Where to Buy Property Investments in Brighton: Yields of 5.4%

Brighton's status as one of the UK's most desirable coastal cities creates a competitive houseing market and although it is often viewed as a high-entry market, specific pockets of the city offer property investment opportunities with rental yields reaching 5.4% in BN2, largely driven by a robust student and professional rental sector.

The property data reflects the city's premium nature. Brighton's average sold price of £428,343 sits 45% above the England average, a premium justified by the severe housing supply constraints sandwiched between the South Downs and the sea. This pressure on supply and demand keeps home prices high.

Our buy-to-let analysis examines the city's key postcodes, evaluating capital growth, rental yields, and the investment potential across Brighton and Hove.

Article updated: November 2025

Brighton Buy-to-Let Market Overview 2025

Brighton's property market delivers asking house prices ranging from 35% to 67% above the England average actual property sold prices across its postcodes, creating distinct property ownership entry points from accessible to premium with these key statistics:

- Asking price range: £399,711 (BN41) to £494,199 (BN3) across Brighton postcodes

- Rental yields: 3.9% (BN1) to 5.4% (BN2) across different postcodes

- Rental income: Monthly rents from £1,451 to £1,990 (BN43 to BN2)

- Price per sq ft: House prices from £411/sq ft (BN42) to £534/sq ft (BN3)

- Market activity: Sales ranging from 5 per month (BN42) to 47 per month (BN3)

- Deposit requirements: 30% deposits range from £119,913 (BN41) to £148,260 (BN3)

- Affordability ratios: Property prices from 12.4 to 15.3 times Brighton's median annual salary of £32,226

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Brighton?

Let’s be realistic: Brighton is not the place to look if you want a cheap entry point or double-digit yields overnight. It is a premium market. However, the reason seasoned investors stick with Brighton is simple. The tenant demand here is relentless, and the geography means supply is permanently capped.

The value proposition is about stability and long-term capital preservation. Brighton's average sold price is £428,343, which sits 45% above the national average. That premium exists because the city is physically squeezed between the South Downs and the sea, so they literally cannot build outwards, which protects property values.

Two massive tenant bases drive this market. First, the student population. With the University of Sussex and the University of Brighton both expanding, the city has a constant need for accommodation that the universities alone cannot meet. You can see the scale of the student intake via the University of Sussex Facts & Figures.

Second, the "London exodus" crowd. With trains to Victoria taking under an hour and Gatwick just 30 minutes away, Brighton is the first choice for high-earning commuters who want the coastal lifestyle without giving up their London salaries. This demographic underpins the higher rents in areas like Hove (BN3) and the station quarter (BN1).

The city's population is also on an upward trajectory. According to the latest census data, the population of Brighton and Hove increased by 1.3%, rising from 272,952 in 2011 to 276,454 in 2021. This sustained growth underpins long-term tenant demand. You can explore the breakdown via the ONS Census Data for Brighton and Hove.

If you like the south coast dynamics but need a lower price point, it is worth comparing this market with Hastings, Portsmouth, or Southampton.

Regeneration & Investment in Brighton and Hove

Brighton is constantly evolving with a wave of regeneration designed to boost the local economy and make the city an even better place for tenants to live. For investors, these improvements are crucial as they help sustain property values and tenant demand long into the future.

- Black Rock Rejuvenation is currently transforming the eastern seafront near the Marina. This project focuses on improving infrastructure and creating a new event space that pulls tourism and demand towards the Kemptown (BN2) area. You can see the latest updates on the Council's Black Rock project page.

- Hove Beach Park (formerly the Kingsway to the Sea project) is changing the landscape of BN3. This massive upgrade brings new gardens, sports hubs, and leisure facilities to West Hove which significantly increases the appeal for professional tenants looking for lifestyle perks. Check out the progress at the official Hove Beach Park portal.

- Housing Supply Targets are putting pressure on the council to deliver at least 13,200 new homes by 2030. While "buy backs" and new affordable schemes are in the works, the sheer lack of space between the sea and the South Downs means demand is likely to stay ahead of supply for the foreseeable future. You can read the full strategy in the City Plan Part One.

- Madeira Terrace Restoration sees the city's heritage assets getting a new lease of life. These improvements are not just cosmetic as they sustain Brighton's status as a premium destination which underpins property values for the long term. View the restoration plans on the Madeira Terrace project page.

Brighton & Hove Property Market Analysis

When Was the Last House Price Crash in Brighton & Hove?

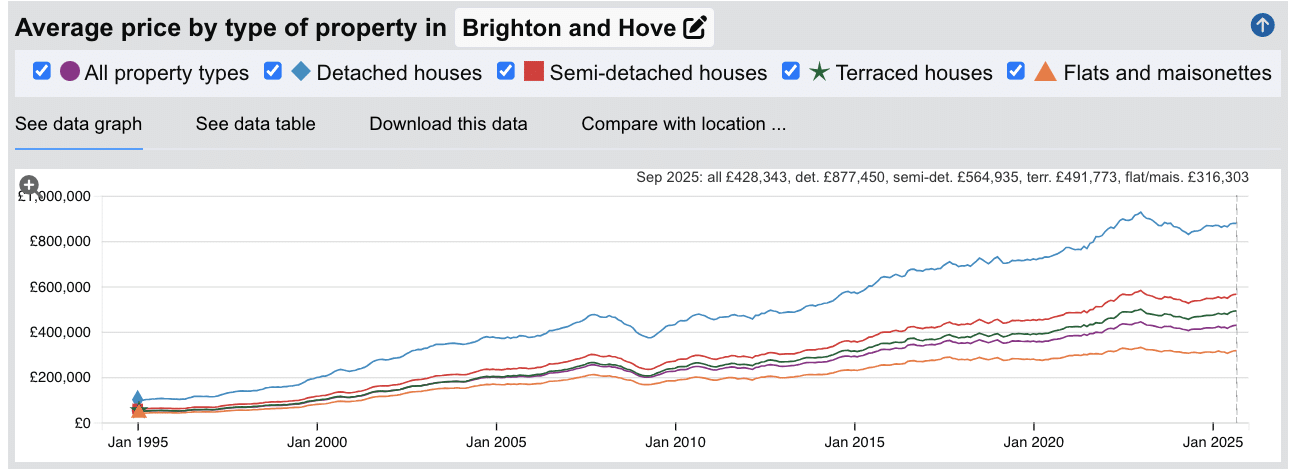

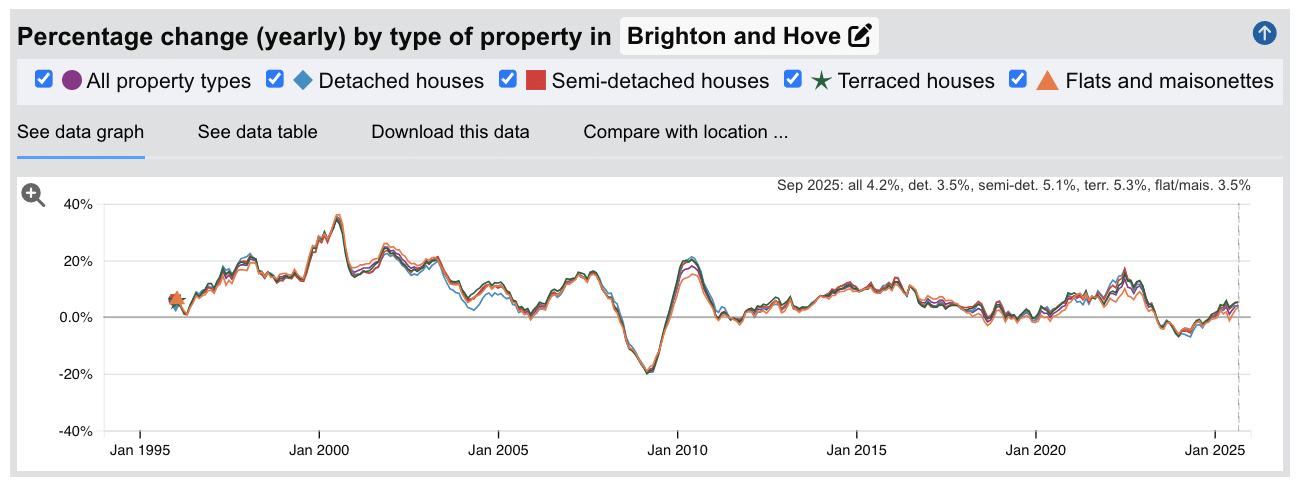

The last time Brighton experienced a significant market shock was during the 2008 global financial crisis. Since then, the city has proven remarkably resilient. We saw a brief correction in 2023 as interest rates climbed, but unlike some other UK markets that are still struggling to find their footing, Brighton has already bounced back with positive growth returning throughout 2024 and continuing into 2025.

Source: HM Land Registry House Price Index for Brighton and Hove

Here is how the market has performed over the key cycles:

- 1995-2005 saw a decade of explosive growth where property values quadrupled, establishing Brighton as a prime commuter hub.

- 2008-2009 brought the financial crisis correction where values dropped by approximately 21% at the lowest point before recovering relatively quickly compared to the north of England.

- 2010-2020 was a period of steady, consistent appreciation averaging solid annual gains as the city cemented its status as a tech and creative hub.

- 2020-2022 delivered the "Pandemic Boom" where the race for space pushed prices to record highs, peaking at over £443,000 in early 2023.

- 2023-2024 saw a necessary market correction of around 8.6% as mortgage rates spiked, cooling the post-pandemic fever.

- 2025 has marked a clear recovery phase. Prices have stabilised and are climbing again, sitting at £428,343 as of September 2025, showing that buyer demand has returned.

Long-Term Property Value Growth in Brighton

For buy-to-let investors, the long-term picture shows exactly why Brighton commands a premium. It delivers sustained capital appreciation over extended holding periods:

- 5 years (2020-2025) 16.7% growth (average prices rising from £367,050 to £428,343)

- 10 years (2015-2025) 36.0% growth (average prices rising from £315,002 to £428,343)

- 15 years (2010-2025) 73.9% growth (average prices rising from £246,380 to £428,343)

- 20 years (2005-2025) 110.9% growth (average prices rising from £203,092 to £428,343)

- 30 years (1995-2025) 726.8% growth (average prices rising from £51,808 to £428,343)

The dip we saw in 2023 was a temporary reaction to national economic headwinds rather than a local failure. The swift return to growth in 2025 demonstrates that the fundamental desire to live in Brighton remains as strong as ever.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Brighton and Hove

The latest sold house price index by the Land Registry confirms Brighton's status as a premium market, with values significantly outpacing the national benchmark.

Brighton property prices average £428,343, which is 44.9% above the England average of £295,670. This premium reflects the intense competition for space in a city where geography limits new supply.

Flats and maisonettes are the most accessible entry point, averaging £316,303. While this is still 40.5% above the national average for flats, it represents the sector with the lowest premium, making it the primary target for investors and first-time buyers. Terraced houses, often the iconic Victorian streets in areas like Hanover and Poets Corner, command a massive 99.7% premium over the national average at £491,773, reflecting their scarcity and enduring popularity.

Semi-detached houses average £564,935 (92.8% above national), while detached houses are a rarity in central Brighton, commanding £877,450—an 84% premium that puts them out of reach for most yield-focused investors but firmly in the sights of capital growth strategies.

Updated November 2025

| Property Type | Brighton Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £877,450 | £476,862 | +84.0% |

| Semi-detached houses | £564,935 | £292,942 | +92.8% |

| Terraced houses | £491,773 | £246,321 | +99.7% |

| Flats and maisonettes | £316,303 | £225,149 | +40.5% |

| All property types | £428,343 | £295,670 | +44.9% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Brighton & Hove

Updated November 2025

The data represents the average asking prices of properties currently listed for sale across Brighton's postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | BN3 (Hove) | £494,199 |

| 2 | BN1 (Brighton Central & North) | £490,745 |

| 3 | BN42 (Southwick) | £477,330 |

| 4 | BN2 (Kemptown & Marina) | £444,099 |

| 5 | BN43 (Shoreham-by-Sea) | £423,610 |

| 6 | BN41 (Portslade) | £399,711 |

Brighton's pricing landscape offers distinct tiers for investors. BN3 (Hove) sits at the top of the market at £494,199, attracting established professionals and families drawn to the regency architecture and the famous "Hove Actually" prestige. Closely following is BN1 at £490,745, which covers the city centre and the prime commuter belt near Preston Park station.

For investors seeking better entry yields, BN2 averages £444,099. This area is the engine room of the student rental market (hosting the universities) and the vibrant Kemptown community, offering a lower purchase price than Hove but often with higher rental density.

The most accessible entry points are found to the west. BN41 (Portslade) is the only postcode dipping under the £400k mark at £399,711, making it a primary target for first-time investors or those looking to maximise value while staying connected to the city network.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Brighton & Hove (£)

Updated November 2025

The data represents the average price per square foot across Brighton's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | BN3 (Hove) | £534 |

| 2 | BN1 (Brighton Central & North) | £510 |

| 3 | BN2 (Kemptown & Marina) | £480 |

| 4 | BN43 (Shoreham-by-Sea) | £447 |

| 5 | BN41 (Portslade) | £440 |

| 6 | BN42 (Southwick) | £411 |

This metric reveals the true "premium" cost of Brighton's most popular addresses. BN3 (Hove) commands the highest density value at £534 per sq ft, largely due to the prevalence of high-ceilinged Regency apartments and period conversions that carry a significant status premium.

Interestingly, the gap between the city centre (BN1 at £510) and the eastern coastal strip (BN2 at £480) suggests that Kemptown offers slightly better value for money if you are looking for square footage near the sea.

For investors focused on maximising space—perhaps for HMO conversions or family lets—the data points firmly to the west. BN42 (Southwick) at £411 per sq ft offers a substantial discount, effectively giving you over £100 per sq ft more value compared to central Hove, just a few stops away on the train.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Brighton & Hove (%)

Updated November 2025

The data represents the average house price growth over the past five years, calculated using postcode-level data blending sold prices and asking prices to identify the highest performing areas.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | BN42 (Southwick) | 29.4% |

| 2 | BN3 (Hove) | 20.5% |

| 3 | BN1 (Brighton Central & North) | 19.2% |

| 4 | BN41 (Portslade) | 17.4% |

| 5 | BN2 (Kemptown & Marina) | 12.4% |

| 6 | BN43 (Shoreham-by-Sea) | 7.2% |

The data reveals a fascinating trend for investors: the highest capital appreciation hasn't come from the famous city centre, but from the "next town over." BN42 (Southwick) has delivered a remarkable 29.4% growth over five years. This is a classic "ripple effect" where buyers priced out of Hove moved just across the border to find better value, pushing up prices significantly.

BN3 (Hove) and BN1 (Brighton Central) have proved their resilience as "blue chip" locations, delivering solid, steady growth of 20.5% and 19.2% respectively. These areas rarely see dramatic spikes or crashes; they just steadily tick upwards due to consistent demand.

In contrast, BN2 has seen more modest growth of 12.4%, potentially due to a saturation of student properties and flats which haven't seen the same post-pandemic demand surge as family homes with gardens in the west.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Brighton & Hove

Updated November 2025

The data represents the average number of residential property sales per month across Brighton's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | BN3 (Hove) | 47 |

| 2 | BN2 (Kemptown & Marina) | 45 |

| 3 | BN1 (Brighton Central & North) | 41 |

| 4 | BN43 (Shoreham-by-Sea) | 13 |

| 5 | BN41 (Portslade) | 8 |

| 6 | BN42 (Southwick) | 5 |

For investors, volume is vanity, but liquidity is sanity. The data shows an incredibly active market in the core three postcodes. BN3 (Hove) tops the list with 47 sales per month, proving that despite the high price point, there is no shortage of buyers ready to transact. BN2 and BN1 follow closely, creating a "liquid core" where properties rarely stick on the market if priced correctly.

In contrast, the outer areas like BN41 and BN42 see much lower transaction volumes (8 and 5 per month respectively). This is not necessarily a sign of low demand, but rather low stock turnover—people who buy in these affordable pockets tend to stay put, which can frustrate investors looking for quick acquisitions but bodes well for long-term tenant retention.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: November 2025. All data is presented as provided by our sources without adjustments or amendments.

Brighton & Hove Rental Market Analysis

For first-time buyers buying their first rental property in the vibrant coastal city of Brighton and thinking how much they can charge for rent across the city centre and its diverse neighbourhoods, the rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for their AST buy to lets. This is helpful if you are considering how to start a property portfolio in this area.

Rental Prices in Brighton & Hove (£)

Updated November 2025

The data represents the average monthly rent for long-let AST properties in Brighton.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | BN2 (Kemptown & Marina) | £1,990 |

| 2 | BN3 (Hove) | £1,709 |

| 3 | BN1 (Brighton Central & North) | £1,610 |

| 4 | BN41 (Portslade) | £1,610 |

| 5 | BN43 (Shoreham-by-Sea) | £1,451 |

BN2 (Kemptown & Marina) commands the city's highest average rents at £1,990. This figure is driven by a "perfect storm" of demand: high-spec apartments in the Marina attracting wealthy professionals, combined with large student HMOs closer to the universities which command significant rent-per-room income.

BN3 (Hove) follows at £1,709, reflecting the premium family rental market where tenants pay for the lifestyle and regency architecture. Perhaps the most interesting takeaway for investors is BN41 (Portslade). Despite being an "outer" area with much lower property prices than the city centre, it achieves the exact same average monthly rent as BN1 (£1,610). This disparity between high rent and lower entry price is exactly why Portslade is becoming a yield hotspot.

Note: These figures represent average rents across all property types. Actual achievable rents vary based on property size, condition, and specific location.

Gross Rental Yields in Brighton & Hove (%)

Updated November 2025

The data represents the average gross rental yields across Brighton's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | BN2 (Kemptown & Marina) | 5.4% |

| 2 | BN41 (Portslade) | 4.8% |

| 3 | BN3 (Hove) | 4.1% |

| 4 | BN43 (Shoreham-by-Sea) | 4.1% |

| 5 | BN1 (Brighton Central & North) | 3.9% |

Ideally, investors look for yields above 5%, and BN2 (Kemptown) delivers this with an average of 5.4%. This area offers the sweet spot of high student density and premium coastal living, driving up rental income relative to purchase price.

BN41 (Portslade) is the standout performer for those with a lower budget. Achieving 4.8% yields, it offers a strong return on investment without the premium price tag of central Brighton. Meanwhile, BN1 and BN3 offer lower yields of 3.9% and 4.1%, which is typical for "blue chip" locations where the primary investment focus is often long-term capital preservation and growth rather than immediate cash flow.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy to let ownership costs.

Is Brighton & Hove Rent High?

Brighton's rental market is notoriously competitive. The high demand from students and professionals pushes prices up, meaning tenants commit a significant portion of their salary to rent compared to other UK cities.

Average rent in Brighton costs between 54% and 74% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Brighton residents is £32,226 (based on £619.70 per week).

The highest-rent postcode, BN2, requires 74.1% of the median local income, driven by the dual pressure of student HMOs and luxury marina apartments. In contrast, postcodes like BN43 offer relatively better value, though still requiring 54% of the average wage, reflecting the premium nature of the entire coastal strip.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | BN2 (Kemptown & Marina) | 74.1% |

| 2 | BN3 (Hove) | 63.6% |

| 3 | BN1 (Brighton Central & North) | 60.0% |

| 4 | BN41 (Portslade) | 60.0% |

| 5 | BN43 (Shoreham-by-Sea) | 54.0% |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Brighton & Hove House Prices High?

For a local property buyer on average mean full-time earnings, the gap between wages and property values in Brighton is significant.

Purchasing a property in Brighton requires between 12.4 and 15.3 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Brighton residents is £32,226.

The most expensive area relative to income is BN3 (Hove), requiring 15.3 times the average salary, reflecting its status as a prime location for established wealth. Even the most accessible postcode, BN41 (Portslade), requires 12.4 times earnings, which is well above the national average and underscores why the rental market is so essential for the local workforce.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | BN3 (Hove) | 15.3x |

| 2 | BN1 (Brighton Central) | 15.2x |

| 3 | BN42 (Southwick) | 14.8x |

| 4 | BN2 (Kemptown) | 13.8x |

| 5 | BN43 (Shoreham-by-Sea) | 13.1x |

| 6 | BN41 (Portslade) | 12.4x |

Compared to nearby locations, Brighton sits at the top of the price pyramid. For investors or tenants priced out of this market, nearby coastal towns offer a discount. Hastings and Eastbourne provide significantly lower entry points, while Worthing offers a similar coastal lifestyle at a reduced premium.

How Much Deposit to Buy a House in Brighton & Hove?

Assuming a standard 30% deposit for a buy-to-let mortgage, while the city average is high, the data shows a nearly £30,000 difference between the most accessible and most expensive areas.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | BN41 (Portslade) | £119,913 |

| 2 | BN43 (Shoreham-by-Sea) | £127,083 |

| 3 | BN2 (Kemptown & Marina) | £133,230 |

| 4 | BN42 (Southwick) | £143,199 |

| 5 | BN1 (Brighton Central & North) | £147,224 |

| 6 | BN3 (Hove) | £148,260 |

If you are new to the market, BN41 (Portslade) offers the most affordable way to get on the Brighton property ladder, requiring a deposit of £119,913. Crucially, this area still delivers strong yields (4.8%), making it highly efficient for capital deployment.

At the other end of the scale, BN3 (Hove) and BN1 (Central) require deposits approaching £150,000. For this level of capital commitment, investors are primarily buying into "blue chip" stability and long-term appreciation rather than immediate cash flow, with many places around the country offering lower prices and higher yields.

How to Invest in Buy-to-Let in Brighton & Hove

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Brighton, Sussex and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Brighton and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Brighton for Buy-to-Let Investment

For investors seeking similar coastal dynamics, buy-to-let in Bournemouth offers a comparable mix of sandy beaches and student demand (home to two universities) often at a slightly more accessible price point. If the heritage appeal is your primary driver, buy-to-let in Chichester provides a premium cathedral city environment with high tenant stability.

Or to understand the wider regional market, see our guide to buy-to-let across Kent and the South East.