Where to Buy Property Investments in Liverpool: Yields of 7.5%

Liverpool's gross rental yields range from 3.6% to 7.5% across postcodes with rental data, with L5 delivering the highest returns. Average sold prices sit 36.9% below the England average, and the city's population grew 4.2% to 486,088 between the 2011 and 2021 censuses.

Liverpool's average sold price of £185,023 makes it one of the most affordable major cities in England for buy-to-let investors. That is 14.6% below the North West regional average of £216,741 and creates entry points that most English cities cannot match. Asking prices start from £127,803 in L20 (Bootle, Kirkdale), and rental data is available for 17 of the city's 25 postcodes.

This guide covers all 25 Liverpool postcodes from L1 to L36 under the Liverpool metropolitan borough (ONS code E08000012). Liverpool sits on the River Mersey in the North West of England, anchored by a major port, two Premier League football clubs, and three universities. Investors comparing options in the region may also consider Manchester, Birkenhead, or St Helens. Browse all our North West location guides.

Article updated: February 2026

Liverpool Buy-to-Let Market Overview 2026

Liverpool offers some of the lowest entry prices in England, backed by a major regeneration pipeline, a new Premier League stadium, and three universities generating year-round rental demand.

- Average sold price: £185,023 (36.9% below England's £293,131)

- Asking price range: £127,803 (L20) to £356,833 (L16), excluding L27 with no price data

- Rental yields: 3.6% (L15) to 7.5% (L5) across postcodes with rental data

- Rental income: Monthly rents from £586 (L6) to £1,285 (L18)

- Price per sq ft: Sold prices from £123/sq ft (L4) to £302/sq ft (L16)

- Market activity: Sales ranging from 3 per month (L2, L27) to 37 per month (L4)

- Deposit requirements: 30% deposits range from £38,341 (L20) to £107,050 (L16)

- Affordability ratios: Property prices from 3.4 to 9.4 times Liverpool's median annual salary of £37,788

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Liverpool?

Liverpool's economy has changed more dramatically in the last twenty years than almost any other English city. The city that was losing population for decades is now growing. The waterfront that was derelict is now a UNESCO-removed heritage site being rebuilt with billions in private investment. The narrative has shifted from post-industrial decline to genuine regeneration, and the property market reflects that.

Three universities bring around 70,000 students to the city. The University of Liverpool, Liverpool John Moores University, and the Liverpool Institute for Performing Arts create rental demand across the city centre and inner suburbs year-round. Student lets dominate postcodes like L6, L7, and L15, but the graduate retention rate also fuels demand for young professional housing in L1, L2, and L3.

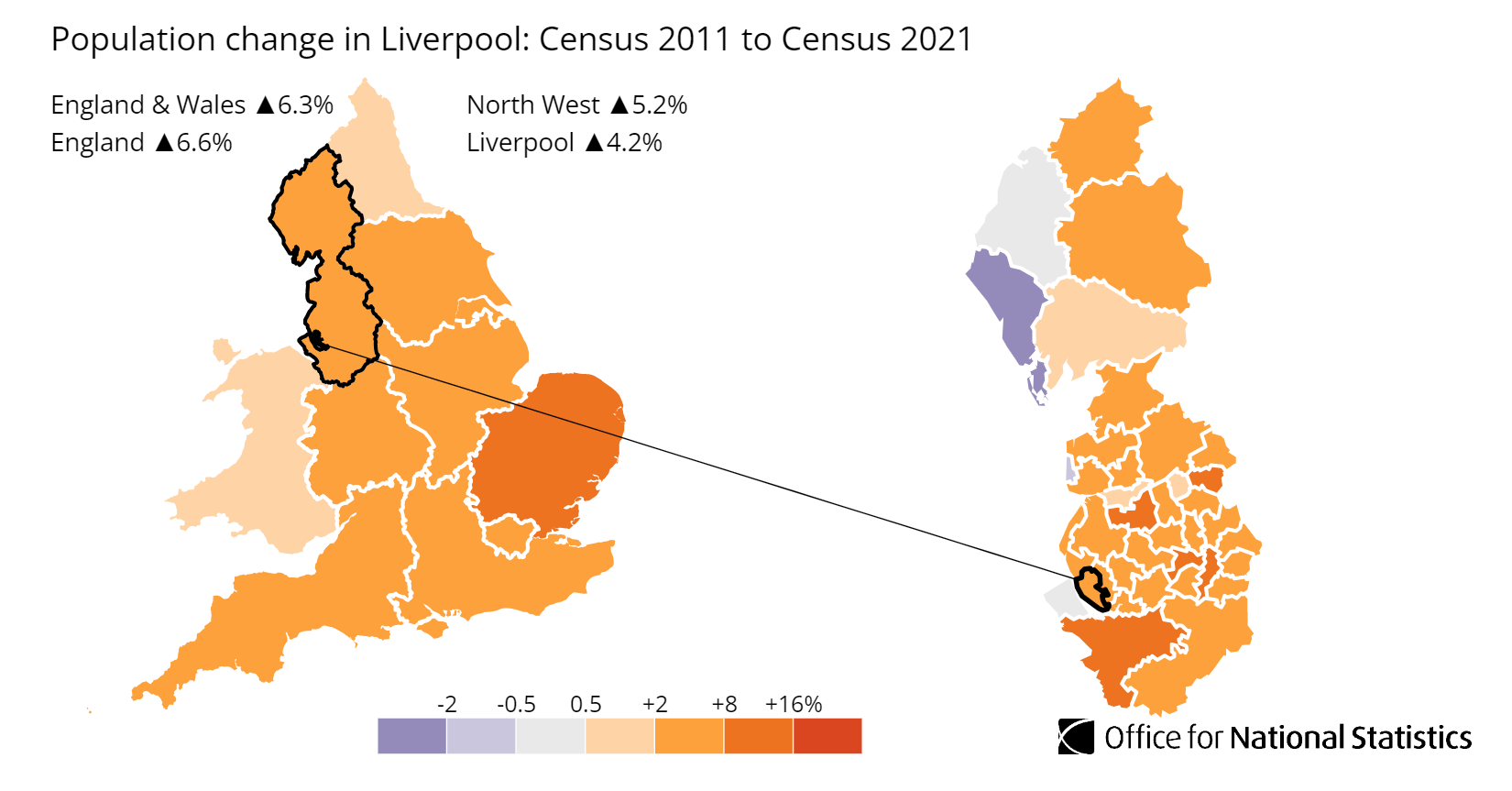

Between the 2011 and 2021 censuses, Liverpool's population grew from 466,415 to 486,088, a rise of 4.2%. That reverses a long-term trend. Liverpool was losing residents for most of the twentieth century. The growth is concentrated in the city centre and waterfront areas where new apartment developments have added thousands of units.

Earnings in Liverpool sit below both the regional and national averages. The median annual salary is £37,788, compared to £38,210 across the North West and £39,863 for Great Britain. Lower local wages combined with property prices 36.9% below the England average create a market where rental yields are among the highest in the country.

The NHS is Liverpool's largest employer. The Royal Liverpool University Hospital, Alder Hey Children's Hospital, and Liverpool Heart and Chest Hospital together employ thousands of healthcare workers. The Port of Liverpool handles more trade than any other UK port outside London and Felixstowe. Jaguar Land Rover's Halewood plant sits on the city boundary. These are not industries that disappear overnight.

Liverpool Economic Summary

- Population: 486,088 (2021 Census). Growth of 4.2% from 2011.

- Median annual salary: £37,788 (Liverpool), £38,210 (North West), £39,863 (Great Britain)

- Employment rate: 69.1% (Liverpool), 74.3% (North West), 75.6% (Great Britain)

- Unemployment rate: 6.0% (Liverpool), 4.5% (North West), 4.3% (Great Britain)

- Key employment sectors: Healthcare, port and logistics, higher education, financial services, creative and digital industries

Source: ONS Census 2021, Nomis Labour Market Profile (ASHE 2025, Employment Oct 2024-Sep 2025)

Liverpool's employment rate of 69.1% sits below the North West average of 74.3% and the national 75.6%. The unemployment rate of 6.0% is above both the regional 4.5% and national 4.3%. That combination reflects a city where parts of the population remain economically inactive, often in areas with high deprivation. For buy-to-let investors, this is relevant context rather than a dealbreaker. The postcodes where investors typically buy (L1-L5, L17, L18) have very different employment profiles from the outer suburbs. Tenant demand in the city centre and university belt comes from students, healthcare workers, and young professionals, not from the citywide average.

Regeneration and Investment in Liverpool

Liverpool's regeneration is no longer a promise. It is happening on the ground, with billions of pounds committed and construction visible across the city. The new Everton stadium alone has changed the north docks skyline, and the pipeline behind it runs deeper than any single project.

- Everton's Hill Dickinson Stadium at Bramley-Moore Dock (open, 52,888 capacity): The £500m stadium opened for the 2025/26 Premier League season and will host UEFA Euro 2028 matches. It has already drawn hundreds of thousands of visitors to the north docks. For investors, the stadium anchors a wider regeneration zone expected to deliver over 10,000 new homes and thousands of jobs across North Liverpool. Updates at Everton FC.

- Liverpool Waters Central Docks (under construction, £5.5bn masterplan): Peel L&P's 60-hectare waterfront regeneration is Liverpool's largest single development. The Central Docks phase covers 26 acres and will deliver over 2,000 new homes with a five-acre Central Park. Construction began in late 2025, backed by £55m of government funding. Developer sign-ups for residential plots are expected throughout 2026. Updates at Liverpool Waters.

- Knowledge Quarter and Paddington Village (under construction, £1bn+): Liverpool's science and innovation district stretches from Lime Street to the Royal Liverpool Hospital. The Paddington South phase broke ground in 2025 with Morgan Sindall delivering new research, residential, and commercial space including the HEMISPHERE office buildings due by 2027. Around 300 affordable homes are planned at Paddington Central. This creates a new tenant pool of research workers and medical professionals. Updates at Invest Liverpool.

- £1.6bn Transport Investment (announced December 2025): The largest transport settlement in Liverpool City Region's history includes three new rail stations, a rapid transit network linking the city centre to John Lennon Airport, and bus franchising to return services to public control. The package is expected to increase the number of residents who can reach Liverpool city centre by public transport within 30 minutes by 20%. For investors, better transport links extend the viable commuter catchment for tenants. Updates at Liverpool City Region Combined Authority.

- King Edward Triangle (planning submitted, £1bn): A 3,000-home residential-led development on the northern waterfront including high-rise buildings, hotels, and a potential events arena. The first 28-storey building planning application was submitted in 2025. This is early-stage but the scale signals long-term confidence in Liverpool's residential market. Updates at Liverpool City Region Combined Authority.

Liverpool Property Market Analysis

When Was the Last House Price Crash in Liverpool?

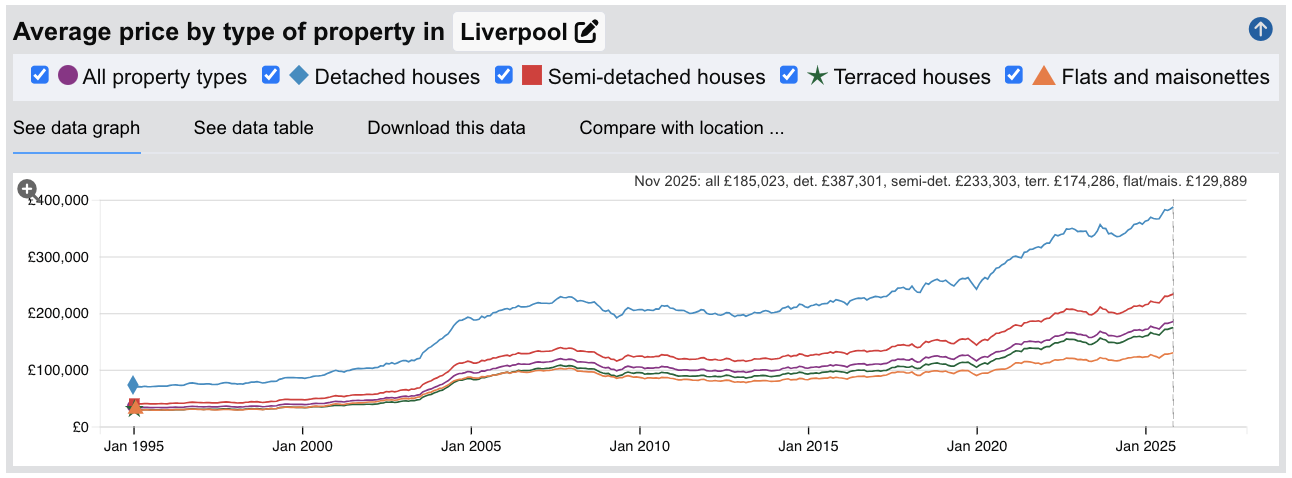

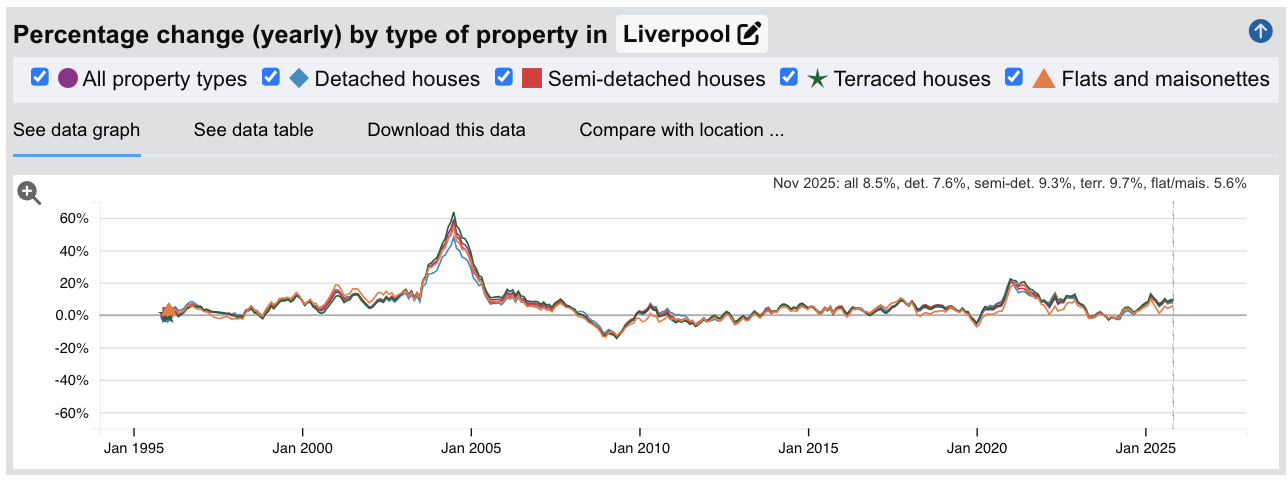

Liverpool's full house price history from the HM Land Registry House Price Index runs from January 1995 to November 2025. The data shows one major crash, a prolonged double-dip recovery, and a sharp pandemic-era surge.

- 1995-2000 (Slow start): Liverpool began 1995 at £33,517. Growth was sluggish. By January 2000, prices had only reached £38,741. That is 15.6% growth over five years while much of southern England was booming. Liverpool was still losing population and the docklands were largely derelict.

- 2000-2007 (The boom): Liverpool caught up violently. Prices more than tripled from £38,741 in January 2000 to a peak of £119,306 in September 2007. The sharpest growth came in 2004-2005, when annual change hit 36.2%. European Capital of Culture in 2008 was generating investment. Buy-to-let lending was loose. Terraced houses in L8 that sold for £20,000 in 2000 were changing hands at £80,000 by 2007.

- 2007-2009 (The financial crisis): From the peak of £119,306 in September 2007, prices fell to £97,851 by May 2009. That is an 18.0% decline in 20 months. The worst annual change reading was -13.8% in May 2009. But Liverpool's crash played out differently across property types. Detached houses lost 16.3% (peak to trough). Flats lost 24.7%. The city centre flat market that had been built on speculative buy-to-let demand collapsed hardest. Liverpool's overall decline of 18.0% was broadly in line with England (-18.2%) and the North West (-18.3%).

- 2009-2013 (The double dip): Unlike many cities, Liverpool did not recover after 2009. Prices bounced briefly to £104,670 by December 2009 but then fell again. The second trough came in March 2013 at £94,993. That is lower than the first trough. Liverpool lost 20.4% from peak to the true bottom. Four years of stagnation and decline while London was already back above pre-crash levels.

- 2013-2018 (Slow recovery): Growth returned but at a modest pace. Annual changes of 4-6% gradually closed the gap. Prices finally passed the pre-crash peak of £119,306 in July 2018 at £121,907. That recovery took nearly 11 years from the September 2007 peak. Liverpool was one of the slowest major cities to recover, largely because the speculative city centre flat stock that drove the boom took years to be absorbed.

- 2019 (Brief dip): Prices slipped from £121,907 to £118,898 by December 2019. Brexit uncertainty and rising stamp duty costs for investors cooled the market. Annual change turned negative at -3.3%. A pause rather than a crash.

- 2020-2022 (Pandemic surge): The stamp duty holiday and the remote working shift pushed Liverpool hard. Prices jumped from £121,669 in March 2020 to £164,488 by December 2022. That is 35.2% growth in under three years. Liverpool's low base and high yields attracted investors who could no longer stomach London and South East prices.

- 2023 (Rate shock): Interest rate rises cooled the market. Prices dipped from £164,488 in December 2022 to £160,204 by December 2023. A decline of 2.6%. Brief and mild compared to 2008.

- 2024-2025 (Strong recovery): Prices bounced back decisively. By November 2025, the average reached £185,023 with annual growth of 8.5%. That 8.5% is well above the England average of 2.2% and the North West average of 4.1%. Liverpool is outperforming the national market.

Long-Term Property Value Growth in Liverpool

- 5 years (2020-2025): +38.3% (£133,826 to £185,023)

- 10 years (2015-2025): +70.4% (£108,585 to £185,023)

- 15 years (2010-2025): +76.3% (£104,963 to £185,023)

- 20 years (2005-2025): +77.8% (£104,037 to £185,023)

- 30 years (1995-2025): +458.3% (£33,141 to £185,023)

The 2008 crash is the reference point for Liverpool investors assessing downside risk. A 20.4% decline took nearly 11 years to recover. That is longer than most English cities and reflects how hard the speculative flat market was hit. But Liverpool in 2026 is fundamentally different from Liverpool in 2007. The Everton stadium was not there. Liverpool Waters was a planning document. The Knowledge Quarter did not exist. The regeneration pipeline today is backed by real construction, not just renderings.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Liverpool

The latest sold house price index by the Land Registry confirms Liverpool's position as one of the most affordable major cities in England. The headline figure of £185,023 is 36.9% below England's £293,131 and 14.6% below the North West's £216,741. That discount is significant but it varies depending on property type.

Flats in Liverpool average £129,889. That is 41.4% below the England average of £221,565. The widest discount in Liverpool's market. It reflects a large stock of city centre apartments built during the 2000s buy-to-let boom, plus ex-council flats in the inner suburbs. The oversupply in the flat market is what drove the prolonged double-dip recovery after 2008.

| Property Type | Liverpool Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £387,301 | £474,400 | -18.4% |

| Semi-detached houses | £233,303 | £290,004 | -19.6% |

| Terraced houses | £174,286 | £245,002 | -28.9% |

| Flats and maisonettes | £129,889 | £221,565 | -41.4% |

| All property types | £185,023 | £293,131 | -36.9% |

Detached houses show the narrowest discount at 18.4%. Liverpool has relatively few detached properties, concentrated in the southern suburbs of L18 (Allerton, Mossley Hill), L25 (Woolton, Gateacre), and L16 (Childwall). These areas attract owner-occupier families rather than investors. The detached market trades on its own dynamics, closer to national patterns than the rest of Liverpool.

Semi-detached houses sit 19.6% below England at £233,303. Semis are the core family housing stock in Liverpool's outer suburbs. L12 (West Derby), L9 (Fazakerley), and L19 (Garston) are dominated by semi-detached streets. Owner-occupier demand competes with investors in these areas, which keeps semi prices relatively closer to national levels.

Terraced houses average £174,286, a 28.9% discount. The Victorian and Edwardian terraces in L4 (Anfield, Walton), L5 (Everton), and L8 (Toxteth) are the backbone of Liverpool's rental stock. Many HMO and multi-let properties sit in terraced streets. They offer the lowest entry prices in the city outside the flat market and the strongest combination of yield and tenant demand.

Flats represent the deepest value play at 41.4% below the national market. But Liverpool's flat market comes with a health warning. The city centre was over-built with apartments in the mid-2000s. Some developments still trade below their original off-plan prices. L1, L2, and L3 have the highest concentration of city centre flat stock. The postcode-level data in the sections below shows which areas have recovered and which remain under pressure.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Price Per Square Foot in Liverpool

Average asking prices can mislead. A postcode might look expensive simply because it has larger properties. Price per square foot strips out that size bias and shows what you are actually paying for space. It is the closest measure to true underlying value across different property types and sizes.

Liverpool's price per square foot ranges from £123 in L4 to £302 in L16, a spread of almost 2.5x across 25 postcodes. That is a wider range than most cities and it reflects the gulf between Liverpool's cheapest inner-city terraces and its affluent southern suburbs.

| Rank | Area | Price Per Sq Ft |

|---|---|---|

| 1 | L4 (Anfield, Walton) | £123 |

| 2 | L20 (Bootle, Kirkdale) | £128 |

| 3 | L5 (Anfield, Everton) | £132 |

| 4 | L6 (Tuebrook, Kensington) | £137 |

| 5 | L13 (Old Swan, Stoneycroft) | £152 |

| 6 | L9 (Fazakerley, Aintree) | £154 |

| 7 | L11 (Norris Green, Croxteth) | £167 |

| 8 | L27 (Netherley) | £174 |

| 9 | L7 (Edge Hill, Kensington) | £174 |

| 10 | L2 (City Centre) | £175 |

| 11 | L8 (Toxteth, Dingle) | £180 |

| 12 | L24 (Speke, Hale) | £192 |

| 13 | L15 (Wavertree) | £193 |

| 14 | L36 (Huyton, Roby) | £199 |

| 15 | L10 (Aintree Village, Fazakerley) | £202 |

| 16 | L14 (Broadgreen, Dovecot) | £204 |

| 17 | L12 (West Derby, Croxteth Park) | £234 |

| 18 | L1 (City Centre) | £236 |

| 19 | L19 (Garston, Aigburth) | £249 |

| 20 | L3 (City Centre, Vauxhall) | £251 |

| 21 | L26 (Halewood) | £274 |

| 22 | L17 (Aigburth, Sefton Park) | £275 |

| 23 | L25 (Woolton, Gateacre) | £279 |

| 24 | L18 (Allerton, Mossley Hill) | £299 |

| 25 | L16 (Childwall, Bowring Park) | £302 |

L4 at £123 per square foot is the cheapest space in Liverpool. This is the Anfield area, home to Liverpool FC's stadium and streets of Victorian terraces. The low per-foot cost is why yields here hit 7.3%. Investors buying for income have been active in L4 for years. The Everton stadium nearby in the docks is expected to lift demand across the north Liverpool postcodes as the surrounding regeneration takes shape.

L16, L18, and L25 form the premium tier at £279 to £302 per square foot. These are the affluent southern suburbs where larger family homes and period properties command higher rates. L16 Childwall at £302 is the most expensive per foot in Liverpool. It is an owner-occupier area with 157% turnover, suggesting properties sell fast.

The city centre postcodes of L1, L2, and L3 tell an interesting story. L2 and L3 sit at £175 and £251 per square foot respectively, but L1 is at £236. The spread within the city centre reflects different stock types. L3 includes newer waterfront developments at higher per-foot rates. L2 is dominated by older commercial conversions. For buy-to-let, the city centre price per square foot needs to be read alongside the growth data. L1 has lost 40.5% in one year. L2 has lost 32.4%. The city centre flat market is not a simple value play.

Figures reflect averages across all property types and ages. Individual values depend on condition, location within the postcode, and building age.

For Sale Asking Prices in Liverpool

Asking prices reflect what sellers and agents think the market will pay. They are not the same as sold prices, which capture what buyers actually paid. The gap between the two matters. In a rising market, asking prices run ahead of sold prices. In a cooling market, asking prices sit above what eventually transacts.

Liverpool's asking prices range from £127,803 in L20 to £356,833 in L16. L27 has no price data due to very low transaction volumes. The urban range across the remaining 24 postcodes is wide, reflecting Liverpool's mix of deprived inner-city areas and affluent southern suburbs.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | L20 (Bootle, Kirkdale) | £127,803 |

| 2 | L2 (City Centre) | £136,468 |

| 3 | L5 (Anfield, Everton) | £137,672 |

| 4 | L4 (Anfield, Walton) | £139,055 |

| 5 | L6 (Tuebrook, Kensington) | £146,970 |

| 6 | L7 (Edge Hill, Kensington) | £152,790 |

| 7 | L13 (Old Swan, Stoneycroft) | £156,305 |

| 8 | L9 (Fazakerley, Aintree) | £157,497 |

| 9 | L11 (Norris Green, Croxteth) | £162,330 |

| 10 | L8 (Toxteth, Dingle) | £174,648 |

| 11 | L1 (City Centre) | £181,672 |

| 12 | L3 (City Centre, Vauxhall) | £186,021 |

| 13 | L10 (Aintree Village, Fazakerley) | £192,729 |

| 14 | L14 (Broadgreen, Dovecot) | £193,586 |

| 15 | L15 (Wavertree) | £207,288 |

| 16 | L24 (Speke, Hale) | £211,351 |

| 17 | L36 (Huyton, Roby) | £225,637 |

| 18 | L19 (Garston, Aigburth) | £253,542 |

| 19 | L17 (Aigburth, Sefton Park) | £262,628 |

| 20 | L12 (West Derby, Croxteth Park) | £275,511 |

| 21 | L25 (Woolton, Gateacre) | £280,518 |

| 22 | L26 (Halewood) | £299,265 |

| 23 | L18 (Allerton, Mossley Hill) | £346,267 |

| 24 | L16 (Childwall, Bowring Park) | £356,833 |

| — | L27 (Netherley) | Not enough data |

Ten postcodes sit below £175,000. L20, L2, L5, L4, L6, L7, L13, L9, L11, and L8 all offer asking prices under that threshold. For investors, that means 30% deposits under £52,400 across ten different areas. Liverpool's affordable tier is not a single postcode. It is spread across the north and inner city with different tenant profiles in each.

L16 Childwall at £356,833 is Liverpool's most expensive postcode. It attracts families and professional owner-occupiers. No rental data is available, which tells you this is not a buy-to-let postcode. L18 Allerton at £346,267 is similar in character but does have rental data, returning a 4.5% yield from higher absolute rents.

The mean asking price across all 24 Liverpool postcodes with data is £206,849. That figure appears in the comparison section later, where Liverpool is measured against Manchester, Leeds, Sheffield, and Sunderland.

House Price Growth in Liverpool

Growth data shows where prices have moved over 1, 3, and 5 years. For buy-to-let investors, the five-year figure matters most. It captures a full market cycle and filters out short-term noise. One-year growth can swing on a handful of transactions. Five years tells you whether an area is genuinely appreciating.

Liverpool's five-year growth story divides sharply between the inner suburbs and the city centre. L26 Halewood leads at 57.1% and L11 Norris Green follows at 51.5%. At the other end, L3 City Centre managed just 4.7% and L1 lost 23.3%. The areas that performed best over five years are the family housing suburbs where owner-occupier demand competes with investors.

| Area | 1 Year | 3 Years | 5 Years |

|---|---|---|---|

| L26 (Halewood) | -4.7% | 14.8% | 57.1% |

| L11 (Norris Green, Croxteth) | 10.0% | 18.7% | 51.5% |

| L4 (Anfield, Walton) | 11.7% | 18.5% | 47.4% |

| L20 (Bootle, Kirkdale) | 11.8% | 10.6% | 42.8% |

| L10 (Aintree Village, Fazakerley) | 2.5% | 22.0% | 37.9% |

| L25 (Woolton, Gateacre) | 15.0% | 12.2% | 37.2% |

| L9 (Fazakerley, Aintree) | 6.1% | 15.5% | 36.6% |

| L6 (Tuebrook, Kensington) | -4.2% | 0.8% | 35.1% |

| L15 (Wavertree) | -1.9% | 12.0% | 34.2% |

| L19 (Garston, Aigburth) | 16.2% | 15.5% | 34.0% |

| L13 (Old Swan, Stoneycroft) | 5.9% | 6.0% | 32.7% |

| L17 (Aigburth, Sefton Park) | 12.5% | 15.6% | 31.5% |

| L12 (West Derby, Croxteth Park) | 4.9% | 15.4% | 28.4% |

| L5 (Anfield, Everton) | 10.8% | 9.2% | 24.6% |

| L14 (Broadgreen, Dovecot) | -1.5% | 3.7% | 22.2% |

| L8 (Toxteth, Dingle) | -11.0% | -8.3% | 22.0% |

| L24 (Speke, Hale) | 6.7% | 1.8% | 18.2% |

| L7 (Edge Hill, Kensington) | 6.7% | 12.4% | 18.0% |

| L16 (Childwall, Bowring Park) | -0.3% | -1.9% | 17.2% |

| L36 (Huyton, Roby) | 1.1% | 7.7% | 14.1% |

| L18 (Allerton, Mossley Hill) | -0.8% | 2.4% | 13.8% |

| L27 (Netherley) | 5.5% | 24.4% | 11.6% |

| L2 (City Centre) | -32.4% | -33.3% | 10.2% |

| L3 (City Centre, Vauxhall) | 0.4% | -4.6% | 4.7% |

| L1 (City Centre) | -40.5% | -39.0% | -23.3% |

The top five postcodes for five-year growth are all outer suburbs. L26, L11, L4, L20, and L10 each delivered over 37% growth. These are working-class residential areas where rising demand from first-time buyers and investors has pushed prices up from a very low base. An investor who bought at £95,000 in L4 five years ago is sitting on a property now asking £139,055.

L1 and L2 stand out as clear warnings. L1 has lost 40.5% in one year and 23.3% over five years. L2 has lost 32.4% in one year. These are city centre postcodes dominated by apartment stock. Oversupply from new-build developments, combined with some landlords exiting the market, has pushed prices down sharply. L3 at 4.7% five-year growth is performing better but still trails the suburban postcodes by a wide margin.

L8 Toxteth shows a mixed picture. Five-year growth of 22.0% looks solid, but the one-year figure of -11.0% and three-year figure of -8.3% suggest recent price falls. This is an area in transition. Some streets are gentrifying rapidly while others remain among the most deprived in England. The postcode average masks significant variation within L8.

Monthly Property Sales in Liverpool

Transaction volumes reveal which areas have the deepest buyer pools. For buy-to-let investors, this is an exit strategy question. If you need to sell, can you? High volume and high turnover mean a liquid market. Low volume means you may wait.

Liverpool's monthly sales range from 3 in L2 and L27 to 37 in L4, with a combined total of 450 transactions per month across all 25 postcodes. The standout figures are L16 Childwall's turnover rate of 157% and L9 Fazakerley at 115%, meaning properties change hands faster than new stock comes to market.

| Area | Sales Per Month | Turnover | Asking Price |

|---|---|---|---|

| L4 (Anfield, Walton) | 37 | 74% | £139,055 |

| L9 (Fazakerley, Aintree) | 33 | 115% | £157,497 |

| L13 (Old Swan, Stoneycroft) | 28 | 52% | £156,305 |

| L15 (Wavertree) | 28 | 55% | £207,288 |

| L17 (Aigburth, Sefton Park) | 28 | 61% | £262,628 |

| L36 (Huyton, Roby) | 27 | 43% | £225,637 |

| L18 (Allerton, Mossley Hill) | 25 | 77% | £346,267 |

| L20 (Bootle, Kirkdale) | 24 | 42% | £127,803 |

| L3 (City Centre, Vauxhall) | 24 | 5% | £186,021 |

| L19 (Garston, Aigburth) | 23 | 84% | £253,542 |

| L6 (Tuebrook, Kensington) | 22 | 20% | £146,970 |

| L25 (Woolton, Gateacre) | 21 | 56% | £280,518 |

| L12 (West Derby, Croxteth Park) | 18 | 38% | £275,511 |

| L14 (Broadgreen, Dovecot) | 17 | 64% | £193,586 |

| L8 (Toxteth, Dingle) | 17 | 9% | £174,648 |

| L11 (Norris Green, Croxteth) | 13 | 79% | £162,330 |

| L10 (Aintree Village, Fazakerley) | 12 | 109% | £192,729 |

| L16 (Childwall, Bowring Park) | 11 | 157% | £356,833 |

| L5 (Anfield, Everton) | 10 | 9% | £137,672 |

| L7 (Edge Hill, Kensington) | 9 | 17% | £152,790 |

| L1 (City Centre) | 9 | 1% | £181,672 |

| L26 (Halewood) | 9 | 27% | £299,265 |

| L24 (Speke, Hale) | 8 | 56% | £211,351 |

| L2 (City Centre) | 3 | 2% | £136,468 |

| L27 (Netherley) | 3 | 111% | Not enough data |

L3 City Centre has 24 sales per month but only 5% turnover. That combination means a massive for-sale stock relative to buyer demand. There are a lot of apartments listed and relatively few selling. For investors considering a city centre flat, that low turnover is a red flag for exit strategy. Selling could take months. L1 at 1% turnover and L2 at 2% are even worse.

L4 Anfield leads on volume at 37 sales per month with healthy 74% turnover. This is Liverpool's most liquid affordable postcode. Investors can buy with confidence that if they need to sell, there is a ready market. L9 Fazakerley at 33 sales and 115% turnover is similarly strong.

L16 and L10 both show turnover above 100% despite lower volumes. Properties sell faster than new listings appear. L16 at 157% is extraordinary but reflects a small, desirable postcode where stock rarely lingers. For exit strategy planning, L4, L9, and L13 offer the strongest combination of volume and liquidity in Liverpool's affordable tier.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: February 2026. All data is presented as provided by our sources without adjustments or amendments.

Liverpool Rental Market Analysis

For investors weighing up whether rental property is a worthwhile investment in Liverpool, the data below breaks down average monthly rents and gross rental yields across the city's postcodes.

Rental data is available for 17 of 25 postcodes. Eight postcodes (L10, L11, L14, L16, L24, L26, L27, L36) have insufficient current listings for reliable figures. For the seventeen with data, monthly rents range from £586 in L6 to £1,285 in L18 and gross yields range from 3.6% to 7.5%. If you are looking to build a property company in the North West, Liverpool's combination of low entry prices and high yields makes it a strong contender.

Average Rent & Gross Rental Yields in Liverpool

Gross rental yield is calculated from the average asking price and average monthly rent for each postcode. It does not account for void periods, maintenance, management fees, or mortgage costs. It is a starting point for comparison, not a profit forecast.

L5 delivers Liverpool's highest gross yield at 7.5%, where monthly rents of £862 meet asking prices of £137,672. At the other end, L15 Wavertree at 3.6% reflects a mismatch between higher asking prices and lower rental returns. The yield spread across Liverpool is 3.9 percentage points. That gap means the difference between a property that cash-flows comfortably and one that barely covers the mortgage.

| Area | Avg Monthly Rent | Avg Asking Price | Gross Yield |

|---|---|---|---|

| L5 (Anfield, Everton) | £862 | £137,672 | 7.5% |

| L20 (Bootle, Kirkdale) | £790 | £127,803 | 7.4% |

| L4 (Anfield, Walton) | £846 | £139,055 | 7.3% |

| L2 (City Centre) | £809 | £136,468 | 7.1% |

| L9 (Fazakerley, Aintree) | £880 | £157,497 | 6.7% |

| L13 (Old Swan, Stoneycroft) | £863 | £156,305 | 6.6% |

| L3 (City Centre, Vauxhall) | £970 | £186,021 | 6.3% |

| L8 (Toxteth, Dingle) | £825 | £174,648 | 5.7% |

| L1 (City Centre) | £835 | £181,672 | 5.5% |

| L25 (Woolton, Gateacre) | £1,268 | £280,518 | 5.4% |

| L6 (Tuebrook, Kensington) | £586 | £146,970 | 4.8% |

| L7 (Edge Hill, Kensington) | £592 | £152,790 | 4.6% |

| L18 (Allerton, Mossley Hill) | £1,285 | £346,267 | 4.5% |

| L19 (Garston, Aigburth) | £913 | £253,542 | 4.3% |

| L12 (West Derby, Croxteth Park) | £961 | £275,511 | 4.2% |

| L17 (Aigburth, Sefton Park) | £914 | £262,628 | 4.2% |

| L15 (Wavertree) | £621 | £207,288 | 3.6% |

| L10 (Aintree Village) | Not enough data | £192,729 | Not enough data |

| L11 (Norris Green, Croxteth) | Not enough data | £162,330 | Not enough data |

| L14 (Broadgreen, Dovecot) | Not enough data | £193,586 | Not enough data |

| L16 (Childwall, Bowring Park) | Not enough data | £356,833 | Not enough data |

| L24 (Speke, Hale) | Not enough data | £211,351 | Not enough data |

| L26 (Halewood) | Not enough data | £299,265 | Not enough data |

| L27 (Netherley) | Not enough data | Not enough data | Not enough data |

| L36 (Huyton, Roby) | Not enough data | £225,637 | Not enough data |

Seven postcodes sit above 6% gross yield: L5, L20, L4, L2, L9, L13, and L3. Each taps into a different tenant pool. L5 and L4 draw from Anfield's working population. L20 Bootle attracts key workers and young families. L2 and L3 are city centre apartment stock for students and young professionals. L9 benefits from family demand near Aintree Racecourse. L13 Old Swan is a mid-market residential area. That diversity of demand is a strength.

L6 and L7 at 4.8% and 4.6% look modest given their low asking prices (£147,000 and £153,000). Rents of £586 and £592 are the lowest in Liverpool. These are student-heavy areas where the headline single-let rent underplays what experienced landlords actually achieve through HMO or multi-let strategies. Per-room income in shared houses in L6 and L7 can be substantially higher than the single-let figure.

L18 commands Liverpool's highest absolute rent at £1,285 per month but delivers only 4.5% yield. Allerton and Mossley Hill attract professional tenants willing to pay a premium for leafy suburban living near Calderstones Park. The yield is compressed by asking prices of £346,267. Investors here buy for tenant quality and long-term appreciation rather than cash flow.

Is Liverpool Rent High?

Rent affordability matters from both sides. For tenants, it determines whether they can sustain payments long-term. For landlords, areas where rent consumes a lower share of income tend to produce more reliable tenants and fewer arrears.

The median gross weekly salary in Liverpool is £726.70, which equates to £3,149 per month or £37,788 per year. This is below the North West regional median of £734.80 per week and the Great Britain median of £766.60 per week. Data from the Nomis Labour Market Profile (ASHE 2025).

Across Liverpool's 17 postcodes with rental data, rent ranges from 18.6% to 40.8% of the local median gross monthly salary. The general benchmark is that rent becomes stretched above 30% of gross income. Only three postcodes sit above that level: L25 at 40.3%, L18 at 40.8%, and L3 at 30.8%. Most of Liverpool's rental market is comfortably affordable relative to local earnings.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | L18 (Allerton, Mossley Hill) | 40.8% |

| 2 | L25 (Woolton, Gateacre) | 40.3% |

| 3 | L3 (City Centre, Vauxhall) | 30.8% |

| 4 | L12 (West Derby, Croxteth Park) | 30.5% |

| 5 | L19 (Garston, Aigburth) | 29.0% |

| 6 | L17 (Aigburth, Sefton Park) | 29.0% |

| 7 | L9 (Fazakerley, Aintree) | 27.9% |

| 8 | L13 (Old Swan, Stoneycroft) | 27.4% |

| 9 | L5 (Anfield, Everton) | 27.4% |

| 10 | L4 (Anfield, Walton) | 26.9% |

| 11 | L1 (City Centre) | 26.5% |

| 12 | L8 (Toxteth, Dingle) | 26.2% |

| 13 | L2 (City Centre) | 25.7% |

| 14 | L20 (Bootle, Kirkdale) | 25.1% |

| 15 | L15 (Wavertree) | 19.7% |

| 16 | L7 (Edge Hill, Kensington) | 18.8% |

| 17 | L6 (Tuebrook, Kensington) | 18.6% |

| — | L10, L11, L14, L16, L24, L26, L27, L36 | Not enough data |

L18 and L25 at 40.8% and 40.3% look stretched on paper. But these are Liverpool's affluent southern suburbs. Tenants here are not on the citywide median of £37,788. They are professionals, senior NHS staff, and university academics earning well above that figure. The median salary is a city-wide average that understates what tenants in these postcodes actually earn.

The high-yield postcodes (L5, L4, L20, L9, L13) all sit between 25% and 28% of income. That is the sweet spot for investors. Rents are high enough to deliver yields above 6.5% but low enough relative to income that tenants can pay reliably without financial stress. Liverpool's affordable rents are a structural advantage. Arrears risk is lower when tenants are not stretching to pay.

L6 and L7 at 18.6% and 18.8% are the most affordable. Rents under £600 per month mean these postcodes serve tenants on lower incomes, including students. The very low affordability ratio means headroom for rent increases, but the tenant profile in these areas typically limits what the market will bear.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Liverpool House Prices High? Price-to-Earnings Ratios

The price-to-earnings ratio compares a postcode's average asking price to the local median annual salary. Lower ratios mean more affordable entry points relative to local wages. The national benchmark is 7.4x, calculated from England's average sold price of £293,131 against Great Britain's median annual salary of £39,863.

Purchasing a property in Liverpool requires between 3.4 and 9.4 times the median annual salary. This is based on the Nomis Labour Market Profile for Liverpool showing the median gross annual income for Liverpool residents is £37,788.

Twenty of Liverpool's 24 postcodes with price data sit below the national benchmark of 7.4x. Only L25 (7.4x), L26 (7.9x), L18 (9.2x), and L16 (9.4x) sit at or above it. Liverpool is fundamentally affordable relative to local and national earnings.

| Rank | Area | Price-to-Earnings Ratio |

|---|---|---|

| 1 | L20 (Bootle, Kirkdale) | 3.4x |

| 2 | L2 (City Centre) | 3.6x |

| 3 | L5 (Anfield, Everton) | 3.6x |

| 4 | L4 (Anfield, Walton) | 3.7x |

| 5 | L6 (Tuebrook, Kensington) | 3.9x |

| 6 | L7 (Edge Hill, Kensington) | 4.0x |

| 7 | L13 (Old Swan, Stoneycroft) | 4.1x |

| 8 | L9 (Fazakerley, Aintree) | 4.2x |

| 9 | L11 (Norris Green, Croxteth) | 4.3x |

| 10 | L8 (Toxteth, Dingle) | 4.6x |

| 11 | L1 (City Centre) | 4.8x |

| 12 | L3 (City Centre, Vauxhall) | 4.9x |

| 13 | L10 (Aintree Village, Fazakerley) | 5.1x |

| 14 | L14 (Broadgreen, Dovecot) | 5.1x |

| 15 | L15 (Wavertree) | 5.5x |

| 16 | L24 (Speke, Hale) | 5.6x |

| 17 | L36 (Huyton, Roby) | 6.0x |

| 18 | L19 (Garston, Aigburth) | 6.7x |

| 19 | L17 (Aigburth, Sefton Park) | 7.0x |

| 20 | L12 (West Derby, Croxteth Park) | 7.3x |

| 21 | L25 (Woolton, Gateacre) | 7.4x |

| 22 | L26 (Halewood) | 7.9x |

| 23 | L18 (Allerton, Mossley Hill) | 9.2x |

| 24 | L16 (Childwall, Bowring Park) | 9.4x |

| — | L27 (Netherley) | Not enough data |

The six highest-yielding postcodes all sit below 4.2x price-to-earnings. L5, L20, L4, L2, L9, and L13 deliver yields from 6.6% to 7.5% with price-to-earnings ratios of 3.4x to 4.2x. That means properties cost less than 4.2 years of local salary while delivering rental returns well above 6%. That combination is rare in any English city and it is why Liverpool attracts out-of-area investors.

L16 at 9.4x is the most stretched postcode. Childwall is Liverpool's most expensive residential area, attracting owner-occupier families willing to pay above local earnings capacity. L18 at 9.2x is similar. These are not investment postcodes for yield seekers, but they do offer tenant quality and long-term stability for those who can absorb the higher entry costs.

For investors comparing across the North West, Liverpool's price-to-earnings ratios are more favourable than Manchester and comparable to St Helens and Wigan at the affordable end.

Deposit Requirements in Liverpool

Most buy-to-let mortgage lenders require a minimum 25% deposit. The table below uses a more conservative 30% to reflect the rates and products available at higher loan-to-value ratios. A 30% deposit typically unlocks better interest rates, which matters for cash flow in a yield-driven market.

Liverpool's entry costs range from £38,341 in L20 to £107,050 in L16. Twelve postcodes require deposits under £55,000, putting buy-to-let within reach for investors who might be priced out of Manchester, Leeds, or southern English cities.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | L20 (Bootle, Kirkdale) | £38,341 |

| 2 | L2 (City Centre) | £40,940 |

| 3 | L5 (Anfield, Everton) | £41,301 |

| 4 | L4 (Anfield, Walton) | £41,716 |

| 5 | L6 (Tuebrook, Kensington) | £44,091 |

| 6 | L7 (Edge Hill, Kensington) | £45,837 |

| 7 | L13 (Old Swan, Stoneycroft) | £46,892 |

| 8 | L9 (Fazakerley, Aintree) | £47,249 |

| 9 | L11 (Norris Green, Croxteth) | £48,699 |

| 10 | L8 (Toxteth, Dingle) | £52,394 |

| 11 | L1 (City Centre) | £54,502 |

| 12 | L3 (City Centre, Vauxhall) | £55,806 |

| 13 | L10 (Aintree Village, Fazakerley) | £57,819 |

| 14 | L14 (Broadgreen, Dovecot) | £58,076 |

| 15 | L15 (Wavertree) | £62,186 |

| 16 | L24 (Speke, Hale) | £63,405 |

| 17 | L36 (Huyton, Roby) | £67,691 |

| 18 | L19 (Garston, Aigburth) | £76,062 |

| 19 | L17 (Aigburth, Sefton Park) | £78,788 |

| 20 | L12 (West Derby, Croxteth Park) | £82,653 |

| 21 | L25 (Woolton, Gateacre) | £84,155 |

| 22 | L26 (Halewood) | £89,779 |

| 23 | L18 (Allerton, Mossley Hill) | £103,880 |

| 24 | L16 (Childwall, Bowring Park) | £107,050 |

| — | L27 (Netherley) | Not enough data |

L5 at £41,301 is arguably the best value entry in the table. It requires a similar deposit to L20, L2, and L4 but delivers the highest yield (7.5%) and solid five-year growth (24.6%). The extra £3,000 over L20's deposit buys access to higher rental returns in an area that benefits from the Everton stadium regeneration zone.

A clear gap separates the sub-£56,000 tier from the rest. Twelve postcodes sit below that threshold. L10 at £57,819 is the next step up, followed by L14, L15, and L24 in the £58,000-£63,000 range. For investors with limited capital, Liverpool's twelve cheapest postcodes include five with yields above 6%. You do not need to stretch into the higher deposit brackets to access Liverpool's strongest rental returns.

Deposit is only part of the upfront cost. Budget for stamp duty (use our stamp duty calculator for an accurate figure), legal fees, and survey costs. For a full breakdown, see our guide to buy-to-let costs.

What the Liverpool Data Tells Buy-to-Let Investors

The postcode-level data across this guide points to three distinct approaches depending on whether you are optimising for income, growth, or both.

For yield, the numbers favour L5 (7.5%), L20 (7.4%), and L4 (7.3%). All three sit below 3.7x price-to-earnings with 30% deposits between £38,000 and £42,000. L5 stands out as the top yield in Liverpool with rents of £862 against asking prices of £137,672. L4 Anfield also delivers the highest transaction volume in the city at 37 sales per month, giving investors liquidity if they need to exit. L20 Bootle offers Liverpool's cheapest entry at £127,803.

For growth, look at the outer suburbs. L26 Halewood (57.1%), L11 Norris Green (51.5%), and L4 Anfield (47.4%) delivered the strongest five-year appreciation. L4 appears in both the yield and growth rankings, which is unusual. In most cities, growth and yield pull in opposite directions. L4's combination of 7.3% yield, 47.4% five-year growth, and 37 monthly sales makes it Liverpool's most complete investment postcode on the data.

Avoid the city centre unless you understand the specific risks. L1 has lost 40.5% in one year and 23.3% over five years. L2 has lost 32.4% in one year. These are apartment-dominated postcodes where oversupply has driven prices down sharply. Turnover rates of 1% and 2% mean your exit could take months or years. L3 is performing better (6.3% yield, 4.7% five-year growth) but the 5% turnover rate still signals a saturated market. City centre flats can work for investors buying at the right price and holding long-term, but the data says the risk is higher here than anywhere else in Liverpool.

How Liverpool Buy-to-Let Compares to Nearby Areas

Investors looking at Liverpool are typically also considering other northern English cities. The table below compares Liverpool against four nearby locations using the same methodology: mean asking price across all postcodes, mean monthly rent across postcodes with data, and top single-postcode gross yield.

| Location | Mean Asking Price | Mean Monthly Rent | Top Gross Yield |

|---|---|---|---|

| Liverpool | £206,849 | £872 | 7.5% |

| Manchester | £265,494 | £1,314 | 7.9% |

| Leeds | £285,040 | £1,111 | 9.5% |

| Sheffield | £240,707 | £900 | 7.7% |

| Sunderland | £164,426 | £691 | 9.7% |

Liverpool offers one of the lowest mean asking price of the four major cities in this comparison. At £206,849, entry costs are £59,000 below Manchester and £78,000 below Leeds. Only Sunderland is cheaper at £164,426, but Sunderland's mean rent of £691 is significantly lower than Liverpool's £872.

Manchester and Leeds both show higher top yields (7.9% and 9.5%), but those headline figures require substantially more capital. Manchester's mean asking price of £265,494 means a 30% deposit of £79,600 for an average property. Leeds at £285,040 requires £85,500. Liverpool's highest-yield postcodes need deposits of £38,000 to £42,000. For yield per pound of deposit, Liverpool is the most efficient in this group.

Sheffield is the closest comparison. Similar mean rent (£900 vs £872), similar top yield (7.7% vs 7.5%), but asking prices £34,000 higher. Liverpool's lower entry point combined with a deeper regeneration pipeline (Everton stadium, Liverpool Waters, £1.6bn transport investment) gives it a stronger growth catalyst argument than Sheffield currently has.

Frequently Asked Questions

Is Liverpool a good place to invest in property?

Liverpool's data makes a strong case for buy-to-let investment. Average sold prices of £185,023 sit 36.9% below the England average, creating low entry points. Seven postcodes deliver gross yields above 6%, with L5 reaching 7.5%. Five-year growth of 38.3% at the Land Registry level shows the market is appreciating. The combination of low prices, high yields, and a major regeneration pipeline (Everton stadium, Liverpool Waters, £1.6bn transport investment) attracts investors from across the UK. The risk sits in the city centre apartment market, where postcodes L1 and L2 have seen sharp recent price falls.

What are the best areas to buy investment property in Liverpool?

Based on the data in this guide, the strongest postcodes for buy-to-let combine high yield, strong growth, and market liquidity. L5 (Anfield, Everton) delivers the top yield at 7.5% with five-year growth of 24.6%. L4 (Anfield, Walton) offers 7.3% yield, 47.4% five-year growth, and the highest transaction volume in the city. L20 (Bootle) provides the cheapest entry at £127,803 with a 7.4% yield. For investors prioritising tenant quality over yield, L17 (Aigburth) and L25 (Woolton) offer more affluent tenant pools with yields of 4.2% and 5.4% respectively.

How does Liverpool compare to Manchester for property investment?

Liverpool offers lower entry prices (mean asking price £206,849 vs Manchester's £265,494), while Manchester delivers higher absolute rents (£1,314 vs £872) and a marginally higher top yield (7.9% vs 7.5%). The key difference is capital efficiency. Liverpool's highest-yield postcodes need 30% deposits of £38,000-£42,000. Manchester's equivalent postcodes require £55,000-£65,000. Liverpool's lower deposit requirements mean investors can enter the market with less capital or diversify across multiple properties for the same outlay. Both cities have strong regeneration pipelines. Manchester has a longer track record of price growth. Liverpool has more room to grow from a lower base.

Should I avoid Liverpool city centre apartments?

The data suggests caution rather than avoidance. L1 has lost 40.5% in one year and L2 has lost 32.4%. Turnover rates of 1-2% mean very few apartments are selling relative to stock. L3 is performing better with 6.3% yield and positive (if modest) five-year growth of 4.7%. The oversupply from the 2000s build-out is still being absorbed. For investors who buy at the right price and can hold long-term, city centre flats can work. But the exit risk is real. If you need to sell within five years, the suburban postcodes offer much better liquidity.

What impact will the Everton stadium have on Liverpool property prices?

The Hill Dickinson Stadium at Bramley-Moore Dock opened for the 2025/26 season and anchors a wider regeneration zone expected to deliver over 10,000 new homes. The stadium has already drawn hundreds of thousands of visitors to the north docks. It is confirmed as a host venue for UEFA Euro 2028. The nearby postcodes (L3, L5, L20) stand to benefit most from increased footfall, improved infrastructure, and the £1.6bn transport investment announced in December 2025. The price impact is not yet fully visible in the data, but L5's top yield of 7.5% and L20's 42.8% five-year growth suggest demand is already building in the surrounding areas.