Are Apartments Good for Buy-to-Let Investors?

Should you invest in apartments? It's one of the most common questions from new property investors, and the honest answer is.

Yes. No. Actually, it depends.

Why? Because the answer is nuanced depending on the person asking the question, there position, their risk profile, their goals and of course their property budget.

City centre apartments used to be straightforward buy-to-let investments. Purchase off-plan, let to young professionals, collect steady rental income. Job done. But the market has shifted considerably since 2020, with many new rental strategies becoming popular.

Additionally tenants lifestyles have changed. Working from home or hybrid working, for a number of city centre workers, means people have the luxury of choice and can choose between city centre living or suburban communities. The city centre landscape has changed.

This guide examines whether apartments remain good investments for landlords or should you only consider houses. You'll discover the true costs of owning apartments, understand which factors determine profitability, and learn exactly when these real estate assets work (and when they don't).

Article updated: October 2025

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: October 2025. All data is presented as provided by our sources without adjustments or amendments.

What Does It Actually Cost to Buy an Apartment?

Apartments are rarely built in rural hamlets or small villages. They provide high density affordable living in city and town centres. Understanding the complete costs is importnat and the purchase price is just the beginning.

Top 10 UK Cities for Apartment Investment

Major UK cities offer the strongest combination of tenant demand, employment growth, and infrastructure investment, however their prices reflect this strong buyer demand. These are the current average flat asking prices across the UK's largest Cities.

| Ranked by Population | City | Average Flat Asking Price |

|---|---|---|

| 1 | London | £764,478 |

| 2 | Birmingham | £146,374 |

| 3 | Manchester | £199,002 |

| 4 | Leeds | £151,181 |

| 5 | Glasgow | £161,632 |

| 6 | Liverpool | £130,338 |

| 7 | Sheffield | £135,656 |

| 8 | Edinburgh | £236,970 |

| 9 | Bristol | £245,775 |

| 10 | Newcastle upon Tyne | £129,432 |

London's average flat price sits over five times higher than most northern cities, putting it out of reach of most landlords. Birmingham represents the most affordable of the major cities at £146,374 average, making it accessible for investors with modest capital. Manchester commands a premium amongst northern cities at £199,002, reflecting strong investor demand and significant recent growth in the Manchester population.

Scottish capitals Edinburgh and Glasgow show contrasting markets, with Edinburgh's affluent local residents and demographics pushing prices to £236,970 whilst Glasgow offers better value for landlords budgets at £161,632.

Northern cities generally deliver superior gross yields compared to London, Bristol, and Edinburgh. Liverpool, Newcastle, and Sheffield all offer sub-£140,000 average prices whilst maintaining strong rental demand from large student populations good local homeowner demand. These cities often suit investors prioritising cash flow over capital appreciation. Our comprehensive guides on Manchester, Birmingham, Liverpool, and Leeds explore these housing markets in detail.

Most Expensive Areas for Apartment Investments

Whilst the lowest level on the housing ladder, apartments are not 'affordable' everywhere. Based on the latest Land Registry data, these are the UK's most expensive local authorities for flat and maisonette purchases:

| Rank | Local Authority | Average Flat Sold Price |

|---|---|---|

| 1 | Kensington and Chelsea | £1,088,323 |

| 2 | Westminster | £870,687 |

| 3 | Camden | £766,047 |

| 4 | Hammersmith and Fulham | £613,720 |

| 5 | Islington | £574,600 |

| 6 | Wandsworth | £540,215 |

| 7 | Hackney | £537,157 |

| 8 | Richmond upon Thames | £499,450 |

| 9 | Southwark | £483,120 |

| 10 | Tower Hamlets | £473,430 |

| 11 | Haringey | £471,160 |

| 12 | Lambeth | £460,383 |

| 13 | Merton | £428,270 |

| 14 | Ealing | £414,339 |

| 15 | Waltham Forest | £385,917 |

| 16 | Lewisham | £384,843 |

| 17 | Brent | £380,690 |

| 18 | Barnet | £380,433 |

| 19 | Kingston upon Thames | £373,548 |

| 20 | Hounslow | £369,278 |

London dominates the premium apartment market entirely. Every single location in the top 20 most expensive sits within the capital. Central London boroughs like Kensington and Chelsea command prices over £1 million on average, reflecting their global appeal and constrained supply. Even outer London boroughs like Hounslow, which benefits from Heathrow Airport proximity, average nearly £370,000 for flats.

These premium prices create significant barriers for most buy-to-let investors. Yields in expensive locations typically sit between 3% and 5% gross, making cash flow challenging even with substantial deposits. Investors targeting these markets usually prioritise capital appreciation over rental income, accepting lower yields in exchange for potential value growth. Even the lowest entries on this list, if you are buying a buy to let in Hounslow or Barnet, you will have to pay significantly more than for a large house in most other UK cities.

Most Affordable Areas for Apartment Investments

These 20 local authorities offer the UK's most affordable apartment prices for first time and established landlords looking for affordable homes outside the usual city centres.

| Rank | Local Authority | Average Flat Sold Price |

|---|---|---|

| 1 | Merthyr Tydfil | £66,781 |

| 2 | Na h-Eileanan Siar | £71,876 |

| 3 | East Ayrshire | £73,854 |

| 4 | Blackpool | £73,724 |

| 5 | North East Lincolnshire | £75,573 |

| 6 | Hartlepool | £76,024 |

| 7 | Middlesbrough | £76,406 |

| 8 | Boston | £76,596 |

| 9 | North Lincolnshire | £76,962 |

| 10 | Burnley | £76,904 |

| 11 | Hyndburn | £78,125 |

| 12 | Blaenau Gwent | £79,937 |

| 13 | Kingston upon Hull | £79,724 |

| 14 | Redcar and Cleveland | £80,139 |

| 15 | County Durham | £80,412 |

| 16 | Sunderland | £83,489 |

| 17 | Rhondda Cynon Taf | £84,332 |

| 18 | North Ayrshire | £84,994 |

| 19 | Neath Port Talbot | £85,087 |

| 20 | Blackburn with Darwen | £85,854 |

Affordable apartment markets concentrate in former industrial areas across the North of England, Scotland, and Wales. Merthyr Tydfil in South Wales tops the affordability rankings with average flat prices below £67,000. Seaside town Blackpool and northern former manufacturing centres like Burnley, Hartlepool, and Middlesbrough all offer sub-£80,000 average prices.

These low entry costs can deliver impressive gross rental yields, often 8% to 12% or higher. However, significant challenges accompany the high yields. Many of these areas face economic headwinds including population decline, limited employment growth, and weak demand for owner-occupied properties. This affects both tenant quality and capital appreciation prospects. Void periods tend to run longer, and properties may require more intensive management. Investors succeeding in these markets typically have strong local knowledge, excellent property management, or accept higher operational involvement. Our guides on Blackpool buy-to-let and Middlesbrough buy-to-let examine these markets in detail.

Do Apartments Go Up In Value?

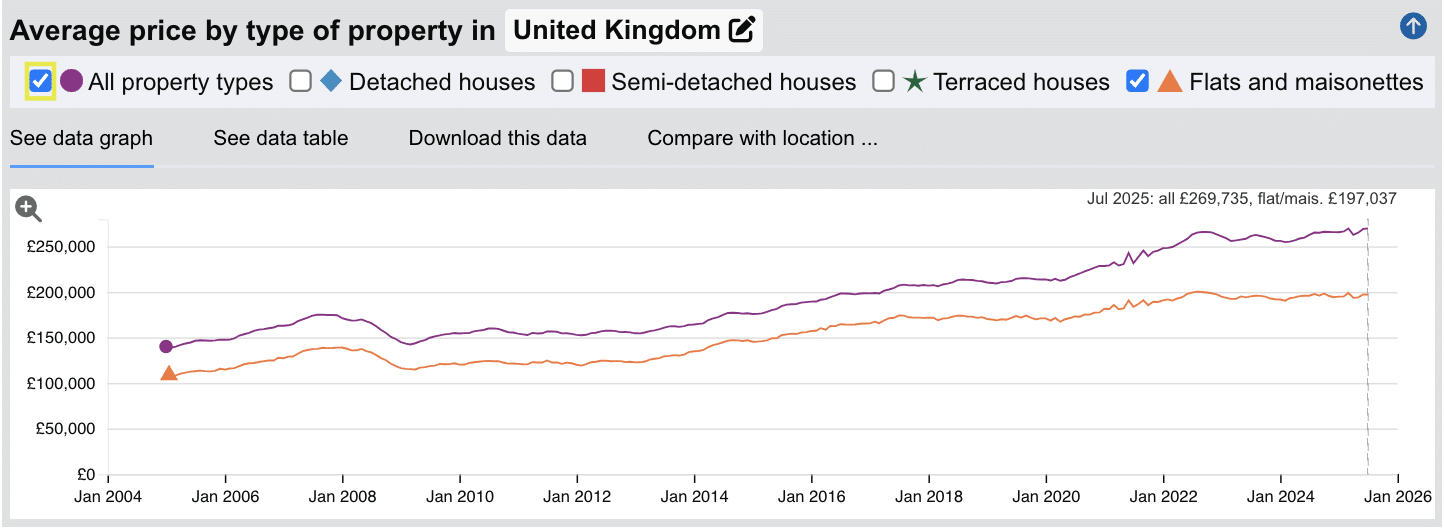

History shows they do. In January 1995 the average sold price for an apartment in the UK was £107,188. By July 2025 the average sold price for an apartment in the UK reached £197,037. This is an 82.83% increase.

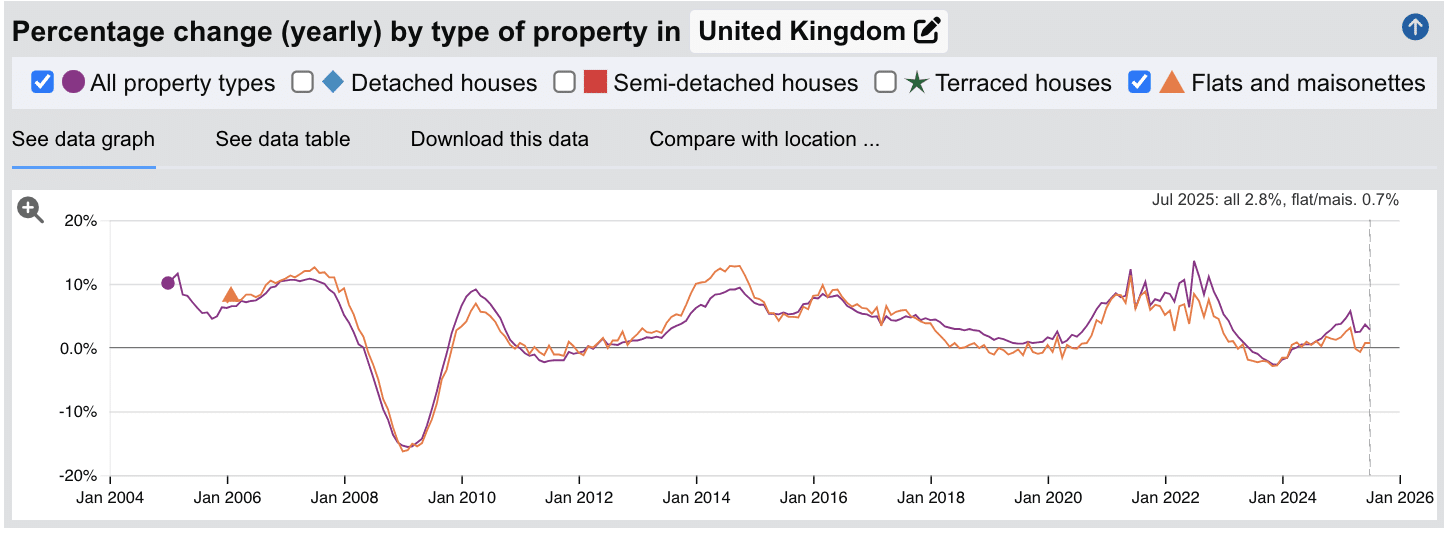

When you view the UK property data side by side with the HM Land Registry sold house prices for 'All property types' (as shown in the images below) you can see the the house price growth trends are very similar.

Apartments have historically risen in value at the same time as houses and dropped in value at the same time too. Of course, each local market will have their own data story to tell, with some areas performing uniquely depending on local supply and demand, but as a whole, across the UK, apartments have gone up in value over time at a similar level of capital growth to houses.

What are the Costs Involved in Buying a City Centre Apartment?

Beyond the purchase price, budget for these immediate costs:

Stamp Duty: Buy-to-let investors pay an additional 3% stamp duty surcharge. On a £150,000 apartment, you'll pay approximately £7,500 in stamp duty. Use our stamp duty calculator for precise figures.

Legal Fees: Conveyancing for apartments typically costs £1,200 to £2,000 because leasehold properties require additional legal work compared to freehold houses.

Survey Costs: A basic home valuation survey costs £300 to £500, whilst a full building survey costs £600 to £1,000.

Mortgage Arrangement Fees: Lenders typically charge £995 to £1,500 for buy-to-let mortgages, though some offer fee-free products at slightly higher interest rates.

Total Upfront Investment: For a £150,000 apartment with a 25% deposit, expect to invest approximately £50,000 to £55,000 once you include all purchase costs.

Annual Ownership Costs

Ongoing buy to let costs significantly impact profitability. Here's what apartment owners typically pay annually:

Service Charges: £1,500 to £4,000 per year depending on the building and facilities. Buildings with gyms, concierges, and lifts charge premium rates. These charges are likely increase annually inline with inflation.

Ground Rent: £150 to £500 per year for most apartments. Some older leases include escalating ground rent clauses that double the charge every 10 to 15 years. Always check ground rent terms before purchasing.

Buildings Insurance: Usually included in service charges, but verify this. If not included, expect £200 to £400 annually.

Letting Agent Fees: Typically 10% to 15% of rental income for full management services. On £900 monthly rent, that's £1,080 to £1,620 annually.

Maintenance and Repairs: Budget £300 to £600 annually for internal maintenance like boiler servicing, appliance repairs, and general wear and tear.

Safety Certificates: Annual gas safety certificates cost £60 to £100. Electrical safety checks every five years cost £150 to £250.

Real Cost Example: A £150,000 apartment generating £900 monthly rent (£10,800 annually) might face these annual costs: Service charge £1,200, ground rent £250, management fees £1,300, maintenance £400, certificates £80. Total ongoing costs: £3,230. This reduces your gross yield from 7.2% to a net yield of approximately 5.05%.

Frequently Asked Questions

How do service charges affect apartment investment returns?

Service charges represent the biggest ongoing cost difference between apartments and houses. These charges cover building maintenance, communal area cleaning, insurance, management fees, and any shared facilities. Annual charges typically range from £1,500 to £4,000, but premium developments with extensive facilities can charge £5,000 or more. On a property generating £10,800 annual rent, a £3,000 service charge immediately reduces your yield by nearly 3%. This transforms what appears to be an attractive 7% gross yield into a more modest 4% net yield before considering other costs. When you own a house you will still have similar outgoings, however with a leasehold this is managed for you and you simply pay your monthly service charge fee, unlike owning a house when you might get a large one-off maintenance bill. Always request the last three years of service charge accounts before purchasing. Look for unexplained cost increases, high management fees, or insufficient sinking fund reserves for major works.

What lease length should I avoid when buying an apartment?

To help homeowners and landlords the Government provides a leasehold advisory service for free. Lease length directly affects property value. Apartments with more than 100 years remaining face minimal value reduction from the lease. Once a lease drops below 80 years, extension costs increase substantially. Properties with fewer than 70 years remaining become increasingly difficult to mortgage. Most lenders won't offer buy-to-let mortgages on short lease properties, limiting your buyer pool when you want to sell. Our complete guide to leasehold properties explains this further.

How long do apartments last?

Modern purpose-built apartments should last 100+ years or more with proper maintenance. The building structure, primarily concrete or steel frame construction, remains sound for many decades. However, several factors affect practical lifespan. Building quality varies considerably. Premium developments with robust construction and quality materials age better than budget builds using cheaper specifications. Buildings constructed in the 1960s and 1970s often face remediation work for issues like concrete degradation or inadequate insulation. Recent construction improvements and building standards generally mean higher quality builds. Maintenance quality determines how well buildings age. Well-managed blocks with adequate sinking fund reserves can address issues before they become serious.

Do new-build apartments have better energy efficiency than older properties?

New-build apartments typically achieve EPC ratings of A or B, making them among the most energy-efficient residential properties available. This efficiency translates into low running costs that appeal to tenants, particularly given recent energy price increases. Many landlords now try and target a minimum EPC rating of C. Based on recent Government net zero targets, properties rated D or below could need expensive upgrades to remain lettable. Our EPC regulations guide explains these requirements.

What fire safety checks should I do before buying an apartment?

Fire safety concerns continue affecting apartment investments following the Grenfell Tower tragedy and subsequent investigations. Some buildings require expensive remediation work for cladding or other safety issues. Before purchasing any apartment, request evidence that all fire safety assessments are complete. Specifically ask for an EWS1 form (External Wall Fire Review) if the building is over 18 metres tall. This certificate confirms whether external walls meet safety standards.

Should I invest in apartments or houses for buy-to-let?

Neither apartments nor houses are universally better investments as shown with the historic house price graph above for the UK over a 30 year time frame across all property types. The right choice depends on your available capital, investment goals, and preferred management approach. Apartments suit investors with limited capital who want city centre exposure. They provide lower entry costs, with some locations around £100,000 compared to £250,000 or more for houses. They deliver higher gross yields, usually 6% to 8% versus 4% to 5% for more expensive houses in the same city, due to the higher asset cost. Houses on the other hand generally provide more buyer demand, stronger control over costs and management, and freehold ownership. They appeal to families, offering more tenancy demand from more people.