Where to Buy Property Investments in Peterborough: Yields of 5.3%

Peterborough offers something increasingly hard to find in the East of England: a city where property investment numbers work from day one. With gross rental yields reaching 5.3% in PE1 and average sold prices sitting well below regional benchmarks, this fast-growing cathedral city delivers genuine value for buy-to-let investors who have been priced out of nearby Cambridge.

UK property data confirms the opportunity. Peterborough's average sold price of £233,356 sits 20% below the England average of £291,515 and 31% below the East of England regional average of £340,037. For the price of a one-bed flat in Cambridge, you can buy a three-bed terrace in Peterborough with immediate rental income.

Our buy-to-let analysis examines Peterborough's seven postcode districts, evaluating how to work out rental yields, capital growth patterns, and investment potential across this historic city and its surrounding market towns.

Article updated: January 2026

Peterborough Buy-to-Let Market Overview 2026

Peterborough's property market delivers sold prices 20% below the England average and 31% below the East of England regional average, creating accessible entry points for buy-to-let investors with these key statistics:

- Average sold price: £233,356 (20% below England's £291,515)

- Asking price range: £207,528 (PE1) to £325,040 (PE6) across Peterborough postcodes

- Rental yields: 4.0% (PE6) to 5.3% (PE1) across different postcodes

- Rental income: Monthly rents from £924 (PE1) to £1,189 (PE7)

- Price per sq ft: House prices from £227/sq ft (PE1) to £277/sq ft (PE6)

- Market activity: Sales ranging from 3 per month (PE5) to 61 per month (PE7)

- Deposit requirements: 30% deposits range from £62,258 (PE1) to £97,512 (PE6)

- Affordability ratios: Property prices from 5.6 to 8.8 times Peterborough's median annual salary of £36,951

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Peterborough?

Peterborough operates as one of the East of England's key growth corridors. Designated as a New Town in 1967, the city has expanded rapidly ever since and shows no signs of slowing. This is a market driven by genuine population growth, employment expansion, and infrastructure investment rather than speculative demand.

The employment base is more diversified than people assume. Peterborough has a jobs density of 0.98, meaning jobs nearly match the working-age population. The economy spans manufacturing (8.5% of jobs), wholesale and retail (17.1%), health and social care (15.4%), and a growing financial services sector. Major employers include IKEA's UK distribution centre, Perkins Engines, Bauer Media, and the regional hospital trust. You can see the full employment breakdown via the Nomis Labour Market Profile for Peterborough.

Transport links punch above the city's weight. The East Coast Main Line delivers direct trains to London King's Cross in just 46 minutes, with up to five services per hour. That's faster than many Zone 4-6 London commutes. The A1(M) provides direct motorway access north and south, while the A47 connects to the Midlands and Norfolk coast.

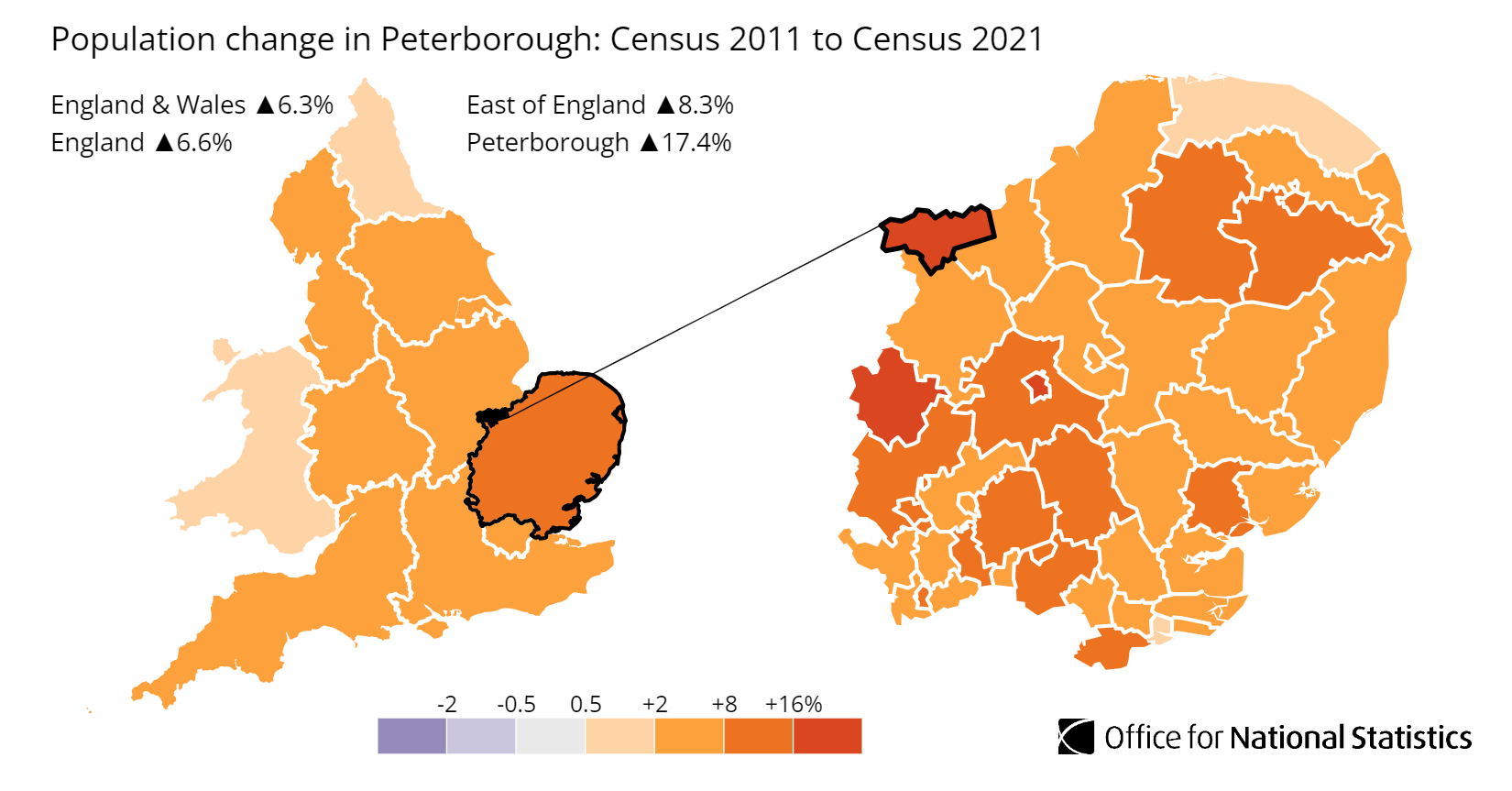

Population growth has been exceptional. According to the latest census data, the population of Peterborough increased by 17.4%, rising from 183,600 in 2011 to 215,700 in 2021. That's the third-highest growth rate in the East of England, behind only Bedford and Cambridge. The median age is just 36, below both the regional average of 41 and the England average of 40. You can explore the breakdown via the ONS Census Data for Peterborough.

For comparable affordable markets with strong yields, consider Luton (similar London commuter appeal with airport employment), Milton Keynes (new town with strong infrastructure investment), or Northampton (Midlands logistics hub with similar price points).

Regeneration and Investment in Peterborough

Peterborough is actively delivering on its "Fast Growth City" status. While other cities are still debating masterplans, Peterborough spent late 2025 breaking ground. The narrative for investors has shifted from the completion of the Fletton Quays riverside to the massive infrastructure overhaul of the Station Quarter, backed by fresh government funding and a new Mayoral growth strategy launched in December 2025.

Major projects delivering real change include:

- The Station Quarter (Active Delivery): This is the city's flagship £65m project. After securing Levelling Up Fund backing, preliminary works including site clearance and utility enabling officially began in November 2025. The project transforms the station with a new western entrance and a "City Link" pedestrian bridge, directly unlocking the Great Northern Hotel area for future commercial development. Main construction is scheduled to accelerate throughout 2026. Updates are available at Peterborough City Council Station Quarter.

- ARU Peterborough (Phase 3 "The Living Lab"): The city's university continues to expand ahead of schedule. Phase 3, known as "The Living Lab," officially opened to students in January 2025. This £32m facility featuring a publicly accessible science centre has allowed the university to launch new courses in Civil Engineering and Data Science. For investors, this growing student population (now targeting 12,500 by 2030) underpins rising demand for HMOs in the PE1 and PE2 postcodes. Details at ARU Peterborough Development.

- Queensgate Leisure Pivot (Odeon Luxe): The transition of Queensgate Shopping Centre from pure retail to mixed leisure is now a proven success. The new Odeon Luxe cinema celebrated its first anniversary in November 2025, reporting strong footfall that has revitalised the evening economy in the city centre. This success is driving new lettings in the surrounding food court and reducing void rates for commercial landlords.

- The Local Growth Plan (December 2025 Launch): In December 2025, the Mayor officially launched the new Local Growth Plan, designating Peterborough as a "Fast Growth City" Opportunity Zone. This policy framework specifically targets a tripling of the region's economy by 2050, focusing on attracting Advanced Manufacturing and Agri-Tech jobs. For investors, this provides long-term confidence that the city's population growth will be matched by employment opportunities. Read the launch details at Cambridgeshire & Peterborough Combined Authority.

- Fletton Quays - The Hilton Opportunity: While the majority of the Fletton Quays riverside district is a roaring success with the Government Hub fully operational, the Hilton Hotel site remains the final piece of the puzzle. Following the developer's administration, the site was marketed for sale in late 2025. This distressed asset is likely to be picked up by a new operator in 2026. Once a deal is announced to complete this hotel, the final construction blight will be removed, likely triggering a value uplift for surrounding apartments in the PE2 postcode.

Peterborough Property Market Analysis

When Was the Last House Price Crash in Peterborough?

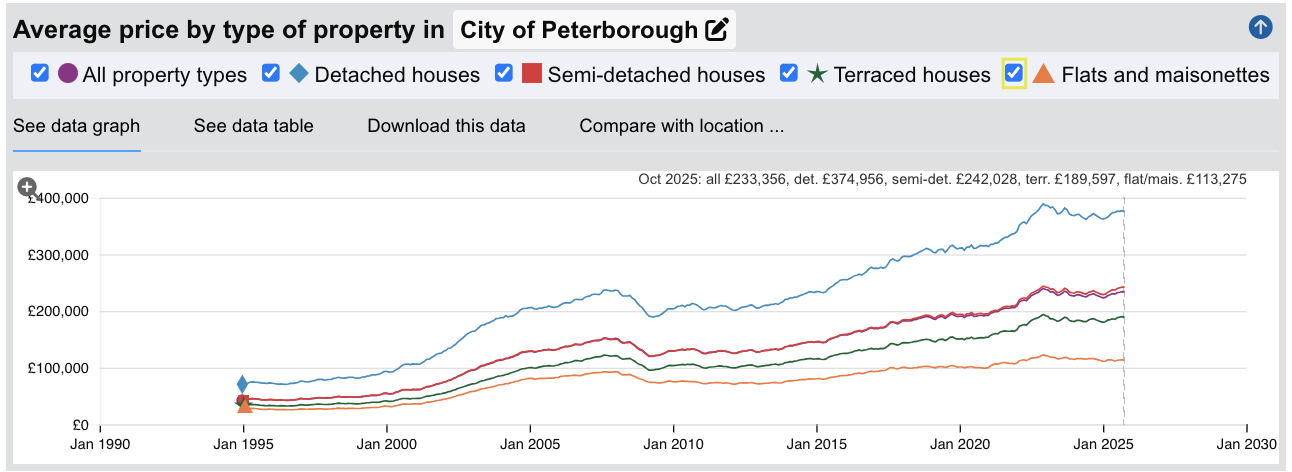

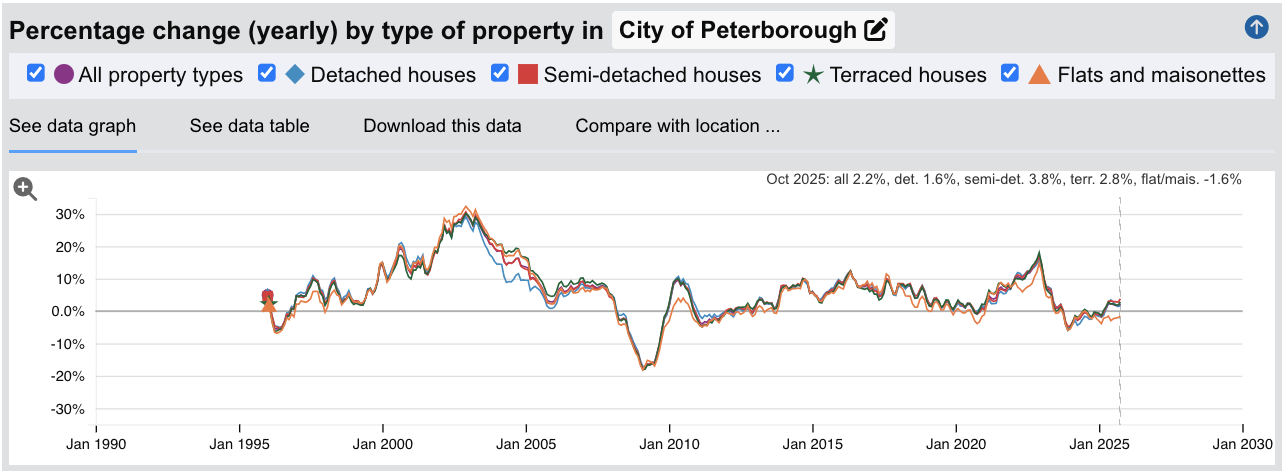

Peterborough experienced a significant correction during the 2008 financial crisis. Average prices fell from a peak of £152,290 in September 2007 to a trough of £120,604 by April 2009, a decline of 20.8%. Recovery was gradual, with prices not returning to pre-crash levels until mid-2017, nearly a decade later.

Source: HM Land Registry House Price Index for Peterborough

Here is how the market has performed over the key cycles:

- 1995-2007 saw property values nearly quadruple, rising from around £41,000 to over £152,000 as Peterborough's New Town expansion continued and London commuter demand strengthened.

- 2008-2009 brought a sharp correction of 20.8%. Peterborough fell harder than the national average, reflecting its reliance on manufacturing and logistics employment during the recession.

- 2010-2016 was a period of slow recovery and consolidation. Prices fluctuated between £125,000 and £170,000, with growth finally accelerating from 2015 onwards as the wider economic recovery took hold.

- 2017-2019 delivered steady gains as prices climbed from £168,781 to £194,445. The 46-minute London commute became increasingly attractive to buyers priced out of Cambridge and the home counties.

- 2020-2022 brought the pandemic surge. Prices climbed from £190,784 to £239,869 as demand for affordable family housing with good transport links intensified.

- 2023-2024 saw a mild correction of around 6.3% as mortgage rates spiked, with prices falling from the December 2022 peak of £239,869 to £224,765 by June 2024.

- 2024-2025 has marked a clear recovery. Prices have rebounded to £233,356 as of October 2025, with year-on-year growth of 2.2%.

Long-Term Property Value Growth in Peterborough

For buy-to-let investors focused on capital preservation and steady appreciation, Peterborough's long-term trajectory shows substantial gains:

- 5 years (2020-2025): 21.2% growth (£192,527 to £233,356)

- 10 years (2015-2025): 50.7% growth (£154,832 to £233,356)

- 15 years (2010-2025): 76.1% growth (£132,505 to £233,356)

- 20 years (2005-2025): 77.8% growth (£131,278 to £233,356)

- 30 years (1995-2025): 438.0% growth (£43,370 to £233,356)

The relatively shallow 2023 correction and swift recovery demonstrate Peterborough's resilience compared to more speculative markets. This is not a city driven by investor sentiment or international capital flows. Demand comes from working families, London commuters seeking value, and a stable local employment base. The numbers tell a consistent story: steady growth without the dramatic peaks and troughs of premium southern markets.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Peterborough

The latest sold house price index by the Land Registry confirms Peterborough's position as one of the most affordable city markets in the East of England, with values sitting comfortably below national benchmarks across every property type.

Peterborough property prices average £233,356, which is 20% below the England average of £291,515. This discount exists despite the 46-minute train to London King's Cross, reflecting Peterborough's New Town heritage and the sheer volume of housing built since the 1967 designation.

Flats and maisonettes offer the sharpest value, averaging just £113,275, a 48% discount against the national average. City centre apartments in PE1 attract young professionals and London commuters seeking affordable entry points. Terraced houses average £189,597, sitting 22% below the national figure. These are the workhorses of the Peterborough rental market, concentrated in inner suburbs like Fletton and Woodston.

Semi-detached houses average £242,028, representing a 17% discount on the England average. Family homes in townships like Bretton and Werrington dominate this segment, popular with local workers and commuters alike. Detached houses average £374,956, still 20% below the national figure, with stock spread across the newer developments in Hampton and the surrounding villages.

For context, neighbouring Cambridge averages £495,517, more than double Peterborough's prices despite being just 38 miles away. That gap explains why Peterborough continues to attract buyers priced out of the wider Cambridgeshire market.

Updated January 2026

| Property Type | Peterborough Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £374,956 | £470,151 | -20.2% |

| Semi-detached houses | £242,028 | £289,909 | -16.5% |

| Terraced houses | £189,597 | £243,978 | -22.3% |

| Flats and maisonettes | £113,275 | £219,065 | -48.3% |

| All property types | £233,356 | £291,515 | -20.0% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Peterborough (£)

Updated January 2026

The data represents the average sold price per square foot across Peterborough's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | PE5 (Ailsworth, Castor, Wansford) | £343 |

| 2 | PE6 (Market Deeping, Crowland, Eye) | £277 |

| 3 | PE7 (Yaxley, Whittlesey, Hampton) | £272 |

| 4 | PE4 (Werrington, Gunthorpe, Paston) | £270 |

| 5 | PE2 (Fletton, Stanground, Orton) | £261 |

| 6 | PE3 (Bretton, Longthorpe, Westwood) | £240 |

| 7 | PE1 (City Centre, Eastgate, New England) | £228 |

For context, Norwich averages around £300 per square foot. Peterborough's city centre postcode PE1 offers just £228, giving you roughly 30% more space for your money than the East of England's other major city.

The pattern reflects Peterborough's urban-rural divide. PE5 at £343 per square foot commands the highest premium, covering stone-built Nene Valley villages like Castor and Wansford where period character drives prices. PE1 at £228 per square foot sits at the other extreme, where higher-density housing and New Town stock keeps costs down.

The practical difference is significant. A £62,000 deposit buys roughly 910 sq ft in PE1 versus around 605 sq ft in PE5 for the same outlay. For investors prioritising space over character, the urban postcodes stretch your capital further.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

For Sale Asking House Prices in Peterborough

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Peterborough's seven postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | PE6 (Market Deeping, Crowland, Eye) | £325,040 |

| 2 | PE7 (Yaxley, Whittlesey, Hampton) | £297,052 |

| 3 | PE4 (Werrington, Gunthorpe, Paston) | £242,532 |

| 4 | PE2 (Fletton, Stanground, Orton) | £237,527 |

| 5 | PE3 (Bretton, Longthorpe, Westwood) | £236,514 |

| 6 | PE1 (City Centre, Eastgate, New England) | £207,528 |

| 7 | PE5 (Ailsworth, Castor, Wansford) | Not enough data |

Peterborough's asking prices show a £117,000 gap between the most expensive and most affordable postcodes with sufficient data. That range creates genuine choice for investors at different capital levels.

The rural and semi-rural postcodes command premiums. PE6 at £325,040 covers Market Deeping and the villages towards Crowland, where larger detached properties push averages higher. PE7 at £297,052 includes the expanding Hampton townships and market town of Whittlesey, offering newer family housing. PE5 lacks sufficient sales data to calculate a reliable average, reflecting its small, owner-occupier character.

The urban postcodes cluster tightly between £207,000 and £243,000, representing Peterborough's core buy-to-let territory. PE1 at £207,528 offers the lowest entry point, covering the city centre and inner suburbs where Victorian terraces and ex-council stock dominate. The £90,000 gap between PE1 and PE6 buys you village life versus city convenience.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary by property size, condition, and specific location within each postcode.

House Price Growth in Peterborough (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| PE1 (City Centre, Eastgate, New England) | +4.9% | +11.4% | +23.6% |

| PE6 (Market Deeping, Crowland, Eye) | -3.7% | +0.5% | +16.4% |

| PE3 (Bretton, Longthorpe, Westwood) | -3.4% | +0.9% | +15.5% |

| PE4 (Werrington, Gunthorpe, Paston) | +0.1% | -2.3% | +15.0% |

| PE2 (Fletton, Stanground, Orton) | +1.5% | +1.3% | +13.3% |

| PE7 (Yaxley, Whittlesey, Hampton) | -4.6% | -0.8% | +10.4% |

| PE5 (Ailsworth, Castor, Wansford) | Not enough data | Not enough data | Not enough data |

The five-year picture is consistently positive across all Peterborough postcodes with sufficient data, ranging from +10.4% to +23.6%. This reflects the post-pandemic repricing of housing in affordable commuter markets rather than speculative growth.

The one-year figures tell a more mixed story. PE1 leads at +4.9%, the only postcode showing meaningful current momentum. The urban housing core has recovered faster than the surrounding areas. PE7 shows the weakest recent performance at -4.6%, with the Hampton and Whittlesey areas giving back some pandemic-era gains.

For investors, the pattern suggests Peterborough has already absorbed its post-2023 house price correction and the urban postcodes are growing in property value again. The rural and semi-rural postcodes (PE6, PE7) remain in consolidation.

Note: PE5 lacks sufficient house transaction volume for reliable growth calculations.

Average Monthly Property Sales in Peterborough

Updated January 2026

The data represents the average number of residential property sales per month across Peterborough's postcode districts, a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | PE7 (Yaxley, Whittlesey, Hampton) | 61 |

| 2 | PE2 (Fletton, Stanground, Orton) | 41 |

| 3 | PE6 (Market Deeping, Crowland, Eye) | 35 |

| 4 | PE4 (Werrington, Gunthorpe, Paston) | 27 |

| 5 | PE1 (City Centre, Eastgate, New England) | 21 |

| 6 | PE3 (Bretton, Longthorpe, Westwood) | 21 |

| 7 | PE5 (Ailsworth, Castor, Wansford) | 3 |

Peterborough's real estate sales activity is driven by its expanding townships rather than the historic core. PE7 leads with 61 monthly sales, reflecting ongoing development in Hampton and steady turnover in Whittlesey. PE2 follows at 41, covering the established Orton townships where family homes change hands regularly.

The city centre postcode PE1 ranks fifth at just 21 sales per month. This isn't weak demand. It reflects a smaller, denser housing stock compared to the sprawling townships. For BRR strategies where exit speed matters, the suburban postcodes offer more opportunities to buy and sell quickly.

PE5 at just 3 sales per month confirms its character as a small, tightly-held village market. Properties here sell infrequently, so expect longer marketing periods when exiting.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Peterborough Rental Market Analysis

For investors considering if buy-to-let is worth it in Peterborough and thinking how much they can charge for rent across the city and its surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Peterborough (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Peterborough. These figures reflect rents across all property types and do not account for differences in property size or number of bedrooms.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | PE7 (Yaxley, Hampton, Whittlesey) | £1,189 |

| 2 | PE6 (Market Deeping, Crowland) | £1,073 |

| 3 | PE3 (Bretton, Longthorpe) | £1,005 |

| 4 | PE2 (Orton, Fletton, Woodston) | £982 |

| 5 | PE4 (Werrington, Walton, Paston) | £969 |

| 6 | PE1 (City Centre, Eastgate, Stanground) | £924 |

| 7 | PE5 (Ailsworth, Castor) | Not enough data |

The highest rents appear in the outer postcodes, but this reflects property size rather than premium demand. PE7 (Hampton, Yaxley) at £1,189 and PE6 (Market Deeping) at £1,073 both cover areas with larger family homes and newer developments. These postcodes attract families rather than young professionals, with correspondingly lower yields despite higher absolute rents.

For yield-focused investors, the urban postcodes tell the real story. PE1 (City Centre) achieves £924 on average prices of just £207,528, delivering the city's highest yield at 5.3%. PE2 (Orton, Fletton) at £982 offers the best combination of rental income and market liquidity with 41 sales per month. PE5 lacks sufficient rental listings to calculate reliable averages, reflecting its small, rural character with just 616 households.

Gross Rental Yields in Peterborough (%)

Updated January 2026

The data represents the average gross rental yields across Peterborough's postcode districts, calculated using average asking prices and average asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | PE1 (City Centre, Eastgate, Stanground) | 5.3% |

| 2 | PE3 (Bretton, Longthorpe) | 5.1% |

| 3 | PE2 (Orton, Fletton, Woodston) | 5.0% |

| 4 | PE4 (Werrington, Walton, Paston) | 4.8% |

| 5 | PE7 (Yaxley, Hampton, Whittlesey) | 4.8% |

| 6 | PE6 (Market Deeping, Crowland) | 4.0% |

| 7 | PE5 (Ailsworth, Castor) | Not enough data |

Peterborough's urban postcodes comfortably clear the 5% gross yield threshold that many buy-to-let investors target. PE1 (City Centre) leads at 5.3%, combining the lowest entry prices in the city with steady tenant demand from workers, young professionals and the nearby hospital. PE2 and PE3 both deliver above 5% with better market liquidity, particularly PE2 with 41 sales per month.

The outer postcodes tell a different story. PE6 (Market Deeping) at just 4.0% reflects higher purchase prices relative to achievable rents. These areas attract owner-occupiers seeking village life rather than tenants, compressing yields despite higher absolute rents. For investors prioritising rental income, the urban core outperforms.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses. Landlords can use our rental yield calculator to factor in these buy-to-let ownership costs.

Is Peterborough Rent High?

Peterborough's rental market is notably affordable compared to other East of England cities. Tenants commit a manageable portion of their salary to rent, which supports consistent demand and lower void risk for landlords.

Average rent in Peterborough costs between 30% and 39% of the average gross annual earnings for a full-time resident. This is based on the ONS Annual Survey of Hours and Earnings showing the median gross annual income for Peterborough residents is £36,951 (based on £710.60 median weekly pay).

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | PE7 (Yaxley, Hampton, Whittlesey) | 38.6% |

| 2 | PE6 (Market Deeping, Crowland) | 34.8% |

| 3 | PE3 (Bretton, Longthorpe) | 32.6% |

| 4 | PE2 (Orton, Fletton, Woodston) | 31.9% |

| 5 | PE4 (Werrington, Walton, Paston) | 31.5% |

| 6 | PE1 (City Centre, Eastgate, Stanground) | 30.0% |

| 7 | PE5 (Ailsworth, Castor) | Not enough data |

The urban postcodes hover around the 30% affordability guideline that housing experts recommend. PE1 (City Centre) sits exactly at 30%, meaning tenants on average local wages can comfortably afford rent without financial stress. This contrasts sharply with Cambridge, where rents consume 40-48% of income across all postcodes.

The outer postcodes push higher, with PE7 (Hampton) at 38.6%, but this reflects larger family homes commanding higher absolute rents rather than affordability pressure. For landlords, Peterborough's balanced rent-to-income ratios mean reliable tenants who can sustain payments through economic cycles.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Peterborough House Prices High?

For a local buyer on average full-time earnings, Peterborough offers genuine affordability compared to most of the East of England. The combination of new-town housing stock and distance from London creates entry points accessible to first-time buyers and investors alike.

Purchasing a property in Peterborough requires between 5.6 and 8.8 times the median annual salary. This is based on the ONS Annual Survey of Hours and Earnings showing the median gross annual income for Peterborough residents is £36,951.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | PE6 (Market Deeping, Crowland) | 8.8x |

| 2 | PE7 (Yaxley, Hampton, Whittlesey) | 8.0x |

| 3 | PE4 (Werrington, Walton, Paston) | 6.6x |

| 4 | PE2 (Orton, Fletton, Woodston) | 6.4x |

| 5 | PE3 (Bretton, Longthorpe) | 6.4x |

| 6 | PE1 (City Centre, Eastgate, Stanground) | 5.6x |

| 7 | PE5 (Ailsworth, Castor) | Not enough data |

The urban postcodes sit comfortably below the UK long-term average of around 8x income. PE1 (City Centre) at just 5.6x offers the most accessible entry point, where a dual-income household on average wages could realistically save a deposit within a few years. This healthy owner-occupier demand sustains a balanced market of buyers and renters.

The outer postcodes PE6 and PE7 push toward 8-9x income, but this reflects larger detached and semi-detached family homes in villages like Market Deeping and Hampton rather than affordability pressure. For context, Norwich typically sits at 7-10x income, making Peterborough's urban postcodes notably more accessible for both buyers and investors.

How Much Deposit to Buy a House in Peterborough?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £35,000 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | PE1 (City Centre, Eastgate, Stanground) | £62,258 |

| 2 | PE2 (Orton, Fletton, Woodston) | £71,258 |

| 3 | PE3 (Bretton, Longthorpe) | £70,954 |

| 4 | PE4 (Werrington, Walton, Paston) | £72,760 |

| 5 | PE7 (Yaxley, Hampton, Whittlesey) | £89,116 |

| 6 | PE6 (Market Deeping, Crowland) | £97,512 |

| 7 | PE5 (Ailsworth, Castor) | Not enough data |

For investors entering the market, PE1 (City Centre) requires just £62,258. That's roughly half what you'd need in Ipswich for comparable yields, making Peterborough one of the most capital-efficient entry points in the East of England.

The urban core postcodes PE2, PE3, and PE4 cluster tightly between £71,000 and £73,000 in deposit requirements, all delivering yields between 4.8% and 5.1%. This consistency means investors can choose based on tenant profile and property type rather than being forced into one postcode by budget constraints.

The outer postcodes PE6 and PE7 require deposits approaching £90,000-£100,000, reflecting larger family homes in villages like Market Deeping and Hampton. These areas deliver lower yields (4.0-4.8%) but offer stronger capital growth potential for investors with longer holding periods.

For comparison, the same £97,000 deposit that buys one property in PE6 could secure one property in PE1 plus leave capital for refurbishment or a second deposit elsewhere. Unless you're specifically targeting the village lifestyle market, the numbers favour splitting your investment across the urban postcodes where rental demand is strongest.

How to Invest in Buy-to-Let in Peterborough

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Peterborough, Cambridgeshire and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Peterborough and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Peterborough for Buy-to-Let Investment

For investors seeking similar affordability with strong transport links, buy-to-let in Lincoln offers comparable entry prices and yields in another cathedral city with a growing economy. If you want to stay within the East of England but with a larger tenant pool, buy-to-let in Colchester delivers university-driven demand and garrison town stability.

Or to understand the wider regional market, see our guides to buy-to-let in Cambridge for Peterborough's higher-priced neighbour with world-class capital growth, and buy-to-let in Leicester for a larger East Midlands city with similar affordability and strong rental demand.