Where to Buy Property Investments in Sheffield: Yields of 7.8%

Sheffield's reputation as an affordable northern city with strong rental demand makes it one of Yorkshire's most compelling property investment locations, with rental yields reaching 7.8% in S3 (Kelham Island), driven by a combination of 60,000 university students, a growing professional workforce, and ongoing city centre regeneration.

The property data reflects exceptional value for investors. Sheffield's average sold price of £216,120 sits 27% below the England average, creating accessible entry points across most postcodes whilst the city's economic fundamentals continue to strengthen through advanced manufacturing investment and significant regeneration programmes.

Our buy-to-let analysis examines Sheffield's 21 postcode districts, evaluating capital growth, rental yields, and the investment potential across this South Yorkshire city.

Article updated: December 2025

Sheffield Buy-to-Let Market Overview 2025

Sheffield's property market delivers property for sale asking house prices ranging from 59% below to 55% above the England average across its postcodes, creating a massive range of purchase prices from budget-friendly to premium with these key statistics:

- Asking price range: £121,136 (S3) to £453,472 (S17) across Sheffield postcodes

- Rental yields: 3.4% (S10, S21) to 7.8% (S3) across different postcodes

- Rental income: Monthly rents from £746 (S1) to £1,048 (S11)

- Price per sq ft: House prices from £122/sq ft (S4) to £355/sq ft (S17)

- Market activity: Sales ranging from 3 per month (S14) to 54 per month (S6)

- Deposit requirements: 30% deposits range from £36,341 (S3) to £136,042 (S17)

- Affordability ratios: Property prices from 3.2 to 11.9 times Sheffield's median annual salary of £38,116

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Sheffield?

Sheffield offers something increasingly rare in UK property: genuine affordability combined with strong rental yields in a major city with real economic momentum. While investors chase overheated markets elsewhere, Sheffield delivers yields up to 7.8% in S3 with entry prices from just £121,136.

The value proposition is straightforward. Sheffield's average sold price is £216,120, which sits 27% below the England average of £295,670. That discount exists despite Sheffield being England's fifth largest city, home to two major universities, and benefiting from over £500 million in recent regeneration investment. The numbers stack up.

Two massive tenant bases drive this market. First, the student population. With around 60,000 students across the University of Sheffield (Russell Group) and Sheffield Hallam University, the city has constant demand for accommodation that purpose-built student accommodation alone cannot meet. This creates opportunities for student let investors in areas like Broomhill (S10), Crookes (S10), and the city centre (S1).

Second, the professional workforce. Sheffield's economy has transformed from steel to advanced manufacturing, healthcare, and digital industries. The Advanced Manufacturing Research Centre, NHS teaching hospitals, and growing tech sector create demand for quality rental housing from young professionals who can't yet afford to buy in areas like Kelham Island (S3), Ecclesall Road (S11), and Hillsborough (S6).

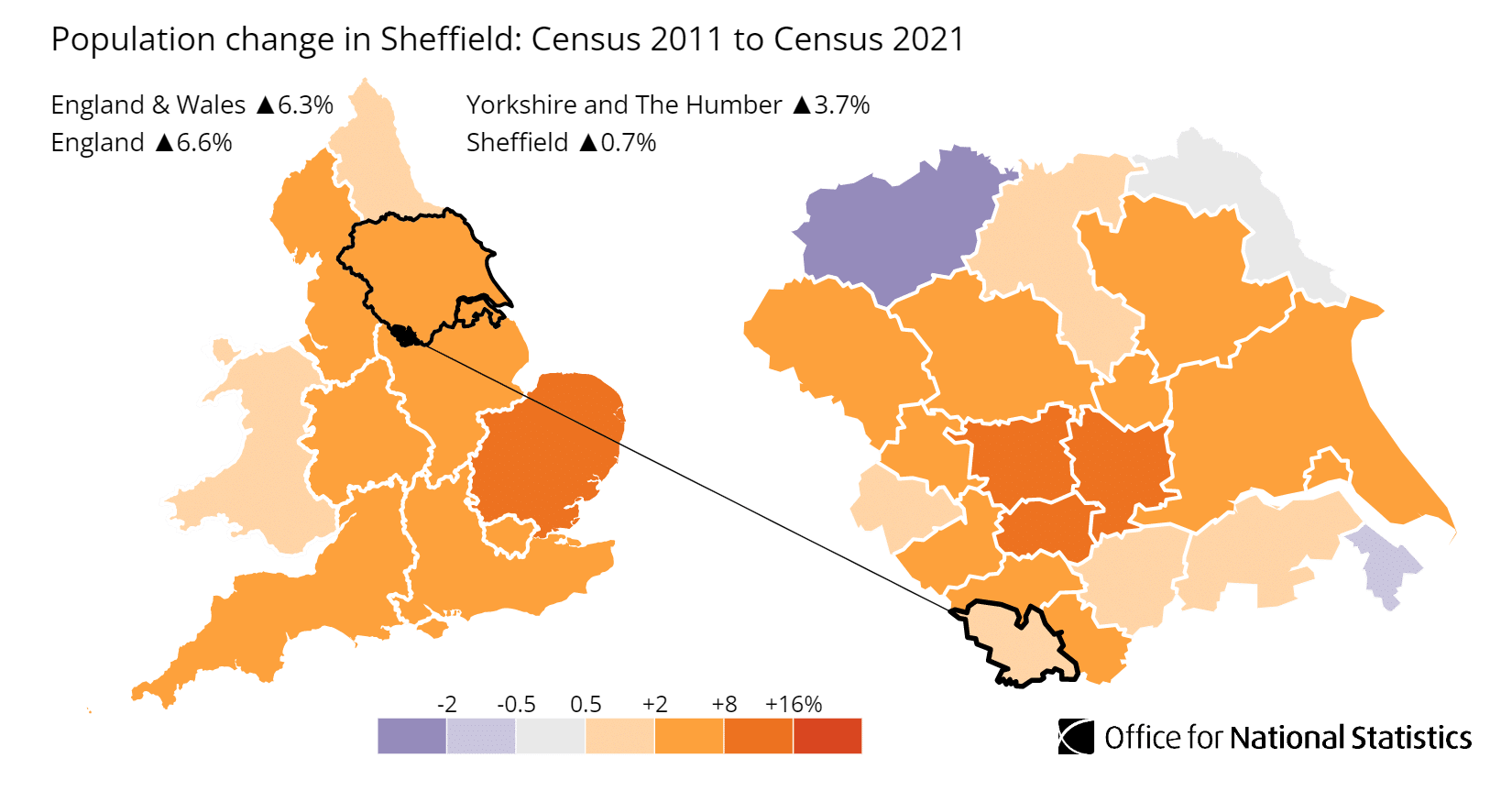

The city's population tells an interesting story. According to the latest census data, the population of Sheffield increased by 0.6%, rising from 551,756 in 2011 to 555,035 in 2021. That modest headline figure masks significant churn. Sheffield's student population cycles every three years, creating constant tenant turnover that benefits landlords. You can explore the full breakdown via the ONS Census Data for Sheffield.

If you like Sheffield's affordability but want to compare nearby Yorkshire markets, explore buy-to-let in Leeds (larger economy, higher prices), buy-to-let in Doncaster (even lower entry points), or buy-to-let in Wakefield (strong commuter links to Leeds).

Regeneration and Investment in Sheffield

Sheffield is experiencing its most significant period of regeneration since the post-war reconstruction, with over £800 million of combined investment transforming the city centre. For property investors, these improvements are crucial as they help sustain property values and tenant demand long into the future.

- Heart of the City (£470m): This flagship regeneration scheme is now nearing completion, creating 1.5 million sq ft of space across new, repurposed and retained buildings. The award-winning Cambridge Street Collective (Europe's largest purpose-built food hall) opened in 2024 alongside 70,000 sq ft of Grade A office space at Elshaw House, Kangaroo Works residential apartments, and the restored heritage workshops at Leah's Yard. The scheme is generating significant footfall and creating demand for city centre housing. View the latest at Heart of Sheffield.

- West Bar (£300m): Sheffield's largest ever private sector investment deal has delivered Phase 1, including No.1 West Bar Square (100,000 sq ft Grade A offices) handed over in October 2024, and Soho Yard (368 build-to-rent apartments) completed in April 2025. Phase 2 is now underway with additional office space and public realm improvements creating a new city centre gateway connecting to Kelham Island. Track progress at Urbo Regeneration West Bar.

- Castlegate (£25m): This historic site at the confluence of the Rivers Sheaf and Don is being transformed into a new public park with exposed medieval castle remains and the River Sheaf de-culverted for the first time since 1912. Archaeological discoveries have extended the timeline, with completion now expected late 2026. The project is changing investment perceptions of the eastern city centre. Updates available at Sheffield City Council Castlegate.

- Fargate Transformation (£15.8m): Government Future High Streets Fund investment is creating 'Event Central' (a community hub for entertainment, culture and co-working at 20-26 Fargate), new landscaping with pocket parks inspired by Sheffield's Grey to Green project, and a 'Front Door Scheme' unlocking upper floors for new homes and offices. Construction begins spring/summer 2025. Full details at Welcome to Sheffield Fargate Regeneration.

Sheffield Property Market Analysis

When Was the Last House Price Crash in Sheffield?

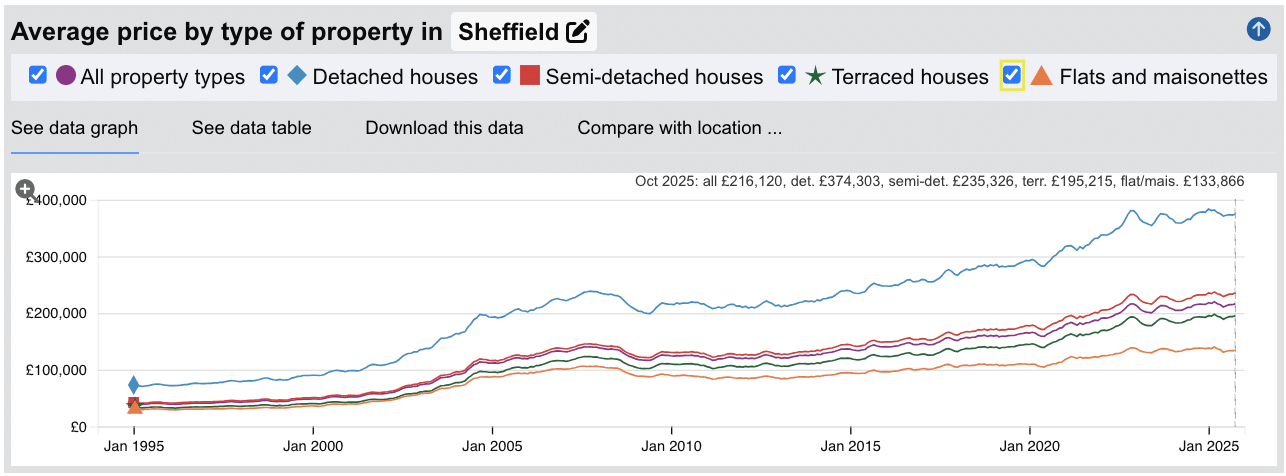

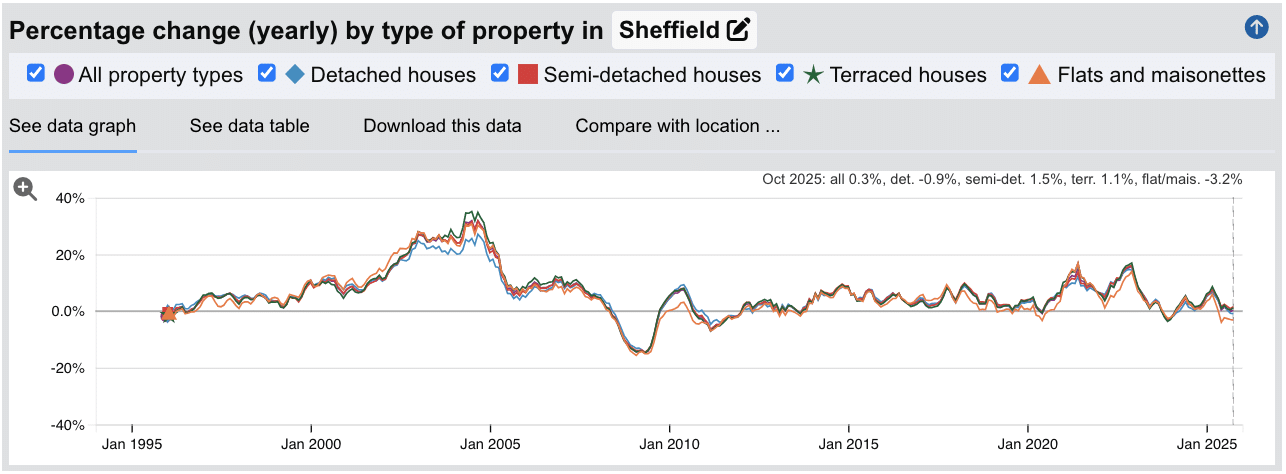

The last time Sheffield experienced a significant market shock was during the 2008 global financial crisis. Property values dropped approximately 17% from the October 2007 peak of £140,321 to a low of £116,415 in June 2009. Recovery took until late 2014 to surpass pre-crash levels, reflecting the north's slower bounce-back compared to southern markets.

A more recent correction occurred during 2023 as interest rates climbed sharply. Sheffield peaked at £216,097 in November 2022 before falling 7.3% to £200,355 by June 2023. Unlike the 2008 crash, this correction was short-lived. Prices stabilised through the second half of 2023 and returned to growth throughout 2024, reaching £216,120 by October 2025.

Source: HM Land Registry House Price Index for Sheffield

Here is how the market has performed over the key cycles:

- 1995-2000 saw modest growth with prices rising from £39,832 to £52,346, a 31% increase as the market recovered from the early 1990s recession.

- 2000-2007 delivered exceptional growth. Prices nearly tripled from £52,346 to £140,321 during the credit boom, with annual growth exceeding 25% in 2002-2003.

- 2008-2009 brought the financial crisis correction. Values dropped 17% from peak to trough, with the lowest point of £116,415 recorded in June 2009.

- 2010-2014 was a period of stagnation. Prices fluctuated between £116,000 and £126,000 as the market struggled to find direction, with several years of negative or flat growth.

- 2015-2019 saw steady recovery. Annual growth returned, averaging 3-5% as confidence rebuilt and the northern powerhouse agenda gained traction.

- 2020-2022 delivered the pandemic boom. Prices surged from £164,587 to £216,097, a 31% increase in under three years as remote working and the stamp duty holiday fuelled demand.

- 2023 brought a necessary correction of 7.3% as mortgage rates spiked from historic lows, cooling the post-pandemic surge.

- 2024-2025 marks the recovery phase. Positive growth returned from spring 2024, with prices reaching £216,120 by October 2025, broadly matching the November 2022 peak.

Long-Term Property Value Growth in Sheffield

For buy-to-let investors, the long-term picture shows why Sheffield delivers solid capital appreciation over extended holding periods, even accounting for the 2008 crash and 2023 correction:

- 5 years (2020-2025): 27.4% growth (average prices rising from £169,594 to £216,120)

- 10 years (2015-2025): 52.5% growth (average prices rising from £141,721 to £216,120)

- 15 years (2010-2025): 73.6% growth (average prices rising from £124,493 to £216,120)

- 20 years (2005-2025): 78.2% growth (average prices rising from £121,262 to £216,120)

- 30 years (1995-2025): 432.5% growth (average prices rising from £40,587 to £216,120)

The 2023 correction reflected national mortgage affordability pressures rather than local market weakness. Sheffield's swift return to growth demonstrates resilient buyer demand, supported by the city's improving employment base and ongoing regeneration. For more on understanding the 2008 housing market crash and its lessons for investors, see our detailed analysis.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Sheffield

The latest sold house price index by the Land Registry confirms Sheffield's position as one of England's most affordable major cities, with values sitting well below the national benchmark across all property types.

Sheffield property prices average £216,120, which is 26.9% below the England average of £295,670. This discount reflects the city's northern location and industrial heritage, but masks a market with genuine growth potential driven by regeneration and an expanding professional workforce.

Flats and maisonettes offer the most accessible entry point at £133,866, sitting 40.5% below the national average. This makes Sheffield apartments particularly attractive for investors targeting the city's 60,000 students and young professionals. Terraced houses, including the iconic Victorian terraces in areas like Crookes and Walkley, average £195,215, a 20.7% discount versus England.

Semi-detached houses average £235,326 (19.7% below national), popular with families seeking suburban living in areas like S6 and S8. Detached houses command £374,303, still 21.5% below the England average, with premium locations in S10, S11 and S17 attracting owner-occupiers rather than yield-focused investors.

Updated December 2025

| Property Type | Sheffield Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £374,303 | £476,862 | -21.5% |

| Semi-detached houses | £235,326 | £292,942 | -19.7% |

| Terraced houses | £195,215 | £246,321 | -20.7% |

| Flats and maisonettes | £133,866 | £225,149 | -40.5% |

| All property types | £216,120 | £295,670 | -26.9% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Sheffield

Updated December 2025

The data represents the average asking prices of properties currently listed for sale across Sheffield's 21 postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | S17 (Dore, Totley & Bradway) | £453,472 |

| 2 | S11 (Ecclesall, Sharrow & Nether Edge) | £342,524 |

| 3 | S10 (Broomhill, Crookes & Fulwood) | £323,988 |

| 4 | S7 (Millhouses, Abbeydale & Beauchief) | £282,273 |

| 5 | S36 (Stocksbridge & Deepcar) | £280,762 |

| 6 | S21 (Eckington & Killamarsh) | £276,117 |

| 7 | S35 (Chapeltown & High Green) | £274,518 |

| 8 | S8 (Norton, Woodseats & Meersbrook) | £254,300 |

| 9 | S26 (Aston & Swallownest) | £245,952 |

| 10 | S25 (Dinnington & Anston) | £243,463 |

| 11 | S20 (Crystal Peaks & Mosborough) | £224,116 |

| 12 | S6 (Hillsborough, Walkley & Stannington) | £215,095 |

| 13 | S12 (Gleadless, Hackenthorpe & Intake) | £191,932 |

| 14 | S13 (Handsworth & Woodhouse) | £191,539 |

| 15 | S2 (Highfield, Heeley & Lowfield) | £170,647 |

| 16 | S9 (Darnall, Attercliffe & Tinsley) | £166,043 |

| 17 | S5 (Firth Park, Shiregreen & Southey) | £158,302 |

| 18 | S1 (City Centre) | £136,611 |

| 19 | S14 (Manor & Arbourthorne) | £132,079 |

| 20 | S4 (Burngreave, Fir Vale & Pitsmoor) | £122,496 |

| 21 | S3 (Kelham Island & Neepsend) | £121,136 |

Sheffield's pricing landscape spans a remarkable £332,336 range, from the premium family suburbs of S17 (Dore and Totley) at £453,472 down to the regeneration hotspot of S3 (Kelham Island) at just £121,136. This spread creates opportunities across every investment strategy and budget.

The premium tier includes S17, S11 and S10, all sitting above £320,000. These western suburbs attract owner-occupiers seeking period properties, excellent schools and proximity to the Peak District. Yields here are lower, but capital growth has historically been strong.

For investors seeking balance between entry price and tenant demand, the middle tier from S6 to S8 (£215,000-£255,000) offers family housing in established suburbs with good transport links and rental appeal to professionals. S6 (Hillsborough and Walkley) benefits from Supertram connectivity and Hillsborough Stadium, while S8 (Woodseats and Meersbrook) attracts young families priced out of neighbouring Ecclesall.

The value tier below £170,000 includes S3, S4, S5 and S9, where entry prices from £121,136 deliver the highest yields but require careful stock selection. S3 (Kelham Island) stands out as the area to watch, combining the lowest prices with the city's most dynamic regeneration and the highest rental yields at 7.8%.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Sheffield (£)

Updated December 2025

The data represents the average price per square foot across Sheffield's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | S17 (Dore, Totley & Bradway) | £355 |

| 2 | S10 (Broomhill, Crookes & Fulwood) | £317 |

| 3 | S11 (Ecclesall, Sharrow & Nether Edge) | £311 |

| 4 | S7 (Millhouses, Abbeydale & Beauchief) | £281 |

| 5 | S8 (Norton, Woodseats & Meersbrook) | £265 |

| 6 | S1 (City Centre) | £264 |

| 7 | S35 (Chapeltown & High Green) | £260 |

| 8 | S20 (Crystal Peaks & Mosborough) | £258 |

| 9 | S36 (Stocksbridge & Deepcar) | £249 |

| 10 | S6 (Hillsborough, Walkley & Stannington) | £245 |

| 11 | S21 (Eckington & Killamarsh) | £243 |

| 12 | S26 (Aston & Swallownest) | £242 |

| 13 | S3 (Kelham Island & Neepsend) | £240 |

| 14 | S12 (Gleadless, Hackenthorpe & Intake) | £225 |

| 15 | S25 (Dinnington & Anston) | £222 |

| 16 | S13 (Handsworth & Woodhouse) | £209 |

| 17 | S2 (Highfield, Heeley & Lowfield) | £198 |

| 18 | S9 (Darnall, Attercliffe & Tinsley) | £185 |

| 19 | S5 (Firth Park, Shiregreen & Southey) | £184 |

| 20 | S14 (Manor & Arbourthorne) | £139 |

| 21 | S4 (Burngreave, Fir Vale & Pitsmoor) | £122 |

This metric reveals the true cost of Sheffield's most desirable addresses. S17 (Dore and Totley) commands the highest price at £355 per sq ft, reflecting the premium families pay for access to top-rated schools, Peak District proximity, and established period homes on generous plots.

The university corridor of S10 and S11 follows closely at £317 and £311 per sq ft respectively. These areas attract both owner-occupiers seeking proximity to the hospitals and universities, and investors targeting the professional rental market. The premium reflects competition from students, NHS staff, and academics.

For investors focused on maximising space, the data points to the east. S4 (Burngreave) at £122 per sq ft and S14 (Manor) at £139 per sq ft offer nearly three times more space per pound than Dore. These areas suit investors considering HMO property where room count matters more than postcode prestige.

The regeneration hotspot of S3 (Kelham Island) sits mid-table at £240 per sq ft. This reflects the area's apartment-heavy stock where smaller floor areas push up the per-foot cost, despite absolute prices being among Sheffield's lowest.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Sheffield (%)

Updated December 2025

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| S3 (Kelham Island & Neepsend) | -11.5% | +3.6% | +52.3% |

| S5 (Firth Park, Shiregreen & Southey) | +4.4% | +8.8% | +43.6% |

| S36 (Stocksbridge & Deepcar) | +10.6% | +13.7% | +35.9% |

| S14 (Manor & Arbourthorne) | +2.8% | +6.2% | +34.7% |

| S9 (Darnall, Attercliffe & Tinsley) | +1.2% | +14.3% | +34.4% |

| S12 (Gleadless, Hackenthorpe & Intake) | +2.0% | +11.2% | +32.6% |

| S17 (Dore, Totley & Bradway) | +1.1% | +4.8% | +29.7% |

| S35 (Chapeltown & High Green) | +3.7% | +7.2% | +28.4% |

| S26 (Aston & Swallownest) | +5.3% | +17.0% | +28.1% |

| S13 (Handsworth & Woodhouse) | -1.5% | +6.9% | +27.2% |

| S6 (Hillsborough, Walkley & Stannington) | +2.6% | +5.7% | +26.5% |

| S8 (Norton, Woodseats & Meersbrook) | +3.9% | +8.3% | +26.4% |

| S4 (Burngreave, Fir Vale & Pitsmoor) | -6.7% | +3.1% | +26.3% |

| S11 (Ecclesall, Sharrow & Nether Edge) | +7.7% | -1.5% | +25.1% |

| S2 (Highfield, Heeley & Lowfield) | -3.9% | +7.0% | +24.6% |

| S25 (Dinnington & Anston) | -3.8% | +2.5% | +20.5% |

| S20 (Crystal Peaks & Mosborough) | -0.7% | +0.4% | +18.3% |

| S7 (Millhouses, Abbeydale & Beauchief) | +3.7% | +3.4% | +17.4% |

| S10 (Broomhill, Crookes & Fulwood) | -6.3% | -8.1% | +11.4% |

| S21 (Eckington & Killamarsh) | -0.8% | +4.6% | +7.5% |

| S1 (City Centre) | -18.4% | +16.1% | -1.8% |

The numbers tell a compelling story about where value has been created. S3 (Kelham Island) has delivered the strongest five-year growth at +52.3%, despite a sharp 11.5% correction over the past year. This is classic regeneration territory: early investors who bought into the brewery conversions and new-build apartments before Kelham became "cool" have seen exceptional returns.

S5 (Firth Park) follows with +43.6% over five years, continuing to show positive momentum at +4.4% annually. This is a pattern we see across many affordable areas in England: locations with lower entry prices often outperform on percentage growth because they started from a lower base.

The outer suburbs tell an interesting tale. S36 (Stocksbridge) is the only postcode showing double-digit annual growth at +10.6%, driven by remote workers seeking space and Peak District access at prices far below the premium western suburbs. Meanwhile, S26 (Aston and Swallownest) has delivered strong three-year growth of +17.0%, benefiting from the Advanced Manufacturing Park employment corridor.

The premium postcodes have underperformed on percentage terms. S10 (Broomhill) shows just +11.4% over five years and has declined 8.1% over three years, while S7 (Millhouses) managed only +17.4%. When you're already paying £320,000+ for a property, the ceiling for growth is naturally lower than areas starting at £120,000.

The city centre S1 stands out as the only postcode showing negative five-year growth at -1.8%. The student apartment market has faced headwinds from PBSA oversupply and changing demand patterns post-pandemic, though the +16.1% three-year figure suggests a recovery is underway.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Sheffield

Updated December 2025

The data represents the average number of residential property sales per month across Sheffield's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | S6 (Hillsborough, Walkley & Stannington) | 54 |

| 2 | S8 (Norton, Woodseats & Meersbrook) | 39 |

| 3 | S20 (Crystal Peaks & Mosborough) | 29 |

| 4 | S35 (Chapeltown & High Green) | 29 |

| 5 | S36 (Stocksbridge & Deepcar) | 29 |

| 6 | S2 (Highfield, Heeley & Lowfield) | 27 |

| 7 | S5 (Firth Park, Shiregreen & Southey) | 27 |

| 8 | S10 (Broomhill, Crookes & Fulwood) | 27 |

| 9 | S12 (Gleadless, Hackenthorpe & Intake) | 25 |

| 10 | S11 (Ecclesall, Sharrow & Nether Edge) | 23 |

| 11 | S13 (Handsworth & Woodhouse) | 18 |

| 12 | S25 (Dinnington & Anston) | 18 |

| 13 | S26 (Aston & Swallownest) | 18 |

| 14 | S21 (Eckington & Killamarsh) | 13 |

| 15 | S9 (Darnall, Attercliffe & Tinsley) | 12 |

| 16 | S7 (Millhouses, Abbeydale & Beauchief) | 10 |

| 17 | S17 (Dore, Totley & Bradway) | 10 |

| 18 | S3 (Kelham Island & Neepsend) | 7 |

| 19 | S4 (Burngreave, Fir Vale & Pitsmoor) | 7 |

| 20 | S1 (City Centre) | 4 |

| 21 | S14 (Manor & Arbourthorne) | 3 |

For investors, volume is vanity, but liquidity is sanity. The data reveals S6 (Hillsborough and Walkley) as Sheffield's most active market with 54 sales per month. This isn't surprising. S6 combines affordable family housing, Supertram connectivity, and proximity to both the city centre and the Peak District fringes. Properties here rarely linger if priced correctly.

S8 (Woodseats and Meersbrook) follows with 39 monthly sales, reflecting its position as the "next step up" for buyers priced out of neighbouring Ecclesall. The south-eastern suburban corridor of S20, S35, and S36 each see 29 sales monthly, indicating healthy demand from families seeking space and value outside the inner city.

The premium postcodes tell a different story. S17 (Dore) and S7 (Millhouses) see just 10 sales per month each. This isn't weak demand but rather a limited supply of property opportunities.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Sheffield Rental Market Analysis

For first-time buyers buying their first rental property in Sheffield (Steel City) and thinking how much they can charge for rent across the city centre and its diverse neighbourhoods, the rental data below gives an indication on the rental income per month and the rental yields landlords can aim to achieve for their AST buy to lets. This is helpful if you are considering how to start a property portfolio in this area.

Rental Prices in Sheffield (£)

Updated December 2025

The data represents the average monthly rent for long-let AST properties in Sheffield.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | S11 (Ecclesall, Sharrow & Nether Edge) | £1,048 |

| 2 | S26 (Aston & Swallownest) | £939 |

| 3 | S10 (Broomhill, Crookes & Fulwood) | £929 |

| 4 | S8 (Norton, Woodseats & Meersbrook) | £907 |

| 5 | S13 (Handsworth & Woodhouse) | £900 |

| 6 | S20 (Crystal Peaks & Mosborough) | £894 |

| 7 | S36 (Stocksbridge & Deepcar) | £893 |

| 8 | S35 (Chapeltown & High Green) | £883 |

| 9 | S6 (Hillsborough, Walkley & Stannington) | £881 |

| 10 | S9 (Darnall, Attercliffe & Tinsley) | £869 |

| 11 | S12 (Gleadless, Hackenthorpe & Intake) | £864 |

| 12 | S25 (Dinnington & Anston) | £861 |

| 13 | S5 (Firth Park, Shiregreen & Southey) | £856 |

| 14 | S2 (Highfield, Heeley & Lowfield) | £831 |

| 15 | S7 (Millhouses, Abbeydale & Beauchief) | £815 |

| 16 | S3 (Kelham Island & Neepsend) | £790 |

| 17 | S21 (Eckington & Killamarsh) | £777 |

| 18 | S1 (City Centre) | £746 |

The standout insight here is the rental compression across Sheffield. Just £302 separates the highest rent (S11 at £1,048) from the lowest (S1 at £746). For investors, this means the value postcodes achieve surprisingly competitive rents. S5 (Firth Park) commands £856 monthly despite entry prices under £160,000, while premium S7 (Millhouses) achieves just £815 despite prices approaching £280,000.

S26 (Aston) outperforming the university corridor reflects the pull of the Advanced Manufacturing Park employment hub. Tenants working at Boeing, McLaren, and Rolls-Royce will pay premium rents for a short commute, creating opportunities in areas most investors overlook.

Note: Postcodes S4, S14, and S17 have insufficient rental data available.

Gross Rental Yields in Sheffield (%)

Updated December 2025

The data represents the average gross rental yields across Sheffield's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | S3 (Kelham Island & Neepsend) | 7.8% |

| 2 | S1 (City Centre) | 6.6% |

| 3 | S5 (Firth Park, Shiregreen & Southey) | 6.5% |

| 4 | S9 (Darnall, Attercliffe & Tinsley) | 6.3% |

| 5 | S2 (Highfield, Heeley & Lowfield) | 5.8% |

| 6 | S13 (Handsworth & Woodhouse) | 5.6% |

| 7 | S12 (Gleadless, Hackenthorpe & Intake) | 5.4% |

| 8 | S6 (Hillsborough, Walkley & Stannington) | 4.9% |

| 9 | S20 (Crystal Peaks & Mosborough) | 4.8% |

| 10 | S26 (Aston & Swallownest) | 4.6% |

| 11 | S8 (Norton, Woodseats & Meersbrook) | 4.3% |

| 12 | S25 (Dinnington & Anston) | 4.2% |

| 13 | S35 (Chapeltown & High Green) | 3.9% |

| 14 | S11 (Ecclesall, Sharrow & Nether Edge) | 3.7% |

| 15 | S7 (Millhouses, Abbeydale & Beauchief) | 3.5% |

| 16 | S10 (Broomhill, Crookes & Fulwood) | 3.4% |

| 17 | S21 (Eckington & Killamarsh) | 3.4% |

Sheffield delivers yields that most southern investors can only dream of. Seven postcodes exceed 5%, with S3 (Kelham Island) topping the table at 7.8%. The regeneration area combines Sheffield's lowest entry prices with strong rental demand from young professionals drawn to the brewery conversions and riverside apartments. For yield-focused investors, the eastern postcodes of S5, S9, and S2 all deliver above 5.5% without the regeneration premium risk.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses. Postcodes S4, S14, S17, and S36 have insufficient data to calculate yields.

Landlords can use our rental investment calculator to factor in these buy to let ownership costs.

Is Sheffield Rent High?

Sheffield's rental market offers genuine affordability compared to most major English cities. Tenants here commit a far smaller proportion of their salary to rent than those in London, Brighton, or Manchester.

Average rent in Sheffield costs between 23% and 33% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Sheffield residents is £38,116 (based on £733.0 per week).

Even the highest-rent postcode, S11 (Ecclesall), requires just 33.0% of median local income. The 30% benchmark often cited as "affordable" is met or beaten by most Sheffield postcodes, giving tenants breathing room and landlords confidence in sustainable rental affordability.

| Rank | Area | Annual Rent | Rent as % of Income |

|---|---|---|---|

| 1 | S11 (Ecclesall, Sharrow & Nether Edge) | £12,576 | 33.0% |

| 2 | S26 (Aston & Swallownest) | £11,268 | 29.6% |

| 3 | S10 (Broomhill, Crookes & Fulwood) | £11,148 | 29.2% |

| 4 | S8 (Norton, Woodseats & Meersbrook) | £10,884 | 28.5% |

| 5 | S13 (Handsworth & Woodhouse) | £10,800 | 28.3% |

| 6 | S20 (Crystal Peaks & Mosborough) | £10,728 | 28.1% |

| 7 | S36 (Stocksbridge & Deepcar) | £10,716 | 28.1% |

| 8 | S35 (Chapeltown & High Green) | £10,596 | 27.8% |

| 9 | S6 (Hillsborough, Walkley & Stannington) | £10,572 | 27.7% |

| 10 | S9 (Darnall, Attercliffe & Tinsley) | £10,428 | 27.4% |

| 11 | S12 (Gleadless, Hackenthorpe & Intake) | £10,368 | 27.2% |

| 12 | S25 (Dinnington & Anston) | £10,332 | 27.1% |

| 13 | S5 (Firth Park, Shiregreen & Southey) | £10,272 | 26.9% |

| 14 | S2 (Highfield, Heeley & Lowfield) | £9,972 | 26.2% |

| 15 | S7 (Millhouses, Abbeydale & Beauchief) | £9,780 | 25.7% |

| 16 | S3 (Kelham Island & Neepsend) | £9,480 | 24.9% |

| 17 | S21 (Eckington & Killamarsh) | £9,324 | 24.5% |

| 18 | S1 (City Centre) | £8,952 | 23.5% |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Sheffield House Prices High?

For a local property buyer on average mean full-time earnings, Sheffield offers genuine accessibility compared to most major English cities.

Purchasing a property in Sheffield requires between 3.2 and 11.9 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Sheffield residents is £38,116.

The most expensive area relative to income is S17 (Dore and Totley), requiring 11.9 times the average salary, reflecting its status as Sheffield's premier residential location. At the other end, S3 (Kelham Island) requires just 3.2 times earnings, making it one of the most accessible city centre locations in any major English city and explaining why first-time homebuyers and investors alike are drawn to the area.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | S17 (Dore, Totley & Bradway) | 11.9x |

| 2 | S11 (Ecclesall, Sharrow & Nether Edge) | 9.0x |

| 3 | S10 (Broomhill, Crookes & Fulwood) | 8.5x |

| 4 | S7 (Millhouses, Abbeydale & Beauchief) | 7.4x |

| 5 | S36 (Stocksbridge & Deepcar) | 7.4x |

| 6 | S21 (Eckington & Killamarsh) | 7.2x |

| 7 | S35 (Chapeltown & High Green) | 7.2x |

| 8 | S8 (Norton, Woodseats & Meersbrook) | 6.7x |

| 9 | S26 (Aston & Swallownest) | 6.5x |

| 10 | S25 (Dinnington & Anston) | 6.4x |

| 11 | S20 (Crystal Peaks & Mosborough) | 5.9x |

| 12 | S6 (Hillsborough, Walkley & Stannington) | 5.6x |

| 13 | S12 (Gleadless, Hackenthorpe & Intake) | 5.0x |

| 14 | S13 (Handsworth & Woodhouse) | 5.0x |

| 15 | S2 (Highfield, Heeley & Lowfield) | 4.5x |

| 16 | S9 (Darnall, Attercliffe & Tinsley) | 4.4x |

| 17 | S5 (Firth Park, Shiregreen & Southey) | 4.2x |

| 18 | S1 (City Centre) | 3.6x |

| 19 | S14 (Manor & Arbourthorne) | 3.5x |

| 20 | S4 (Burngreave, Fir Vale & Pitsmoor) | 3.2x |

| 21 | S3 (Kelham Island & Neepsend) | 3.2x |

Compared to nearby locations, Sheffield sits at the affordable end of major city markets.

How Much Deposit to Buy a House in Sheffield?

Assuming a standard 30% deposit for a buy-to-let mortgage, Sheffield offers exceptional accessibility. The data shows a £99,700 difference between the most affordable and most expensive areas, giving investors genuine choice across risk profiles.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | S3 (Kelham Island & Neepsend) | £36,341 |

| 2 | S4 (Burngreave, Fir Vale & Pitsmoor) | £36,749 |

| 3 | S14 (Manor & Arbourthorne) | £39,624 |

| 4 | S1 (City Centre) | £40,983 |

| 5 | S5 (Firth Park, Shiregreen & Southey) | £47,491 |

| 6 | S9 (Darnall, Attercliffe & Tinsley) | £49,813 |

| 7 | S2 (Highfield, Heeley & Lowfield) | £51,194 |

| 8 | S13 (Handsworth & Woodhouse) | £57,462 |

| 9 | S12 (Gleadless, Hackenthorpe & Intake) | £57,580 |

| 10 | S6 (Hillsborough, Walkley & Stannington) | £64,529 |

| 11 | S20 (Crystal Peaks & Mosborough) | £67,235 |

| 12 | S25 (Dinnington & Anston) | £73,039 |

| 13 | S26 (Aston & Swallownest) | £73,786 |

| 14 | S8 (Norton, Woodseats & Meersbrook) | £76,290 |

| 15 | S35 (Chapeltown & High Green) | £82,355 |

| 16 | S21 (Eckington & Killamarsh) | £82,835 |

| 17 | S36 (Stocksbridge & Deepcar) | £84,229 |

| 18 | S7 (Millhouses, Abbeydale & Beauchief) | £84,682 |

| 19 | S10 (Broomhill, Crookes & Fulwood) | £97,196 |

| 20 | S11 (Ecclesall, Sharrow & Nether Edge) | £102,757 |

| 21 | S17 (Dore, Totley & Bradway) | £136,042 |

If you are new to the market, S3 (Kelham Island) offers the most affordable entry point, requiring a deposit of just £36,341. Crucially, this area also delivers Sheffield's highest yields (7.8%), making it highly efficient for capital deployment. The regeneration story adds growth potential on top.

How to Invest in Buy-to-Let in Sheffield

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Sheffield, South Yorkshire and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Sheffield and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Sheffield for Buy-to-Let Investment

For investors seeking similar property prices, buy-to-let in Nottingham offers a comparable mix of two universities, strong employment base, and accessible entry prices with proven rental demand. If the northern powerhouse growth story appeals, buy-to-let in Manchester provides higher capital growth potential however it comes at a premium price point.