Where to Buy Property Investments in Stevenage: Yields of 5.0%

Stevenage delivers rental yields of 5.0% in SG1, with 25-minute train times to London King's Cross. For a property investment in the commuter belt, those numbers get attention.

The latest property data insights shows where Stevenage sits in the market. Average asking prices of £333,065 in SG1 sit 14% above the England average of £291,515, but 2% below the East of England average of £340,037. Not cheap, but accessible for Hertfordshire.

Our buy-to-let analysis examines Stevenage's four postcode districts, evaluating capital growth, rental yields, and investment potential across this New Town and its surrounding villages.

Article updated: January 2026

Stevenage Buy-to-Let Market Overview 2026

Stevenage's property market delivers asking prices ranging from 14% to 76% above the England average across its postcodes, reflecting the premium for London commuter belt locations, with these key statistics:

- Asking price range: £333,065 (SG1) to £513,886 (SG4) across Stevenage postcodes

- Rental yields: 3.3% (SG4) to 5.0% (SG1) across different postcodes

- Rental income: Monthly rents from £1,390 (SG1) to £1,458 (SG2)

- Price per sq ft: House prices from £377/sq ft (SG1) to £503/sq ft (SG4)

- Market activity: Sales ranging from 9 per month (SG3) to 37 per month (SG1)

- Deposit requirements: 30% deposits range from £99,920 (SG1) to £154,166 (SG4)

- Affordability ratios: Property prices from 7.2 to 11.1 times Stevenage's median annual salary of £46,504

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Stevenage?

Stevenage has an unusual characteristic for a commuter town: people commute into it as well as out of it. The jobs density here is 0.99, meaning there's almost one job for every working-age resident. Workplace wages average £966 per week, higher than resident wages of £894. Employers here pay well to attract talent, and that tells you something about the quality of jobs on offer.

This creates a rental market with two distinct demand drivers. London-bound commuters are the obvious tenant pool. But you also have professionals relocating for roles at GSK's global R&D headquarters, Airbus Defence & Space, and MBDA missile systems who need rental accommodation while they decide whether to buy locally. Healthcare adds further depth, with the Lister Hospital anchoring 20.4% of local employment. Manufacturing runs at 13%, nearly double the national average.

That dual demand underpins rental stability. You're not solely reliant on the London job market or train timetable changes. Local employers provide a floor.

The property stock is distinctive too. As Britain's first designated New Town (1946), Stevenage was planned from scratch with separated residential neighbourhoods, dedicated cycle paths, and a pedestrianised town centre. The housing is predominantly post-war: 1950s-1970s terraces, semi-detached houses, and low-rise flats. Fewer period conversions, fewer Victorian terraces, more predictable stock. For investors, that means easier comparables and fewer surprises on surveys. You can see the full employment breakdown via the Nomis Labour Market Profile for Stevenage.

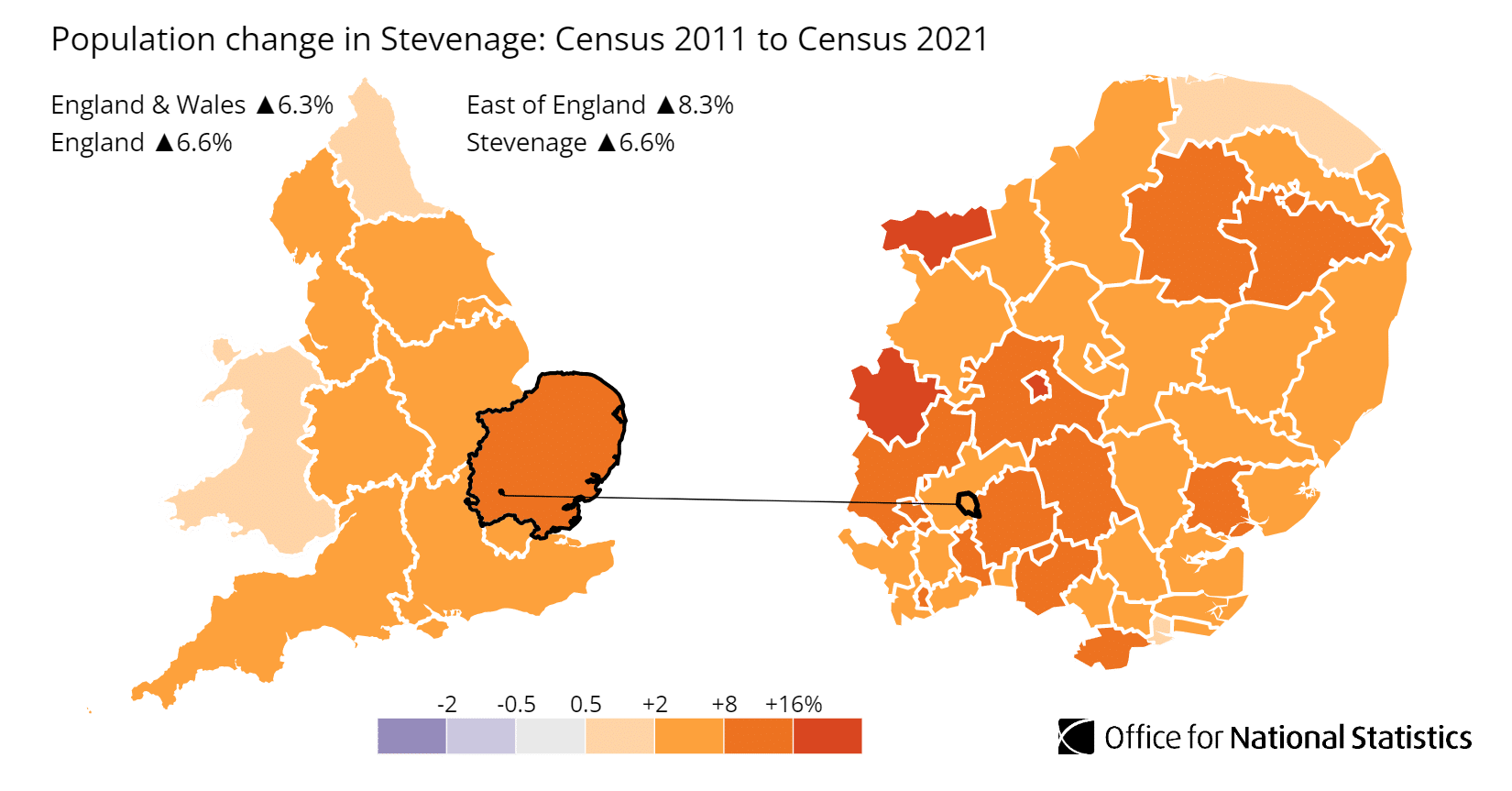

Population growth has been steady. According to the latest census data, the population of Stevenage increased by 6.6%, rising from around 84,000 in 2011 to 89,500 in 2021. The median age is 38, younger than the regional average of 41, suggesting a working-age tenant pool rather than a retirement market. You can explore the breakdown via the ONS Census Data for Stevenage.

For comparable commuter belt markets, consider Luton (15 miles west, airport-driven demand, higher yields but different tenant profile), Peterborough (similar train times, lower entry prices, less established employment base), or Cambridge (tech hub premium with compressed yields where the numbers rarely work for rental cash flow).

Regeneration and Investment in Stevenage

Stevenage is in the middle of a £1 billion, 20-year regeneration programme that's reshaping the town centre. For investors, the story here is less about speculative future promises and more about projects already delivering or in advanced planning. The life sciences angle is real and already generating jobs.

- Station Gateway (up to 1,000 homes): In May 2025, Stevenage Borough Council formalised a partnership with ECF (a joint venture between Homes England, Legal & General and Muse) to develop a masterplan for the area around the railway station. The scheme covers up to 30 acres and could deliver around 1,000 new homes alongside workspace, retail, a 175-key hotel and improved public spaces. The project is positioned as a new "front door" for Stevenage, better connecting the station to the town centre. Masterplan development is now underway. Updates at English Cities Fund - Station Gateway Stevenage.

- Sports & Leisure Hub (£44m): Planning permission was granted in September 2025 for a new state-of-the-art sports and leisure centre on St George's Way, consolidating swimming, gym and sports facilities currently spread across multiple aging sites. Morgan Sindall Construction has been appointed to deliver the scheme, with FaulknerBrowns as architects. Part-funded through the Government's Towns Fund (£10m of a £37.5m allocation), construction is expected to begin in 2026. The facility will include swimming pools, studios, gym space and a café overlooking Town Centre Gardens. Details at Stevenage Even Better.

- Life Sciences Campus (£900m expansion): This is the big story. Stevenage is already home to the third-largest cell and gene therapy cluster in the world, centred on the Stevenage Bioscience Catalyst adjacent to GSK's global R&D headquarters. UBS Asset Management and Reef Group are investing up to £900m to develop 33 acres of adjacent land, delivering an estimated 1.4 million sq ft of laboratory and office space and up to 5,000 new jobs. The Autolus "Nucleus" facility (70,000 sq ft) is already operational, manufacturing CAR-T cell therapies and employing 400 people. This isn't speculative. It's happening. More at Stevenage Bioscience Catalyst.

- Town Centre Residential: Multiple residential schemes are progressing in the town centre core, including the Guinness Partnership development on Danesgate (former Matalan site) delivering 526 new homes. A new multi-storey car park with electric vehicle charging and cycle storage has completed on the former bus station site, freeing up surface parking for future development.

- The Tenant Profile Shift: The life sciences expansion is changing who rents in Stevenage. Relocating lab technicians, researchers and pharmaceutical professionals typically earn above local averages and expect higher-spec accommodation. For landlords, this creates an opportunity to target a different tenant demographic with properties that justify premium rents.

The regeneration creates a potential tension for investors. New housing supply could soften rental growth in SG1 over the medium term. But the life sciences jobs pipeline is the counter-balance. If 5,000 new scientific roles materialise over the next decade, rental demand from relocating professionals should absorb the additional stock.

Stevenage Property Market Analysis

When Was the Last House Price Crash in Stevenage?

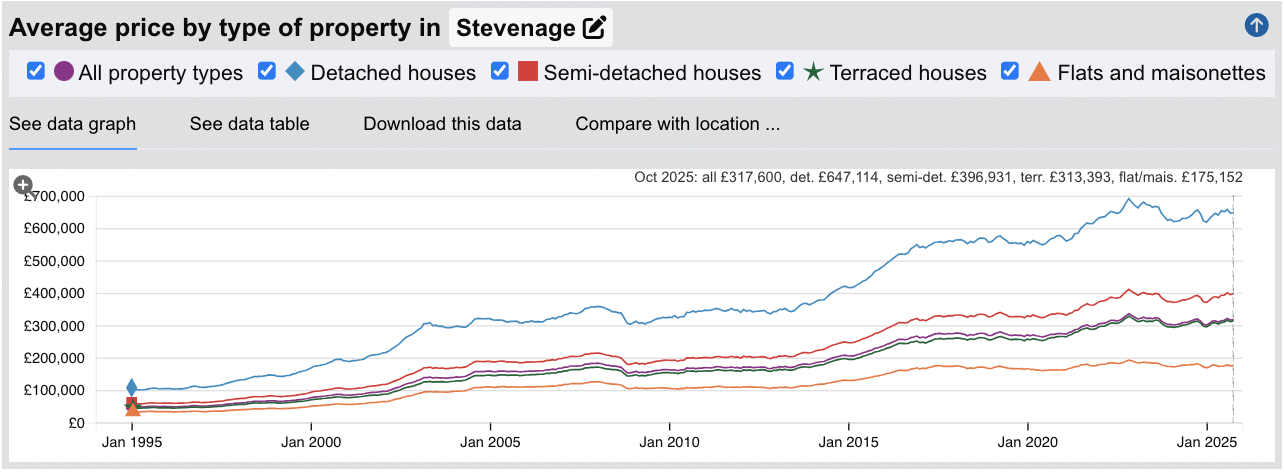

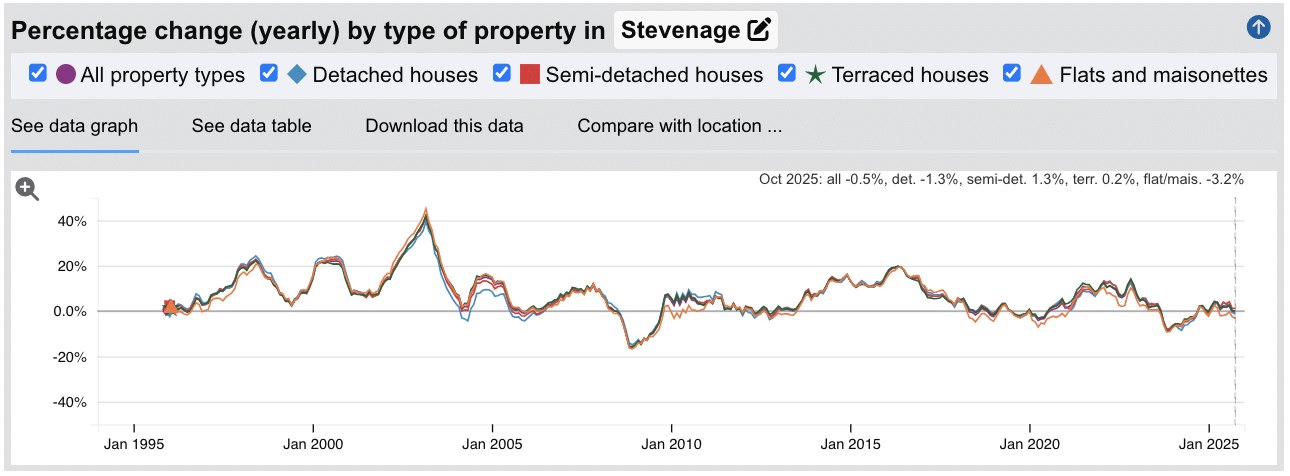

The last significant market correction in Stevenage came during the 2008 financial crisis. The town experienced a 16.4% peak-to-trough decline, with average prices falling from £182,841 in January 2008 to £152,924 by December 2008. Recovery was slow. Prices didn't return to pre-crash levels until mid-2014, roughly six years later.

Source: HM Land Registry House Price Index for Stevenage

Here is how the market has performed over the key cycles:

- 1995-2007 saw property values nearly quadruple, rising from around £48,000 to over £180,000 as the national boom lifted all markets. Stevenage's London connectivity made it a prime beneficiary.

- 2008-2009 brought the financial crisis correction where values dropped by 16.4% at the lowest point. As a commuter belt market tied to London sentiment, Stevenage felt the impact more sharply than some northern cities.

- 2010-2014 was a period of gradual recovery, with prices fluctuating between £160,000 and £170,000 as the market consolidated.

- 2015-2019 delivered strong growth. Prices climbed from £205,000 to £275,000 as London's affordability crisis pushed buyers further along rail corridors.

- 2020-2022 saw the pandemic-driven surge. Prices rose from £270,000 to a peak of £335,157 in November 2022, driven by the stamp duty holiday and demand for commuter belt space.

- 2023 brought a sharper correction of approximately 9.8% as mortgage rates spiked following the mini-budget turmoil. Prices fell to £302,301 by December 2023.

- 2024-2025 has marked recovery. Prices have stabilised and grown modestly, reaching £317,600 as of October 2025, essentially flat year-on-year (-0.5%).

Long-Term Property Value Growth in Stevenage

For buy-to-let investors focused on capital preservation and steady appreciation, the long-term trajectory shows consistent gains:

- 5 years (2020-2025): 17.0% growth (average prices rising from £271,519 to £317,600)

- 10 years (2015-2025): 39.0% growth (average prices rising from £228,492 to £317,600)

- 20 years (2005-2025): 101.4% growth (average prices rising from £157,683 to £317,600)

- 30 years (1995-2025): 552.9% growth (average prices rising from £48,647 to £317,600)

The 16.4% crash in 2008 and 9.8% correction in 2023 demonstrate Stevenage's character as a commuter belt market. Prices here track London sentiment more closely than affordable northern cities, meaning sharper swings in both directions. For investors focused on rental cash flow rather than capital timing, the fundamentals matter more than cycle positioning. Stevenage's 5.0% yields, strong life sciences employment pipeline, and consistent tenant demand from King's Cross commuters provide the underlying stability.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Stevenage

The latest sold house price index by the Land Registry shows Stevenage sitting above the England average but below the East of England regional figure. This positions the town as a relative value play within a premium region rather than an outright affordable market.

Stevenage property prices average £317,600, which is 9.0% above the England average of £291,515 but 6.6% below the East of England average of £340,037. For investors priced out of Cambridge, St Albans or Welwyn Garden City, Stevenage offers commuter belt access at a meaningful discount to neighbouring Hertfordshire towns.

Flats and maisonettes are the standout value, averaging £175,152, a 20.0% discount against the England average and 9.4% below the regional figure. For investors seeking affordable entry points with strong yields, this is where the numbers work hardest. Terraced houses average £313,393, sitting 28.4% above the national figure but only 8.3% above regional levels.

Semi-detached houses average £396,931, representing a 36.9% premium over England but just 11.7% above the East of England average. Detached houses command £647,114, a significant 37.6% premium over the national average. These are concentrated in the village postcodes (SG3, SG4) where owner-occupier demand dominates and rental stock is limited.

Updated January 2026

| Property Type | Stevenage Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £647,114 | £470,151 | +37.6% |

| Semi-detached houses | £396,931 | £289,909 | +36.9% |

| Terraced houses | £313,393 | £243,978 | +28.4% |

| Flats and maisonettes | £175,152 | £219,065 | -20.0% |

| All property types | £317,600 | £291,515 | +9.0% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Stevenage

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Stevenage's postcode districts. Note that SG3 and SG4 extend beyond the Stevenage boundary into surrounding villages and Hitchin, but are included for investors considering the wider area.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | SG4 (Hitchin, Letchworth, Ickleford) | £513,886 |

| 2 | SG3 (Knebworth, Woolmer Green, Datchworth) | £503,697 |

| 3 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | £401,536 |

| 4 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | £333,065 |

Stevenage's pricing shows a clear town-village divide. The outlying postcodes SG4 and SG3 command asking prices above £500,000, driven by detached properties in sought-after villages like Knebworth and the market town of Hitchin. These areas attract owner-occupiers rather than landlords, with limited rental stock and yields compressed to 3.3% or below.

For yield-focused investors, the core Stevenage postcodes offer stronger value. SG1 at £333,065 covers the town centre, Old Town and northern suburbs. This is where the 5.0% yields sit, driven by affordable terraces and flats within walking distance of the station. SG2 at £401,536 covers south Stevenage including Broadwater, Shephall and the newer Great Ashby development, delivering 4.4% yields with a more family-oriented tenant profile.

The £180,000 gap between SG1 and SG4 reflects two different markets. SG1 is a rental play. SG4 is a lifestyle play. Know which one you're buying into.

Sold Price Per Square Foot in Stevenage (£)

Updated January 2026

The data represents the average price per square foot across Stevenage's postcodes, blending current asking prices and recent sold prices to show where you get the most physical space for your money.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | SG4 (Hitchin, Letchworth, Ickleford) | £503 |

| 2 | SG3 (Knebworth, Woolmer Green, Datchworth) | £475 |

| 3 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | £398 |

| 4 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | £377 |

For context, Brighton averages over £450 per square foot. Stevenage's town centre postcode SG1 comes in at £377, offering roughly 20% more space for your money compared to the south coast while still delivering 25-minute trains to King's Cross.

The village postcodes SG4 and SG3 command the highest price per square foot at £503 and £475 respectively. This reflects the premium for period properties, larger plots and village character in areas like Knebworth and Hitchin, where buyers pay for lifestyle rather than pure square footage.

For investors focused on maximising rental space, the urban postcodes offer better value. SG1 at £377 per square foot is where you get the most property for your deposit. A £100,000 deposit (30% on a £333,000 property) buys roughly 885 sq ft of living space in SG1, compared to around 660 sq ft in SG4 for a £154,000 deposit. SG2 at £398 per sq ft offers a middle ground with newer housing stock in areas like Great Ashby.

House Price Growth in Stevenage (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| SG3 (Knebworth, Woolmer Green, Datchworth) | +4.5% | +14.4% | +24.8% |

| SG1 (Town Centre, Old Town, Pin Green, Bedwell) | +2.8% | +5.4% | +20.1% |

| SG2 (Broadwater, Shephall, Chells, Great Ashby) | +4.5% | +1.9% | +18.6% |

| SG4 (Hitchin, Letchworth, Ickleford) | -2.0% | +2.3% | +8.1% |

The numbers reveal where capital growth has been strongest over different holding periods. SG3 (Knebworth) stands out as the clear winner across all timeframes, delivering +24.8% over five years and maintaining momentum with +4.5% annual growth. This village postcode has benefited from buyers seeking period properties and good schools while staying within commuting distance of London.

SG4 (Hitchin) shows the weakest performance, with a -2.0% decline over the past year and modest five-year growth of just +8.1%. At £513,886 average, this postcode has reached a ceiling where affordability constraints are biting. When prices exceed half a million, the buyer pool shrinks and growth stalls.

The core Stevenage postcodes tell a more consistent story. SG1 has delivered +20.1% over five years with steady +2.8% annual growth, reflecting the ongoing regeneration momentum and life sciences employment. SG2 shows similar five-year performance at +18.6%, though the flatter three-year growth (+1.9%) suggests this postcode felt the 2023 correction more sharply before recovering.

For investors, SG1 offers the best balance: affordable entry prices, strong yields at 5.0%, and growth that tracks the town's regeneration progress rather than speculative village premiums.

Note: These figures represent growth rates across all property types and include both properties for sale and sold prices. 7-year data was not available for these postcodes.

Average Monthly Property Sales in Stevenage

Updated January 2026

The data represents the average number of residential property sales per month across Stevenage's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | 37 |

| 2 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | 34 |

| 3 | SG4 (Hitchin, Letchworth, Ickleford) | 29 |

| 4 | SG3 (Knebworth, Woolmer Green, Datchworth) | 9 |

Stevenage's core postcodes offer healthy liquidity for a commuter town. SG1's 37 monthly sales and 21% turnover rate creates a market where you can buy and sell without waiting months for the right buyer. This matters for BRR strategies where exit speed affects your return on capital. SG2 is similarly active at 34 sales per month with a higher 35% turnover, reflecting the family-oriented stock that moves when circumstances change.

The contrast with SG3 is significant. Just 9 sales per month in the Knebworth villages means properties sit longer and comparables are harder to find. When SG3 shows +24.8% growth over five years but only 9 monthly transactions, a handful of premium period property sales can skew the averages. Investors should treat SG3 growth figures with caution. They reflect a different market where negotiating with sellers is easier but finding tenants is harder.

SG4 sits in between at 29 sales per month, though this postcode covers the larger Hitchin area rather than Stevenage proper. For investors focused specifically on Stevenage, SG1 and SG2 offer the liquidity and comparables that make accurate valuations and confident refinancing possible.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Stevenage Rental Market Analysis

For investors buying their first rental property in Stevenage and thinking how much they can charge for rent across the town and surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Stevenage (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Stevenage.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | £1,458 |

| 2 | SG4 (Hitchin, Letchworth, Ickleford) | £1,394 |

| 3 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | £1,390 |

| 4 | SG3 (Knebworth, Woolmer Green, Datchworth) | Not enough data |

SG2 (Broadwater, Shephall) commands the highest average rent at £1,458, reflecting the family-oriented stock profile: larger semi-detached and detached houses in areas like Great Ashby letting to professional families. With average prices of £401,536, this translates to a 4.4% yield.

The yield story sits in SG1. At £1,390 rent on average prices of £333,065, this postcode delivers 5.0% yields. The town centre location, station proximity and life sciences employment drive consistent tenant demand from both London commuters and relocating professionals. For investors focused on monthly cash flow rather than absolute rent figures, SG1 outperforms.

SG4 (Hitchin) achieves £1,394 rent but on average prices exceeding £513,000, compressing yields to just 3.3%. You're paying a premium for the market town lifestyle that tenants value but the numbers don't work as hard. SG3 lacks sufficient rental listings to calculate reliable averages, reflecting the village postcode's predominantly owner-occupier character where rental stock is limited.

Gross Rental Yields in Stevenage (%)

Updated January 2026

The data represents the average gross rental yields across Stevenage's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | 5.0% |

| 2 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | 4.4% |

| 3 | SG4 (Hitchin, Letchworth, Ickleford) | 3.3% |

| 4 | SG3 (Knebworth, Woolmer Green, Datchworth) | Not enough data |

SG1 is the only Stevenage postcode clearing the 5% threshold that many investors target, delivering 5.0% gross yields on entry prices around £333,000. For a commuter belt location with 25-minute trains to King's Cross, this represents strong value. Compare this to St Albans or Welwyn Garden City where yields are compressed well below 4% despite similar commute times.

SG2 delivers 4.4%, reflecting higher purchase prices for family housing in areas like Great Ashby. SG4 (Hitchin) drops to 3.3%, where the market town premium pushes prices above £500,000 but rents don't scale proportionally. At this yield level, you're relying on capital growth rather than cash flow.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy-to-let ownership costs.

Is Stevenage Rent High?

Stevenage's rental market sits at the upper edge of affordability for a commuter belt location. Tenants commit a meaningful portion of their salary to rent, though this remains below London levels and reflects the premium for fast access to King's Cross.

Average rent in Stevenage costs between 36% and 38% of the average gross annual earnings for a full-time resident. This is based on the official ONS earnings data showing the median gross annual income for Stevenage residents is £46,504 (based on £894.30 per week).

All three postcodes with rental data exceed the 30% threshold that housing experts typically consider affordable. SG2 requires 37.6% of the median local income, reflecting the larger family housing stock. SG1 and SG4 sit just below at 35.9% and 36.0% respectively.

For landlords, this creates a double-edged dynamic. Rents are high enough to generate reasonable yields, but tenants are stretched. In practice, Stevenage's tenant pool skews toward dual-income households and life sciences professionals earning above the local median, which supports the rent levels. The regeneration and 5,000 projected science jobs should sustain demand from higher earners who can absorb these costs.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | 37.6% |

| 2 | SG4 (Hitchin, Letchworth, Ickleford) | 36.0% |

| 3 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | 35.9% |

| 4 | SG3 (Knebworth, Woolmer Green, Datchworth) | Not enough data |

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Stevenage House Prices High?

For a local property buyer on average full-time earnings, Stevenage sits at the upper end of affordability for a commuter belt location, though below the extremes seen in prime Hertfordshire towns.

Purchasing a property in Stevenage requires between 7.2 and 11.1 times the median annual salary. This is based on the official ONS earnings data showing the median gross annual income for Stevenage residents is £46,504.

The core Stevenage postcodes remain within reach for dual-income households. SG1 requires 7.2 times the average salary and SG2 requires 8.6 times, both around the UK long-term average of 8x. This keeps the tenant pool healthy, with genuine demand from people who could buy but choose to rent for flexibility or affordability reasons.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | SG4 (Hitchin, Letchworth, Ickleford) | 11.1x |

| 2 | SG3 (Knebworth, Woolmer Green, Datchworth) | 10.8x |

| 3 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | 8.6x |

| 4 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | 7.2x |

The village postcodes SG3 and SG4 exceed 10x income, but this reflects larger detached properties in sought-after locations like Knebworth and Hitchin rather than investor territory. For comparison, Luton offers lower price-to-income ratios with similar London connectivity, while Cambridge pushes well beyond 12x for its tech-driven premium.

How Much Deposit to Buy a House in Stevenage?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £54,000 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | SG1 (Town Centre, Old Town, Pin Green, Bedwell) | £99,920 |

| 2 | SG2 (Broadwater, Shephall, Chells, Great Ashby) | £120,461 |

| 3 | SG3 (Knebworth, Woolmer Green, Datchworth) | £151,109 |

| 4 | SG4 (Hitchin, Letchworth, Ickleford) | £154,166 |

For investors entering the Stevenage market, SG1 offers the most efficient capital deployment at just under £100,000 for a 30% deposit. This postcode also delivers the strongest yields at 5.0%, making it the clear choice for cash-flow focused investors. SG2 requires around £120,000 but offers larger family housing stock that appeals to longer-term tenants.

The village postcodes SG3 and SG4 require deposits exceeding £150,000, entering territory where the same capital could secure a property in SG1 plus have £50,000 remaining for a second deposit elsewhere. Unless you're specifically targeting the Knebworth or Hitchin lifestyle market, the numbers favour concentrating on the core Stevenage postcodes where yields work harder.

For context, a £100,000 deposit in Peterborough buys more property at lower price-to-income ratios, while the same deposit in Hertfordshire's premium towns like St Albans barely covers a flat.

How to Invest in Buy-to-Let in Stevenage

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Stevenage, Hertfordshire and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Stevenage and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Stevenage for Buy-to-Let Investment

For investors seeking similar commuter belt access with different price points, buy-to-let in Luton offers lower entry prices and airport-driven employment just 15 minutes down the line. If you're drawn to the life sciences angle, buy-to-let in Cambridge provides access to the UK's premier biotech cluster, though yields are compressed by the tech premium.

For investors priced out of Hertfordshire entirely, buy-to-let in Peterborough delivers stronger yields on lower deposits with fast trains to King's Cross. Or to understand the wider regional market, see our guide to buy-to-let in Hertfordshire.