Where to Buy Property Investments in Chester: Yields of 5.1%

Chester's reputation for being exclusive and expensive overlooks a genuine buy-to-let opportunity hiding in plain sight. This Roman walled city, with its UNESCO heritage status and millions of annual visitors, offers those buyers looking for property investment average rental yields reaching 5.1% in CH1, a postcode where average house prices of £264,774 sit 10.5% below the England average despite the city's prestige location.

The disconnect between perception and reality creates the opportunity that other property investors may be over looking. Many investors assume Chester's historic prestige translates to unaffordable property prices across the board, yet the data reveals accessible entry points in CH1 and CH4 (averaging £264,774 and £342,470 respectively) next door to premium postcodes CH2 and CH3 where period properties and riverside locations command higher prices up to £453,715 and attract wealthy homeowners that helps house price growth spill in to all areas across Chester as homeowners and investors that can't quiet afford a premium street or postcode can still find homes in their budget.

Our buy-to-let analysis examines Chester's four postcode districts, evaluating property price growth over multiple timeframes, rental yields, and the true cost of entering this historic city's property market as an investor.

Article updated: November 2025

Chester Buy-to-Let Market Overview 2025

Chester's property market delivers house prices ranging from 10.5% below to 53.4% above the England average across its four postcodes, creating distinct property ownership entry points from accessible to premium with these key statistics:

- Asking price range: £264,774 (CH1) to £453,715 (CH3) across Chester postcodes

- Rental yields: 3.9% (CH3) to 5.1% (CH1) across different postcodes

- Rental income: Monthly rents from £1,117 to £1,382 (CH2 to CH4)

- Price per sq ft: House prices from £262/sq ft (CH1) to £322/sq ft (CH3)

- Market activity: Sales ranging from 22 per month (CH3) to 36 per month (CH1)

- Deposit requirements: 30% deposits range from £79,432 (CH1) to £136,114 (CH3)

- Affordability ratios: Property prices from 7.5 to 12.9 times Cheshire West and Chester's mean annual salary of £35,130

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Chester?

Chester combines the prestige of Britain's most complete walled city with accessible property investment entry points in CH1 where house prices of £264,774 sit 10.5% below the England average, creating opportunities for landlords seeking rental yields of 5.1% in a location with genuine heritage appeal and sustained rental demand.

Located at the heart of North West transport networks, Chester benefits from excellent M53, M56, and A55 motorway connectivity providing 40-minute access to Manchester, 45 minutes to Liverpool, and direct rail services to London Euston in under 2 hours that might interest buy to let investors in London.

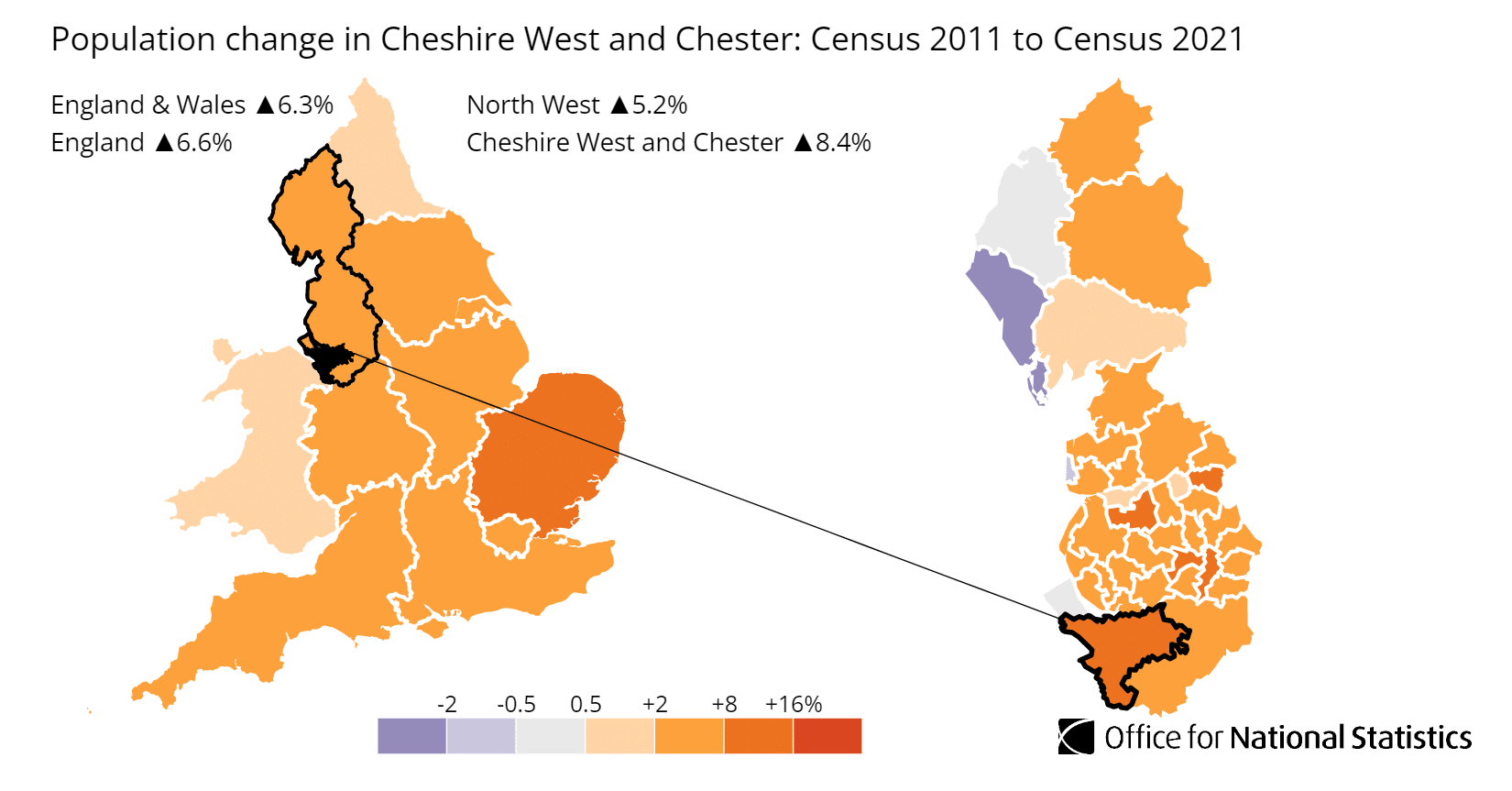

The total population of Cheshire West and Chester was 357,730 (as of the last UK government census in 2021) and the area's population has increased by 8.5%, rising from 329,526 in 2011.

This population growth exceeds many comparable heritage cities, reflecting Chester's sustained appeal alongside its strong economic fundamentals including major employers like Bank of America Merrill Lynch, M&S Bank, and nearby Airbus.

Chester's rental market has tenant demand from all types of demographics, from families to high networth transient employees and even a large university population. The 19,000 university students create consistent demand for accommodation and interest from investors looking to purchase student lets, whilst the city's position as a major international tourist destination (attracting millions of visitors annually) supports both traditional buy-to-let and holiday let strategies.

Chester is covered by four main postcodes: CH1, CH2, CH3, CH4

For investors considering other historic cities with similar heritage appeal, explore buy-to-let in York (another Roman walled city with strong tourist demand), buy-to-let in Bath (UNESCO World Heritage city), or buy-to-let in Chichester (historic cathedral city with comparable housing market prices).

Regeneration and Investment in Chester

Chester is undergoing significant regeneration guided by its "One City Plan," which has directed over £1 billion in combined public and private investment since 2012. This strategy aims to enhance the city as a place to live, work, and visit. Major projects include:

- Chester Northgate: A landmark retail and leisure development. Phase 1, which opened in 2022, was a £75 million investment by Cheshire West and Chester Council. It includes a new public market, a six-screen cinema, an 800-space car park, and new restaurants. "Future Phases" are now being planned with private developers (VINCI and ION) to create a new residential community of over 400 new homes.

- Chester City Gateway: A large-scale regeneration programme focused on the area around Chester's railway station. The council is collaborating with Network Rail and LCR (a government-owned property company) to deliver a mixed-use scheme including new homes, offices, and station improvements.

- High Street Heritage Action Zone (HSHAZ): A £1.08 million government-funded programme delivered by Historic England to restore and revitalise the city's unique medieval 'Rows'. The project focuses on repairing the historic fabric, improving shopfronts, and finding new uses for empty units.

- HyNet North West: While a regional project, it is centred near Chester at the Stanlow Manufacturing Complex. It represents a £5 billion private sector investment (as part of a wider £22bn government pledge) to create one of the world's first low-carbon industrial clusters. The project will produce low-carbon hydrogen to power industry and transport, aiming to create over 6,000 jobs.

- Storyhouse: A major cultural centre that opened in 2017, representing a £36.6 million investment (combining public and private funding). The project transformed the city's former Odeon cinema into an award-winning library, theatre, and cinema.

Chester Property Market Analysis

When Was the Last House Price Crash in Chester?

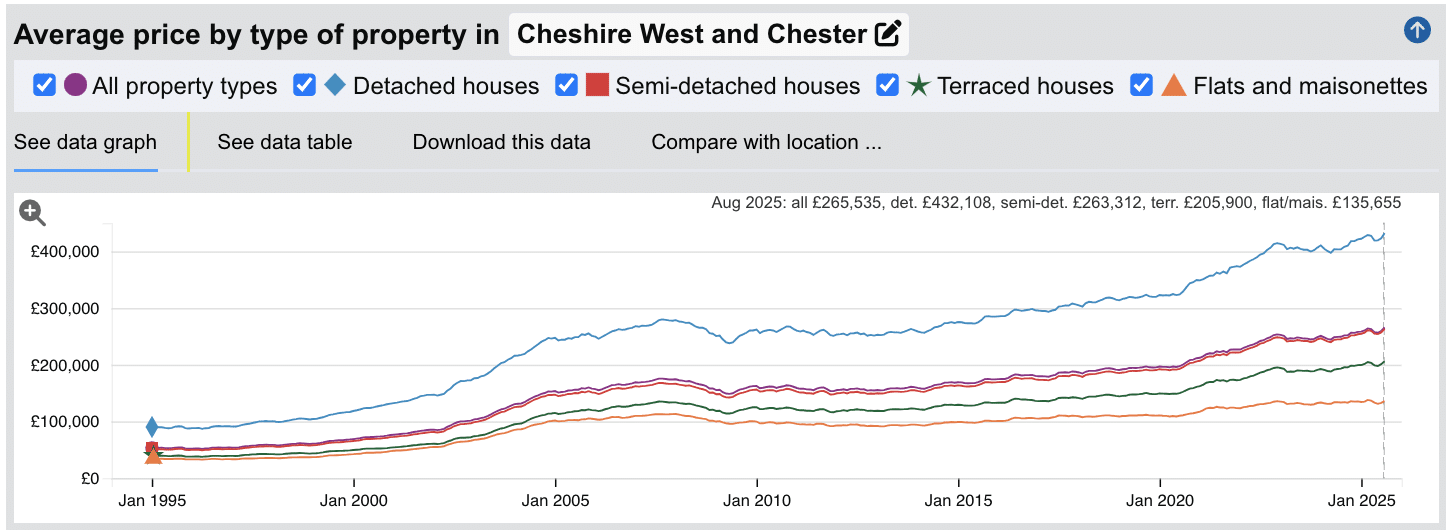

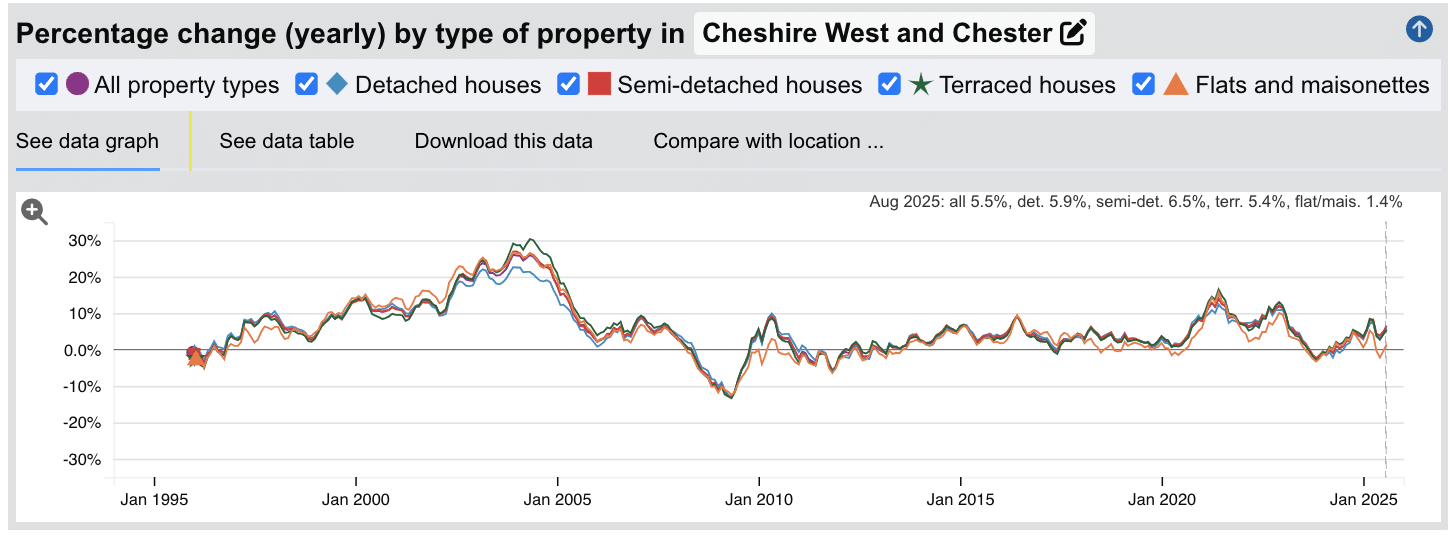

The last significant property price crash in Cheshire West and Chester occurred during the global financial crisis of 2008-2010, with a brief correction period in 2023. Unlike many UK markets experiencing ongoing price pressure in 2024-2025, Chester has shown strong recovery with positive annual growth returning throughout 2024 and continuing into 2025.

Source: HM Land Registry House Price Index for Cheshire West and Chester

Looking at Chester's historical property prices:

- 1995-2000: Steady appreciation with annual increases reaching 10-14% during the late 1990s housing boom

- 2000-2004: Exceptional growth period with annual increases exceeding 20% (2002-2004), reflecting North West England's economic expansion

- 2004-2007: Sustained growth moderating to 5-9% annually as the market matured, peaking at 6.8% in September 2007

- 2008-2010: Sharp correction during the financial crisis, with values dropping approximately 11.8% at the worst point (March 2009), followed by gradual recovery from late 2009

- 2010-2014: Mixed performance with modest volatility, though maintaining modest positive growth overall averaging 1-4% annually

- 2014-2018: Steady growth period averaging 2-6% annually, reflecting the North West's economic recovery

- 2018-2020: Continued modest appreciation around 2-4% annually before pandemic disruption

- 2020-2021: Pandemic-driven surge with exceptional growth reaching 14.1% in June 2021 as buyers sought heritage locations and larger properties

- 2021-2022: Peak market performance with annual growth reaching 11.8% in December 2022, driven by stamp duty holidays and remote working trends

- 2023: Market correction as interest rate increases impacted affordability, with negative growth through much of the year (reaching -2.6% in November 2023)

- 2024-2025: Strong recovery phase with positive growth returning: +3.7% (December 2024), +2.9% (January 2025), and +5.5% (August 2025), demonstrating resilient buyer demand

Long-Term Property Value Growth in Chester

Cheshire West and Chester has delivered strong capital appreciation for buy-to-let landlords and homeowners over extended holding periods:

- 5 years (2020-2025): +32.6% (average sold house prices from £200,237 to £265,535)

- 10 years (2015-2025): +54.9% (average sold house prices from £171,450 to £265,535)

- 15 years (2010-2025): +65.3% (average sold house prices from £160,639 to £265,535)

- 20 years (2005-2025): +70.5% (average sold house prices from £155,778 to £265,535)

- 30 years (1995-2025): +394.5% (average sold house prices from £53,700 to £265,535)

The 2023 market correction reflected temporary affordability constraints from rapid interest rate increases. Chester's swift recovery to positive growth in 2024-2025 (annual +5.5% growth in August 2025) demonstrates the city's resilient buyer demand fundamentals driven by its heritage appeal, strong employment base, and sustained population growth.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Chester

The latest sold house price index by the Land Registry shows the following average sold house prices across Cheshire West and Chester local authority, which includes Chester city and the surrounding areas.

Cheshire West and Chester property prices average £265,535. That's actually 10.2% below the England average of £295,670, with the local authority encompassing Chester city alongside rural villages and smaller towns that bring overall averages below premium Chester city centre pricing.

Flats and maisonettes show the strongest value proposition at 39.8% below England average at £135,655, making them particularly attractive for buy-to-let investors targeting university students, young professionals, or those seeking entry-level investment properties. Terraced houses at £205,900 offer 16.4% savings versus national average, with many Victorian and Georgian terraces in Chester's residential areas providing character appeal that justifies premium rents.

Semi-detached houses at £263,312 represent 10.1% savings versus England average, popular with families seeking suburban living with good schools and green space, while detached houses at £432,108 sit 9.4% below national pricing.

These larger properties often feature period character like Victorian homes and gardens that attract familes and long term tenants.

Updated November 2025

| Property Type | Cheshire West and Chester Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £432,108 | £476,862 | -9.4% |

| Semi-detached houses | £263,312 | £292,942 | -10.1% |

| Terraced houses | £205,900 | £246,321 | -16.4% |

| Flats and maisonettes | £135,655 | £225,149 | -39.8% |

| All property types | £265,535 | £295,670 | -10.2% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Chester

Updated November 2025

The data represents the average asking prices of properties currently listed for sale across Chester's four postcode districts.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | CH3 (Vicars Cross & Huntington) | £453,715 |

| 2 | CH2 (Hoole & Upton) | £353,804 |

| 3 | CH4 (Westminster Park & Handbridge) | £342,470 |

| 4 | CH1 (Chester City Centre) | £264,774 |

Chester's asking prices range from £264,774 in CH1 city centre to £453,715 in CH3 Vicars Cross and Huntington. A £188,941 spread that creates options for property buyers. CH1 offers the most accessible property ladder entry at £264,774. CH4 Westminster Park and Handbridge at £342,470 provides mid-range options south and west of the city with riverside appeal and Welsh border proximity for those working in Broughton, Wrexham or on the North Wales Coast.

Whilst CH2 Hoole and Upton at £353,804 attracts families seeking larger homes, gardens, off road parking and garages. CH3 includes Vicars Cross and Huntington, commanding the highest prices at £453,715. CH3 also includes the affulent village of Christleton which pushes these average prices higher. These locations are close by the major Chester high schools and the demand from family owner occupiers and tenants increases prices.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Chester (£)

Updated November 2025

The data represents the average price per square foot across Chester postcodes, blending current asking prices and recent sold prices.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | CH3 (Vicars Cross & Huntington) | £322 |

| 2 | CH2 (Hoole & Upton) | £300 |

| 3 | CH4 (Westminster Park & Handbridge) | £288 |

| 4 | CH1 (Chester City Centre) | £262 |

Price per square foot values show a £60 spread across Chester's four postcodes. CH3 Vicars Cross and Huntington commands the highest at £322 per square foot, reflecting the Christleton village premium and proximity to Abbey Gate High School and Christleton High School catchment area. CH2 Hoole follows at £300, where large Victorian and Edwardian terraces on streets like Hoole Road attract significant demand from families and is still within walking distance of the city walls.

CH4 Westminster Park and Handbridge sits at £288 per square foot, where the River Dee location and access to the Meadows creates appeal for buyers wanting green space whilst remaining in the city. Interestingly CH1 city centre offers the lowest per square foot cost at £262. This is mainly apartment houses, with some new build and conversion developments serve the university student market and young professionals working in the City.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Chester (%)

Updated November 2025

The data represents the average house price growth over the past five years, calculated using postcode-level data blending sold prices and asking prices.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | CH2 (Hoole & Upton) | 23.8% |

| 2 | CH4 (Westminster Park & Handbridge) | 16.3% |

| 3 | CH1 (Chester City Centre) | 16.6% |

| 4 | CH3 (Vicars Cross & Huntington) | 15.7% |

CH2 Hoole and Upton has delivered the strongest capital appreciation at 23.8% over five years, substantially outperforming the other Chester postcodes. The area's Victorian housing stock, proximity to Chester University's Parkgate Road campus, and walking distance to both the city centre and railway station have driven sustained buyer demand from all types of homeowners. CH1 and CH4 have both delivered solid appreciation around 16%, whilst CH3 is close with 15.7% growth despite commanding the highest absolute prices, reflecting its established premium positioning with affordable already on the high end for local Chester families.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Chester

Updated November 2025

The data represents the average number of residential property sales per month across Chester's postcode districts.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | CH2 (Hoole & Upton) | 25 |

| 2 | CH4 (Westminster Park & Handbridge) | 24 |

| 3 | CH1 (Chester City Centre) | 23 |

| 4 | CH3 (Vicars Cross & Huntington) | 22 |

Chester's housing market activity shows remarkably consistent sale volumes across all four postcodes, with just 3 sales per month separating the highest from lowest. CH2 Hoole and Upton leads with 25 monthly sales. CH4 and CH1 follow closely at 24 and 23 monthly sales respectively, indicating steady buyer interest across the whole city and all prices points which is a sign of a healthy market as people move up the housing ladder.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Chester Rental Market Analysis

For first-time buyers buying their first rental property in the historic city of Chester and thinking how much they can charge for rent across Chester and it's nearby suburban housing estates, the rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for their AST buy to lets. This is helpful if you are considering how to start a property portfolio in this area.

Rental Prices in Chester (£)

Updated November 2025

The data represents the average monthly rent for long-let AST properties in Chester.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | CH4 (Westminster Park & Handbridge) | £1,382 |

| 2 | CH3 (Vicars Cross & Huntington) | £1,274 |

| 3 | CH1 (Chester City Centre) | £1,127 |

| 4 | CH2 (Hoole & Upton) | £1,117 |

CH4 Westminster Park and Handbridge commands Chester's highest rents at £1,382 monthly, reflecting the riverside location premium, large detached homes and 5 minute walk to the city centre. CH3 follows at £1,274 monthly. CH1 and CH2 achieve similar rental levels at £1,127 and £1,117 respectively, serving different tenant demographics with CH1 focused on city centre apartments and CH2 on surburban family homes.

Note: These figures represent average rents across all property types. Actual achievable rents vary based on property size, condition, and specific location.

Gross Rental Yields in Chester (%)

Updated November 2025

The data represents the average gross rental yields across Chester's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | CH1 (Chester City Centre) | 5.1% |

| 2 | CH4 (Westminster Park & Handbridge) | 4.8% |

| 3 | CH2 (Hoole & Upton) | 4.1% |

| 4 | CH3 (Vicars Cross & Huntington) | 3.9% |

Remember these are average rents. Some properties may achieve much higher yields by an extra 1-3% gross rental yields if you buy at the right price. CH1 city centre delivers Chester's highest rental yield at 5.1%, with average property prices of £264,774 and monthly rents of £1,127. The combination of university student demand, young professionals, and proximity to the railway station creates very high tenant demand all year round. CH4 follows at 4.8% with monthly rents of £1,382. CH2 and CH3 show lower yields at 4.1% and 3.9% respectively, reflecting higher home prices typical of established family areas.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy to let ownership costs.

Is Chester Rent High?

Chester's rental prices represent a moderate percentage of local incomes, with rents ranging from 38% to 47% of average earnings. This is a good average, reflecting the city's premium positioning in the north west area yet with some affordable housing areas.

Average rent in Chester costs between 38.2% to 47.3% as a percentage of earnings based on the ONS earnings data showing Cheshire West and Chester's mean annual income at £35,130 (£675 per week).

The highest-rent postcode, CH4 Westminster Park and Handbridge at £319 per week, requires 47.3% of local average income, approaching but remaining below the often cited 50% affordability threshold across the UK.

CH3 Vicars Cross and Huntington sits at 43.6% (£294 per week), whilst CH1 and CH2 both fall below 39% of local income at £260 and £258 per week respectively.

Here's what tenants face across Chester for rental costs as a percentage of income:

- CH4 (Westminster Park & Handbridge) - 47.3% of local income (£319 per week)

- CH3 (Vicars Cross & Huntington) - 43.6% of local income (£294 per week)

- CH1 (Chester City Centre) - 38.5% of local income (£260 per week)

- CH2 (Hoole & Upton) - 38.2% of local income (£258 per week)

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Chester House Prices High?

For a local property buyer on average mean full-time earnings.

Purchasing a property in Chester requires between 7.5 and 12.9 times annual salary.

CH1 city centre remains accessible at 7.5 times salary, comparable to many UK cities, whilst CH3's 12.9 multiple reflects premium village locations competing with affluent Cheshire commuter belt pricing.

Salary to House Price Ratios

Based on Cheshire West and Chester's mean earnings of £35,130:

- CH3 (Vicars Cross & Huntington) - £453,715 asking price = 12.9 times annual salary

- CH2 (Hoole & Upton) - £353,804 asking price = 10.1 times annual salary

- CH4 (Westminster Park & Handbridge) - £342,470 asking price = 9.7 times annual salary

- CH1 (Chester City Centre) - £264,774 asking price = 7.5 times annual salary

So Chester presents a mixed picture. The Cheshire West and Chester local authority average sits below the England average, but Chester city itself commands premium pricing reflective of its heritage status, large green spaces and city centre coffee shop, restaurants and lifestyle appeal.

Cheshire West and Chester's average property price of £265,535 sits 10.2% below the England average of £295,670, yet this includes rural villages and smaller towns beyond Chester city. Within Chester's four postcodes, prices range from £264,774 in CH1 to £453,715 in CH3, with the city overall averaging £353,691, which is 19.6% above the England average.

Compared to nearby locations, Chester sits between Liverpool (lower average prices) and affluent Cheshire towns like Alderley Edge or Wilmslow (significantly higher). Warrington offers more affordable alternatives 20 minutes east, whilst Wrexham across the Welsh border provides even lower entry points.

Remember the average asking prices for properties in Chester currently on the market show CH3 (Vicars Cross & Huntington) at £453,715 commanding the highest prices, followed by CH2 (Hoole & Upton) at £353,804, whilst CH1 (Chester City Centre) at £264,774 offers the most accessible house prices.

Mean annual earnings in Cheshire West and Chester are £35,130, which sits 10.0% below the England average of £39,030, creating a tighter affordability squeeze than many heritage cities where higher local wages offset premium property prices.

How Much Deposit to Buy a House in Chester?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across Chester's four postcodes:

- CH1 (Chester City Centre): A buy-to-let investor looking at an average property would need a 30% deposit of £79,432.

- CH4 (Westminster Park & Handbridge): An investor would need a 30% deposit of £102,741 for an average property.

- CH2 (Hoole & Upton): A buy-to-let investor would need a 30% deposit of £106,141 for an average property.

- CH3 (Vicars Cross & Huntington): An investor would need a 30% deposit of £136,114 for an average property.

If you're new to property, or just starting out through a property investment course, CH1 city centre offers the most accessible deposit requirement in Chester at £79,432, whilst also delivering the city's highest rental yield of 5.1%. This combination of lower entry cost and stronger yields makes CH1 particularly attractive for first-time buy-to-let investors, especially those targeting the university student market or young professionals working in Chester's business quarter.

How to Invest in Buy-to-Let in Chester

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Chester, Cheshire and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Chester and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Chester for Buy-to-Let Investment

For nearby North West investment opportunities just over the Welsh border, buy-to-let in Wrexham (voted Wales' happiest place to live) and buy-to-let in Rhyl provide lower entry costs whilst maintaining Chester commuting distance. Investors should also explore the cheapest places to live in Wales for alternative opportunities. For renovation projects, review empty home grants available across the North West.

Or to understand the wider county market, see our guide to buy-to-let across Cheshire.