Where to Buy Property Investments in Leicester: Yields of 7.3%

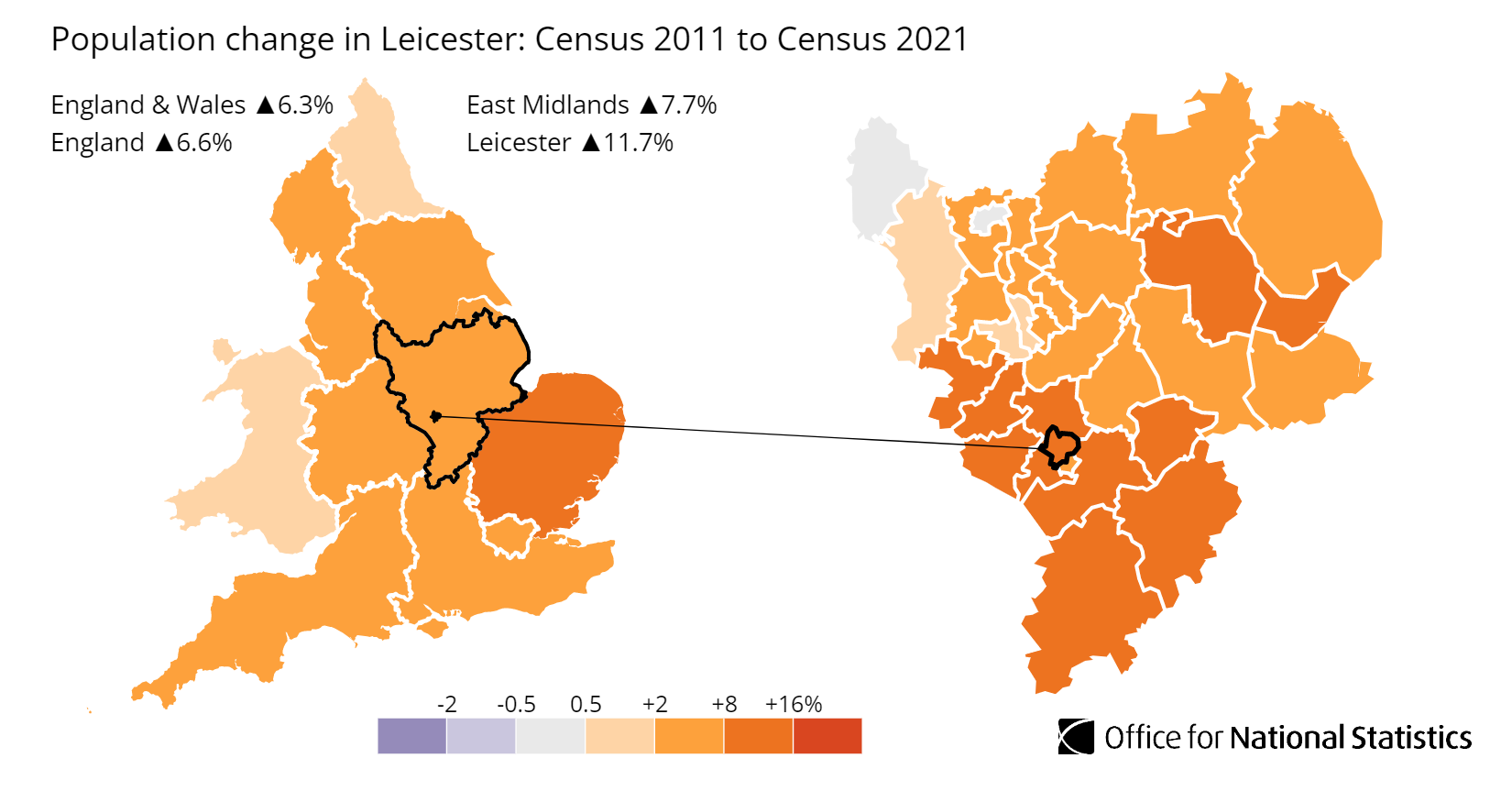

Leicester's gross rental yields range from 3.3% to 7.3% across postcodes with rental data, with LE1 delivering the highest returns. Average sold prices sit 20.5% below the England average, and the city's population grew 11.7% to 368,571 between the 2011 and 2021 censuses.

Leicester's average sold price of £233,048 places it firmly in the affordable tier for East Midlands buy-to-let investors. That is 18.4% below the Leicestershire regional average of £285,594 and creates entry points that the wider county cannot match. Asking prices start from £128,596 in LE1, and rental data is available for 8 of the city's 9 postcodes.

This guide covers all 9 Leicester postcodes from LE1 to LE19 under the City of Leicester unitary authority (ONS code E06000016). Leicester sits at the heart of the East Midlands, equidistant between Nottingham and Coventry. Browse all our Midlands location guides.

Article updated: February 2026

Leicester Buy-to-Let Market Overview 2026

Leicester offers East Midlands entry prices with city-centre yields that outperform most regional competitors, backed by two universities and a diverse manufacturing economy.

- Average sold price: £233,048 (20.5% below England's £293,131)

- Asking price range: £128,596 (LE1) to £383,481 (LE7)

- Rental yields: 3.3% (LE7) to 7.3% (LE1) across postcodes with rental data

- Rental income: Monthly rents from £784 (LE1) to £1,178 (LE8)

- Price per sq ft: House prices from £181/sq ft (LE1) to £310/sq ft (LE7)

- Market activity: Sales ranging from 7 per month (LE1) to 74 per month (LE3)

- Deposit requirements: 30% deposits range from £38,579 (LE1) to £115,044 (LE7)

- Affordability ratios: Property prices from 4.0 to 11.9 times Leicester's median annual salary of £32,281

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Leicester?

Leicester's economy has transformed over the past two decades. The city that built its wealth on textiles and hosiery now runs on a far broader base. Two universities, a major teaching hospital, and one of the UK's largest food and drink manufacturing clusters anchor employment across different sectors and skill levels.

The University of Leicester and De Montfort University together bring over 40,000 students into the city each year. That student population creates consistent rental demand in the inner postcodes, particularly LE1 and LE2. De Montfort's campus sits right in the city centre. The University of Leicester's medical school trains NHS staff who stay in the region. Both institutions are large employers in their own right.

Between the 2011 and 2021 censuses, Leicester's population grew from 329,839 to 368,571, a rise of 11.7%. That is well above the England average and reflects both natural growth and inward migration. Leicester has one of the youngest age profiles of any English city outside London.

Earnings in Leicester sit below both the regional and national averages. The median annual salary is £32,281, compared to £36,192 across the East Midlands and £39,125 for Great Britain. Lower local wages combined with affordable house prices create a market where rental yields hold up well. LE1 delivers 7.3% gross yield from a city-centre postcode with asking prices of £128,596.

Leicester Royal Infirmary and Leicester General Hospital are part of University Hospitals of Leicester NHS Trust, one of the largest trusts in the country. Healthcare employment runs through the city's economy at every level, from consultants to support staff, and creates tenant demand that does not follow economic cycles.

Leicester Economic Summary

- Population: 368,571 (2021 Census). Growth of 11.7% from 2011.

- Median annual salary: £32,281 (Leicester), £36,192 (East Midlands), £39,125 (Great Britain)

- Employment rate: 69.4% (Leicester), 75.6% (East Midlands), 75.6% (Great Britain)

- Unemployment rate: 7.4% (Leicester), 4.3% (East Midlands), 4.3% (Great Britain)

- Key employment sectors: Higher education, healthcare, food and drink manufacturing, textiles, logistics and distribution

Source: ONS Census 2021, Nomis Labour Market Profile (ASHE 2025, Employment Oct 2024-Sep 2025)

Leicester's employment rate of 69.4% is notably below both the East Midlands and Great Britain averages of 75.6%. The unemployment rate of 7.4% is also above the regional and national 4.3%. These figures reflect Leicester's younger population profile and higher proportion of economically inactive students. For buy-to-let investors, the student population drives rental demand even as it lowers headline employment statistics.

Regeneration and Investment in Leicester

Leicester's regeneration programme is spread across transport, heritage, and waterfront projects. The common thread is improving connectivity between the city centre and surrounding residential areas.

- Leicester Transport Investment Programme (funding confirmed, £80 million): Government-funded transport improvements running through 2030, including up to 48 new electric buses, road resurfacing on key routes like Melton Road and Aylestone Road, and highway access improvements at Ashton Green and St George's Cultural Quarter. Transport upgrades on arterial routes directly benefit rental properties in LE4 and LE2. Updates at Leicester City Council.

- Leicester Waterside (under construction, £80 million+): Keepmoat Homes delivering 350+ new homes on former industrial land beside the Grand Union Canal and River Soar. Over 200 homes already complete, with further phases completing through 2026. The brownfield-to-residential transformation in the LE3 postcode area adds canal-side premium to a postcode already delivering 5.3% yields. Updates at East Midlands Business Link.

- Corah Works Redevelopment (planning approved, October 2025): Cityregen Leicester and Galliford Try Investments transforming the historic 1865 Corah Works textile factory into 1,000 new homes with commercial units and public spaces. The original facade and landmark chimneys are preserved. This scheme improves links between the city centre and Abbey Park, benefiting surrounding LE1 and LE4 postcodes. Updates at Galliford Try Investments.

Leicester Property Market Analysis

When Was the Last House Price Crash in Leicester?

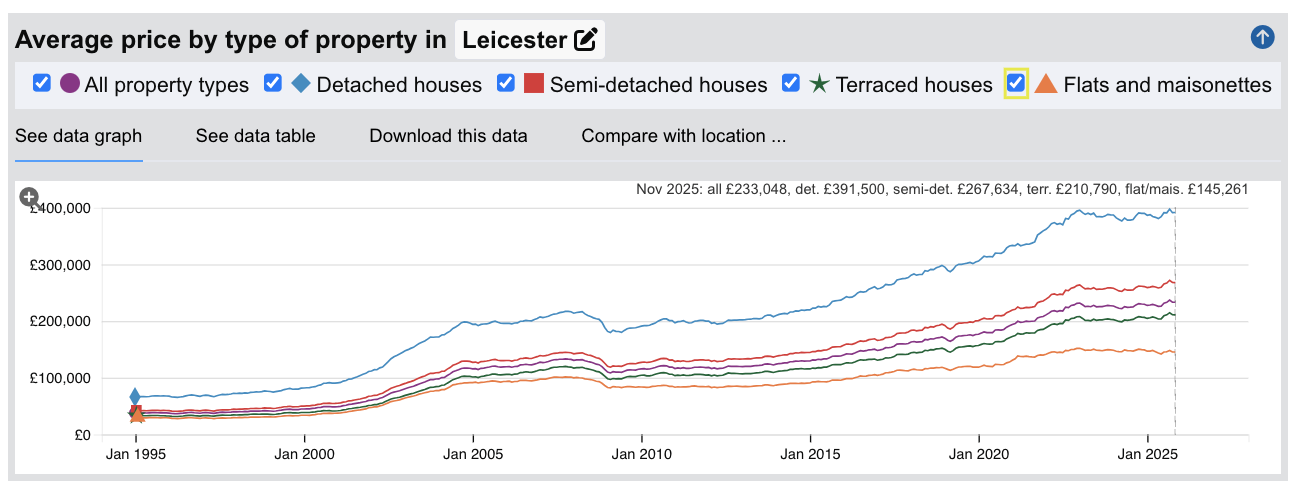

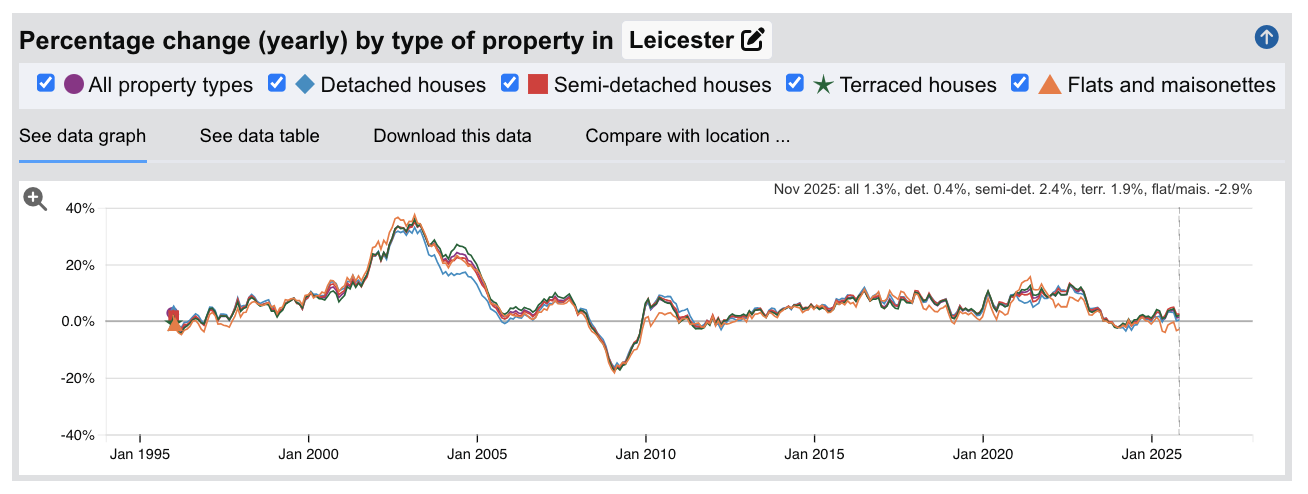

Leicester's last major crash saw prices fall 18.7% between October 2007 and February 2009, taking nearly 8 years to recover. The full house price history from the HM Land Registry House Price Index runs from January 1995 to November 2025.

- 1995-2007 (The boom): Leicester began 1995 at £36,512. Growth was slow at first, with annual changes barely above inflation until 2001. Then prices accelerated sharply. By January 2003, annual growth hit 33.5%. Prices more than tripled from £36,512 to a peak of £133,205 in October 2007. Cheap credit and speculative demand pushed Leicester well beyond what local wages could support.

- 2007-2009 (The financial crisis): From the peak of £133,205 in October 2007 to the trough of £108,353 in February 2009, Leicester lost 18.7% of its value in 16 months. The worst annual change reading was -17.5% in February 2009. All property types fell heavily: detached -17.2%, semi-detached -18.2%, terraced -19.2%, flats -19.0%. Terraced houses and flats took the hardest hit. Leicester's decline of 18.7% was worse than England overall (-18.2%) and broadly in line with the Leicestershire region (-15.6% worst annual reading).

- 2009-2013 (Stagnation): Prices bounced off the trough quickly. By December 2009, the average had recovered to £114,776. But then growth stalled completely. Prices traded sideways between £116,000 and £122,000 for four years. By December 2013, the average sat at £122,378. Still 8.1% below the pre-crash peak.

Recovery and Beyond (2014-2025)

- 2014-2016 (Recovery): Growth returned with conviction. Annual changes of 4-10% pushed prices through the pre-crash peak in August 2015 at £135,025. That recovery took nearly 8 years from the October 2007 peak. By December 2016, prices had reached £150,371. Leicester was catching up with the national recovery that London and the South East had led from 2013.

- 2017-2019 (Steady growth): Prices rose from £153,736 in June 2017 to £176,149 by December 2019. Consistent annual growth of 3-9%. Leicester's relative affordability attracted first-time buyers and investors who were being priced out of London and the South East. The university expansion and hospital investment provided a solid employment floor.

- 2020-2022 (Pandemic surge): The stamp duty holiday and the shift toward working from home pushed Leicester prices sharply higher. From £179,441 in June 2020 to £231,136 by December 2022. That is 28.8% growth in two and a half years. Leicester benefited from buyers seeking more space at lower prices than the South East could offer.

- 2023 (Rate shock): Interest rate rises cooled the market. Prices eased from £231,136 in December 2022 to £226,980 by December 2023. A decline of 1.8%. Mild compared to the 2008 crash and shorter in duration.

- 2024-2025 (Stabilisation): Prices dipped further in the first half of 2024, reaching £224,195 by June. By November 2025, the average had recovered to £233,048 with annual growth of 1.3%. Leicester now sits 75.0% above its pre-crash peak.

Long-Term Property Value Growth in Leicester

- 5 years (2020-2025): +23.2% (£189,201 to £233,048)

- 10 years (2015-2025): +68.8% (£138,068 to £233,048)

- 15 years (2010-2025): +96.5% (£118,614 to £233,048)

- 20 years (2005-2025): +96.7% (£118,504 to £233,048)

- 30 years (1995-2025): +514.2% (£37,941 to £233,048)

The 2008 crash is the reference point for Leicester investors assessing downside risk. An 18.7% decline took nearly 8 years to recover. The stagnation period from 2009-2013 is what hurt most. Prices bounced quickly off the trough but then went nowhere for four years. Leicester's market today is more diversified than in 2007. Two universities, a major NHS trust, and the growth of logistics and distribution along the M1 corridor give the city multiple economic pillars that it lacked during the credit-fuelled boom.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Leicester

The latest sold house price index by the Land Registry confirms Leicester's position as one of the more affordable cities in the East Midlands. The headline figure of £233,048 is 20.5% below England's £293,131 and 18.4% below the Leicestershire regional average of £285,594. The discount is widest on flats and narrowest on semi-detached houses.

Flats in Leicester average £145,261. That is 34.4% below the England average of £221,565. Leicester's flat market is dominated by city-centre student stock and purpose-built blocks near De Montfort University. The LE1 postcode alone has an average asking price of £128,596, heavily skewed by smaller units. That deep discount on flat prices is what drives the 7.3% gross yield in LE1.

| Property Type | Leicester Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £391,500 | £474,400 | -17.5% |

| Semi-detached houses | £267,634 | £290,004 | -7.7% |

| Terraced houses | £210,790 | £245,002 | -14.0% |

| Flats and maisonettes | £145,261 | £221,565 | -34.4% |

| All property types | £233,048 | £293,131 | -20.5% |

Semi-detached houses show the narrowest discount at 7.7%. Semis are the backbone of Leicester's suburban housing stock in LE3 (Braunstone), LE4 (Beaumont Leys), and LE5 (Hamilton). Owner-occupier demand competes directly with buy-to-let investors for these properties, which keeps semi prices closer to the national average than any other type.

Detached houses sit 17.5% below England at £391,500. Leicester's detached stock concentrates in the outer postcodes: LE7 (Syston, Rothley), LE8 (Blaby, Countesthorpe), and LE19 (Narborough, Enderby). These are commuter belt areas where families settle rather than investment hotspots. The discount reflects Leicester's distance from the premium that inflates detached prices in the South East.

Terraced houses average £210,790, a 14.0% discount. The Victorian and Edwardian terraces across LE1, LE2, and LE3 are the core of Leicester's rental stock. These properties offer lower entry prices than semis and attract a mix of students, young professionals, and families. Terraces in LE3 generate 5.3% gross yield with five-year growth of 22.6%. Investors hunting deeper discounts may find opportunities through below market value properties.

Flats represent the deepest discount at 34.4% below England. For investors, that gap means relatively modest rents can still produce meaningful yields. LE1 city-centre flats drive the 7.3% headline yield. The postcode-level data in the sections below shows where rental income performs strongest against purchase price.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Price Per Square Foot in Leicester

What does space actually cost across Leicester? Price per square foot strips out the size bias in asking prices and shows true underlying value. A postcode might look expensive simply because it has larger properties. Per-foot pricing is the closest measure to what you are actually paying for space across different property types and sizes.

The range runs from £181 in LE1 to £310 in LE7, a spread of 1.7x across nine postcodes. The cheapest space in the city sits in the same postcode that delivers the highest yield. That is not a coincidence.

| Rank | Area | Price Per Sq Ft |

|---|---|---|

| 1 | LE1 (City Centre) | £181 |

| 2 | LE3 (Braunstone, Westcotes) | £256 |

| 3 | LE2 (Oadby, Clarendon Park, Highfields) | £278 |

| 4 | LE5 (Hamilton, Evington) | £287 |

| 5 | LE18 (Wigston) | £291 |

| 6 | LE4 (Beaumont Leys, Belgrave) | £296 |

| 7 | LE8 (Blaby, Countesthorpe) | £307 |

| 8 | LE19 (Narborough, Enderby) | £307 |

| 9 | LE7 (Syston, Rothley) | £310 |

LE1 at £181 per square foot is the cheapest space in Leicester by a wide margin. The next nearest postcode, LE3, sits £75 higher at £256. LE1's low per-foot cost reflects the dominance of smaller flats and converted properties in the city centre. For investors buying by the square foot, LE1 offers the most space for money in Leicester.

The mid-range cluster from LE2 to LE4 (£278 to £296) contains four postcodes within £18 of each other. These are Leicester's established residential areas where terraced and semi-detached housing sets the price. The tight clustering tells you that space costs roughly the same across the bulk of the city. The differentiation comes from rental returns, growth rates, and tenant profiles rather than purchase price per foot.

LE8 (Blaby, Countesthorpe) and LE19 (Narborough, Enderby) share the second-highest rate at £307, with LE7 (Syston, Rothley) at £310. These outer postcodes have larger detached and semi-detached properties that command higher per-foot rates. LE7 at £310 is the most expensive space in Leicester, 71% above LE1. Read this alongside the yield data. LE7 delivers the lowest yield at 3.3%, confirming the inverse relationship between premium space costs and rental returns.

For Sale Asking Prices in Leicester

Asking prices in Leicester range from £128,596 in LE1 to £383,481 in LE7. These reflect what sellers and agents think the market will pay, not what buyers actually paid (that is the sold prices above). LE1 sits in a different market to the rest of the city. Exclude LE1 and the range narrows to £251,341 to £383,481. That is still a meaningful spread of £132,000 between the most affordable suburban postcode and the most expensive.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | LE1 (City Centre) | £128,596 |

| 2 | LE3 (Braunstone, Westcotes) | £251,341 |

| 3 | LE4 (Beaumont Leys, Belgrave) | £287,084 |

| 4 | LE2 (Oadby, Clarendon Park, Highfields) | £298,523 |

| 5 | LE5 (Hamilton, Evington) | £300,794 |

| 6 | LE18 (Wigston) | £306,824 |

| 7 | LE19 (Narborough, Enderby) | £339,117 |

| 8 | LE8 (Blaby, Countesthorpe) | £355,461 |

| 9 | LE7 (Syston, Rothley) | £383,481 |

LE1 at £128,596 is almost half the price of the next cheapest postcode. This is the city-centre student and apartment market. For investors with limited capital, LE1 offers the lowest entry in Leicester with a 30% deposit of just £38,579. The yield of 7.3% means the numbers can work even with higher management costs that city-centre flats typically carry.

LE3 (Braunstone, Westcotes) at £251,341 is the gateway to Leicester's family rental market. It has the highest sales volume in the city at 74 per month and delivers 5.3% yield. The gap between LE1 and LE3 is £123,000. That is the cost of stepping from city-centre apartments into terraced and semi-detached housing with a different tenant profile.

Five postcodes cluster between £287,000 and £307,000. LE4, LE2, LE5, and LE18 sit within a £20,000 range. At this price point, the decision comes down to yield, growth, and tenant demand rather than affordability. LE4 (Beaumont Leys) delivers the strongest five-year growth at 26.9% from this cluster.

The mean asking price across all nine Leicester postcodes is £294,580. That figure appears in the comparison section later, where Leicester is measured against Nottingham, Derby, Coventry, and Birmingham.

House Price Growth in Leicester

Growth data shows where prices have moved over 1, 3, and 5 years. For buy-to-let investors, the five-year figure matters most. It captures a full market cycle and filters out short-term noise. One-year growth can swing on a handful of transactions in smaller postcodes. Five years tells you whether an area is genuinely appreciating.

Eight of Leicester's nine postcodes delivered positive five-year growth, with LE4 leading at 26.9%. An investor who bought a £226,000 property in LE4 five years ago would be sitting on a property now asking £287,084. That is £61,000 in equity growth from one of Leicester's mid-priced postcodes. LE1 is the exception at 11.6% five-year growth but with sharp recent declines.

| Area | 1 Year | 3 Years | 5 Years |

|---|---|---|---|

| LE4 (Beaumont Leys, Belgrave) | 2.1% | 5.1% | 26.9% |

| LE3 (Braunstone, Westcotes) | -0.2% | 0.7% | 22.6% |

| LE5 (Hamilton, Evington) | 2.4% | 7.4% | 21.0% |

| LE18 (Wigston) | 1.2% | -1.5% | 18.5% |

| LE2 (Oadby, Clarendon Park, Highfields) | -1.1% | -0.1% | 14.1% |

| LE7 (Syston, Rothley) | -0.9% | 3.9% | 14.1% |

| LE19 (Narborough, Enderby) | 2.0% | 0.6% | 14.2% |

| LE8 (Blaby, Countesthorpe) | 3.1% | 1.0% | 12.2% |

| LE1 (City Centre) | -31.7% | -23.1% | 11.6% |

LE4 (Beaumont Leys, Belgrave) leads on five-year growth at 26.9% and is one of only three postcodes showing positive one-year growth above 2%. LE4 is Leicester's most ethnically diverse postcode with strong family demand for larger terraced and semi-detached homes. The Beaumont Leys area has benefited from new development at Ashton Green, which is drawing families into the postcode and pushing up values.

LE3 and LE5 both delivered over 21% five-year growth. LE3 (Braunstone, Westcotes) combines that growth with the city's highest sales volume (74/month) and a 5.3% yield. LE5 (Hamilton, Evington) shows the strongest three-year growth at 7.4%, suggesting momentum is building rather than fading.

LE1 at -31.7% one-year growth stands out sharply. City-centre flat markets across the UK have struggled since the pandemic as remote working reduced demand for small urban units. LE1's five-year figure of 11.6% is still positive, but the recent trajectory is clear. Investors buying in LE1 for the 7.3% yield need to be comfortable holding through a period of capital value adjustment.

The outer postcodes (LE7, LE8, LE19) show modest but stable five-year growth of 12-14%. These are family-oriented areas where owner-occupier demand sets the pace. LE8 stands out with the strongest one-year growth in the table at 3.1%, suggesting the outer ring may be seeing renewed interest as buyers seek more space.

Monthly Property Sales in Leicester

A combined 381 transactions per month across nine postcodes makes Leicester a liquid market by Midlands standards. Transaction volumes reveal which areas have the deepest buyer pools. For buy-to-let investors, this is an exit strategy question. High volume and high turnover mean you can sell when you need to.

Volumes range from 7 in LE1 to 74 in LE3. LE3's dominance is emphatic. Pair its 74 monthly sales with 39% turnover and £251,341 average asking price and LE3 emerges as Leicester's most liquid residential market.

| Area | Sales Per Month | Turnover | Asking Price |

|---|---|---|---|

| LE3 (Braunstone, Westcotes) | 74 | 39% | £251,341 |

| LE2 (Oadby, Clarendon Park, Highfields) | 64 | 28% | £298,523 |

| LE7 (Syston, Rothley) | 63 | 45% | £383,481 |

| LE4 (Beaumont Leys, Belgrave) | 60 | 46% | £287,084 |

| LE8 (Blaby, Countesthorpe) | 41 | 39% | £355,461 |

| LE5 (Hamilton, Evington) | 37 | 35% | £300,794 |

| LE18 (Wigston) | 22 | 25% | £306,824 |

| LE19 (Narborough, Enderby) | 13 | 26% | £339,117 |

| LE1 (City Centre) | 7 | 4% | £128,596 |

LE4 has the highest turnover at 46% with 60 sales per month. Properties in Beaumont Leys and Belgrave move quickly. For investors planning an exit, LE4 offers the combination of strong demand and fast turnover that makes selling straightforward. LE7 at 45% turnover is close behind, though at a much higher price point.

LE1's 4% turnover rate stands out for the wrong reasons. Seven sales per month and 4% turnover means the city-centre flat market is thin. A small pool of buyers and high investor concentration means selling can take time. The 7.3% yield compensates for the illiquidity, but investors need to plan for longer hold periods.

LE18 and LE19 both sit below 30% turnover with modest volumes. Wigston (22 sales/month) and Narborough (13 sales/month) are quieter markets where properties sell at a steady but slower pace. LE19 also has no rental data, which limits the investment case to capital growth alone. In lower-volume postcodes, off-market properties can surface deals that never reach the portals.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Leicester Rental Market Analysis

For investors weighing up whether rental property is a worthwhile investment in Leicester, the data below breaks down average monthly rents and gross rental yields across the city's postcodes.

Rental data is available for 8 of 9 postcodes. LE19 (Narborough, Enderby) has insufficient current listings for reliable figures. For the eight with data, monthly rents range from £784 in LE1 to £1,178 in LE8 and gross yields range from 3.3% to 7.3%. If you are looking to build a property portfolio in the Midlands, Leicester's combination of university-driven demand and affordable entry prices makes it a strong contender.

Average Rent & Gross Rental Yields in Leicester

LE1 delivers Leicester's highest gross yield at 7.3%, where monthly rents of £784 meet asking prices of just £128,596. Gross rental yield is calculated from asking price and average monthly rent for each postcode. It does not account for void periods, maintenance, or mortgage costs. It is a starting point for comparison, not a profit forecast.

At the other end, LE7 (Syston, Rothley) at 3.3% reflects high asking prices of £383,481 absorbing rents of £1,066. The yield spread across Leicester is 4.0 percentage points. That is one of the widest spreads in any Midlands city and reflects the gulf between LE1's city-centre apartment market and the outer suburban postcodes.

| Area | Avg Monthly Rent | Avg Asking Price | Gross Yield |

|---|---|---|---|

| LE1 (City Centre) | £784 | £128,596 | 7.3% |

| LE3 (Braunstone, Westcotes) | £1,109 | £251,341 | 5.3% |

| LE4 (Beaumont Leys, Belgrave) | £1,074 | £287,084 | 4.5% |

| LE2 (Oadby, Clarendon Park, Highfields) | £1,091 | £298,523 | 4.4% |

| LE5 (Hamilton, Evington) | £1,072 | £300,794 | 4.3% |

| LE8 (Blaby, Countesthorpe) | £1,178 | £355,461 | 4.0% |

| LE18 (Wigston) | £958 | £306,824 | 3.7% |

| LE7 (Syston, Rothley) | £1,066 | £383,481 | 3.3% |

| LE19 (Narborough, Enderby) | Not enough data | £339,117 | Not enough data |

LE1 and LE3 are the clear yield leaders, but they achieve it in completely different ways. LE1 at 7.3% is driven by low purchase prices. The rent of £784 is actually the lowest in Leicester. The yield comes from the denominator, not the numerator. LE3 at 5.3% works because rents of £1,109 sit against asking prices of £251,341. LE3 offers both stronger absolute income and a more diversified tenant base.

Five postcodes cluster between 3.3% and 4.5% yield. LE4, LE2, LE5, LE8, and LE7 all sit in this band. The rents are remarkably similar (£1,066 to £1,178 across the five) but asking prices vary from £287,084 to £383,481. For investors choosing between these postcodes, the growth data and tenant profile matter more than yield alone.

LE8 commands Leicester's highest absolute rent at £1,178 per month but delivers only 4.0% yield. Blaby and Countesthorpe attract professional families willing to pay a premium for space and village character. The yield is compressed by asking prices of £355,461. Investors here are typically buying for tenant quality and long-term appreciation rather than cash flow.

Is Leicester Rent High?

Across Leicester's eight postcodes with rental data, rent ranges from 29.1% to 43.8% of the local median gross monthly salary. Rent affordability matters from both sides. For tenants, it determines whether they can sustain payments long-term. For landlords, areas where rent consumes a lower share of income tend to produce more reliable tenants and fewer arrears.

The median gross weekly salary in Leicester is £620.80, which equates to £2,690 per month or £32,281 per year. This is below the East Midlands regional median of £696.00 per week and the Great Britain median of £752.40 per week. Data from the Nomis Labour Market Profile (ASHE 2025).

Seven of the eight postcodes sit above the 30% benchmark. The general threshold where rent becomes stretched is 30% of gross income. That so many postcodes exceed it is a reflection of Leicester's lower earnings rather than unusually high rents.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | LE8 (Blaby, Countesthorpe) | 43.8% |

| 2 | LE3 (Braunstone, Westcotes) | 41.2% |

| 3 | LE2 (Oadby, Clarendon Park, Highfields) | 40.6% |

| 4 | LE4 (Beaumont Leys, Belgrave) | 39.9% |

| 5 | LE5 (Hamilton, Evington) | 39.9% |

| 6 | LE7 (Syston, Rothley) | 39.6% |

| 7 | LE18 (Wigston) | 35.6% |

| 8 | LE1 (City Centre) | 29.1% |

| — | LE19 (Narborough, Enderby) | Not enough data |

LE8 at 43.8% looks stretched on paper, but this is a suburban postcode attracting tenants who earn above the Leicester median. Professional families renting in Blaby and Countesthorpe are not earning £32,281. The median salary is a city-wide figure that understates what tenants in these postcodes actually earn. The same applies to LE7 at 39.6%.

LE1 at 29.1% is the only postcode below the 30% benchmark. City-centre rents of £784 are Leicester's lowest, which keeps the affordability ratio manageable. For landlords, this is a double-edged finding. Tenants can afford the rent comfortably, but the low absolute rent limits income unless you hold multiple units or operate as an HMO.

LE18 (Wigston) at 35.6% sits in a moderate band. Rents of £958 are below the city average, and Wigston's suburban character attracts long-term tenants. The combination of moderate affordability pressure and low turnover (25%) suggests a stable rental market with lower tenant churn.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Leicester House Prices High? Price-to-Earnings Ratios

The price-to-earnings ratio compares a postcode's average asking price to the local median annual salary. Lower ratios mean more affordable entry points relative to local wages. The national benchmark is 7.5x, calculated from England's average sold price of £293,131 against Great Britain's median annual salary of £39,125.

Purchasing a property in Leicester requires between 4.0 and 11.9 times the median annual salary. This is based on the Nomis Labour Market Profile for Leicester showing the median gross annual income for Leicester residents is £32,281.

Only LE1 sits below the national benchmark of 7.5x at 4.0x. LE3 at 7.8x is the next most affordable and sits just above the benchmark. The remaining seven postcodes range from 8.9x to 11.9x. Leicester's lower local earnings push the ratios higher than the property prices alone would suggest. A £287,084 property in LE4 produces an 8.9x ratio because Leicester's median salary is £32,281 rather than the national £39,125.

| Rank | Area | Price-to-Earnings Ratio |

|---|---|---|

| 1 | LE1 (City Centre) | 4.0x |

| 2 | LE3 (Braunstone, Westcotes) | 7.8x |

| 3 | LE4 (Beaumont Leys, Belgrave) | 8.9x |

| 4 | LE2 (Oadby, Clarendon Park, Highfields) | 9.2x |

| 5 | LE5 (Hamilton, Evington) | 9.3x |

| 6 | LE18 (Wigston) | 9.5x |

| 7 | LE19 (Narborough, Enderby) | 10.5x |

| 8 | LE8 (Blaby, Countesthorpe) | 11.0x |

| 9 | LE7 (Syston, Rothley) | 11.9x |

LE1 at 4.0x is dramatically below the national benchmark. That ratio reflects the city-centre flat market where asking prices of £128,596 sit against the city-wide median salary. It is the most affordable entry point relative to earnings in any Leicester postcode and helps explain the 7.3% yield.

LE3 at 7.8x is the most affordable suburban postcode, sitting just above the 7.5x benchmark. Combined with its 5.3% yield and 22.6% five-year growth, LE3 offers the strongest balance of affordability, income, and growth in Leicester. Every other suburban postcode sits above 8.9x.

LE7 at 11.9x and LE8 at 11.0x are the most stretched postcodes. These outer areas attract buyers from outside Leicester who earn above the local median. The ratios overstate the affordability challenge for the actual buyer pool in these postcodes, but they confirm that the outer ring is firmly in owner-occupier territory rather than buy-to-let.

Deposit Requirements in Leicester

Most buy-to-let mortgage lenders require a minimum 25% deposit. The table below uses a more conservative 30% to reflect the rates and products available at higher loan-to-value ratios. A 30% deposit typically unlocks better interest rates, which matters for cash flow in a yield-driven market.

Leicester's entry costs range from £38,579 in LE1 to £115,044 in LE7. LE1 offers one of the lowest deposit requirements of any city-centre postcode in the Midlands. LE3 at £75,402 is the next step up and gives access to a postcode delivering 5.3% yield with strong liquidity.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | LE1 (City Centre) | £38,579 |

| 2 | LE3 (Braunstone, Westcotes) | £75,402 |

| 3 | LE4 (Beaumont Leys, Belgrave) | £86,125 |

| 4 | LE2 (Oadby, Clarendon Park, Highfields) | £89,557 |

| 5 | LE5 (Hamilton, Evington) | £90,238 |

| 6 | LE18 (Wigston) | £92,047 |

| 7 | LE19 (Narborough, Enderby) | £101,735 |

| 8 | LE8 (Blaby, Countesthorpe) | £106,638 |

| 9 | LE7 (Syston, Rothley) | £115,044 |

LE1 at £38,579 is the standout entry point. A sub-£40,000 deposit for a 7.3% yielding postcode is unusual in any English city. The trade-off is clear from the growth data: LE1 has shown -31.7% one-year capital decline. The yield compensates, but investors need to accept capital volatility alongside the income.

A clear gap separates LE1 and LE3 from the rest. From LE4 onwards, deposits sit between £86,000 and £115,000. Five postcodes (LE4, LE2, LE5, LE18) cluster in the £86,000-£92,000 range. At this level, yield differences of 0.1-0.2 percentage points matter less than growth trajectory and tenant demand. LE4 stands out in this cluster with the strongest five-year growth (26.9%).

Deposit is only part of the upfront cost. Budget for stamp duty (use our stamp duty calculator for an accurate figure), legal fees, and survey costs. For a full breakdown, see our guide to buy-to-let costs.

What the Leicester Data Tells Buy-to-Let Investors

For yield, the numbers favour LE1 (7.3%) and LE3 (5.3%). LE1 delivers the highest gross yield in Leicester from a 30% deposit of just £38,579. The tenant base is predominantly students and young professionals near De Montfort University. LE3 offers stronger absolute rents (£1,109 vs £784) with better liquidity (74 sales/month vs 7) and a more diversified tenant mix across Braunstone and Westcotes.

For growth, LE4 (26.9%) and LE3 (22.6%) lead the table over five years. LE4 also shows the strongest recent momentum with 2.1% one-year growth and 5.1% over three years. The Ashton Green development and transport investment along Melton Road are adding value to this postcode. LE3 combines five-year growth of 22.6% with the city's best yield outside LE1, making it the standout all-rounder.

LE1's -31.7% one-year decline is the sharpest negative movement in Leicester's data. City-centre flat values have corrected after the pandemic-era surge. The five-year figure is still positive at 11.6%, and the 7.3% yield means income-focused investors can ride out the capital adjustment. The numbers show a postcode delivering strong income from a falling asset base.

Leicester operates a selective licensing scheme in several wards. Landlords renting properties in designated areas need a licence before letting. The cost is modest but the compliance requirements add to management overhead. Check the current designated areas before purchasing. For a wider view of available stock, see our investment property listings.

How Leicester Buy-to-Let Compares to Nearby Areas

Leicester's mean asking price of £294,580 and top yield of 7.3% position it in the middle of the Midlands pack. The table below compares Leicester against four nearby locations using the same methodology: mean asking price across all postcodes, mean monthly rent across postcodes with data, and top single-postcode gross yield.

| Location | Mean Asking Price | Mean Monthly Rent | Top Gross Yield |

|---|---|---|---|

| Leicester | £294,580 | £1,041 | 7.3% |

| Nottingham | £244,881 | £1,089 | 9.2% |

| Birmingham | £272,648 | £1,121 | 7.0% |

| Derby | £276,761 | £946 | 5.9% |

| Coventry | £295,504 | £1,137 | 7.3% |

Leicester and Coventry share an identical top yield of 7.3% and nearly identical mean asking prices (£294,580 vs £295,504). Coventry edges ahead on mean rent (£1,137 vs £1,041). The two cities offer comparable investment profiles, though Leicester's two universities give it a deeper student rental market. Read our Coventry guide for the postcode-level comparison.

Nottingham leads the group on top yield at 9.2% with the lowest mean asking price at £244,881. For investors purely focused on yield, Nottingham's numbers are the strongest in this group. Birmingham offers higher mean rents (£1,121) and a 7.0% top yield with the scale and liquidity of the UK's second city.

Derby is the outlier with the lowest mean rent (£946) and top yield (5.9%). Leicester offers stronger rental returns than Derby across every metric. For investors choosing between the two East Midlands cities, Leicester's higher yields and deeper tenant pool from two universities give it the edge.

Frequently Asked Questions

What are the best areas in Leicester for buy-to-let?

LE3 (Braunstone, Westcotes) leads across the widest range of metrics: 5.3% yield, 22.6% five-year growth, the highest sales volume at 74 per month, and a 30% deposit of £75,402. LE1 (City Centre) delivers the highest yield at 7.3% from the lowest entry point (£38,579 deposit) but carries higher capital volatility. LE4 (Beaumont Leys, Belgrave) delivers the strongest five-year growth at 26.9% with 4.5% yield. Each postcode suits a different strategy: LE3 for all-round performance, LE1 for income, LE4 for growth.

Is student accommodation a good investment in Leicester?

Leicester has two universities with a combined student population exceeding 40,000. The University of Leicester and De Montfort University create consistent demand in LE1 and LE2. De Montfort's campus is in the city centre, which supports LE1's 7.3% yield. Student lets can generate higher per-room income through HMO arrangements, but bring seasonal void risk during summer months and higher management costs. Some investors convert summer voids into short-term lets through Airbnb properties. For a broader view of the sector, see our guide to purpose-built student accommodation.

How does Leicester compare to Nottingham for property investment?

Nottingham offers a higher top yield (9.2% vs 7.3%) and lower mean asking prices (£244,881 vs £294,580). The key differentiator is price. Nottingham's lower entry points produce stronger yields.

Leicester's advantage is population: 368,571 versus Nottingham's smaller boundary population, and two universities versus one. Both cities sit on the M1 corridor with strong logistics employment. The choice depends on whether you prioritise yield (Nottingham) or tenant pool depth (Leicester).

Are there property investment companies operating in Leicester?

Several firms market buy-to-let properties in Leicester, particularly new-build developments and off-plan stock near the city centre. Be cautious with any company offering guaranteed yields or sourcing fees above 2-3% of purchase price. The data in this guide covers the open market. Any property sold through an investment company can be benchmarked against these figures to check whether the price and projected returns are realistic.

What is the average rent in Leicester?

Average monthly rents across Leicester's eight postcodes with data range from £784 in LE1 (City Centre) to £1,178 in LE8 (Blaby, Countesthorpe). The mean monthly rent across all postcodes with data is £1,041. LE8 commands the highest absolute rent, reflecting demand from professional families in the suburban south. LE1's lower absolute rent produces the highest yield (7.3%) because asking prices are so much lower than the rest of the city.

Is Leicester a posh area?

Leicester has a wide range of neighbourhoods. LE2 (Oadby, Clarendon Park) and LE7 (Syston, Rothley) are the most affluent areas, with the highest prices per square foot (£278 and £310 respectively) and largest detached housing stock. LE8 (Blaby, Countesthorpe) commands the highest rents at £1,178 per month. At the other end, LE1 (City Centre) and LE3 (Braunstone) offer more affordable stock and stronger yields. The postcode data shows a city with clear tiers rather than a single character.