Where to Buy Property Investments in Hemel Hempstead: Yields of 4.8%

Hemel Hempstead won't win any beauty contests. A decade ago it was voted Britain's ugliest town. But for property investment, aesthetics matter far less than fundamentals, and Hemel's fundamentals are solid: 33-minute trains to London Euston, over 20,000 jobs at Maylands Business Park, and asking prices that sit comfortably between affordable Luton and premium St Albans.

Recent property data confirms where Hemel Hempstead sits in the market. Average asking prices range from £389,517 (HP2) to £487,360 (HP3), sitting 15% to 44% above the East of England average of £338,286, and 33% to 66% above the England average of £293,131. This reflects the commuter premium that defines the Hertfordshire market.

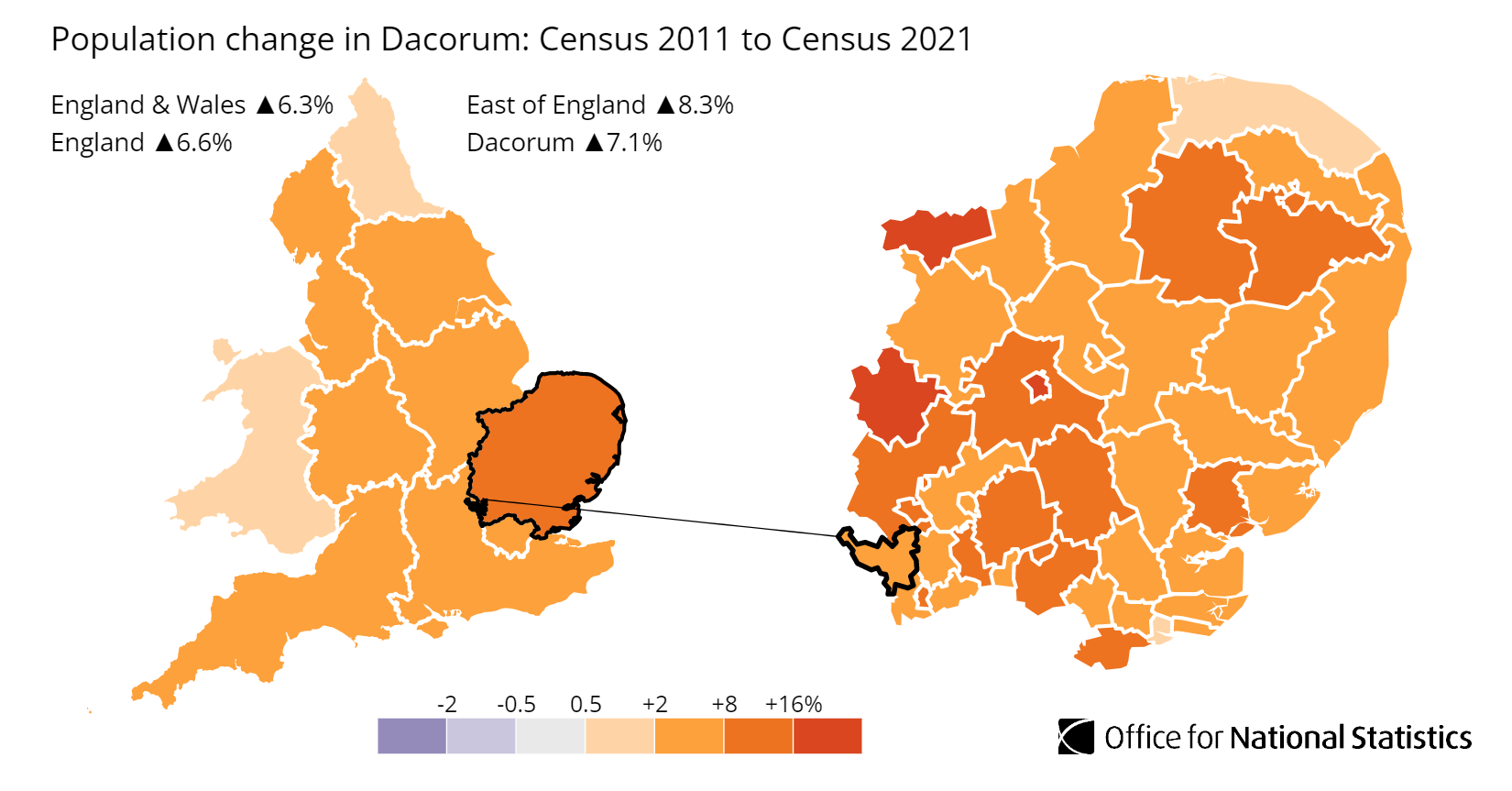

Hemel Hempstead sits within the Dacorum local authority, which recorded 7.1% population growth between the 2011 and 2021 censuses. Some data in this guide relates to Dacorum as a whole, while postcode-level figures focus specifically on the three Hemel Hempstead postcodes: HP1, HP2, and HP3.

Our buy-to-let analysis examines these three postcode districts, evaluating capital growth, rental yields (you can also use our rental yield calculator here to help), and the investment potential across the town centre (HP1), the south-west suburbs (HP2), and the rural villages to the south (HP3).

Article updated: January 2026

Hemel Hempstead Buy-to-Let Market Overview 2026

Hemel Hempstead's property market delivers asking prices 33% to 66% above the England average, reflecting the commuter premium for this Hertfordshire new town, with these key statistics:

- Asking price range: £389,517 (HP2) to £487,360 (HP3) across Hemel Hempstead postcodes

- Rental yields: 3.9% (HP3) to 4.8% (HP2) across different postcodes

- Rental income: Monthly rents from £1,458 (HP1) to £1,567 (HP3)

- Price per sq ft: House prices from £415/sq ft (HP2) to £466/sq ft (HP1)

- Market activity: Sales ranging from 24 per month (HP3) to 37 per month (HP2)

- Deposit requirements: 30% deposits range from £116,855 (HP2) to £146,208 (HP3)

- Affordability ratios: Property prices from 8.4 to 10.5 times Dacorum's median annual salary of £46,207

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Hemel Hempstead?

Hemel Hempstead's investment case rests on practical fundamentals rather than kerb appeal. The 33-minute train to London Euston puts City workers within easy commuting distance, while property prices sit roughly 40% below the capital. That gap sustains consistent tenant demand from professionals who've done the maths on renting here versus buying in London.

The employment base is stronger than most commuter towns. Maylands Business Park is one of the largest in the southeast, with over 20,000 people working there across companies including Amazon, Bourne Leisure, Sopra Steria, Henkel and Britvic. Administrative and support services account for 49.2% of local jobs according to the latest data, reflecting the concentration of business park employment. You can see the full employment breakdown via the Nomis Labour Market Profile for Dacorum.

Local earnings reflect this professional employment mix. The median salary of £46,207 sits 45% above the national median of £31,875, giving tenants genuine spending power. An employment rate of 88.3% and economic activity rate of 91.7% both significantly exceed regional and national averages. Jobs create rental demand. Simple as that.

Population growth has been steady. According to the latest census data, the population of Dacorum increased by 7.1%, rising from 144,800 in 2011 to 155,100 in 2021. The 2024 estimate puts the population at 161,420. The area is forecast to continue growing as major housing developments come forward through the Hemel Garden Communities project. You can explore the breakdown via the ONS Census Data for Dacorum.

For comparable Hertfordshire commuter markets, consider Watford (15 miles south with faster London trains but higher prices), Stevenage (similar new town character with more affordable entry points), or Milton Keynes (larger new town 20 miles north with comparable yields and stronger capital growth).

Regeneration and Investment in Hemel Hempstead

Hemel Hempstead is shedding its concrete new town reputation. For investors, the narrative in 2026 has shifted from simple renovation to massive structural expansion. With The Crown Estate now moving forward with Hertfordshire's largest urban extension, Hemel is positioning itself as a garden city for the 21st century.

- Hemel Garden Communities (East Hemel Submission): This is the headline project for the region. In late 2025, The Crown Estate submitted the outline planning application for East Hemel, a 4,000-home district forming the first phase of the wider Garden Community. This unlocks the Hertfordshire Innovation Quarter (Herts IQ), creating 1.8 million sq ft of commercial space and over 8,000 new jobs. For investors, this confirms that the long-promised employment growth is finally entering the delivery pipeline. Updates at Hemel Garden Communities Official Site.

- Dacorum Investment Partnership (Town Centre Reset): The mechanism for delivering town centre regeneration changed fundamentally in August 2025, when Dacorum Borough Council launched a 50:50 partnership with The Hill Group. This joint venture is designed to fast-track redevelopment of complex brownfield sites including Market Square. The introduction of private-sector capital and delivery expertise should accelerate progress on sites that have stalled for years.

- Paradise Depot (Active Construction): While the Garden Communities are long-term plays, this project is delivering now. Construction is well advanced on this key town centre site, with the new community hub scheduled for completion in September 2026 and 56 residential units following in early 2027. This serves as proof of concept for higher-density modern living in the town core.

The wider picture matters for rental demand. Maylands Business Park has traditionally been viewed as a logistics and distribution hub. With Herts IQ progressing, the employment base is shifting toward environmental technology and agri-science sectors. This should support demand for professional lets in HP2, which covers the Adeyfield and Maylands areas closest to these expanding employment zones.

Hemel Hempstead Property Market Analysis

When Was the Last House Price Crash in Hemel Hempstead?

HM Land Registry records house price data at local authority level, so the figures below cover Dacorum as a whole rather than Hemel Hempstead specifically. Dacorum includes Hemel Hempstead (the largest town), plus Berkhamsted, Tring, and surrounding villages. Hemel Hempstead accounts for roughly two-thirds of the borough's population.

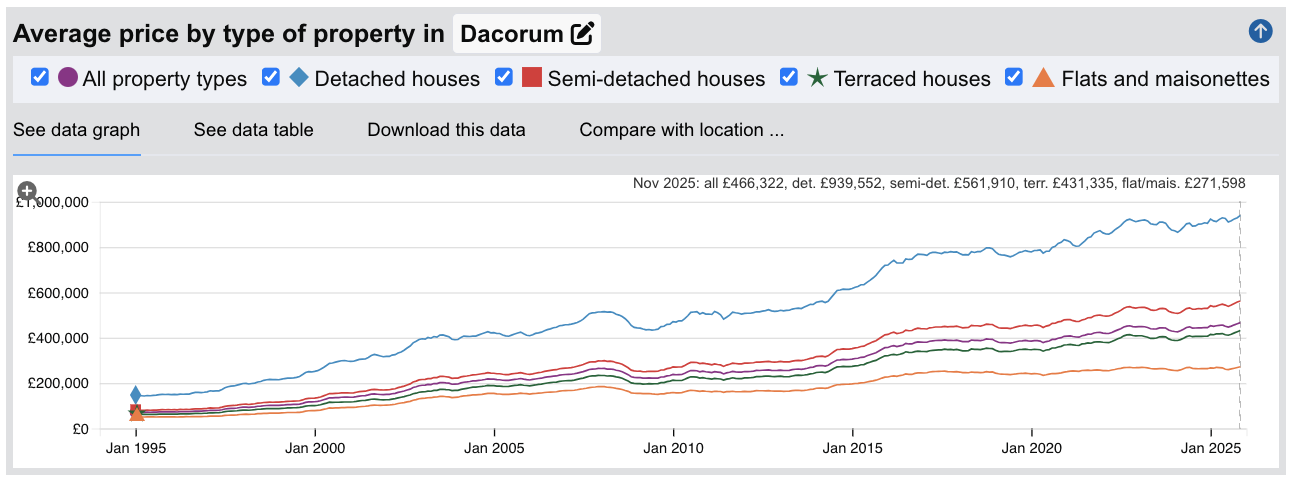

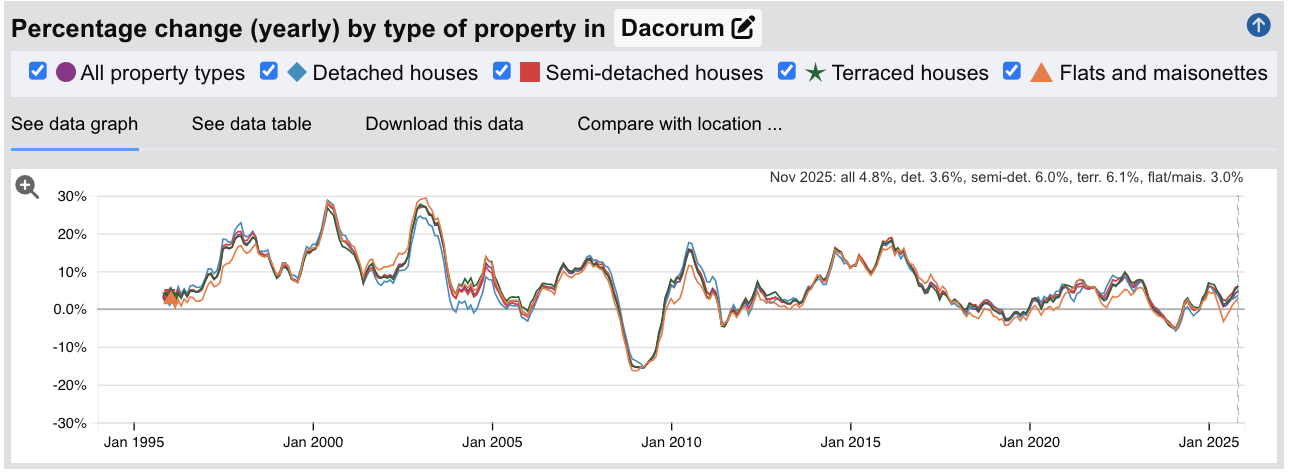

Dacorum experienced a significant correction during the 2008 financial crisis. Average sold prices fell from a peak of £264,386 in December 2007 to a trough of £221,357 by July 2009, a decline of 16.3%. Recovery was slow for this commuter market, with prices not returning to pre-crash levels until late 2013.

Source: HM Land Registry House Price Index for Dacorum

Here is how the Dacorum property market has performed over key cycles:

- 1995-2007 saw property values nearly quadruple, rising from £70,474 to £264,386 as Hemel Hempstead established itself as a prime London commuter location with Maylands Business Park driving local employment growth.

- 2008-2009 brought a correction of 16.3%. Dacorum fell broadly in line with the wider Hertfordshire market, though held up slightly better than some premium locations.

- 2010-2013 saw a prolonged sideways movement with prices fluctuating between £237,000 and £270,000. The market essentially treaded water for four years as buyers remained cautious following the financial crisis.

- 2014-2016 delivered exceptional growth. Prices surged from £270,135 to £380,424, a gain of 41% in three years. London's affordability crisis pushed commuters further out along the West Coast Main Line, and Hemel's combination of fast trains and local employment made it increasingly attractive.

- 2017-2019 saw a plateau as stamp duty changes and Brexit uncertainty cooled demand. Prices fluctuated between £375,000 and £394,000 with no clear direction.

- 2020-2022 brought the pandemic surge. Prices climbed from £386,596 to £452,532 as demand for family homes with gardens intensified. Hemel's new town housing stock, with its larger plots and off-street parking, proved particularly appealing to those leaving London.

- 2023 saw a mild correction of around 4.0% as mortgage rates spiked, with prices falling from the October 2022 peak of £452,532 to £429,394 by December 2023.

- 2024-2025 has marked clear recovery. Prices have climbed back to £466,322 as of November 2025, surpassing the previous peak and showing year-on-year growth of 7.5%.

Long-Term Property Value Growth in Dacorum

For buy-to-let investors focused on capital preservation and long-term appreciation, Dacorum's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 20.6% growth (£386,596 to £466,322)

- 10 years (2015-2025): 32.8% growth (£351,239 to £466,322)

- 15 years (2010-2025): 85.0% growth (£252,082 to £466,322)

- 20 years (2005-2025): 117.3% growth (£214,566 to £466,322)

- 30 years (1995-2025): 561.7% growth (£70,474 to £466,322)

The 2008 and 2023 corrections demonstrate that Hemel Hempstead is not immune to market cycles. However, the area's fundamentals remain strong. Structural demand from London commuters, a substantial local employment base at Maylands, and the constrained housing supply within the greenbelt have consistently driven recovery. The Hemel Garden Communities project will add significant new stock over the coming decades, but this is phased delivery rather than a supply glut.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Hemel Hempstead

The latest sold house price index by the Land Registry covers Dacorum local authority, which includes Hemel Hempstead alongside the more expensive market towns of Berkhamsted and Tring. The figures below therefore reflect the broader Dacorum average rather than Hemel Hempstead specifically, where prices tend to sit slightly below the borough average.

Dacorum property prices average £466,322, which is 59% above the England average of £293,131. This premium reflects the area's strong commuter appeal, with London Euston just 33 minutes by train from Hemel Hempstead, combined with substantial local employment at Maylands Business Park.

Detached houses command the steepest premium in absolute terms, averaging £939,552, more than double the national average. These are concentrated in the villages around Hemel and the premium areas of Berkhamsted and Bovingdon. Semi-detached houses average £561,910, sitting 94% above the England figure, popular with families seeking space within commuting distance of the station.

Terraced houses average £431,335, representing a 76% premium on the national average. Victorian and Edwardian terraces in the Old Town attract young professionals, while post-war terraces in the New Town areas offer more accessible entry points. Flats and maisonettes offer the most affordable option at £271,598, sitting 23% above the national average. For investors, flats in HP1 and HP2 near the town centre and station typically offer the strongest rental yield returns in the area.

Updated January 2026

| Property Type | Dacorum Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £939,552 | £474,400 | +98.1% |

| Semi-detached houses | £561,910 | £290,004 | +93.8% |

| Terraced houses | £431,335 | £245,002 | +76.1% |

| Flats and maisonettes | £271,598 | £221,565 | +22.6% |

| All property types | £466,322 | £293,131 | +59.1% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Hemel Hempstead (£)

Updated January 2026

The data represents the average sold price per square foot across Hemel Hempstead's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | HP1 (Old Town, Boxmoor, Felden) | £466 |

| 2 | HP3 (Apsley, Kings Langley, Bovingdon) | £463 |

| 3 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | £415 |

The £51 per square foot gap between HP1 and HP2 reflects the difference between Hemel Hempstead's established residential areas and its new town estates. HP1 covers Boxmoor and the Old Town, where Victorian terraces and period conversions near the station command premium prices per square foot despite often being smaller properties. HP2's post-war housing stock offers more space for less, which is precisely why it delivers the town's strongest rental yields at 4.8%.

For context, St Albans averages over £550 per square foot, while Luton sits closer to £320. Hemel Hempstead occupies the middle ground for Hertfordshire commuter towns: cheaper than the cathedral city but more expensive than the airport town. A £117,000 deposit (30% on a typical HP2 property) buys roughly 940 sq ft of living space here, compared to around 710 sq ft for the same capital in St Albans.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

For Sale Asking House Prices in Hemel Hempstead

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Hemel Hempstead's three postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | HP3 (Apsley, Kings Langley, Bovingdon) | £487,360 |

| 2 | HP1 (Old Town, Boxmoor, Felden) | £425,567 |

| 3 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | £389,517 |

HP3 commands a near £100,000 premium over HP2, but this reflects geography rather than desirability within Hemel Hempstead itself. HP3 extends south to cover Kings Langley and Bovingdon, both sought-after villages with their own character and communities. Apsley, closer to the town centre, anchors the lower end of this postcode with its canal-side developments and railway station offering direct trains to Euston.

HP1 and HP2 represent the core Hemel Hempstead market. HP1 covers the historic Old Town and Boxmoor, where period properties and proximity to the main station push prices above the town average. HP2 is the new town heartland: Adeyfield, Bennetts End, Highfield and Leverstock Green. The post-war housing estates here offer the most affordable entry point at £389,517, which is why HP2 also delivers the town's strongest yields.

All three postcodes exceed both the England average (£293,131) and Hertfordshire averages. Even HP2, the most accessible postcode, sits 33% above the national figure. Hemel Hempstead is not a bargain market. It trades on its 33-minute commute to London Euston, strong local employment at Maylands Business Park, and proximity to the M1 and M25.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

House Price Growth in Hemel Hempstead (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| 1. HP3 (Apsley, Kings Langley, Bovingdon) | +1.3% | +2.6% | +20.1% |

| 2. HP2 (Adeyfield, Bennetts End, Leverstock Green) | +3.1% | +2.6% | +17.7% |

| 3. HP1 (Old Town, Boxmoor, Felden) | +4.1% | +9.7% | +12.3% |

HP3 delivers the strongest five-year growth at +20.1%, driven by the pandemic-era demand for village living in Kings Langley and Bovingdon. Recent momentum has slowed to +1.3% annually as higher mortgage rates cooled the lifestyle buyer market. Investors who bought in 2020-2021 have done exceptionally well, but the easy gains have passed.

HP1 shows the strongest recent trajectory with +4.1% annual growth and +9.7% over three years. The Old Town and Boxmoor continue to attract buyers willing to pay a premium for character properties and station proximity. This steady appreciation reflects genuine demand rather than speculative excess.

HP2 sits in the middle with +3.1% annual growth and +17.7% over five years. The new town estates have benefited from buyers priced out of HP1 and HP3 seeking more affordable family homes. For yield-focused investors, HP2's combination of the lowest entry prices, strongest yields at 4.8%, and solid capital growth makes it the most balanced option across the three postcodes.

Average Monthly Property Sales in Hemel Hempstead

Updated January 2026

The data represents the average number of residential property sales per month across Hemel Hempstead's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | 37 |

| 2 | HP1 (Old Town, Boxmoor, Felden) | 30 |

| 3 | HP3 (Apsley, Kings Langley, Bovingdon) | 24 |

Hemel Hempstead's transaction volumes are healthy but not exceptional. Combined, the three postcodes see around 91 sales per month, which is lower than nearby Watford but reflects a stable market where properties sell without distress pricing. For investors considering refurbishment strategies, this level of activity supports confident exits without extended marketing periods.

HP2 leads with 37 monthly sales and the highest turnover rate at 25%. The combination of affordable entry prices, strong yields, and active buyer demand makes this the most liquid postcode for investors. HP1 at 30 sales shows steady activity in the Old Town and Boxmoor areas, where period properties attract both owner-occupiers and landlords.

HP3 records 24 monthly sales with an 18% turnover rate, the lowest across the three postcodes. Kings Langley and Bovingdon attract lifestyle buyers who tend to hold longer, which explains both the reduced transaction volume and the stronger five-year capital growth. Investors here should plan for longer holding periods and less predictable exit timing.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Hemel Hempstead Rental Market Analysis

For landlords considering purchasing their first residential property in Hemel Hempstead and thinking how much they can charge for rent across the town and its surrounding villages, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are weighing up the costs of running a buy-to-let in this area.

Rental Prices in Hemel Hempstead (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Hemel Hempstead.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | HP3 (Apsley, Kings Langley, Bovingdon) | £1,567 |

| 2 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | £1,564 |

| 3 | HP1 (Old Town, Boxmoor, Felden) | £1,458 |

The rental figures reveal something counterintuitive: HP2 achieves almost identical rents to HP3 (just £3 difference) despite asking prices £98,000 lower. This is precisely why HP2 delivers the town's strongest yields at 4.8%. Tenants pay for space and bedrooms, not postcode prestige, and HP2's larger new town family homes compete directly with the villages on rental income.

HP1 records the lowest average rent at £1,458, which seems surprising given its premium positioning around Boxmoor and the Old Town. The explanation lies in property mix: HP1 postcode district has a higher proportion of smaller flats and period conversions near the station, which command strong per-square-foot values but lower absolute rents than three and four-bed family homes elsewhere.

Hemel Hempstead rents sit comfortably above most Hertfordshire towns. Stevenage averages £1,100-£1,200, while Welwyn Garden City sits around £1,400. Only St Albans commands significantly higher rents in the county. The premium reflects Hemel's combination of fast London commuting, strong local employment, and proximity to both the M1 and M25.

Gross Rental Yields in Hemel Hempstead (%)

Updated January 2026

The data represents the average gross rental yields across Hemel Hempstead's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | 4.8% |

| 2 | HP1 (Old Town, Boxmoor, Felden) | 4.1% |

| 3 | HP3 (Apsley, Kings Langley, Bovingdon) | 3.9% |

HP2 leads at 4.8%, the only Hemel Hempstead postcode approaching the 5% threshold many investors target. The new town estates deliver competitive rents on significantly lower purchase prices, making HP2 the clear choice for yield-focused landlords. HP1 at 4.1% reflects the premium paid for period character and station proximity in Boxmoor and the Old Town. HP3 at 3.9% shows that Kings Langley and Bovingdon's village appeal commands prices that rents cannot fully justify from an investment standpoint.

Hemel Hempstead yields are typical for the Hertfordshire commuter belt but sit below what's achievable further from London. Luton delivers yields above 5.5% with entry prices around £250,000, while Milton Keynes offers similar commute times to Euston with yields approaching 5%. The trade-off is tenant profile and long-term growth. Dacorum's median earnings of £46,207 sit 16% above the national average, attracting professional tenants with stable employment at Maylands Business Park and the surrounding M1 corridor. Lower yields, but dependable demand.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Is Hemel Hempstead Rent High?

Hemel Hempstead rents sit firmly above the affordability threshold, though local earnings are strong enough to sustain demand without excessive tenant stress.

Average rent in Hemel Hempstead costs between 38% and 41% of the average gross annual earnings for a full-time resident. This is based on the Nomis Labour Market Profile for Dacorum showing the median gross annual income for Dacorum residents is £46,207 (based on £888.60 median weekly pay).

The general affordability guideline suggests rent should not exceed 30% of gross income. All three Hemel Hempstead postcodes exceed this threshold by a significant margin. However, Dacorum's median earnings sit 16% above the England average, reflecting the professional workforce drawn to Maylands Business Park and the London commuter population earning City salaries. The tenants who rent in Hemel Hempstead typically earn above the local median.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | HP3 (Apsley, Kings Langley, Bovingdon) | 40.7% |

| 2 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | 40.6% |

| 3 | HP1 (Old Town, Boxmoor, Felden) | 37.9% |

The near-identical percentages for HP2 and HP3 (40.6% vs 40.7%) reflect their similar average rents despite very different property profiles. HP2's new town family homes and HP3's village properties both attract tenants willing to commit a substantial portion of income for space and quality of life outside London. HP1's lower percentage stems from its smaller average property sizes near the station rather than genuinely cheaper rents.

For investors, these figures indicate a mature rental market where tenants accept premium pricing for the combination of fast London access, local employment, and Hertfordshire schools. Unlike London where affordability constraints are forcing tenants outward, Hemel Hempstead is often where they land. The 33-minute Euston commute means tenants compare these rents to Zone 3-4 London alternatives, not to Dacorum wages alone.

Note: These calculations use median gross salary for Dacorum residents from the 2025 ASHE data. Actual tenant affordability varies based on household income, with many Hemel Hempstead tenants earning above the local median due to the commuter profile of the town.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Hemel Hempstead House Prices High?

Hemel Hempstead sits in the middle ground for Hertfordshire affordability. Prices are elevated compared to the national average, but the town remains more accessible than St Albans, Harpenden, or the premium parts of the county that compete for similar buyers.

Purchasing a property in Hemel Hempstead requires between 8.4 and 10.5 times the median annual salary. This is based on the Nomis Labour Market Profile for Dacorum showing the median gross annual income for Dacorum residents is £46,207 (based on £888.60 median weekly pay).

HP2 at 8.4x offers the most accessible entry point, sitting below the England average ratio of around 9.1x despite being a London commuter location. This is where Dacorum's strong local earnings (16% above the national median) genuinely help buyers and investors. HP1 at 9.2x reflects the premium for period properties and station proximity in Boxmoor and the Old Town. HP3 at 10.5x covers Kings Langley and Bovingdon, where larger village homes push ratios into territory that requires dual professional incomes or substantial deposits.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | HP3 (Apsley, Kings Langley, Bovingdon) | 10.5x |

| 2 | HP1 (Old Town, Boxmoor, Felden) | 9.2x |

| 3 | HP2 (Adeyfield, Bennetts End, Leverstock Green) | 8.4x |

For context, the England average price-to-income ratio sits around 9.1x based on national median earnings of £31,875 against average sold prices of £293,131. Hemel Hempstead's most affordable postcode, HP2, actually undercuts this national benchmark. Higher local salaries genuinely offset property prices here, which is not always the case in commuter towns where wages lag behind house price inflation.

This relative affordability explains why Hemel Hempstead continues to attract London leavers and first-time buyers priced out of the capital. A couple unable to stretch to St Albans (where ratios exceed 13x) can realistically purchase in HP2 while keeping the same London job. For investors, this sustained buyer demand from relocating professionals supports both rental occupancy and the steady property equity growth the town has delivered over the past decade.

How Much Deposit to Buy a House in Hemel Hempstead?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £29,000 difference between the most accessible postcode and the premium areas to the south.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | HP2 (Adeyfield, Leverstock Green) | £116,855 |

| 2 | HP1 (Old Town, Boxmoor) | £127,670 |

| 3 | HP3 (Apsley, Kings Langley) | £146,208 |

For investors comparing Hertfordshire options, the same £117,000 deposit required for HP2 would secure entry into Stevenage with change to spare, or stretch further still in Luton where asking prices sit around 25% below Hemel Hempstead. However, Hemel's combination of Euston commute times and Maylands Business Park employment keeps tenant demand consistently strong.

Investors targeting HP2's higher yields might consider using our loan to value calculator to model different purchase scenarios. With 37 sales per month, HP2 postcode district offers enough market liquidity to find competitively priced stock without waiting months for the right opportunity.

How to Invest in Buy-to-Let in Hemel Hempstead

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Hemel Hempstead, Hertfordshire and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Hemel Hempstead and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Alternative Markets to Hemel Hempstead for Buy-to-Let Investment

Hemel Hempstead offers strong employment fundamentals and reliable commuter demand, but investors seeking different risk-return profiles have options across the region. For higher yields within the same commuter belt, buy-to-let in Watford delivers faster trains into Euston with a more urban tenant profile, while buy-to-let in Milton Keynes combines similar journey times with a younger, faster-growing population.

If Hertfordshire remains your focus but entry prices feel stretched, buy-to-let in Welwyn Garden City offers direct King's Cross services with comparable new town stock. For investors comfortable looking further north where yields climb significantly, buy-to-let in Birmingham and buy-to-let in Leicester provide strong rental markets at entry prices 40% below Hemel Hempstead's average.