Where to Buy Property Investments in Warrington: Yields of 4.7%

Warrington might not grab headlines like Manchester or Liverpool, but for buy-to-let investors who know the North West, it has quietly delivered solid returns for two decades. I bought my first property here in 2005, and the fundamentals that made it attractive then still hold today: consistent tenant demand, steady employment growth, and house prices that actually make the numbers work.

The property data confirms the value proposition. Warrington's average sold price of £257,390 sits 12% below the England average, yet local wages run 8% above the national median. That combination of affordable entry prices and higher-than-average incomes creates a rental market where tenants can actually afford to pay, and landlords can achieve yields towards 4.7% in the right postcodes. This might sound lower than some headline grabbing towns and cities in the North (like buy to let in Leeds or buy to let in Tameside) however, remember this is an 'average' and the steady homebuyer demand is keeping house prices and rental yields balanced.

Our buy-to-let analysis examines the town's key postcodes from WA1 to WA5, evaluating capital growth, rental yields, and the property investment potential across Warrington and its surrounding areas.

Article updated: December 2025

Warrington Buy-to-Let Market Overview 2025

Warrington's property market delivers asking prices 12% below the England average, with local wages 8% above the national median, creating these key investment metrics:

- Asking price range: £215,234 (WA2) to £331,096 (WA4) across Warrington postcodes

- Rental yields: 3.9% (WA4) to 4.7% (WA2) across different postcodes

- Rental income: Monthly rents from £845 (WA2) to £1,066 (WA4)

- Price per sq ft: House prices from £224/sq ft (WA2) to £297/sq ft (WA4)

- Market activity: Sales ranging from 23 per month (WA1) to 50 per month (WA4)

- Deposit requirements: 30% deposits range from £64,570 (WA2) to £99,329 (WA4)

- Affordability ratios: Property prices from 6.2 to 9.6 times Warrington's median annual salary of £34,460

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Warrington?

Warrington hasn't delivered the headline capital growth of Manchester or Liverpool, but that's not what makes it special. What it offers is something more reliable: a town where the fundamentals consistently stack up. Affordable prices, strong local wages, steady tenant demand, and infrastructure that keeps improving year on year.

The value proposition is clear. Warrington's average sold price is £257,390, sitting 12% below the national average of £293,292. Yet median earnings here are £34,460, which is 8% above the England median of £31,875. That gap between affordable house prices and above-average wages is exactly what creates a healthy rental market. Tenants have money to pay rent, and landlords don't need to overpay for stock.

The town's location is the engine behind this. Warrington sits at the crossroads of the M6, M62, and M56, making it one of the best-connected towns in the country. You can reach Manchester or Liverpool in under 30 minutes by train from Warrington Bank Quay or Warrington Central. London is under two hours on the West Coast Main Line. For employers, that accessibility is gold, which is why major companies like Amazon, Sellafield Ltd, United Utilities, and AECOM have operations here. The Omega and Birchwood business parks alone provide tens of thousands of jobs within the borough.

This employment base is what underpins tenant demand. People come to Warrington for work, and they need somewhere to live. The rental market here isn't driven by speculation or short-term trends. It's driven by jobs. Simple as that.

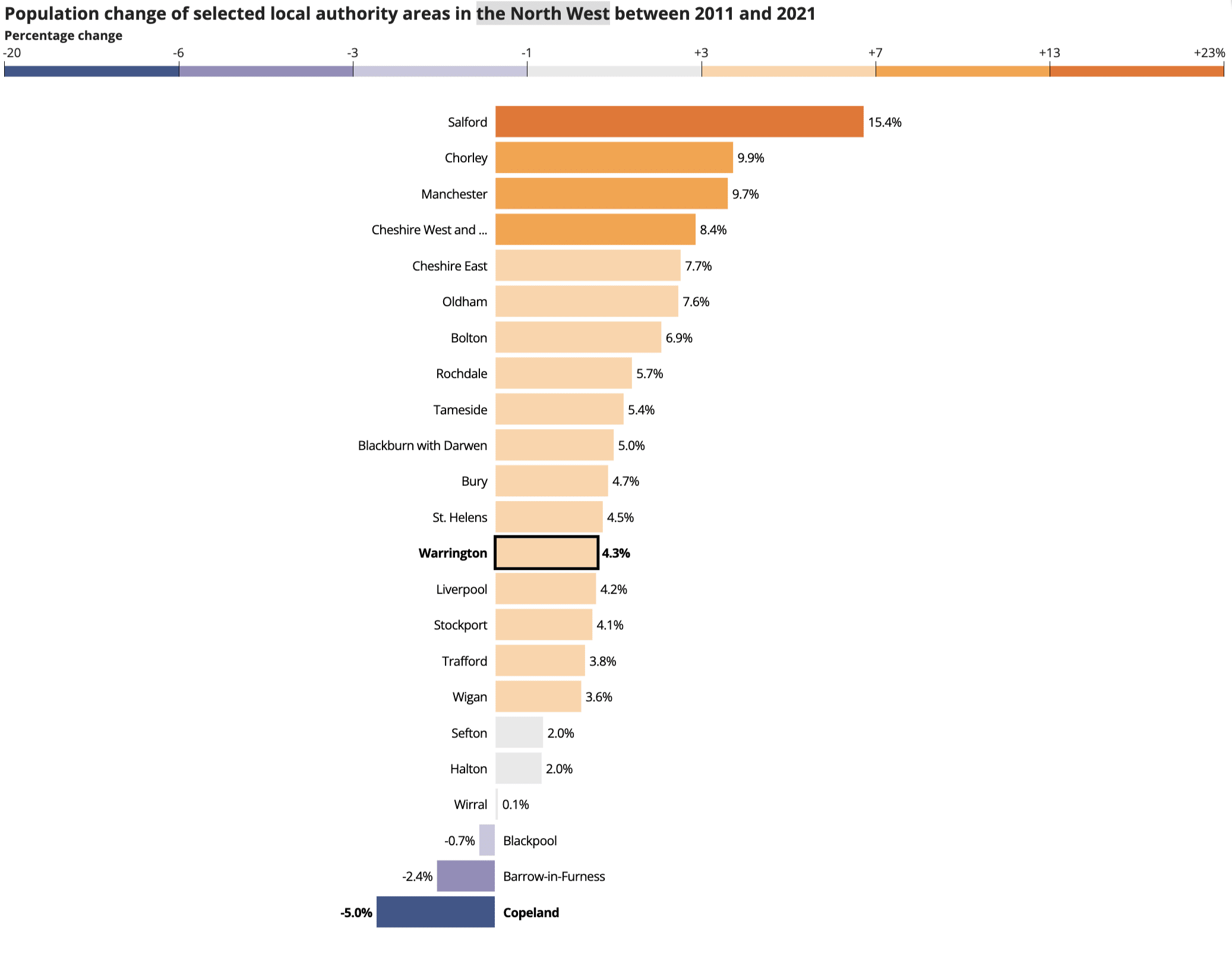

The town's population reflects this steady growth. According to the latest census data, the population of Warrington increased by 4.2%, rising from 202,709 in 2011 to 211,182 in 2021. That's an additional 8,473 residents over the decade, all of whom need housing. You can explore the full breakdown via the ONS Census Data for Warrington.

There's also the lifestyle appeal. Unlike some industrial towns that struggle to attract families, Warrington has genuinely nice areas to live. Villages like Lymm, Stockton Heath, and Grappenhall offer a semi-rural feel with good schools, country pubs, and canal walks, yet you're still 10 minutes from the motorway. That combination attracts long-term tenants who stay put, which means fewer voids and more stable returns.

For investors seeking similar North West dynamics at different price points, it's worth comparing Warrington with buy-to-let in Manchester for higher growth potential, buy-to-let in Liverpool for stronger yields, or buy-to-let in Chester for a similar commuter-town profile with a greater. depth of property styles at a higher price point.

Regeneration and Investment in Warrington

Warrington's investment case is built on a "two-stage" narrative. The first stage, driven by the "Warrington Means Business" strategy, delivered the economic bedrock of the town: the £142m Time Square redevelopment and the colossal Omega logistics hub. These completed projects have already secured high tenant demand and steady yields.

The second stage, active right now from 2025, is about transformational capital growth. The focus has shifted from pure infrastructure to creating new high-quality residential districts and green energy hubs.

Major projects driving this next phase of growth include:

- Fiddler's Ferry (The New Giant): This is the defining project for Warrington's next decade. Following the demolition of the northern cooling towers, the 820-acre brownfield site has moved into active delivery. In May 2025, the council approved the first major phase, which includes 1.4 million sq ft of industrial space and the first wave of over 1,700 new homes. This project is effectively building a new sustainable town district from scratch. Updates are available at Peel NRE's Fiddler's Ferry page.

- The Stadium Quarter (The Wireworks): While the Stadium Quarter has long been a commercial zone, 2025 marks its shift into a primary residential destination. The headline development is "The Wireworks," a massive scheme on the former industrial site between Tanners Lane and Winwick Street. Recently approved to deliver 550 new apartments and a hotel, this development is set to create the high-density city-centre living culture that Warrington has previously lacked. You can track the wider masterplan at Warrington & Co.

- Southern Gateway (Bevan Mews): This regeneration zone unlocks the land connecting the River Mersey to the town centre. A key milestone was reached in early 2025 with the deal to transform the former Wilderspool Stadium site into "Bevan Mews," a new housing scheme by Edwards Homes. Coupled with the relocation of the bus depot to Dallam Lane, this area is rapidly changing from industrial "backlands" into a desirable riverside residential corridor. Details are available via Wire Regeneration.

- Omega (The Final Phase): Omega is now a mature investment location, housing giants like Amazon and Domino's. However, the story isn't quite finished. In November 2025, Miller Homes acquired the land for the "Final Phase" of residential development (Zone 4), cementing the area as a complete live-work district. For investors, this signals that the area has transitioned from a construction site to a fully established, low-risk community. Read more at Omega Warrington.

Warrington Property Market Analysis

When Was the Last House Price Crash in Warrington?

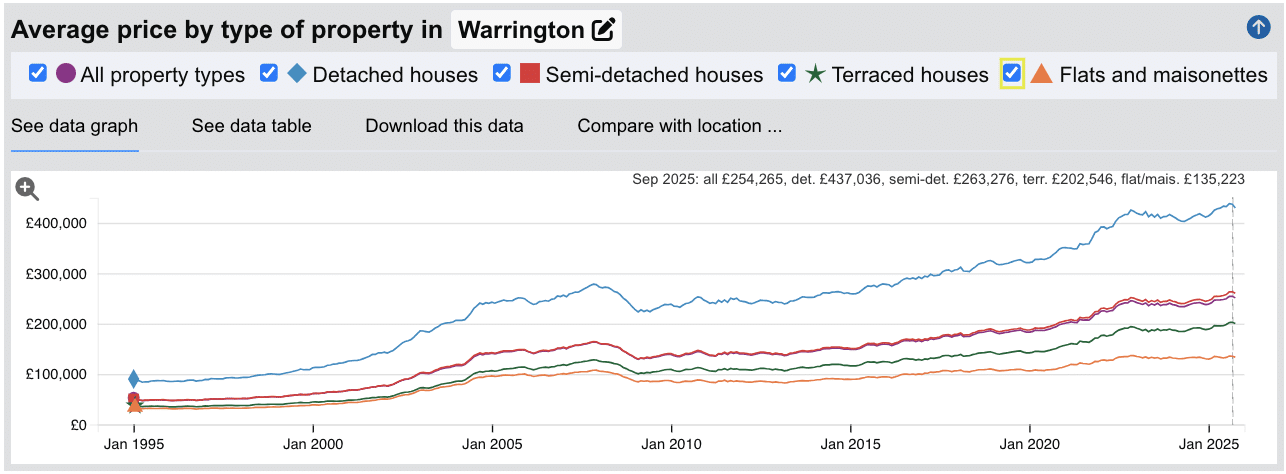

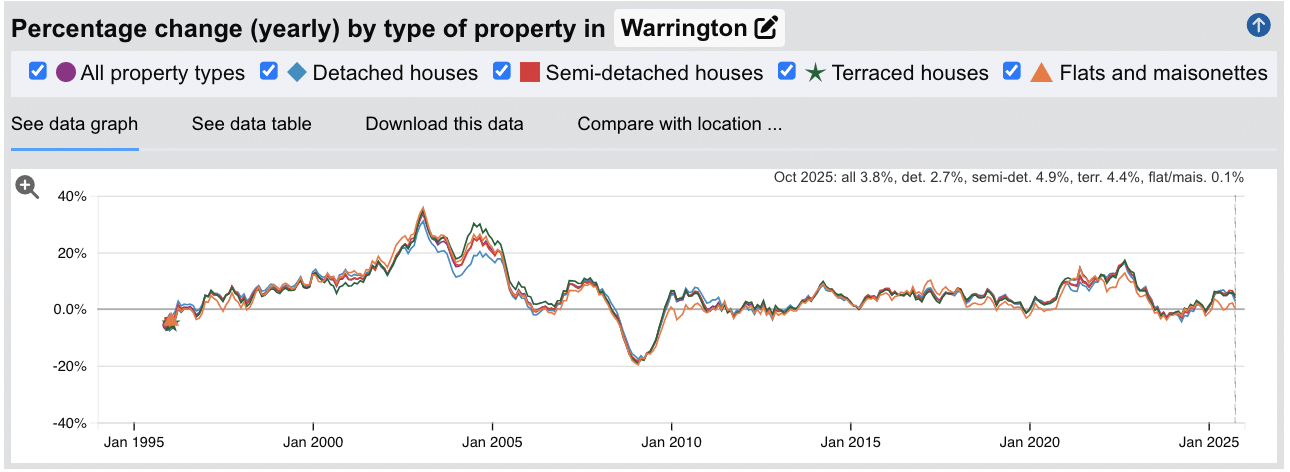

The last significant property price crash in Warrington occurred during the global financial crisis of 2008-2009, with prices falling approximately 20% from peak to trough. Unlike some northern markets that took years to recover, Warrington bounced back relatively quickly, supported by its strong employment base and strategic location between Manchester and Liverpool.

More recently, 2023 saw a brief correction as interest rate increases impacted affordability across the UK. Warrington experienced negative annual growth through much of 2023, reaching -3.2% in November 2023. However, the market has since stabilised with positive growth returning throughout 2025.

Source: HM Land Registry House Price Index for Warrington

Here is how the Warrington property market has performed over the key cycles:

- 1995-2007 saw sustained growth where property values more than tripled, rising from around £50,000 to over £160,000 as Warrington's new town infrastructure matured and major employers moved in.

- 2008-2009 brought the financial crisis correction where values dropped by approximately 20% from the October 2007 peak of £161,913 to a low of £129,198 in February 2009.

- 2010-2019 was a period of steady recovery and growth. Prices regained their pre-crash peak by around 2014 and continued climbing as Omega and Birchwood Park attracted major employers.

- 2020-2022 delivered the pandemic boom with exceptional growth reaching 16.5% annually in September 2022, pushing average prices from £183,000 to over £245,000.

- 2023-2024 saw a market correction as mortgage rates spiked. Annual growth turned negative, reaching -3.2% in November 2023 before stabilising.

- 2025 has marked a recovery phase with positive growth returning. By October 2025, prices sit at £251,026, up 3.8% year-on-year, demonstrating resilient buyer demand.

Long-Term Property Value Growth in Warrington

For buy-to-let investors, the long-term picture demonstrates why Warrington has attracted sustained interest. It delivers strong capital appreciation over extended holding periods:

- 5 years (2020-2025): +29.4% growth (average prices rising from £193,924 to £251,026)

- 10 years (2015-2025): +60.9% growth (average prices rising from £156,014 to £251,026)

- 15 years (2010-2025): +73.3% growth (average prices rising from £144,813 to £251,026)

- 20 years (2005-2025): +70.2% growth (average prices rising from £147,449 to £251,026)

- 30 years (1995-2025): +419.5% growth (average prices rising from £48,333 to £251,026)

The 2023 correction reflected temporary affordability constraints from rapid interest rate increases rather than any weakness in Warrington's fundamentals. The swift return to positive growth in 2025 demonstrates that demand remains robust, underpinned by the town's strong employment base, excellent transport links, and ongoing regeneration investment.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Warrington

The latest sold house price index by the Land Registry confirms Warrington's position as an affordable alternative to nearby cities, with values sitting comfortably below the national benchmark.

Warrington property prices average £257,390, which is 12.2% below the England average of £293,292. This discount is notable given Warrington's strong economy, high local wages, and excellent transport links to Manchester and Liverpool.

Flats and maisonettes offer the most significant value proposition, averaging £137,084. This is a substantial 38.6% below the national average, making them particularly attractive for investors targeting young professionals and key workers. Terraced houses at £204,547 represent a 16.1% saving versus the England average, with many Victorian and Edwardian terraces in areas like Latchford and central Warrington offering character properties at accessible prices.

Semi-detached houses average £266,696 (7.7% below national), popular with families seeking suburban living with good schools and garden space. Detached houses command £442,869, still 7.1% below the national average, offering larger family homes in areas like Stockton Heath, Grappenhall, and Appleton at prices that would be unthinkable in the commuter belt around London.

Updated December 2025

| Property Type | Warrington Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £442,869 | £476,505 | -7.1% |

| Semi-detached houses | £266,696 | £289,308 | -7.8% |

| Terraced houses | £204,547 | £243,944 | -16.1% |

| Flats and maisonettes | £137,084 | £223,264 | -38.6% |

| All property types | £257,390 | £293,292 | -12.2% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Warrington

Updated December 2025

The data represents the average asking prices of properties currently listed for sale across Warrington's five postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | WA4 (Stockton Heath, Grappenhall, Appleton) | £331,096 |

| 2 | WA3 (Culcheth, Birchwood, Risley) | £288,800 |

| 3 | WA5 (Great Sankey, Penketh, Westbrook) | £285,008 |

| 4 | WA1 (Warrington Town Centre) | £253,558 |

| 5 | WA2 (Orford, Padgate, Winwick) | £215,234 |

Warrington's property market spans a £115,862 range from most to least expensive postcode, creating distinct investment options for landlords. WA4 (Stockton Heath, Grappenhall, Appleton) commands the highest prices at £331,096, reflecting its village atmosphere, period properties, and proximity to sought-after schools. This is Warrington's premium residential area, attracting families and professionals willing to pay for lifestyle.

WA3 (Culcheth, Birchwood, Risley) follows at £288,800. Birchwood Park's business hub drives demand here, with major employers including Sellafield Ltd and Cavendish Nuclear creating a steady tenant pool of professionals. WA5 (Great Sankey, Penketh, Westbrook) sits close behind at £285,008, popular with families and commuters working at the nearby Omega development.

For yield-focused investors, the most accessible entry points are WA1 (Town Centre) at £253,558 and WA2 (Orford, Padgate, Winwick) at £215,234. WA2 offers the lowest average prices in Warrington, with the University of Chester's Padgate campus and good rail connections to Manchester and Liverpool supporting rental demand. The £115,862 gap between WA4 and WA2 means investors can choose between capital growth plays in premium areas or higher-yielding opportunities in more affordable postcodes.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Warrington (£)

Updated December 2025

The data represents the average price per square foot across Warrington's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | WA4 (Stockton Heath, Grappenhall, Appleton) | £281 |

| 2 | WA3 (Culcheth, Birchwood, Risley) | £249 |

| 3 | WA5 (Great Sankey, Penketh, Westbrook) | £241 |

| 4 | WA1 (Warrington Town Centre) | £227 |

| 5 | WA2 (Orford, Padgate, Winwick) | £206 |

WA4 (Stockton Heath, Grappenhall, Appleton) commands the highest density value at £281 per sq ft, reflecting its larger detached properties and village character that buyers pay extra for.

The gap between WA4 and WA2 is £75 per square foot. That's significant when you're buying larger properties. A 1,000 sq ft family home in WA2 costs roughly £75,000 less than the same sized property in WA4, purely based on location.

For investors focused on maximising space, perhaps for HMO conversions or larger family lets, the data points to WA2 (Orford, Padgate, Winwick) at £206 per sq ft. You're getting over 35% more floor space for your money compared to the premium WA4 postcodes.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Warrington (%)

Updated December 2025

The data represents the average house price growth over the past five years, calculated using postcode-level data blending sold prices and asking prices to identify the highest performing areas.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | WA1 (Warrington Town Centre) | 33.6% |

| 2 | WA2 (Orford, Padgate, Winwick) | 33.3% |

| 3 | WA3 (Culcheth, Birchwood, Risley) | 24.8% |

| 4 | WA5 (Great Sankey, Penketh, Westbrook) | 22.7% |

| 5 | WA4 (Stockton Heath, Grappenhall, Appleton) | 18.2% |

The data reveals a pattern that often catches investors off guard: the highest capital appreciation hasn't come from Warrington's premium postcodes, but from the most affordable areas. WA1 (Town Centre) and WA2 (Orford, Padgate, Winwick) have delivered remarkable growth of 33.6% and 33.3% respectively over five years.

This is the value catch-up effect in action. Lower-priced areas had more room to grow as buyers priced out of premium locations looked for alternatives. WA1 has also benefited directly from the town centre regeneration projects, including the £22.1m Town Deal investment and new residential developments like The Steelworks.

WA4 (Stockton Heath, Grappenhall, Appleton) shows the slowest growth at 18.2%, despite being the most expensive postcode. This is typical of established premium areas. They're already priced at a premium, so percentage growth tends to lag behind emerging locations even when absolute price increases are healthy.

For investors weighing yield against growth, this data suggests WA2 offers a rare combination: the lowest entry prices, the highest yields (4.7%), and some of the strongest historic growth. That's unusual and worth noting.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Warrington

Updated December 2025

The data represents the average number of residential property sales per month across Warrington's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | WA5 (Great Sankey, Penketh, Westbrook) | 68 |

| 2 | WA1 (Warrington Town Centre) | 54 |

| 3 | WA4 (Stockton Heath, Grappenhall, Appleton) | 53 |

| 4 | WA2 (Orford, Padgate, Winwick) | 44 |

| 5 | WA3 (Culcheth, Birchwood, Risley) | 37 |

Warrington's transaction volumes tell a story of a healthy, active market across all postcodes. WA5 (Great Sankey, Penketh, Westbrook) leads with 68 sales per month, driven by ongoing new-build activity around the Omega development and strong family demand for the area's newer housing stock.

WA1 (Town Centre) and WA4 (Stockton Heath) both see consistent activity at 54 and 53 sales monthly. WA4's volume is particularly notable given its premium pricing. High transaction counts in expensive areas signal genuine buyer depth, not just aspirational listings sitting unsold.

The spread between highest and lowest is relatively tight compared to many markets. Even WA3 (Culcheth, Birchwood) at 37 monthly sales represents a liquid market. This matters when you come to sell. A property in WA3 won't languish on the market the way it might in some lower-volume postcodes elsewhere in the North West.

One pattern worth noting: WA2 shows the highest yields and strongest growth, but ranks fourth for liquidity. This is relative though and is still ahead of many other markets, it's simply that across Warrington demand is strong and property sales liquidity is high currently.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Warrington Rental Market Analysis

For investors considering buying their first rental property in Warrington, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are building a portfolio in this area or comparing Warrington against many of the other best buy-to-let locations in the North West.

Rental Prices in Warrington (£)

Updated December 2025

The data represents the average monthly rent for long-let AST properties in Warrington.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | WA4 (Stockton Heath, Grappenhall, Appleton) | £1,066 |

| 2 | WA5 (Great Sankey, Penketh, Westbrook) | £1,049 |

| 3 | WA3 (Culcheth, Birchwood, Risley) | £1,001 |

| 4 | WA1 (Warrington Town Centre) | £908 |

| 5 | WA2 (Orford, Padgate, Winwick) | £845 |

WA4 (Stockton Heath, Grappenhall, Appleton) commands Warrington's highest average rents at £1,066 per month. This reflects the family rental market here, with tenants paying for village character, good schools, and larger properties. WA5 follows closely at £1,049, driven by demand from professionals working at Omega and families attracted to the newer housing stock.

The rental spread across Warrington is relatively compressed. Just £221 separates the highest rent (WA4) from the lowest (WA2). Compare that to cities like Brighton where the gap between top and bottom postcodes can exceed £500. This compression works in favour of yield-focused investors: WA2's lower purchase prices combined with rents not far behind premium areas is exactly why it delivers the best returns.

WA1 (Town Centre) at £908 and WA2 at £845 offer the most accessible entry points for tenants, which translates to broader tenant pools and typically shorter void periods. For landlords, the trade-off is clear: accept slightly lower rents in exchange for stronger demand and faster lets.

Note: These figures represent average rents across all property types. Actual achievable rents vary based on property size, condition, and specific location.

Gross Rental Yields in Warrington (%)

Updated December 2025

The data represents the average gross rental yields across Warrington's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | WA2 (Orford, Padgate, Winwick) | 4.7% |

| 2 | WA5 (Great Sankey, Penketh, Westbrook) | 4.4% |

| 3 | WA1 (Warrington Town Centre) | 4.3% |

| 4 | WA3 (Culcheth, Birchwood, Risley) | 4.2% |

| 5 | WA4 (Stockton Heath, Grappenhall, Appleton) | 3.9% |

WA2 (Orford, Padgate, Winwick) delivers Warrington's strongest yields at 4.7%. This postcode combines the lowest entry prices with rents that aren't dramatically lower than premium areas, creating the best return on capital. For investors focused on cash flow, WA2 is the clear target.

WA5 and WA1 offer solid middle-ground options at 4.4% and 4.3% respectively. WA1 is particularly interesting given its town centre location and direct benefit from regeneration investment. These aren't spectacular yields, but they're competitive for the North West and come with strong liquidity.

WA4 (Stockton Heath) shows the lowest yield at 3.9%, which is typical for premium locations. Investors here are trading immediate cash flow for lifestyle appeal and long-term stability. The tenant profile in WA4 skews toward established professionals and families who tend to stay longer, reducing turnover costs.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental yield calculator to factor in these buy-to-let ownership costs.

Is Warrington Rent High?

Warrington's rental market is notably affordable, particularly given the town's strong employment base. The combination of above-average local earnings and moderate rents means tenants commit a smaller portion of their salary to housing than in many comparable markets.

Average rent in Warrington costs between 25% and 32% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Warrington residents is £40,669 (based on £782.1 per week).

The highest-rent postcode, WA4, requires 31.5% of the median local income. That's comfortable by any standard and would be considered highly affordable in southern markets. The most accessible option, WA2, requires just 24.9% of median income, leaving tenants with significantly more disposable income than renters in cities like Brighton or Manchester.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | WA4 (Stockton Heath, Grappenhall, Appleton) | 31.5% |

| 2 | WA5 (Great Sankey, Penketh, Westbrook) | 31.0% |

| 3 | WA3 (Culcheth, Birchwood, Risley) | 29.5% |

| 4 | WA1 (Warrington Town Centre) | 26.8% |

| 5 | WA2 (Orford, Padgate, Winwick) | 24.9% |

For landlords, this affordability translates to a deeper tenant pool. When rent takes around a quarter of gross income, tenants have genuine financial resilience. That means fewer missed payments, longer tenancies, and lower void risk. Warrington's combination of above-average local earnings (£40,669 vs the North West median of £38,210) and moderate rents creates one of the more stable rental markets in the region.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Warrington House Prices High?

For a local property buyer on average full-time earnings, Warrington offers genuinely accessible home ownership compared to most of the South and even some northern cities.

Purchasing a property in Warrington requires between 5.3 and 8.1 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Warrington residents is £40,669.

The most expensive area relative to income is WA4 (Stockton Heath, Grappenhall, Appleton), requiring 8.1 times the average salary. That's still below the UK average of around 9x and significantly more accessible than southern equivalents. The most affordable postcode, WA2 (Orford, Padgate, Winwick), requires just 5.3 times earnings, putting home ownership within reach for many local workers.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | WA4 (Stockton Heath, Grappenhall, Appleton) | 8.1x |

| 2 | WA3 (Culcheth, Birchwood, Risley) | 7.1x |

| 3 | WA5 (Great Sankey, Penketh, Westbrook) | 7.0x |

| 4 | WA1 (Warrington Town Centre) | 6.2x |

| 5 | WA2 (Orford, Padgate, Winwick) | 5.3x |

This affordability has two implications for investors. First, it supports a healthy owner-occupier market, which means strong resale demand when you come to exit. Second, it creates competition for rental stock. When buying is achievable, tenants who stay renting are often doing so by choice or circumstance rather than being permanently locked out. That tends to produce a more stable tenant base than markets where renting is the only option.

How Much Deposit to Buy a House in Warrington?

Assuming a standard 30% deposit for a buy-to-let mortgage, Warrington offers genuinely accessible entry points. The gap between most and least expensive postcodes is around £35,000, giving investors flexibility based on their capital position.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | WA2 (Orford, Padgate, Winwick) | £64,570 |

| 2 | WA1 (Warrington Town Centre) | £76,068 |

| 3 | WA5 (Great Sankey, Penketh, Westbrook) | £85,502 |

| 4 | WA3 (Culcheth, Birchwood, Risley) | £86,640 |

| 5 | WA4 (Stockton Heath, Grappenhall, Appleton) | £99,329 |

For investors entering the market, WA2 (Orford, Padgate, Winwick) offers the lowest barrier at £64,570. This postcode also delivers the highest yields (4.7%) and has shown the strongest five-year growth (33.3%). That combination of low entry cost, strong returns, and proven appreciation is unusual and worth highlighting.

WA1 (Town Centre) at £76,068 provides another accessible option with direct exposure to the regeneration investment currently reshaping central Warrington.

At the top end, WA4 (Stockton Heath) requires just under £100,000. For context, that's roughly what you'd need for a mid-range postcode in Brighton, yet here it buys into Warrington's most desirable residential area. Investors at this level are targeting tenant quality and long-term stability over maximum yield.

How to Invest in Buy-to-Let in Warrington

Property Investments UK and our partners have ready-to-go buy-to-let properties to purchase across Warrington, Cheshire, and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Warrington and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- The buy, refurbish, refinance strategy

Consider Similar Areas to Warrington for Buy-to-Let Investment

For investors seeking similar fundamentals, strong employment, good transport links, and affordable entry prices, several nearby markets offer comparable opportunities. Buy-to-let in Salford provides exposure to Greater Manchester's growth story with MediaCityUK driving professional tenant demand. Buy-to-let in Stockport offers a similar commuter appeal with prices that have shown strong recent growth.

For lower entry points with higher yields, buy-to-let in Bolton and buy-to-let in Oldham provide Greater Manchester alternatives at more accessible price levels. Or to understand the wider regional market, see our guide to buy-to-let across Cheshire.