Where to Buy Property Investments in Colchester: Yields of 5.7%

Colchester delivers rental yields of 5.7% in CO1, with direct trains to London Liverpool Street in under 55 minutes. For a property investment in the commuter belt, those fundamentals work.

The latest property data shows where Colchester sits in the market. Average asking prices of £226,379 in CO1 sit 22% below the England average of £291,515, and 33% below the East of England average of £340,037. For Essex, that represents genuine value.

Our buy-to-let analysis examines Colchester's seven postcode districts, evaluating capital growth, rental yields, and investment potential across this historic city and its surrounding villages.

Article updated: January 2026

Colchester Buy-to-Let Market Overview 2026

Colchester's property market delivers asking prices broadly in line with the England average, with the urban postcodes offering yields above 5% for buy-to-let investors seeking London commuter belt opportunities:

- Asking price range: £226,379 (CO1) to £470,641 (CO6) across Colchester postcodes

- Rental yields: 3.2% (CO5) to 5.7% (CO1) across different postcodes

- Rental income: Monthly rents from £1,071 (CO1) to £1,450 (CO4)

- Price per sq ft: House prices from £301/sq ft (CO1) to £376/sq ft (CO5)

- Market activity: Sales ranging from 27 per month (CO1) to 53 per month (CO4)

- Deposit requirements: 30% deposits range from £67,914 (CO1) to £141,192 (CO6)

- Affordability ratios: Property prices from 5.7 to 11.8 times Colchester's median annual salary of £39,863

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Colchester?

Colchester offers something increasingly rare in the South East: entry prices below the national average with yields above 5%. The urban postcodes CO1 and CO2 deliver 5.7% and 5.3% respectively, while sitting 22% and 6% below the England average price. For investors priced out of Cambridge or Chelmsford, Colchester is where the numbers actually work.

The employment base here is broader than a typical commuter town. Health and social care accounts for 18.4% of jobs, anchored by Colchester Hospital. Education adds 13.8%, with the University of Essex employing a significant local workforce. Retail and wholesale contributes 16.1%. These aren't sectors that disappear when London sneezes. You can see the full breakdown via the Nomis Labour Market Profile for Colchester.

London commuters form the obvious tenant pool. Greater Anglia runs direct services to Liverpool Street in 50-55 minutes, putting Colchester at the outer edge of practical daily commuting. But that's actually become an advantage. Hybrid working patterns mean tenants doing 2-3 days in London now prioritise space over proximity. Colchester delivers more square footage for the rent than anywhere closer in.

The military adds a demand layer most investors miss. Colchester Garrison houses several thousand personnel, with families needing rental accommodation on posting timescales. It's consistent, predictable demand that doesn't correlate with the London job market.

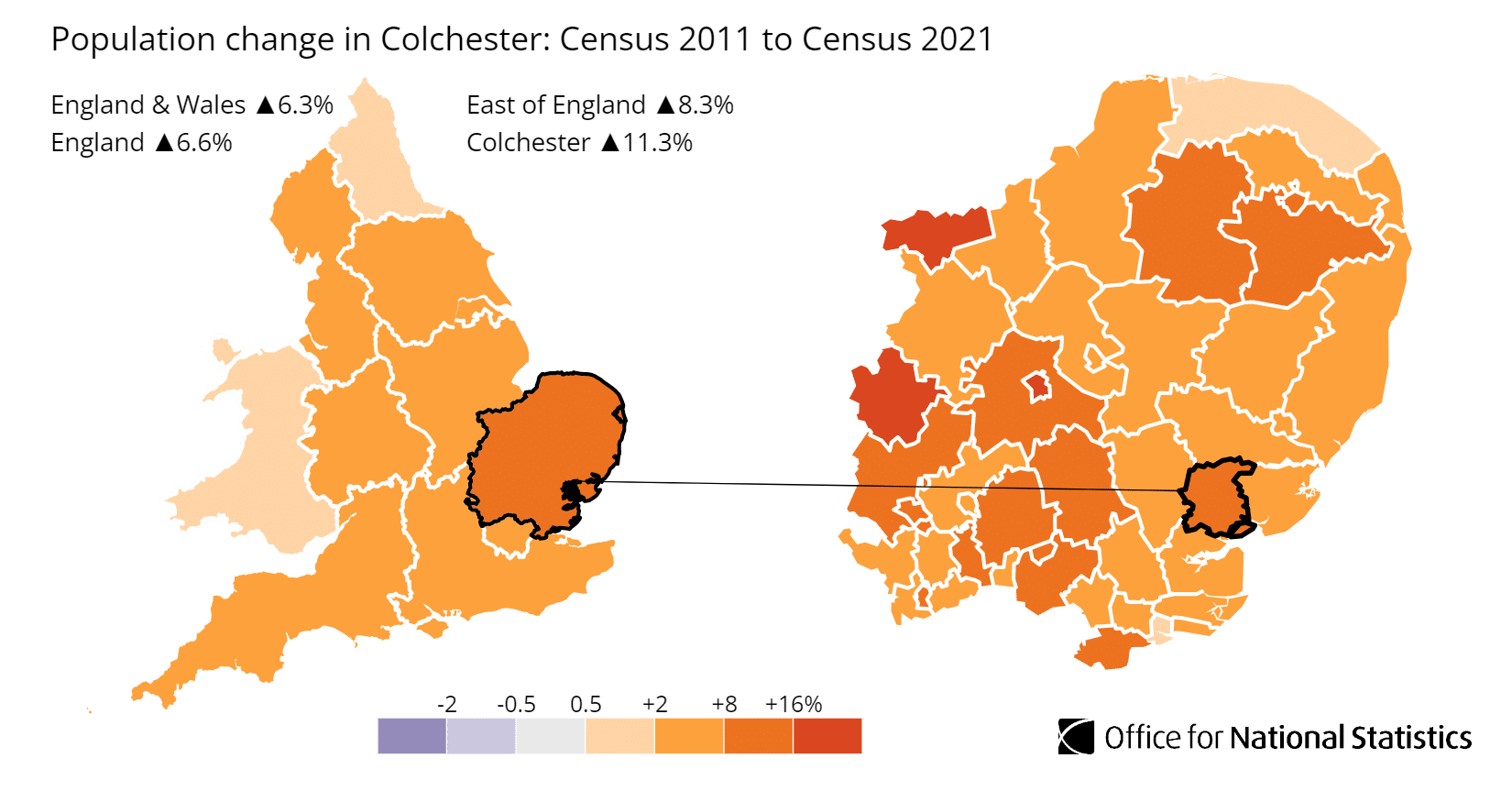

Population growth tells the underlying story. According to the latest census, Colchester's population increased by 11.3%, rising from 173,100 in 2011 to 192,700 in 2021. That outpaces both the East of England (8.3%) and England overall (6.6%). New developments continue expanding the city, particularly around CO4 to the north. You can explore the data via the ONS Census Data for Colchester.

For comparable markets, Ipswich sits 20 miles north with similar pricing and regeneration momentum. Chelmsford offers faster London trains but entry prices run 30% higher. Cambridge commands tech-hub premiums where yields compress below 4%.

Regeneration and Investment in Colchester

Colchester secured City Status in 2022. Since then, the focus has shifted from suburban expansion to city-centre consolidation. Several major projects are now moving from planning into delivery, with real implications for where rental demand concentrates.

St Botolph's Quarter represents the most tangible city-centre improvement. In August 2025, a formal planning application was submitted for the £7m transformation of the Britannia Car Park and St Botolph's Priory area. The project creates a new public square and heritage trail linking Colchester Town station directly to the castle. Construction is scheduled for Spring 2026. For investors, this matters because it improves the southern gateway to the city centre, potentially lifting values in the CO1 fringe around Vineyard Street. Updates via Colchester City Council.

The University of Essex Southend closure changes the student accommodation picture significantly. In December 2025, the University announced it will close its Southend campus by August 2026, with around 800 students transferring to the Colchester campus. The closure follows a 52% drop in international student numbers at Southend since 2021. For investors, this creates immediate pressure on HMO and student accommodation in CO4, particularly the Greenstead and Wivenhoe corridors near the main campus. The University's FAQ page has details: University of Essex.

The Rapid Transit System is taking shape, though progress has been uneven. The Northern Approach bus lane opened in October 2025, cutting Park and Ride journey times into the city centre to around 13 minutes. The Clingoe Hill section remains delayed. The full rapid transit service connecting the city centre to the planned Garden Community won't operate until housing is occupied there. For now, the Northern Approach improvements benefit the CO4 northern corridor.

The Tendring Colchester Borders Garden Community is the long-term growth engine. In May and June 2025, both councils formally adopted the Development Plan Document, cementing the masterplan for 7,500 homes on the Tendring-Colchester border near the University. The A120-A133 link road is under construction. This is a 20-year project, so don't expect immediate impact on rental demand. But it signals where the city is heading and will eventually create new tenant pools as phases complete. Full details at Tendring District Council.

Colchester Property Market Analysis

When Was the Last House Price Crash in Colchester?

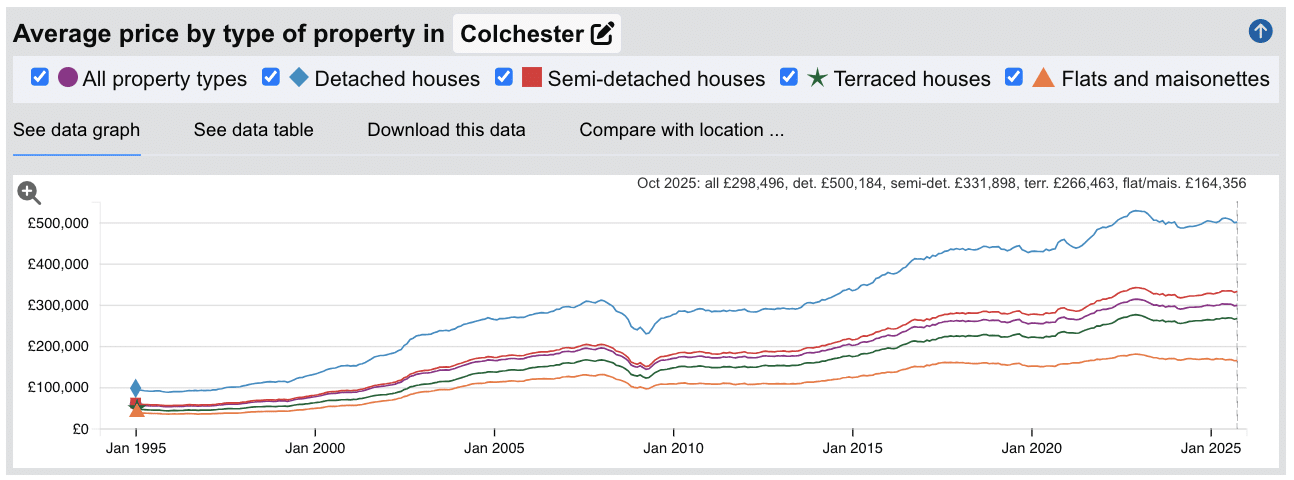

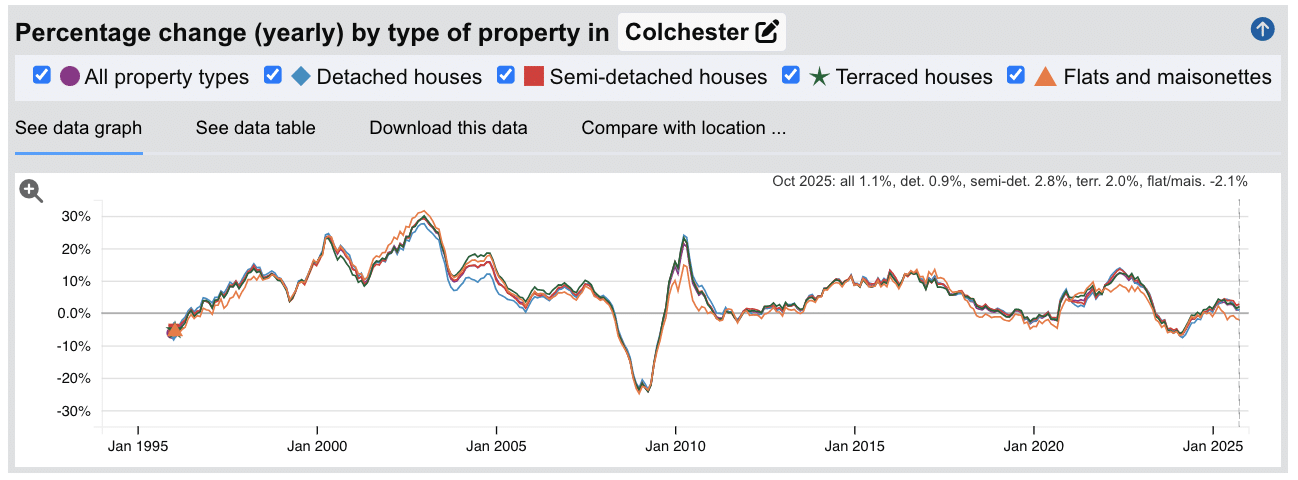

The last significant market correction in Colchester came during the 2008 financial crisis. The city experienced a 26.7% peak-to-trough decline, with average prices falling from £195,177 in January 2008 to £143,042 by April 2009. This was steeper than many northern markets, reflecting the South East's greater exposure to mortgage lending conditions. Recovery took longer here. Prices did not return to pre-crash levels until mid-2014.

Source: HM Land Registry House Price Index for Colchester

Here is how the market has performed over the key cycles:

- 1995-2007 saw property values more than triple, rising from around £56,600 to over £194,000 as the national boom lifted all markets.

- 2008-2009 brought the financial crisis correction where values dropped by 26.7% at the lowest point. This was notably deeper than northern markets like Carlisle (12.2%), reflecting the South East's sensitivity to credit conditions.

- 2010-2019 was a decade of recovery and growth, with prices climbing steadily from £170,000 to £264,000 before a brief dip in late 2019.

- 2020-2022 delivered the pandemic-driven surge. Prices climbed from £254,000 to over £313,000 as buyers sought space outside London.

- 2023 saw a correction of around 6.2% as mortgage rates spiked, cooling the post-pandemic momentum.

- 2024-2025 has seen gradual stabilisation. Prices have recovered to £298,496 as of October 2025, with modest year-on-year growth of 1.1%.

Long-Term Property Value Growth in Colchester

For buy-to-let investors focused on capital preservation and steady appreciation, the long-term trajectory shows consistent gains:

- 5 years (2020-2025): 12.5% growth (average prices rising from £265,784 to £298,496)

- 10 years (2015-2025): 36.3% growth (average prices rising from £219,021 to £298,496)

- 15 years (2010-2025): 70.1% growth (average prices rising from £175,502 to £298,496)

- 20 years (2005-2025): 76.9% growth (average prices rising from £168,718 to £298,496)

- 30 years (1995-2025): 427.4% growth (average prices rising from £56,599 to £298,496)

The deeper 2008 correction and moderate 2023 dip reflect Colchester's position in the South East property cycle. This is not a low-volatility market like some northern cities. It moves with the wider regional economy and London commuter demand. For investors, this means greater upside potential but also more exposure to credit cycles and interest rate shifts.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Colchester

The latest sold house price index by the Land Registry shows Colchester sitting close to the England average but notably below the East of England regional benchmark. For investors, this positions the city as relative value within the South East commuter belt.

Colchester property prices average £298,496, which is 2.4% above the England average of £291,515 but 12.2% below the East of England average of £340,037. This regional discount is where the opportunity lies. You get South East fundamentals at prices closer to the Midlands.

Terraced houses average £266,463, sitting 9.2% above the national average but 7.9% below the regional figure. These dominate the rental stock in urban postcodes like CO1 and CO2, delivering the strongest yields. Semi-detached houses average £331,898, running 14.5% above the England average but 6.6% below the East of England, offering family-sized accommodation at a regional discount.

Detached houses average £500,184, which is 6.4% above the England average but 5.0% below the regional benchmark. These are concentrated in the outer postcodes (CO3, CO5, CO6) where owner-occupier demand dominates. Flats and maisonettes present the sharpest value at £164,356, a striking 25.0% below the England average and 14.9% below the regional figure, reflecting older apartment stock in the city centre.

Updated January 2026

| Property Type | Colchester Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £500,184 | £470,151 | +6.4% |

| Semi-detached houses | £331,898 | £289,909 | +14.5% |

| Terraced houses | £266,463 | £243,978 | +9.2% |

| Flats and maisonettes | £164,356 | £219,065 | -25.0% |

| All property types | £298,496 | £291,515 | +2.4% |

The flat discount is worth noting. Colchester's apartment stock skews older, with fewer premium new-builds than nearby Chelmsford. For investors, this means lower entry prices but also properties that may need updating. The terraced and semi-detached segments align more closely with national pricing, reflecting steady demand from both owner-occupiers and landlords.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Colchester

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Colchester's postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | CO6 (Earls Colne, Halstead, Rural West) | £470,641 |

| 2 | CO5 (Tiptree, Mersea Island, Rural South) | £436,064 |

| 3 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | £409,011 |

| 4 | CO3 (Lexden, Stanway, West Colchester) | £362,381 |

| 5 | CO4 (University, Greenstead, North Colchester) | £316,294 |

| 6 | CO2 (Shrub End, Berechurch, South Colchester) | £273,314 |

| 7 | CO1 (City Centre, Old Town, Hythe) | £226,379 |

Colchester's pricing follows a familiar pattern: rural and coastal postcodes command premiums while urban areas offer entry points for investors. The rural west (CO6) and south (CO5) average over £435,000, driven by detached village properties in places like Earls Colne, Tiptree, and Mersea Island. These attract owner-occupiers, not landlords.

CO7 (Wivenhoe, Brightlingsea) sits at £409,011, covering the coastal and estuary communities east of the city. Wivenhoe has particular character as a former fishing village with a strong arts community, though its proximity to the University of Essex creates some student rental demand at the lower end.

CO3 (Lexden, Stanway) at £362,381 represents Colchester's premium suburban belt to the west. This is established family territory with good schools and easy A12 access, skewing heavily toward owner-occupiers.

For yield-focused investors, the urban postcodes offer the strongest value. CO4 at £316,294 covers the University of Essex catchment and northern suburbs including Greenstead, combining student demand with family housing. CO2 at £273,314 covers the southern suburbs like Shrub End and Berechurch, delivering solid yields with less student exposure. CO1 is the most affordable at £226,379, covering the city centre, Old Town, and Hythe areas where Victorian terraces and older flats provide entry points under £200,000.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Colchester (£)

Updated January 2026

The data represents the average price per square foot across Colchester's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | CO5 (Tiptree, Mersea Island, Rural South) | £376 |

| 2 | CO6 (Earls Colne, Halstead, Rural West) | £365 |

| 3 | CO3 (Lexden, Stanway, West Colchester) | £360 |

| 4 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | £350 |

| 5 | CO4 (University, Greenstead, North Colchester) | £333 |

| 6 | CO2 (Shrub End, Berechurch, South Colchester) | £319 |

| 7 | CO1 (City Centre, Old Town, Hythe) | £301 |

For context, Brighton averages over £450 per square foot. Colchester's most expensive postcode, CO5, comes in at £376. You get roughly 20% more space for your money in Colchester compared to the south coast, though the gap is narrower than northern markets like Carlisle where £150 per square foot is achievable.

The rural postcodes CO5 and CO6 command the highest price per square foot despite having the largest properties. This reflects the premium for village life in places like Tiptree, Mersea Island, and Earls Colne, where buyers pay for character, gardens, and the Essex countryside.

For investors focused on maximising rental space, the urban postcodes offer better value. CO1 at £301 per square foot is where you get the most property for your deposit. A £68,000 deposit (30% on a £226,000 property) buys roughly 750 sq ft of living space in CO1, compared to around 580 sq ft in CO5 for a £130,000 deposit.

CO2 at £319 per sq ft offers a middle ground for yield-focused investors. You get reasonable space at more affordable prices than the premium suburbs, combined with solid yields of 5.3%.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Colchester (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| CO2 (Shrub End, Berechurch, South Colchester) | -1.5% | +1.8% | +20.7% |

| CO3 (Lexden, Stanway, West Colchester) | +2.6% | +3.5% | +17.9% |

| CO1 (City Centre, Old Town, Hythe) | -0.8% | -8.3% | +14.7% |

| CO5 (Tiptree, Mersea Island, Rural South) | -0.4% | -1.9% | +13.2% |

| CO4 (University, Greenstead, North Colchester) | +3.9% | +3.1% | +12.1% |

| CO7 (Wivenhoe, Brightlingsea, Coastal East) | -4.1% | -6.1% | +10.0% |

| CO6 (Earls Colne, Halstead, Rural West) | +5.2% | -2.5% | +4.8% |

The numbers reveal a mixed picture, with recent softening across several postcodes but solid five-year gains overall. CO2 (Shrub End, Berechurch) leads with +20.7% over five years, despite a modest pullback of 1.5% in the past year. CO3 (Lexden, Stanway) follows at +17.9%, with recent one-year growth of +2.6% suggesting continued momentum in this premium suburban belt.

The urban postcodes show diverging patterns. CO1 (City Centre) has delivered +14.7% over five years but has softened recently, down 0.8% over one year and 8.3% over three years. However, this postcode offers the highest yields in Colchester at 5.7%, making it attractive for income-focused investors willing to accept flatter capital appreciation. CO4 (University, Greenstead) has delivered consistent growth across all timeframes, with +3.9% over the past year and +12.1% over five years, benefiting from University demand and the northern growth corridor.

The coastal and rural postcodes have softened recently. CO5 (Tiptree, Mersea) shows modest recent declines but solid longer-term gains of +13.2%. CO7 (Wivenhoe, Brightlingsea) is down 4.1% over the past year and 6.1% over three years, though still up 10.0% over five years.

CO6 (Earls Colne, Halstead) presents an interesting anomaly: the strongest one-year performance at +5.2%, but the weakest five-year growth at just +4.8%. This suggests a recent rebound after years of underperformance relative to other Colchester postcodes.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Colchester

Updated January 2026

The data represents the average number of property transactions per month across Colchester's postcodes, indicating market liquidity and how quickly you could expect to sell.

| Rank | Area | Sales Per Month |

|---|---|---|

| 1 | CO4 (University, Greenstead, North Colchester) | 53 |

| 2 | CO3 (Lexden, Stanway, West Colchester) | 41 |

| 3 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | 37 |

| 4 | CO2 (Shrub End, Berechurch, South Colchester) | 35 |

| 5 | CO5 (Tiptree, Mersea Island, Rural South) | 30 |

| 6 | CO6 (Earls Colne, Halstead, Rural West) | 29 |

| 7 | CO1 (City Centre, Old Town, Hythe) | 27 |

Colchester recent averages are around 252 property sales per month across all seven postcodes. This is a liquid market by regional standards, giving investors reasonable confidence about exit options.

CO4 is the clear leader at 53 sales per month, driven by a mix of new-build developments, family housing, and student-adjacent properties near the University. This postcode also offers the highest rents (£1,450/month) and strong yields (5.5%), making it the most active investment zone in Colchester.

CO3 (Lexden, Stanway) follows at 41 sales per month. This is Colchester's established family market, with steady turnover from owner-occupiers moving up or downsizing. CO7 at 37 sales shows healthy activity for a coastal postcode, reflecting Wivenhoe's popularity with both buyers and renters.

The city centre (CO1) records the lowest volume at 27 sales per month. This reflects the postcode's smaller geographic footprint and older housing stock rather than weak demand. For BRR investors, lower transaction volumes can actually work in your favour as there is less competition for off-market deals and motivated sellers.

The rural postcodes (CO5 and CO6) average around 30 sales per month each. Properties here take longer to sell and the buyer pool is smaller, but this is typical for village markets where turnover is naturally lower.

Note: These figures represent averages across all property types. Individual property sale times vary based on pricing, condition, and market conditions.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Colchester Rental Market Analysis

For investors considering if buy to let is worth it in Colchester and thinking how much they can charge for rent across the city and surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Colchester (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Colchester.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | CO4 (University, Greenstead, North Colchester) | £1,450 |

| 2 | CO6 (Earls Colne, Halstead, Rural West) | £1,359 |

| 3 | CO3 (Lexden, Stanway, West Colchester) | £1,272 |

| 4 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | £1,245 |

| 5 | CO2 (Shrub End, Berechurch, South Colchester) | £1,209 |

| 6 | CO5 (Tiptree, Mersea Island, Rural South) | £1,152 |

| 7 | CO1 (City Centre, Old Town, Hythe) | £1,071 |

CO4 commands the highest average rent at £1,450, driven by proximity to the University of Essex and the northern growth corridor. With the Southend campus closing in August 2026 and around 800 students transferring to Colchester, rental pressure in this postcode is likely to intensify. This is where student HMOs and professional lets compete for the same housing stock.

The rural postcodes (CO6 and CO5) show higher rents than you might expect at £1,359 and £1,152 respectively. This reflects property size rather than demand. Village rentals tend to be larger detached or semi-detached houses letting to families, pushing average rents up despite lower tenant volumes.

CO3 (Lexden, Stanway) achieves £1,272 on average prices of £362,000. This is Colchester's premium suburban belt, attracting professional families willing to pay for space and school catchments. CO7 at £1,245 reflects Wivenhoe's appeal to both University staff and commuters seeking character housing near the estuary.

CO1 (City Centre) records the lowest average rent at £1,071, but on entry prices of just £226,000, this delivers the highest yield in Colchester at 5.7%. For investors focused on monthly cash flow rather than absolute rent figures, the city centre outperforms the premium suburbs.

Gross Rental Yields in Colchester (%)

Updated January 2026

The data represents the average gross rental yields across Colchester's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | CO1 (City Centre, Old Town, Hythe) | 5.7% |

| 2 | CO4 (University, Greenstead, North Colchester) | 5.5% |

| 3 | CO2 (Shrub End, Berechurch, South Colchester) | 5.3% |

| 4 | CO3 (Lexden, Stanway, West Colchester) | 4.2% |

| 5 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | 3.7% |

| 6 | CO6 (Earls Colne, Halstead, Rural West) | 3.5% |

| 7 | CO5 (Tiptree, Mersea Island, Rural South) | 3.2% |

Colchester's urban postcodes clear the 5% threshold that many investors target. CO1 leads at 5.7%, benefiting from the lowest entry prices in the city combined with steady tenant demand from commuters and city centre workers. CO4 follows at 5.5%, where University proximity and the highest rents (£1,450/month) offset higher purchase prices. CO2 rounds out the yield hotspots at 5.3%.

These yields compare favourably to nearby Chelmsford where increased investor competition and higher prices have compressed returns. For investors priced out of closer-to-London markets, Colchester's urban postcodes deliver South East fundamentals with northern-style yields.

The suburban and rural postcodes tell a different story. CO3 at 4.2% reflects Lexden's premium pricing, while the coastal and village postcodes (CO7, CO6, CO5) deliver yields between 3.2% and 3.7%. These are owner-occupier markets where investors would be betting on capital growth rather than income.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy-to-let ownership costs.

Is Colchester Rent High?

Colchester's rental market sits at the affordable end of the South East, though tenants still commit a significant portion of income to housing. This is typical for the London commuter belt, where rents have outpaced local wage growth.

Average rent in Colchester costs between 32% and 44% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Colchester residents is £39,863 (based on £766.60 per week).

The highest-rent postcode, CO4, requires 43.7% of the median local income, reflecting both University-driven demand and larger family properties. This exceeds the 30% threshold that housing experts consider affordable, though many CO4 tenants are dual-income households or students with parental support.

The city centre (CO1) is the most accessible at 32.2% of income. Still above the affordability threshold, but the lowest in Colchester and competitive with many East of England markets. For landlords, this balance matters: rents high enough to generate yields above 5%, but not so stretched that tenants struggle to pay.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | CO4 (University, Greenstead, North Colchester) | 43.7% |

| 2 | CO6 (Earls Colne, Halstead, Rural West) | 40.9% |

| 3 | CO3 (Lexden, Stanway, West Colchester) | 38.3% |

| 4 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | 37.5% |

| 5 | CO2 (Shrub End, Berechurch, South Colchester) | 36.4% |

| 6 | CO5 (Tiptree, Mersea Island, Rural South) | 34.7% |

| 7 | CO1 (City Centre, Old Town, Hythe) | 32.2% |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Colchester House Prices High?

For a local property buyer on average full-time earnings, Colchester sits in the middle ground for the South East: more affordable than Cambridge or Chelmsford, but stretched compared to northern markets.

Purchasing a property in Colchester requires between 5.7 and 11.8 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Colchester residents is £39,863.

The urban postcodes are the most accessible. CO1 requires 5.7 times the average salary and CO2 requires 6.9 times. These sit below the UK long-term average of around 8x, making them realistic targets for first-time buyers and investors alike. CO4 at 7.9x remains within reach, particularly for dual-income households near the University.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | CO6 (Earls Colne, Halstead, Rural West) | 11.8x |

| 2 | CO5 (Tiptree, Mersea Island, Rural South) | 10.9x |

| 3 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | 10.3x |

| 4 | CO3 (Lexden, Stanway, West Colchester) | 9.1x |

| 5 | CO4 (University, Greenstead, North Colchester) | 7.9x |

| 6 | CO2 (Shrub End, Berechurch, South Colchester) | 6.9x |

| 7 | CO1 (City Centre, Old Town, Hythe) | 5.7x |

The rural and coastal postcodes (CO5, CO6, CO7) all exceed 10x income, reflecting larger properties and village premiums rather than typical starter homes. CO3 (Lexden) at 9.1x marks the threshold between accessible and stretched. For investors comparing East of England markets, Ipswich and Peterborough offer lower price-to-income ratios with similar commuter dynamics.

How Much Deposit to Buy a House in Colchester?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £73,000 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | CO1 (City Centre, Old Town, Hythe) | £67,914 |

| 2 | CO2 (Shrub End, Berechurch, South Colchester) | £81,994 |

| 3 | CO4 (University, Greenstead, North Colchester) | £94,888 |

| 4 | CO3 (Lexden, Stanway, West Colchester) | £108,714 |

| 5 | CO7 (Wivenhoe, Brightlingsea, Coastal East) | £122,703 |

| 6 | CO5 (Tiptree, Mersea Island, Rural South) | £130,819 |

| 7 | CO6 (Earls Colne, Halstead, Rural West) | £141,192 |

For investors entering the market, CO1 requires just under £68,000 and CO2 around £82,000. These are the only postcodes where you can realistically enter below £100,000. Crucially, these areas deliver the city's strongest yields at 5.7% and 5.3%, making them the most efficient for capital deployment.

CO4 at £95,000 offers an interesting middle ground: higher entry cost than the city centre, but access to the University tenant pool and the highest rents in Colchester (£1,450/month). With the Southend campus closure bringing 800 additional students to Colchester by September 2026, demand pressure in CO4 is likely to intensify.

The rural and coastal postcodes (CO5, CO6, CO7) all require deposits exceeding £120,000. At that level, the same capital could secure two properties in CO1, spreading risk and doubling rental income streams. Unless you're specifically targeting the village or coastal lifestyle market, the numbers favour the urban postcodes.

How to Invest in Buy-to-Let in Colchester

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Colchester, Essex and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Colchester and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Colchester for Buy-to-Let Investment

For investors seeking similar commuter belt dynamics with competitive yields, buy-to-let in Ipswich offers comparable pricing just 20 miles north with its own regeneration momentum around the Waterfront. If you want faster London trains and are prepared to pay a premium, buy-to-let in Chelmsford delivers 35-minute connections to Liverpool Street.

For a broader view of the region, see our guides to buy-to-let in Essex and buy-to-let in Cambridge for tech-driven demand at higher price points.