Understanding Capital Growth in Property Investment

Capital growth is the increase in a property's value.

Also known as equity growth and capital appreciation of a house price. It is the holy grail of property investment. Buying a property with the plan that if you hold it for a number of years, it should go up in value over time.

This is how many of the world's wealthiest families have made their money in real estate. Sounds simple, right?

Not so fast. In this article, we look at all things capital growth, including the past 30 years of UK property growth and decline cycles, what 'good' capital growth looks like, and if you can 'predict' capital growth.

Article updated: October 2025

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

How to Predict Capital Growth

What is the best location to buy a property in the UK for capital growth?

I'd love to be able to say, it's this town (like Oldham or Bury) or it's this street (likely not one of the most expensive streets in Manchester), or it's this postcode, but the reality is, nobody knows what's going to happen in the future.

As a property investment company based in the North West, we get asked this question all the time.

Our answer on how you can predict the perfect area:

All you need to do is ...

If only we could say this and accurately predict prices. We all wish it were possible to predict capital growth, but the reality is that it is crystal ball stuff.

Even property investors who got it right and purchased properties in areas of significant growth at the perfect time can't actually predict 'when' and buy 'how much' equity growth they will see.

Sometimes they simply get lucky, sometimes they research property data in depth, and sometimes they simply focus on buying at a discount and don't actually worry about growth.

Imagine buying in London in the 1980s or Salford in early 2014, your investment properties would have seen a significant capital gain, and you may be claiming that you can 'predict' growth as your timing was perfect.

However, would those same investors have seen the great financial crash coming in 2008 and sold just in time before it hit ? and then purchased again in the same area in 2010 ready for the upcoming boom? Highly unlikely.

Predicting capital growth is folly and can lead to speculative beats as you try and find the next big growth area that is primed for a population boom and regeneration investment.

It's possible to see the signs, but predicting exact outcomes isn't going to happen.

Instead, you can focus on the underlying rules of capital growth and the levers that help 'drive' capital growth. Then all being well, if they align and the market is rising, you too can ride the wave of the UK property cycle and achieve a fantastic outcome.

So what are the rules of capital growth?

Rules of Capital Growth

There are 3 rules to capital growth.

1. Prediction is impossible

Property markets respond to countless variables that interact in unpredictable ways. Interest rate changes, government policy shifts (like the renters' rights act and selective licensing schemes, infrastructure investments, employment trends, demographic movements, and unexpected events like pandemics all influence local property values. These factors don't move in isolation, and their combined effects create outcomes that defy precise forecasting.

Look at the past 10 years. Who predicted that Brexit would slow London property markets while regional cities continued growing? Who forecasted that a pandemic would trigger a race for space, driving up house prices in rural areas and smaller towns?

2. Historic performance is not a guarantee of future returns

Many investors make decisions by looking at recent growth figures or historic growth charts, and whilst these can be valuable, simply assuming they'll continue is a real risk.

An area showing 10% annual growth for the past three years seems like a safe bet. But property cycles don't work that way. Areas that boom hardest often correct most severely. By the time strong growth becomes obvious enough to attract widespread investor attention, you're often buying near the peak and rather than an investment that provides you with future capital growth, if you buy at the peak and prices drop you will actually fall in to negative equity.

Consider buy to let in London during the 2010-2016 period. Spectacular growth attracted massive investment. Investors piled in expecting continued appreciation. Then growth stalled, and some areas experienced declines. Those who bought in 2015-2016 based on recent performance faced years of flat or negative returns.

3. Short-term predicting is dangerous

Predicting growth over 1-2 years is particularly futile. Markets can remain flat, decline, or surge based on temporary factors that quickly reverse. Over longer periods like 10-15 years, you can make more educated assessments based on fundamental strength, population trends, and planned government involvement, but you still can't predict with certainty.

30 Years of Capital Growth in the UK Property Market

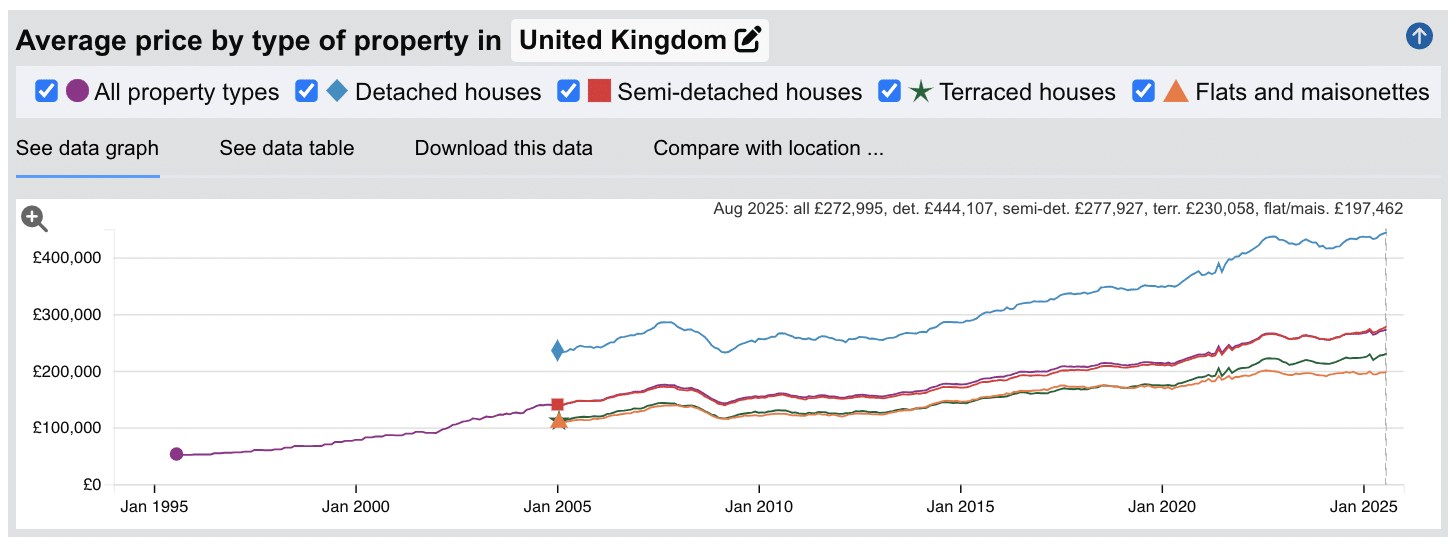

The latest property data sets from HM Land Registry show equity growing significantly in houses across the UK.

Here are the property prices in August 1995:

- United Kingdom - average property price £52,066

- England - average property price £50,606

- Wales - average property price £40,870

- Scotland - average property price £42,242

- Northern Ireland - average property price £40,606

Here are the property prices in August 2025:

- United Kingdom - average property price £272,995

- England - average property price £295,670

- Wales - average property price £211,361

- Scotland - average property price £193,786

- Northern Ireland - average property price £185,108

The capital growth, equity growth or capital appreciation, however you call it, was significant in all of these countries.

In 30 years, the capital gain 'average' was:

- United Kingdom: 5.7% per year

- England: 6.1% per year

- Wales: 5.6% per year

- Scotland: 5.1% per year

- Northern Ireland: 5.1% per year

These figures demonstrate substantial wealth creation over three decades.

A property purchased in England for £50,606 in 1995 would be worth £295,670 in 2025, representing a gain of £245,064 compounded over 30 years of ownership.

The crucial lesson? While the long-term trajectory is clearly upward, the journey involved multiple booms, crashes, and periods of stagnation. Investors who entered the market at different points experienced vastly different outcomes depending on their timing and holding periods.

What is a "Good" Rate of Capital Growth in Property?

Clients frequently ask whether 3%, 5%, or 7% annual growth represents good performance.

As above, averaged over 30 years, all the UK countries performed between a spread of 5.1% - 6.1% house price growth.

Now, of course, there will be significant regional differences in this. If we compared Nottingham to Newcastle, or Brighton to Bath, you will likely see significant differences in when their local property markets boom and bust and by how much.

The 10% Combined Return Framework

Rather than chasing maximum capital growth or maximum rental yield separately, one way landlords approach this is by targeting a combined 10% annual return from both sources together. This framework provides flexibility across different property types and markets while ensuring your buy to let property deal generates acceptable total returns.

Here's how it works in practice:

Scenario 1: High Yield, Lower Growth

2% annual capital growth + 8% rental yield = 10% total return

Example: A property in Blackburn purchased for £120,000 generating £800 monthly rent

Scenario 2: Balanced Approach

5% annual capital growth + 5% rental yield = 10% total return

Example: A buy to let property in York purchased for £180,000 generating £750 monthly rent

Scenario 3: High Growth, Lower Yield

6% annual capital growth + 4% rental yield = 10% total return

Example: A property in an up-and-coming area of Cambridge purchased for £300,000 generating £1,500 monthly rent

All three scenarios achieve the 10% target, but they suit different landlord circumstances. Scenario 1 generates strong monthly cash flow but builds equity slowly. Scenario 3 builds equity faster but provides less monthly income.

The crucial requirement for any scenario? Your rental income must cover the costs of running your buy to let like mortgage costs, maintenance, and void periods. Without positive cash flow, even strong growth creates unsustainable financial pressure.

Frequently Asked Questions About Capital Growth

Is a 5% growth rate good?

Five percent annual capital growth sits right in the middle of the UK's long-term historical average of 4-6%. Over complete property cycles spanning decades, accounting for both boom periods delivering 10-15% growth and bust periods showing flat or negative returns - 5% represents solid, sustainable performance.

However, context matters. A property delivering consistent 5% growth year after year outperforms one showing 15% growth for two years followed by eight years of flat performance.

More importantly, 5% house price capital growth alone doesn't tell you whether an investment is good. You need to consider what rental yield accompanies that growth and whether the combined return meets your objectives.

How do I get a 10% return on my property investment?

Achieving a 10% combined return typically involves selecting locations and properties where the rental yield and capital gain fundamentals align. Start by using our rental yield calculator to understand what yield you can expect from properties in your target price range.

Then examine 5-year historical capital growth data for those same areas. If an area has consistently delivered 4-5% annual growth, investors typically then look for properties generating a minimum of 5-6% rental yield to reach their 10% target. If growth has been weaker at 2-3%, they would look for higher yields of 7-8%.

The key is finding areas where both fundamentals exist.

What will my property be worth in 5-10 years?

While you can use property tools to look at many datasets, they can't predict exact values and neither can we unfortunately. Although we can model potential outcomes based on different growth scenarios. Let's use a £200,000 property as an example:

After 5 Years:

- At 3% annual growth: £231,855

- At 5% annual growth: £255,256

- At 7% annual growth: £280,510

After 10 Years:

- At 3% annual growth: £268,783

- At 5% annual growth: £325,779

- At 7% annual growth: £393,430

So a house purchased in 2025 for £200,000 might be worth £268,783 by the year 2035 or even as much as £393,430 !

Notice how the differences compound over time. The difference between 3% and 7% growth is about £49,000 after 5 years, but £125,000 after 10 years. This illustrates why longer holding periods matter and why consistent growth compounds into substantial wealth.

However, these calculations assume steady, consistent growth. Reality involves cycles. Your property might grow 8% one year, stay flat the next, decline 2% the following year, then grow 6% in year four. Over time, these fluctuations average out, but short-term predictions remain unreliable.

Will house prices double by 2030?

Unlikely. For house prices to double from 2025 to 2030 would require approximately 15% annual growth sustained over five years. Based on the 30 years of cycles we examined earlier, this level of sustained growth is extremely unlikely.

The last time UK property prices doubled in five years was during the exceptional 2002-2007 period, fueled by historically low interest rates, expanding mortgage availability, and strong economic growth. Those conditions don't exist today, and that boom was followed by the 2008 crash, illustrating why exceptional growth periods prove unsustainable.

More realistic forecasts for 2025-2030 suggest total cumulative growth of 20-30% in cities where population is growing significantly, which would increase a £200,000 property to £240,000-£260,000. Some areas might perform better, others worse, but expecting prices to double within five years sets unrealistic expectations likely to lead to poor decisions.

Should I prioritise rental yield or capital growth?

The choice between prioritising yield or growth depends on your own personal goals. As a guide some landlords choose to:

Prioritise Rental Yield When:

- They need monthly cash flow to cover costs and living expenses

- They are building a portfolio and rely on mortgage finance to fund the next purchase

- They are not speculating on growth but instead want the property to pay for itself

Prioritise Capital Growth When:

- They have substantial cash reserves to cover any shortfalls

- They have a long time horizon (15+ years)

- They prefer premium locations and will buy in the best area they can afford

- Their other income sources are stable and sufficient to cover their costs and day to day needs

Why is there an inverse relationship between yield and growth?

Properties in expensive areas like London generate lower rental yields because house prices have grown faster than rents. A £500,000 property might rent for £2,000 monthly (4.8% gross yield), while a £150,000 property in Stoke-on-Trent rents for £700 monthly (5.6% gross yield).

The expensive London property has already experienced substantial growth which has pushed yields down. Investors buying the London property are betting on continued growth and accepting lower yields. Those buying in Stoke prioritise immediate cash flow with the hope of some potential appreciation.

Neither approach is inherently superior. They serve different investment strategies and risk profiles.

How do I calculate capital growth rate?

Capital growth rate shows how much an investment has increased in value over time.

Formula for total capital growth:

( (Current Value - Purchase Price) / Purchase Price ) × 100 = Total Growth %

Formula for average annual growth (compound annual growth rate, CAGR):

( (Current Value / Purchase Price)^(1 / Number of Years) - 1 ) × 100 = Average Annual Growth %

Example: You purchased a property for £180,000 five years ago, and it's now worth £230,000.

- Total growth: ((£230,000 - £180,000) / £180,000) × 100 = 27.8%

- Average annual growth: ((£230,000 / £180,000)^(1/5) - 1) × 100 = 5.0%

This means your property grew by 27.8% overall across five years, averaging 5.0% growth per year. Note that 5.0% is slightly less than 27.8% ÷ 5 (5.56%) because compound growth builds on the previous year’s increased value.

You can use our loan-to-value calculator to estimate the deposit required for a property you’re considering buying.