Where to Buy Property Investments in Harlow: Yields of 5.9%

Harlow delivers rental yields of 5.9% in CM18 and CM20, with 30-minute trains to Liverpool Street (in the heart of the City of London) and a population that grew 13.9% between the last two censuses. For property investment in a genuine London commuter town without London prices, those buy-to-let fundamentals deserve attention.

New property data confirms where Harlow sits in the market. Average sold prices in Harlow of £362,464 sit 24% above the England average of £293,131, but 7% above the East of England average of £338,286. This is a value commuter town by regional standards, positioned between premium neighbours like Cambridge to the north and London to the south.

Our buy-to-let analysis examines Harlow's four postcode districts, evaluating capital growth, rental yields (you can also use our rental yield calculator here to help), and the investment potential across the town centre and surrounding areas (CM17, CM18, CM19, CM20).

Article updated: January 2026

Harlow Buy-to-Let Market Overview 2026

Harlow's property market delivers sold prices 24% above the England average, reflecting the premium for this London commuter town, with these key statistics:

- Average sold price: £362,464 (24% above England's £293,131)

- Asking price range: £311,601 (CM20) to £466,909 (CM17) across Harlow postcodes

- Rental yields: 4.3% (CM17) to 5.9% (CM18, CM20) across postcodes with rental data

- Rental income: Monthly rents from £1,521 (CM20) to £1,668 (CM17)

- Price per sq ft: House prices from £364/sq ft (CM18) to £430/sq ft (CM17)

- Market activity: Sales ranging from 13 per month (CM19, CM20) to 29 per month (CM17)

- Deposit requirements: 30% deposits range from £93,480 (CM20) to £140,073 (CM17)

- Affordability ratios: Property prices from 8.2 to 12.3 times Harlow's median annual salary of £37,861

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Harlow?

Harlow's investment case rests on a simple equation: a standard London commute time, but with cheaper Essex house prices. The 30-minute train to Liverpool Street puts City workers within easy reach, while property prices sit roughly 70% below the capital. That gap sustains consistent tenant demand from professionals who've done the maths on renting here versus buying in London.

The employment base combines local industry with commuter convenience. Wholesale and retail accounts for 20.9% of local jobs, with health and social work adding another 20.9%. The Harlow Enterprise Zone has attracted science and technology employers, while administrative and support services contribute 11.6%. Construction and manufacturing each add 7%, reflecting the town's ongoing regeneration activity. You can see the full employment breakdown via the Nomis Labour Market Profile for Harlow.

Local earnings tell a more modest story than premium commuter towns. The median salary of £37,861 sits 19% above the national median of £31,875, but below the East of England average of £41,855. An employment rate of 76.2% and economic activity rate of 82.1% both compare reasonably to regional benchmarks. The claimant count of 4.3% runs slightly above the regional average of 3.2%, reflecting pockets of deprivation alongside the commuter population.

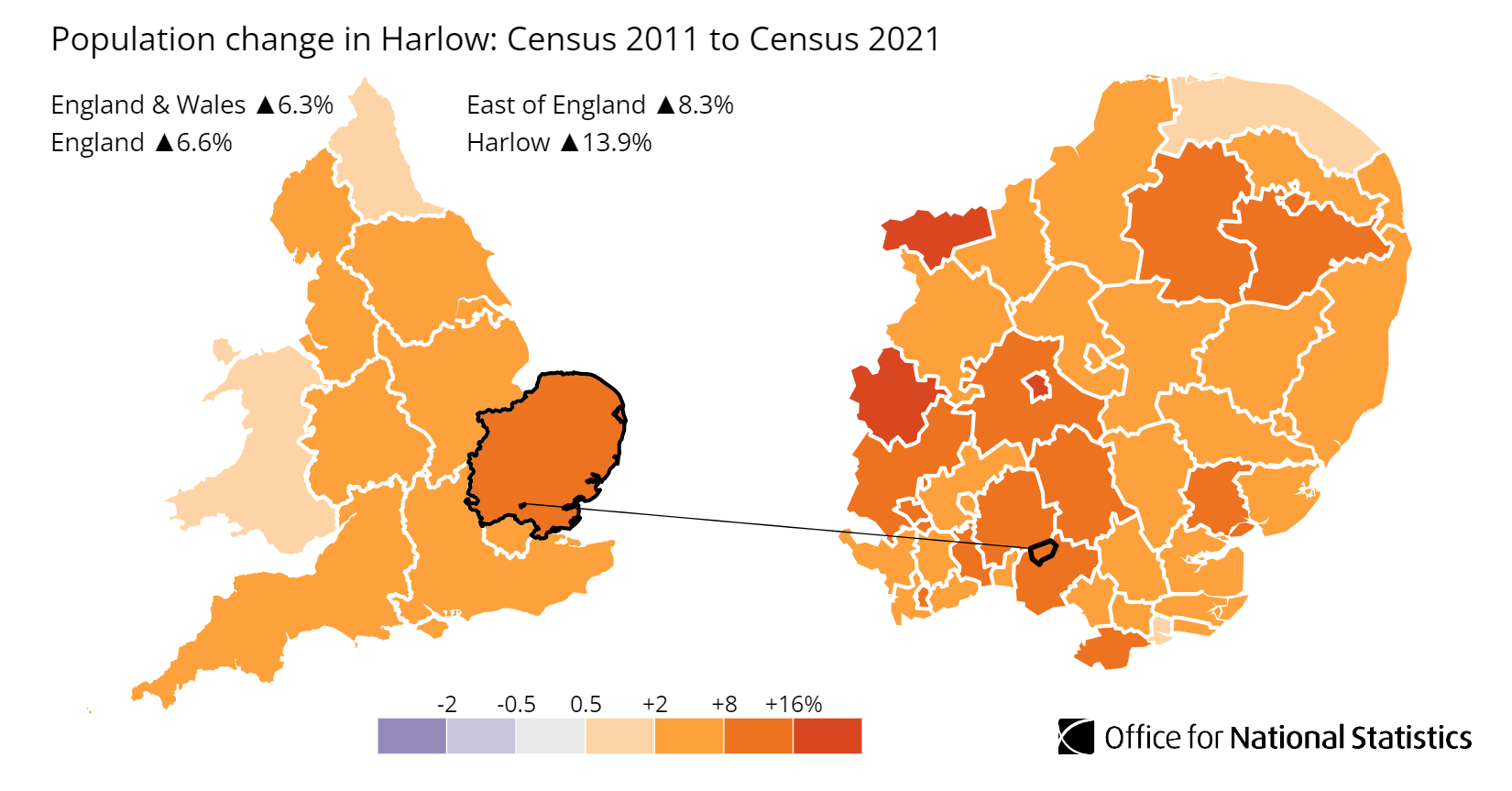

Population growth has been notably strong. According to the latest census data, the population of Harlow increased by 13.9%, rising from 81,900 in 2011 to 93,300 in 2021. That growth rate nearly doubled the England average of 6.6% and exceeded the East of England's 8.3%. The median age of 37 sits below both regional and national averages, suggesting a younger, working-age population driving rental demand. You can explore the breakdown via the ONS Census Data for Harlow.

For comparable London commuter markets, consider Basildon (similar new town origins with comparable prices and yields), Chelmsford (15 miles south with higher prices but more established city status), or Stevenage (another post-war new town with similar affordability dynamics on the other side of the M11).

Regeneration and Investment in Harlow

Harlow entered 2026 at a pivotal moment. After decades defined by its post-war new town architecture and pockets of decline, the government has now formally committed to making it a national science hub. The physical rebuilding of the town centre has moved from planning to construction, and infrastructure is arriving before the new housing it serves. For buy-to-let investors, the investment case is no longer speculative.

Major projects delivering real change include:

- National Biosecurity Centre (Government Confirmed): On 17 July 2025, the Health Secretary formally announced the UK Health Security Agency will relocate its headquarters and high-containment laboratories from Porton Down and Colindale to Harlow. This multi-billion pound investment includes £250 million committed this Parliament to kickstart delivery. The campus will create 2,750 permanent scientific jobs and inject an estimated £80 million annually into the local economy. First facilities open mid-2030s, fully operational by 2038. For investors, this locks in a future tenant demographic of high-skilled professionals. Details at GOV.UK Biosecurity Centre Announcement.

- Town Centre Regeneration (Active Construction): In December 2025, construction began on the transformation of Market Square backed by £23.7 million from the Towns Fund. The council has acquired Market House and Adams House, with the programme completing by Summer 2026. Simultaneously, work continues on the new Sustainable Transport Hub replacing the old bus station, and the Arts and Cultural Quarter at Playhouse Square. This is described as the largest regeneration programme undertaken by any district council in the UK. Updates at Harlow Council Market Square.

- Harlow and Gilston Garden Town (Infrastructure Unlocked): Following the Court of Appeal's dismissal of legal challenges in December 2025, the 10,000-home Gilston development can now proceed. Planning permission was granted in January 2025, and construction on the Central Stort Crossing is underway. The first Sustainable Transport Corridor connecting town centre to Burnt Mill roundabout reached completion at end of 2025, with dedicated bus lanes, walking and cycling infrastructure now operational. First homes expected 2026/27. Details at Harlow and Gilston Garden Town.

Harlow Property Market Analysis

When Was the Last House Price Crash in Harlow?

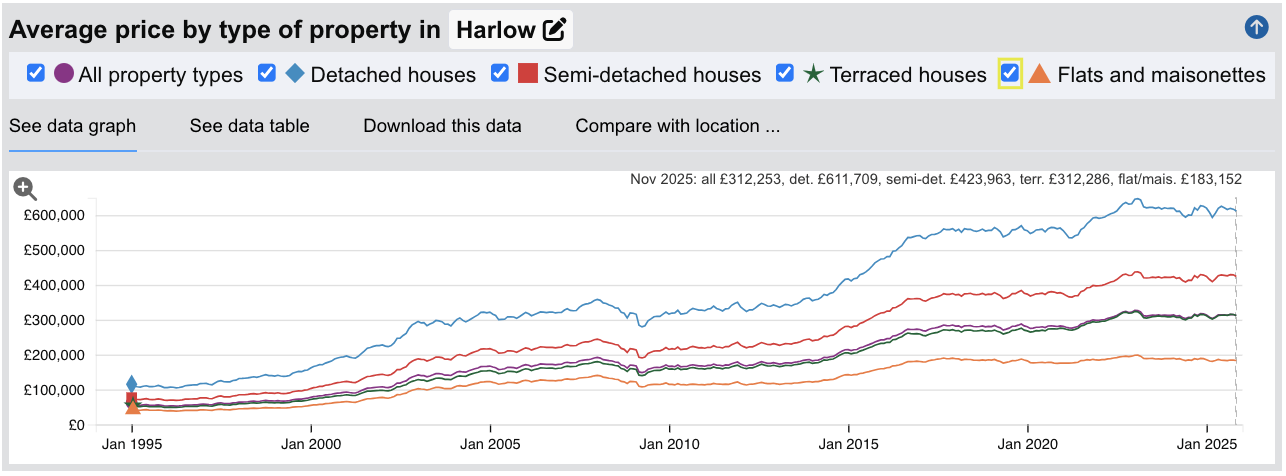

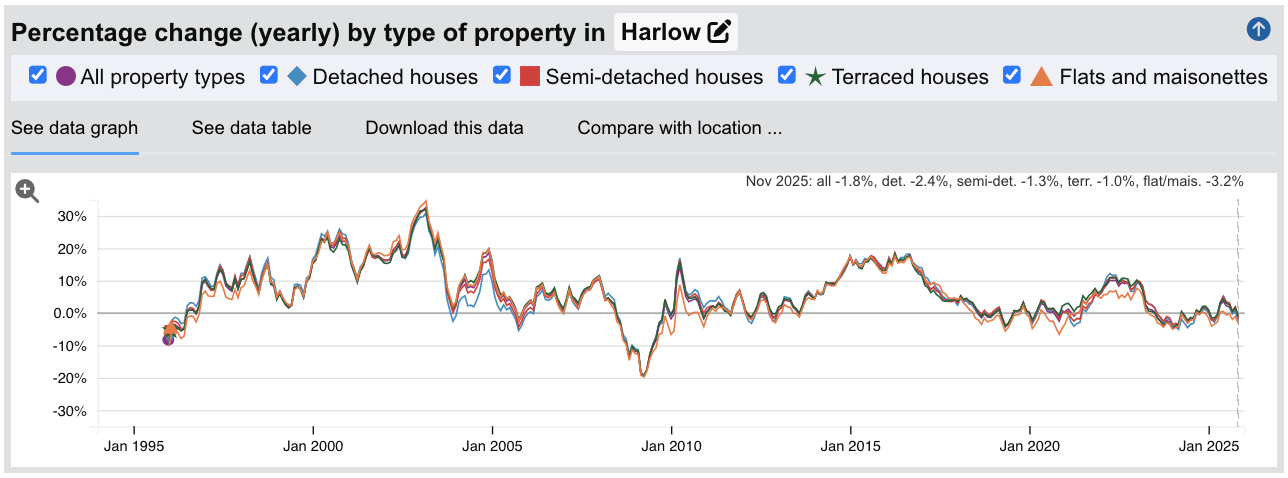

Harlow experienced a significant correction during the 2008 financial crisis. Average sold prices fell from a peak of £187,366 in November 2007 to a trough of £150,308 by March 2009, a decline of 19.8%. Recovery was slower than premium commuter towns, with prices not returning to pre-crash levels until April 2014.

Source: HM Land Registry House Price Index for Harlow

Here is how the Harlow property market has performed over key cycles:

- 1995-2007 saw property values more than triple, rising from £57,853 to £187,366 as Harlow benefited from its position on the West Anglia Main Line and relative affordability compared to inner Essex towns.

- 2008-2009 brought a correction of 19.8%. Harlow fell broadly in line with the wider South East, though the town's lower price point meant the absolute loss was less severe than premium markets.

- 2010-2013 saw a prolonged recovery with prices fluctuating between £165,000 and £185,000. The market essentially moved sideways for four years as the town's regeneration plans remained stalled.

- 2014-2016 delivered strong growth. Prices surged from £187,609 to £272,888, a gain of 45% in under three years. London's affordability crisis pushed first-time buyers and investors to look beyond traditional commuter towns, and Harlow's transport links made it an attractive option.

- 2017-2019 saw a plateau as stamp duty changes and Brexit uncertainty cooled demand. Prices fluctuated between £267,000 and £288,000 with modest gains.

- 2020-2022 brought the pandemic surge. Prices climbed from £275,922 to £323,640 as demand for affordable housing with London access intensified. Harlow's combination of space and value proved appealing to those priced out of Essex's premium markets.

- 2023 saw a modest correction of around 4.1% as mortgage rates spiked, with prices falling from the October 2022 peak of £323,640 to £310,296 by May 2023.

- 2024-2025 has shown stabilisation rather than recovery. Prices have hovered around £312,253 as of November 2025, essentially flat year-on-year as buyers await the regeneration investment to materialise.

Long-Term Property Value Growth in Harlow

For buy-to-let investors focused on capital preservation and long-term appreciation, Harlow's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 13.2% growth (£275,922 to £312,253)

- 10 years (2015-2025): 30.5% growth (£239,259 to £312,253)

- 15 years (2010-2025): 86.2% growth (£167,610 to £312,253)

- 20 years (2005-2025): 90.2% growth (£164,145 to £312,253)

- 30 years (1995-2025): 439.6% growth (£57,853 to £312,253)

The 2008 and 2023 corrections demonstrate that Harlow is not immune to property market cycles. However, the confirmed UKHSA investment and accelerating town centre regeneration change the forward picture. Previous cycles saw Harlow recover more slowly than premium Essex markets due to perception issues. The question for 2026 is whether confirmed government investment triggers a re-rating. For buy-to-let investors considering entry, the current flat market may represent an opportunity before regeneration delivery lifts values.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Harlow

The latest sold house price index by the Land Registry positions Harlow as one of the more affordable London commuter markets, with values sitting above national benchmarks but significantly below nearby Chelmsford or Essex averages.

Harlow property prices average £312,253, which is 7% above the England average of £293,131. This modest premium reflects the town's position as a value-oriented commuter market, with Liverpool Street just 30 minutes by train, combined with ongoing regeneration that has yet to fully reprice assets.

Detached houses command the steepest premium in absolute terms, averaging £611,709, a 28% uplift against the national average. These are concentrated in sought-after areas like Old Harlow and the fringes of the town near open countryside. Semi-detached houses average £423,963, sitting 47% above the England figure, popular with families seeking space within commuting distance of London.

Terraced houses average £312,286, representing a 30% premium on the national average. Much of Harlow's original new town housing stock falls into this category, including the distinctive mid-century designs across The Stow and older neighbourhoods. Flats and maisonettes offer the most accessible entry point at £183,152, sitting 17% below the national average. For investors, flats in CM20 near the town centre and station typically offer the strongest rental yield returns in the area.

Updated January 2026

| Property Type | Harlow Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £611,709 | £477,169 | +28.2% |

| Semi-detached houses | £423,963 | £287,166 | +47.7% |

| Terraced houses | £312,286 | £240,977 | +29.6% |

| Flats and maisonettes | £183,152 | £220,521 | -16.9% |

| All property types | £312,253 | £293,131 | +6.5% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Harlow (£)

Updated January 2026

The data represents the average sold price per square foot across Harlow's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | CM17 (Old Harlow, Churchgate Street) | £430 |

| 2 | CM19 (Church Langley, Newhall) | £385 |

| 3 | CM20 (Town Centre, Netteswell, Mark Hall) | £369 |

| 4 | CM18 (Staple Tye, Great Parndon, Potter Street) | £364 |

The £66 per square foot gap between CM17 and CM18 tells you everything about Harlow's internal market. Old Harlow (CM17) commands a 18% premium because it predates the new town entirely. Its period properties, village green, and independent character attract owner-occupiers willing to pay more for something that doesn't feel like Harlow. For investors, this premium typically translates to lower yields and longer void periods.

The real opportunity sits in the middle postcodes. CM20's town centre location near the station offers the lowest price per square foot after CM18, but with stronger rental demand from commuters. A £100,000 deposit buys approximately 270 sq ft of living space in CM17, or 275 sq ft in CM20. The difference is marginal, but CM20's 5.9% yields significantly outperform CM17's 4.3%. For refurbish property investors and developers, CM18 and CM20 offer the best combination of low entry cost and exit liquidity.

For Sale Asking House Prices in Harlow

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Harlow's four postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | CM17 (Old Harlow, Churchgate Street) | £466,909 |

| 2 | CM19 (Church Langley, Newhall) | £355,107 |

| 3 | CM18 (Staple Tye, Great Parndon, Potter Street) | £316,240 |

| 4 | CM20 (Town Centre, Netteswell, Mark Hall) | £311,601 |

Harlow's pricing reveals a clear old-versus-new town divide. CM17 commands a £155,000 premium over CM20, reflecting Old Harlow's character as a historic Essex village that predates the 1947 new town designation. Period cottages, the village high street, and proximity to countryside attract owner-occupiers willing to pay a 50% premium for something that doesn't feel like the new town.

CM18 and CM20 sit within £5,000 of each other, offering the core investment territory. CM20 covers the town centre, station area, and neighbourhoods closest to the future UKHSA campus. CM18 covers the western estates including Great Parndon and Potter Street, with strong transport links via the A414. Both represent classic new town housing stock: predominantly 1950s-1970s terraces and semis originally built for London overspill.

The positioning against national benchmarks is telling. CM18 and CM20 sit just 7-8% above the England average of £293,131, while CM17 commands a 59% premium. For investors seeking value commuter markets, the new town postcodes offer London access at near-national-average prices. The trade-off is aesthetic: you're buying into Harlow's post-war architecture, not Essex village charm.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

House Price Growth in Harlow (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| 1. CM19 (Church Langley, Newhall) | +4.6% | +5.2% | +19.3% |

| 2. CM18 (Staple Tye, Great Parndon, Potter Street) | +4.9% | +1.1% | +14.8% |

| 3. CM17 (Old Harlow, Churchgate Street) | +2.0% | +4.1% | +11.5% |

| 4. CM20 (Town Centre, Netteswell, Mark Hall) | +7.5% | -1.0% | +8.3% |

CM20 leads on recent momentum with +7.5% annual growth, the strongest one-year performance across all Harlow postcodes. This likely reflects early market anticipation of the UKHSA confirmation and town centre regeneration. The negative three-year figure (-1.0%) shows how far the postcode fell during the 2022-2023 correction, making recent gains a recovery rather than new highs.

CM19 demonstrates the strongest five-year growth at +19.3%, driven by newer housing stock at Church Langley and Newhall that appeals to families seeking modern builds. The consistent trajectory across all three timeframes suggests steady demand rather than speculative spikes.

CM17 shows the most muted growth across all periods, with five-year appreciation of just +11.5%. Old Harlow's premium pricing limits upside. Buyers at the top of the market rarely see the same percentage gains as those entering at lower price points. For capital growth, the value postcodes have outperformed.

Average Monthly Property Sales in Harlow

Updated January 2026

The data represents the average number of residential property sales per month across Harlow's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | CM17 (Old Harlow, Churchgate Street) | 29 |

| 2 | CM18 (Staple Tye, Great Parndon, Potter Street) | 19 |

| 3 | CM20 (Town Centre, Netteswell, Mark Hall) | 13 |

| 4 | CM19 (Church Langley, Newhall) | 13 |

Harlow's residential real estate transaction volumes are modest compared to larger Essex markets. The combined 74 monthly sales across all four postcodes is roughly what Chelmsford achieves in a single postcode. This matters for exit strategy. In a slower market or if you need to sell quickly, expect longer listing periods than you'd see in higher-volume locations.

CM17 leads with 29 monthly sales despite its premium pricing, reflecting Old Harlow's appeal to owner-occupiers and the broader catchment it serves beyond the new town. CM18 at 19 sales offers the best balance for investors: affordable entry prices, strong yields at 5.9%, and sufficient liquidity to transact without extended delays.

CM20 and CM19 both record 13 monthly sales. For CM20, this lower volume sits alongside the town's highest rental yields, suggesting properties are being held rather than flipped. For investors comfortable with longer holding periods, the combination of high yields and potential appreciation driven by the UK Health Security Agency (UKHSA) relocation makes the thinner market acceptable.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Harlow Rental Market Analysis

For new landlords and investors considering buying a first rental property in Harlow and thinking how much they can charge for rent across the town and its neighbourhoods, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering growing your real estate business in this area.

Rental Prices in Harlow (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Harlow.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | CM17 (Old Harlow, Churchgate Street) | £1,668 |

| 2 | CM18 (Staple Tye, Great Parndon, Potter Street) | £1,544 |

| 3 | CM20 (Town Centre, Netteswell, Mark Hall) | £1,521 |

| 4 | CM19 (Church Langley, Newhall) | Not enough data |

CM17 commands the highest rents at £1,668, but this reflects property size and Old Harlow's village character rather than stronger tenant demand. The 4.3% yield shows that premium rents don't offset the £466,909 average asking price. Tenants here are typically families seeking period properties and a quieter lifestyle outside the new town.

CM18 at £1,544 and CM20 at £1,521 represent the core rental market. The £23 monthly gap between them is negligible, but CM20's lower property prices translate to significantly better yields at 5.9% versus CM18's 5.9%. Both postcodes draw London commuters via Harlow Town station and workers at the Harlow Enterprise Zone. As the UKHSA campus develops through the 2030s, expect CM20 to see the strongest rental demand given its proximity to both the station and the future science hub.

CM19 lacks sufficient rental data to report, reflecting its predominantly owner-occupier character. Church Langley and Newhall were developed as family housing estates rather than rental stock. Investors targeting this postcode should note the limited comparable evidence for setting rents.

Gross Rental Yields in Harlow (%)

Updated January 2026

The data represents the average gross rental yields across Harlow's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | CM18 (Central Harlow, Staple Tye, Mark Hall) | 5.9% |

| 2 | CM20 (Town Centre, Netteswell, The Stow) | 5.9% |

| 3 | CM17 (Old Harlow, Church Langley, Newhall) | 4.3% |

| 4 | CM19 (Potter Street, Latton Bush, Sumners) | Not enough data |

CM18 and CM20 both deliver 5.9% gross yields, making them standout performers for the East of England. The difference lies in character: CM20 covers the town centre with 13 monthly sales and stronger 7.5% annual growth, while CM18 offers 19 monthly transactions and the more established residential neighbourhoods around Staple Tye. CM17 at 4.3% reflects Old Harlow's premium pricing and the newer Church Langley and Newhall developments where owner-occupiers dominate.

These yields place Harlow firmly among the strongest rental return markets within London commuter distance. Nearby Chelmsford tops out at 4.2% in CM1, while Basildon offers similar returns but without the direct Liverpool Street service. The 30-minute commute and sub-£320k average prices in CM18 and CM20 create a rare combination: genuine cash flow potential without sacrificing London accessibility. For investors priced out of the capital but wanting tenant demand driven by City workers, Harlow's yield profile is difficult to match this close to London.

Is Harlow Rent High?

Harlow rents are surprisingly affordable for a town just 30 minutes from Liverpool Street, making it one of the more accessible rental markets within the London commuter belt.

Average rent in Harlow costs between 48% and 53% of the average gross annual earnings for a full-time resident. This is based on the Nomis Labour Market Profile for Harlow showing the median gross annual income for Harlow residents is £37,861 (£728.10 weekly).

These percentages appear high against the 30% affordability guideline, but context matters. Harlow's median earnings reflect its local workforce, not its tenant base. Many renters are London commuters earning City salaries who choose Harlow precisely because rents here are a fraction of what they would pay in the capital. A £1,544 monthly rent in CM18 would consume over 70% of income in many London boroughs but represents genuine value for someone earning £50,000+ in Canary Wharf.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | CM17 (Old Harlow, Church Langley, Newhall) | 52.9% |

| 2 | CM18 (Central Harlow, Staple Tye, Mark Hall) | 48.9% |

| 3 | CM20 (Town Centre, Netteswell, The Stow) | 48.2% |

| 4 | CM19 (Potter Street, Latton Bush, Sumners) | Not enough data |

CM17's higher percentage reflects larger properties in the premium Old Harlow village and newer Newhall development, where rents are driven by family houses rather than the flats and terraces typical of central Harlow. CM18 and CM20 cluster around 48-49%, representing the core rental market where most buy-to-let activity concentrates.

For landlords, the gap between local earnings and actual tenant incomes creates opportunity. Harlow tenants are comparing rents to London alternatives, not to local wages. A professional couple paying £1,521 in CM20 might otherwise face £2,200+ for equivalent space in East London. This pricing headroom, combined with the town's regeneration trajectory, suggests rents have room to grow as Harlow's profile continues to improve.

Note: These calculations use median gross salary for Harlow residents from the 2025 ASHE data. Actual tenant affordability varies based on household income, with many Harlow tenants earning above the local median due to the commuter profile of the town.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Harlow House Prices High?

Harlow offers genuinely affordable entry points for a town with direct London commuter links. While prices have risen over the past decade, the town remains one of the most accessible markets within 30 minutes of Liverpool Street.

Purchasing a property in Harlow requires between 8.2 and 12.3 times the median annual salary. This is based on the Nomis Labour Market Profile for Harlow showing the median gross annual income for Harlow residents is £37,861.

The core urban postcodes tell the real story. CM18 and CM20 both sit around 8.2-8.4x income, placing them among the most affordable options in the London commuter belt. CM19 at 9.4x reflects a mix of established estates and newer developments, while CM17 at 12.3x captures the premium Old Harlow village market and contemporary Newhall housing where owner-occupiers, not investors, dominate.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | CM17 (Old Harlow, Church Langley, Newhall) | 12.3x |

| 2 | CM19 (Potter Street, Latton Bush, Sumners) | 9.4x |

| 3 | CM18 (Central Harlow, Staple Tye, Mark Hall) | 8.4x |

| 4 | CM20 (Town Centre, Netteswell, The Stow) | 8.2x |

For context, the England average price-to-income ratio sits around 9.2x based on national median earnings of £31,772 against average sold prices of £293,131. Harlow's CM18 and CM20 come in comfortably below this benchmark despite offering a 30-minute commute to the City. Lower local salaries are offset by lower property prices, creating a market that remains within reach for first-time buyers and investors alike.

This affordability gap explains Harlow's appeal to London leavers. A couple priced out of North London or stretching beyond their means in Hertfordshire can realistically purchase in CM18 or CM20 while keeping the same job. The Harlow and Gilston Garden Town expansion, with 10,000 planned homes, suggests the council expects this inward migration to continue. For investors, sustained demand from relocating Londoners supports both rental occupancy and the long-term case for capital growth.

How Much Deposit to Buy a House in Harlow?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £47,000 difference between the most affordable town centre postcode and the premium Old Harlow and Newhall areas.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | CM20 (Town Centre, Netteswell, The Stow) | £93,480 |

| 2 | CM18 (Central Harlow, Staple Tye, Mark Hall) | £94,872 |

| 3 | CM19 (Potter Street, Latton Bush, Sumners) | £106,532 |

| 4 | CM17 (Old Harlow, Church Langley, Newhall) | £140,073 |

Sub-£95,000 deposits in CM18 and CM20 place Harlow among the most accessible London commuter markets for new investors. The same capital required for a single property in nearby St Albans or Watford could secure two buy-to-lets in central Harlow, each delivering 5.9% yields. For portfolio builders focused on cash flow rather than prestige postcodes, the mathematics favour Harlow.

CM17's £140,000 deposit reflects a different market entirely. Old Harlow's period cottages and Newhall's contemporary architecture attract owner-occupiers and lifestyle buyers. Investors targeting this postcode should expect lower yields but potentially stronger tenant quality and longer tenancies from professionals seeking village character with London access.

How to Invest in Buy-to-Let in Harlow

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Harlow, Essex and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Harlow and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Alternative Markets to Harlow for Buy-to-Let Investment

Harlow delivers an unusual combination: near-6% yields within 30 minutes of Liverpool Street. But investors seeking different characteristics have options across the region. For similar commuter credentials with a different tenant profile, buy-to-let in Luton offers airport-driven demand and comparable entry prices, while buy-to-let in Southend-on-Sea provides coastal lifestyle appeal with strong yields along the c2c line.

If you're drawn to Essex but want deeper market liquidity, buy-to-let across Essex covers the full county with larger transaction volumes in towns like Colchester and Basildon. For investors prioritising raw yield over London proximity, buy-to-let in Stoke and buy-to-let in Hull deliver 7%+ returns at entry prices well below Harlow's, though with different growth trajectories and tenant demographics.