Where to Buy Property Investments in Southend-on-Sea: Yields of 4.8%

Southend-on-Sea delivers rental yields of 4.8% in SS2, with 53-minute trains to Fenchurch Street and a population that grew 4.0% between the last two censuses. For property investment in a genuine seaside commuter market without London prices, those buy-to-let numbers are worth exploring further.

New property data confirms where Southend-on-Sea sits in the market. Average sold prices in Southend-on-Sea of £330,526 sit 12.8% above the England average of £293,131, but 2.3% below the East of England average of £338,286. This positions Southend as one of the more affordable entry points into the Essex property market, with coastal living and London commuter access included.

Our buy-to-let analysis examines Southend-on-Sea's five postcode districts, evaluating capital growth, gross rental yields, and the investment potential across the seafront (SS0, SS1), the northern suburbs (SS2), the eastern beaches (SS3), and the premium market of Leigh-on-Sea (SS9).

Article updated: January 2026

Southend-on-Sea Buy-to-Let Market Overview 2026

Southend-on-Sea's property market delivers sold prices 12% above the England average, reflecting the premium for this coastal commuter city just 45 minutes from London, with these key statistics:

- Average sold price: £329,000 (12% above England's £293,131)

- Asking price range: £312,809 (SS0) to £441,816 (SS9) across Southend postcodes

- Rental yields: 3.9% (SS3) to 4.8% (SS2) across different postcodes

- Rental income: Monthly rents from £1,129 (SS0) to £1,489 (SS9)

- Price per sq ft: House prices from £338/sq ft (SS0) to £439/sq ft (SS9)

- Market activity: Sales ranging from 23 per month (SS3) to 55 per month (SS9)

- Deposit requirements: 30% deposits range from £93,843 (SS0) to £132,545 (SS9)

- Affordability ratios: Property prices from 7.4 to 10.5 times Southend-on-Sea's median annual salary of £42,130

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Southend-on-Sea?

Southend-on-Sea offers something unusual in the South East: coastal living within genuine commuting distance of London. The 45-minute train to Fenchurch Street puts City workers on the seafront, while property prices sit 12% above the national average but well below what you'd pay for equivalent space in the capital. That combination sustains steady tenant demand from commuters, young professionals, and families priced out of London.

The city gained city status in 2022, a posthumous tribute to the campaigning of local MP Sir David Amess. Beyond the ceremonial significance, city status has helped raise Southend's profile for inward investment and regeneration funding. The council has been actively pursuing major projects ever since.

The employment base is more varied than a pure commuter town. Health and social work accounts for 18.8% of local jobs, anchored by Southend University Hospital. Education adds another 12.5%, while retail and accommodation services reflect the tourism economy. Major employers include HMRC (one of the largest regional offices), the NHS, and the growing cluster of businesses around London Southend Airport. You can see the full employment breakdown via the Nomis Labour Market Profile for Southend-on-Sea.

Local earnings are solid. The median salary of £42,130 sits above the national median, giving tenants reasonable spending power. An employment rate of 82.4% and economic activity rate of 85.9% both exceed regional and national averages, reflecting a working population rather than a retirement town. Jobs matter.

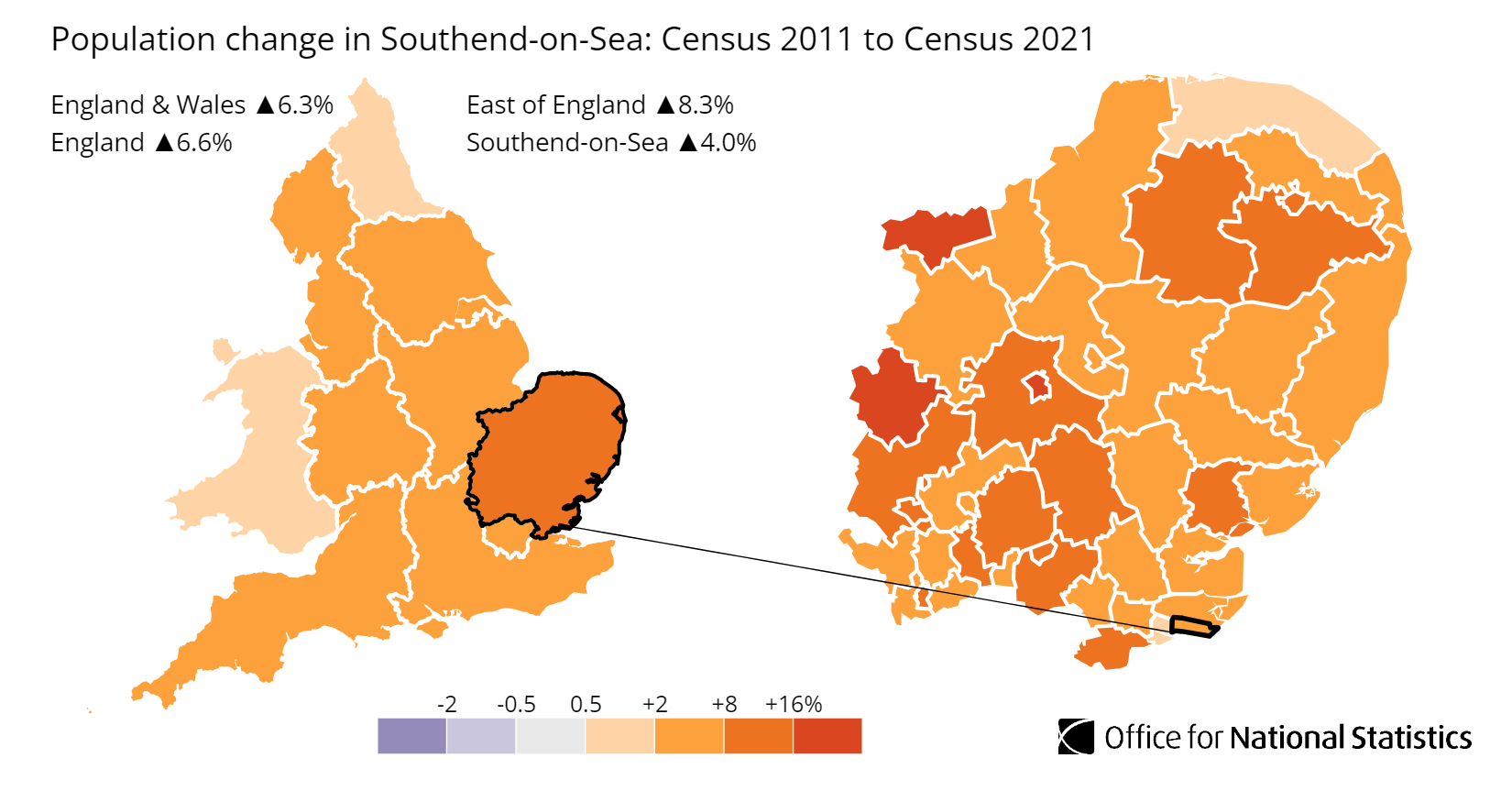

Population growth has been steady rather than spectacular. According to the latest census data, the population of Southend-on-Sea increased by 4.0%, rising from 173,700 in 2011 to 180,700 in 2021. The 2024 estimate puts the population at 185,256. The median age of 41 reflects the mix of families and working professionals. Private renting has grown significantly, rising from 22.0% to 26.5% of households between the 2011 and 2021 censuses. You can explore the breakdown via the ONS Census Data for Southend-on-Sea.

For comparable Essex commuter markets, consider Basildon (15 minutes inland with similar prices and yields), Chelmsford (30 minutes north with higher prices but stronger professional tenant demand), or Colchester (further north with lower entry prices and university-driven rental demand).

Regeneration and Investment in Southend-on-Sea

Southend is in transition. The confirmed closure of the University of Essex campus in summer 2026 has cooled the student market, but two major housing projects are finally progressing after years of delays. For investors in 2026, the strategy is shifting from student HMOs to professional lets and family housing.

The key developments to watch:

- Fossetts Farm: After years of deadlock, March 2025 saw the breakthrough. Southend City Council and Thames Plaza signed conditional contracts to deliver around 805 new homes on the former Southend United training ground. The first phase of 122 family homes was approved in July 2025, with construction expected to begin in summer 2026. The deal also unlocks £12 million for refurbishing Roots Hall stadium. This is houses-led development rather than apartment blocks, targeting long-term family tenants. Updates at Southend City Council.

- Better Queensway: This £500m estate regeneration has finally moved to physical delivery. While the search for a new housing partner continues, infrastructure works began in September 2025, with contractor Taylor Woodrow filling in the Queensway underpass to create street-level crossings. This work, backed by a £15m Homes England grant, is de-risking the site for the eventual delivery of 1,600 new homes. Details at Better Queensway Project.

- The Dirty Dozen: In December 2025, the council launched an enforcement strategy targeting 12 prominent stalled sites including Marine Plaza and the Kursaal. The policy forces owners to either develop or sell. For investors watching for renovation opportunities or land deals, this signals forced movement on long-stalled projects throughout 2026. The full list is at Southend City Council.

University Campus Closure: What It Means for Investors

The University of Essex will close its Southend campus in August 2026, relocating approximately 800 students to Colchester. International student numbers at the campus had fallen 52% since 2021-22, making the site unviable.

For investors, this is a significant market shift. If you own or are considering HMOs in the SS1 city centre postcode, you're facing a guaranteed demand drop from September 2026. The strategy is conversion to professional lets: with 45-minute trains to London and prices below Basildon or Chelmsford, there's a commuter market to serve. But don't buy student accommodation in Southend expecting the demand you'd find in established university towns.

Southend-on-Sea Property Market Analysis

When Was the Last House Price Crash in Southend-on-Sea?

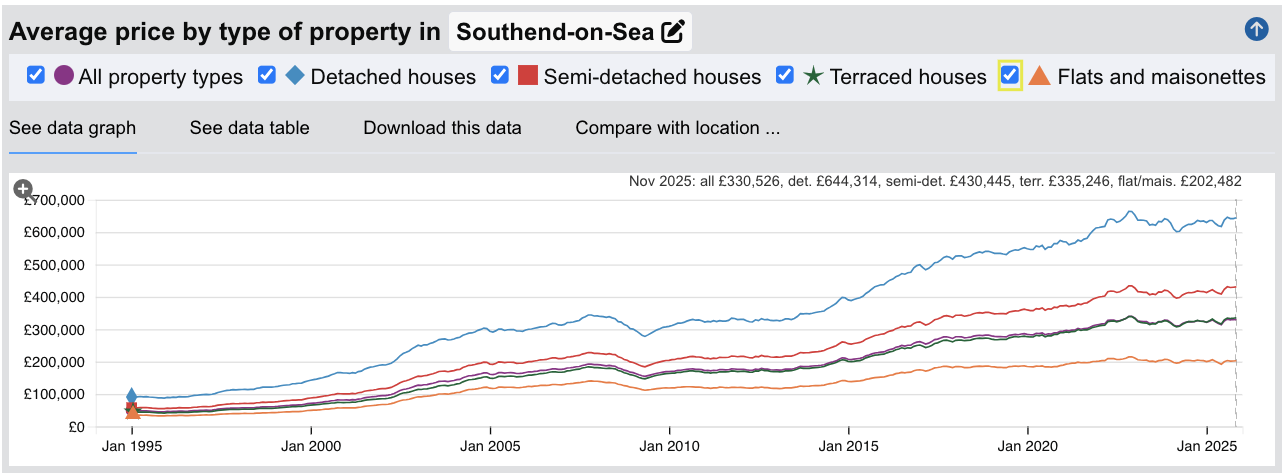

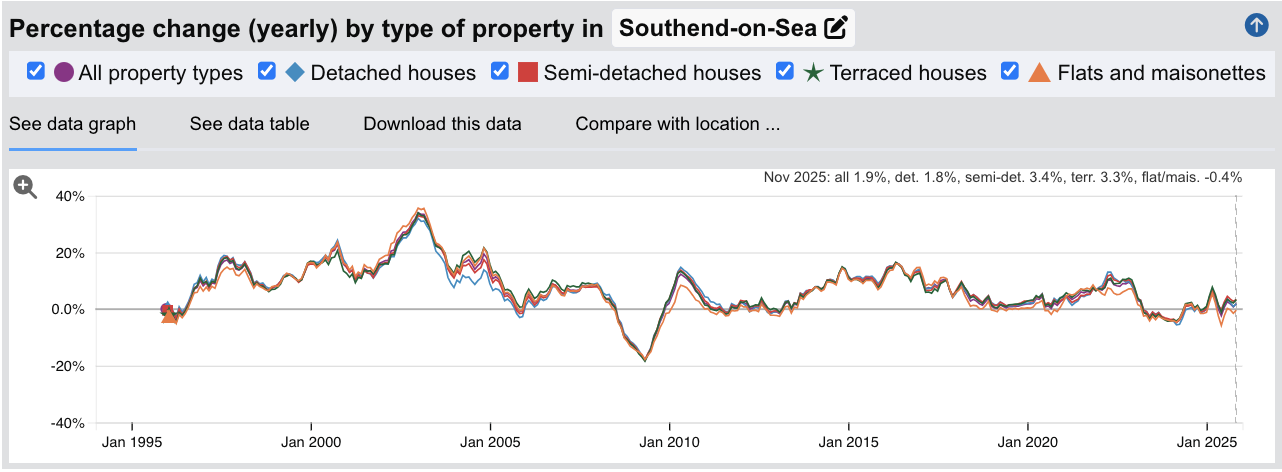

Southend experienced a notable correction during the 2008 financial crisis, though slightly less severe than nearby Chelmsford. Average sold prices fell from a peak of £192,269 in November 2007 to a trough of £159,349 by March 2009, a decline of 17.1%. Recovery was relatively swift, with prices returning to pre-crash levels by late 2013.

Source: HM Land Registry House Price Index for Southend-on-Sea

Here is how the Southend property market has performed over key cycles:

- 1995-2007 saw property values more than quadruple, rising from £45,939 to £192,269 as Southend benefited from improving rail links to London and growing demand from commuters priced out of the capital.

- 2008-2009 brought a correction of 17.1%. Southend held up slightly better than some Essex neighbours, partly due to its more affordable entry point attracting buyers who couldn't stretch to Chelmsford or Brentwood.

- 2010-2013 saw a slow recovery with prices fluctuating between £170,000 and £185,000. The market essentially moved sideways for four years as buyers remained cautious post-crash.

- 2014-2016 delivered exceptional growth. Prices surged from £186,212 to £260,164, a gain of 40% in under three years. London's affordability crisis pushed commuters further out, and Southend's combination of coastal lifestyle and c2c rail links proved compelling.

- 2017-2019 saw a plateau as stamp duty changes and Brexit uncertainty cooled demand. Prices fluctuated between £271,000 and £286,000 with no clear direction.

- 2020-2022 brought the pandemic surge. Prices climbed from £282,650 to £340,088 as demand for space intensified. Southend's seafront and proximity to green spaces proved particularly appealing to those leaving London.

- 2023 saw a correction of around 7.3% as mortgage rates spiked, with prices falling from the November 2022 peak of £340,088 to £317,616 by June 2023.

- 2024-2025 has marked recovery. Prices have climbed back to £330,526 as of November 2025, approaching the previous peak and showing year-on-year growth of 0.7%.

Long-Term Property Value Growth in Southend-on-Sea

For buy-to-let investors focused on capital preservation and long-term appreciation, Southend's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 16.9% growth (£282,650 to £330,526)

- 10 years (2015-2025): 45.1% growth (£227,772 to £330,526)

- 15 years (2010-2025): 89.2% growth (£174,804 to £330,526)

- 20 years (2005-2025): 101.8% growth (£163,680 to £330,526)

- 30 years (1995-2025): 619.6% growth (£45,939 to £330,526)

The 2008 and 2023 corrections demonstrate that Southend is not immune to property market cycles. However, the city's fundamentals remain intact. Structural demand from London commuters, the coastal lifestyle premium, and constrained housing supply have consistently driven recovery. The key risk for investors is overpaying at the top of a cycle, but those who held through 2008 have seen their investments more than double.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Southend-on-Sea

The latest sold house price index by the Land Registry confirms Southend's position as a mid-market coastal commuter location, with values sitting above national benchmarks but remaining more accessible than nearby Chelmsford or the prime Essex markets.

Southend property prices average £330,526, which is 13.4% above the England average of £291,515. This modest premium reflects the city's coastal lifestyle appeal combined with practical London commuting, though it remains significantly more affordable than Chelmsford (34% above average) or Cambridge.

Detached houses command the steepest premium in absolute terms, averaging £644,314, a 37% uplift against the national average. These are concentrated in Thorpe Bay (SS1), Leigh-on-Sea (SS9), and the seafront roads of Westcliff. Semi-detached houses average £430,445, sitting 48% above the England figure, popular with families seeking space near good schools and the beach.

Terraced houses average £335,246, representing a 37% premium on the national average. Victorian and Edwardian terraces in Westcliff and Southchurch attract young professionals and landlords targeting the commuter market. Flats and maisonettes offer the most accessible entry point at £202,482, sitting 8% below the national average. For investors, flats near Southend Central and Southend Victoria stations typically offer the strongest rental yields in the city.

Updated January 2026

| Property Type | Southend Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £644,314 | £470,151 | +37.0% |

| Semi-detached houses | £430,445 | £289,909 | +48.5% |

| Terraced houses | £335,246 | £243,978 | +37.4% |

| Flats and maisonettes | £202,482 | £219,065 | -7.6% |

| All property types | £330,526 | £291,515 | +13.4% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Southend-on-Sea (£)

Updated January 2026

The data represents the average sold price per square foot across Southend's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | SS9 (Leigh-on-Sea) | £442 |

| 2 | SS0 (Westcliff-on-Sea) | £367 |

| 3 | SS1 (Southend Central, Southchurch) | £339 |

| 4 | SS2 (Prittlewell, Eastwood) | £336 |

| 5 | SS3 (Shoeburyness) | £312 |

The spread here is significant. £130 per square foot separates the most expensive postcode (SS9) from the cheapest (SS3). This reflects the clear premium buyers pay for Leigh-on-Sea's village character, independent shops, and established community feel. Leigh commands prices comparable to Chelmsford (£421-425/sq ft), despite being further from London.

For comparison, Chelmsford averages £421-425 per square foot, while Basildon sits closer to £300. Southend's central postcodes (SS1, SS2, SS3) occupy the more affordable end, offering genuine value for investors willing to look beyond the Leigh premium.

The practical implication for investors is that location selection matters significantly in Southend. A £100,000 deposit in SS3 (Shoeburyness) buys roughly 320 sq ft of living space, while the same capital in SS9 (Leigh-on-Sea) gets you just 226 sq ft. That's a 42% difference in property size for the same money. However, yield dynamics partly offset this: SS1 delivers yields of 4.8% while SS9 offers just 3.9%. The cheaper postcodes work harder as rental investments, even if capital growth potential favours Leigh.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

For Sale Asking House Prices in Southend-on-Sea

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Southend's five postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | SS9 (Leigh-on-Sea) | £441,816 |

| 2 | SS0 (Westcliff-on-Sea) | £359,432 |

| 3 | SS2 (Prittlewell, Eastwood) | £324,156 |

| 4 | SS3 (Shoeburyness) | £315,605 |

| 5 | SS1 (Southend Central, Southchurch) | £312,809 |

Southend's pricing reveals a clear coastal premium hierarchy. SS9 (Leigh-on-Sea) commands a £129,000 premium over SS1, reflecting its status as the city's most desirable address. Leigh's independent shops, Old Town character, and strong community feel attract buyers willing to pay Chelmsford prices for a seaside location.

SS0 (Westcliff-on-Sea) sits in the middle ground at £359,432, offering Victorian and Edwardian properties with sea views at a significant discount to Leigh. The cliffs area and roads running down to the seafront command the highest prices within SS0.

The remaining three postcodes cluster tightly between £312,809 and £324,156. SS1 covers the city centre and Southchurch, offering the most affordable entry point but also facing the impact of the university campus closure. SS2 spans Prittlewell and Eastwood, more residential and family-oriented. SS3 (Shoeburyness) sits at the eastern end of the city, quieter and more self-contained with its own high street and beach.

Compared to other East of England markets, Southend offers genuine value. SS1 at £312,809 undercuts the regional average of £340,037 by 8%, while even premium SS9 sits below Cambridge entry prices. For investors targeting the London commuter market, Southend represents more accessible capital requirements than most Essex alternatives.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

House Price Growth in Southend-on-Sea (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| SS2 (Prittlewell, Eastwood) | +2.5% | -3.9% | +10.2% |

| SS3 (Shoeburyness) | +4.1% | -4.9% | +9.7% |

| SS0 (Westcliff-on-Sea) | +2.2% | -3.8% | +7.3% |

| SS9 (Leigh-on-Sea) | +0.7% | -5.7% | +5.9% |

| SS1 (Southend Central, Southchurch) | +0.3% | -5.1% | +5.9% |

The pattern here tells an important story: Southend's most affordable postcodes are now outperforming its premium areas. SS2 and SS3 lead on five-year growth, while SS9 (Leigh-on-Sea) and SS1 lag behind. This is the affordability effect in action. As prices in Leigh pushed beyond £440,000, buyers shifted to areas where the same money stretches further.

The negative three-year figures across all postcodes reflect the 2022-2023 correction when mortgage rates spiked. Every postcode gave back ground, with premium SS9 falling hardest (-5.7%). But the five-year view shows all areas remain in positive territory, confirming that investors who held through the correction are still ahead. For those weighing up whether is buy-to-let a good investment, the data suggests the recovery phase is underway, with the more affordable entry points currently showing the strongest momentum.

Average Monthly Property Sales in Southend-on-Sea

Updated January 2026

The data represents the average number of residential property sales per month across Southend's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | SS0 (Westcliff-on-Sea) | 55 |

| 2 | SS9 (Leigh-on-Sea) | 55 |

| 3 | SS2 (Prittlewell, Eastwood) | 49 |

| 4 | SS1 (Southend Central, Southchurch) | 42 |

| 5 | SS3 (Shoeburyness) | 23 |

Southend records 224 property sales per month across its five postcodes, indicating a liquid market where investors can buy and exit without extended waiting periods. For context, this is higher than many Kent coastal towns and comparable to Portsmouth, another commuter-friendly seaside city.

SS0 and SS9 share the top spot with 55 monthly sales each, though for different reasons. Westcliff's activity reflects its mix of flats and family homes at mid-market prices, while Leigh's volume shows sustained demand despite premium pricing. Both offer confident exit routes for investors considering the brrrr strategy in the uk looking to refinance or sell after refurbishment.

SS3 (Shoeburyness) at 23 monthly sales is notably quieter, reflecting its position at the eastern edge of the city. Properties here take longer to sell, which cuts both ways: harder to exit quickly, but also less competition when buying and more room for negotiation. Investors with longer holding periods and patience for the right deal will find this works in their favour.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Southend-on-Sea Rental Market Analysis

For landlords and investors considering the Southend rental market, the data below shows monthly rental income and yields across the city's postcodes. With the University of Essex campus closing in August 2026, the tenant profile is shifting from students toward working professionals and commuters. Understanding where demand is strongest helps you target the right properties. If you're starting a property business or expanding an existing portfolio, these figures provide the baseline for your investment calculations.

Rental Prices in Southend-on-Sea (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Southend-on-Sea.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | SS9 (Leigh-on-Sea) | £1,449 |

| 2 | SS0 (Westcliff-on-Sea) | £1,284 |

| 3 | SS3 (Shoeburyness) | £1,264 |

| 4 | SS1 (Southend Central, Southchurch) | £1,253 |

| 5 | SS2 (Prittlewell, Eastwood) | £1,129 |

SS9 (Leigh-on-Sea) commands the highest rents at £1,449, reflecting its status as Southend's premium address. Tenants here are typically professional families and London commuters willing to pay for the Old Town character, independent shops, and village feel. The 3.9% yield shows that high rents don't fully offset the £441,816 average asking price.

The middle three postcodes cluster within £31 of each other, from £1,253 to £1,284. SS0 (Westcliff) edges ahead on rent but offers similar yields to SS1 and SS3. These areas draw a mix of commuters, young professionals, and families who want coastal living without the Leigh premium. SS2 (Prittlewell) at £1,129 offers the lowest rents but also the lowest entry prices, making it attractive for investors focused on yield rather than absolute rental income.

Southend rents sit competitively against other Sussex and Essex coastal markets. Brighton commands significantly higher rents but at much steeper entry prices. Hastings offers lower rents but weaker commuter links. Southend occupies a middle ground: genuine London access with rents that support positive cash flow at current mortgage rates.

Gross Rental Yields in Southend-on-Sea (%)

Updated January 2026

The data represents the average gross rental yields across Southend's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | SS1 (Southend Central, Southchurch) | 4.8% |

| 2 | SS3 (Shoeburyness) | 4.8% |

| 3 | SS0 (Westcliff-on-Sea) | 4.3% |

| 4 | SS2 (Prittlewell, Eastwood) | 4.2% |

| 5 | SS9 (Leigh-on-Sea) | 3.9% |

SS1 and SS3 share the top spot at 4.8%, though for different reasons. SS1's yield reflects its lower entry prices and city centre location near both train stations. The university closure will test this, but commuter demand should absorb much of the gap. SS3 (Shoeburyness) combines affordable prices with decent rents, appealing to families seeking quieter coastal living away from the town centre.

For context, Southend yields sit competitively against other Essex markets. Colchester delivers similar yields in its urban postcodes, while Chelmsford sits slightly lower at 4.0-4.2%. The trade-off with premium SS9 (Leigh-on-Sea) at 3.9% is familiar: lower yield but stronger capital growth potential and a more affluent tenant pool. Investors must decide whether they're optimising for cash flow or long-term appreciation.

Is Southend-on-Sea Rent High?

Southend rents sit at the upper end of affordability for a coastal commuter city, though they remain more manageable than Brighton or London markets that many tenants might otherwise consider.

Average rent in Southend-on-Sea costs between 32% and 41% of the average gross annual earnings for a full-time resident. This is based on the Nomis Labour Market Profile for Southend-on-Sea showing the median gross annual income for Southend residents is £42,130.

The general affordability guideline suggests rent should not exceed 30% of gross income. Four of Southend's five postcodes exceed this threshold, with only SS2 (Prittlewell) sitting close to the guideline at 32.2%. However, these figures compare favourably to nearby Chelmsford (34-39%) and are significantly below Brighton where rents consume 45-50% of local income. Southend offers a more affordable alternative for professionals who want coastal living with London access.

The city's tenant profile explains this pricing. Southend attracts London commuters on the c2c line, NHS workers from Southend University Hospital, HMRC staff from one of the largest regional offices, and young professionals priced out of the capital. These tenants can absorb rents above the 30% guideline because their actual household incomes often exceed the local median.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | SS9 (Leigh-on-Sea) | 41.3% |

| 2 | SS0 (Westcliff-on-Sea) | 36.6% |

| 3 | SS3 (Shoeburyness) | 36.0% |

| 4 | SS1 (Southend Central, Southchurch) | 35.7% |

| 5 | SS2 (Prittlewell, Eastwood) | 32.2% |

The higher percentage in SS9 (Leigh-on-Sea) reflects its premium positioning rather than affordability pressure. Tenants choosing Leigh are paying for the village character, independent shops, and community feel. They're making a lifestyle choice, not stretching to afford basic housing. SS2 offers the most accessible entry point for tenants, which partly explains its appeal to families and first-time renters.

For investors, these figures indicate a market where rents have room to grow. Unlike Brighton where yields are compressed because rents have hit their ceiling, Southend tenants are not yet stretched to breaking point. The 45-minute commute to Fenchurch Street means tenants compare Southend rents to East London alternatives, not to local wages alone.

Note: These calculations use median gross salary for Southend residents from the 2025 ASHE data. Actual tenant affordability varies based on household income, with many Southend tenants earning above the local median due to the commuter profile of the city.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Southend-on-Sea House Prices High?

Southend sits in accessible territory for a coastal commuter market. Prices are elevated compared to the national average, but the city remains more affordable than Brighton, Chelmsford, or the premium Essex markets that compete for similar tenants.

Purchasing a property in Southend-on-Sea requires between 7.4 and 10.5 times the median annual salary. This is based on the Nomis Labour Market Profile for Southend-on-Sea showing the median gross annual income for Southend residents is £42,130.

Four of five postcodes cluster between 7.4x and 8.5x income. This is stretched by historic standards but within reach for dual-income professional households, particularly those earning London salaries. Premium SS9 (Leigh-on-Sea) at 10.5x reflects its status as the city's most desirable address rather than the typical buy-to-let entry point.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | SS9 (Leigh-on-Sea) | 10.5x |

| 2 | SS0 (Westcliff-on-Sea) | 8.5x |

| 3 | SS2 (Prittlewell, Eastwood) | 7.7x |

| 4 | SS3 (Shoeburyness) | 7.5x |

| 5 | SS1 (Southend Central, Southchurch) | 7.4x |

For context, the England average price-to-income ratio sits around 9.1x based on national median earnings of £31,875 against average sold prices of £291,515. Southend's central postcodes actually come in below this national benchmark despite being a coastal commuter location. Higher local salaries partially offset property prices, and the absence of a significant premium market (unlike Cambridge or Brighton) keeps ratios accessible.

This relative affordability explains why Southend continues to attract London leavers. A couple priced out of South London or unable to stretch to Chelmsford can realistically purchase in SS1, SS2, or SS3 while keeping the same job. For investors, this sustained buyer demand from relocating Londoners supports both rental occupancy and long-term capital growth.

Investors seeking even lower entry points in Essex might consider Colchester with similar ratios but university-driven demand, or look further afield to Ipswich where sub-6x ratios offer stronger yields with improving transport links.

How Much Deposit to Buy a House in Southend-on-Sea?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £39,000 difference between the most accessible city postcode and premium Leigh-on-Sea.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | SS1 (Southend Central, Southchurch) | £93,843 |

| 2 | SS3 (Shoeburyness) | £94,682 |

| 3 | SS2 (Prittlewell, Eastwood) | £97,247 |

| 4 | SS0 (Westcliff-on-Sea) | £107,830 |

| 5 | SS9 (Leigh-on-Sea) | £132,545 |

The sub-£100,000 deposits in SS1, SS2, and SS3 make Southend one of the more accessible coastal markets in the South East. The same £94,000 deposit that buys one property in SS1 wouldn't stretch as far in Brighton or Eastbourne, both coastal commuter towns with higher entry prices. Southend's 45-minute c2c journey to Fenchurch Street offers genuine London access at a lower capital requirement than most South Coast alternatives.

Investors with larger deposits might consider targeting SS9 (Leigh-on-Sea) for its stronger capital growth potential, or splitting capital across two properties in SS1 or SS3 to diversify risk and maximise rental income. The stamp duty calculator can help you model the total acquisition costs for each scenario.

How to Invest in Buy-to-Let in Southend-on-Sea

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Southend-on-Sea, Essex and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Southend-on-Sea and across the region including:

- Buy-to-let investment properties

- BMV properties for sale

- Airbnbs for sale

- Holiday lets for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a holiday home investment or a serviced accommodation asset

- Due diligence when buying investment property

Consider Alternative Markets to Southend-on-Sea for Buy-to-Let Investment

Southend offers coastal living with genuine London commuter credentials, but investors seeking different risk-return profiles have options across the country. For higher yields with faster cash flow, buy-to-let in Liverpool and buy-to-let in Manchester deliver 6%+ returns with strong tenant demand from growing city economies.

If coastal living remains your priority but Southend's university closure concerns you, buy-to-let in Bournemouth offers a larger student market with two universities, while buy-to-let in Portsmouth combines naval employment stability with seaside appeal. For investors comfortable looking further north, buy-to-let in Leeds and buy-to-let in Sheffield provide strong rental markets at significantly lower entry points.