Where to Buy Property Investments in Norwich: Yields of 9.0%

Norwich delivers rental yields reaching 9.0% in NR5, with asking prices starting 28% below the England average. For a property investment in the East of England, those numbers stand out against a region where Cambridge and commuter belt premiums dominate.

The latest property data shows where Norwich sits in the market. Average sold prices of £224,871 sit 23% below the England average of £291,515, and 34% below the East of England average of £340,037. This is one of the few places in the region where entry prices remain accessible and yields can still clear 5%.

Our buy-to-let analysis examines Norwich's eight postcode districts from NR1 to NR8, evaluating capital growth, rental yields, and investment potential across this historic cathedral city, its university quarter, and surrounding suburbs.

Article updated: January 2026

Norwich Buy-to-Let Market Overview 2026

Norwich's property market delivers asking prices ranging from 28% below to 34% above the England average across its postcodes, with yields stretching from 3.9% in the rural fringes to 9.0% in the student-influenced west:

- Asking price range: £211,540 (NR1) to £390,423 (NR4) across Norwich postcodes

- Rental yields: 3.9% (NR8) to 9.0% (NR5) across different postcodes

- Rental income: Monthly rents from £1,040 (NR7) to £2,116 (NR5)

- Price per sq ft: Asking prices from £282/sq ft (NR3) to £337/sq ft (NR4)

- Market activity: Sales ranging from 19 per month (NR5) to 37 per month (NR2)

- Deposit requirements: 30% deposits range from £63,462 (NR1) to £117,127 (NR4)

- Affordability ratios: Property prices from 5.7 to 10.5 times Norwich's median annual salary of £37,118

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Norwich?

Norwich combines two things investors look for: a university driving consistent tenant demand and an employment base substantial enough that you're not solely reliant on students. The jobs density here is 1.06, meaning there are more jobs than working-age residents. People commute into Norwich for work, not just out of it.

The employment mix runs deeper than most regional cities. Financial services anchors the economy through Aviva, which employs thousands at its headquarters here. The Norwich Research Park houses 3,000 scientists and researchers across organisations including the John Innes Centre and Earlham Institute, creating professional tenant demand in the NR4 postcode. Public administration accounts for 10.3% of employment, education 12.6%, and healthcare 9.2%. Manufacturing is modest at 4.6%, but the service sector dominates. You can see the full employment breakdown via the Nomis Labour Market Profile for Norwich.

Student demand provides the yield kicker. The University of East Anglia and Norwich University of the Arts bring a combined student population of around 20,000. The NR5 postcode, covering Bowthorpe and Earlham, shows the impact: yields hitting 9.0% reflect the student HMO market rather than standard buy-to-let. If you're targeting professional tenants, NR2's 6.9% yield in the Golden Triangle offers a more representative picture.

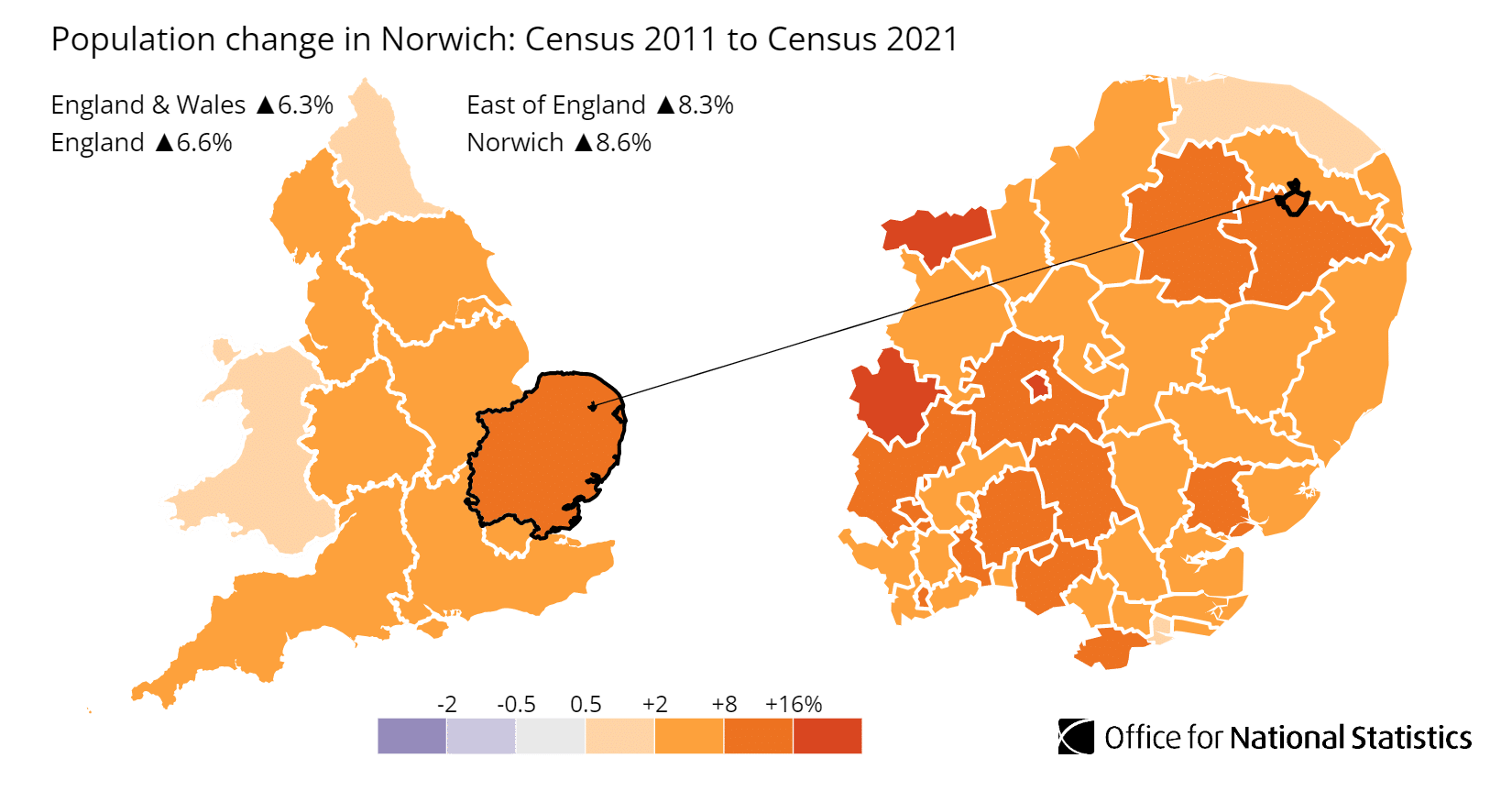

Population growth has been solid. According to the latest census data, the population of Norwich increased by 8.6%, rising from 132,500 in 2011 to 143,900 in 2021. The median age is 34, six years younger than the England average of 40, reflecting that student and young professional demographic. You can explore the breakdown via the ONS Census Data for Norwich.

Transport links are decent without being exceptional. Trains to London Liverpool Street take around 1 hour 50 minutes, making daily commuting a stretch. This isn't a commuter town. Your tenants live and work locally, which actually provides stability. You're not exposed to train fare increases or timetable changes affecting demand.

For comparable university city markets in the region, consider Cambridge (40 miles south, tech-driven premiums, yields compressed below 4%), Ipswich (45 miles south, similar price points, less established university presence), or Peterborough (faster London trains, lower entry prices, but less diverse employment base).

Regeneration and Investment in Norwich

Norwich spent years watching regeneration projects stall. Private developers pulled out of Anglia Square, heritage buildings sat empty, and the city's largest brownfield site remained stuck in planning limbo. That changed in 2024-25 when the City Council stepped in to acquire and unlock key sites directly. For investors, this shift matters. Council-led delivery with Homes England backing removes the viability gaps that killed previous schemes.

The projects now moving include:

- Anglia Square (Active Demolition): After twenty years of false starts, this is finally happening. Norwich City Council acquired the 11-acre site in December 2024, backed by Homes England funding. DSM Contractors commenced demolition in late 2025, with site clearance scheduled to finish by Spring 2026. This £350m regeneration will eventually deliver 1,100 new homes. For investors, the immediate signal is the removal of the derelict Sovereign House. A physical sign that the northern city centre is finally unlocking. Updates at Norwich City Council Anglia Square.

- Norwich Castle (Completed August 2025): The £27.5m "Royal Palace Reborn" project officially reopened the Castle Keep on 7 August 2025. All five floors are now accessible for the first time in 900 years. For serviced accommodation investors, this strengthens Norwich as a heritage destination, supporting short-term let demand in the historic Norwich Lanes district. Details at Norwich Castle Museum.

- East Norwich Masterplan (Long-term): The city's largest growth opportunity covers 50 hectares, including the former Colman's Mustard factory at Carrow Works. The masterplan targets 3,500+ homes and 6,000 jobs over the next decade. The East Norwich Delivery Board is currently finalising infrastructure planning for new bridges across the Wensum. This represents long-term capital appreciation rather than an immediate rental play. Progress updates at East Norwich Masterplan.

- Creative Technology Hub: In late 2025, Norwich University of the Arts launched its Immersive Visualisation Lab in partnership with Sony. This facility supports high-end virtual production for film and gaming. For investors, the relevance is tenant profile. Digital creative professionals working remotely or for local studios represent a growing niche in NR1 and NR2, particularly for high-spec city centre apartments.

The pipeline is real and funded. Anglia Square is the near-term catalyst, with demolition visible now and construction starting in 2026. East Norwich is the decade-long bet. Both will reshape tenant demand patterns, shifting gravity toward the northern city centre and the eastern riverside.

Norwich Property Market Analysis

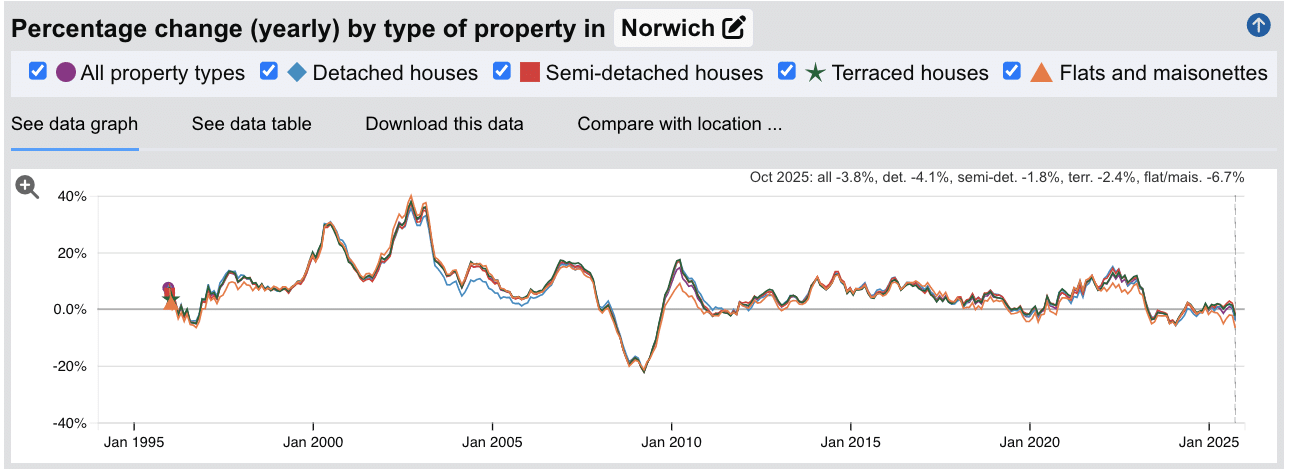

When Was the Last House Price Crash in Norwich?

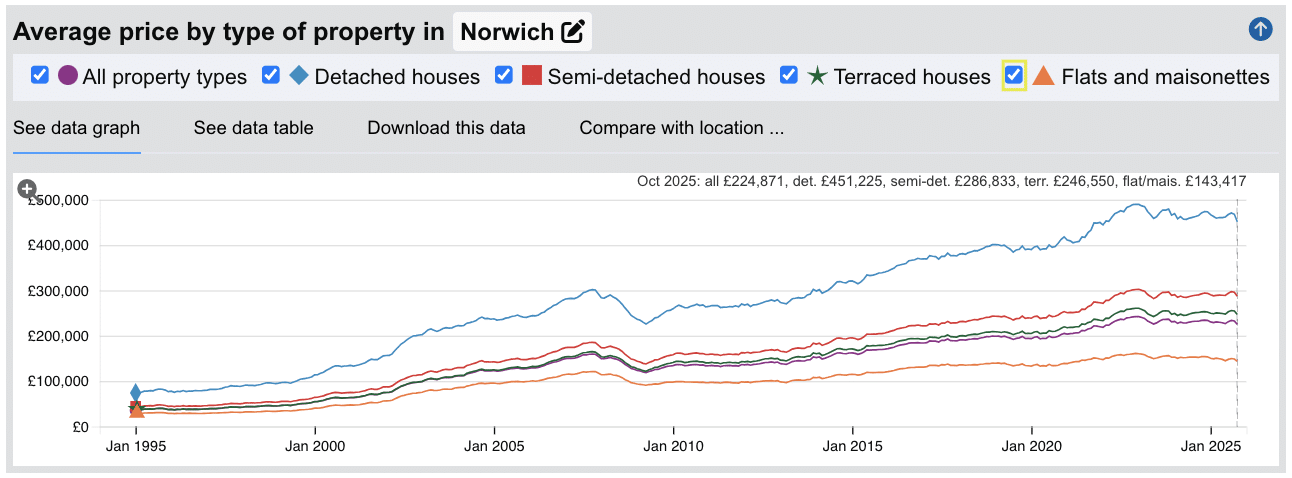

The last significant market correction in Norwich came during the 2008 financial crisis. The city experienced a 25.7% peak-to-trough decline, with average prices falling from £159,510 in October 2007 to £118,507 by April 2009. This was notably steeper than many regional markets. Recovery took approximately six years, with prices not returning to pre-crash levels until late 2014.

Source: HM Land Registry House Price Index for Norwich

Here is how the market has performed over the key cycles:

- 1995-2007 saw property values quadruple, rising from around £35,000 to over £159,000 as the national boom lifted all markets.

- 2008-2009 brought a severe correction where values dropped by approximately 25.7% at the lowest point. Norwich fell harder than many comparable cities, reflecting its exposure to financial services employment through Aviva.

- 2010-2014 was a slow recovery period, with prices fluctuating between £118,000 and £160,000 as the market gradually rebuilt confidence.

- 2015-2019 delivered steady growth, with prices climbing from £159,000 to £198,000 as the university expansion and professional employment base strengthened demand.

- 2020-2022 saw the pandemic-driven surge. Prices climbed from £193,000 to over £242,000 as buyers sought quality of life outside London.

- 2023 brought a correction of around 6.9% as mortgage rates spiked, cooling the post-pandemic momentum.

- 2024-2025 has seen prices stabilise but remain under pressure. The October 2025 average of £224,871 represents a year-on-year decline of 3.8%, suggesting the market is still finding its floor.

Long-Term Property Value Growth in Norwich

For buy-to-let investors focused on capital preservation and steady appreciation, the long-term trajectory shows consistent gains despite the volatility:

- 5 years (2020-2025): 13.2% growth (average prices rising from £198,714 to £224,871)

- 10 years (2015-2025): 32.6% growth (average prices rising from £169,539 to £224,871)

- 15 years (2010-2025): 66.6% growth (average prices rising from £134,977 to £224,871)

- 20 years (2005-2025): 76.6% growth (average prices rising from £127,297 to £224,871)

- 30 years (1995-2025): 467.5% growth (average prices rising from £39,627 to £224,871)

The steeper 2008 crash and current 2024-25 softness show Norwich is more sensitive to economic cycles than some northern markets. This reflects its exposure to financial services and its role as a regional centre. For investors, this means timing matters more here than in steadier markets like Carlisle. The trade-off is stronger long-term growth potential when the cycle turns.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Norwich

The latest sold house price index by the Land Registry positions Norwich as one of the more affordable markets in the East of England, though the discount varies significantly by property type.

Norwich property prices average £224,871, which is 22.9% below the England average of £291,515. However, Norwich sits 33.9% below the East of England regional average of £340,037, making it one of the few accessible entry points in a region dominated by Cambridge and commuter belt premiums.

Flats and maisonettes offer the sharpest value, averaging just £143,417, a 34.5% discount against the national average. City centre apartments in NR1 and NR2 represent the most accessible entry point for investors targeting young professional and student tenants. Detached houses average £451,225, sitting 4.0% below the national figure, reflecting the quality of stock in suburbs like NR4 and NR8.

Semi-detached houses average £286,833, just 1.1% below the national average. Terraced houses are the exception, averaging £246,550, which is actually 1.1% above the England average. This reflects demand for period terraces in popular areas like the Golden Triangle (NR2) and Unthank Road, where Victorian and Edwardian stock commands a premium.

Updated January 2026

| Property Type | Norwich Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £451,225 | £470,151 | -4.0% |

| Semi-detached houses | £286,833 | £289,909 | -1.1% |

| Terraced houses | £246,550 | £243,978 | +1.1% |

| Flats and maisonettes | £143,417 | £219,065 | -34.5% |

| All property types | £224,871 | £291,515 | -22.9% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Norwich

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Norwich's eight postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | NR4 (Eaton, Cringleford, University) | £390,423 |

| 2 | NR8 (Taverham, Drayton, Rural North-West) | £342,139 |

| 3 | NR7 (Thorpe St Andrew, Sprowston) | £297,754 |

| 4 | NR6 (Hellesdon, Old Catton) | £294,256 |

| 5 | NR5 (Bowthorpe, Costessey, Earlham) | £281,412 |

| 6 | NR2 (Golden Triangle, Earlham Road) | £258,257 |

| 7 | NR3 (North Norwich, Catton, Mile Cross) | £221,712 |

| 8 | NR1 (City Centre, Thorpe Hamlet) | £211,540 |

Norwich pricing follows a suburban premium pattern rather than the urban-rural divide seen in some northern markets. NR4 commands the highest asking prices at £390,423, covering the affluent Eaton and Cringleford areas plus the UEA campus fringes. This is owner-occupier territory with large detached homes, though student HMO conversions near the university can generate strong yields.

NR8 at £342,139 covers the rural north-west villages of Taverham and Drayton. Low density (2,318 people per sq km versus NR2's 14,641) confirms this is a commuter suburb with limited rental stock. NR7 and NR6 sit in the mid-£290,000s, covering the established eastern and northern suburbs of Thorpe St Andrew, Sprowston, Hellesdon, and Old Catton.

For yield-focused investors, the value sits in the urban postcodes. NR5 at £281,412 delivers the highest yields (9.0%) driven by student lets near the university, though this figure reflects HMO rents rather than standard buy-to-let. NR2 at £258,257 covers the Golden Triangle and Unthank Road, the heart of Norwich's professional rental market with 6.9% yields and the highest sales activity (37 per month).

NR3 and NR1 offer the most accessible entry points below £225,000. NR1 at £211,540 covers the city centre and Thorpe Hamlet, ideal for young professional and student tenants seeking walkable locations. NR3 at £221,712 covers the northern suburbs including Mile Cross, offering 5.9% yields with strong 5-year growth of 14.6%.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Norwich (£)

Updated January 2026

The data represents the average price per square foot across Norwich's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | NR4 (Eaton, Cringleford, University) | £337 |

| 2 | NR2 (Golden Triangle, Earlham Road) | £321 |

| 3 | NR7 (Thorpe St Andrew, Sprowston) | £316 |

| 4 | NR8 (Taverham, Drayton, Rural North-West) | £302 |

| 5 | NR6 (Hellesdon, Old Catton) | £300 |

| 6 | NR1 (City Centre, Thorpe Hamlet) | £285 |

| 7 | NR5 (Bowthorpe, Costessey, Earlham) | £282 |

| 8 | NR3 (North Norwich, Catton, Mile Cross) | £282 |

For context, Cambridge averages over £450 per square foot. Norwich's most expensive postcode, NR4, comes in at £337. You get roughly 35% more space for your money in Norwich compared to its East Anglian neighbour.

The premium postcodes NR4 and NR2 command the highest price per square foot, reflecting demand for period properties and proximity to the university. NR4 at £337 covers the affluent Eaton area with large detached homes, while NR2 at £321 captures the desirable Victorian terraces of the Golden Triangle where character commands a premium.

NR7 at £316 may seem high given its suburban location, but Thorpe St Andrew includes riverside properties along the Broads fringe that inflate the average. Similarly, NR8 at £302 reflects larger rural homes in Taverham and Drayton where buyers pay for space and gardens.

For investors focused on maximising rental space, the northern and western postcodes offer better value. NR1 at £285 per square foot is the city centre entry point. A £63,000 deposit (30% on a £211,000 property) buys roughly 740 sq ft of living space in NR1, compared to around 580 sq ft in NR4 for a £117,000 deposit.

NR3 and NR5 at £282 per sq ft offer the most space for money. NR3 covers the northern suburbs including Mile Cross, while NR5 covers Bowthorpe and Costessey. Both deliver yields above 5.9%, making them attractive for investors prioritising rental returns over location prestige.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

House Price Growth in Norwich (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| NR8 (Taverham, Drayton, Rural North-West) | +3.4% | -0.2% | +18.9% |

| NR7 (Thorpe St Andrew, Sprowston) | +5.5% | -1.4% | +17.2% |

| NR3 (North Norwich, Catton, Mile Cross) | +0.2% | -3.2% | +14.6% |

| NR6 (Hellesdon, Old Catton) | -1.3% | -5.9% | +14.5% |

| NR2 (Golden Triangle, Earlham Road) | +1.6% | +9.0% | +11.1% |

| NR4 (Eaton, Cringleford, University) | +0.1% | -3.5% | +10.1% |

| NR5 (Bowthorpe, Costessey, Earlham) | -1.7% | -6.1% | +9.3% |

| NR1 (City Centre, Thorpe Hamlet) | +0.1% | -4.0% | +8.2% |

The numbers reveal a market still digesting the post-pandemic correction. Five-year figures capture the pandemic surge and remain positive across all postcodes, but three-year growth is negative in six of eight areas, reflecting the 2023 mortgage rate spike and subsequent price softening.

NR8 (Taverham) and NR7 (Thorpe St Andrew) lead on five-year growth at +18.9% and +17.2% respectively. These suburban and semi-rural postcodes benefited most from the pandemic "race for space" as buyers sought larger homes with gardens. NR7 is also the strongest current performer at +5.5% annual growth, suggesting continued demand for established eastern suburbs with good schools and transport links.

NR3 and NR6 delivered solid five-year growth above 14%, though both show recent weakness. NR6 at -5.9% over three years and -1.3% annually suggests the northern suburbs may be reaching affordability limits for local buyers.

NR2 (Golden Triangle) stands out with the only positive three-year growth at +9.0%. This reflects sustained demand for period properties in Norwich's most desirable rental area. The combination of professional tenant demand, university proximity, and limited stock keeps prices resilient even when other postcodes soften.

The weakest performers on five-year growth are NR1 at +8.2% and NR5 at +9.3%. For NR1, this reflects its city centre flat-heavy stock, which saw muted pandemic gains compared to houses with gardens. NR5's -6.1% three-year decline is the sharpest in Norwich, though its 9.0% yield provides income to offset capital stagnation.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices. Seven-year data is not available for Norwich postcodes.

Average Monthly Property Sales in Norwich

Updated January 2026

The data represents the average number of residential property sales per month across Norwich's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | NR2 (Golden Triangle, Earlham Road) | 37 |

| 2 | NR7 (Thorpe St Andrew, Sprowston) | 34 |

| 3 | NR1 (City Centre, Thorpe Hamlet) | 33 |

| 4 | NR3 (North Norwich, Catton, Mile Cross) | 32 |

| 5 | NR6 (Hellesdon, Old Catton) | 28 |

| 6 | NR8 (Taverham, Drayton, Rural North-West) | 28 |

| 7 | NR4 (Eaton, Cringleford, University) | 20 |

| 8 | NR5 (Bowthorpe, Costessey, Earlham) | 19 |

Norwich shows a more evenly distributed market than many regional cities. The top four postcodes all record 32-37 sales per month, creating liquid conditions across the urban core. This matters for BRR strategies where exit speed affects your return on capital.

NR2 (Golden Triangle) leads with 37 monthly sales and a 50% turnover rate, the highest in Norwich. This reflects its position as the city's most active rental investment area, with frequent transactions between landlords, first-time buyers, and professional tenants trading up. Competition for good stock is fierce here. Expect to move quickly and negotiate hard to secure the best properties.

NR7 and NR1 follow closely at 34 and 33 sales respectively. NR7's activity reflects strong demand for family homes in Thorpe St Andrew and Sprowston, while NR1's city centre location attracts both investors and young professionals buying their first flat.

The quieter postcodes tell a different story. NR4 at 20 sales per month and NR5 at 19 reflect their different characters. NR4's affluent Eaton and Cringleford areas see lower turnover because owner-occupiers stay longer. NR5's lower activity despite its 9.0% yield suggests a smaller pool of properties suitable for the student HMO market that drives those returns.

For investors, the sweet spot may be NR3 at 32 monthly sales. It combines decent liquidity with the lowest entry prices (£221,712 average) and solid 5.9% yields, offering both the ability to transact and the margins to make deals work.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Norwich Rental Market Analysis

For investors considering if buy to let is worth it in Norwich and thinking how much they can charge for rent across the city and its surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Norwich (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Norwich.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | NR5 (Bowthorpe, Costessey, Earlham) | £2,116 |

| 2 | NR4 (Eaton, Cringleford, University) | £1,969 |

| 3 | NR2 (Golden Triangle, Earlham Road) | £1,491 |

| 4 | NR6 (Hellesdon, Old Catton) | £1,209 |

| 5 | NR1 (City Centre, Thorpe Hamlet) | £1,114 |

| 6 | NR8 (Taverham, Drayton, Rural North-West) | £1,108 |

| 7 | NR3 (North Norwich, Catton, Mile Cross) | £1,086 |

| 8 | NR7 (Thorpe St Andrew, Sprowston) | £1,040 |

NR5 (Bowthorpe, Earlham) commands the highest average rent at £2,116, but this figure needs context. It reflects student HMO rents near the University of East Anglia rather than standard single-let properties. A four-bedroom house let as an HMO at £500+ per room generates these headline figures. Standard buy-to-let in NR5 would achieve significantly less.

NR4 at £1,969 tells a similar story. This postcode includes the UEA campus and Earlham Road corridor where larger properties let to student groups. The high rent reflects property size and multi-let premiums rather than exceptional per-unit demand.

For a clearer picture of the professional rental market, look at NR2 (Golden Triangle) at £1,491. This is Norwich's prime rental postcode for young professionals, combining Victorian terraces, good transport links, and walkable access to the city centre. The rent-to-price ratio here (£1,491 on £258,257) delivers 6.9% yields with a more straightforward tenant profile than HMO management.

The suburban postcodes cluster between £1,040 and £1,209. NR7 (Thorpe St Andrew) at £1,040 offers the lowest rents but also the lowest yields at 4.2%, reflecting its owner-occupier character. NR1 (City Centre) at £1,114 on just £211,540 average prices delivers 6.3% yields, making it the strongest value play for investors targeting professional tenants who want walkable city living.

Gross Rental Yields in Norwich (%)

Updated January 2026

The data represents the average gross rental yields across Norwich's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | NR5 (Bowthorpe, Costessey, Earlham) | 9.0% |

| 2 | NR2 (Golden Triangle, Earlham Road) | 6.9% |

| 3 | NR1 (City Centre, Thorpe Hamlet) | 6.3% |

| 4 | NR4 (Eaton, Cringleford, University) | 6.1% |

| 5 | NR3 (North Norwich, Catton, Mile Cross) | 5.9% |

| 6 | NR6 (Hellesdon, Old Catton) | 4.9% |

| 7 | NR7 (Thorpe St Andrew, Sprowston) | 4.2% |

| 8 | NR8 (Taverham, Drayton, Rural North-West) | 3.9% |

NR5 leads at 9.0%, but this headline figure reflects student HMO returns near the University of East Anglia rather than standard single-let buy-to-let. If you are comfortable with multi-let management, licensing requirements, and summer void periods, NR5 offers exceptional income. If you want a simpler tenant relationship, look elsewhere.

For conventional buy-to-let, the top performers are NR2 (Golden Triangle) at 6.9% and NR1 (City Centre) at 6.3%. Both comfortably clear the 5% threshold many investors target. NR2 combines strong professional tenant demand with period property appeal. NR1 offers the lowest entry prices in Norwich with walkable city centre locations attractive to young professionals.

NR4 at 6.1% may surprise given its £390,000 average prices, but the university fringe location supports strong rents. NR3 at 5.9% offers the best balance of affordability (£222k average) and yield for investors wanting straightforward terraced housing without the HMO complexity.

The suburban postcodes NR6, NR7, and NR8 deliver yields below 5%, reflecting their owner-occupier character. These are areas where capital growth and tenant quality may compensate for lower immediate cash flow, but the numbers rarely work for yield-focused investors. Compare this to Cambridge where similar yields come with significantly higher entry prices.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental yield calculator to factor in these buy-to-let ownership costs.

Is Norwich Rent High?

Norwich's rental affordability varies dramatically by postcode, reflecting the split between student HMO markets and conventional single-let properties. The headline figures need careful interpretation.

Average rent in Norwich costs between 34% and 68% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Norwich residents is £37,118 (based on £713.8 per week).

The apparent extremes at the top of the table reflect HMO rents, not single-tenant affordability. NR5 at 68.4% and NR4 at 63.7% are skewed by student house shares where the total property rent is split between multiple tenants. No individual tenant pays these figures.

For conventional single-let properties, the picture is more reasonable. NR7 (Thorpe St Andrew) requires just 33.6% of median income, close to the 30% threshold housing experts consider affordable. NR3 and NR8 sit around 35%, while NR1 (City Centre) at 36.0% remains accessible for young professionals on median salaries.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | NR5 (Bowthorpe, Costessey, Earlham)* | 68.4% |

| 2 | NR4 (Eaton, Cringleford, University)* | 63.7% |

| 3 | NR2 (Golden Triangle, Earlham Road) | 48.2% |

| 4 | NR6 (Hellesdon, Old Catton) | 39.1% |

| 5 | NR1 (City Centre, Thorpe Hamlet) | 36.0% |

| 6 | NR8 (Taverham, Drayton, Rural North-West) | 35.8% |

| 7 | NR3 (North Norwich, Catton, Mile Cross) | 35.1% |

| 8 | NR7 (Thorpe St Andrew, Sprowston) | 33.6% |

*Note: NR5 and NR4 figures reflect HMO/student house rents where the total is typically split between 3-5 tenants.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Norwich House Prices High?

For a local property buyer on average full-time earnings, Norwich sits in the middle ground. More affordable than Cambridge or the commuter belt, but less accessible than the northern cities that dominate affordability rankings.

Purchasing a property in Norwich requires between 5.7 and 10.5 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Norwich residents is £37,118.

No Norwich postcode falls below the historic UK average of around 4-5x income. Even the most affordable areas, NR1 at 5.7x and NR3 at 6.0x, require deposits and mortgages that stretch local first-time buyers. This sustains rental demand from young professionals who could afford to buy in Hull or Stoke but not in their home city.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | NR4 (Eaton, Cringleford, University) | 10.5x |

| 2 | NR8 (Taverham, Drayton, Rural North-West) | 9.2x |

| 3 | NR7 (Thorpe St Andrew, Sprowston) | 8.0x |

| 4 | NR6 (Hellesdon, Old Catton) | 7.9x |

| 5 | NR5 (Bowthorpe, Costessey, Earlham) | 7.6x |

| 6 | NR2 (Golden Triangle, Earlham Road) | 7.0x |

| 7 | NR3 (North Norwich, Catton, Mile Cross) | 6.0x |

| 8 | NR1 (City Centre, Thorpe Hamlet) | 5.7x |

The suburban postcodes NR4, NR7, and NR8 sit at 8-10.5x income, reflecting larger family homes in desirable areas rather than investor territory. NR2 (Golden Triangle) at 7.0x represents the ceiling for professional rental demand, where tenants can afford rents but struggle to save deposits for purchase.

For investors comparing East of England markets, Ipswich and Peterborough offer similar price points with different employment profiles, while Cambridge sits well above 12x income across most postcodes.

How Much Deposit to Buy a House in Norwich?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £54,000 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | NR1 (City Centre, Thorpe Hamlet) | £63,462 |

| 2 | NR3 (North Norwich, Catton, Mile Cross) | £66,514 |

| 3 | NR2 (Golden Triangle, Earlham Road) | £77,477 |

| 4 | NR5 (Bowthorpe, Costessey, Earlham) | £84,424 |

| 5 | NR6 (Hellesdon, Old Catton) | £88,277 |

| 6 | NR7 (Thorpe St Andrew, Sprowston) | £89,326 |

| 7 | NR8 (Taverham, Drayton, Rural North-West) | £102,642 |

| 8 | NR4 (Eaton, Cringleford, University) | £117,127 |

For investors entering the market, NR1 and NR3 require deposits under £70,000. That's roughly half what you'd need in Cambridge for a comparable property type. Crucially, these areas deliver yields of 6.3% and 5.9% respectively, making them efficient for capital deployment.

NR2 (Golden Triangle) at £77,477 represents the sweet spot for many investors. The additional £14,000 over NR1 buys access to Norwich's strongest professional rental market with 6.9% yields and the highest sales liquidity (37 transactions per month).

The suburban postcodes NR8 and NR4 require deposits exceeding £100,000, entering territory where the same capital could secure properties in both NR1 and NR3. Unless you're specifically targeting the student HMO market in NR4 or the rural commuter demographic in NR8, the numbers favour the urban postcodes where yields outperform.

How to Invest in Buy-to-Let in Norwich

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Norwich, Norfolk and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Norwich and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Norwich for Buy-to-Let Investment

For investors seeking similar yields with comparable entry prices, buy-to-let in Ipswich offers another East Anglian market with strong transport links to London and prices around 25% below Norwich. If you're drawn to university cities with professional tenant demand, buy-to-let in Cambridge delivers lower yields but exceptional capital growth potential driven by the tech sector.

Or to understand the wider regional market, see our guides to buy-to-let in Peterborough with its faster London commute, and buy-to-let in Colchester for Essex's historic garrison town.