Where to Buy Property Investments in Wrexham: Yields of 4.7%

Wrexham offers buy-to-let investors something increasingly rare in the UK property market: genuine affordability combined with real economic momentum. This Welsh city, now famous globally thanks to Ryan Reynolds and Rob McElhenney's takeover of the football club, delivers rental yields reaching 4.7% in LL14 where average house prices of £215,432 sit comfortably below national benchmarks.

The numbers tell a straightforward story. Wrexham's average sold price of £204,598 sits 24.7% below the UK average of £271,531, 30.2% below England's £293,292, and 2.2% below the Wales average of £209,253. Yet the city benefits from one of Europe's largest industrial estates, a university with over 6,000 students, and a £160m Advanced Manufacturing Investment Zone now driving job creation in aerospace and net-zero technology. For those researching property investment opportunities in Wales, Wrexham presents an affordable option with growth potential.

This buy-to-let analysis examines Wrexham's four postcode districts (LL11, LL12, LL13, LL14), evaluating rental yields, property price growth over multiple timeframes, and what the regeneration activity around the Wrexham Gateway and football stadium means for investors entering this market.

Article updated: December 2025

Wrexham Buy-to-Let Market Overview 2025

Wrexham's property market delivers house sold prices at 24.7% below the UK average, creating accessible entry points for buy-to-let investors with these key statistics:

- Asking price range: £215,432 (LL14) to £287,735 (LL12) across Wrexham postcodes

- Rental yields: 4.2% (LL11) to 4.7% (LL14) across different postcodes

- Rental income: Monthly rents from £796 (LL11) to £1,096 (LL12)

- Price per sq ft: House prices from £161/sq ft (LL14) to £222/sq ft (LL12)

- Market activity: Sales ranging from 20 per month (LL12) to 35 per month (LL11)

- Deposit requirements: 30% deposits range from £64,630 (LL14) to £86,321 (LL12)

- Affordability ratios: Property prices from 6.0 to 8.0 times Wrexham's median annual income of £36,093

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Wrexham?

Wrexham is not trying to compete with Cardiff or Swansea for headline-grabbing yields or massive regeneration budgets. What it offers instead is something more practical: affordable entry prices, a genuine employment base, and a level of global attention that no marketing budget could ever buy.

The value proposition is straightforward. Wrexham's average sold price of £204,598 sits 24.7% below the UK average, yet the city is home to one of Europe's largest industrial estates. Wrexham Industrial Estate hosts over 300 businesses and provides around 8,000 jobs. Major employers include JCB, Kellogg's, and Wockhardt, alongside aerospace suppliers feeding into the Airbus facility just across the border in Broughton. Jobs create tenant demand. Simple as that.

The university adds another layer. Wrexham University has around 6,045 students (2023/24 figures), creating consistent demand for accommodation in the LL11 and LL13 postcodes closest to campus. It's not on the scale of a Russell Group city, but for a market this size, the student population is meaningful. Investors looking specifically at the student market should also consider Bangor, which has a larger university presence on the North Wales coast.

Then there's the football club. Since Ryan Reynolds and Rob McElhenney took over Wrexham AFC in 2020, the city has received global media coverage that most Welsh towns could only dream of. The Disney documentary "Welcome to Wrexham" has put the city on the map internationally. Whether this translates directly into property demand is debatable, but the knock-on effects are real: increased tourism, new hospitality businesses, and a confidence boost that's attracting further investment.

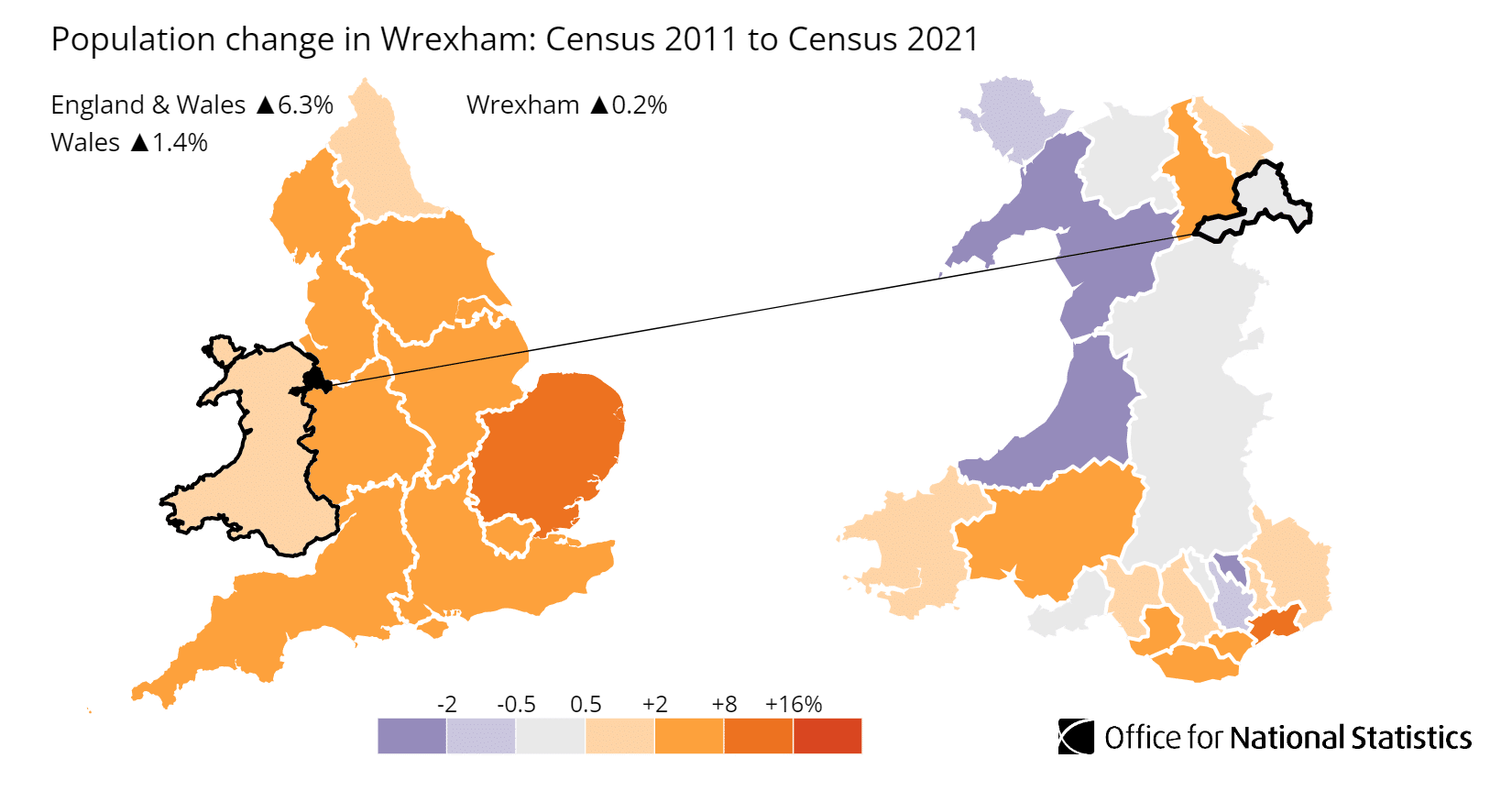

The population picture is more modest. According to the latest census data, the population of Wrexham increased by just 0.2%, rising from 134,800 in 2011 to 135,100 in 2021. That's roughly 300 additional residents over a decade. You can explore the full breakdown via the ONS Census Data for Wrexham. The growth isn't dramatic, but the economic fundamentals, particularly the jobs base and the £160m Investment Zone, matter more for rental demand than raw population numbers.

Transport links are solid rather than spectacular. Wrexham has two railway stations (Wrexham General and Wrexham Central) with direct services to Chester in 15 minutes, Liverpool in under an hour, and connections to London via Crewe. The A483 provides quick road access to Chester and the M56 motorway network. For investors weighing up North Wales options, it's worth comparing Wrexham with Rhyl (coastal regeneration play) or Newport in South Wales (similar price point, different dynamics).

One thing to note: Wales has its own landlord regulations. All landlords letting property in Wales must register with Rent Smart Wales, and those who self-manage need a licence. It's not complicated, but it's an extra step that England-based investors sometimes overlook. You'll also pay Land Transaction Tax (LTT) rather than Stamp Duty when purchasing.

Wrexham is covered by four main postcodes: LL11, LL12, LL13, LL14.

Regeneration & Investment in Wrexham

Wrexham is capitalising on a unique combination: unprecedented global brand visibility from the football club and substantial government investment in infrastructure. For investors, the narrative has shifted from speculative interest to tangible delivery. The city is no longer just "on the map"; it is actively building the capacity to stay there.

- The Wrexham Gateway (Kop Stand): This is the most visible sign of regeneration. After years of planning, 2025 has seen the project move into full delivery. The new 5,500-seat Kop Stand at STōK Cae Ras (Racecourse Ground) isn't just for football; it is designed to unlock the wider "Gateway" district, eventually including conference facilities and a 4-star hotel. This transforms the Mold Road corridor into a genuine destination. Track progress at the Wrexham AFC news page.

- Wrexham General Station Redevelopment: Addressing the city's first impression, detailed plans progressed in November 2025 to transform the area adjacent to the station. The "Western Gateway" vision includes a new transport hub and a mixed-use commercial zone featuring a brewery and taproom to celebrate Wrexham's heritage. This improves connectivity for commuters and increases footfall for commercial investors. Details are available via Ambition North Wales.

- Advanced Manufacturing Investment Zone: This cements Wrexham's position as the engine room of the North Wales economy. Officially confirmed by the Chancellor in January 2025, this status is backed by £160m in government funding over 10 years. It focuses on the Wrexham Industrial Estate, driving expansion in aerospace and net-zero technology sectors to create the high-salary jobs that underpin rental growth. Read more at Trade & Invest Wales.

- The Museum of Two Halves: Cultural regeneration is critical for city centre vibrancy. Work is currently underway on the radical refurbishment of the Wrexham Museum on Regent Street. This project creates the "Football Museum for Wales" alongside a modernised local history museum. Set to open in 2026, it is already driving investor interest in buying short-term lets and retail units in the city centre. Project updates are on the Museum of Two Halves official site.

- Transforming Towns Funding: Wrexham is now cited as the national model for this Welsh Government scheme. Following the successful reopening of the refurbished Butchers' and General Markets in late 2024 (£2.5m+ investment), the government announced a further £17m national boost in August 2025, with Wrexham highlighted as an exemplar site. This sustained funding ensures the high street remains attractive to residents and businesses alike.

Wrexham Property Market Analysis

When Was the Last House Price Crash in Wrexham?

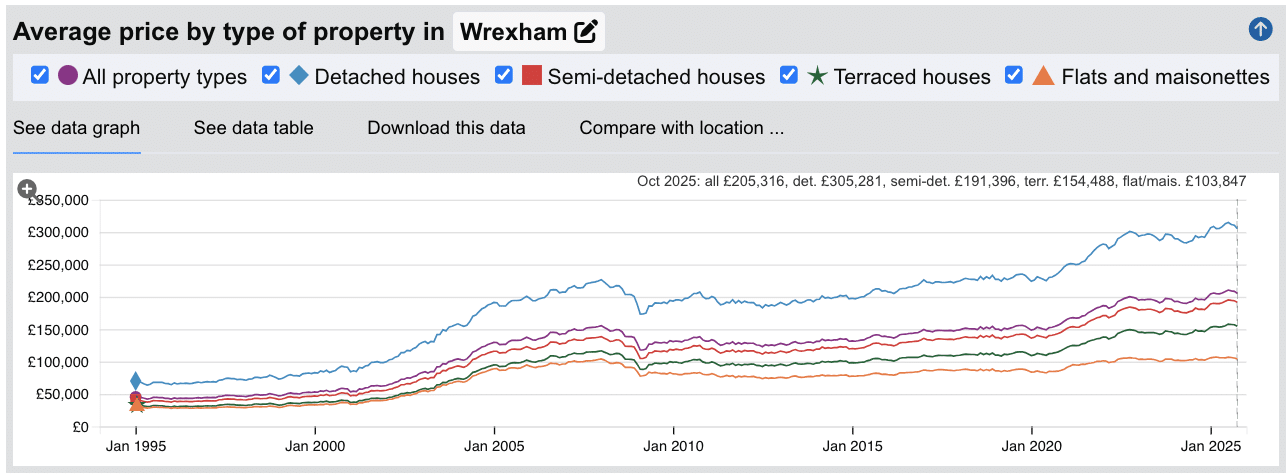

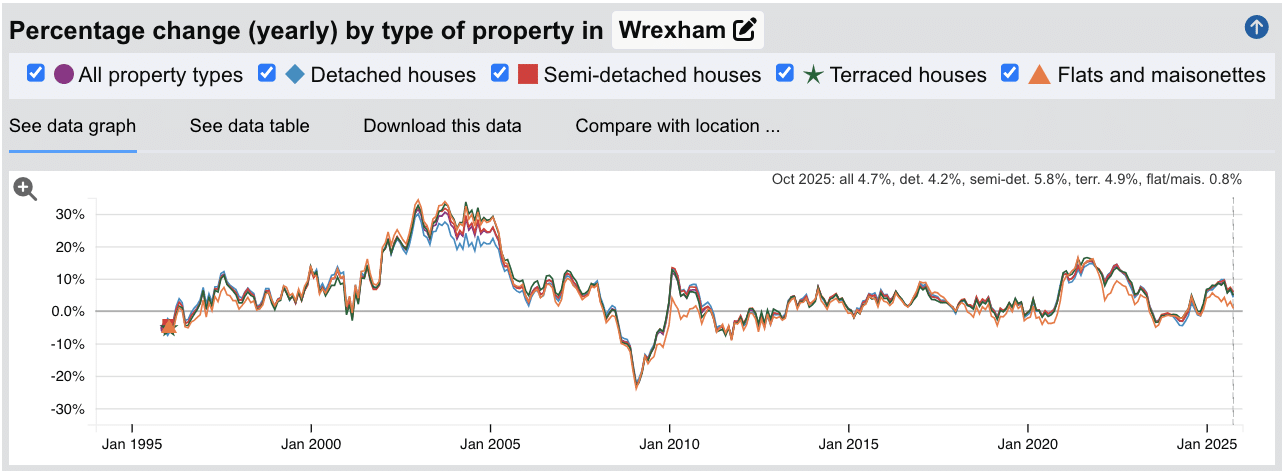

The last significant property crash in Wrexham occurred during the 2008-2009 global financial crisis, when prices dropped by approximately 24% from their pre-crash peak. The market took until around 2014 to fully recover to those 2007 levels. More recently, a brief correction in 2023 saw prices soften as interest rates climbed, but Wrexham has bounced back with positive growth returning through 2024 and accelerating into 2025.

Source: HM Land Registry House Price Index for Wrexham

Here is how the market has performed over the key cycles:

- 1995-2007 saw sustained growth where average prices rose from £44,580 to over £154,000, more than tripling in value during the pre-financial crisis boom.

- 2008-2009 brought the financial crisis correction. Prices peaked at £155,480 in January 2008 before dropping to £117,847 by March 2009, a fall of approximately 24.2%. This was a sharper correction than many southern markets experienced.

- 2010-2019 was a slow recovery period. Unlike London and the South East, Wrexham took until around 2014 to return to pre-crash levels, with modest annual gains averaging 2-4% through the decade.

- 2020-2022 delivered the pandemic boom. The race for space and affordability pushed prices from £148,600 in January 2020 to £200,156 by October 2022, a 34.7% increase in under three years.

- 2023-2024 saw a mild correction of around 5% as mortgage rates spiked, with prices dipping to £190,705 by August 2023 before stabilising.

- 2025 has marked a clear recovery. Prices climbed to £210,422 by July 2025, with annual growth reaching 9% at one point, before settling at £205,316 by October 2025.

Long-Term Property Value Growth in Wrexham

For buy-to-let investors focused on capital growth, Wrexham has delivered solid appreciation over extended holding periods, though less dramatic than premium southern markets:

- 5 years (2020-2025): +31.4% growth (average prices rising from £156,280 to £205,316)

- 10 years (2015-2025): +45.5% growth (average prices rising from £141,062 to £205,316)

- 15 years (2010-2025): +48.5% growth (average prices rising from £138,274 to £205,316)

- 20 years (2005-2025): +54.4% growth (average prices rising from £132,981 to £205,316)

- 30 years (1995-2025): +360.5% growth (average prices rising from £44,580 to £205,316)

The 2023 correction was a temporary response to national interest rate rises rather than any local weakness. The strong recovery in 2025, driven by renewed buyer confidence and the city's high-profile regeneration activity, suggests the market has found its footing again.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Wrexham

The latest sold house price index by the Land Registry confirms Wrexham's position as an affordable market, with values sitting comfortably below both national and Welsh benchmarks.

Wrexham property prices average £204,598, which is 30.2% below the England average of £293,292 and 2.2% below the Wales average of £209,253. This discount creates accessible entry points across all property types.

Flats and maisonettes offer the sharpest discount, averaging £103,684, which is 53.6% below the England average and 18.7% below the Wales average. With deposits from around £31,000, flats provide the lowest barrier to entry for new investors. Terraced houses average £153,394, sitting 37.1% below England and 7.8% below Wales, making them the natural target for buy-to-let investors seeking a balance of affordability and tenant appeal.

Semi-detached houses average £189,965 (34.3% below England, 9.1% below Wales), offering family-sized accommodation at prices that still allow for healthy yields. Detached houses command £306,159, a 35.7% discount versus England and 7.0% below Wales, providing options for investors targeting higher-value tenants or long-term capital appreciation.

Updated December 2025

| Property Type | Wrexham Average | Wales Average | England Average |

|---|---|---|---|

| Detached houses | £306,159 | £329,307 | £476,505 |

| Semi-detached houses | £189,965 | £208,981 | £289,308 |

| Terraced houses | £153,394 | £166,304 | £243,944 |

| Flats and maisonettes | £103,684 | £127,499 | £223,264 |

| All property types | £204,598 | £209,253 | £293,292 |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Wrexham

Updated December 2025

The data represents the average asking prices of properties currently listed for sale across Wrexham's four postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | LL12 (Gresford, Llay, Rossett) | £287,735 |

| 2 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | £229,076 |

| 3 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | £226,183 |

| 4 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | £215,432 |

Wrexham's pricing landscape shows a clear divide between the commuter villages and the town itself. LL12 (Gresford, Llay, Rossett) commands the highest prices at £287,735, reflecting its popularity with Chester commuters and families seeking village living with easy access to the A483. These areas attract owner-occupiers more than tenants, so yields here tend to be lower.

LL11 and LL13 sit in the middle ground at £229,076 and £226,183 respectively. LL11 covers Wrexham town centre and the suburbs closest to Wrexham University and the Industrial Estate, making it the natural focus for buy-to-let investors targeting working professionals and students. LL13 stretches east towards Ruabon and the Welsh borders, offering a mix of traditional terraces and rural properties.

The most accessible entry point is LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) at £215,432. This former mining area to the south of Wrexham offers the lowest prices and, as we'll see in the yields section, the highest rental returns. It's the postcode to watch for investors prioritising cash flow over capital growth.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Wrexham (£)

Updated December 2025

The data represents the average price per square foot across Wrexham's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | LL12 (Gresford, Llay, Rossett) | £222 |

| 2 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | £187 |

| 3 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | £182 |

| 4 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | £161 |

For context, these figures sit well below the England average of around £280 per square foot, giving Wrexham investors significantly more physical space for their capital.

LL12 (Gresford, Llay, Rossett) commands the highest price per square foot at £222, reflecting the premium attached to the commuter villages. Even so, this is less than half the cost per square foot you'd pay in markets like Brighton or Manchester city centre.

The gap between LL11 (£187) and LL13 (£182) is marginal, suggesting similar value across central Wrexham and the eastern districts. Both offer solid options for investors seeking standard buy-to-lets without overpaying for location.

For investors focused on maximising space, perhaps for HMO conversions or larger family lets, LL14 stands out at just £161 per square foot. That's £61 less per square foot than LL12, meaning a 1,000 sq ft property in LL14 would cost roughly £61,000 less than the equivalent space in Gresford or Rossett.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Wrexham (%)

Updated December 2025

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| LL14 (Rhosllanerchrugog, Cefn Mawr) | -0.2% | +3.9% | +22.2% |

| LL12 (Gresford, Llay, Rossett) | +5.5% | +6.4% | +19.9% |

| LL11 (Wrexham Town, Brynteg) | -1.3% | +2.8% | +19.7% |

| LL13 (Wrexham East, Ruabon) | +0.8% | +1.1% | +14.2% |

The numbers tell an interesting story. LL14 has delivered the strongest five-year growth at +22.2%, despite being the lowest-priced postcode. This is a pattern we see across many affordable areas in Wales: locations with solid employment bases often outperform on percentage growth because they started from a lower base.

Over the past year, the picture is more mixed. LL12 is the only postcode showing meaningful growth at +5.5%, driven by continued demand from Chester commuters. The commuter villages have held their value while the wider market has softened. In contrast, LL11 has dipped 1.3% over twelve months, reflecting the broader correction after the 2020-2022 pandemic surge.

LL13 has seen the slowest growth across all timeframes, with just +14.2% over five years and +1.1% over three. This eastern district, stretching towards the Welsh borders, hasn't benefited from the same demand drivers as central Wrexham or the commuter belt.

For context, the Wrexham local authority as a whole has delivered +31.4% over five years according to HM Land Registry data, suggesting these postcode figures may be conservative. Either way, the trend is clear: Wrexham has comfortably outpaced inflation over the medium term.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices.

Average Monthly Property Sales in Wrexham

Updated December 2025

The data represents the average number of residential property sales per month across Wrexham's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | 35 |

| 2 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | 25 |

| 3 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | 24 |

| 4 | LL12 (Gresford, Llay, Rossett) | 20 |

LL11 leads with 35 sales per month, which makes sense given it covers central Wrexham and the largest population base. This is a healthy level of activity for a market of this size. You won't struggle to find stock or buyers when it comes time to exit.

The other three postcodes show similar activity levels between 20 and 25 sales monthly. LL12 has the lowest volume at 20, but that's typical of commuter villages where owners tend to stay put. People buy in Gresford or Rossett for the long term, which means fewer properties come to market but also suggests strong holding appeal.

LL14 at 24 sales per month is encouraging for investors targeting this affordable postcode. Despite the lower prices, there's sufficient market depth to buy and sell without difficulty. Combined with its yield profile, LL14 offers both income potential and reasonable liquidity.

Across all four postcodes, Wrexham sees around 104 sales per month in total. For comparison, that's roughly two-thirds of Brighton's core three postcodes combined, reflecting Wrexham's smaller but still active market.

Note: These figures include all property prices and property types. Transaction volumes indicate market liquidity and buyer demand levels.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: December 2025. All data is presented as provided by our sources without adjustments or amendments.

Wrexham Rental Market Analysis

For first-time landlords buying their first rental property in Wrexham and wondering how much they can charge for rent across the town and surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields Welsh landlords can aim to achieve. This is helpful if you are considering how to start a property business in this part of North Wales.

Rental Prices in Wrexham (£)

Updated December 2025

The data represents the average monthly rent for long-let AST properties in Wrexham.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | LL12 (Gresford, Llay, Rossett) | £1,096 |

| 2 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | £840 |

| 3 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | £833 |

| 4 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | £796 |

LL12 (Gresford, Llay, Rossett) commands the highest rents at £1,096 per month, reflecting the larger family homes and commuter appeal of these villages. Tenants here are typically professionals working in Chester or at nearby business parks, willing to pay more for space and a quieter setting.

The remaining three postcodes cluster tightly between £796 and £840 monthly. The interesting story for investors is LL14. Despite being the cheapest postcode to buy into, it achieves the second-highest rents at £840. This disparity between low entry price and solid rental income is exactly why LL14 delivers Wrexham's strongest yields.

LL11 has the lowest average rent at £796, partly due to the mix of property types including more flats and smaller terraces near the town centre and university.

Note: These figures represent average rents across all property types. Actual achievable rents vary based on property size, condition, and specific location.

Gross Rental Yields in Wrexham (%)

Updated December 2025

The data represents the average gross rental yields across Wrexham's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | 4.7% |

| 2 | LL12 (Gresford, Llay, Rossett) | 4.6% |

| 3 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | 4.4% |

| 4 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | 4.2% |

Wrexham's yields cluster between 4.2% and 4.7%, which is respectable for a Welsh market but won't excite investors chasing 6%+ returns. The story here is consistency rather than headline figures.

LL14 delivers the strongest yield at 4.7%, confirming what the earlier data suggested: the lowest purchase prices combined with competitive rents create the best income returns. For cash flow focused investors, this former mining area south of Wrexham offers the clearest opportunity.

LL12 at 4.6% is perhaps the surprise. Despite commanding Wrexham's highest prices, the premium rents in the commuter villages keep yields competitive. You're paying more to get in, but you're also collecting more each month.

LL11 at 4.2% reflects the town centre dynamic: lower rents and a mixed property stock that includes more flats. It's the natural choice for investors targeting students or young professionals near Wrexham University, but pure yield isn't its strength.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy-to-let ownership costs.

Is Wrexham Rent High?

Wrexham's rental market is notably more affordable than most English cities. Tenants here commit a much smaller portion of their salary to rent, which supports stable tenancies and lower void risk for landlords.

Average rent in Wrexham costs between 27% and 36% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Wrexham residents is £36,093 (based on £694.10 per week, 2025 figures).

The highest-rent postcode, LL12, requires 36.4% of the median local income, reflecting the larger family homes in the commuter villages. Even this top figure sits comfortably below the 50% threshold that often signals affordability stress. The most affordable postcode, LL11, requires just 26.5% of income, making it accessible to a wide range of tenants including students and young professionals.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | LL12 (Gresford, Llay, Rossett) | 36.4% |

| 2 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | 27.9% |

| 3 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | 27.7% |

| 4 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | 26.5% |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Wrexham House Prices High?

For a local property buyer on average full-time earnings, Wrexham remains accessible compared to most of England and the UK's major cities.

Purchasing a property in Wrexham requires between 6.0 and 8.0 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Wrexham residents is £36,093 (2025 figures).

The most expensive area relative to income is LL12 (Gresford, Llay, Rossett), requiring 8.0 times the average salary, reflecting its appeal to Chester commuters seeking village living. The most accessible postcode, LL14, requires just 6.0 times earnings. For context, the UK average sits around 8-9x, and southern cities like Brighton exceed 12-15x.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | LL12 (Gresford, Llay, Rossett) | 8.0x |

| 2 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | 6.3x |

| 3 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | 6.3x |

| 4 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | 6.0x |

Compared to nearby locations, Wrexham offers solid value. For investors seeking even lower entry points, Rhyl and Stoke-on-Trent provide cheaper options, while Chester offers a premium market with stronger capital growth prospects just 12 miles away.

How Much Deposit to Buy a House in Wrexham?

Assuming a standard 30% deposit for a buy-to-let mortgage, Wrexham offers accessible entry points across all four postcodes, with a £21,691 difference between the most affordable and most expensive areas.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | LL14 (Rhosllanerchrugog, Cefn Mawr, Chirk) | £64,630 |

| 2 | LL13 (Wrexham East, Ruabon, Bangor-on-Dee) | £67,855 |

| 3 | LL11 (Wrexham Town, Brynteg, Coedpoeth) | £68,723 |

| 4 | LL12 (Gresford, Llay, Rossett) | £86,321 |

If you are new to the market, LL14 offers the most affordable way into Wrexham property, requiring a deposit of £64,630. Crucially, this area also delivers the strongest yields (4.7%), making it highly efficient for capital deployment.

At the other end of the scale, LL12 requires a deposit of £86,321. For this level of capital commitment, investors are buying into the commuter village premium and proximity to Chester rather than maximising immediate cash flow. The trade-off is typically lower yields but potentially stronger tenant quality and capital preservation.

For comparison, the same £86,000 deposit in Brighton would barely cover entry into the cheapest postcode (BN41 at £120,000). In Wrexham, it gets you into the most desirable area with change to spare.

How to Invest in Buy-to-Let in Wrexham

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Wrexham, North Wales and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Wrexham and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Wrexham for Buy-to-Let Investment

For investors seeking similar affordable Welsh markets with solid employment bases, buy-to-let in Newport offers comparable pricing with strong transport links to Bristol and Cardiff. If cross-border commuter appeal is your primary driver, buy-to-let in Chester provides a premium market just 12 miles away with established tenant demand from professionals.

For higher yields in North Wales, consider buy-to-let in Rhyl or property investment in Bangor with its university-driven rental market. Or explore opportunities across the border in Liverpool or Stoke-on-Trent for accessible English markets within easy reach.