Where to Buy Property Investments in Ipswich: Yields of 5.1%

Ipswich delivers rental yields of 5.1% in IP2, with property prices sitting 22% below the England average and just over an hour from London Liverpool Street. For property investment in the East of England without Cambridge prices, those fundamentals deserve attention.

New property data confirms where Ipswich sits in the market. Average sold prices in Ipswich of £227,730 sit 22% below the England average of £291,515, and 33% below the East of England average of £340,037. This is a working county town with genuine affordability, not a commuter premium market.

Our buy-to-let analysis examines Ipswich's five postcode districts, evaluating capital growth, rental yields, (you can also use our rental yield calculator here to help), and the real estate investment potential across the city (IP1-IP4 postcodes) and the suburban fringe at Kesgrave (IP5).

Article updated: January 2026

Ipswich Buy-to-Let Market Overview 2026

Ipswich's property market delivers sold prices 22% below the England average, offering genuine affordability in a region where prices typically run high, with these key statistics:

- Average sold price: £227,730 (22% below England's £291,515)

- Asking price range: £222,353 (IP2) to £367,563 (IP5) across Ipswich postcodes

- Rental yields: 3.9% (IP5) to 5.1% (IP2) across different postcodes

- Rental income: Monthly rents from £929 (IP3) to £1,182 (IP5)

- Price per sq ft: House prices from £248/sq ft (IP2) to £337/sq ft (IP5)

- Market activity: Sales ranging from 20 per month (IP5) to 38 per month (IP1)

- Deposit requirements: 30% deposits range from £66,706 (IP2) to £110,269 (IP5)

- Affordability ratios: Property prices from 6.2 to 10.2 times Ipswich's median annual salary of £35,948

Contents

-

by Robert Jones, Founder of Property Investments UK

With two decades in UK property, Rob has been investing in buy-to-let since 2005, and uses property data to develop tools for property market analysis.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Why Invest in Ipswich?

Ipswich operates as Suffolk's county town and the commercial hub for the eastern corner of England. This isn't a glamorous tech cluster or university city. It's a working town with a diversified employment base, solid transport links, and property prices that actually allow positive cash flow from day one.

The employment picture shows why tenant demand remains steady. Ipswich has a jobs density of 0.94, meaning jobs nearly match the working-age population. Health and social care leads at 18.1% of employment, anchored by Ipswich Hospital. Financial services runs at 5.6%, well above the 3.4% national average, with Willis Towers Watson and Ipswich Building Society among the major employers. The Port of Felixstowe, the UK's busiest container port just 12 miles south, drives a logistics sector accounting for 6.9% of local jobs. You can see the full employment breakdown via the Nomis Labour Market Profile for Ipswich.

Transport links connect Ipswich to London and the wider region without the price premium of closer commuter towns. Greater Anglia runs direct trains to Liverpool Street in around 1 hour 10 minutes, with two services per hour. The A14 provides dual carriageway access to Cambridge in 45 minutes, linking to the M11 and Midlands beyond. For a town of 140,000, the infrastructure punches above its weight.

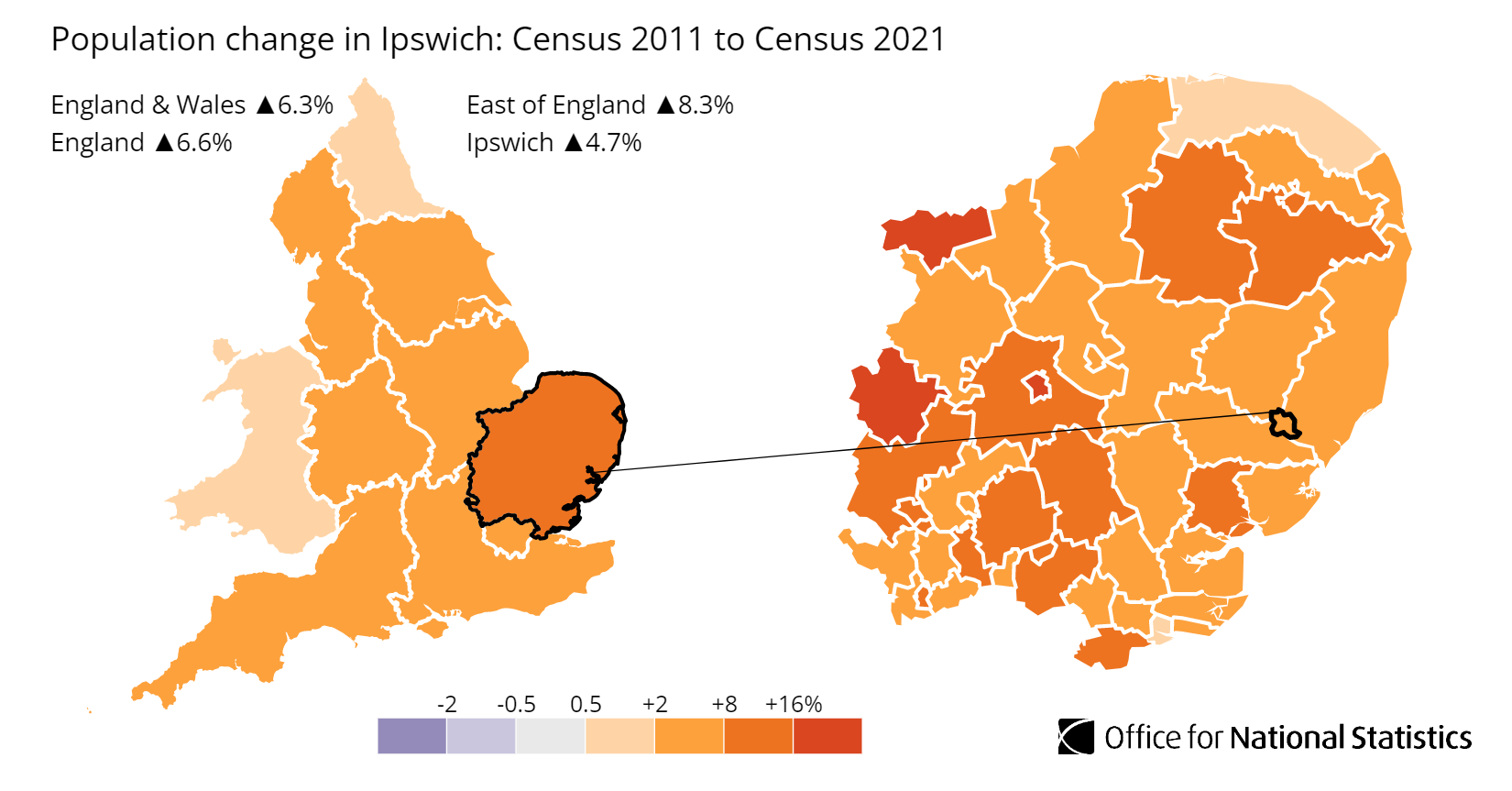

Population growth has been modest but consistent. According to the latest census data, the population of Ipswich increased by 4.7%, rising from 133,400 in 2011 to 139,600 in 2021. That's below the East of England average of 8.3%, but steady growth in a market this affordable supports stable rental demand without the speculative pressures of faster-growing areas. You can explore the breakdown via the ONS Census Data for Ipswich.

For comparable markets in the East of England, consider Peterborough (similar affordability, although much greater population growth, 46 minutes to London), Norwich (larger regional capital with university demand), or Colchester (newly awarded city status, 50 minutes to Liverpool Street).

Regeneration and Investment in Ipswich

Ipswich has spent years in the shadow of Norwich and Cambridge, but 2025 marked the year delivery overtook planning. The Freeport East designation, combined with renewed interest from London commuters priced out of closer markets, has shifted the narrative from "potential" to "construction." For investors, 2026 is when long-stalled heritage projects and major housing expansions hit key milestones simultaneously.

Major projects delivering real change include:

- Ipswich Garden Suburb - Henley Gate (Local Centre): This is the town's most significant residential expansion in decades. With Phase 1 on the northern fringe largely occupied, developer Crest Nicholson has confirmed that construction of the new Local Centre is accelerating in Q2 2026. This critical phase delivers the retail and community heart that transforms the housing estate into a functioning neighbourhood. For investors, this creates a sustainable rental catchment in the IP4 postcode. Updates at Henley Gate Official Site.

- Broomhill Pool (Reopening Summer 2026): After 24 years of closure, Ipswich's Grade II listed lido is in its final fit-out phase following a £10m restoration funded by the National Lottery Heritage Fund and Fusion Lifestyle. The confirmed target is a grand reopening for the Summer 2026 season. For investors, this restores a major leisure anchor to the western suburbs, significantly boosting the desirability of the Sherrington Road conservation area.

- The Baths Creative Hub (Spring 2026 Start): In December 2025, the Council confirmed a £1.92m Towns Fund grant to transform the former Baths music venue into a digital skills lab. Construction is officially scheduled to begin in Spring 2026. This project is designed to retain young creative talent in the town centre—exactly the demographic that drives demand for high-spec flats in IP1. Read the announcement at Ipswich Borough Council News.

- Freeport East Innovation Showcase (March 2026): While centred on the port, the economic benefits are flooding into Ipswich. The "Clean Growth Pre-Accelerator" is holding its major Innovation Showcase in March 2026. This initiative effectively markets Ipswich as a low-cost, high-connectivity alternative to Cambridge for green-tech start-ups, driving a new wave of commercial tenant demand. Details at Freeport East.

- University of Suffolk Dental School: The new Dental CIC (Community Interest Company) at Neptune Quay became fully operational in 2025. Unlike general undergraduates, dental students have 5-year courses and higher budget requirements. This has created a "micro-market" of premium demand for 2-bed waterfront apartments around Duke Street, driven by medical staff and students who need proximity to the new training facilities.

Ipswich Property Market Analysis

When Was the Last House Price Crash in Ipswich?

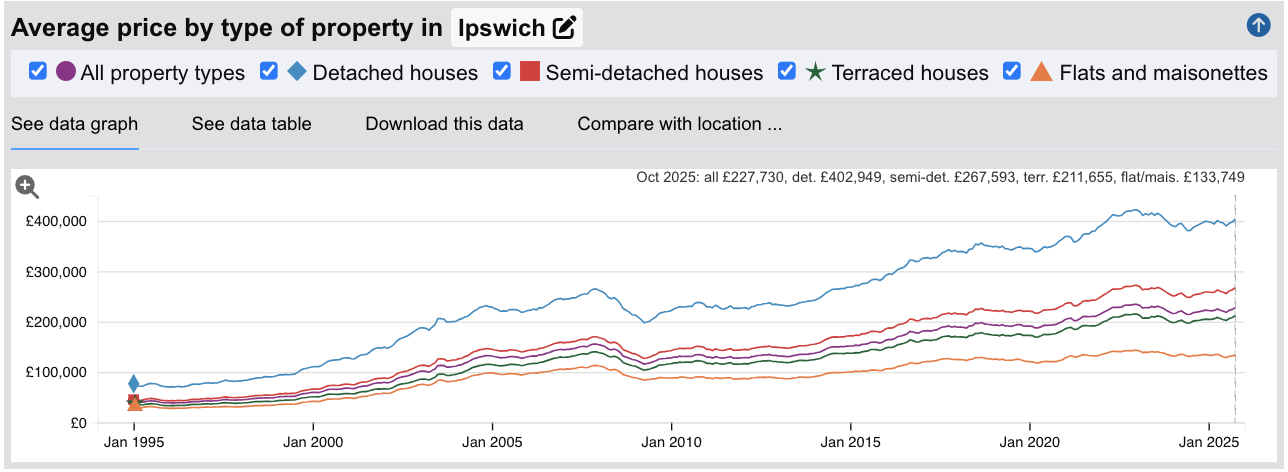

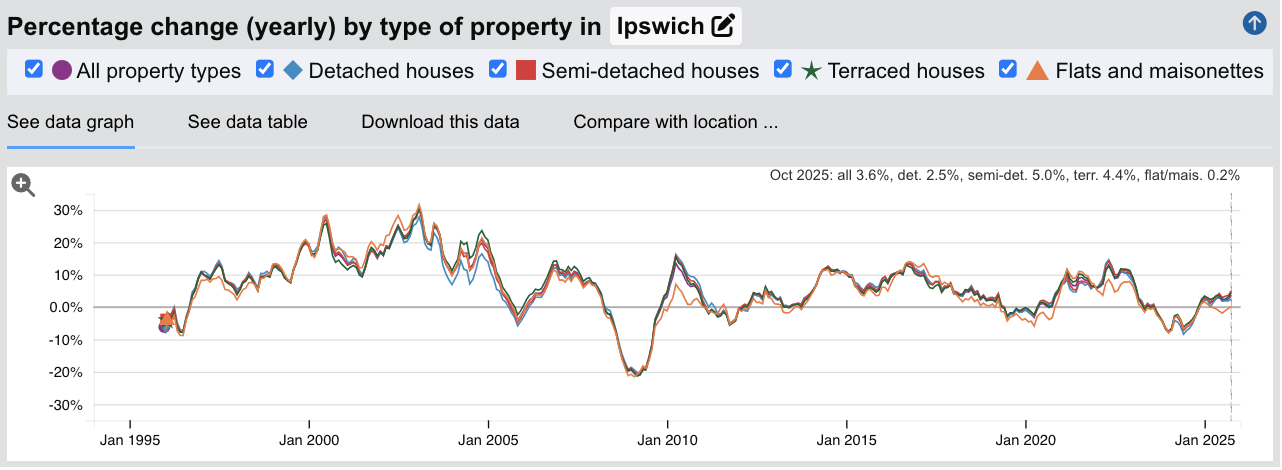

Ipswich experienced a significant correction during the 2008 financial crisis. Average sold prices fell from a peak of £155,487 in December 2007 to a trough of £115,679 by April 2009, a decline of 25.6%. Recovery was gradual, with prices not returning to pre-crash levels until mid-2014, approximately five and a half years later.

Source: HM Land Registry House Price Index for Ipswich

Here is how the Ipswich property market has performed over the key cycles:

- 1995-2007 saw property values nearly quadruple, rising from £41,154 to £155,487 as Ipswich benefited from the national housing boom and growing recognition as an affordable alternative to London and Cambridge.

- 2008-2009 brought a sharp correction of 25.6%. Ipswich fell harder than the national average, reflecting its sensitivity to economic uncertainty and mortgage availability.

- 2010-2016 delivered steady recovery. Prices climbed from £127,697 to £177,596 as the economy stabilised and London commuters increasingly discovered Ipswich's value proposition.

- 2017-2019 saw continued growth but at a slower pace. Prices rose from £180,732 to £191,112, with Brexit uncertainty creating some hesitation in the market.

- 2020-2022 brought the pandemic surge. Prices climbed from £190,940 to £234,277 as demand for affordable housing with space intensified, and Ipswich's sub-hour commute to London became more attractive to hybrid workers.

- 2023-2024 saw a correction of around 8.6% as mortgage rates spiked, with prices falling from the December 2022 peak of £234,277 to £214,035 by June 2024.

- 2024-2025 has marked recovery. Prices have climbed back to £227,730 as of October 2025, now just 2.8% below the 2022 peak and showing year-on-year growth of 3.6%.

Long-Term Sold House Price Growth in Ipswich

For buy-to-let investors focused on capital preservation and long-term appreciation, Ipswich's trajectory shows substantial gains despite periodic corrections:

- 5 years (2020-2025): 17.1% growth (£194,412 to £227,730)

- 10 years (2015-2025): 43.4% growth (£158,841 to £227,730)

- 15 years (2010-2025): 69.2% growth (£134,597 to £227,730)

- 20 years (2005-2025): 76.6% growth (£128,978 to £227,730)

- 30 years (1995-2025): 453.3% growth (£41,154 to £227,730)

The 2008 and 2023 corrections demonstrate that Ipswich is not immune to market cycles. The 2008 crash hit harder here than in some premium markets, but recovery has been consistent. Ipswich's affordability relative to Cambridge and London, combined with improving transport links and waterfront regeneration, continues to underpin demand. For investors, the key takeaway is that Ipswich rewards patience: those who held through 2008 have seen values increase by 96% since the trough.

Access our exclusive, high-yielding, buy-to-let property deals.

Sold House Prices in Ipswich

The latest sold house price index by the Land Registry confirms Ipswich's position as one of the more affordable markets in the East of England, with values sitting comfortably below national benchmarks across every property type.

Ipswich property prices average £227,730, which is 22% below the England average of £291,515. This discount reflects the town's industrial heritage and distance from London, though the gap has narrowed as commuters and remote workers have discovered Ipswich's value proposition.

Flats and maisonettes offer the steepest discount, averaging £133,749, a 39% saving against the national average. Waterfront apartments and conversions in the town centre dominate this segment, attractive to young professionals and first-time landlords. Terraced houses average £211,655, sitting 13% below the national figure, with Victorian and Edwardian stock in areas like IP1 and IP3 offering solid rental yields.

Semi-detached houses average £267,593, representing an 8% discount on the England average. These family homes in suburbs like Kesgrave and Rushmere attract owner-occupiers and family lets. Detached houses offer the narrowest gap at £402,949, just 14% below the national average, reflecting strong demand for larger properties in IP4 and IP5 from professionals working at Adastral Park and the nearby Port of Felixstowe.

Updated January 2026

| Property Type | Ipswich Average | England Average | Difference |

|---|---|---|---|

| Detached houses | £402,949 | £470,151 | -14.3% |

| Semi-detached houses | £267,593 | £289,909 | -7.7% |

| Terraced houses | £211,655 | £243,978 | -13.2% |

| Flats and maisonettes | £133,749 | £219,065 | -38.9% |

| All property types | £227,730 | £291,515 | -21.9% |

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Sold Price Per Square Foot in Ipswich (£)

Updated January 2026

The data represents the average sold price per square foot across Ipswich's postcodes, based on completed transactions to show where you get the most physical space for your money.

| Rank | Area | Sold Price Per Square Foot |

|---|---|---|

| 1 | IP5 (Kesgrave, Martlesham, Rushmere) | £344 |

| 2 | IP4 (East Ipswich, Rushmere St. Andrew) | £278 |

| 3 | IP3 (South-East Ipswich, Priory Heath) | £271 |

| 4 | IP1 (Town Centre, Westbourne, Castle Hill) | £262 |

| 5 | IP2 (South-West Ipswich, Chantry, Stoke Park) | £251 |

For context, Cambridge averages over £500 per square foot across its city postcodes. Ipswich's most expensive postcode, IP5, comes in at just £344. You get roughly 45% more space for your money in Ipswich compared to its university neighbour 40 minutes up the A14.

The price gap across Ipswich is narrower than in many cities. Just £93 per square foot separates the most expensive postcode (IP5) from the cheapest (IP2), reflecting a compact urban market without the extreme premium pockets found in larger regional centres.

IP5's higher price per square foot reflects its stock profile rather than location premium. These are predominantly larger detached family homes in commuter villages, attracting owner-occupiers seeking space and A12 access to London. For yield-focused investors, the urban postcodes offer better value. A £67,000 deposit in IP2 buys roughly 885 sq ft of living space at the city's highest yield of 5.1%. The same capital wouldn't cover a 30% deposit in IP5, where average prices sit at £367,000.

Note: These figures reflect averages across all property types and ages. Individual property value depends on condition, specific location, and building age.

For Sale Asking House Prices in Ipswich

Updated January 2026

The data represents the average asking prices of properties currently listed for sale across Ipswich's five postcode districts.

| Rank | Area | Average Asking Price |

|---|---|---|

| 1 | IP5 (Kesgrave, Martlesham, Rushmere) | £367,563 |

| 2 | IP4 (East Ipswich, Rushmere St. Andrew) | £267,414 |

| 3 | IP1 (Town Centre, Westbourne, Castle Hill) | £239,202 |

| 4 | IP3 (South-East Ipswich, Priory Heath) | £231,671 |

| 5 | IP2 (South-West Ipswich, Chantry, Stoke Park) | £222,353 |

Ipswich pricing shows a clear urban-commuter divide. IP5 sits £100,000 above the next postcode, reflecting its position as a commuter belt for families seeking larger detached homes with A12 access to London. The remaining four postcodes cluster within a £45,000 range, offering genuine choice without dramatic price jumps between areas.

The urban postcodes (IP1-IP4) all sit below the Ipswich local authority sold price average of £227,730, making them accessible entry points compared to the wider East of England market where average sold prices reach £340,037.

IP2 at £222,353 offers the lowest entry point in Ipswich while delivering the borough's strongest yields. IP3 at £231,671 covers the south-east suburbs with good access to the A14 and employment at Ransomes Europark. IP1 at £239,202 includes the town centre, waterfront regeneration area, and the University of Suffolk campus, appealing to a mix of young professionals and students.

IP4 at £267,414 commands a modest premium for its position in east Ipswich, covering established residential areas like Rushmere St. Andrew and proximity to Ipswich Hospital. This postcode bridges the gap between affordable urban stock and the commuter villages.

Note: These figures represent average asking prices across all property types. Actual achievable prices vary depending on property size, condition, and specific location within each postcode.

House Price Growth in Ipswich (%)

Updated January 2026

The data represents average house price growth across multiple timeframes, calculated using postcode-level data blending sold prices and asking prices.

| Area | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

| 1. IP5 (Kesgrave, Martlesham, Rushmere) | +8.2% | +0.5% | +16.3% |

| 2. IP2 (South-West Ipswich, Chantry, Stoke Park) | 0.0% | -5.2% | +14.7% |

| 3. IP3 (South-East Ipswich, Priory Heath) | 0.0% | +1.7% | +12.9% |

| 4. IP1 (Town Centre, Westbourne, Castle Hill) | -6.1% | -2.8% | +11.7% |

| 5. IP4 (East Ipswich, Rushmere St. Andrew) | +3.9% | -3.9% | +10.3% |

Ipswich shows a more resilient picture than Norwich and Cambridge, where multiple postcodes are experiencing double-digit annual declines. Only one Ipswich postcode (IP1) shows negative one-year growth, and even that is a modest -6.1%.

IP5 (Kesgrave, Martlesham) leads on both annual growth (+8.2%) and five-year growth (+16.3%). The commuter villages continue attracting families seeking space and A12 access, with demand holding firm despite higher mortgage rates. The flat three-year figure (+0.5%) suggests prices consolidated in 2022-2023 before resuming growth.

IP2 and IP3 show flat annual growth but solid five-year returns of +14.7% and +12.9% respectively. These affordable urban postcodes appear to have found a stable floor after the post-pandemic adjustment. For yield-focused investors, flat capital values combined with steady rents mean returns are coming from income rather than speculation.

IP1 (Town Centre) shows the weakest recent performance at -6.1% annual growth, though the five-year picture remains positive at +11.7%. The town centre market is more exposed to first-time buyer sentiment and mortgage affordability pressures. IP4 at +3.9% annual growth demonstrates quiet resilience, sitting between the commuter premium of IP5 and the urban consolidation of IP1-IP3.

Average Monthly Property Sales in Ipswich

Updated January 2026

The data represents the average number of residential property sales per month across Ipswich's postcode districts, acting as a key indicator of market liquidity.

| Rank | Area | Average Monthly Sales |

|---|---|---|

| 1 | IP1 (Town Centre, Westbourne, Castle Hill) | 38 |

| 2 | IP4 (East Ipswich, Rushmere St. Andrew) | 34 |

| 3 | IP3 (South-East Ipswich, Priory Heath) | 31 |

| 4 | IP2 (South-West Ipswich, Chantry, Stoke Park) | 24 |

| 5 | IP5 (Kesgrave, Martlesham, Rushmere) | 20 |

Ipswich shows healthy property sales liquidity across all postcodes, a positive sign for investors tracking where UK house prices are heading. Even IP5 at 20 sales per month offers sufficient volume to buy and sell without extended waiting periods. This aligns with Colchester, which has very similar property sales activity across its postcodes.

IP1 (Town Centre) leads with 38 monthly sales, offering the deepest buyer pool in Ipswich. The trade-off is more competition when purchasing.

IP2 at 24 sales combines the lowest asking prices, the highest yields at 5.1%, and sufficient liquidity for straightforward transactions. For investors focused on the UK rental market, IP2 delivers buy to let fundamentals without the premium price tags.

Property Data Sources

Our location guide relies on diverse, authoritative datasets including:

- HM Land Registry UK House Price Index

- Ministry of Housing, Communities and Local Government

- Ordnance Survey Data Hub

- Propertydata.co.uk

We update our property data quarterly to ensure accuracy. Last update: January 2026. All data is presented as provided by our sources without adjustments or amendments.

Ipswich Rental Market Analysis

For new landlords and investors considering if buy to let is worth it in Ipswich and thinking how much they can charge for rent across the town and its surrounding areas, the rental data below gives an indication of the rental income per month and the rental yields landlords can aim to achieve. This is helpful if you are considering starting a property business in this area.

Rental Prices in Ipswich (£)

Updated January 2026

The data represents the average monthly rent for long-let AST properties in Ipswich.

| Rank | Area | Average Monthly Rent |

|---|---|---|

| 1 | IP5 (Kesgrave, Martlesham, Rushmere) | £1,182 |

| 2 | IP4 (East Ipswich, Rushmere St. Andrew) | £994 |

| 3 | IP1 (Town Centre, Westbourne, Castle Hill) | £969 |

| 4 | IP2 (South-West Ipswich, Chantry, Stoke Park) | £949 |

| 5 | IP3 (South-East Ipswich, Priory Heath) | £929 |

IP5 (Kesgrave, Martlesham) commands the highest average rent at £1,182, but this reflects property size rather than location premium. These are predominantly larger detached family homes in commuter villages, attracting tenants who need space and A12 access. The 3.9% yield here is the lowest in Ipswich, as high rents don't offset the £367,000 average asking price.

The urban postcodes cluster tightly between £929 and £994, a spread of just £65 per month. This narrow range means tenant decisions often come down to property condition and specific location rather than postcode. For landlords, it simplifies pricing decisions but limits scope for premium positioning.

IP4 at £994 edges ahead of the urban pack, reflecting its mix of established family housing near Ipswich Hospital and the eastern suburbs. IP1 at £969 covers the town centre and waterfront, drawing young professionals and students from the University of Suffolk.

For context, Ipswich rents sit well below regional comparators. Chelmsford averages £1,300-£1,500 in its urban postcodes, while Cambridge exceeds £1,600. The gap reflects Ipswich's more affordable employment base and greater housing supply relative to demand.

Gross Rental Yields in Ipswich (%)

Updated January 2026

The data represents the average gross rental yields across Ipswich's postcode districts, based on asking prices and asking rents.

| Rank | Area | Gross Rental Yield |

|---|---|---|

| 1 | IP2 (South-West Ipswich, Chantry, Stoke Park) | 5.1% |

| 2 | IP1 (Town Centre, Westbourne, Castle Hill) | 4.9% |

| 3 | IP3 (South-East Ipswich, Priory Heath) | 4.8% |

| 4 | IP4 (East Ipswich, Rushmere St. Andrew) | 4.5% |

| 5 | IP5 (Kesgrave, Martlesham, Rushmere) | 3.9% |

IP2 (Chantry, Stoke Park) leads at 5.1%, combining the lowest asking prices (£222,353) with solid rental demand from working tenants. This is the postcode where the numbers stack up most favourably for yield-focused investors. IP1 at 4.9% offers marginally lower yields but the highest transaction volume, giving investors more options when building a portfolio.

IP3 at 4.8% and IP4 at 4.5% occupy the middle ground. Both serve employment catchments around the A14 corridor and offer a balance of yield and property quality. The step down to IP4 reflects its higher average prices (£267,414) rather than weaker rents.

IP5 at 3.9% is the outlier. High average rents (£1,182) don't compensate for the £367,563 entry price. This postcode suits owner-occupiers or investors prioritising capital growth over income.

For context, Ipswich yields compare favourably to Cambridge where no postcode exceeds 4.7%, and sit broadly in line with Colchester. Investors seeking higher returns in the East of England would need to look toward Peterborough or Norwich.

Note: These figures represent gross rental yields calculated from average asking rents and asking prices. Net yields will be lower after accounting for mortgage costs, maintenance, void periods, letting agent fees, insurance, and property management expenses.

Landlords can use our rental investment calculator to factor in these buy-to-let ownership costs.

Is Ipswich Rent High?

Ipswich rents sit close to the 30% affordability threshold in most postcodes, making it one of the more accessible rental markets in the East of England for working tenants.

Average rent in Ipswich costs between 31% and 40% of the average gross annual earnings for a full-time resident. This is based on the ONS Annual Survey of Hours and Earnings (ASHE) showing the median gross weekly pay for Ipswich residents is £691, equivalent to approximately £35,950 per year.

The general affordability guideline suggests rent should not exceed 30% of gross income. Four of Ipswich's five postcodes sit within a few percentage points of this threshold. Only IP5 (Kesgrave, Martlesham) pushes significantly above it at 39.5%, reflecting the larger detached properties that dominate this postcode rather than unaffordable market conditions.

| Rank | Area | Rent as % of Income |

|---|---|---|

| 1 | IP5 (Kesgrave, Martlesham, Rushmere) | 39.5% |

| 2 | IP4 (East Ipswich, Rushmere St. Andrew) | 33.2% |

| 3 | IP1 (Town Centre, Westbourne, Castle Hill) | 32.3% |

| 4 | IP2 (South-West Ipswich, Chantry, Stoke Park) | 31.7% |

| 5 | IP3 (South-East Ipswich, Priory Heath) | 31.0% |

For context, Cambridge tenants pay 40-48% of gross income on rent. Ipswich's affordability means tenants have more disposable income after housing costs, which typically translates to more reliable rent payments and lower void risk. The trade-off is limited headroom for rent increases without pricing out the local workforce.

Note: These calculations use median gross weekly pay (£691) for full-time Ipswich residents. Actual tenant affordability varies based on household composition. Couples or sharers will find these ratios more comfortable; single tenants on below-median wages will find them tighter.

Access our exclusive, high-yielding, buy-to-let property deals.

Buy-to-Let Considerations

Are Ipswich House Prices High?

For a local buyer on average full-time earnings, Ipswich remains one of the more accessible markets in the East of England. While prices have moved beyond the historic UK affordability threshold of 4-5x income, most postcodes sit comfortably below the regional average, making home ownership achievable for dual-income households.

Purchasing a property in Ipswich requires between 6.2 and 10.2 times the median annual salary. This is based on the ONS Annual Survey of Hours and Earnings (ASHE) showing the median gross weekly pay for Ipswich residents is £691, equivalent to approximately £35,950 per year.

Four of Ipswich's five postcodes sit between 6.2x and 7.4x income. This is above the historic UK norm but well below the regional average for the East of England. Only IP5 (Kesgrave, Martlesham) pushes into double figures at 10.2x, reflecting its stock of larger detached family homes rather than typical investor territory.

| Rank | Area | Price to Income Ratio |

|---|---|---|

| 1 | IP5 (Kesgrave, Martlesham, Rushmere) | 10.2x |

| 2 | IP4 (East Ipswich, Rushmere St. Andrew) | 7.4x |

| 3 | IP1 (Town Centre, Westbourne, Castle Hill) | 6.7x |

| 4 | IP3 (South-East Ipswich, Priory Heath) | 6.4x |

| 5 | IP2 (South-West Ipswich, Chantry, Stoke Park) | 6.2x |

IP2 at 6.2x income offers the best affordability in the borough, combining the lowest entry prices (£222k) with the highest yields (5.1%). For first-time buyers and investors alike, this postcode represents the strongest value proposition. IP3 and IP1 sit in similar territory, all accessible to local buyers without stretched borrowing.

For context, Cambridge ranges from 9x to 15x income, putting it out of reach for most local buyers. Colchester sits slightly above Ipswich, while Peterborough and Norwich offer comparable or better affordability for investors seeking accessible East of England markets.

How Much Deposit to Buy a House in Ipswich?

Assuming a standard 30% deposit for a buy-to-let mortgage, the data shows a £43,500 difference between the most accessible and most expensive postcodes.

| Rank | Area | 30% Deposit Required |

|---|---|---|

| 1 | IP2 (South-West Ipswich, Chantry, Stoke Park) | £66,706 |

| 2 | IP3 (South-East Ipswich, Priory Heath) | £69,501 |

| 3 | IP1 (Town Centre, Westbourne, Castle Hill) | £71,761 |

| 4 | IP4 (East Ipswich, Rushmere St. Andrew) | £80,224 |

| 5 | IP5 (Kesgrave, Martlesham, Rushmere) | £110,269 |

For investors entering the Ipswich market, IP2 requires a deposit around £67,000. That's roughly half what you'd need in Cambridge and comparable to entry points in Nottingham or Leicester. IP2 also delivers the highest yields at 5.1%, making it the practical entry point for yield-focused investors.

IP1 (Town Centre) at £71,761 offers access to the highest transaction volume in the borough with 38 sales per month. The additional £5,000 over IP2 buys into a more liquid market with the University of Suffolk nearby, supporting tenant demand from students and university staff.

IP5 at £110,269 sits apart from the urban postcodes. The £30,000+ premium over IP4 reflects the stock profile of detached family homes rather than typical investor territory. Unless you're targeting long-term capital growth in a commuter belt location, the urban postcodes offer better value for rental returns.

For comparison, the same £67,000 deposit that buys one property in IP2 would stretch further in Hull or Stoke with higher yields, but without Ipswich's transport links to London. Investors prioritising capital growth over cash flow might look toward Reading or Milton Keynes, though both require significantly larger deposits.

How to Invest in Buy-to-Let in Ipswich

Property Investments UK and our partners have ready to go buy-to-let properties to purchase across Ipswich, Suffolk and the rest of the UK.

With new properties coming available weekly, we can source suitable investment properties across the region and country to match your criteria.

We have partnered with the best property investment agents we can find for 8+ years and below you can find links to help you buy properties in Ipswich and across the region including:

- Buy-to-let investment properties

- PBSA and student lets

- BMV properties for sale

- Airbnbs for sale

- and other high yielding opportunities

and articles helping you with:

- How to find off-market properties

- Why you should consider a Holiday home investment or a serviced accommodation asset

- Are HMO properties a good investment

Consider Similar Areas to Ipswich for Buy-to-Let Investment

For investors seeking similar affordability with proven rental demand, buy-to-let in Coventry offers comparable entry prices with strong university-driven tenant demand. If you're drawn to port cities with regeneration momentum, buy-to-let in Hull delivers higher yields with even lower deposits, while buy-to-let in Southampton provides south coast exposure with better transport links to London.

Or for investors wanting to compare Ipswich against other commuter belt markets, buy-to-let in Northampton sits on the West Coast Main Line with similar pricing, and buy-to-let in Swindon offers fast Great Western Railway access to London Paddington with strong employment from Honda and financial services.