Where to Buy Property Investments in Cambridge: Yields of 4.7%

Cambridge delivers rental yields of 4.7% in CB2, with the UK's highest concentration of professional occupations and a jobs density above 1.0. For a UK property investment in one of the strongest knowledge economies in the country, those fundamentals get attention.

The latest property data results shows where Cambridge sits in the market. Average sold prices in Cambridge of £495,517 sit 70% above the England average sold property prices of £291,515, and 46% above the East of England average of £340,037. Premium pricing, but underpinned by permanent demand from two world-class universities and a globally significant tech cluster.

Our buy-to-let analysis examines Cambridge's ten postcode districts, evaluating capital growth, gross rental yields, and investment potential across the urban core (CB1-CB5 postcodes) and surrounding South Cambridgeshire villages (CB21-CB25 postcodes).

Article updated: January 2026

Cambridge Buy-to-Let Market Overview 2026

Cambridge's property market delivers sold prices 70% above the England average, reflecting the premium for this world-leading knowledge economy, with these key statistics:

- Average sold price: £495,517 (70% above England's £291,515)

- Asking price range: £421,622 (CB24) to £670,250 (CB21) across Cambridge postcodes

- Rental yields: 3.8% (CB3) to 4.7% (CB2) across city postcodes with rental data

- Rental income: Monthly rents from £1,540 (CB4) to £1,849 (CB2)

- Price per sq ft: House prices from £363/sq ft (CB25) to £611/sq ft (CB3)

- Market activity: Sales ranging from 6 per month (CB5) to 41 per month (CB1)

- Deposit requirements: 30% deposits range from £126,487 (CB24) to £201,075 (CB21)

- Affordability ratios: Property prices from 9.2 to 14.6 times Cambridge's median annual salary of £45,800

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Cambridge?

Cambridge operates differently from most UK property markets. This isn't a value play or a yield hunt. It's a premium knowledge-economy market where constrained supply meets permanent demand from two world-class universities, a globally significant tech cluster, and one of Europe's largest biomedical campuses.

The employment picture explains why demand remains structural rather than cyclical. Cambridge has a jobs density of 1.10, meaning there are more jobs than working-age residents. More striking: 76.3% of the workforce holds professional occupations (SOC groups 1-3), compared to 53.3% nationally. These are high-earning tenants who can absorb premium rents. You can see the full employment breakdown via the Nomis Labour Market Profile for Cambridge.

The tech and science ecosystem runs deep. AstraZeneca relocated its global R&D headquarters here. ARM, the chip designer behind most smartphones, is based here. The Cambridge Biomedical Campus is Europe's largest clinical research hub. These aren't branch offices. They're headquarters operations with the recruitment needs to match.

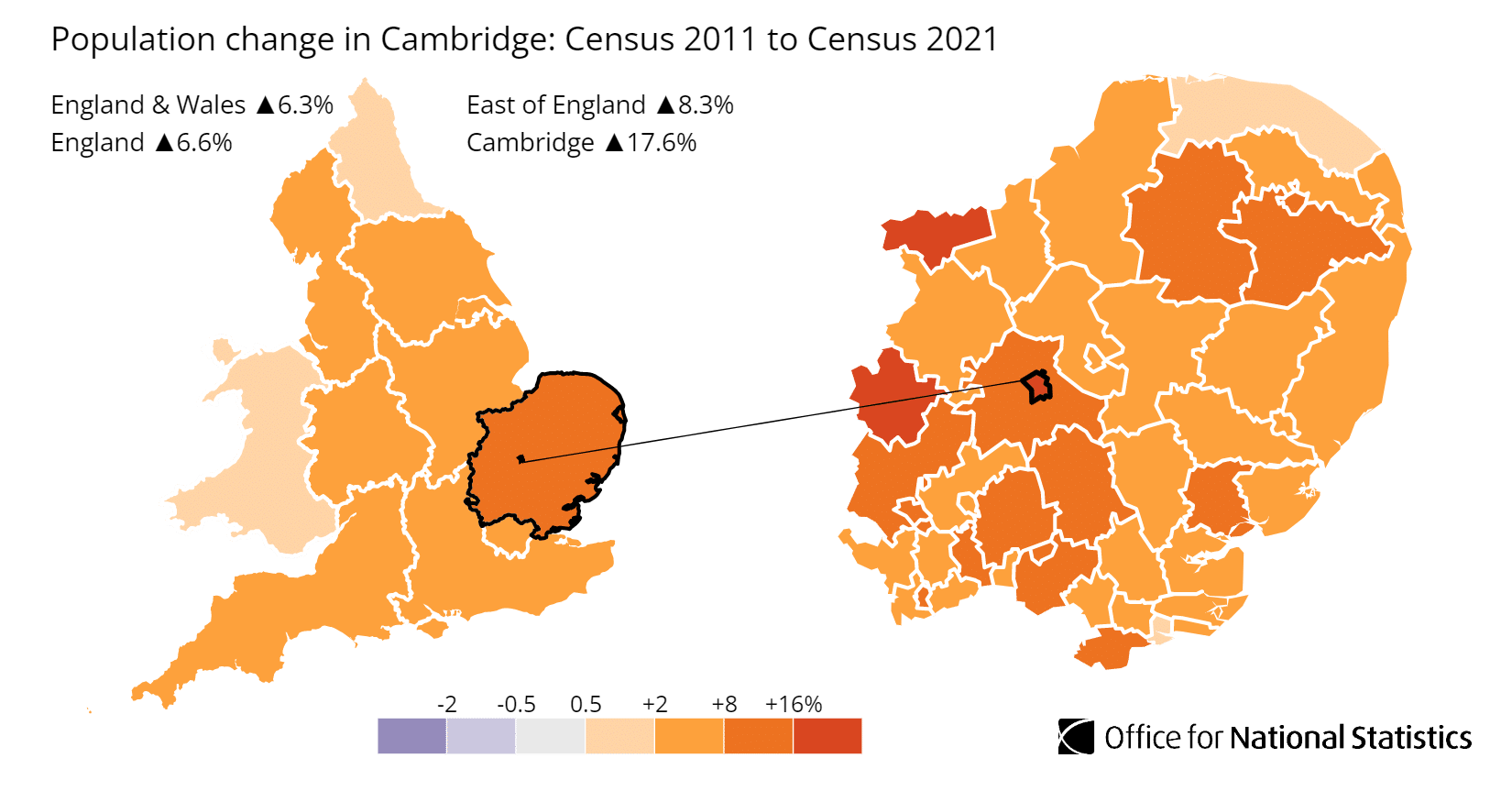

Population growth has been exceptional. According to the latest census data, the population of Cambridge increased by 17.6%, rising from 123,900 in 2011 to 145,700 in 2021. That's the highest growth rate in the East of England, driven by employment expansion rather than retirement migration. The median age is just 31, the lowest in the region. You can explore the breakdown via the ONS Census Data for Cambridge.

For comparable premium markets, consider Oxford (twin university city with similar constraints), Brighton (coastal premium with London spillover demand), or Reading (Thames Valley tech corridor with better yields but less prestige).

Regeneration and Investment in Cambridge

Cambridge operates under a unique growth dynamic. The government's focus on the city as a "science superpower" pushes for expansion, but the reality on the ground is defined by infrastructure delivery and severe water constraints. For investors, the key projects to watch are those that directly affect where people work and how they get there.

Major projects delivering real change include:

- Cambridge South Station (Opening June 2026): The most significant infrastructure project for property investors. This £200m four-platform station will link the Cambridge Biomedical Campus directly to London King's Cross (half-hourly fast trains), Brighton (hourly Thameslink), Birmingham, and Stansted Airport. All four operators (Greater Anglia, Great Northern, Thameslink, CrossCountry) will call from day one, with service levels matching Cambridge main station. The station is forecast to handle 1.8 million passengers annually. For investors, this transforms the accessibility of southern fringe villages like Great Shelford and Trumpington. Updates at Network Rail Cambridge South.

- The Grafton Centre (Work Underway): The transformation of this secondary shopping centre into a life sciences hub is progressing. Planning was approved in February 2024, and archaeological excavations began in April 2025 ahead of demolition of Abbeygate House and part of the centre. The scheme creates 47,000 sqm of laboratory space while retaining 11,000 sqm of retail, plus a new Premier Inn hotel. The developer estimates five times more jobs than current retail use. For investors, this signals the city centre's economic gravity shifting toward science employment in the CB1 postcode. Details at Grafton Centre Regeneration.

- Cambridge Biomedical Campus (Discovery Drive): Expansion continues at Europe's largest biomedical research hub. Construction of 2000 Discovery Drive topped out in November 2025, with this 109,000 sq ft laboratory building scheduled for completion in late 2026. Prologis announced £3 billion investment intentions for the campus in September 2025. With over 20,000 people already working on the campus and tenants including AstraZeneca, BioNTech, and the NHS, these deliveries sustain the demand underpinning rental premiums in southern postcodes.

- North East Cambridge (Funding Cancelled): This 8,500-home regeneration zone near Cambridge North station has hit a major roadblock. While the Development Consent Order for relocating the waste water treatment plant was approved in April 2025, the government withdrew Housing Infrastructure Fund backing in August 2025, citing cost increases from £400m to unaffordable levels. The project cannot proceed without this funding. Anglian Water is now reviewing options to expand capacity at the existing site, with conclusions expected by June 2026. For investors, this removes a significant future housing supply that would have competed with existing stock, putting pressure on supply and potentially increasing future prices for rental and homeownership. The water constraint remains the binding limit on Cambridge's growth.

Cambridge Property Market Analysis

When Was the Last House Price Crash in Cambridge?

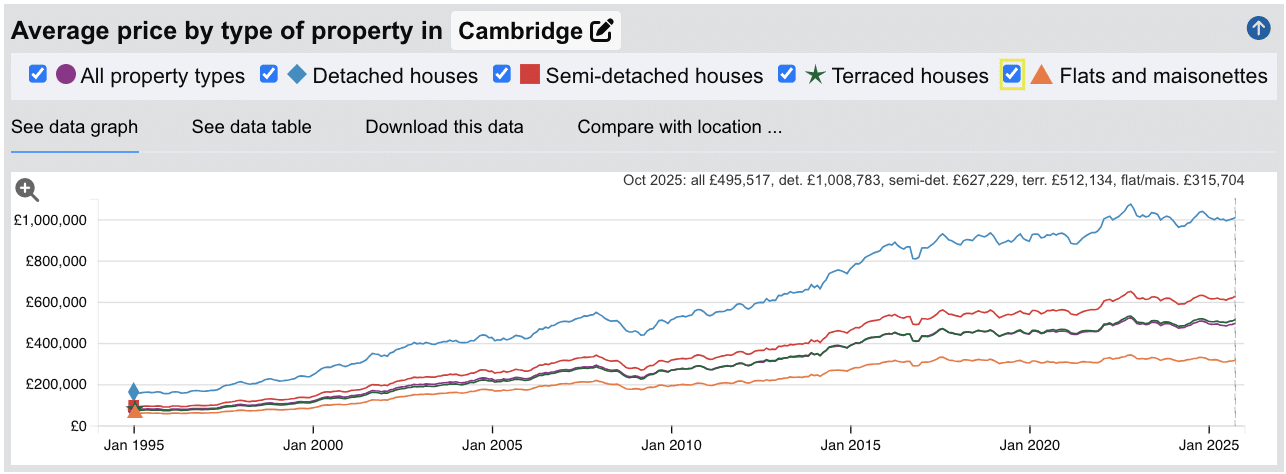

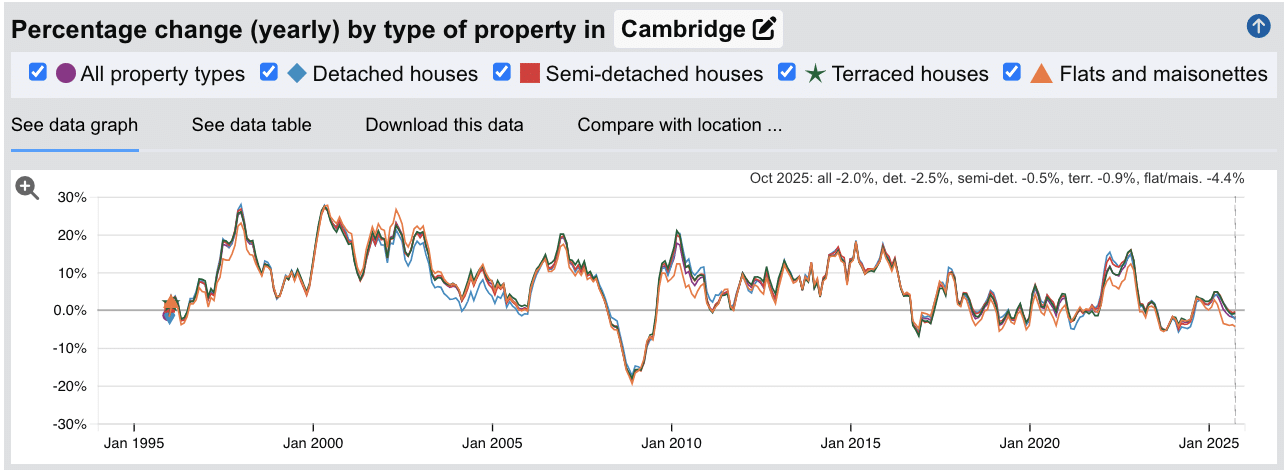

Cambridge experienced a sharper correction during the 2008 financial crisis than many comparable premium markets. Average prices fell from a peak of £291,830 in December 2007 to a trough of £231,276 by March 2009, a decline of 20.7%. Recovery was slow initially, with prices not returning to pre-crash levels until late 2013.

Source: HM Land Registry House Price Index for Cambridge

Here is how the market has performed over the key cycles:

- 1995-2007 saw property values nearly quadruple, rising from £77,379 to £291,830 as Cambridge's knowledge economy expanded and constrained land supply drove premium pricing.

- 2008-2009 brought a significant correction of 20.7%. Cambridge fell harder than many markets, partly because it had risen faster during the boom years.

- 2010-2016 delivered strong recovery and exceptional growth. Prices doubled from £267,594 to £450,477 as tech sector expansion, university growth, and London spillover demand drove a sustained bull run.

- 2017-2019 saw a plateau and mild correction as stamp duty changes and Brexit uncertainty cooled the market. Prices fluctuated between £430,000 and £470,000.

- 2020-2022 brought the pandemic surge. Prices climbed from £457,580 to £521,404 as demand for quality housing with home office space intensified in knowledge-economy locations.

- 2023 saw a correction of around 7.2% as mortgage rates spiked, with prices falling from the November 2022 peak of £521,404 to £484,079 by September 2023.

- 2024-2025 has marked stabilisation. Prices have recovered modestly to £495,517 as of October 2025, still 5% below the 2022 peak but showing year-on-year growth of 3.0%.

Long-Term Property Value Growth in Cambridge

For buy-to-let investors focused on capital preservation and long-term appreciation, Cambridge's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 9.5% growth (£452,466 to £495,517)

- 10 years (2015-2025): 15.9% growth (£427,398 to £495,517)

- 15 years (2010-2025): 71.6% growth (£288,733 to £495,517)

- 20 years (2005-2025): 114.2% growth (£231,306 to £495,517)

- 30 years (1995-2025): 529.6% growth (£78,711 to £495,517)

The 2008 and 2023 corrections demonstrate that Cambridge is not immune to market cycles. Premium markets can fall harder when sentiment shifts. However, the structural demand from universities, tech employers, and biomedical research has consistently driven recovery. The binding constraint remains supply, not demand.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Cambridge

The latest sold house price index by the Land Registry confirms Cambridge's position as one of England's most expensive city markets outside London, with values sitting substantially above national benchmarks across every property type.

Cambridge property prices average £495,517, which is 70% above the England average of £291,515. This premium reflects constrained supply within the city boundary combined with permanent demand from the university, tech, and biomedical sectors.

Semi-detached houses command the steepest premium, averaging £627,229, a 116% uplift against the national average. These family homes in established neighbourhoods like Chesterton and Trumpington attract professional households relocating for Cambridge employment. Detached houses average £1,008,783, sitting 115% above the national figure, with stock concentrated in villages like Great Shelford and Girton.

Terraced houses average £512,134, representing a 110% premium on the England average. Victorian and Edwardian terraces near the city centre dominate this segment, popular with academics and researchers. Flats and maisonettes offer the most accessible entry point at £315,704, though still 44% above the national average. For investors, flats in CB1 and CB2 typically deliver the strongest yields in the city.

Updated January 2026

| Property Type | Cambridge Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £1,008,783 | £470,151 | +114.6% |

| Semi-detached houses | £627,229 | £289,909 | +116.4% |

| Terraced houses | £512,134 | £243,978 | +109.9% |

| Flats and maisonettes | £315,704 | £219,065 | +44.1% |

| All property types | £495,517 | £291,515 | +70.0% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Cambridge (£)

Updated January 2026

The data represents the average sold price per square foot across Cambridge's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | CB3 (West Cambridge, Girton, Madingley) | £577 |

| 2 | CB1 (Central/East Cambridge, Station) | £570 |

| 3 | CB2 (South Cambridge, Trumpington) | £537 |

| 4 | CB4 (North Cambridge, Chesterton) | £502 |

| 5 | CB5 (East Cambridge, Abbey) | £500 |

| 6 | CB22 (Great Shelford, Sawston, Whittlesford) | £446 |

| 7 | CB21 (Fulbourn, Six Mile Bottom) | £421 |

| 8 | CB24 (Histon, Cottenham, Willingham) | £391 |

| 9 | CB25 (Waterbeach, Burwell, Reach) | £384 |

| 10 | CB23 (Cambourne, Hardwick, Dry Drayton) | £382 |

For context, Norwich averages around £300 per square foot. Cambridge's cheapest postcode, CB23, comes in at £382. You get roughly 20% more space for your money in Norwich compared to Cambridge's most affordable areas.

The city postcodes command significant premiums. CB3 at £577 per square foot is the most expensive, covering West Cambridge, Girton, and Madingley. This includes areas close to the West Cambridge science site and historic college properties. CB1 at £570 ranks second, covering the station area and central Cambridge, though it offers the best liquidity (41 sales per month) and 4.4% yields.

CB2 at £537 per square foot covers Trumpington and the Biomedical Campus fringe, where proximity to major employers drives premium pricing. CB4 at £502 and CB5 at £500 complete the city postcode range, with all five city postcodes sitting at or above £500 per square foot.

The village postcodes offer substantially more space for money, though with trade-offs. CB22 at £446 and CB21 at £421 are the closest villages to Cambridge, but lack rental market data. CB24 at £391 covers Histon, Cottenham, and Willingham, offering the first sub-£400 entry point.

For investors focused on maximising space, the outer postcodes offer the best value. CB25 at £384 per square foot covers Waterbeach and Burwell. CB23 at £382 offers the lowest cost per square foot, covering Cambourne with its modern housing stock. A £126,000 deposit (30% on a £421,000 property) buys roughly 1,075 sq ft of living space in CB24, compared to around 805 sq ft in CB1 for a £137,000 deposit. However, the village postcodes show no rental data, suggesting limited investor activity.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age. City postcodes (CB1-CB5) have active rental markets; village postcodes (CB21-CB25) are predominantly owner-occupier.

For Sale Asking House Prices in Cambridge

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Cambridge's ten postcode districts, covering both the city (CB1-CB5) and surrounding South Cambridgeshire villages (CB21-CB25).

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | CB21 (Fulbourn, Six Mile Bottom) | £670,250 |

| 2 | CB22 (Great Shelford, Sawston, Whittlesford) | £631,936 |

| 3 | CB3 (West Cambridge, Girton, Madingley) | £571,749 |

| 4 | CB25 (Waterbeach, Burwell, Reach) | £478,132 |

| 5 | CB5 (East Cambridge, Abbey) | £476,761 |

| 6 | CB2 (South Cambridge, Trumpington) | £471,650 |

| 7 | CB23 (Cambourne, Hardwick, Dry Drayton) | £462,000 |

| 8 | CB1 (Central/East Cambridge, Station) | £457,315 |

| 9 | CB4 (North Cambridge, Chesterton) | £425,745 |

| 10 | CB24 (Histon, Cottenham, Willingham) | £421,622 |

Cambridge pricing follows a village premium pattern. The highest asking prices sit in the South Cambridgeshire villages rather than the city centre. CB21 commands the highest prices at £670,250, covering Fulbourn and Six Mile Bottom, where large detached properties dominate and rental data is largely absent, reflecting an owner-occupier market.

CB22 at £631,936 covers Great Shelford, Sawston, and Whittlesford. The opening of Cambridge South Station in 2026 will transform accessibility here, potentially shifting the investment case for these villages. CB3 at £571,749 covers West Cambridge including Girton and the area around the West Cambridge science site, commanding a premium for proximity to university facilities.

The city postcodes cluster between £425,000 and £480,000. CB5 at £476,761 covers East Cambridge and the Abbey area, while CB2 at £471,650 includes Trumpington and the Biomedical Campus fringe. These postcodes have active rental markets with yields around 4.2-4.7%.

For yield-focused investors, the accessible entry points sit in the northern postcodes. CB4 at £425,745 covers Chesterton and North Cambridge, delivering the highest rental data availability and 4.3% yields. CB24 at £421,622 covers Histon, Cottenham, and Willingham, though rental data is limited here, suggesting owner-occupier dominance.

CB1 at £457,315 deserves attention. This covers the station area and central/east Cambridge with the highest sales activity (41 per month) and 4.4% yields. High liquidity means easier exits but also more competition for stock.

Note: These figures represent average asking prices across all property types. Village postcodes (CB21-CB25) show limited or no rental data, reflecting their predominantly owner-occupier character. City postcodes (CB1-CB5) have active rental markets.

House Price Growth in Cambridge (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| 1. CB23 (Cambourne, Hardwick, Dry Drayton) | +0.9% | +4.1% | +20.7% |

| 2. CB5 (East Cambridge, Abbey) | -14.4% | -15.8% | +15.4% |

| 3. CB22 (Great Shelford, Sawston, Whittlesford) | -0.6% | +4.6% | +14.9% |

| 4. CB24 (Histon, Cottenham, Willingham) | +9.2% | +1.1% | +14.9% |

| 5. CB25 (Waterbeach, Burwell, Reach) | -3.2% | -4.7% | +13.4% |

| 6. CB3 (West Cambridge, Girton, Madingley) | -15.9% | -9.6% | +13.0% |

| 7. CB4 (North Cambridge, Chesterton) | -2.8% | +3.3% | +10.7% |

| 8. CB1 (Central/East Cambridge, Station) | -1.8% | +4.7% | +10.1% |

| 9. CB2 (South Cambridge, Trumpington) | -0.2% | +1.6% | +3.6% |

| 10. CB21 (Fulbourn, Six Mile Bottom) | -7.2% | -12.4% | -2.7% |

The numbers reveal a market under pressure. Eight of ten postcodes show negative one-year growth, with CB3 down 15.9% and CB5 down 14.4% in the past year. This marks a significant correction from the pandemic-era peaks.

CB23 (Cambourne) leads on five-year growth at +20.7%. This new town west of Cambridge benefited from the pandemic "race for space" as buyers sought modern family homes with gardens at prices below the city. CB24 (Histon) is the only postcode showing strong current momentum at +9.2% annual growth, driven by its position as the most affordable entry point to the Cambridge market.

CB22 (Great Shelford) delivered strong five-year growth of +14.9% despite a slight annual decline. The opening of Cambridge South Station in 2026 should support continued appreciation here. CB5 shows the starkest disconnect: strong five-year growth of +15.4% but a sharp -14.4% one-year drop, suggesting recent price corrections after earlier gains.

The city postcodes show more muted five-year growth. CB4 and CB1 cluster around +10%, respectable but below the village postcodes. Both show negative annual figures, suggesting the city market is consolidating at current price levels.

CB2 (Trumpington) continues as the weakest performer among city postcodes, with just +3.6% five-year growth. This postcode saw exceptional gains in the 2014-2017 period as the Biomedical Campus expanded, and prices have since consolidated. For investors, this suggests the easy gains are behind us, though rental demand from campus workers remains strong.

CB21 (Fulbourn) is the only postcode showing negative growth across all timeframes. At £670,250 average asking price, this premium village market appears to have reached its current ceiling.

Average Monthly Property Sales in Cambridge

Updated January 2026

The data represents the average number of residential property sales per month across Cambridge's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | CB1 (Central/East Cambridge, Station) | 41 |

| 2 | CB24 (Histon, Cottenham, Willingham) | 35 |

| 3 | CB23 (Cambourne, Hardwick, Dry Drayton) | 33 |

| 4 | CB4 (North Cambridge, Chesterton) | 25 |

| 5 | CB22 (Great Shelford, Sawston, Whittlesford) | 18 |

| 6 | CB25 (Waterbeach, Burwell, Reach) | 15 |

| 7 | CB21 (Fulbourn, Six Mile Bottom) | 13 |

| 8 | CB2 (South Cambridge, Trumpington) | 12 |

| 9 | CB3 (West Cambridge, Girton, Madingley) | 9 |

| 10 | CB5 (East Cambridge, Abbey) | 6 |

Cambridge shows a concentrated liquidity pattern. The top three postcodes account for over half of all monthly sales, while the bottom three combined barely match CB1 alone. This matters for BRR strategies where exit speed affects your return on capital.

CB1 (Station area) leads decisively with 41 monthly sales, nearly double the next city postcode. This reflects its position as Cambridge's most active market, combining city centre flats, the station quarter, and new developments. Competition for good stock is fierce here. Expect to move quickly and negotiate hard to secure the best properties. The high liquidity also means easier exits when you want to sell.

CB24 and CB23 follow at 35 and 33 sales respectively. Both are village postcodes with new development activity driving transaction volumes. CB24's Histon and Cottenham attract families priced out of the city, while CB23's Cambourne continues to expand as a self-contained new town. Neither shows meaningful rental data, confirming these are owner-occupier markets.

CB4 (Chesterton) at 25 sales is the most active city postcode after CB1. It offers the lowest city entry prices (£425,745) with 4.3% yields and decent liquidity, making it the practical choice for investors who want city exposure without CB1's premium pricing.

The quieter postcodes reflect Cambridge's constrained supply. CB2 at just 12 sales per month despite covering the Biomedical Campus fringe shows how tightly held property is in prime locations. CB3 at 9 sales and CB5 at 6 are the least liquid markets. CB5's low volume is particularly notable given its city location, suggesting a stable resident population with limited turnover.

For investors, CB4 offers the best balance of liquidity and fundamentals. It combines reasonable transaction volume (25/month) with the lowest city entry price and active rental data. CB1 offers superior liquidity but at a price premium. The village postcodes may offer better value, but limited rental demand makes them better suited to owner-occupiers or long-term capital growth plays.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Cambridge Rental Market Analysis

For new landlords and investors considering if buy to let is worth it in Cambridge and thinking how much they can charge for rent across the city and its surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Cambridge (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Cambridge. Note that rental data is only available for the city postcodes (CB1-CB5). The village postcodes (CB21-CB25) show insufficient rental activity to generate reliable averages, reflecting their predominantly owner-occupier character.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | CB2 (South Cambridge, Trumpington) | £1,849 |

| 2 | CB3 (West Cambridge, Girton, Madingley) | £1,830 |

| 3 | CB1 (Central/East Cambridge, Station) | £1,678 |

| 4 | CB5 (East Cambridge, Abbey) | £1,676 |

| 5 | CB4 (North Cambridge, Chesterton) | £1,540 |

CB2 (Trumpington) commands the highest average rent at £1,849. This reflects proximity to the Cambridge Biomedical Campus, where AstraZeneca, Royal Papworth Hospital, and research institutes employ thousands of professionals willing to pay premium rents for short commutes. The tenant profile here skews toward corporate relocations and senior researchers on strong salaries.

CB3 at £1,830 tells a similar story. This postcode includes West Cambridge and areas near the university's science sites. Larger properties and professional tenants drive the high average. However, with just 9 sales per month, finding stock here is challenging.

CB1 (Station area) at £1,678 offers the most liquid rental market. The combination of city centre location, station access, and new apartment developments creates consistent demand from young professionals and commuters. With 41 monthly sales, this is where investors can most easily build and adjust a portfolio.

CB5 at £1,676 nearly matches CB1 but with just 6 monthly sales, reflecting a smaller, more stable rental market. CB4 (Chesterton) at £1,540 offers the lowest rents but also the lowest entry prices (£425,745), delivering 4.3% yields. For investors focused on cash flow rather than premium tenants, CB4 offers the best rent-to-price ratio among city postcodes.

For context, Cambridge rents sit significantly above regional comparators. Norwich averages £1,100-£1,500 in its prime postcodes, while Peterborough sits lower still. The premium reflects Cambridge's unique employment base and constrained housing supply.

Gross Rental Yields in Cambridge (%)

Updated January 2026

The data represents the average gross rental yields across Cambridge's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | CB2 (South Cambridge, Trumpington) | 4.7% |

| 2 | CB1 (Central/East Cambridge, Station) | 4.4% |

| 3 | CB4 (North Cambridge, Chesterton) | 4.3% |

| 4 | CB5 (East Cambridge, Abbey) | 4.2% |

| 5 | CB3 (West Cambridge, Girton, Madingley) | 3.8% |

Cambridge yields sit below the 5% threshold many investors target for cash-flow positive buy-to-let. This is a capital growth market where rental income covers costs rather than generating significant monthly surplus. The investment case rests on long-term appreciation and tenant quality rather than immediate returns.

CB2 (Trumpington) leads at 4.7%, benefiting from strong rents driven by Biomedical Campus demand. Despite the highest rents in Cambridge (£1,849/month), the yield reflects equally high purchase prices. CB1 at 4.4% offers the best combination of yield and liquidity, with 41 monthly sales making it the easiest postcode to enter and exit.

CB4 (Chesterton) at 4.3% delivers the best yield among postcodes with accessible entry prices. At £425,745 average, this is where investors can achieve reasonable returns without the £500k+ commitment required elsewhere. CB5 at 4.2% offers similar returns but with just 6 monthly sales, finding suitable stock is more challenging.

CB3 at 3.8% is the lowest-yielding postcode with data. At £571,749 average prices and £611 per square foot, this is premium owner-occupier territory where rental returns are secondary to capital preservation. The five village postcodes show no yield data, confirming negligible rental market activity.

For context, these yields compare unfavourably to regional alternatives. Norwich delivers 5-7% in its active postcodes, while Peterborough offers similar returns at lower entry prices. Cambridge's compressed yields reflect the premium buyers pay for security, tenant quality, and long-term growth potential.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy-to-let ownership costs.

Is Cambridge Rent High?

Cambridge rents consume a significant portion of income across all postcodes, reflecting the structural imbalance between housing supply and demand from the university, tech, and biomedical sectors.

Average rent in Cambridge costs between 40% and 48% of the average gross annual earnings for a full-time resident. This is based on the Annual Survey of Hours and Earnings (ASHE) showing the median gross annual income for Cambridge residents is £45,800.

The general affordability guideline suggests rent should not exceed 30% of gross income. Every Cambridge postcode with rental data exceeds this threshold by a considerable margin. Even in the most affordable postcode, CB4 (Chesterton), rent takes 40.3% of gross salary. In CB2 (Trumpington), nearly half of pre-tax income goes toward housing costs.

The silver lining for investors: high rent-to-income ratios indicate strong demand relative to supply. Tenants are willing to pay premium rents because the employment opportunities justify the cost. A researcher at the Biomedical Campus or a software engineer at ARM can absorb these rents. Tenant quality in Cambridge is exceptionally high.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | CB2 (South Cambridge, Trumpington) | 48.4% |

| 2 | CB3 (West Cambridge, Girton, Madingley) | 47.9% |

| 3 | CB1 (Central/East Cambridge, Station) | 44.0% |

| 4 | CB5 (East Cambridge, Abbey) | 43.9% |

| 5 | CB4 (North Cambridge, Chesterton) | 40.3% |

These figures also explain why yields are compressed. Rents are already at the upper limit of what the market will bear. There is limited headroom to increase rents further without pricing out even professional tenants. Capital growth rather than rental income growth is the primary return driver in this market.

Note: These calculations use median gross salary for Cambridge residents. Actual tenant affordability varies based on household income and employer housing support, which is common among university and biomedical campus employers. Village postcodes (CB21-CB25) lack sufficient rental data to calculate affordability ratios.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Cambridge House Prices High?

For a local buyer on average full-time earnings, Cambridge is one of the least affordable cities in England outside London. The combination of constrained supply and globally competitive employment creates prices that lock out most first-time buyers without substantial deposits or family support.

Purchasing a property in Cambridge requires between 9.2 and 14.6 times the median annual salary. This is based on the Annual Survey of Hours and Earnings (ASHE) showing the median gross annual income for Cambridge residents is £45,800.

Every Cambridge postcode exceeds 9x income. Even the most affordable areas, CB24 (Histon) at 9.2x and CB4 (Chesterton) at 9.3x, require deposits and mortgages far beyond what local first-time buyers can typically access. This sustains rental demand from professionals who earn well above the median but still cannot save deposits fast enough to buy.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | CB21 (Fulbourn, Six Mile Bottom) | 14.6x |

| 2 | CB22 (Great Shelford, Sawston, Whittlesford) | 13.8x |

| 3 | CB3 (West Cambridge, Girton, Madingley) | 12.5x |

| 4 | CB25 (Waterbeach, Burwell, Reach) | 10.4x |

| 5 | CB5 (East Cambridge, Abbey) | 10.4x |

| 6 | CB2 (South Cambridge, Trumpington) | 10.3x |

| 7 | CB23 (Cambourne, Hardwick, Dry Drayton) | 10.1x |

| 8 | CB1 (Central/East Cambridge, Station) | 10.0x |

| 9 | CB4 (North Cambridge, Chesterton) | 9.3x |

| 10 | CB24 (Histon, Cottenham, Willingham) | 9.2x |

The village postcodes CB21 and CB22 sit at 13-15x income, reflecting large detached properties in premium locations rather than typical investor territory. These are owner-occupier markets with minimal rental activity. The city postcodes cluster around 10x income, still far above the UK historic average of 4-5x but more accessible for dual-income professional households.

For investors comparing knowledge-economy markets, Oxford shows similar affordability constraints, while Reading and Brighton offer slightly better ratios with different employment profiles. For genuine affordability in the East of England, Peterborough and Norwich sit well below Cambridge's entry threshold.

How Much Deposit to Buy a House in Cambridge?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £75,000 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | CB24 (Histon, Cottenham, Willingham) | £126,487 |

| 2 | CB4 (North Cambridge, Chesterton) | £127,723 |

| 3 | CB1 (Central/East Cambridge, Station) | £137,194 |

| 4 | CB23 (Cambourne, Hardwick, Dry Drayton) | £138,600 |

| 5 | CB2 (South Cambridge, Trumpington) | £141,495 |

| 6 | CB5 (East Cambridge, Abbey) | £143,028 |

| 7 | CB25 (Waterbeach, Burwell, Reach) | £143,440 |

| 8 | CB3 (West Cambridge, Girton, Madingley) | £171,525 |

| 9 | CB22 (Great Shelford, Sawston, Whittlesford) | £189,581 |

| 10 | CB21 (Fulbourn, Six Mile Bottom) | £201,075 |

For investors entering the Cambridge market, CB24 and CB4 require deposits around £127,000. That's still roughly double what you'd need in Norwich or Peterborough for a comparable property type. However, CB4 delivers 4.3% yields with active rental data, making it the practical entry point for investors who want city exposure.

CB1 (Station area) at £137,194 represents the sweet spot for many investors. The additional £10,000 over CB4 buys access to Cambridge's most liquid market with 41 transactions per month and 4.4% yields. High turnover means easier exits if you need to sell.

The village postcodes CB21, CB22, and CB25 require deposits exceeding £140,000 but show no rental data, confirming their owner-occupier character. Unless you're specifically targeting long-term capital growth with no rental income requirement, the numbers favour the city postcodes where rental demand is proven.

For comparison, the same £127,000 deposit that buys one property in CB4 could secure two properties in Hull or Stoke with significantly higher yields. Cambridge is a capital growth play, not a cash flow market.

How to Invest in Buy-to-Let in Cambridge

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Cambridge, Cambridgeshire and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Cambridge and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Cambridge for Buy-to-Let Investment

For investors seeking higher yields with lower entry prices, buy-to-let in Peterborough offers another Cambridgeshire market with fast London commutes and deposits around half what Cambridge requires. If you're drawn to knowledge-economy cities with similar tenant profiles, buy-to-let in Oxford delivers comparable capital growth potential with its own world-class university and science parks.

Or to understand the wider regional market, see our guides to buy-to-let in Norwich for East Anglia's largest city with stronger yields, and buy-to-let in Ely for Cambridge's cathedral city neighbour with more accessible pricing.