Islington Property Investment: Best Buy-to-Let Areas

Islington is a vibrant and highly desirable borough in North London, known for its Georgian architecture, bustling high streets and is a paradise for art lovers, with renowned venues like the Almeida theatre and the Sadler's Wells Theatre. It offers a unique blend of urban atmosphere and village-like charm, making it a prime location for high end property investment.

Strategically located just north of the City of London, Islington boasts excellent transport links, including multiple Underground lines and Overground stations. The borough benefits from new investment by the local council, including building 550 new homes and an ambition to achieve net carbon zero by 2030.

Because of all these features Islington consistently attracts strong interest from home-owners, investors and tenants and this sustained demand underpins its potential as a robust, high value buy-to-let market.

Article updated: October 2025.

Islington Buy-to-Let Market Overview 2025

Islington's property market provides sold house prices averaging 24.9% above London's overall average as well as these other Islington statistics:

- Asking price range: £605,430 (N7) to £774,873 (EC1) across Islington postcodes

- Rental yields: 4.5% (N5) to 5.0% (N1) across different postcodes

- Rental income: Weekly rents from £536 to £709 (monthly: £2,324 to £3,073)

- Price per sq ft: Market positioning from £787/sq ft to £1,055/sq ft

- Market activity: Sales ranging from 18 per month (N19, EC1) to 51 per month (N1)

- Deposit requirements: 30% deposits range from £181,629 (N7) to £232,462 (EC1)

- Affordability ratios: Property prices from 11.51 to 14.73 times Islington's mean annual salary of £52,606

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Government Planning and Housing Data

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: October 2025. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Islington?

Islington is an established inner London borough with sold house prices 24.9% higher than the London average.

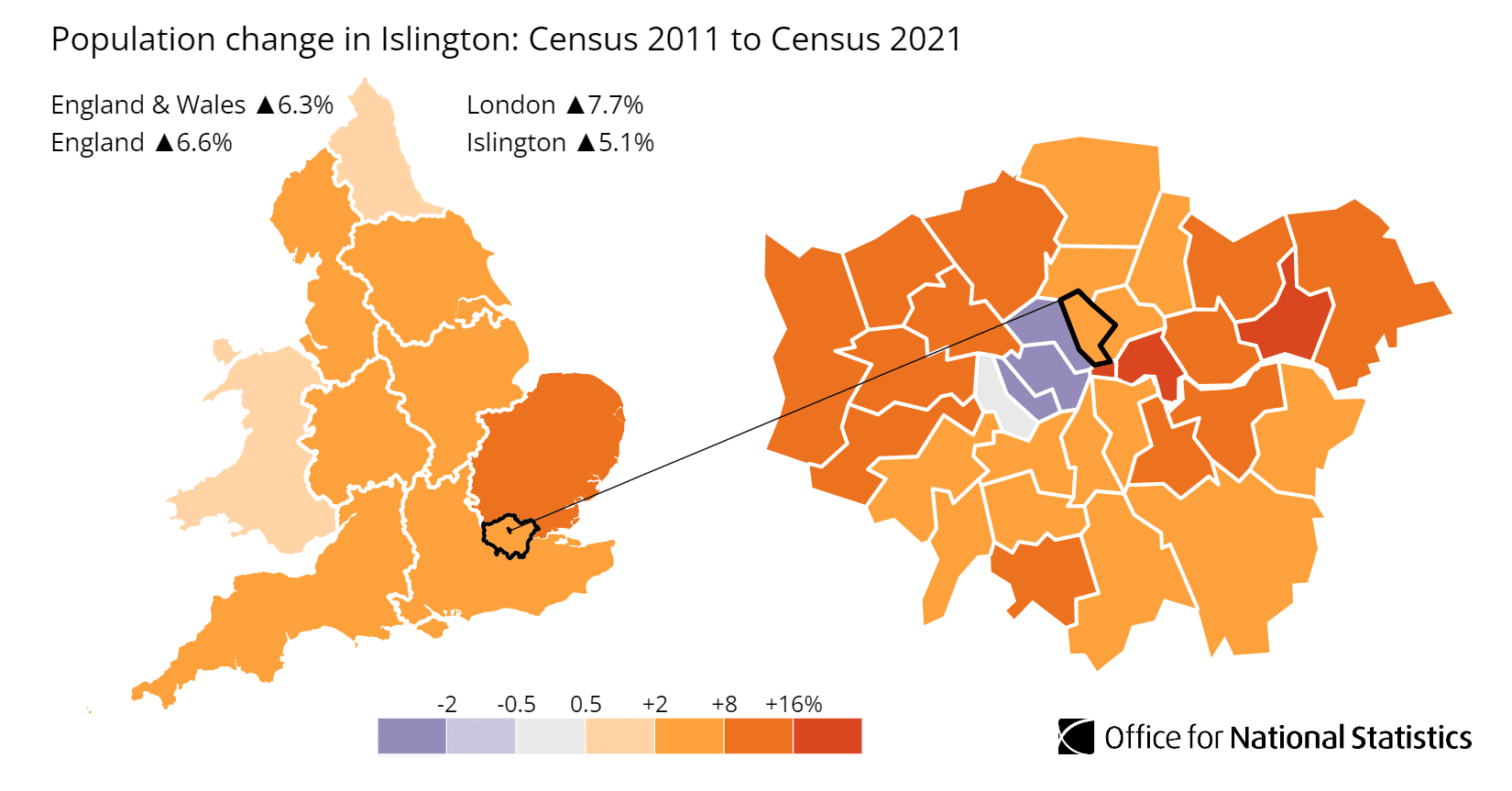

Often in property, house price growth is closely connected with population growth. Islington demonstrates this relationship with population increasing by 5.2% alongside sustained premium pricing, reflecting the borough's enduring appeal as a residential location despite high property values.

The total population of Islington was 217,050 (as of the last UK government census in 2021) and Islington's population has increased by 5.2%, rising from 206,285 in 2011. This population growth aligns with broader London population growth trends, reflecting the borough's successful balance of residential character with commercial development, particularly around areas like Angel and the ongoing Tech City expansion in Clerkenwell.

Islington borough includes the notable London neighbourhoods of Angel, Barnsbury, Highbury, Holloway, Tufnell Park, Archway, Upper Holloway, Clerkenwell and Finsbury.

Islington is covered by the main postcodes: N1, N5, N7, N19, EC1

With additional postcodes that cross Islington and other local London Boroughs including:

- N4 crosses Islington, Haringey and Hackney

- N6 crosses Islington, Haringey and Camden

- N8 crosses Islington and Haringey

- N16 crosses Islington and Hackney

- EC1A crosses Islington and City of London

- EC1M crosses Islington, City of London and Camden

- EC1R crosses Islington and Camden

- EC2A crosses Islington, Hackney and City of London

- WC1X crosses Islington and Camden

For investors considering other nearby areas, you can also explore buy-to-let opportunities across North London.

Islington Property Market Analysis

When Was the Last House Price Crash in Islington?

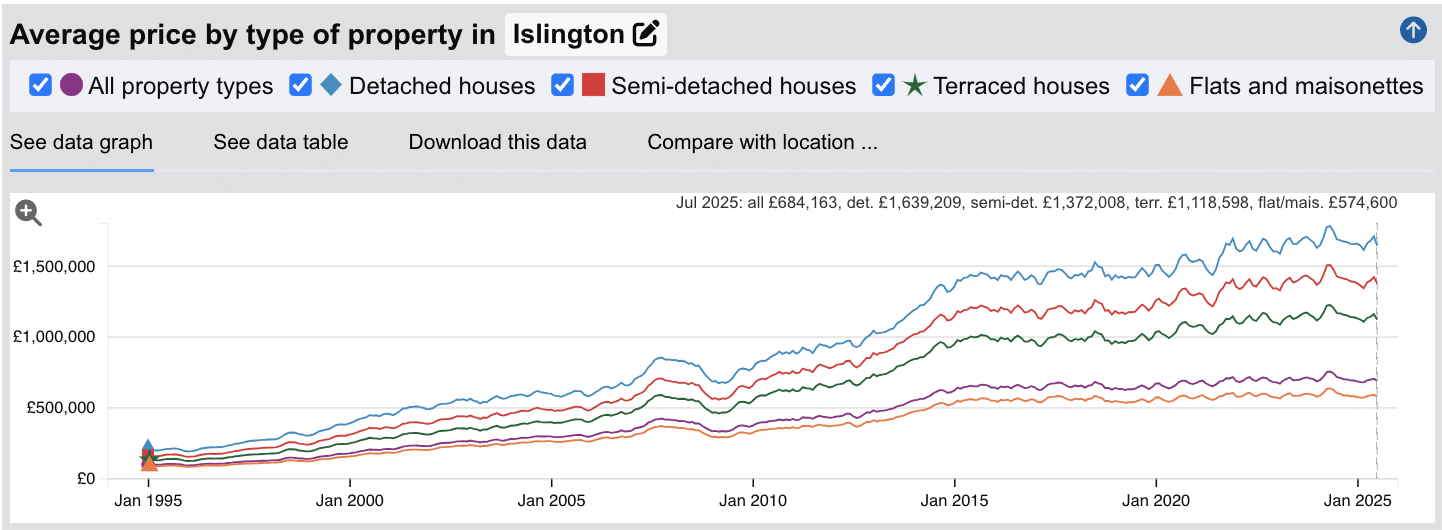

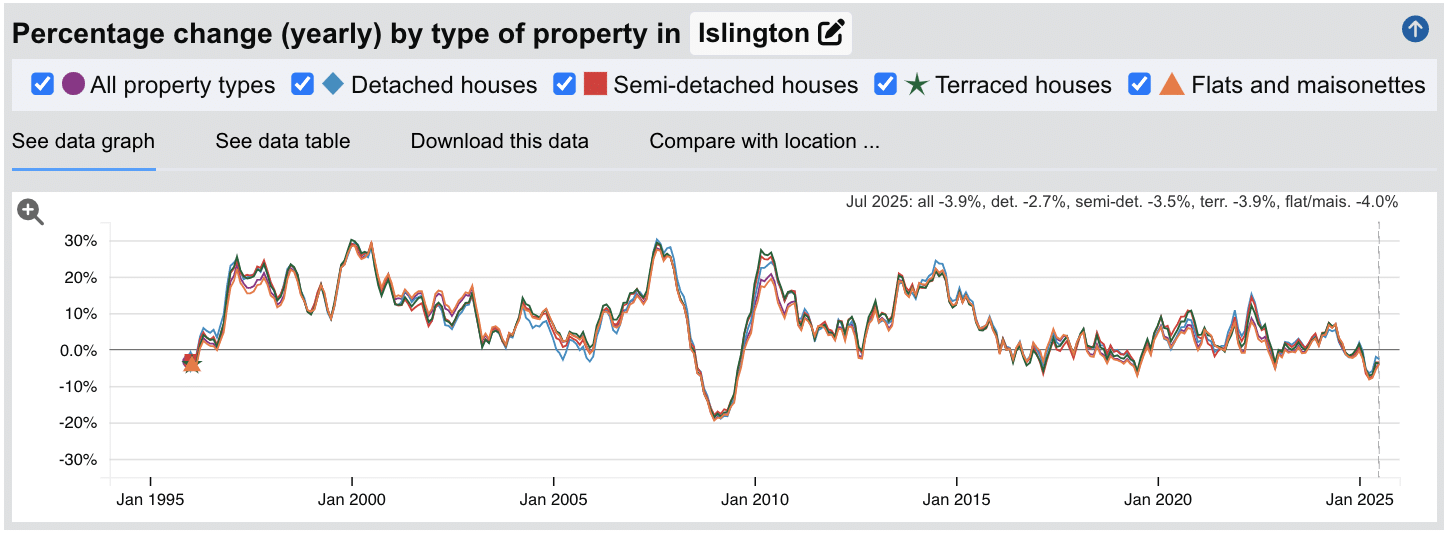

The last significant property price crash in Islington occurred during the global financial crisis of 2008-2010, with smaller corrections in 2016-2017, late 2019, 2022-2024, and ongoing price declines continuing into 2025.

Source: HM Land Registry House Price Index for Islington

Looking at Islington's historical property prices:

- 1995-2000: Steady appreciation with annual increases reaching 28-29% at peak

- 2000-2004: Continued strong growth though moderating from the late 1990s boom

- 2004-2007: Sustained expansion as Islington established itself as a prime inner London borough, with annual increases reaching 27-28% by mid-2007

- 2008-2010: Sharp correction during the financial crisis, with values dropping approximately 19% at the worst point (January 2009)

- 2010-2014: Gradual recovery supported by transport improvements and Angel's regeneration

- 2014-2018: Strong growth period with annual increases reaching 18-22% as inner London peaked

- 2016-2017: Brief softening during Brexit referendum uncertainty

- 2018-2019: Market softening intensified with negative growth across multiple months

- 2020-2021: Pandemic-driven volatility with brief recovery following lockdowns

- 2022-2024: Sustained correction beginning late 2022 with -5.0% in December, continuing through 2024

- 2025: Recent data shows ongoing price declines with annual decreases across all property types: all properties (-3.9%), detached (-2.7%), semi-detached (-3.5%), terraced (-3.9%), and flats (-4.0%)

Islington has demonstrated long-term resilience despite current market headwinds. Properties have increased substantially since January 1995: detached houses from £193,359 to £1,639,209 (8.5x increase), terraced houses from £124,449 to £1,118,598 (9.0x increase), and flats from £82,508 to £574,600 (7.0x increase). Unlike the crisis-driven 2008 Islington property market crash which reflected systemic financial collapse, the 2022-2025 correction stems from affordability constraints where mortgage rate increases and high property values have priced out many potential buyers, even those with substantial incomes.

This pattern reflects Islington's position as an established inner London borough offering Zone 1-2 positioning, excellent transport connectivity via the Northern, Piccadilly, and Victoria lines, and the appeal of areas like Angel and Upper Street. However, the ongoing negative growth into 2025 demonstrates how affordability pressures continue to constrain the market, with buyers requiring significant deposits and dual household incomes to enter even the flat market at current price levels.

Sold House Prices in Islington

The latest sold house price index by the Land Registry, shows the following average 'sold' house prices across the London Borough of Islington.

While detached houses in Islington are relatively scarce, they command 47.0% above the London average, though their limited stock means most buyers focus on the borough's terraced and apartment options. Semi-detached houses show Islington's substantial premium positioning at 99.2% above typical London prices.

Terraced houses in Islington represent significant premiums at 82.4% above London averages, driven by demand for period properties in areas like Barnsbury and Canonbury. Flats and maisonettes offer the most accessible entry point, though still 32.1% above typical London prices, reflecting the borough's established inner London positioning.

For investors considering Islington, the borough represents an inner London location with established cultural appeal, excellent Zone 1-2 transport links, and strong rental demand from professionals and students. Unlike neighbouring Camden to the west with its tourist-driven premium, or Hackney to the east with its creative quarter positioning, Islington balances residential character with commercial vibrancy around areas like Upper Street and Angel. Those ticking off requirements in their investment property checklists will find Islington offers moderate yields in an established inner London market with strong capital preservation characteristics.

With average detached houses selling at £1,710,823, these properties remain rare finds in the borough's predominantly terraced and apartment landscape. The apartment market at £586,276 offers accessible entry compared to many inner London alternatives, whilst terraced houses at £1,164,089 appeal to families seeking period properties near quality schools and green spaces like Highbury Fields.

Investors building portfolios focused on stronger yields may find neighbouring Haringey to the north more suitable, whilst those landlords looking at how to sell a buy-to-let property in Islington will find buyer demand mostly from owner-occupiers or investors interested in capital growth rather than high rental yields.

Updated October 2025

| Property Type | Islington Average Price | London Average | Difference |

|---|---|---|---|

| Detached houses | £1,710,823 | £1,163,469 | +47.0% |

| Semi-detached houses | £1,431,740 | £718,637 | +99.2% |

| Terraced houses | £1,164,089 | £638,278 | +82.4% |

| Flats and maisonettes | £586,276 | £443,692 | +32.1% |

| All property types | £701,055 | £561,309 | +24.9% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Government Planning and Housing Data

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: October 2025. All data is presented as provided by our sources without adjustments or amendments.

For Sale Asking House Prices in Islington

Updated October 2025

The data represents the average asking prices of properties currently listed for sale in Islington.

| Rank | Area | Average House Price |

|---|---|---|

| 1 | EC1 (Clerkenwell) | £774,873 |

| 2 | N1 (Angel) | £729,691 |

| 3 | N19 (Archway) | £672,824 |

| 4 | N5 (Highbury) | £618,469 |

| 5 | N7 (Holloway) | £605,430 |

Clerkenwell and Finsbury (EC1 postcode) commands asking prices of £774,873, reflecting the premium paid for Tech City positioning and converted warehouse apartments near Farringdon's Crossrail interchange. Angel and Islington (N1 postcode) follows at £729,691, where Upper Street's dining scene and Zone 1 transport connections justify values that remain challenging for most London households. Archway and Upper Holloway (N19 postcode) sits at £672,824, benefiting from Hampstead Heath proximity and Northern Line access. Highbury and Highbury Fields (N5 postcode) commands £618,469, reflecting established residential character and strong school catchments that appeal to families. Holloway and Tufnell Park (N7 postcode) provides the most accessible entry point at £605,430, delivering a £169,443 saving compared to EC1 whilst maintaining comparable rental yields and Northern Line connectivity. The £169,443 gap between highest and lowest demonstrates how Islington maintains premium pricing across all neighbourhoods, though the differential creates distinct entry points for different investor strategies. Even Holloway requires roughly £181,629 deposits under typical 30% lending criteria, whilst Clerkenwell demands approximately £232,462, meaning Islington attracts investors, homebuyers on significant dual incomes, and those with family financial support rather than standard first-time buyers working alone.

These figures represent average asking prices across all property types, and actual achievable prices may vary depending on property size, condition, and specific location within each postcode.

Sold Price Per Square Foot in Islington (£)

Updated October 2025

The data represents the average sold price per square foot of residential real estate in Islington.

| Rank | Area | Price Per Square Foot |

|---|---|---|

| 1 | EC1 (Clerkenwell) | £1,055 |

| 2 | N1 (Angel) | £975 |

| 3 | N5 (Highbury) | £898 |

| 4 | N19 (Archway) | £800 |

| 5 | N7 (Holloway) | £787 |

Clerkenwell and Finsbury (EC1) commands £1,055 per square foot, reflecting its Zone 1 location, Tech City positioning, and the premium commanded by warehouse conversions and new-build apartments near Farringdon's Crossrail interchange. Angel and Islington (N1) follows at £975 per square foot, where proximity to King's Cross, Upper Street's restaurant scene, and excellent transport connectivity justify the premium. Highbury and Highbury Fields (N5) sits at £898 per square foot, reflecting strong demand for period properties near Emirates Stadium and quality schools. Archway and Upper Holloway (N19) offers £800 per square foot, where Hampstead Heath access and improving Northern Line connections maintain values. Holloway and Tufnell Park (N7) provides the most accessible entry at £787 per square foot, representing a £268 discount compared to Clerkenwell whilst maintaining strong rental yields and Northern Line access. The £268 spread between highest and lowest shows Islington operates as a premium inner London market across all five postcodes, though the differential creates distinct opportunities for investors seeking either capital appreciation in EC1 and N1 or stronger yield-focused strategies in N7 and N19.

These figures reflect the average across all property types and should be considered alongside factors such as building age, condition, and specific location within each postcode. Period conversions and heritage properties typically command premiums over standard housing stock.

House Price Growth in Islington (%)

Updated October 2025

The data represents the average house price growth over the past five years, calculated using a blended rolling annual comparison of both sold prices and asking prices.

| Rank | Area | 5 Year Growth |

|---|---|---|

| 1 | N19 (Archway) | 5.00% |

| 2 | N7 (Holloway) | 2.80% |

| 3 | N5 (Highbury) | 1.20% |

| 4 | N1 (Angel) | -6.30% |

| 5 | EC1 (Clerkenwell) | -22.20% |

Archway and Upper Holloway (N19) leads Islington with five-year growth of 5.00%, demonstrating resilience in a challenging period for inner London property markets. Holloway and Tufnell Park (N7) recorded growth of 2.80%, while Highbury and Highbury Fields (N5) saw modest appreciation at 1.20%. Angel and Islington (N1) experienced a decline of -6.30%, reflecting the broader correction in prime central London following sustained price increases that pushed average values significantly beyond typical household incomes. Clerkenwell and Finsbury (EC1) saw the most significant correction at -22.20%, heavily influenced by reduced demand from City workers and the shift to hybrid working patterns that removed the necessity for daily commuting. The positive performance in N19, N7 and N5 suggests these more residential, family-oriented areas maintained steady homebuyer demand throughout the period, benefiting from their combination of good transport links and more accessible price points. For more insight into identifying areas with strong appreciation potential, see our guide on potential signs of capital growth.

These figures should be viewed with some caution as they represent average prices across all property types and include both properties 'for sale' and 'sold prices'.

Average Monthly Property Sales in Islington

Updated October 2025

The data represents the average number of residential property sales per month across Islington's postcode districts.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | N1 (Angel) | 51 |

| 2 | N7 (Holloway) | 22 |

| 3 | N5 (Highbury) | 21 |

| 4 | N19 (Archway) | 18 |

| 5 | EC1 (Clerkenwell) | 18 |

Angel, Islington and Barnsbury (N1 postcode) leads transaction activity with 51 sales monthly, reflecting its established residential market, excellent transport links via Angel and Highbury & Islington stations, and strong appeal to both owner-occupiers and investors. Holloway and Tufnell Park (N7 postcode) follows at 22 monthly sales, benefiting from buyer interest in more affordable entry points compared to central Islington and the area's improving connectivity. Highbury and Highbury Fields (N5 postcode) maintains 21 monthly sales, with its appeal to families seeking period properties near excellent schools and green spaces including Highbury Fields and Clissold Park. Archway and Upper Holloway (N19 postcode) along with Clerkenwell and Finsbury (EC1 postcode) both record 18 sales monthly, with EC1's lower volumes reflecting the concentration of commercial property and newer residential developments with fewer resales in this business district.

These figures include all property prices and property types. Higher transaction volumes generally indicate stronger buyer demand and greater property market liquidity.

Planning Applications in Islington

Updated October 2025

The data represents the average number of planning applications submitted per month in each postcode district, along with the percentage of applications that receive approval.

| Rank | Area | Monthly Applications | Success Rate |

|---|---|---|---|

| 1 | N1 (Angel) | 118 | 88% |

| 2 | EC1 (Clerkenwell) | 61 | 92% |

| 3 | N7 (Holloway) | 39 | 90% |

| 4 | N19 (Archway) | 29 | 91% |

| 5 | N5 (Highbury) | 14 | 83% |

Angel, Islington and Barnsbury (N1) dominates planning activity with 118 applications monthly and an 88% success rate, reflecting the area's ongoing regeneration around the canal, Upper Street, and its position as a major commercial and residential hub. Clerkenwell and Finsbury (EC1) follows with 61 monthly applications and the highest success rate at 92%, driven by the area's Tech City developments and conversion of former industrial buildings into residential and creative workspace. Holloway and Tufnell Park (N7) records 39 applications with 90% approval, while Archway and Upper Holloway (N19) shows 29 applications with a 91% success rate. Highbury and Highbury Fields (N5) demonstrates lower application volumes at 14 monthly, likely due to its established residential character and significant conservation area protections around Highbury Fields and the surrounding Victorian squares.

These figures represent averages across each postcode district, and specific streets or property types may experience different levels of planning activity and success rates.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Government Planning and Housing Data

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: October 2025. All data is presented as provided by our sources without adjustments or amendments.

Islington Rental Market Analysis

For first-time buyers buying their first rental property and thinking how much they can charge for rent across the London borough of Islington, the rental data below gives you an indication on the rental yields London landlords can aim to achieve for traditional assured shorthold tenants.

Note: Islington's high property prices and moderate rental yields (4.5%-5.0%) mean investors should carefully evaluate whether returns align with their portfolio strategy, particularly when compared to higher-yielding areas outside London such as Manchester or Birmingham. For those considering how to grow a residential property portfolio with significant budgets, Islington offers excellent capital growth potential in a prime inner London real estate location.

Rental Prices in Islington (£)

Updated October 2025

The data represents the average weekly and monthly rent for long-let AST properties in Islington.

| Rank | Area | Average Weekly Rent | Average Monthly Rent |

|---|---|---|---|

| 1 | EC1 (Clerkenwell) | £709 | £3,073 |

| 2 | N1 (Angel) | £700 | £3,035 |

| 3 | N19 (Archway) | £595 | £2,579 |

| 4 | N7 (Holloway) | £561 | £2,433 |

| 5 | N5 (Highbury) | £536 | £2,324 |

Clerkenwell and Finsbury (EC1) achieves Islington's highest rents at £709 weekly (£3,073 monthly), reflecting its status as a sought-after area for professionals working in the City and Tech City. Angel, Islington and Barnsbury (N1) commands £700 weekly, closely followed by Archway and Upper Holloway (N19) at £595 weekly. Highbury and Highbury Fields (N5) offers the most accessible rents at £536 weekly (£2,324 monthly), which combined with its relatively lower property prices delivers a solid rental yield of 4.5%.

These figures represent average rents across all property types, from studio apartments to larger houses. Actual achievable rents vary significantly based on property size, condition, and specific location within each postcode.

Gross Rental Yields in Islington (%)

Updated October 2025

The data represents the average gross rental yields across different postcode districts in Islington. These figures are based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | N1 (Angel, Islington, Barnsbury) | 5.0% |

| 2 | N7 (Holloway, Tufnell Park) | 4.8% |

| 3 | EC1 (Clerkenwell, Finsbury) | 4.8% |

| 4 | N19 (Archway, Upper Holloway) | 4.6% |

| 5 | N5 (Highbury, Highbury Fields) | 4.5% |

Angel, Islington and Barnsbury (N1) delivers Islington's highest rental yield at 5.0% with average property prices of £729,691 and monthly rents of £3,035, making it the borough's most attractive area for buy-to-let investors seeking strong returns. Holloway and Tufnell Park (N7) follows at 4.8% with excellent Piccadilly line connectivity and more accessible property prices averaging £605,430, while Clerkenwell and Finsbury (EC1) offers 4.8% yields at £774,873 average price with exceptional transport links through Farringdon station.

Highbury and Highbury Fields (N5) shows the lowest yield at 4.5% due to its family-friendly appeal and premium residential character with property values averaging £618,469, even though this desirable postcode typically attracts high-quality tenants and delivers strong long-term capital growth prospects alongside its rental income of £2,324 per month.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these costs.

Access our selection of exclusive, high-yielding, residential investment property deals and a personal consultant to guide you through your options.

Is Islington Rent High?

Yes, Islington's rental prices represent a substantial financial burden for local residents, consuming a significant percentage of local incomes.

Average rent in Islington costs between 53.01% to 70.06% as a percentage of earnings based on the ONS earnings data showing Islington's mean annual income at £52,606 (£1,012 per week).

The pressure is most extreme in EC1 (Clerkenwell, Finsbury) where local rents reach £709 per week. Based on local average mean earnings, tenants would need to pay 70.06% of their income just to cover rental housing costs - a significant burden that highlights the ongoing affordability challenges in this premium area.

Islington's most affordable rental market (although hardly the bottom of the housing ladder and not an affordable location for the average resident to live) is found in N5 (Highbury, Highbury Fields), where rents represent 53.01% of income at £536 per week, yet still requires residents to commit more than half of their earnings solely to rent.

Here's what residents face across Islington for rental costs as a percentage of income:

- EC1 (Clerkenwell, Finsbury) - 70.06% of local income (£709 per week)

- N1 (Angel, Islington, Barnsbury) - 69.23% of local income (£700 per week)

- N19 (Archway, Upper Holloway) - 58.83% of local income (£595 per week)

- N7 (Holloway, Tufnell Park) - 55.49% of local income (£561 per week)

- N5 (Highbury, Highbury Fields) - 53.01% of local income (£536 per week)

Most Islington home owners and tenants require multiple incomes, family support, or earnings significantly above local average income. This creates a rental market primarily serving established high networth professionals or residents with external financial resources like family wealth or inheritance.

For property investors, this might have an appeal as it attracts a wealthy tenant base, however it does require a significant investment to buy in Islington even if you start at the lowest part of the property ladder with a small studio apartment or one bedroom home.

Buy-to-Let Considerations

Are Islington House Prices High?

Yes, Islington is one of London's most expensive boroughs. The Islington housing market has very high property prices especially when compared with national averages for property buyers.

Islington's average 'Sold' property price of £701,055 sits 160.54% above the UK average of £269,079, making affordability a challenge for first time buyers and new property buyers looking to move to the area.

Even in the context of London averages, Islington represents a premium location with substantial price premiums across most postcodes.

Demonstrating its position as a premium inner London borough, Islington has a house price premium of 24.90% compared to the London average of £561,309.

The average asking prices for properties in Islington currently on the market vary considerably across postcodes, from the most expensive Islington postcode of EC1 (Clerkenwell, Finsbury) at £774,873 and N1 (Angel, Islington, Barnsbury) at £729,691 to the relatively more affordable N7 (Holloway, Tufnell Park) at £605,430 and N5 (Highbury, Highbury Fields) at £618,469.

Median annual earnings in Islington are higher than the UK average, coming in at £45,616 (43.11% above the UK average of £31,875).

Despite these higher earnings, the exceptionally high property prices still put significant pressure on affordability, with residents earning even above the local average income finding it challenging to afford Islington's premium property market.

Mean earnings in Islington are £52,606, which is 34.78% above the UK mean of £39,030, yet still insufficient to easily afford the borough's high property prices.

Salary to House Price Ratios

Based on Islington's mean earnings of £52,606:

- Clerkenwell, Finsbury (EC1) - £774,873 asking price = 14.73 times annual salary

- Angel, Islington, Barnsbury (N1) - £729,691 asking price = 13.87 times annual salary

- Archway, Upper Holloway (N19) - £672,824 asking price = 12.79 times annual salary

- Highbury, Highbury Fields (N5) - £618,469 asking price = 11.76 times annual salary

- Holloway, Tufnell Park (N7) - £605,430 asking price = 11.51 times annual salary

Meaning that for a local property buyer on 'average mean full time earnings', to buy a property across Islington would require between 11.51 and 14.73 times annual salary.

Islington you can see therefore isn't your first choice for local residents looking for affordable homes, as it priced at a level that only high networth property buyers can afford.

How Much Deposit to Buy a House in Islington?

Assuming a 30% deposit for the average buy-to-let investor, here's an overview of deposit requirements across different Islington regions:

North Islington

- N19 (Archway, Upper Holloway): A buy-to-let investor looking at an average property would need to put down a 30% deposit of £201,847.

Central Islington

- N5 (Highbury, Highbury Fields): An investor would need a 30% deposit of £185,541 for an average property.

- N7 (Holloway, Tufnell Park): A buy-to-let investor would need a 30% deposit of £181,629 for an average property.

- N1 (Angel, Islington, Barnsbury): In this area, an investor would need a 30% deposit of £218,907 for an average property.

South Islington

- EC1 (Clerkenwell, Finsbury): A buy-to-let investor would require a 30% deposit of £232,462 for an average property.

If you're new to property, or just starting out through a property investment course, Holloway (N7) in Central Islington offers the most affordable deposit requirement in Islington at £181,629, whilst also delivering a strong rental yield of 4.8%.

How to Invest in Buy-to-Let in Islington

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Islington, Greater London and the rest of the UK. With new properties coming available weekly, whether you're targeting the highest-yield areas like Angel (N1) at 5.0%, the well-connected locations in Holloway (N7) and Clerkenwell (EC1) both at 4.8%, or the family-friendly Highbury market (N5) at 4.5%, we can source suitable investment properties across the city and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Islington and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

For more information about specific areas to consider:

If you're interested in the highest rental returns in Islington, consider N1 (Angel, Islington, Barnsbury) with yields of 5.0%, followed by N7 (Holloway, Tufnell Park) at 4.8% and EC1 (Clerkenwell, Finsbury) also at 4.8%. N1 benefits from excellent Northern line connections via Angel station, providing direct access to the City via Bank and King's Cross St Pancras. N7 is served by Caledonian Road and Holloway Road stations on the Piccadilly line, while EC1 offers exceptional connectivity through Farringdon station, serving the Circle, Hammersmith & City, and Metropolitan lines, plus Thameslink rail services.

For mid level entry house prices with mid level London rental yields, N5 (Highbury, Highbury Fields) presents excellent value at £618,469 average price with a 4.5% yield and strong transport links via Arsenal and Highbury & Islington stations, the latter serving both the London Overground and Victoria line.

For an alternative look at the local London housing market, with affordable entry prices, check out our guide to the cheapest areas to live in London.

For similar investment opportunities in neighbouring London boroughs, explore buy-to-let in Camden (directly adjacent to Islington to the west with £876k borough average, excellent schools and shared transport infrastructure through King's Cross and Camden Town stations on the Northern line), buy-to-let in Hackney (neighbouring borough to the east with £586k average, strong rental demand from the creative sector and good Overground and Central line connections via stations like Old Street and Shoreditch High Street), or buy-to-let in Haringey (bordering Islington to the north with £627k borough average and shared Northern line access through Highgate and Archway stations). For opportunities outside London with good transport links to central locations, consider buy-to-let in St Albans (just 20 miles north of Islington with 20-minute trains to London St Pancras, excellent schools and £622k average property prices) or buy-to-let in Watford (18 miles northwest with Metropolitan line connections to central London via Baker Street and more affordable entry around £400k average).