Where to Buy Property Investments in Basildon: Yields of 5.7%

Basildon delivers rental yields of 5.7% in SS14, with 35-minute trains to Fenchurch Street and a population that grew 7.5% between the last two censuses. For property investment in a genuine London commuter market without London prices, those buy-to-let fundamentals deserve attention.

New property data confirms where Basildon sits in the market. Average sold prices in Basildon of £365,000 sit 25% above the England average of £293,131, but 8% below the East of England average of £338,286. This is an affordable Essex commuter town, priced below its regional neighbours, yet only 25 miles from the City of London.

Our buy-to-let analysis examines Basildon's four postcode districts, evaluating capital growth, how to work out the highest rental yields, and the rental investment potential across the town centre and eastern suburbs (SS13, SS14) through to the western districts of Laindon and Langdon Hills (SS15, SS16).

Article updated: January 2026

Basildon Buy-to-Let Market Overview 2026

Basildon's property market delivers sold prices 25% above the England average but 8% below the East of England, making it one of the more affordable commuter options in Essex, with these key statistics:

- Average sold price: £365,000 (25% above England's £293,131)

- Asking price range: £319,632 (SS13) to £387,358 (SS16) across Basildon postcodes

- Rental yields: 4.6% (SS16) to 5.7% (SS14) across different postcodes

- Rental income: Monthly rents from £1,333 (SS13) to £1,594 (SS15)

- Price per sq ft: Sold prices from £338/sq ft (SS13) to £385/sq ft (SS16)

- Market activity: Sales ranging from 17 per month (SS13) to 27 per month (SS15)

- Deposit requirements: 30% deposits range from £95,889 (SS13) to £116,207 (SS16)

- Affordability ratios: Property prices from 7.6 to 9.2 times Basildon's median annual salary of £41,907

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Basildon?

Basildon's investment case rests on affordability within the London commuter belt. The 35-minute train to Fenchurch Street puts City workers within easy reach, while property prices sit around 8% below the East of England average. That combination of accessibility and value sustains consistent tenant demand from workers priced out of the capital.

The employment base is more industrial than many Essex towns. Manufacturing accounts for 9.0% of local jobs, with major employers including Ford Motor Company, New Holland Agriculture, and Leonardo UK. Wholesale and retail adds 15.7%, while health and social work contributes 14.6%, anchored by Basildon University Hospital. The Thames Freeport designation covering nearby London Gateway and Tilbury ports is bringing logistics and distribution jobs to the area. You can see the full employment breakdown via the Nomis Labour Market Profile for Basildon.

Local earnings are solid for the region. The median salary of £41,907 sits 31% above the national median of £31,875, reflecting the mix of manufacturing, logistics and London commuter incomes. An employment rate of 80.3% exceeds both regional and national averages. Jobs create rental demand. Simple as that.

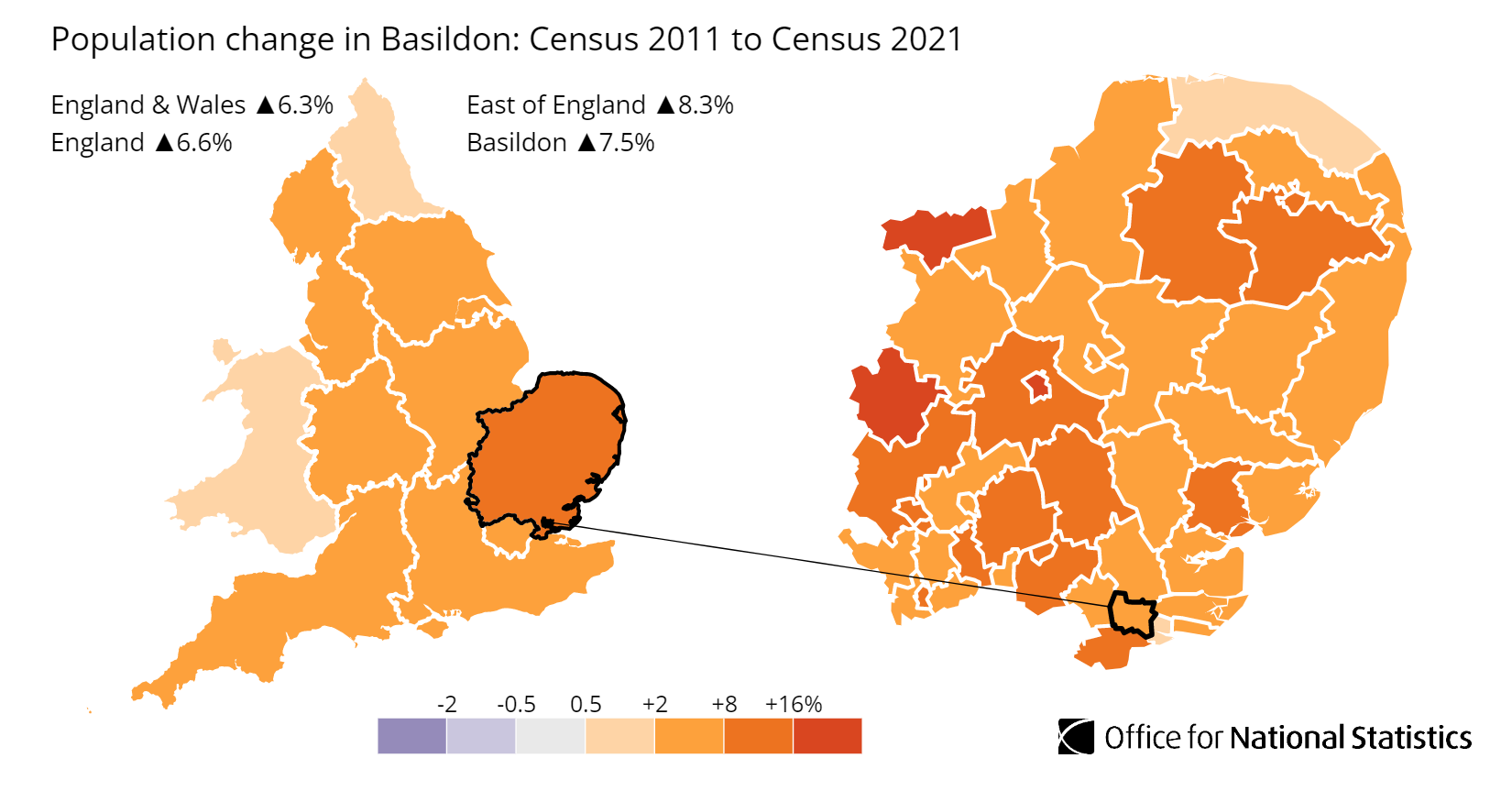

Population growth has been steady. According to the latest census data, the population of Basildon increased by 7.5%, rising from 174,500 in 2011 to 187,600 in 2021. The 2024 estimate puts the population at 193,632. The median age of 39 reflects a working-age demographic, with families and young professionals forming the core tenant pool. You can explore the breakdown via the ONS Census Data for Basildon.

For comparable Essex commuter markets, consider Southend-on-Sea (coastal location 10 miles east with similar prices), Chelmsford (higher prices but stronger prestige as Essex's county city), or Romford (within Greater London offering Elizabeth Line access but at higher entry costs).

Regeneration and Investment in Basildon

Basildon has spent the last two years recovering from the collapse of its key partners (Empire Cinemas and Swan Housing). In 2026, the town has successfully reset. With the cinema finally open and a new major housing association delivering the stalled sites, the investment risk profile has dropped significantly compared to 2024.

Major projects delivering real change include:

- East Square (Vue Cinema): The "white elephant" risk is over. Following the administration of Empire Cinemas, Vue stepped in and officially opened the 10-screen complex on 25 July 2024. By January 2026, this site is a fully operational leisure anchor, now trading late into the evening. For investors, this has restabilised the commercial viability of the surrounding town centre apartments, removing the "ghost town" fear that plagued the square in 2023.

- Laindon Place (Sanctuary & Lidl): The stalled regeneration of the Laindon Shopping Centre is finally moving. After taking over Swan Housing in February 2023, Sanctuary (one of the UK's largest housing associations) restarted the site in 2025. The key milestone: construction of the new flagship Lidl store is well advanced and on track to open in Spring 2026. This provides the essential retail anchor that makes the 205 new affordable homes investable. Updates at Sanctuary Laindon Regeneration.

- South Essex College (Digital Tech Campus): The £9m digital campus, which opened in 2021, is now well established. Located in the town centre with links to Basildon Railway Station, it provides courses in IT, games design and animation for up to 500 students. While this is a further education college (not university), the presence of young adults studying in the town centre does support local rental demand, particularly for rooms in shared houses close to transport links.

- The "Green Belt" Unlock (Local Plan): Basildon Council's critical "Regulation 18 Part 3" consultation closed on 16 January 2026. This document reveals exactly where the Council intends to release Green Belt land to meet its target of 27,111 homes. Now that the consultation is closed, these allocations are effectively the blueprint for the next decade of land value growth.

Basildon Property Market Analysis

When Was the Last House Price Crash in Basildon?

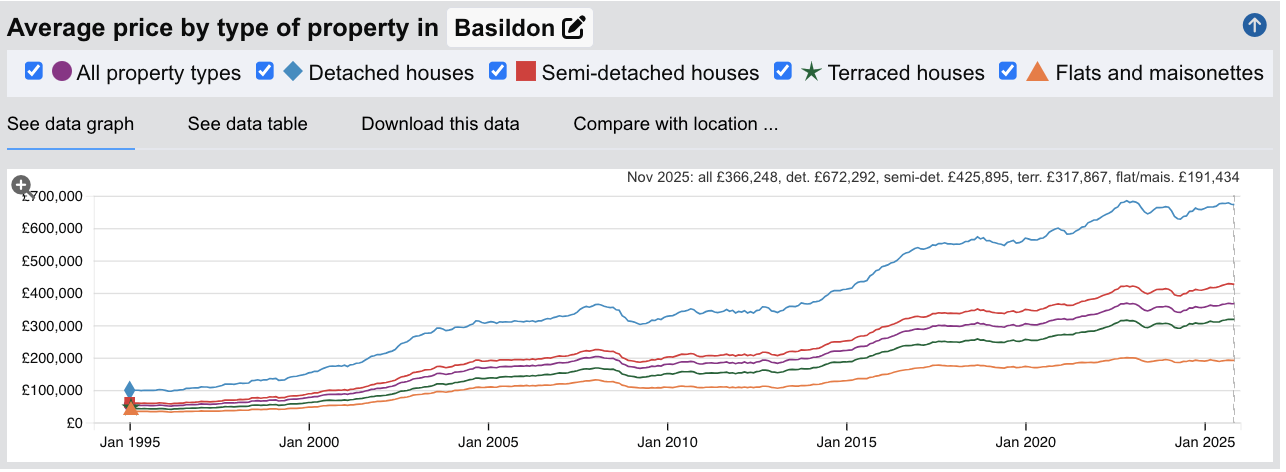

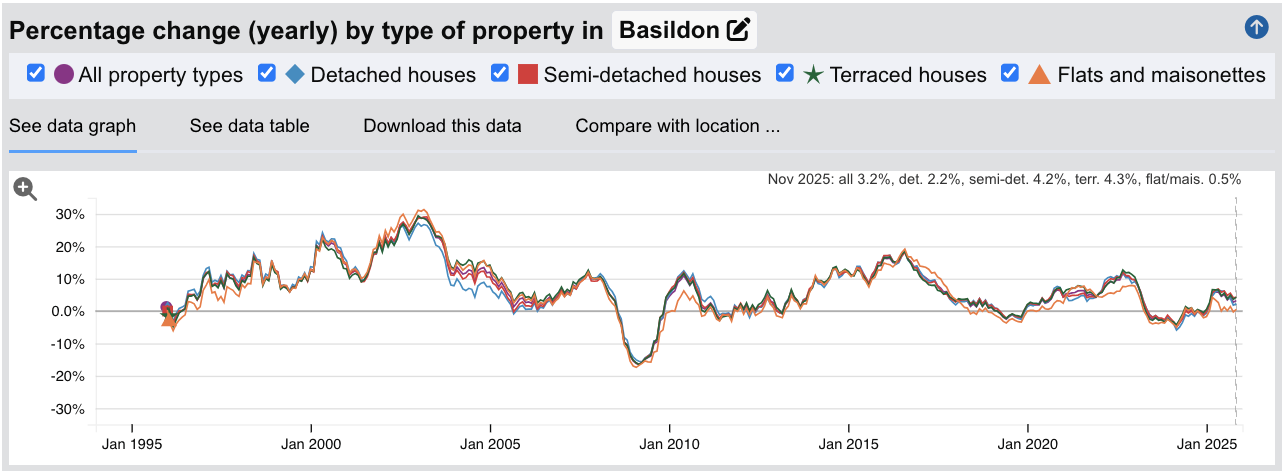

Basildon experienced a significant correction during the 2008 financial crisis, though slightly less severe than some premium southern markets. Average sold prices fell from a peak of £203,216 in February 2008 to a trough of £166,899 by April 2009, a decline of 17.9%. Recovery was relatively slow, with prices not returning to pre-crash levels until early 2014.

Source: HM Land Registry House Price Index for Basildon

Here is how the Basildon property market has performed over key cycles:

- 1995-2007 saw property values nearly quadruple, rising from £52,000 to £200,767 as Basildon benefited from London's affordability crisis pushing buyers further out along the c2c line to Fenchurch Street.

- 2008-2009 brought a correction of 17.9%. Basildon fell broadly in line with the wider Essex market, though held up slightly better than premium markets like Cambridge which dropped over 20%.

- 2010-2013 saw a slow recovery with prices fluctuating between £178,000 and £197,000. The market essentially moved sideways for four years as buyers remained cautious and mortgage lending stayed tight.

- 2014-2016 delivered exceptional growth. Prices surged from £198,025 to £287,554, a gain of 45% in under three years. London's affordability crisis intensified, pushing first-time buyers and investors to seek value in commuter towns with sub-40-minute journey times to the City.

- 2017-2019 saw a plateau as stamp duty surcharges and Brexit uncertainty cooled demand. Prices fluctuated between £293,000 and £307,000 with no clear direction.

- 2020-2022 brought the pandemic surge. Prices climbed from £301,552 to £367,909 as demand for family homes with gardens intensified. Basildon's mix of space, affordability relative to inner Essex, and London access proved particularly appealing to those reassessing their priorities.

- 2023 saw a correction of around 6.5% as mortgage rates spiked, with prices falling from the November 2022 peak of £367,909 to £344,020 by June 2023.

- 2024-2025 has marked recovery. Prices have climbed back to £366,248 as of November 2025, almost matching the previous peak and showing year-on-year growth of 2.8%.

Long-Term Property Value Growth in Basildon

For buy-to-let investors focused on capital preservation and long-term appreciation, Basildon's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 21.5% growth (£301,552 to £366,248)

- 10 years (2015-2025): 46.1% growth (£250,622 to £366,248)

- 15 years (2010-2025): 100.9% growth (£182,418 to £366,248)

- 20 years (2005-2025): 110.6% growth (£173,758 to £366,248)

- 30 years (1995-2025): 590.5% growth (£53,077 to £366,248)

The 2008 and 2023 corrections demonstrate that Basildon is not immune to wider market cycles. However, the town's buy-to-let fundamentals remain intact. Structural demand from London commuters, improving town centre amenities following regeneration, and constrained housing supply within the Green Belt have consistently driven recovery. The key risk for investors is overpaying at the top of a cycle, but those who held through 2008 have seen their investments nearly double in value.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Basildon

The latest sold house price index by the Land Registry shows Basildon sitting above national averages for houses but offering genuine value on flats. This creates an interesting split for investors: family homes command a premium driven by commuter demand, while flats remain competitively priced.

Basildon property prices average £366,248, which is 25% above the England average of £293,131. This premium reflects the town's position as a key commuter hub, with Fenchurch Street reachable in under 40 minutes via the c2c line, combined with significantly lower entry prices than inner Essex locations like Chelmsford or Southend.

Detached houses command a significant premium, averaging £672,292, a 42% uplift against the national average. These are concentrated in Billericay, Wickford, and the more established areas of Laindon and Langdon Hills. Semi-detached houses average £425,895, sitting 47% above the England figure. This strong premium reflects family demand for houses with gardens within commuting range of London.

Terraced houses average £317,867, representing a 30% premium on the national average. The post-war terraces in Basildon town centre and Pitsea attract first-time buyers priced out of closer-to-London markets. Flats and maisonettes tell a different story at £191,434, sitting 14% below the England average. For investors, this discount on flats creates an opportunity. Town centre apartments in SS14, particularly those near the station and regenerated East Square, offer stronger buy-to-let rental yields than comparable properties in premium Essex markets.

Updated January 2026

| Property Type | Basildon Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £672,292 | £474,400 | +41.7% |

| Semi-detached houses | £425,895 | £290,004 | +46.9% |

| Terraced houses | £317,867 | £245,002 | +29.7% |

| Flats and maisonettes | £191,434 | £221,565 | -13.6% |

| All property types | £366,248 | £293,131 | +24.9% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Basildon (£)

Updated January 2026

The data represents the average sold price per square foot across Basildon's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | SS16 (Basildon North, Noak Bridge, Burnt Mills) | £387 |

| 2 | SS15 (Laindon, Langdon Hills, Lee Chapel) | £382 |

| 3 | SS14 (Town Centre, Vange, Laindon Link) | £359 |

| 4 | SS13 (Basildon East, Pitsea, Bowers Gifford) | £337 |

The £50 per square foot spread between SS16 and SS13 reflects a clear pattern: the newer, more established residential areas to the north and west command a premium, while the original new town housing stock in the east and around Pitsea offers better value per square foot.

The practical implication for investors depends on your strategy. A £100,000 deposit in SS13 buys roughly 990 sq ft of living space, while the same capital in SS16 gets you 860 sq ft. That 130 sq ft difference could mean an extra bedroom in a potential HMO conversion. However, SS14 near the town centre and station delivers the strongest yields at 5.7%, while SS16's higher values reflect its appeal to owner-occupiers seeking newer housing stock.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

For Sale Asking House Prices in Basildon

Updated January 2026

The data represents the average asking prices of properties across Basildon's four postcode districts, based on completed transactions.

| Rank | Area | Average Price |

|---|---|---|

| 1 | SS16 (Basildon North, Noak Bridge, Burnt Mills) | £387,358 |

| 2 | SS15 (Laindon, Langdon Hills, Lee Chapel) | £362,326 |

| 3 | SS14 (Town Centre, Vange, Laindon Link) | £325,299 |

| 4 | SS13 (Basildon East, Pitsea, Bowers Gifford) | £319,632 |

SS16 commands a £68,000 premium over SS13, but this reflects housing age rather than location quality. SS16 covers the 1980s-onwards developments around Noak Bridge and the Burnt Mills industrial fringe, where modern family homes with garages and larger plots attract owner-occupiers commuting via the A127. SS13's lower prices reflect the original new town housing stock from the 1950s and 60s, properties that are now 60-70 years old but offer genuine value for investors willing to modernise.

SS14 and SS15 represent the core buy-to-let market. SS14 covers Basildon town centre, including the regenerated East Square with its Vue cinema and restaurants, plus Vange and parts of Laindon. This is where tenant demand concentrates, with young professionals and key workers seeking flats and terraces close to the c2c line into Fenchurch Street. SS15 spans Laindon (where Sanctuary's 205-home regeneration is underway), Langdon Hills, and Lee Chapel. The mix of ex-council stock and private estates creates price variation within the postcode.

All four postcodes exceed the England average of £293,131, but Basildon remains significantly cheaper than the Essex commuter belt average. A three-bedroom semi in SS13 or SS14 costs what you'd pay for a two-bedroom flat in Chelmsford or Brentwood. For London commuters priced out of inner Essex, Basildon offers a 35-minute journey to Fenchurch Street at a fraction of the cost.

Note: These figures represent average prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

House Price Growth in Basildon (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level transaction data.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| SS14 (Town Centre, Vange, Laindon Link) | +1.3% | -3.7% | +19.8% |

| SS15 (Laindon, Langdon Hills, Lee Chapel) | +5.8% | +3.1% | +17.4% |

| SS13 (Basildon East, Pitsea, Bowers Gifford) | -0.7% | -0.1% | +17.0% |

| SS16 (Basildon North, Noak Bridge, Burnt Mills) | -1.2% | -11.5% | +10.8% |

SS14 leads on five-year growth at +19.8%, reflecting the town centre regeneration effect. The Vue cinema opening in 2024 and improving amenities around East Square have supported values. However, the negative three-year figure (-3.7%) indicates a correction following the pandemic surge. For buy-to-let investors, SS14's combination of historical growth and current 5.7% yields makes it the standout postcode.

SS15 shows the strongest recent momentum with +5.8% annual growth, the only postcode with positive movement across all three timeframes. The Sanctuary regeneration at Laindon and demand around Langdon Hills appear to be driving renewed buyer interest.

SS13 has essentially flatlined over the past three years (-0.1%), but the five-year figure of +17.0% shows longer-term holders have still done well. This is Basildon's most affordable postcode, where rental yield (5.0%) rather than capital appreciation tends to drive investor returns.

SS16 presents a cautionary picture with -11.5% over three years, the weakest performance across Basildon. The higher-priced northern postcode appears to have been hit hardest by mortgage rate rises, with owner-occupier demand softening. The five-year figure of +10.8% remains positive but lags the rest of Basildon significantly.

Average Monthly Property Sales in Basildon

Updated January 2026

The data represents the average number of residential property sales per month across Basildon's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | SS15 (Laindon, Langdon Hills) | 27 |

| 2 | SS16 (Pitsea, Vange, Bowers Gifford) | 26 |

| 3 | SS14 (Basildon Town Centre, Fryerns) | 20 |

| 4 | SS13 (Wickford, North Benfleet) | 17 |

Basildon's monthly sales volumes are modest compared to larger Essex markets like Chelmsford, but the consistency across all four postcodes suggests a stable, functioning market rather than a stagnant one. Total monthly transactions across Basildon sit around 90, enough activity for investors and landlords to buy and sell without worrying about void periods.

SS15 and SS16 lead with 27 and 26 monthly sales respectively. These are Basildon's most active markets, covering Laindon, Langdon Hills, Pitsea and Vange. For investors using a refurbishment strategy, this sale liquidity matters. You can exit or refinance without being stuck waiting for the right buyer. SS16 also offers the highest entry prices in Basildon at £387,358, so the active market here reflects genuine owner-occupier demand, not just investor churn.

SS14 at 20 monthly sales covers the town centre and Fryerns. The slightly lower volume reflects a smaller geographic area, but this postcode delivers Basildon's strongest yield at 5.7%. The trade-off between yield and liquidity is worth noting: higher returns, but fewer transactions to benchmark your purchase or sale against.

SS13 records 17 monthly sales, the quietest of the four. This postcode extends into Wickford and North Benfleet, where stock is predominantly owner-occupied family housing. Lower turnover suits longer-term investors less concerned about quick exits, though it means fewer comparable sales when valuing properties.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Basildon Rental Market Analysis

For landlords considering if buy to let is worthwhile in Basildon and thinking how much they can charge for rent across the town and its surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Basildon (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Basildon.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | SS15 (Laindon, Langdon Hills) | £1,594 |

| 2 | SS14 (Basildon Town Centre, Fryerns) | £1,553 |

| 3 | SS16 (Pitsea, Vange, Bowers Gifford) | £1,490 |

| 4 | SS13 (Wickford, North Benfleet) | £1,333 |

SS15 commands the highest rents at £1,594, reflecting its mix of family housing in Laindon and the more desirable properties around Langdon Hills. Despite the top rent, SS15 sits mid-table for yields at 5.3% because average sold prices here also reach £362,326. Tenants are typically working families drawn by access to the A127 and A13 corridors.

SS14 at £1,553 covers the town centre and Fryerns. The combination of lower average prices (£325,299) and strong rents explains why this postcode delivers Basildon's highest yield at 5.7%. Proximity to Basildon station matters here, with the 40-minute commute to London Fenchurch Street attracting tenants who work in the capital but cannot afford London rents.

SS16 at £1,490 and SS13 at £1,333 sit at the lower end, though both still exceed £1,300. SS16 covers Pitsea and Vange with direct A13 access, while SS13 extends into Wickford where stock leans towards owner-occupied family homes rather than rental properties.

Basildon rents compete well against nearby Southend-on-Sea and sit close to Chelmsford levels, despite lower property prices. The rental premium reflects Basildon's role as a major employment hub with companies including Ford, Leonardo UK and Costa's European roastery providing local jobs that sustain tenant demand year-round.

Gross Rental Yields in Basildon (%)

Updated January 2026

The data represents the average gross rental yields across Basildon's postcode districts, based on sold prices and average rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | SS14 (Basildon Town Centre, Fryerns) | 5.7% |

| 2 | SS15 (Laindon, Langdon Hills) | 5.3% |

| 3 | SS13 (Wickford, North Benfleet) | 5.0% |

| 4 | SS16 (Pitsea, Vange, Bowers Gifford) | 4.6% |

SS14 leads at 5.7%, the strongest yield in Basildon and competitive with higher-yielding northern markets. The combination of £325,299 average prices and £1,553 monthly rents creates a genuine cash-flow positive opportunity for landlords. Town centre proximity and Basildon station access drive tenant demand here.

SS15 at 5.3% and SS13 at 5.0% both clear the 5% threshold that many buy-to-let investors target. SS15 offers the highest market liquidity at 27 monthly sales, making it attractive for investors who value exit options alongside yield. SS13 has lower transaction volume but solid fundamentals for longer-term holds.

SS16 at 4.6% sits lowest despite commanding Basildon's highest average prices at £387,358. The maths is straightforward: higher entry costs compress yields even when rents are strong. This postcode suits investors prioritising capital preservation over immediate rental returns.

Basildon's yields outperform nearby Chelmsford (3.4%-4.2%) and Southend-on-Sea (3.3%-4.5%), while entry prices remain lower than both. For investors seeking rental income rather than speculative growth, Basildon offers better buy-to-let fundamentals than much of Essex. Use our rental yield calculator to model specific properties against these averages.

Is Basildon Rent High?

Basildon rents sit above the typical affordability threshold, though this reflects the town's position within the London commuter belt rather than local wage pressure alone.

Average rent in Basildon costs between 38% and 46% of the average gross annual earnings for a full-time resident. This is based on the Nomis Labour Market Profile for Basildon showing the median gross annual income for Basildon residents is £41,907.

The general affordability guideline suggests rent should not exceed 30% of gross income. All four Basildon postcodes exceed this threshold, which is typical for commuter towns within 40 minutes of London. Tenants here are not solely reliant on local wages. Many work in the capital or at major employers like Ford, Leonardo UK and the Thames Freeport zone, earning above the local median.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | SS15 (Laindon, Langdon Hills) | 45.6% |

| 2 | SS14 (Basildon Town Centre, Fryerns) | 44.5% |

| 3 | SS16 (Pitsea, Vange, Bowers Gifford) | 42.7% |

| 4 | SS13 (Wickford, North Benfleet) | 38.2% |

The higher percentages in SS15 and SS14 reflect property mix and location rather than unaffordability. SS15 includes family housing in Langdon Hills where larger properties command higher rents. SS14 covers the town centre where station proximity adds a premium for commuters who prioritise the 40-minute journey to London Fenchurch Street.

SS13 offers the most accessible entry point for tenants at 38.2% of income. This postcode extends into Wickford, where stock leans towards owner-occupied family homes. Lower rental supply keeps competition steady, but tenants here are typically local workers rather than London commuters.

For investors, these figures suggest rental demand is sustained by employment rather than stretched tenants. Basildon's economy supports rents at current levels. The town's manufacturing base, logistics sector around London Gateway, and professional services employers create a tenant pool that can absorb rents above the 30% guideline without significant void risk.

Note: These calculations use median gross salary for Basildon residents from the 2025 ASHE data. Actual tenant affordability varies based on household income, with many Basildon tenants earning above the local median due to the commuter profile of the town.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Basildon House Prices High?

Basildon offers genuine affordability for a London commuter town. Prices sit below both the national average and most Essex competitors, making it one of the more accessible property markets within 40 minutes of the capital.

Purchasing a property in Basildon requires between 7.6 and 9.2 times the median annual salary. This is based on the Nomis Labour Market Profile for Basildon showing the median gross annual income for Basildon residents is £41,907.

Three of four Basildon postcodes sit below the 8x threshold, with only SS16 at 9.2x exceeding the England average ratio of around 9.1x. For a town with direct trains to London Fenchurch Street, these ratios represent strong value compared to nearby Chelmsford (8.6-11.5x) or Romford where London Borough prices push ratios higher still.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | SS16 (Pitsea, Vange, Bowers Gifford) | 9.2x |

| 2 | SS15 (Laindon, Langdon Hills) | 8.6x |

| 3 | SS14 (Basildon Town Centre, Fryerns) | 7.8x |

| 4 | SS13 (Wickford, North Benfleet) | 7.6x |

SS13 and SS14 offer the most accessible entry points at 7.6x and 7.8x respectively. These ratios mean first-time buyers and owner-occupiers can realistically purchase, which sustains a healthy mix of tenants and buyers in the market. For investors, this balance reduces the risk of being stuck in a tenant-only market where exit options narrow.

SS16 at 9.2x is Basildon's most expensive postcode, covering Pitsea, Vange and Bowers Gifford. The higher ratio reflects larger family homes rather than overheated prices. This postcode also delivers the lowest yield at 4.6%, confirming that premium prices compress returns even when rents are strong.

For investors seeking affordable entry with strong yields, SS14 hits the sweet spot: 7.8x affordability, 5.7% yield, and town centre location with station access. Those prioritising even lower entry costs might consider Southend-on-Sea to the east or look further into Essex where some markets offer sub-7x ratios.

How Much Deposit to Buy a House in Basildon?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £20,000 difference between the most affordable and most expensive Basildon postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | SS13 (Wickford, North Benfleet) | £95,889 |

| 2 | SS14 (Basildon Town Centre, Fryerns) | £97,590 |

| 3 | SS15 (Laindon, Langdon Hills) | £108,698 |

| 4 | SS16 (Pitsea, Vange, Bowers Gifford) | £116,207 |

Basildon's deposit requirements sit below nearby Chelmsford where entry starts at £117,680 in CM2. The same £97,590 deposit that buys an average property in SS14 would fall short in most Essex commuter towns with equivalent London access. For investors building a portfolio, lower deposit requirements mean capital stretches further.

SS14 offers the strongest case for capital deployment: a £97,590 deposit secures access to Basildon's highest yielding postcode at 5.7%, with 20 monthly sales providing reasonable liquidity. SS13 requires slightly less at £95,889, though the 5.0% yield and 17 monthly sales suggest a quieter market.

Investors considering brr property strategies should note that SS15 combines the highest transaction volume (27 monthly sales) with mid-range deposit requirements at £108,698. Strong liquidity supports quicker refinance valuations and faster capital recycling. Use our stamp duty calculator to factor in the full acquisition costs beyond the deposit.

How to Invest in Buy-to-Let in Basildon

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Basildon, Essex and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Basildon and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Alternative Markets to Basildon for Buy-to-Let Investment

Basildon offers strong yields and affordable entry for a London commuter market, but investors seeking different profiles have options across Essex and beyond. For similar commuter credentials with a city centre feel, buy-to-let in Chelmsford offers faster trains to Liverpool Street (34 minutes) with a larger retail and employment base, though entry prices run £20,000+ higher per postcode.

If coastal living appeals to your tenant profile, buy-to-let in Southend-on-Sea sits just 10 miles east with its own London rail links and a mix of seaside tourism and residential demand. For investors prioritising yield over location, buy-to-let in Colchester delivers comparable returns with university-driven tenant demand, while buy-to-let in Ipswich offers some of the lowest entry prices in the East of England.

Those comfortable investing further from London might consider buy-to-let in Peterborough where sub-£200k averages and yields above 5% compete directly with Basildon's fundamentals, or look to northern cities like buy-to-let in Nottingham and buy-to-let in Leicester for stronger cash flow at lower capital outlay.