Buying a Rental Property: Is Buy-to-Let Worth It?

Buy-to-let investing has been a popular strategy in the UK property market for decades. Since its boom in the late 1990s with the introduction of buy-to-let mortgage products, it has offered investors the opportunity to generate income through rental payments while potentially benefiting from long-term capital appreciation.

This combination of returns interested both new investors wishing to get a foot on the housing ladder with their first asset, as well as larger-scale landlords and investors aiming to build significant portfolios.

However, the landscape for buy-to-let investors has changed significantly in recent years, with successive governments bringing in a swathe of regulation changes, epc compliance and tax on buy-to-let, with some people seeing many of these changes as a cynical government cash grab, whilst others see underlying changes helping to improve the housing stock across the nation.

Prompting many to question;

Is buy-to-let still a viable investment option for the small-time landlord or new investors?

So is buy-to-let still worth it, and if it is, should you buy one property, consider owning two property investments, or build a portfolio for the future?

Article Updated: September 2025

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

The Current State of UK Buy-to-Let

The buy-to-let market in the UK presents a mixed picture, with many saying buy-to-let is struggling or in a period of decline.

However, when you look across capital growth, rental inflation, and buyer demand it paints a somewhat different picture. The best cities to invest in UK property have achieved their highest returns for landlords for over a decade, with record-high rents and impressive rental returns.

Rental demand consistently outstrips supply. According to a recent Zoopla rental market report, inflation in property rents is on track for a 3-4% increase in 2025.

You can see the significance of the rental demand is putting pressure on affordable housing for tenants.

So what does that mean for the future of buy-to-let? Is it still worth it? Are house prices still affordable? Or is this current government likely to pour cold water on the industry?

Access our selection of exclusive, high-yielding, residential investment property deals and a personal consultant to guide you through your options.

Is Buy-to-Let Still Worthwhile?

The question of whether buy-to-let is still worth it depends on various factors. Putting the financial aspects to one side for a moment.

Comparing today’s landlord requirements to those back in 1980 or 2000 is a world away.

There is more and more pressure on landlords to adhere to ever-increasing compliance, legislation and regulations.

This is no longer a part-time focus. You either need to be a professional landlord, full-time in the management of your own properties or you must have an experienced team behind you and use professional letting agents.

Thankfully, this is simpler than it sounds, with many options for highly qualified and vetted letting agents and refurbishment teams that are up-to-date on the latest tenant requirements.

Once you have this base covered. The financial fundamentals are still pretty sound.

Housing is a basic need, and unfortunately, the facts are that we are simply not building enough properties across the UK in the right areas for our population.

This lack of supply is putting significant pressure on demand from a growing number of tenants and homeowners.

House price growth is variable but trending up. Rental inflation, as mentioned, is very high and demand is strong across the country, with the major cities, like Manchester, Birmingham and our capital London, experiencing exceptional demand from homeowners, investors and tenants.

Advantages of Buy-to-Let

- Rental Income: With average rents rising significantly, there are plenty of good property investment areas in the UK, with many under £150,000.

- Capital Growth: Despite recent stagnation, property has historically shown consistent long-term appreciation over a long enough period, providing some confidence for the future.

- Diversification: Property can serve as a way to diversify an investment portfolio. Compared to stocks and shares, it might not be as attractive as pure yields, but the combination of growth and yields, whilst the option to increase both of these with leverage is appealing.

- Tangible Asset: Unlike stocks or bonds, property is a physical asset you can see, touch and own.

- Leverage: Buy-to-let allows investors to use mortgage financing to purchase a more valuable asset than they could with cash alone.

Disadvantages of Buy-to-Let

- Increased Costs: Recent tax changes, higher mortgage rates, and increased regulatory compliance costs have reduced profitability for many landlords.

- Regulatory Risks: The sector faces ongoing regulatory changes, such as the Renters' Rights Bill, which will increase landlord responsibilities.

- Market Volatility: Property prices can fluctuate, and there's no guarantee of capital growth. A successful buy-to-let portfolio needs to be built on a foundation of good cash flow.

- Illiquid Asset: Property can be difficult to sell quickly if you need to access your capital. This is often overlooked but can be a significant factor when considering your options, as it can take much longer to sell than many other assets.

- Management Responsibilities: Being a landlord involves ongoing responsibilities and potential stress in dealing with tenants and property maintenance. Even with letting agents in place, you will still be dealing with the ongoing requirements that being a landlord entails, and you are ultimately responsible for your asset.

How to Make Money from Buy-to-Let

Simply put, there are 4 ways to make money with a residential buy-to-let property.

- Buying the property below market value at a discount

- Renting the property out and earning rental income

- Capital appreciation with property price growth over time

- Adding value with a small refurbishment or significant value add with preparation, a planning performance agreement or full-scale development.

As always,

The price of any asset (and the ability to make money from it) depends to a great extent on both the supply of it and the demand for it.

Property is no different and when looking at the current UK property market cycle, the supply and demand fundamentals are very strong.

The simple reason demand is so high is that the UK population has grown by 3.7 million over the last ten years, and it is estimated to grow by another 2.2 million in the next ten years. (Source: ONS)

Yet the simple reason supply is so constricted is that the UK has been estimated to need around 300,000 new homes every year, as a nation, we are way below this target, with some local authorities significantly behind.

In England in 2022-2023, the country only delivered 234,00 net new dwellings.

These simple supply and demand fundamentals across the UK market support the argument that property prices will likely continue to rise in the long-term future.

As Mark Twain is credited with saying: “Buy land, they’re not making it anymore.”

Is Buy-to-Let a Good Investment?

Like any asset, property (and therefore buy-to-lets) can go down in price as well as up.

Rather than trying to predict what will happen with a crystal ball in the future, it is best to look at the historical property data of what has happened in the past, as a guide, to see if historically, buy-to-let has been a good investment.

Thankfully, in the UK, this is easy to do with sold house prices available as public record.

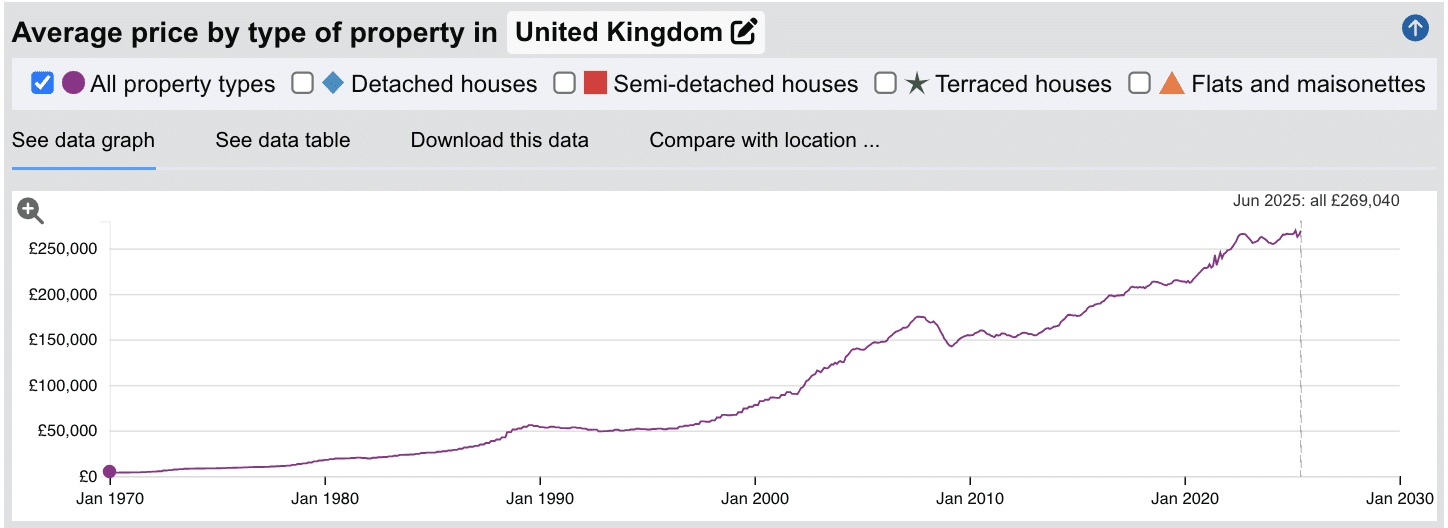

- In January 1970 the average UK house was worth just £3,611.

- In January 1980 the average UK house was worth £17,754.

- In January 1990 the average UK house was worth £53,658.

- In January 2000 the average UK house was worth £77,950.

- In January 2010 the average UK house was worth £154,268,.

- In January 2020 the average UK house was worth £213,657.

- In January 2025 the average UK house was now worth £266,553.

So, in the timeline of 55 years, UK house prices have increased by over £262,942.

Significantly outpacing standard UK inflation.

Recent Changes in Buy-to-Let

It is no secret that the buy-to-let sector has undergone significant changes in recent years, affecting both new and existing landlords.

Our view is that these can be summed up as net positive for the industry, when you consider buyers, sellers, tenants and landlords as a whole.

Change isn’t always all positive, and there are certainly some changes that have hit small landlords hard. However, below we look at these changes piece by piece and their impact as a whole.

Legislative Changes:

The Renters' Rights Bill. Key provisions include:

- Banning Section 21 'no-fault' evictions

- Extending Awaab's Law to the private sector, requiring landlords to investigate and fix reported health hazards within specified timeframes

- Ending fixed-term tenancies, with all tenancies moving to a rolling basis

- Changes to rules around rent increases and notice periods

-

Tax Changes:

- Since 2020/2021 tax year, landlords can no longer deduct mortgage interest from rental income before calculating tax. Instead, they receive a tax credit based on 20% of mortgage interest payments.

- Capital Gains Tax (CGT) on property was reduced in April 2024 from 28% to 24% for higher and additional-rate taxpayers.

- The CGT allowance was cut to £3,000 from April 2024, potentially increasing tax bills when selling properties.

Stamp Duty:

- A 3% surcharge on limited company stamp duty and for additional properties, including buy-to-let, was introduced in April 2016.

Mortgage Stress Tests:

- Lenders have become more stringent in their affordability assessments specifically for landlords. Often requiring rental income to be at least 125% to 135% of the monthly interest-only mortgage payment amount to ensure there is enough affordability and cashflow.

- Some lenders now factor in much higher mortgage rates when assessing affordability, known as "stress testing".

Landlord Compliance & Responsibilities:

- Landlords face increased responsibilities and potential costs related to property maintenance, energy efficiency standards, and tenant safety.

The Future of Buy-to-Let in the UK

Property strategists may be considering whether buy-to-let is still the best option, or if they should consider something a little more hands-on, like investing in holiday homes or buying an Airbnb.

For less management-intensive strategies yet with strong yields, landlords could also consider becoming a student HMO landlord and purchasing a ready-to-go student let, increasing the rental yields and returns when compared with family rentals.

However, landlords can reduce their property risk by keeping things simple and sticking with mainstream buy-to-lets.

Looking ahead, many of the planned changes to the rental market have come in recent years, meaning now could be a great time to get started building a property portfolio with foundations for the long term.

Housing demand is stronger than ever, and a focus on 3 core principles will help future landlords easily answer the question of "is buy to let still worth it?"

- Focus on a quality area. Carry out significant research and look at the latest data (examples like the Manchester housing market and the Birmingham housing market).

- Have a business plan that clearly outlines your resources, your goals and the steps required to achieve them. Knowing how to start a real estate business properly is important. Knowing how to scale it is more so.

- Budget accurately. Consider exploring new locations or alternative rental strategies if the asset costs are too high for your local market.

FAQ of Buying a Rental Property

Q: What is buy-to-let?

A: Buy-to-let refers to the practice of purchasing a property specifically to rent it out to tenants, rather than living in it yourself. It's an investment strategy aimed at generating rental income and potential capital growth.

Q: What is a single let?

A: A single let refers to a property rented out to a single tenant or household under one tenancy agreement. This is the most common form of buy-to-let, where the entire property is let as one unit.

Q: Can a first-time buyer purchase a buy-to-let?

A: Yes of course. There is nothing stopping you from your first property purchase being a buy to let investment property. However, financing might be a bit stricter, and you may have limited options for mortgages, so speaking with your mortgage broker early in the process will help you get a clear idea of what the options are, how much you can leverage and what that means for your overall buy-to-let costs.

Conclusion

While buying rental properties and specifically buy-to-let investing in the UK has become more challenging in recent years due to regulatory changes, tax reforms, and market conditions, the consistent and high demand from tenants means it can still have growth prospects and strong rental returns.

The key to success in today's market lies in thorough local market research, strategic property selection, efficient management, and the ability to adapt to changing regulations.

Investors must carefully weigh the potential for rental income and capital growth when buying rental property against the increased buy-to-let costs and responsibilities of being a landlord.

You should ask yourself,

- Is this an industry you wish to be in for the long term?

- Do you have a strong desire to consistently improve the quality of your properties for yourself and your tenants?

- Can you afford to cover empty periods, maintenance and unforeseen costs?

- What does success look like and how will you know when you have achieved it?

Essentially, list all the pros and cons and be clear on your investment goals.

A long-term focus is needed, and for investors with a long-term plan, buy-to-let can still offer brilliant opportunities for a steady income and generational wealth building.