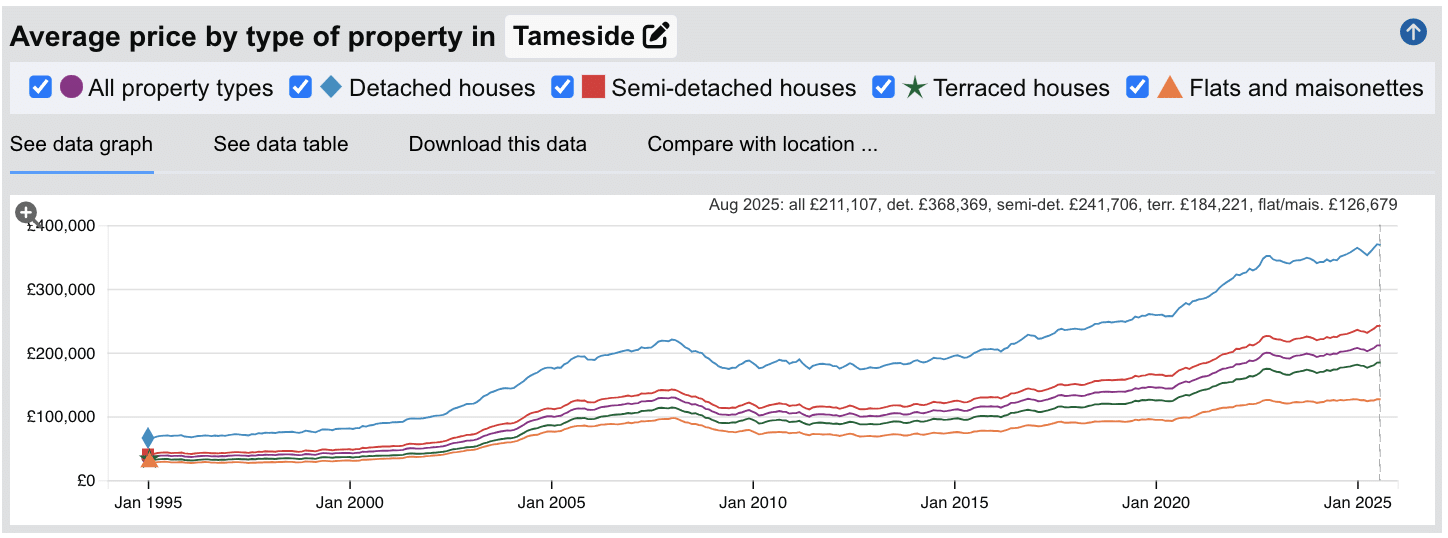

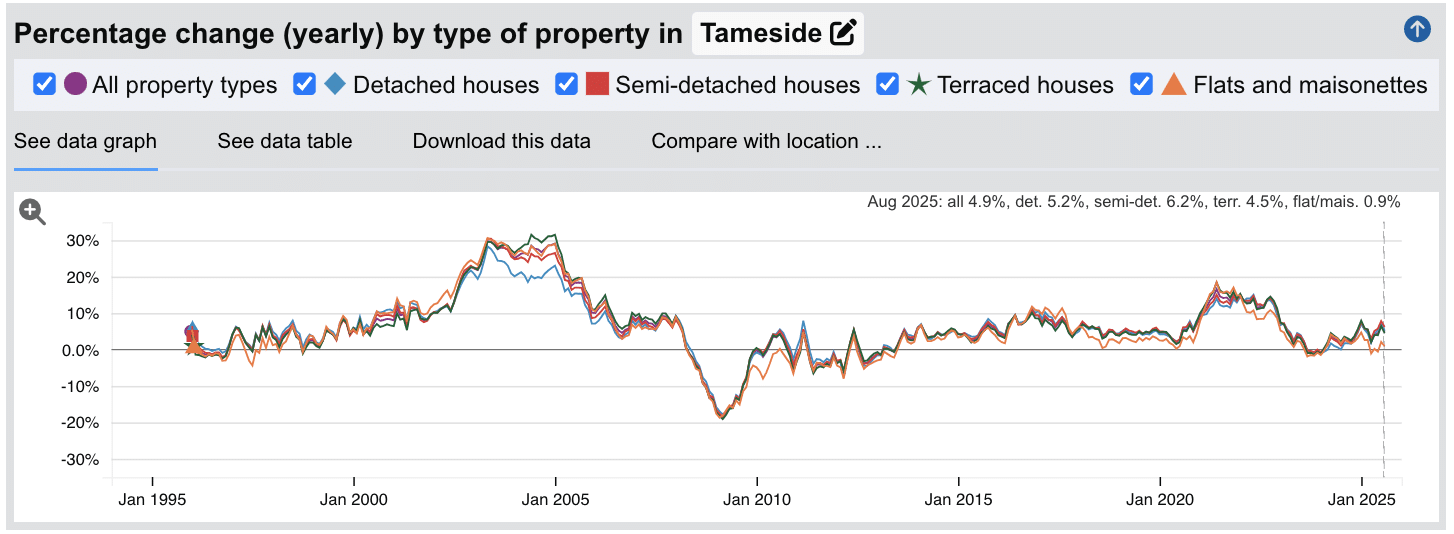

The last significant property price crash in Tameside occurred during the global financial crisis of 2008-2010, with a brief correction period in 2023. Unlike many UK markets experiencing ongoing price pressure in 2024-2025, Tameside has shown strong recovery with positive annual growth returning throughout 2024 and continuing into 2025.

Source: HM Land Registry House Price Index for Tameside

Looking at Tameside's historical property prices:

- 1995-2000: Steady appreciation with annual increases reaching 8-11% during the late 1990s housing boom

- 2000-2004: Exceptional growth period with annual increases exceeding 20% (2002-2004), reflecting Greater Manchester's economic expansion

- 2004-2007: Sustained growth moderating to 5-9% annually as the market matured, peaking at 9.2% in September 2007

- 2008-2010: Sharp correction during the financial crisis, with values dropping approximately 18.7% at the worst point (March 2009), followed by gradual recovery from late 2009

- 2010-2014: Mixed performance with volatility around Brexit referendum, though maintaining modest positive growth overall

- 2014-2018: Steady growth period averaging 3-7% annually, reflecting Greater Manchester's economic recovery

- 2018-2020: Continued modest appreciation around 4-5% annually before pandemic disruption

- 2020-2021: Pandemic-driven surge with exceptional growth reaching 16.6% in June 2021 as buyers sought affordable suburban locations

- 2021-2022: Peak market performance with annual growth reaching 15.1% in January 2022, driven by stamp duty holidays and remote working trends

- 2023: Market correction as interest rate increases impacted affordability, with negative growth through much of the year (reaching -1.1% in November 2023)

- 2024-2025: Strong recovery phase with positive growth returning: +5.1% (December 2024), +7.4% (January 2025), and +4.9% (August 2025), demonstrating resilient demand

Long-Term Property Value Growth in Tameside

Tameside has delivered strong capital appreciation for buy to let landlords and homeowners over extended holding periods:

- 5 years (2020-2025): +39.9% (average sold house prices from £150,877 to £211,107)

- 10 years (2015-2025): +84.7% (average sold house prices from £114,301 to £211,107)

- 15 years (2010-2025): +97.1% (average sold house prices from £107,129 to £211,107)

- 20 years (2005-2025): +89.8% (average sold house prices from £111,217 to £211,107)

- 30 years (1995-2025): +509.0% (average sold house prices from £34,669 to £211,107)

The 2023 market correction reflected temporary affordability constraints from rapid interest rate increases. Tameside's swift recovery to positive growth in 2024-2025 (annual +4.9% growth in August 2025) demonstrates the borough's resilient buyer demand fundamentals.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Tameside

The latest sold house price index by the Land Registry shows the following average sold house prices across Tameside.

Tameside property prices average £211,107—28.6% below the England average of £295,670, offering accessible entry points for property investors across all property types.

Terraced houses show the strongest value proposition at 25.2% below England average, making them particularly attractive for buy-to-let investors seeking affordable stock with broad tenant appeal. Flats and maisonettes offer even deeper discounts at 43.7% below national average, ideal for investors targeting the lower end of the rental market or first-time tenants.

Semi-detached houses at £241,706 represent 17.5% savings versus England average, appealing to family tenants seeking more space, while detached houses at £368,369 sit 22.7% below national pricing, though these represent a smaller proportion of available investment stock.

For investors building buy-to-let portfolios, Tameside's consistent pricing discount across all property types creates portfolio efficiency—your capital purchases more property here than in premium Greater Manchester locations, enabling faster portfolio scaling. The borough's combination of sub-£300k average prices with established Manchester transport links (12-20 minute rail commutes) supports steady tenant demand from city workers seeking affordable accommodation.

Updated November 2025

| Property Type | Tameside Average Price | England Average | Difference |

|---|---|---|---|

| Detached houses | £368,369 | £476,862 | -22.7% |

| Semi-detached houses | £241,706 | £292,942 | -17.5% |

| Terraced houses | £184,221 | £246,321 | -25.2% |

| Flats and maisonettes | £126,679 | £225,149 | -43.7% |

| All property types | £211,107 | £295,670 | -28.6% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Tameside

Updated November 2025

The data represents the average asking prices of properties currently listed for sale across Tameside's eight postcode districts.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | SK15 (Stalybridge) | £298,452 |

| 2 | SK14 (Hyde) | £275,119 |

| 3 | OL7 (Ashton-under-Lyne East) | £250,546 |

| 4 | M43 (Droylsden) | £246,858 |

| 5 | OL6 (Ashton-under-Lyne) | £244,005 |

| 6 | M34 (Denton) | £243,944 |

| 7 | OL5 (Mossley) | £237,713 |

| 8 | SK16 (Dukinfield) | £222,074 |

Tameside's asking prices range from £222,074 in SK16 Dukinfield to £298,452 in SK15 Stalybridge—a £76,378 spread that creates distinct entry points for different investment strategies. The most affordable postcodes (SK16, OL5, M34) sit below £245,000, requiring deposits around £67,000-£73,000 at 30% LTV, making them accessible for first-time buy-to-let investors or portfolio builders seeking multiple properties. Mid-range areas (M43, OL6, OL7) between £244,000-£251,000 balance affordability with established transport links, while premium postcodes (SK14, SK15) command higher prices reflecting better perceived locations and tenant demographics.

Note: These figures represent average asking prices across all property types Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Tameside (£)

Updated November 2025

The data represents the average price per square foot across Tameside postcodes, blending current asking prices and recent sold prices.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | M43 (Droylsden) | £268 |

| 2 | M34 (Denton) | £259 |

| 3 | SK14 (Hyde) | £253 |

| 4 | SK15 (Stalybridge) | £248 |

| 5 | OL5 (Mossley) | £248 |

| 6 | SK16 (Dukinfield) | £246 |

| 7 | OL6 (Ashton-under-Lyne) | £236 |

| 8 | OL7 (Ashton-under-Lyne East) | £232 |

Price per square foot values show relatively tight clustering across Tameside, with just £36 separating the highest (M43 Droylsden at £268) from lowest (OL7 at £232). This narrow spread indicates consistent market pricing borough-wide, unlike areas with more pronounced geographic value disparities. For investors, postcodes closer to Manchester's western boundary (M43, M34) command modest premiums reflecting superior transport connectivity, while eastern areas (OL6, OL7) offer marginally better per-square-foot value with larger houses, off road parking, garages, gardens and more green space nearby.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Tameside (%)

Updated November 2025

The data represents the average house price per square foot growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | M43 (Droylsden) | 46.6% |

| 2 | OL6 (Ashton-under-Lyne) | 45.7% |

| 3 | SK16 (Dukinfield) | 43.6% |

| 4 | OL7 (Ashton-under-Lyne East) | 39.5% |

| 5 | SK14 (Hyde) | 33.2% |

| 6 | SK15 (Stalybridge) | 29.2% |

| 7 | M34 (Denton) | 25.8% |

| 8 | OL5 (Mossley) | 23.2% |

M43 Droylsden and OL6 Ashton-under-Lyne have delivered exceptional capital appreciation exceeding 45% over five years, substantially outperforming Tameside's overall average and demonstrating strong investor returns in these postcodes. Even the lowest-performing area (OL5 Mossley at 23.2%) delivered solid appreciation, indicating borough-wide growth rather than isolated postcode hotspots.

Note: These figures should be viewed with some caution as they represent average prices across all property types and include properties 'for sale' and 'sold prices'.

Average Monthly Property Sales in Tameside

Updated November 2025

The data represents the average number of residential property sales per month across Tameside's postcode districts.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | SK14 (Hyde) | 34 |

| 2 | M34 (Denton) | 33 |

| 3 | OL6 (Ashton-under-Lyne) | 17 |

| 4 | SK15 (Stalybridge) | 15 |

| 5 | M43 (Droylsden) | 11 |

| 6 | OL5 (Mossley) | 8 |

| 7 | OL7 (Ashton-under-Lyne East) | 7 |

| 8 | SK16 (Dukinfield) | 7 |

SK14 Hyde and M34 Denton dominate transaction activity with 34 and 33 monthly sales respectively, indicating strong market liquidity and buyer demand in these established towns. Higher volumes in these postcodes suggest faster potential exit strategies for investors and active rental markets. Mid-tier areas (OL6, SK15, M43) averaging 11-17 monthly sales demonstrate steady market activity, while lower-volume postcodes (OL5, OL7, SK16) averaging 7-8 sales monthly may require longer marketing periods for both purchases and eventual property disposals.

Note: These figures include all property prices and property types. Higher transaction volumes generally indicate stronger buyer demand and greater property market liquidity.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Tameside Rental Market Analysis

For first-time buyers buying their first rental property in Greater Manchester and thinking how much they can charge for rent across Tameside and it's towns,the rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for traditional assured shorthold tenants. This is helpful if you are considering creating a property portfolio in this area

Rental Prices in Tameside (£)

Updated February 2025

The data represents the average monthly rent for long-let AST properties in Tameside.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | M43 (Droylsden) | £259 | £1,120 |

| 2 | SK15 (Stalybridge) | £257 | £1,115 |

| 3 | M34 (Denton) | £241 | £1,044 |

| 4 | OL7 (Ashton-under-Lyne East) | £233 | £1,011 |

| 5 | SK14 (Hyde) | £222 | £962 |

| 6 | SK16 (Dukinfield) | £218 | £945 |

| 7 | OL6 (Ashton-under-Lyne) | £210 | £910 |

| 8 | OL5 (Mossley) | Not enough data | Not enough data |

M43 Droylsden commands Tameside's highest rents at £272 weekly (£1,180 monthly), reflecting superior M60 motorway access and strong Manchester commuter demand. OL6 Ashton-under-Lyne follows at £247 weekly, while M34 Denton achieves £229 weekly supported by its 12-minute rail service to Manchester Piccadilly. OL5 Mossley and SK15 Stalybridge offer the most accessible rents at £211-£210 weekly (£913-£909 monthly), with OL5's lower entry prices delivering a competitive 4.6% rental yield despite modest rent levels.

Note: Remember these figures represent average rents across all property types, from studio apartments to larger houses, and actual achievable rents can vary significantly based on property size, condition, and specific location.

Gross Rental Yields in Tameside (%)

Updated November 2025

The data represents the average gross rental yields across different postcode districts in Tameside. These figures are based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | M43 (Droylsden) | 5.7% |

| 2 | OL6 (Ashton-under-Lyne) | 5.3% |

| 3 | M34 (Denton) | 4.9% |

| 4 | OL5 (Mossley) | 4.6% |

| 5 | SK14 (Hyde) | 4.1% |

| 6 | SK15 (Stalybridge) | 3.7% |

| 7 | OL7 (Ashton-under-Lyne East) | Not enough data available |

| 8 | SK16 (Dukinfield) | Not enough data available |

M43 Droylsden delivers Tameside's highest rental yield at 5.7% with average property prices of £246,858 and monthly rents of £1,180, making it the borough's most attractive area for buy-to-let investors seeking strong immediate returns combined with exceptional 46.6% five-year capital growth. OL6 Ashton-under-Lyne follows at 5.3% with monthly rents of £1,072 and accessible property prices averaging £244,005, while M34 Denton offers 4.9% yields at £243,944 average price with excellent transport connectivity.

SK15 Stalybridge shows the lowest yield at 3.7% due to its premium positioning and higher property values averaging £298,452, though this postcode benefits from strong perceived location appeal and direct rail services to Manchester Victoria, typically attracting more established tenants alongside rental income of £909 per month.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these costs.

Is Tameside Rent High?

No, Tameside's rental prices remain relatively affordable compared to Greater Manchester averages, representing a manageable percentage of local incomes and creating a broad tenant pool for buy-to-let investors.

Average rent in Tameside costs between 34.9% to 45.2% as a percentage of earnings based on the ONS earnings data showing Tameside's mean annual income at £31,271 (£601 per week).

Even the highest-rent postcode, M43 Droylsden at £272 per week, requires just 45.2% of local average income—well below the 50% threshold often cited as the affordability ceiling. This manageable rent burden means tenants retain sufficient disposable income for other expenses, supporting stable tenancies and reducing void risk for landlords.

Tameside's most affordable rental market is found in SK15 Stalybridge and OL5 Mossley, where rents represent just 34.9%-35.1% of local income at £210-£211 per week, creating accessible accommodation for younger workers, key workers, and those establishing careers in Greater Manchester.

Here's what residents face across Tameside for rental costs as a percentage of income:

- M43 (Droylsden) - 45.2% of local income (£272 per week)

- OL6 (Ashton-under-Lyne) - 41.1% of local income (£247 per week)

- M34 (Denton) - 38.1% of local income (£229 per week)

- SK14 (Hyde) - 36.4% of local income (£219 per week)

- OL5 (Mossley) - 35.1% of local income (£211 per week)

- SK15 (Stalybridge) - 34.9% of local income (£210 per week)

For property investors, Tameside's affordable rent-to-income ratios create investment advantages: broader tenant pools including Manchester commuters, young professionals, and key workers; lower tenant financial stress reducing payment defaults; and sustainable rental levels that support long-term tenancies rather than forcing frequent moves due to affordability pressures.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Tameside House Prices High?

No, Tameside offers some of Greater Manchester's most affordable property prices, with house prices significantly below both England and regional averages, creating accessible entry points for investors and owner-occupiers.

Tameside's average sold property price of £211,107 sits 28.6% below the England average of £295,670, making the borough notably affordable for first-time buyers, portfolio investors, and those seeking to enter the Greater Manchester property market at realistic price points.

Even within Greater Manchester context, Tameside represents exceptional value, with average prices substantially below Manchester city centre and neighbouring boroughs like Stockport (£280k average) and Trafford (£350k+ average).

The average asking prices for properties in Tameside currently on the market range across postcodes, from the most expensive SK15 (Stalybridge) at £298,452 and SK14 (Hyde) at £275,119 to the most accessible SK16 (Dukinfield) at £222,074 and OL5 (Mossley) at £237,713.

Mean annual earnings in Tameside are £31,271, which sits 19.9% below the England average of £39,030, yet this income-to-price relationship creates sustainable affordability rather than pricing pressure—residents can realistically purchase homes on local incomes.

Salary to House Price Ratios

Based on Tameside's mean earnings of £31,271:

- SK15 (Stalybridge) - £298,452 asking price = 9.5 times annual salary

- SK14 (Hyde) - £275,119 asking price = 8.8 times annual salary

- OL7 (Ashton-under-Lyne East) - £250,546 asking price = 8.0 times annual salary

- M43 (Droylsden) - £246,858 asking price = 7.9 times annual salary

- OL6 (Ashton-under-Lyne) - £244,005 asking price = 7.8 times annual salary

- M34 (Denton) - £243,944 asking price = 7.8 times annual salary

- OL5 (Mossley) - £237,713 asking price = 7.6 times annual salary

- SK16 (Dukinfield) - £222,074 asking price = 7.1 times annual salary

For a local property buyer on average mean full-time earnings, purchasing a property across Tameside requires between 7.1 and 9.5 times annual salary. This is substantially more accessible than premium Greater Manchester locations and well within reach for dual-income households or investors with moderate deposits.

These lower entry prices compared to other major Greater Manchester districts like Stockport, Salford, Trafford and Bury have sparked increased investor interest in Tameside's more affordable postcodes.

How Much Deposit to Buy a House in Tameside?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Tameside postcodes:

East Tameside

- SK15 (Stalybridge): A buy-to-let investor looking at an average property would need to put down a 30% deposit of £89,536.

- OL5 (Mossley): An investor would need a 30% deposit of £71,314 for an average property.

Central Tameside

- SK14 (Hyde): A buy-to-let investor would need a 30% deposit of £82,536 for an average property.

- OL7 (Ashton-under-Lyne East): An investor would need a 30% deposit of £75,164 for an average property.

- OL6 (Ashton-under-Lyne): In this area, an investor would need a 30% deposit of £73,202 for an average property.

- SK16 (Dukinfield): A buy-to-let investor would require a 30% deposit of £66,622 for an average property.

West Tameside

- M43 (Droylsden): An investor would need a 30% deposit of £74,057 for an average property.

- M34 (Denton): A buy-to-let investor would need a 30% deposit of £73,183 for an average property.

If you're new to property, or just starting out through a property investment course, SK16 (Dukinfield) offers the most affordable deposit requirement in Tameside at £66,622, whilst M43 (Droylsden) delivers the strongest combination of accessible deposits (£74,057) and exceptional rental yields of 5.7% alongside 46.6% five-year capital growth.

How to Invest in Buy-to-Let in Tameside

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Tameside, Greater Manchester and the rest of the UK. With new properties coming available weekly, whether you're targeting the highest-yield areas like Droylsden (M43) at 5.7%, the well-connected locations in Ashton-under-Lyne (OL6) at 5.3%, or the affordable entry points in Mossley (OL5) at 4.6%, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Tameside and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Tameside for your Buy to Lets

For an alternative look at the Greater Manchester housing market with affordable entry prices, check out our guide to the cheapest areas to live in Manchester.

For opportunities with similar post-industrial characteristics and commuter-town dynamics, consider buy-to-let in Dudley (Midlands commuter town with comparable affordability) or buy-to-let in Wakefield (West Yorkshire location with similar regeneration investment and Leeds commuter appeal).